Accounting localization in Odoo, or any other ERP system, is the process of customizing the program's accounting functions to meet the specific legal and regulatory requirements of a particular country or region. We are currently working up the Accounting localization in Germany.

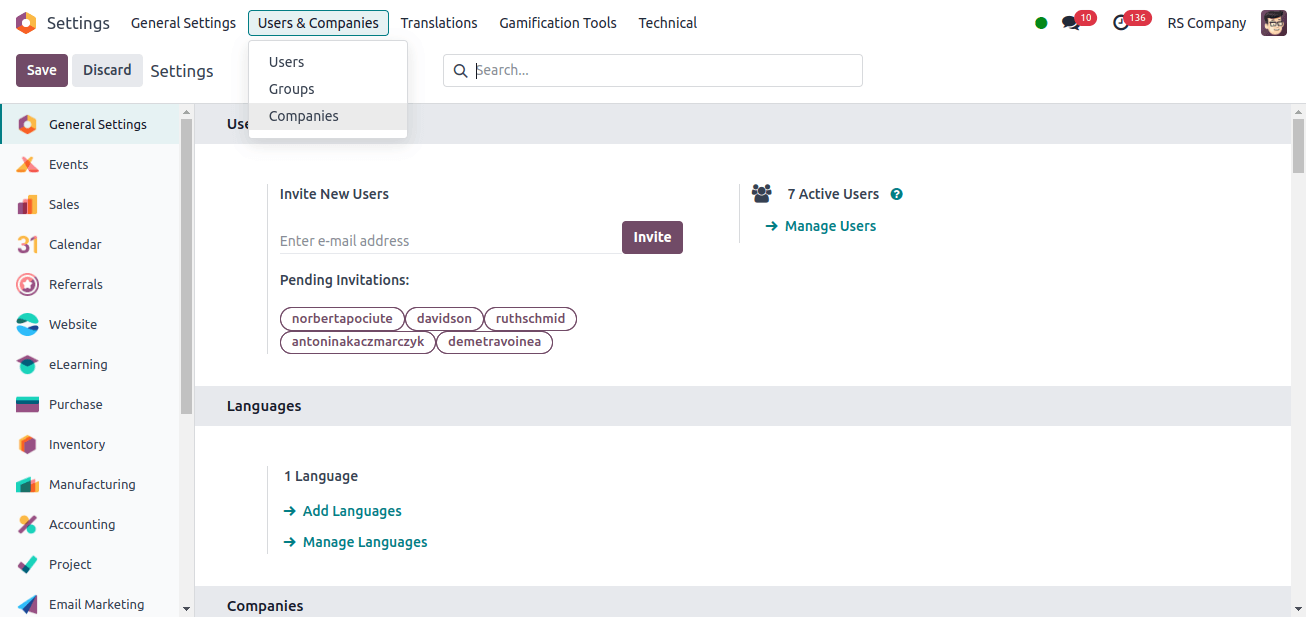

To set up the country-specific localization process, we would need a German company to set it up. So we can start a new company by moving to Odoo’s general settings.

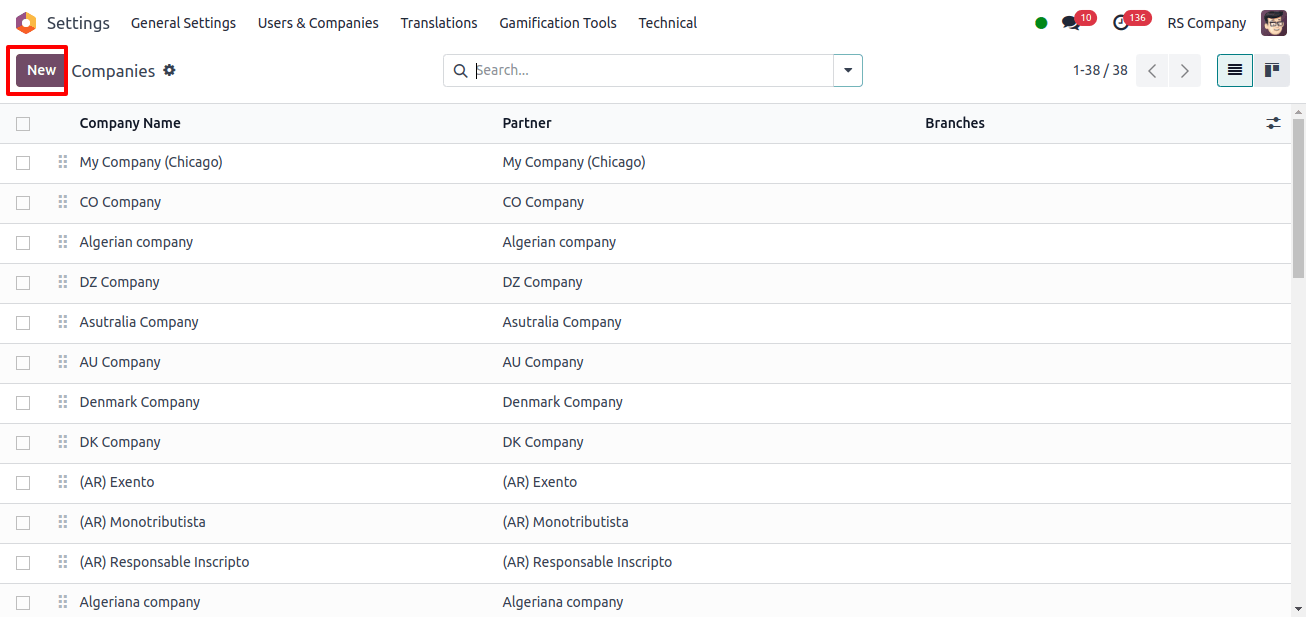

The Go to the Users and Companies menu. This menu has a sub-menu called Companies. After selecting the ‘Companies’ submenu, we will be sent to a new website. On the page, you will see a list of companies, and you can create a new company by clicking the New button.

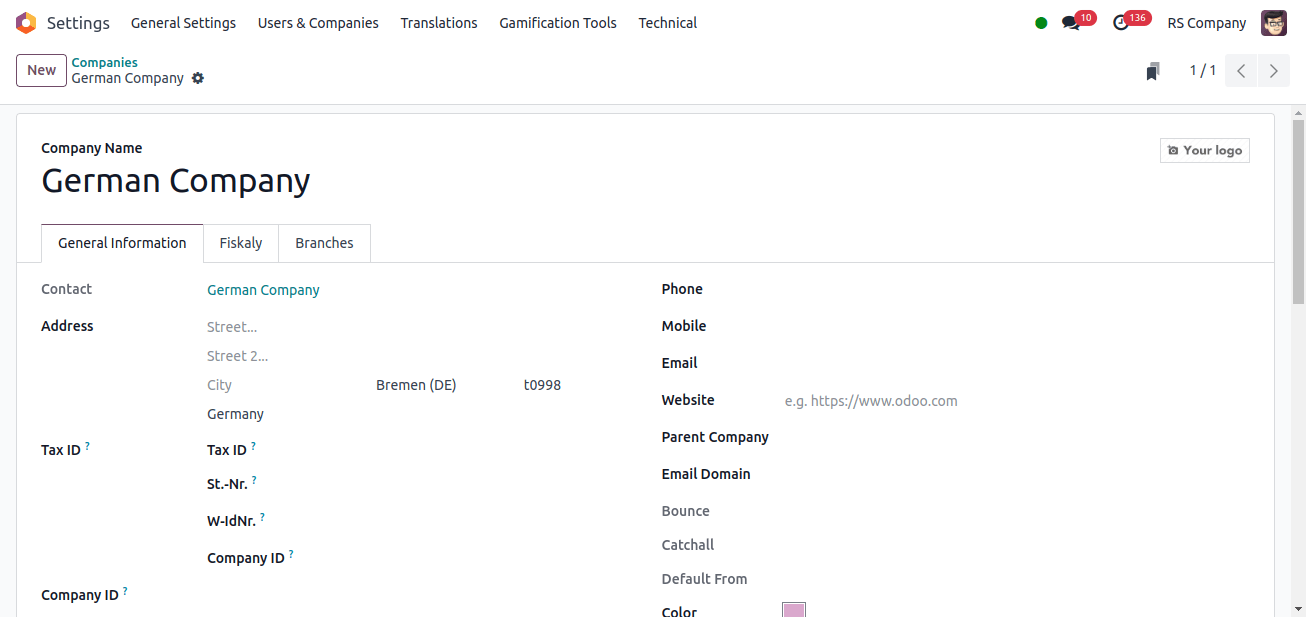

There, we can create a new company and specify the company’s name and country. Now we will build a country in Germany to give a country for the company, such as Germany. In the company creation form, we can enter the company’s address as well as all of its details and save them.

'St.-Nr.' is the Steuer-Nummer, which converts tax numbers into English. In Germany, the tax number is stored in a specific field named Steuer-Nummer. And 'W-IdNr.' is an abbreviation for Wirtschaftssteuer-Identifikationsnummer, or German Tax Identification Number.

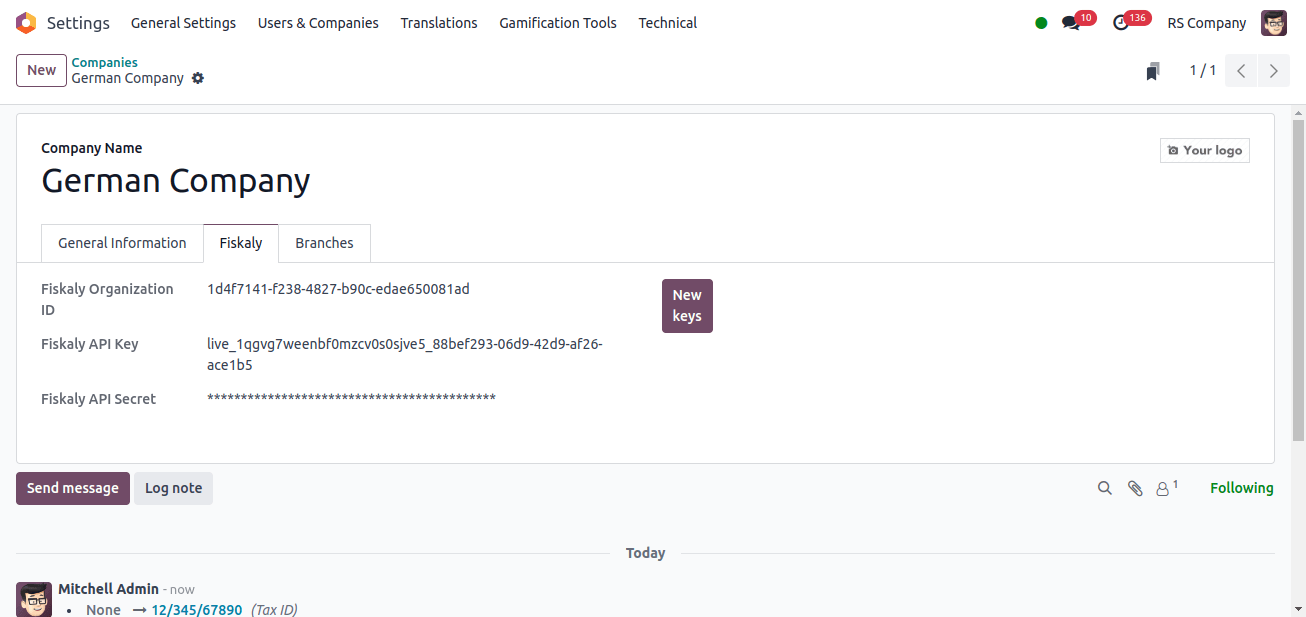

It serves as a unique identification number provided by the German tax authorities to enterprises operating within the country. When we look at the Fisklay tab of the company, we can configure the company’s display information.

* Fisklay Organization ID: It represents our company’s ID on the fisklay side.

* Fisklay API Key: It connects your Odoo system with the Fiskaly service to ensure electronic compliance.

* Fisklay API Secret: It serves as a credential for your Fiskaly account. It enables approved applications to access and edit your tax information.

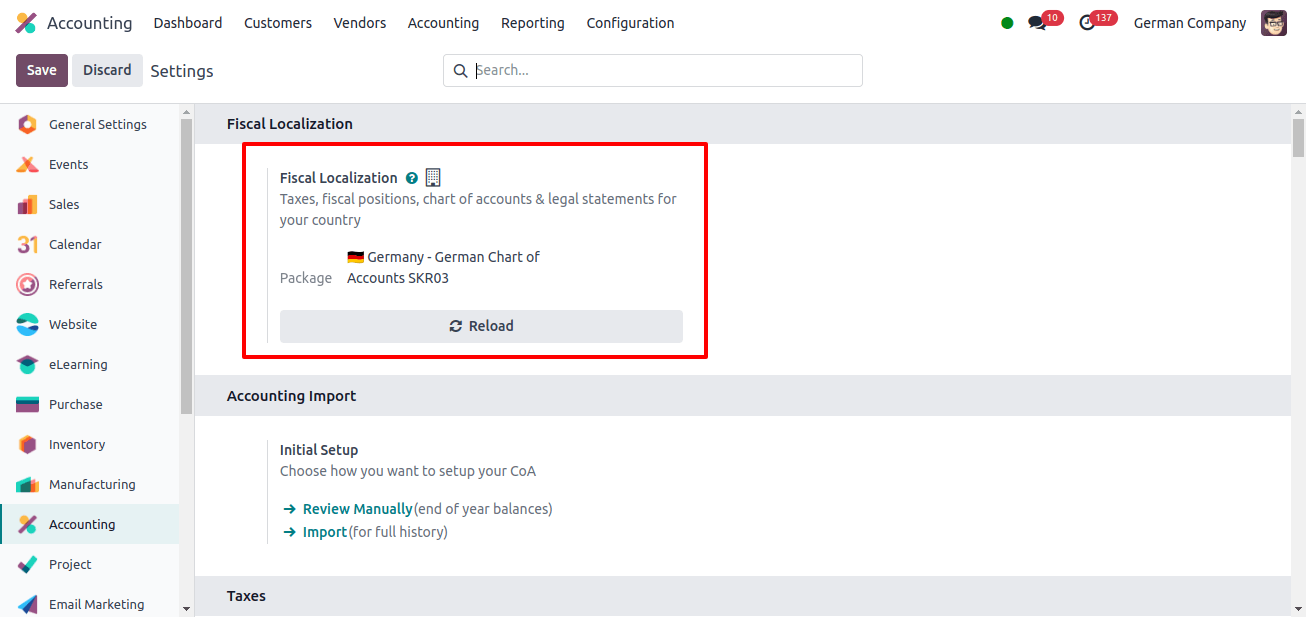

Next, we'll set the translation for Germany; to do so, navigate to Odoo's accounting application and select Configuration Settings. We can supply the package for Germany in the area of fiscal position.

Germany primarily has two localizations, a chart of accounts SKR04 and SKRO3. Odoo supports both, and we can store either one.

When the German localization was set up, changes happened.

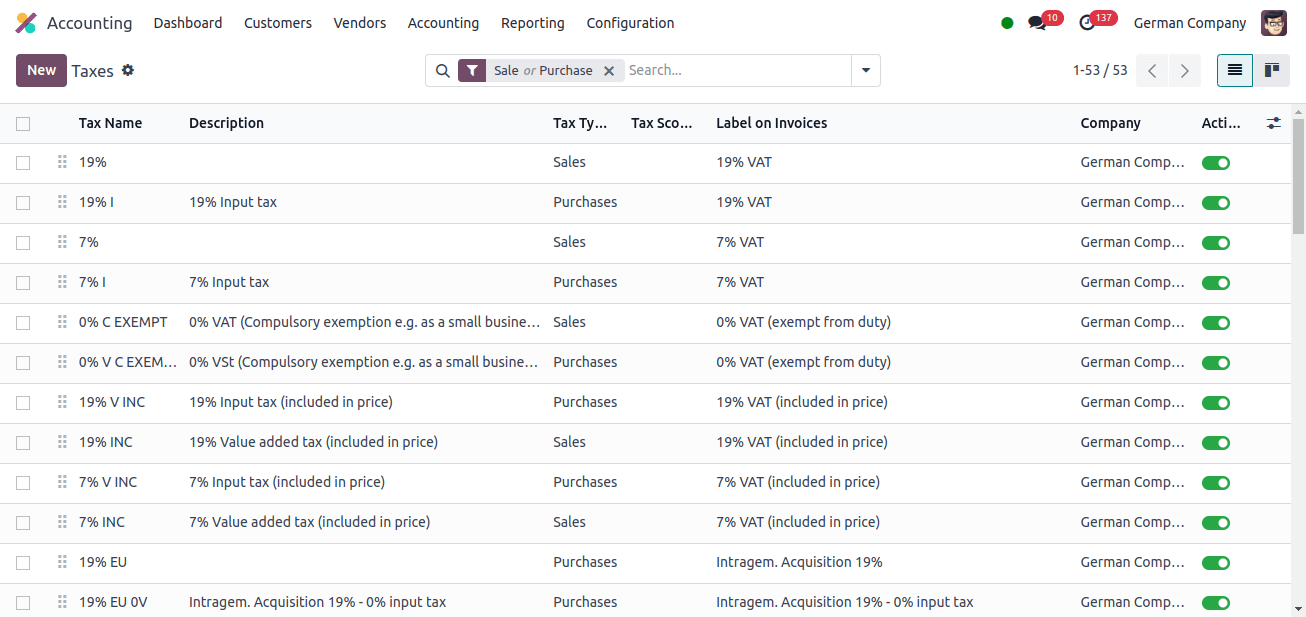

If the German localization has been configured, we can see what changes have occurred in Odoo’s accounting. First, we can look at the Taxes specified for the German company.

So, under the Configuration menu, there is a Taxes submenu that lists all of the taxes that a German company can use. The companies can choose the right taxes from the list.

The default tax in Germany is VAT, which is used by German businesses, and we know that other countries use different taxes for different purposes. As a result, the company can use the listed taxes for a variety of purposes during financial transactions.

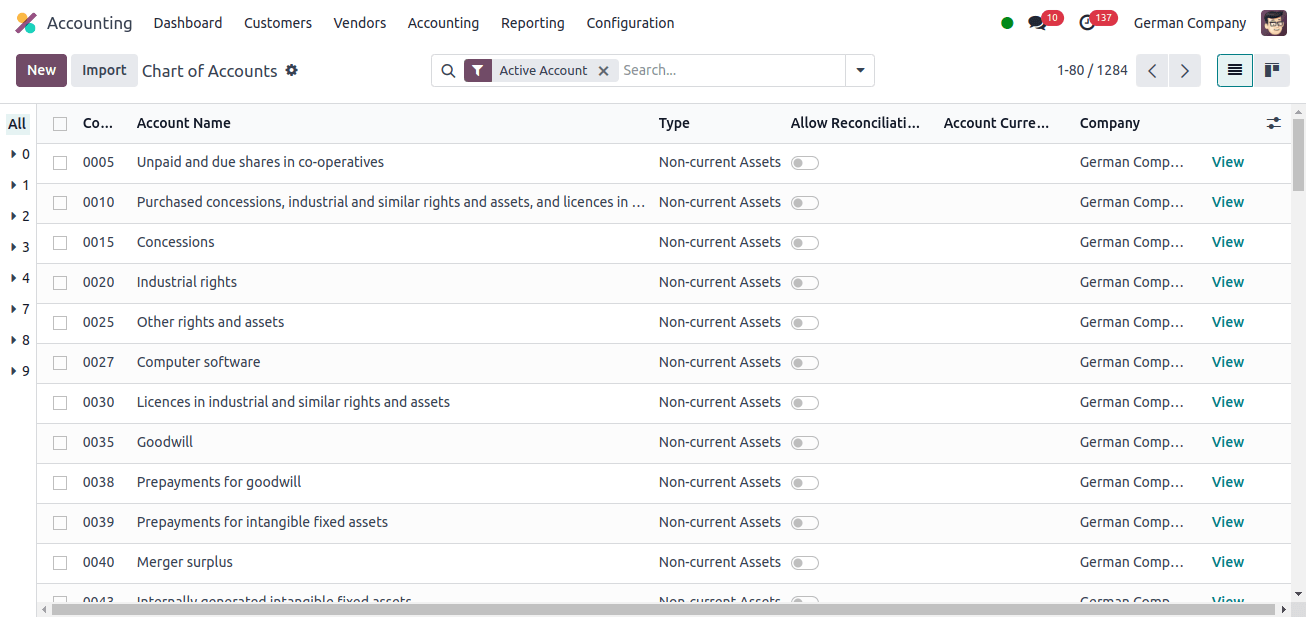

Then we may move to the Chart of Accounts for German companies by clicking the Chart of Accounts sub-menu in the Configuration menu. There will be a chart of accounts.

When we look at the account names, they are all different. Furthermore, the various accounts used by companies in Germany might be considered here.

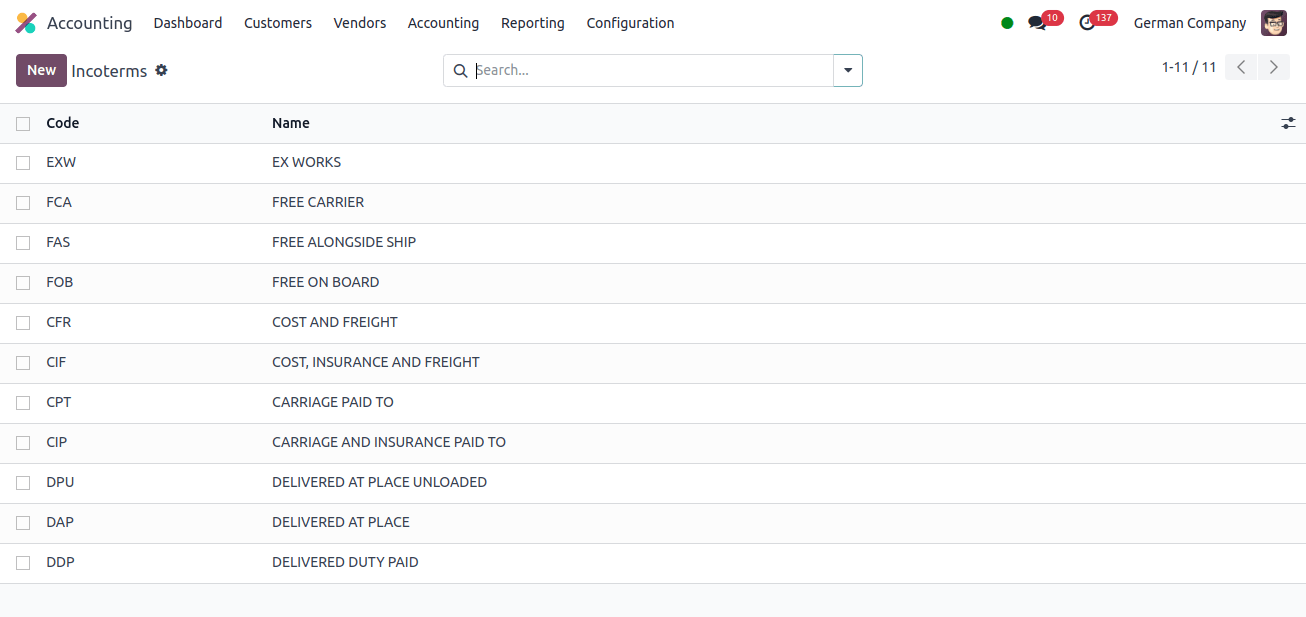

We can now use Incoterms for German companies. Click the Incoterm sub-menu in the Configuration menu. Different companies in Germany will use different Incoterm for different operations.

The definition of Incoterms will be important since it will result in good financial management, which will be extremely beneficial to the company’s financial operations.

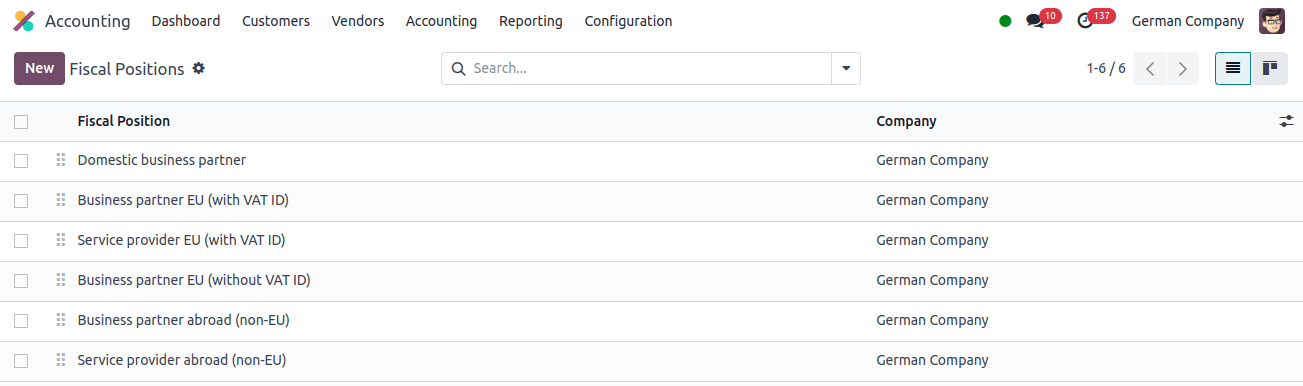

The next option is the fiscal position, which may be accessed by clicking on the Configuration menu. Fiscal positions are a feature that simplifies transaction management with different tax legislation or account formats. Financial positions ensure automated compliance for businesses that operate in multiple locations under different tax legislation.

We can define the accounting operation’s fiscal position using the menu. It can also modify the defined fiscal situation based on our requirements. Automating tax and account mapping saves time and effort compared to manually picking each transaction. This allows accounting professionals to focus on more strategic tasks.

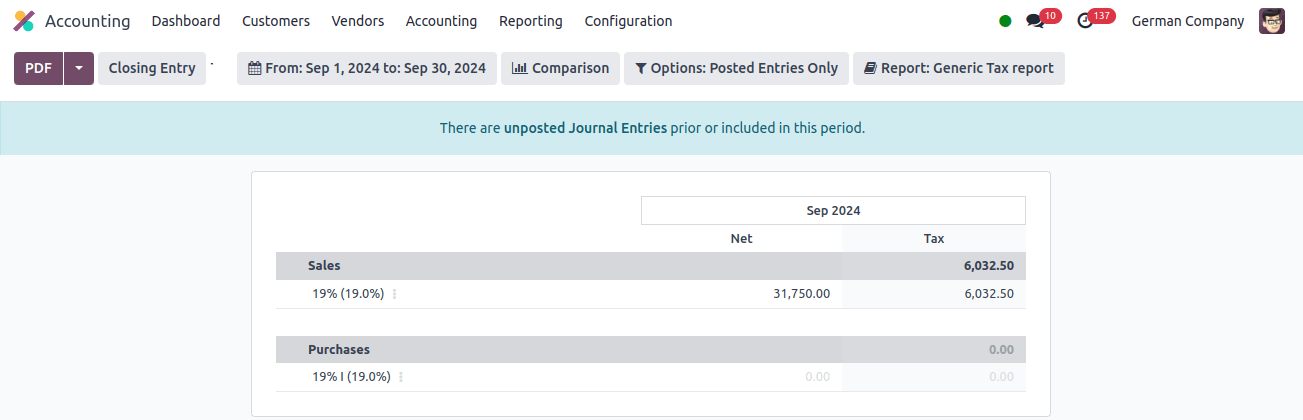

The following is a Tax Report for a German-based corporation. The tax report of the German localized company will be displayed under the Tax Report sub-menu of the Reporting menu. Clicking on Tax Report displays all of the tax reports for that fiscal year.

* Taxable turnover: Refers to the total amount of money obtained from the sale of goods and services after deducting any previous value-added tax (VAT) paid by the customer.

* Tax-exempt transaction With input tax deduction, the client is not charged VAT at the point of sale. However, the tax amount will be reflected in the product price itself.

* Intra-community acquisition: This refers to the exchange of commodities for commercial purposes between enterprises registered in the European Union.

* Supplementary information on turnover: additional information that provides a better grasp of a company's income data.

* Deductible input tax amount: This is the Value Added Tax (VAT) that a firm pays on purchases and subtracts from the VAT it collects on sales.

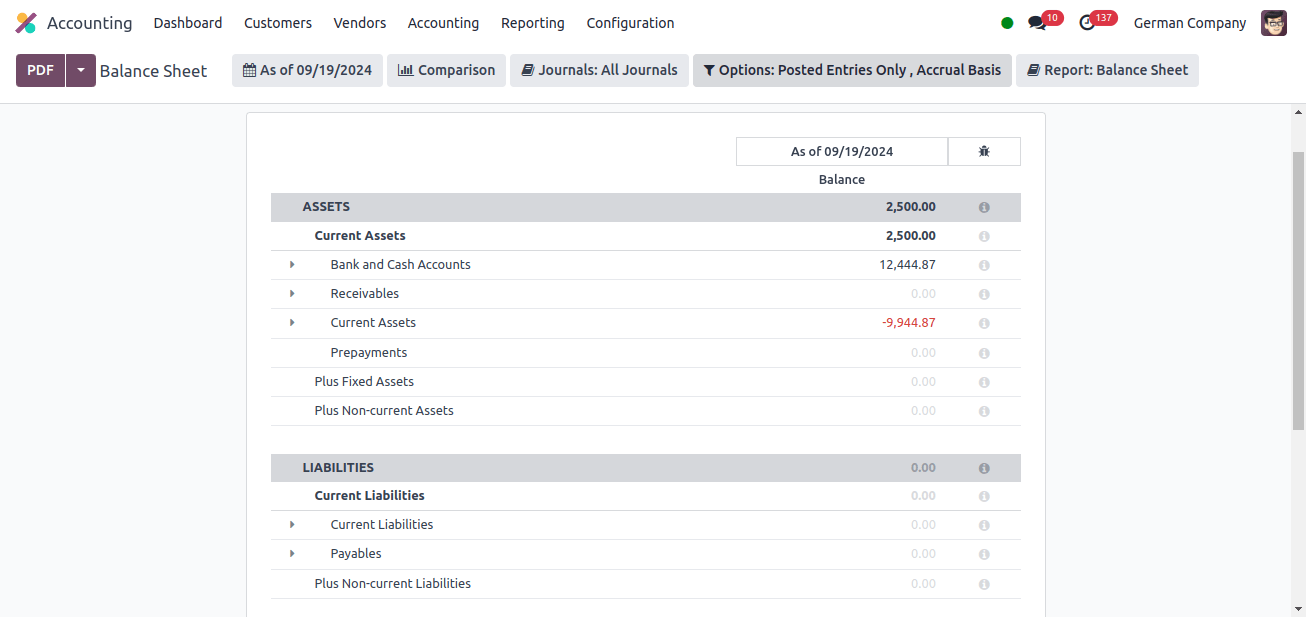

Balance sheets will include Assets, Equity, and Liabilities. There are several sorts of assets, including intangible assets, tangible assets, financial assets, inventories, receivables and other assets, securities, and so on, as well as various types of equity and liabilities, such as subscribed capital, revenue reserves, and legal services.

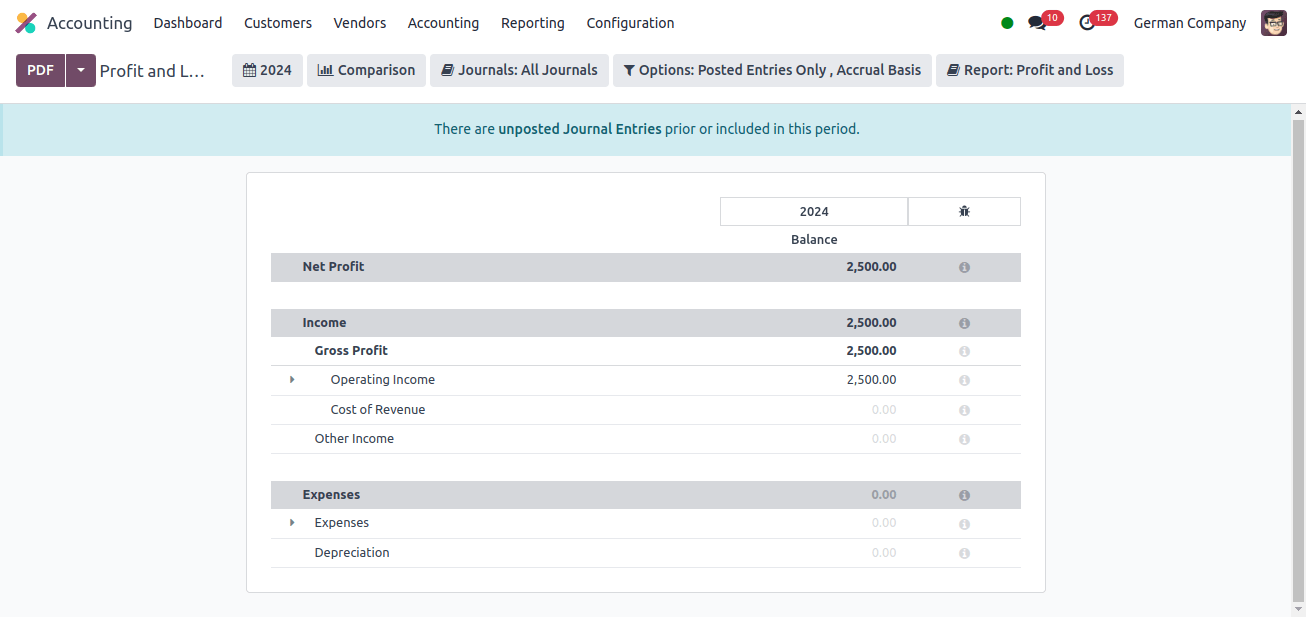

Then we can look at the German company's profit and loss. There will be operating revenue, gross profit, and operational performance. Financial results, earnings after taxes, and so on are the main accounts used to demonstrate German firms' profit and loss.

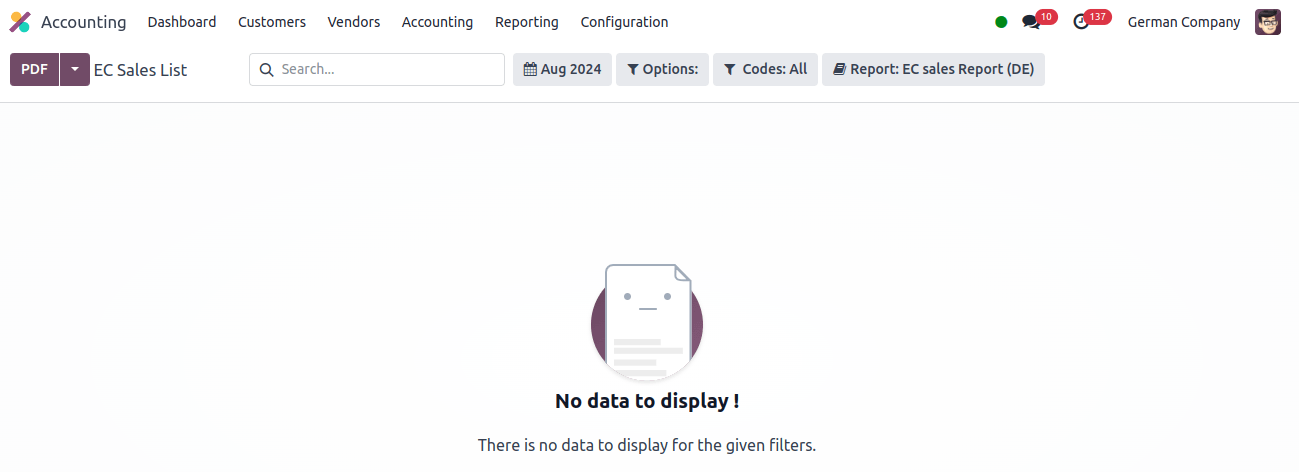

The term "EC Sales List" refers to the European Commission's sales list. These reports contain a summary of product or service sales to VAT-registered firms in other EU countries. They are necessary for EU VAT compliance.

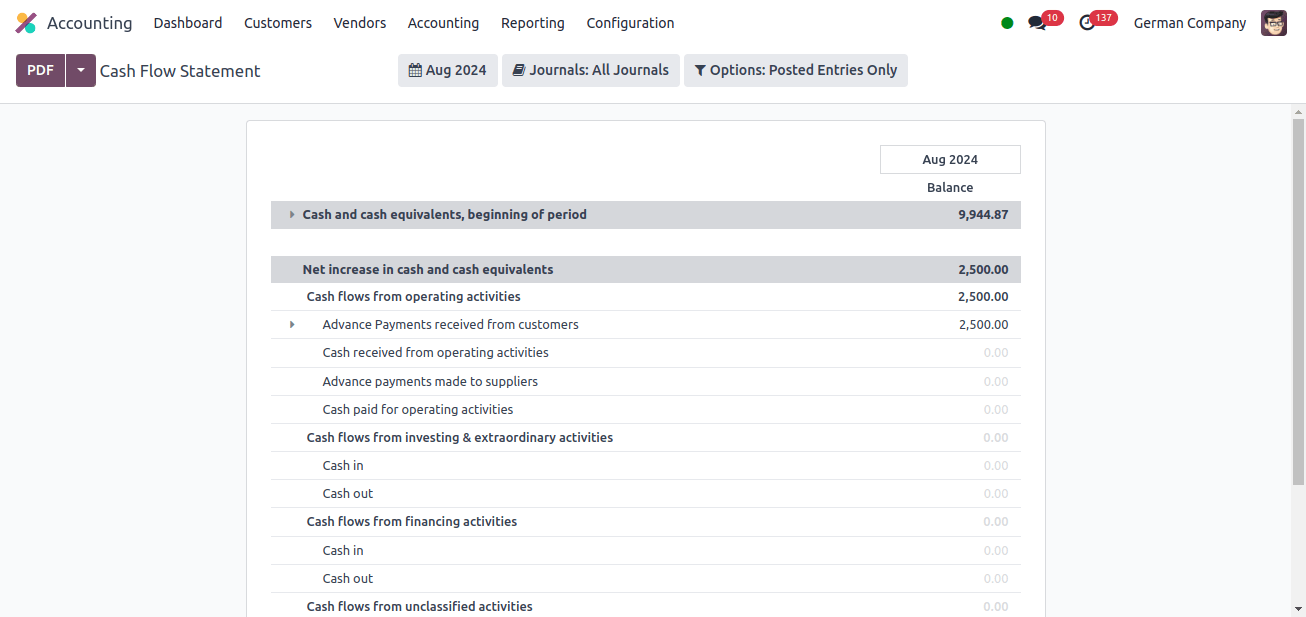

The Cash Flow Statement comes next, and it displays the Cash Flow Statement, Cash and Cash Equivalents, the start of the period, the net growth in cash and cash equivalents, Cash and Cash Equivalents, and the closing balance.

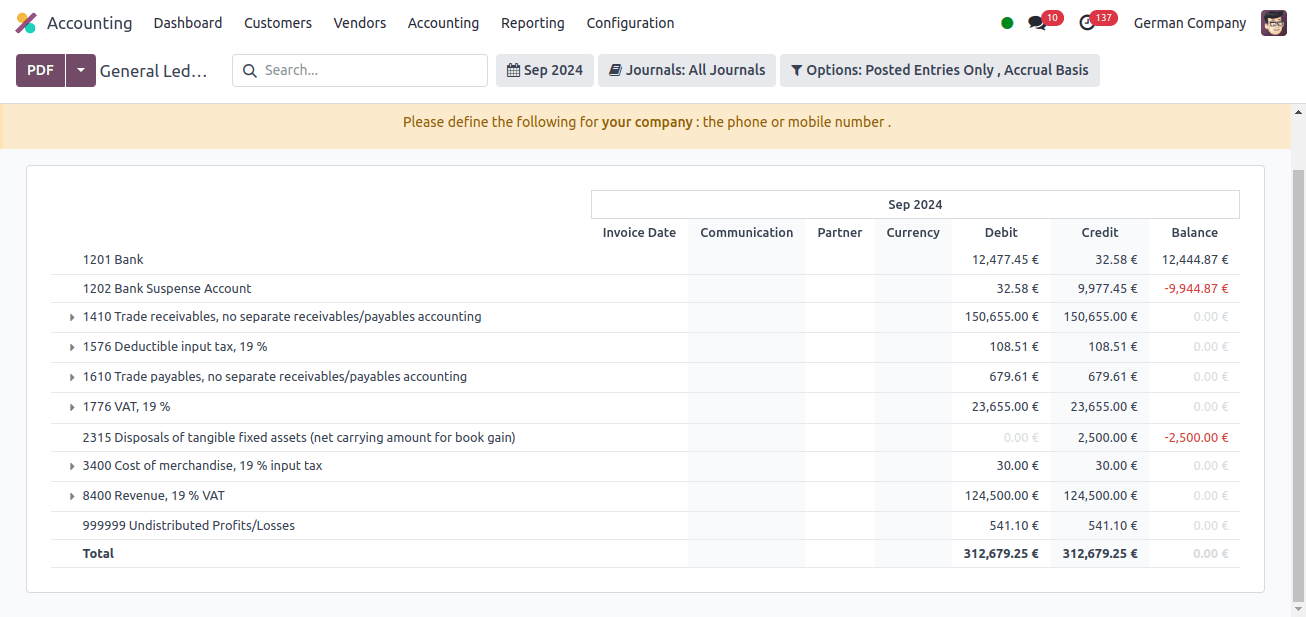

A general ledger is the foundation of a complete financial recording system in accounting, keeping track of all financial transactions made by a company during an accounting period. In the general ledgers, we may examine all of the ledger postings made by German corporations.

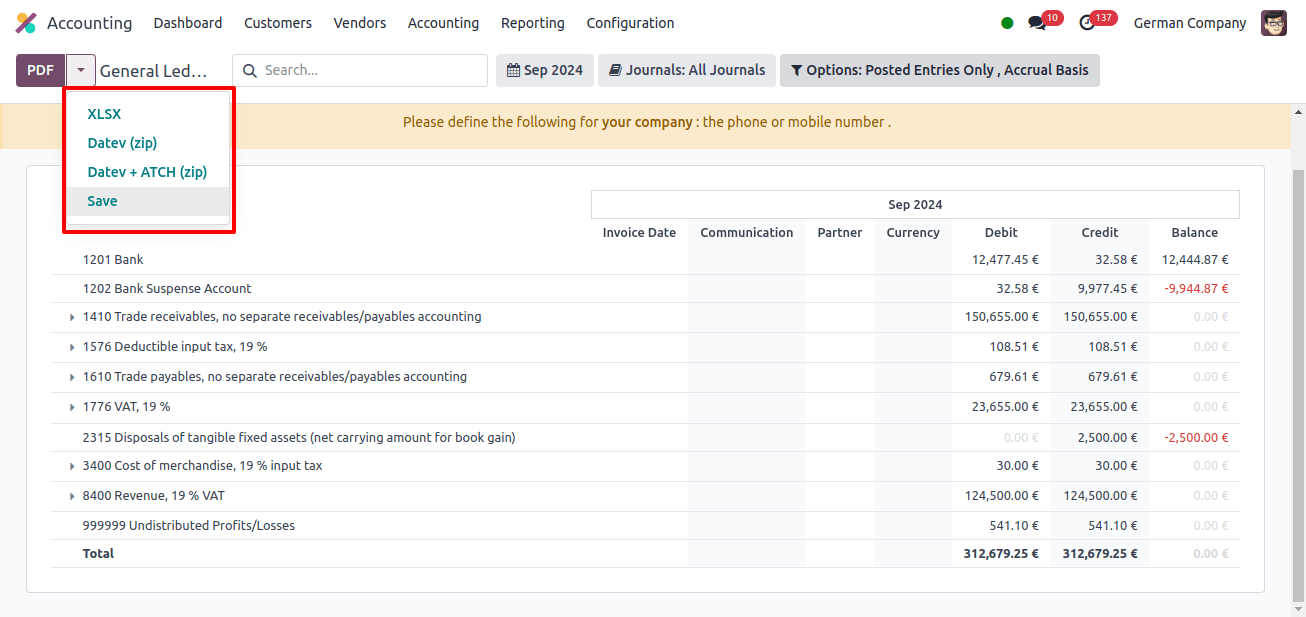

Datev is a popular German accounting software package. In Odoo 17, you can export your accounting entries from Odoo to Datev. It's a popular software suite designed specifically for the German accounting industry. It includes accounting, tax filing, and financial reporting functions that adhere to German tax legislation.

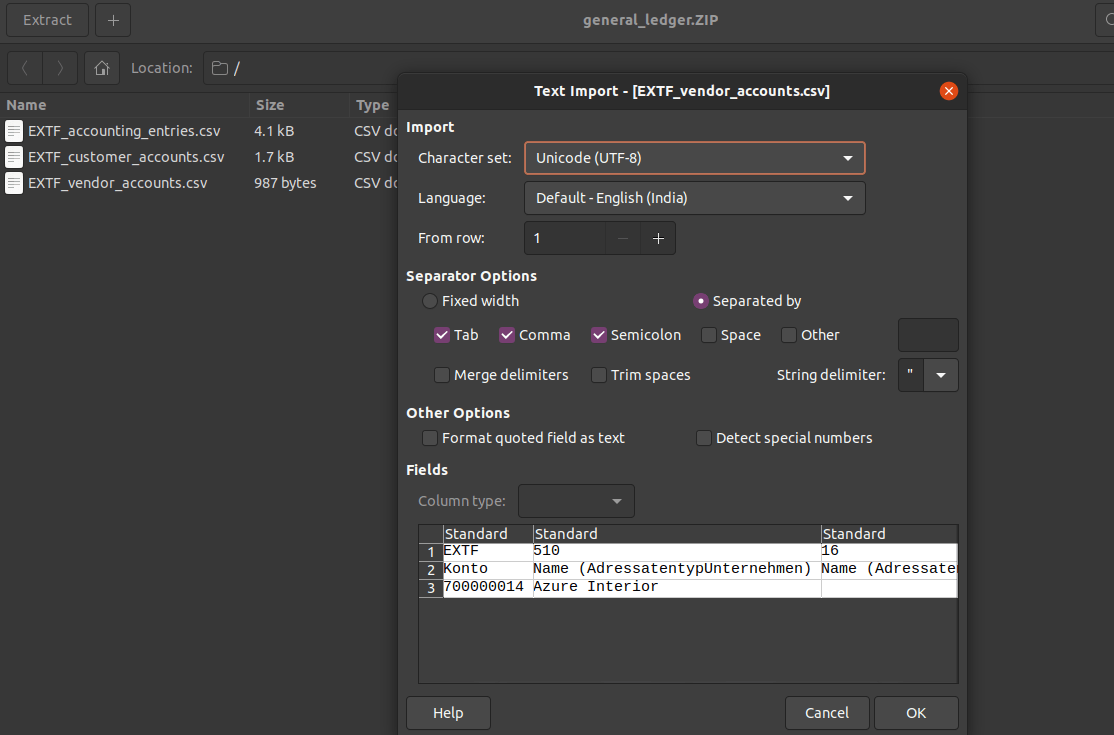

When we select the General Ledger sub-menu from the accounting application's Reporting menu, a drop-down list appears next to the PDF button, listing various exporting formats.

Here we may select the Datev format, and the data will be correctly exported to our system. This data typically consists of journal entries classified according to German accounting rules.

This is how we will obtain accounting data in Datev format in our system. This Odoo 17 feature smooth collaboration with tax consultants or auditors who use Datev. It takes less time and is more convenient than manually entering data into Datev. It also decreases errors that arise during manual data entry.

Odoo German localization brings out a variety of features. All of the capabilities and functions required to run and operate a business in Germany. In this blog, we explored localization for a German company so that it may carry out its accounting responsibilities efficiently.