In today’s ever-changing global marketplace, good financial management is important for any business looking to succeed. Effective financial management is important for any company, particularly in terms of following rules and regulations.

For businesses operating in the Philippines, Odoo provides a comprehensive solution designed to achieve the specific fiscal requirements of the region. Odoo provides reliable solutions for companies that manage in the Philippines that are suited to the unique financial requirements of the field.

In this blog, we will explore how companies are using this effective solution of Odoo’s fiscal localization for the Philippines to simplify their financial processes.

We will look into the key features and advantages that Odoo provides, from managing journal entries to how it follows all the standards to perform proper accounting processes.

Philippine Accounting with Odoo 17

Odoo 17 Philippines localization module makes it easy to follow the local accounting standards and tax laws. First, configure the Philippine accounting localization.

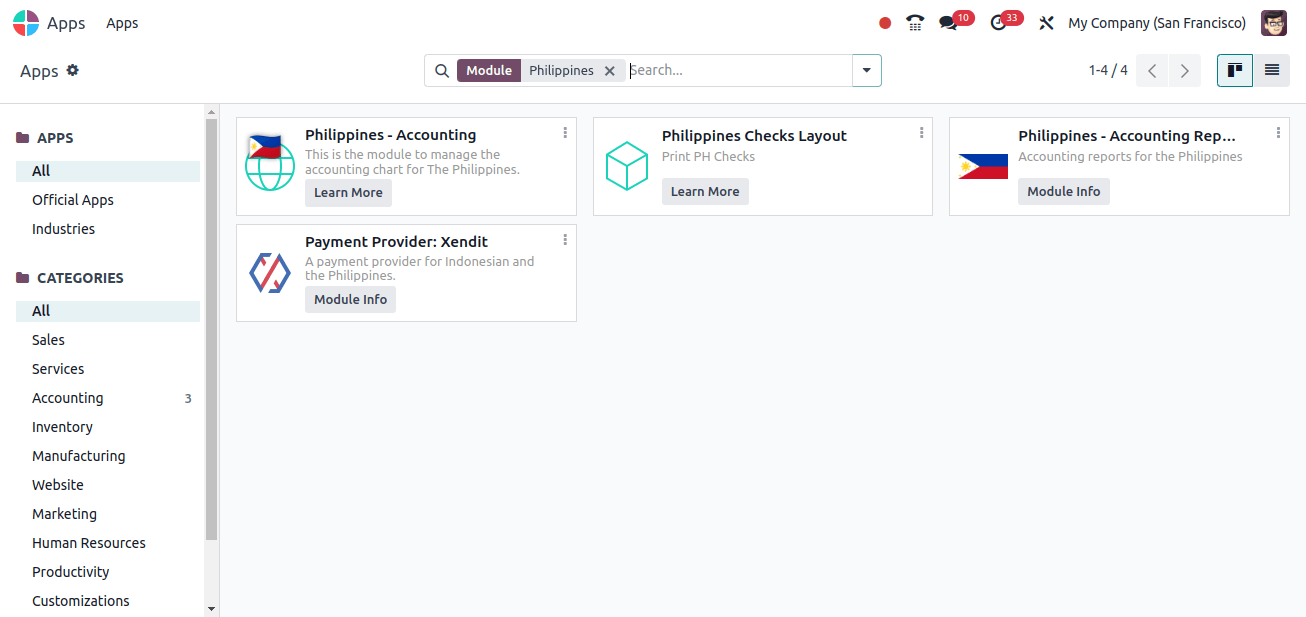

Go to Apps and install the modules required to set up the accounting localization for the Philippines.

Once the Philippine accounting localization modules are installed, it’s easy to check whether the company is configured correctly.

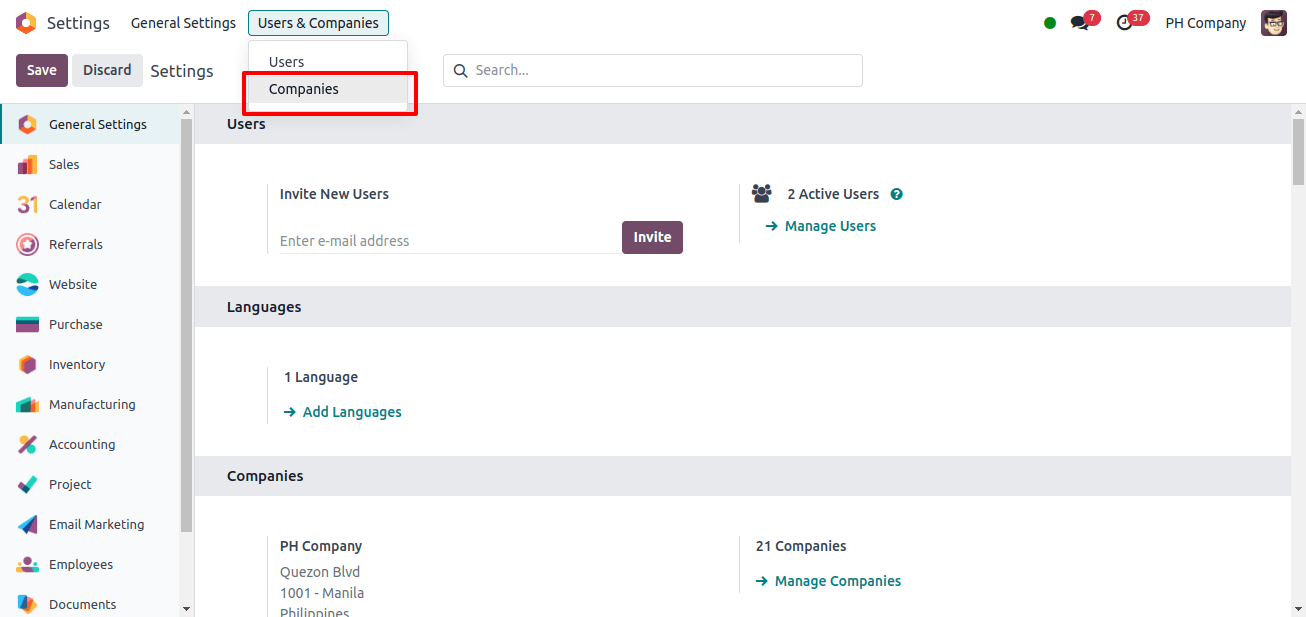

Go to Settings > Users and Companies > Companies.

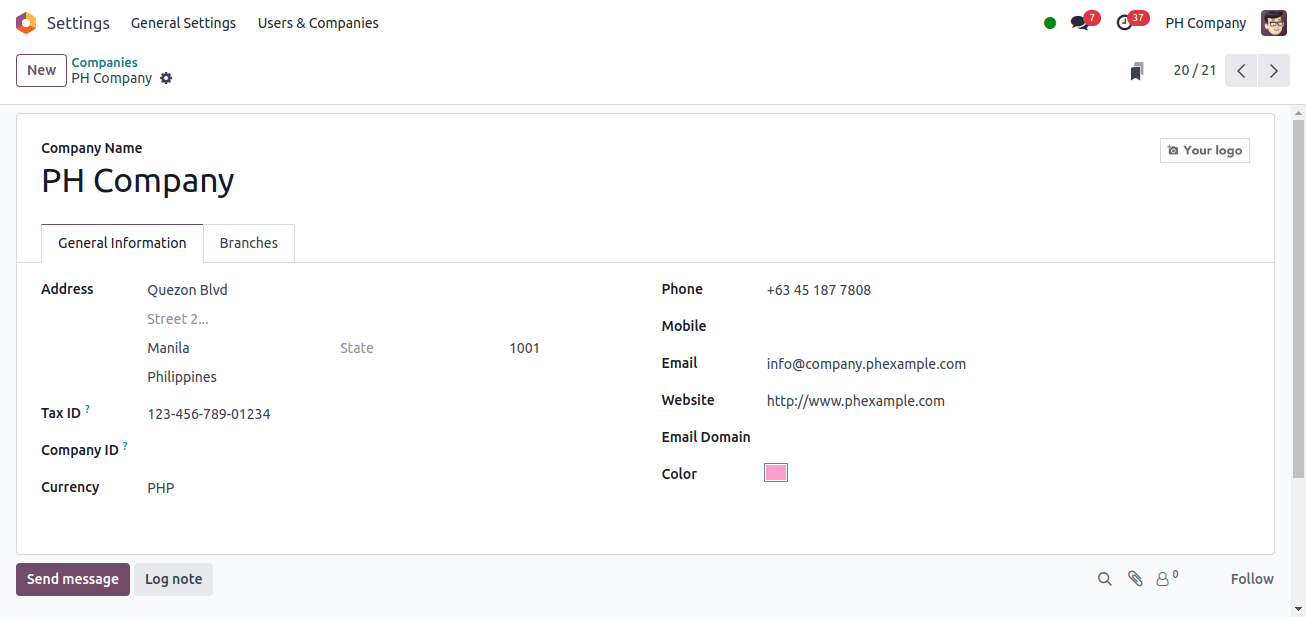

Now it’s easy to select a company and verify that all the details are correct. If required, we can also set up a new company and configure it with specific requirements as per the country’s accounting localization standards. Now, choose the company and check its configuration.

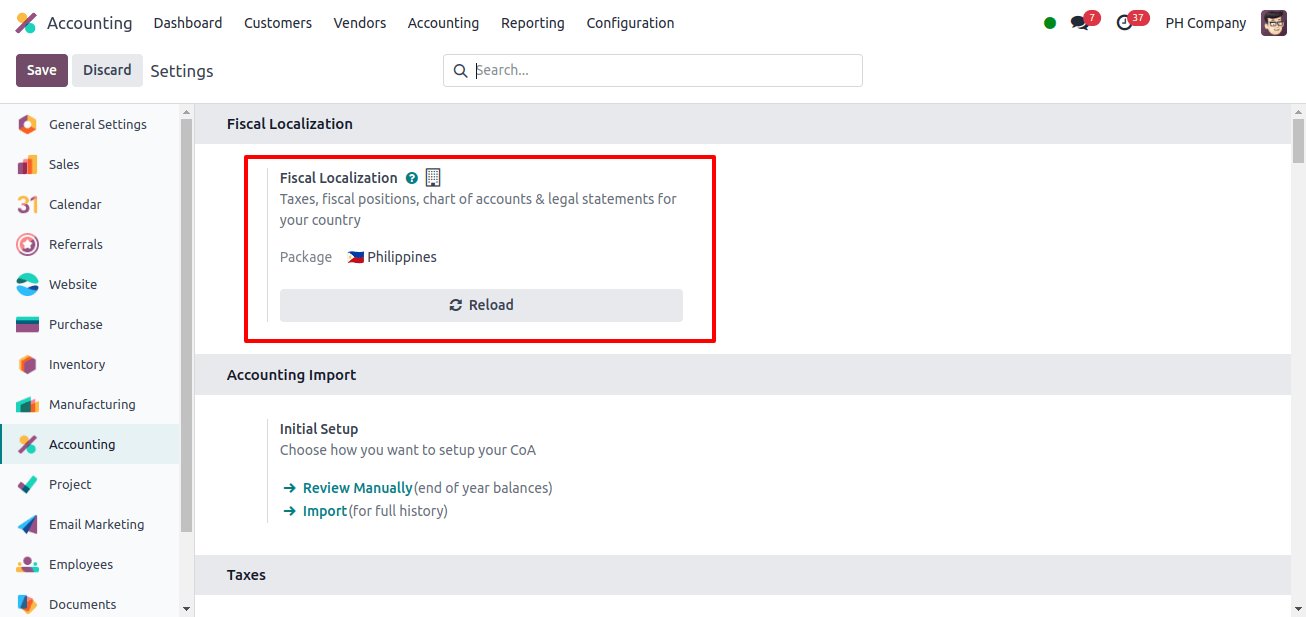

After checking the company configuration, In the Accounting module, go to Configuration > Settings, and check the fiscal localization, which will be set to the Philippines.

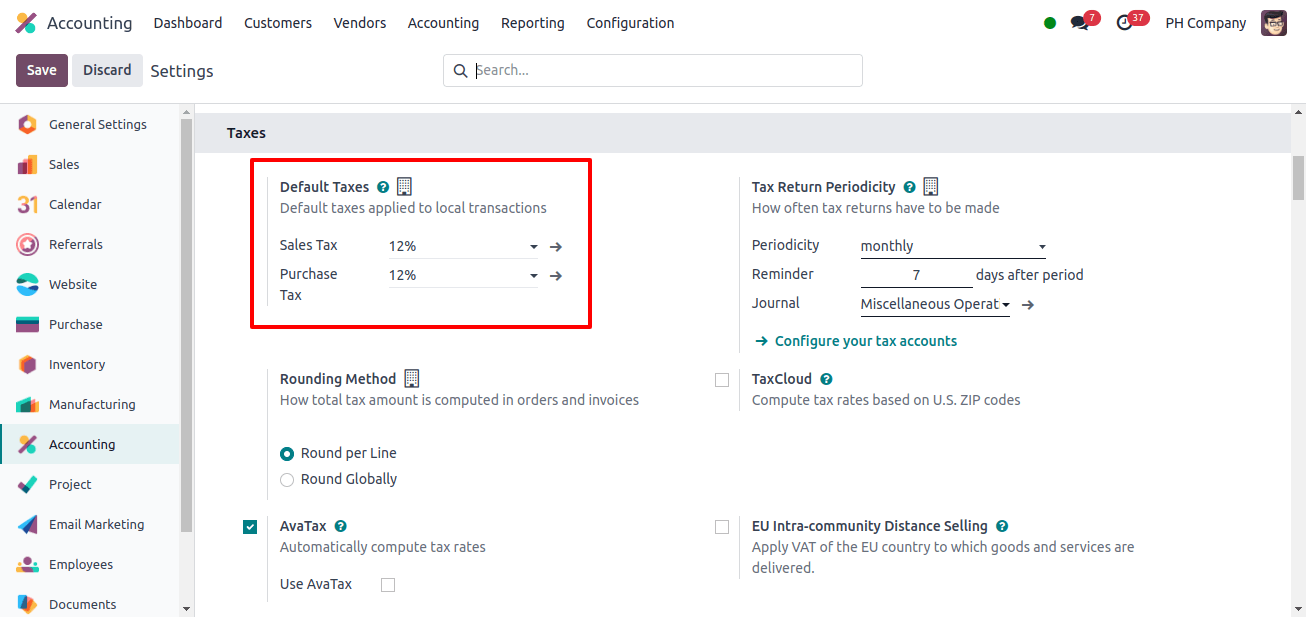

Now the default tax will be set as per the country’s localization which is 12% Sales and Purchase Tax.

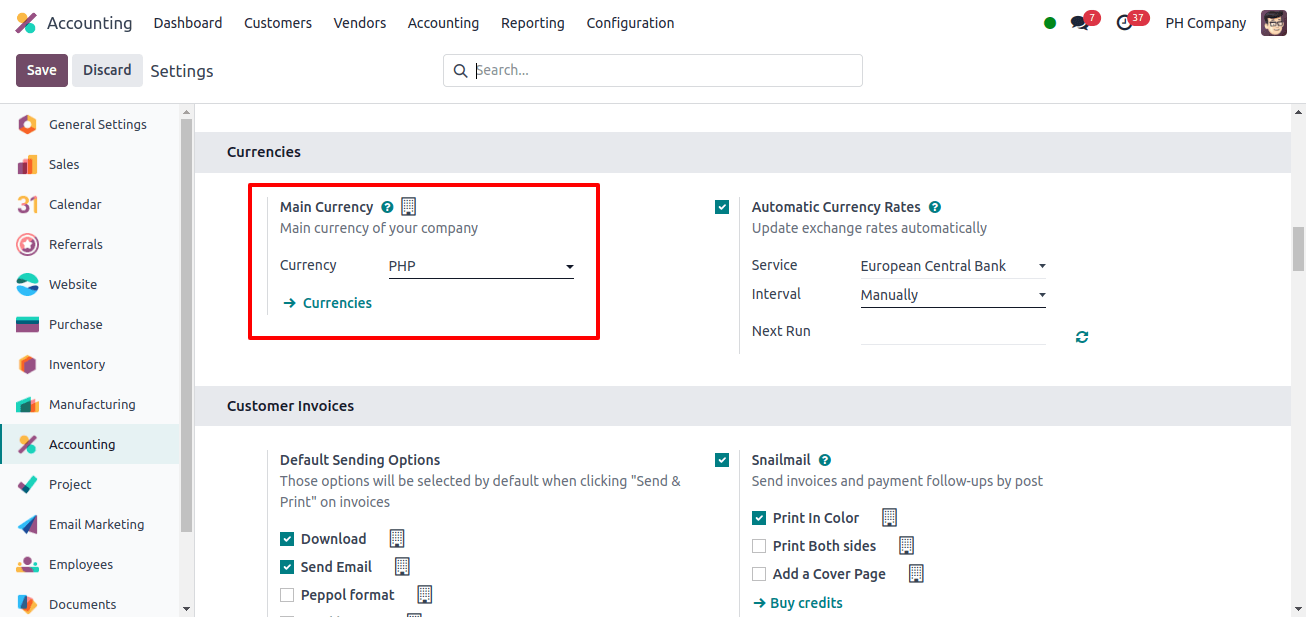

The country’s currency will be configured to Philippine peso (PHP) which is the official currency of the Philippines.

Also configure the Chart of Accounts, Taxes, journals, etc. as per countries localization.

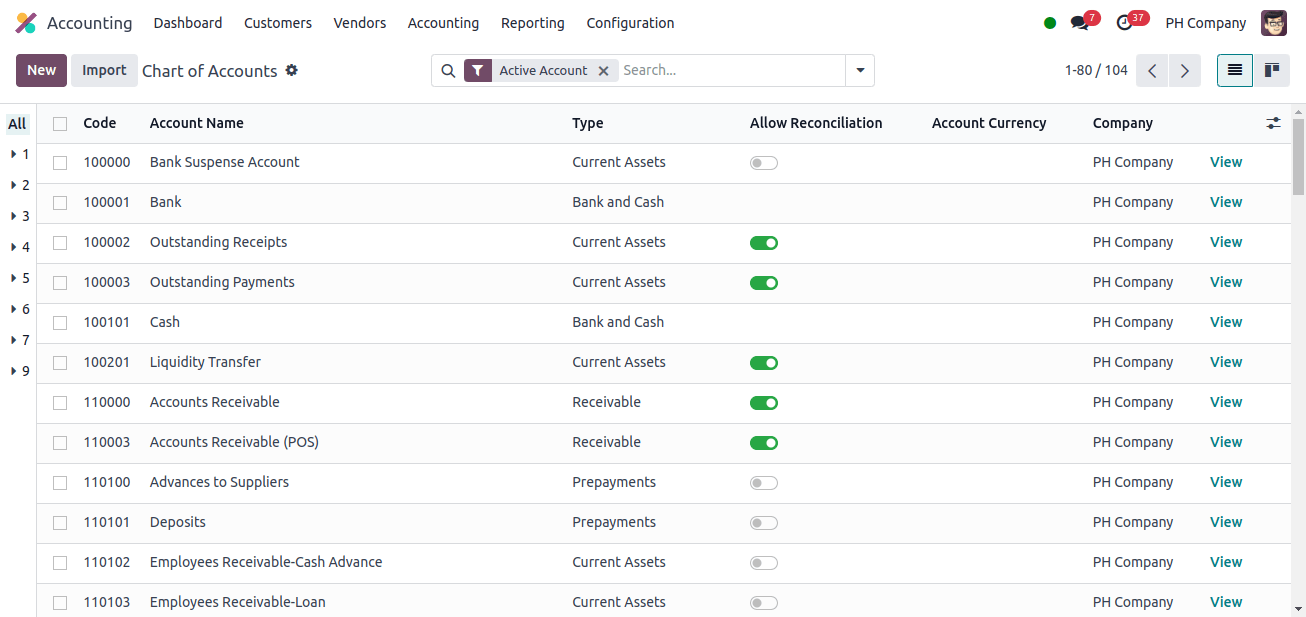

Chart of Accounts

Chart of Accounts provides the basic structure for classifying financial transactions. It has a detailed inventory of every account that a company uses, broken down into sections for income, expenses, liabilities, equity, and assets.

For Philippines users, Odoo provides a default Chart of Accounts that aligns with local accounting standards, with specific accounts for VAT transactions.

While maintaining accurate and efficient financial management, businesses can easily customize the Chart of Accounts as per their specific needs.

When we install the Philippines localization module, we install a minimum configuration Chart of Accounts, which includes the fundamental Charts of Accounts and the accounts needed to conduct the business in that nation.

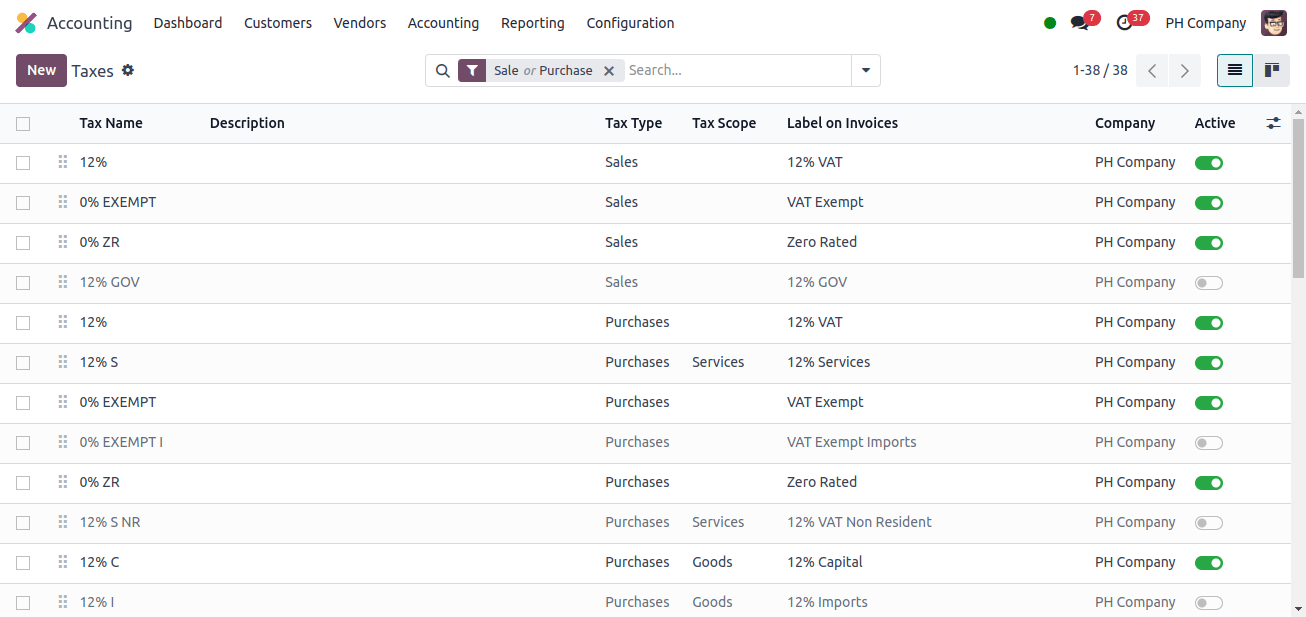

Taxes

As mentioned before, the Philippines localization, taxes required for the operations of that country are configured such as Sales and Purchase VAT 12%, Sales and Purchase VAT ExemptSales and Purchase VAT Zero-Rated, Purchase Withholding.

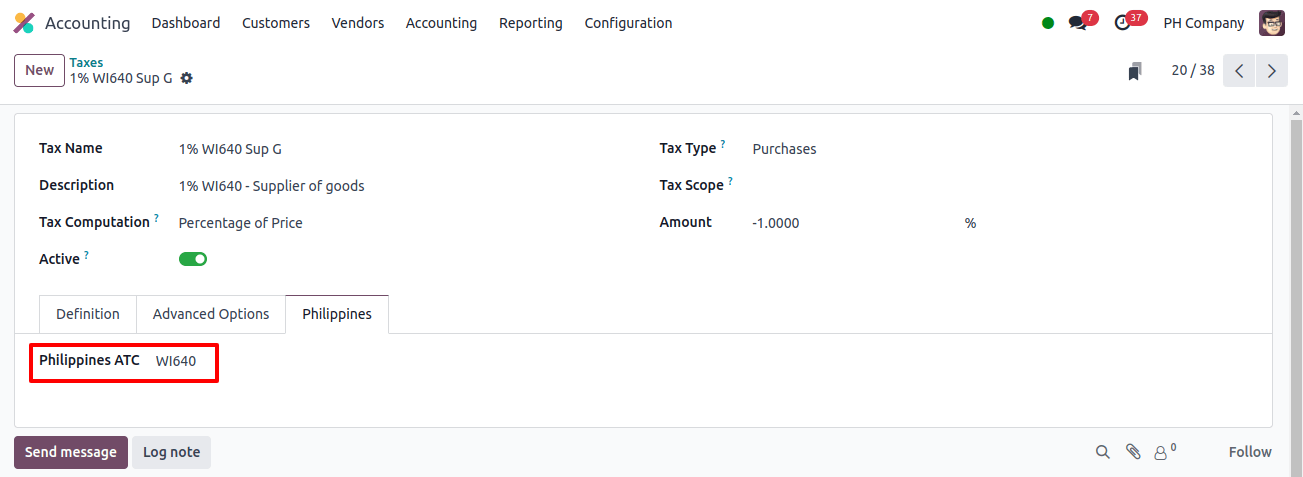

There is an additional Phillipines tab under taxes, and for withholding taxes, there is an additional field under the Phillippines tab for Philippines ATC. Businesses that properly assign ATC codes to transactions can provide compliant tax returns and reduce the risk of tax-related penalties.

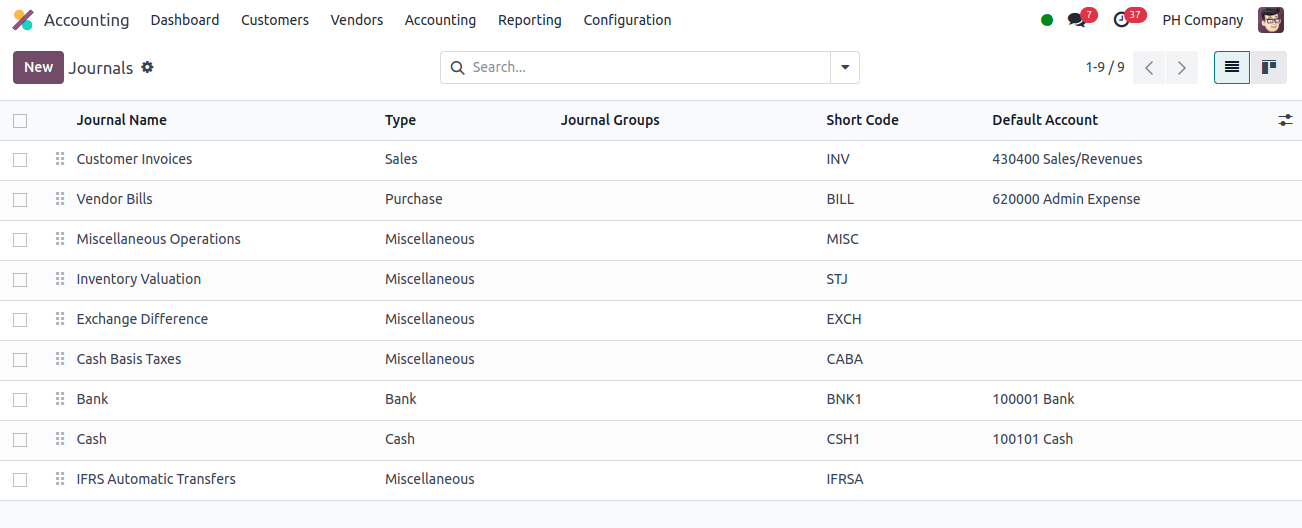

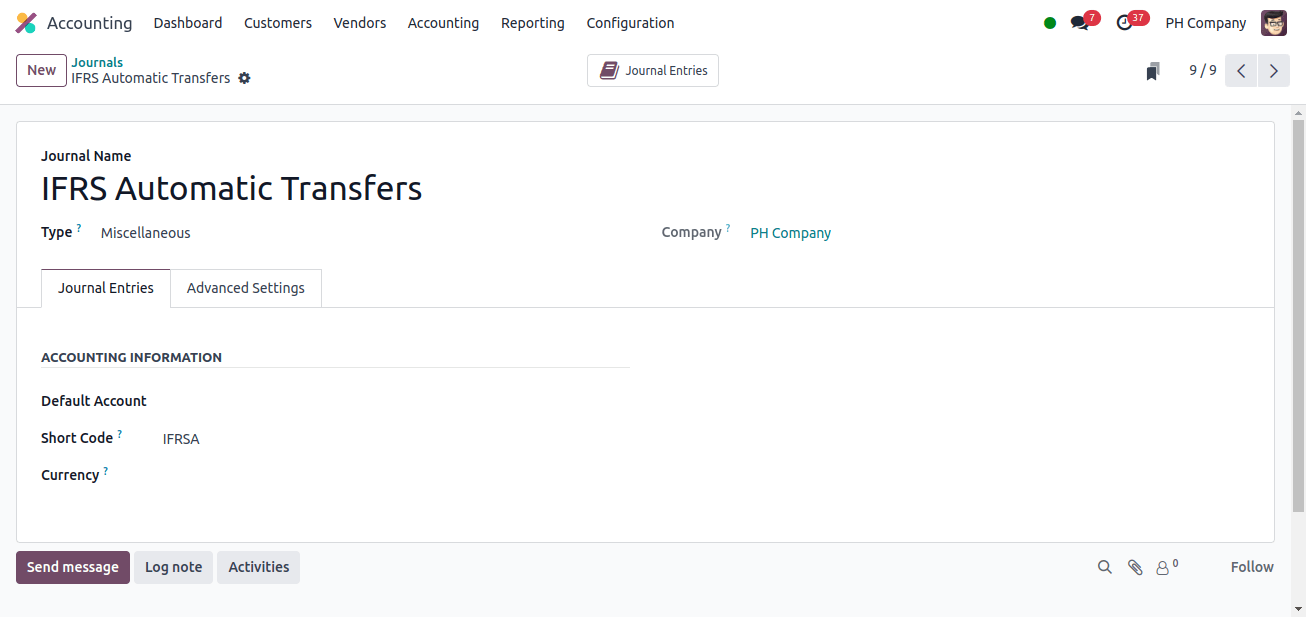

Journals

Journals give an organized record of all of your financial activity by recording all financial transactions and serving as the foundation for your accounting system.

The Philippines localization of journals includes all of the important journals, as well as IFRS Automatic Transfers.

Contact

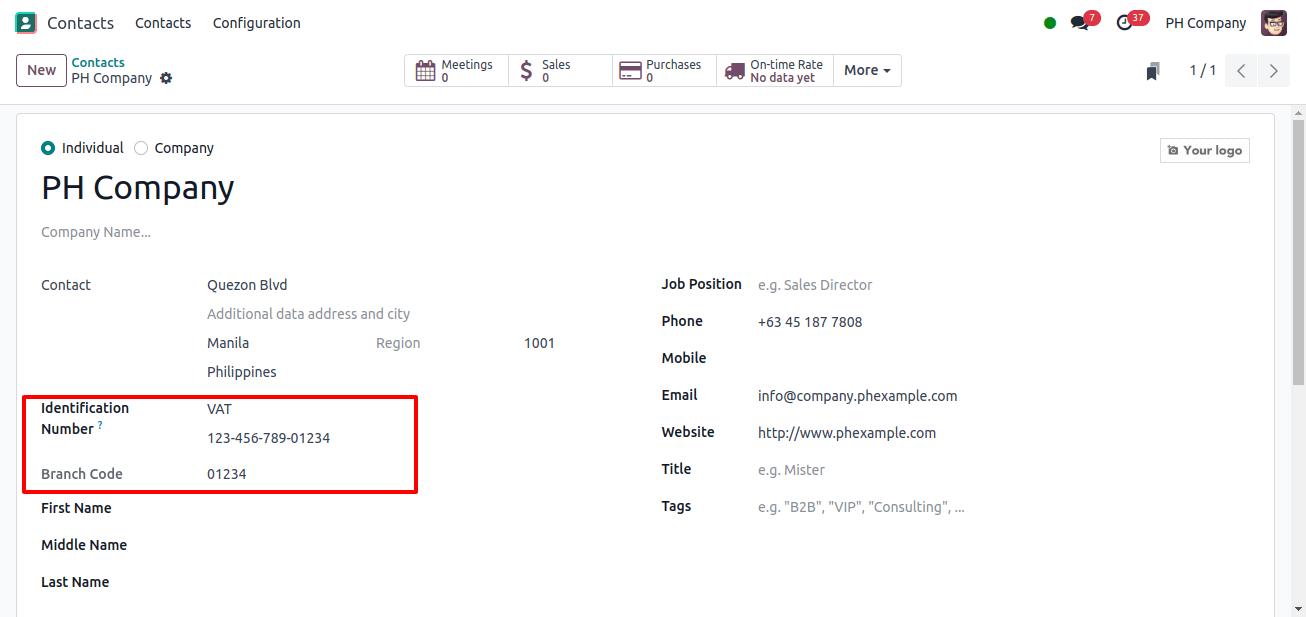

For a business or personal contact in the Philippines, the Tax ID field can be filled with their Taxpayer identification number (TIN), which must follow a specific format.

When adding a new contact, there is a field for the Tax ID, where you can enter their Taxpayer Identification Number. Individuals must also enter additional fields such as First Name, Middle Name, and Last Name to complete their contact information.

The TIN should be formatted as NNN-NNN-NNN-NNNN, with N being a number. An optional branch code field can be inserted after the TIN. The TIN is required to prepare accurate tax returns such as BIR 2307.

Maintaining accurate TINs improves the system’s capacity to sustain data integrity. Odoo may use TIN data to fill out a variety of government forms and reports.

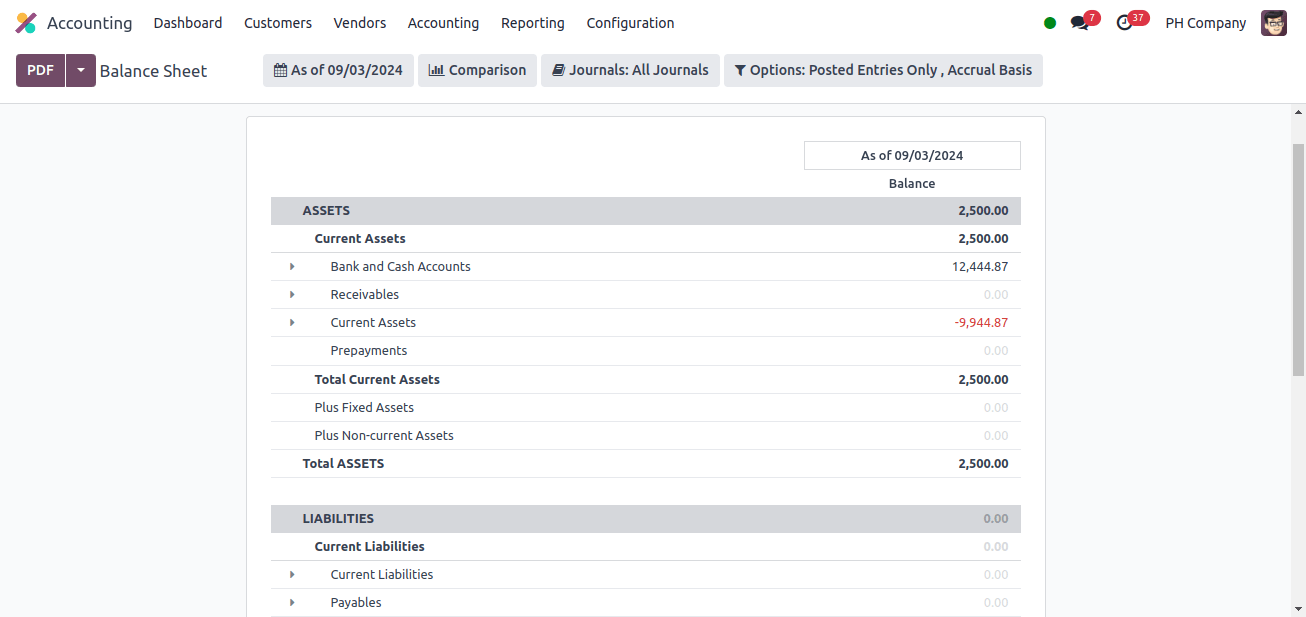

Balance Sheet

The balance sheet is a fundamental financial statement in accounting, and it is especially important in the context of Philippine accounting localization. It provides an overview of a business’s assets, liabilities, and equity at a specific point in time.

Assets reflect economic resources. The balance sheet shows what a company owns. These assets can range from cash and merchandise to property and equipment.

Odoo provides the tracking, management, and depreciation of these assets, resulting in accurate financial reporting. Under Assets, we can see the current assets, total current assets, total assets. Liabilities refer to a company’s financial commitments or debts.

Liabilities in Odoo’s accounting module track what the company owes, ranging from short-term debts such as supplier invoices to longer-term loans. Effective liability management is important for financial stability.

Under Liabilities, we may see current liabilities, total current liabilities, and total liabilities. Equity is the amount remaining after deducting all debts from the company’s assets.

Unallocated Earnings, Current Year Unallocated Earnings, Total Unallocated Earnings, Current Year Earnings, and Total Equity are all available under Equity.

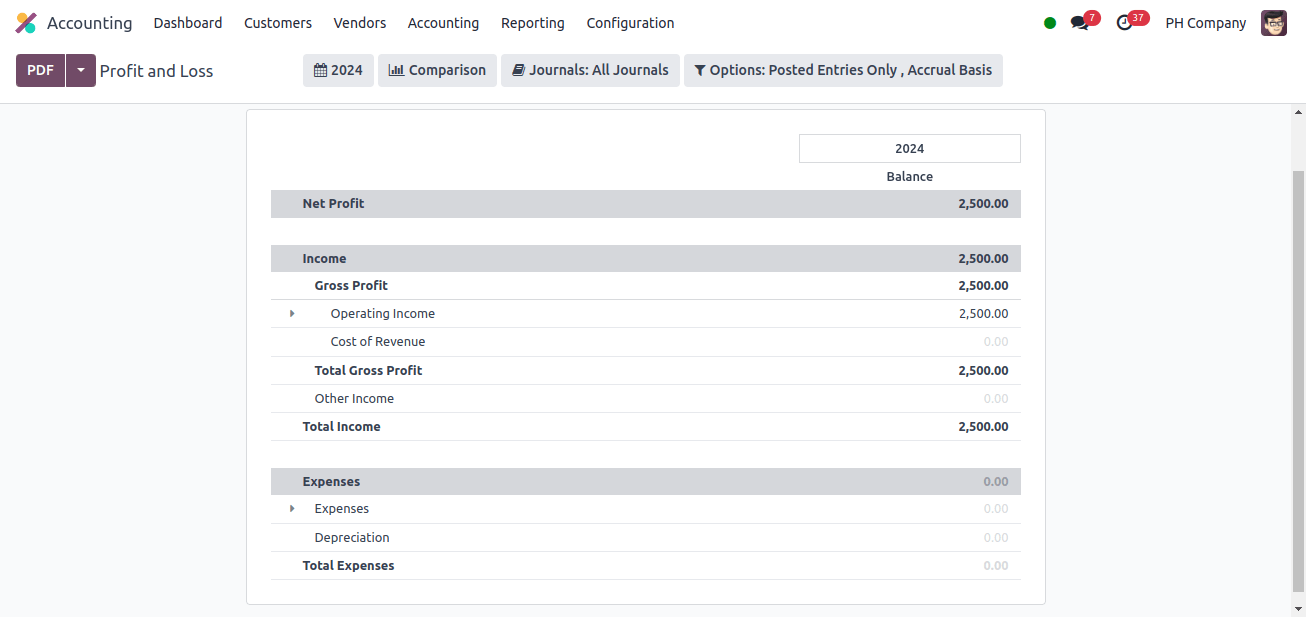

Profit and Loss

A profit and loss report in Odoo Accounting that is designed for the Philippines provides a comprehensive picture of a company’s financial performance over a specific period of time.

This report shows the net profit or loss by summarizing the company’s revenues, expenses, and costs. With the Philippines’ localization, the report follows local accounting standards and tax legislation, ensuring compliance and accuracy.

It simplifies financial analysis, allowing business owners to make better decisions by providing clear insights into their profitability and financial health.

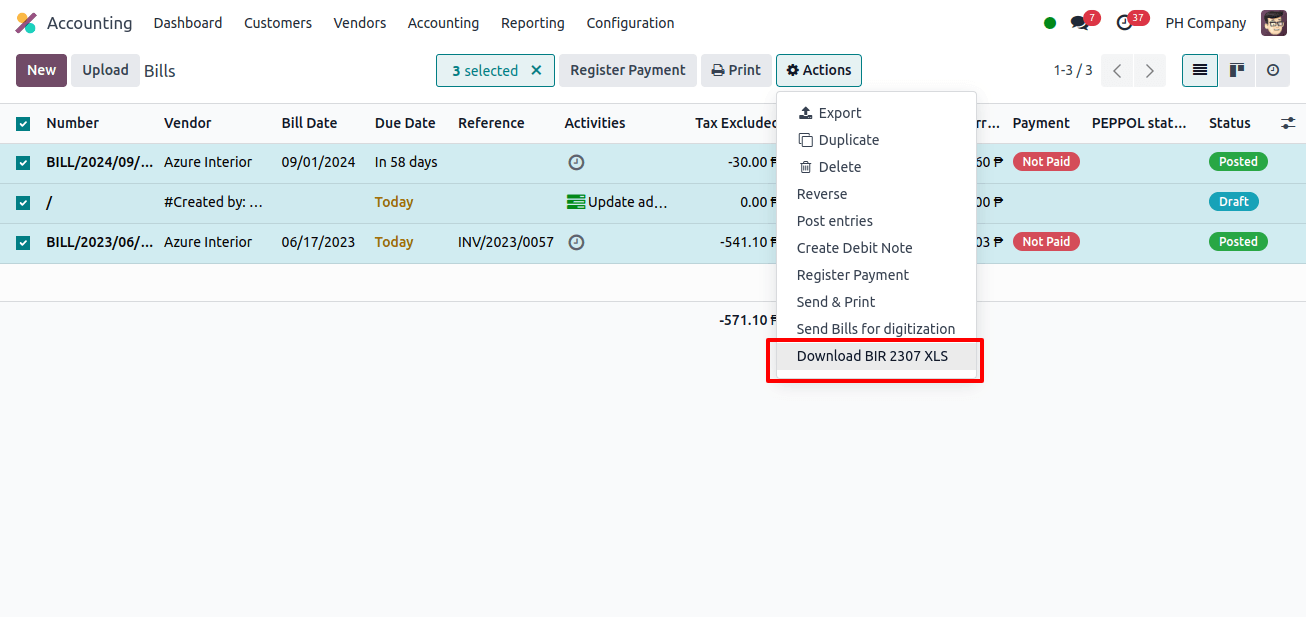

BIR 2307 report

The BIR 2307 report in Odoo Accounting, for the Philippines localization, is an important document for businesses to manage and report withholding taxes.

This report shows the taxes withheld from various transactions, such as purchase orders and vendor invoices, in compliance with Bureau of Internal Revenue (BIR) standards.

Odoo Accounting automates the preparation of the BIR 2307 report, assuring accuracy and compliance with local tax regulations. This helps firms expedite their tax operations, maintain accurate documentation, and avoid potential penalties for noncompliance.

To generate the BIR 2307 report, go to Accounting > Vendors > Bills, select one or more bills, and then click on Actions, which includes the option Download BIR 2307 XLS.

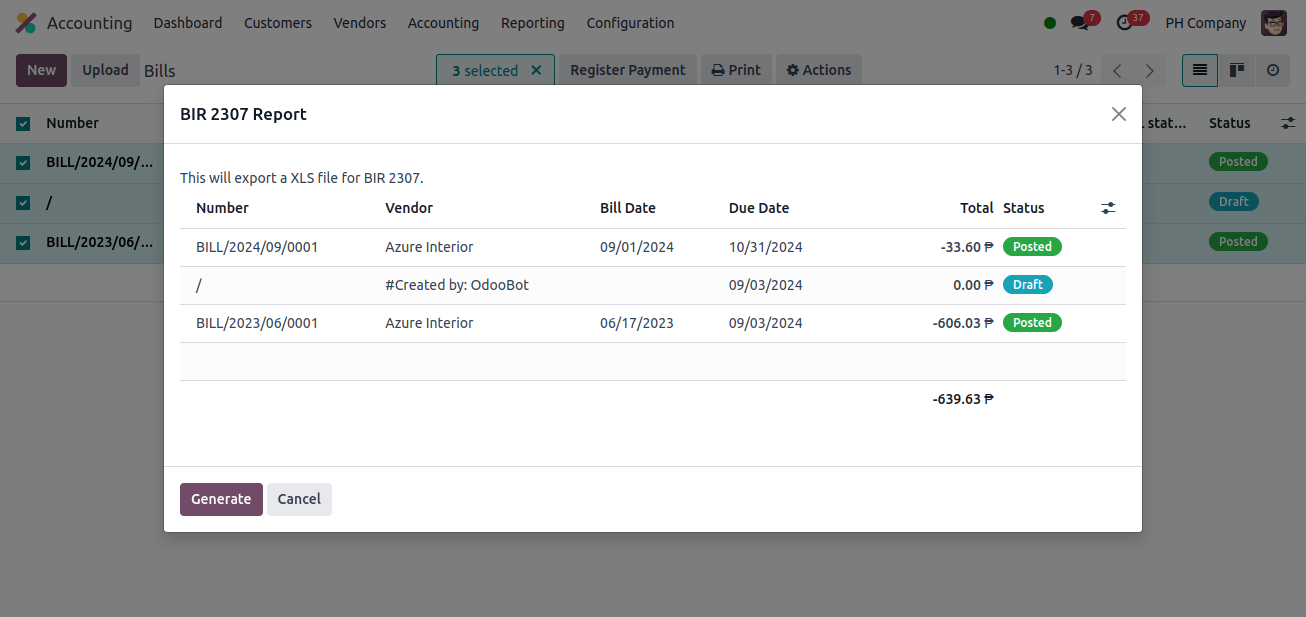

When we click that, a pop-up window appears, allowing us to evaluate our option before clicking Generate.

The Form_2307.xls file is then generated, containing a list of all vendor bill lines as well as the applicable withholding tax. If no withholding tax is imposed, the XLS file will not contain any data for specific vendor bill lines. When multiple bills are combined, Odoo divides the funds based on the contract.

When do you pick Action? When you download BIR 2307 XLS from a payment, it generates a report with only the vendor bills linked with that contact. Odoo cannot create the BIR 2307 PDF report or DAT files directly. Export the generated form_2307.xls file to PDF or BIR DAT format using an external tool.

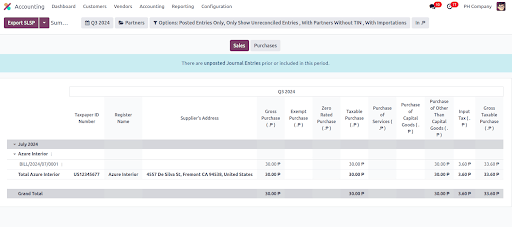

SLSP Report

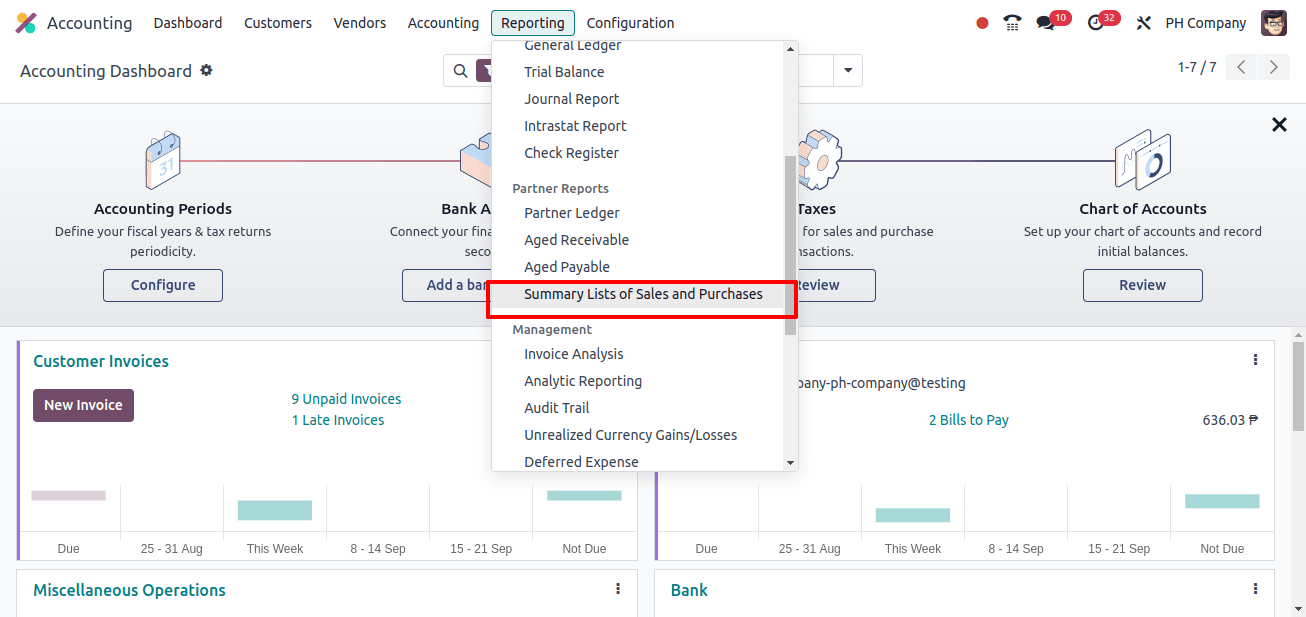

The summary list of sales and purchases, or SLSP report, is available for viewing and exporting in XLSX format. We may find the report by going to Reporting > Partner Reports > Summary List of Sales and Purchases.

The report is separated into two sections, each with a button at the top to access them.

Sales for SLS report

This report displays all client invoices that include the applicable sales tax.

Purchases for SLP report

This report includes all vendor bills, together with the applicable purchase taxes.

Journal entries involving partners who have import taxes set or do not have a TIN number assigned are automatically excluded from both reports. The options: button provides additional filters, such as the following, which can be displayed or concealed:

- Taking Imports Into Account.

- Comprising of Partners Devoid of TIN.

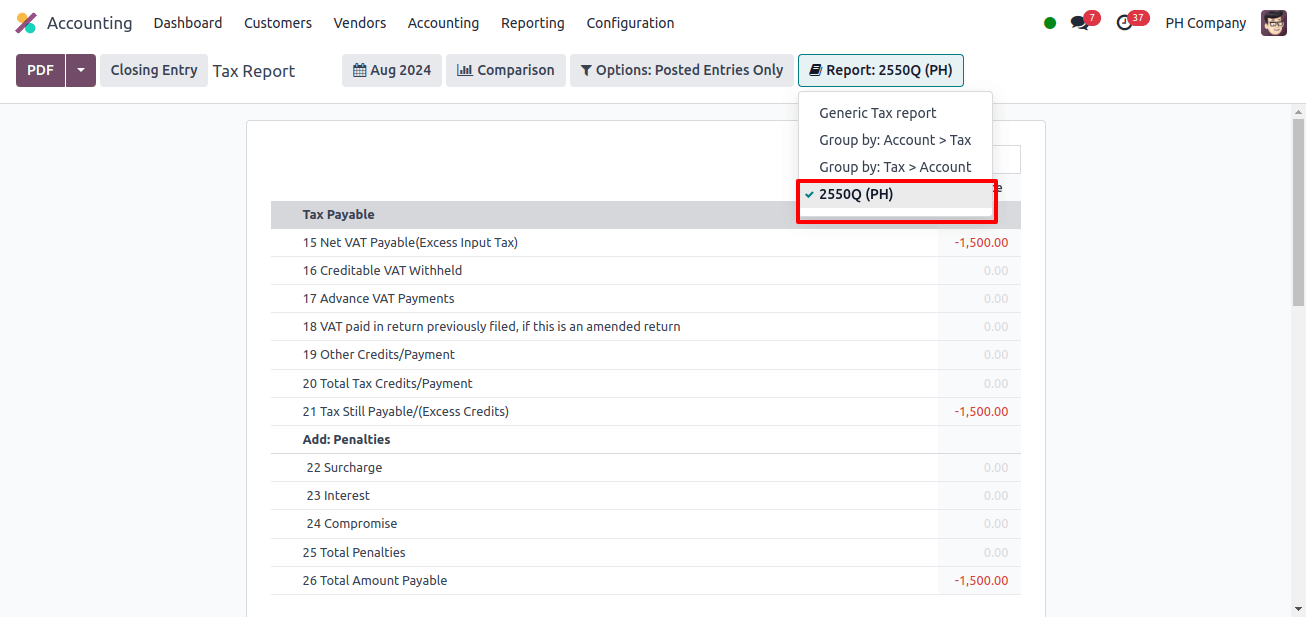

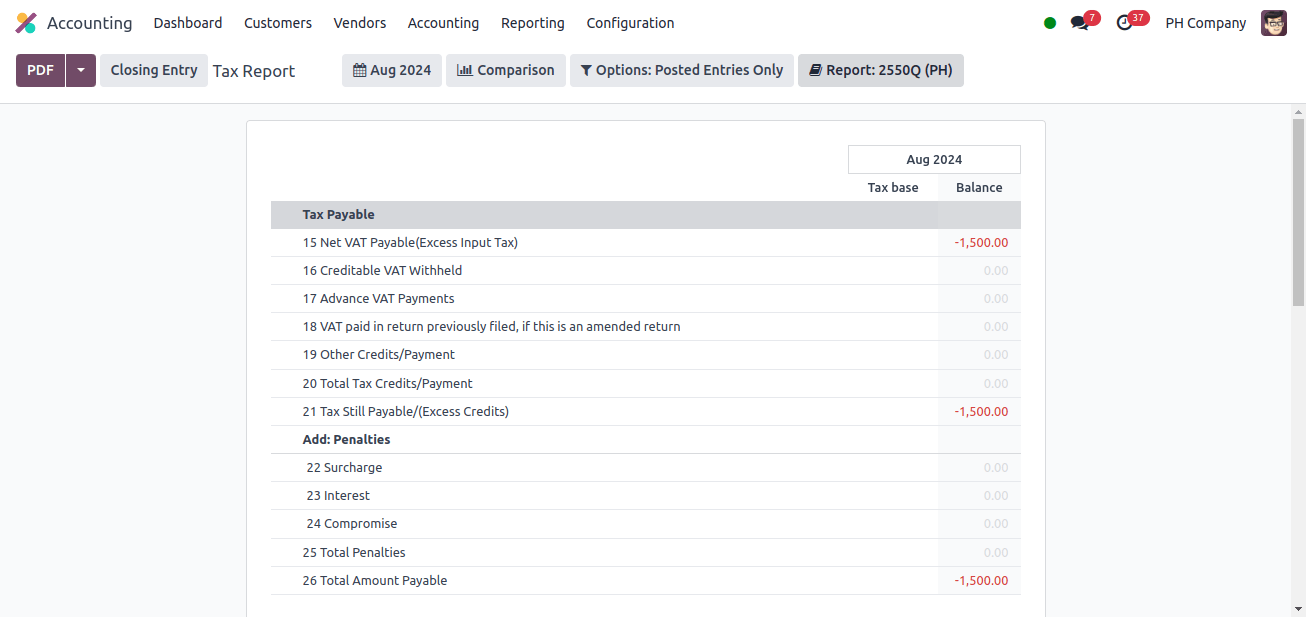

2550Q Tax Report

The 2550Q Tax submit with Philippines localization is required for businesses to appropriately submit their quarterly value-added tax (VAT) obligations.

This report documents all value-added tax transactions to ensure that people follow the Bureau of Internal Revenue’s (BIR) requirements.

Odoo Accounting speeds up the process of the 2550Q report by automating data gathering and calculation, lowering the chance of issues and simplifying the filing process.

Businesses can use this tool to ensure timely and accurate tax payments, avoid penalties, and improve overall financial management.

We can go to Accounting > Reporting > Tax Reports > 2550Q (PH).

This form is based on the most recent 2550Q (Quarterly Value-Added Tax Return) filed in January 2023.

The majority of the tax report’s lines are automatically generated based on the taxes. The tax report can be linked to manually entered journals. Using pre-configured Tax Grids for each tax report line leads to more accurate reporting and filing.

Odoo cannot directly create the 2550Q BIR prepared PDF report. When submitting the form externally, whether physically or online, it should be used as a guide.

In conclusion, Odoo Accounting with Philippines localization provides a comprehensive solution for companies dealing with the difficulties of local tax rules.

Odoo ensures BIR compliance by providing automated and accurate reports like BIR 2307 and 2550Q.

Adopting Odoo Accounting allows businesses in the Philippines to focus more on growth and strategic planning, knowing that their accounting operations are dependable and compliant.