Switzerland is known for its complicated financial regulations and multilingual environment, which can provide considerable complexity to businesses. Odoo 17, a renowned ERP software, has customized its accounting features to match these special requirements.

We may analyze how Odoo 17 satisfies Swiss accounting standards, such as local VAT compliance, Swiss GAAP conformity, and other market-specific needs. Businesses may assure accurate financial reporting and effective operation management by using Switzerland-specific tools and capabilities.

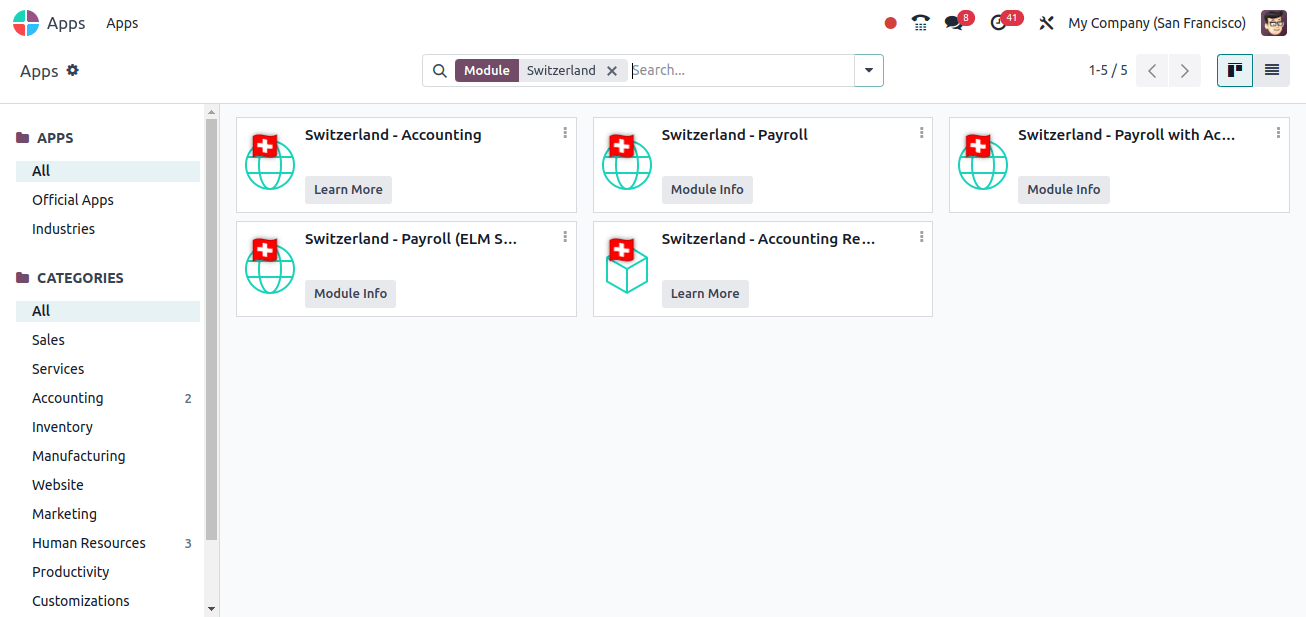

To enable Switzerland accounting localization in Odoo 17, we may either pick Switzerland as the Country when creating the database or install the accounting localization modules. Go to Apps and look for the right localization modules.

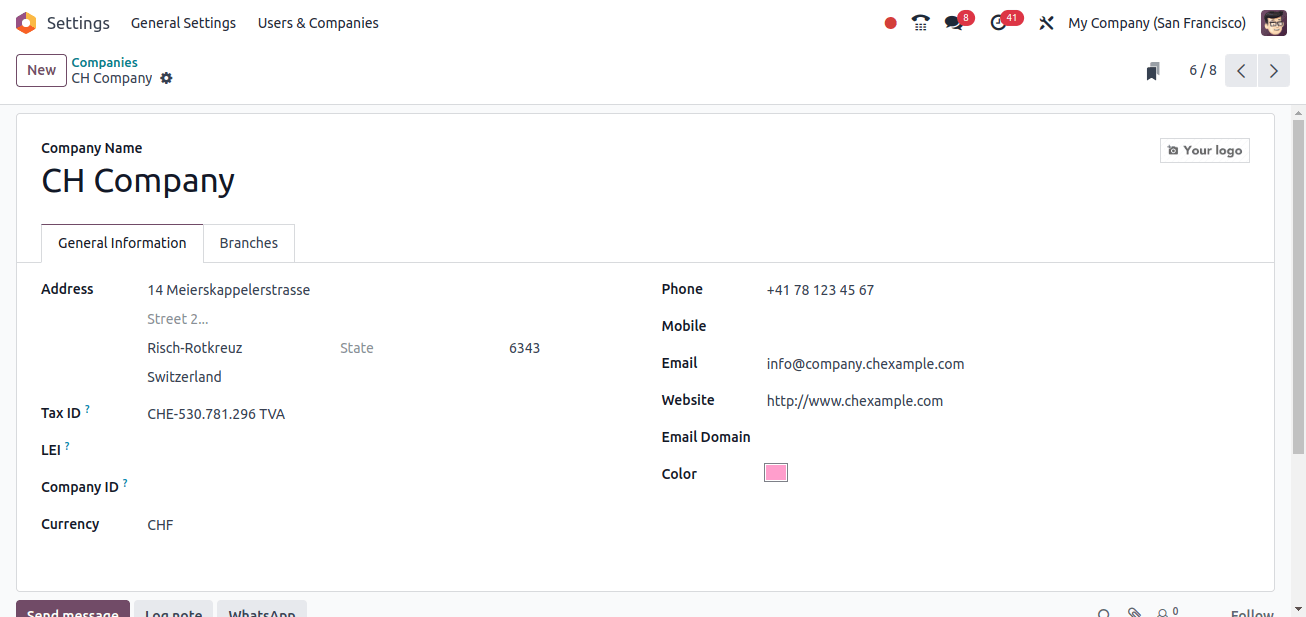

To ensure accurate data and functionality in Odoo, please confirm the present company structure, or we can form a new business with the relevant details if required. This setting establishes important information about your company.

Go to Setting > Users and Companies > Companies, and then choose the form from the list to analyze its configuration.

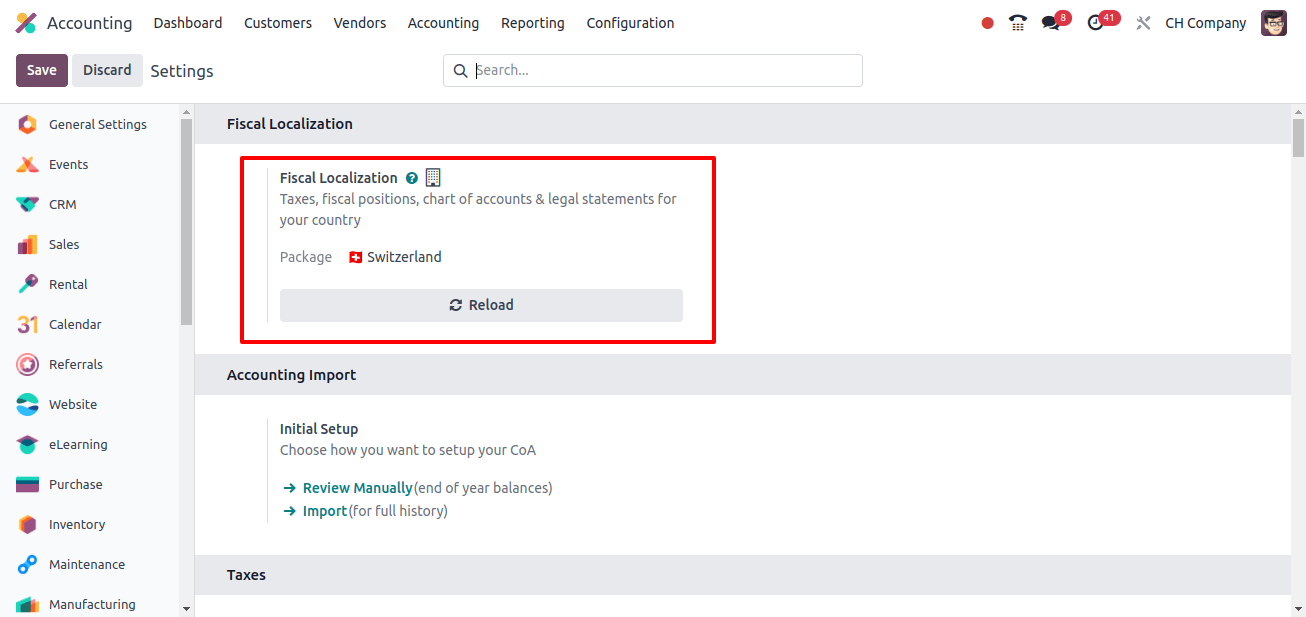

After installing the Switzerland localization and verifying the proper company details, we can go to the configuration page to see the changes for this localization. Go to Accounting > Configuration > Settings to see the fiscal localization set to Switzerland.

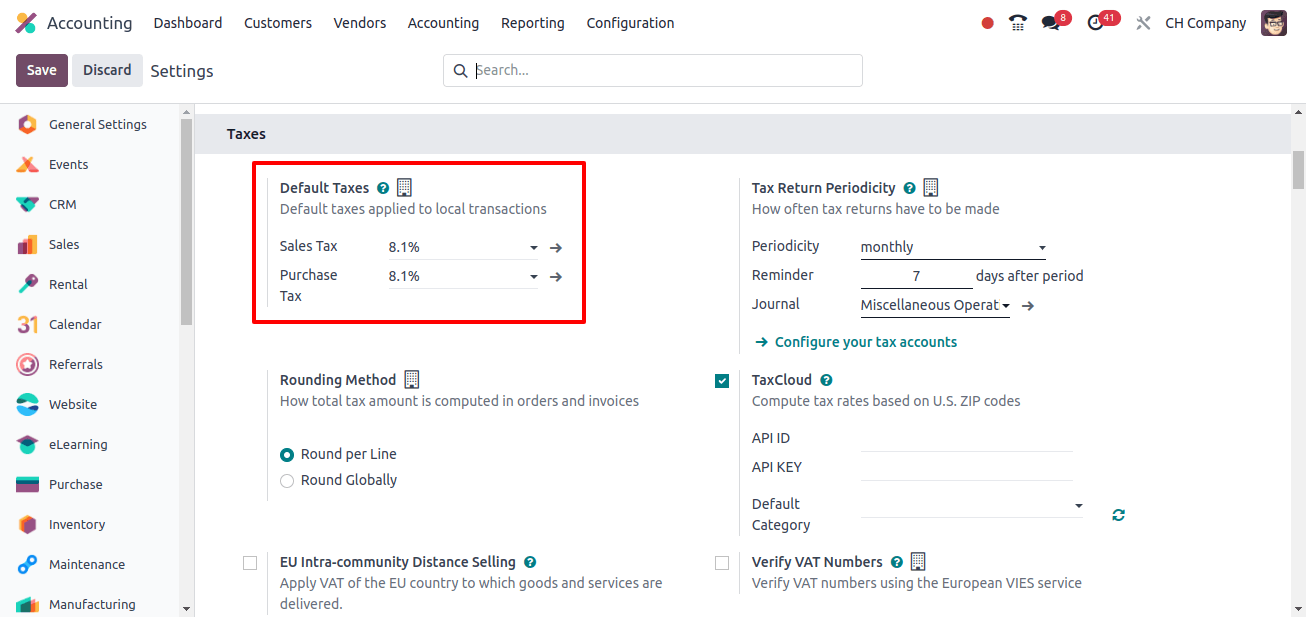

Default Taxes can be found in the Taxes section. Default taxes are predefined tax settings that are automatically applied to transactions based on the tax category.

These options help to ensure accurate tax computations and ease the invoicing process by using the proper tax rates based on specified guidelines. So, when we install Switzerland Accounting Localization, the default tax will be set based on the country’s localization.

The Sales and Purchase Tax is set at 8.1%, and it will be applied to all transactions by default.

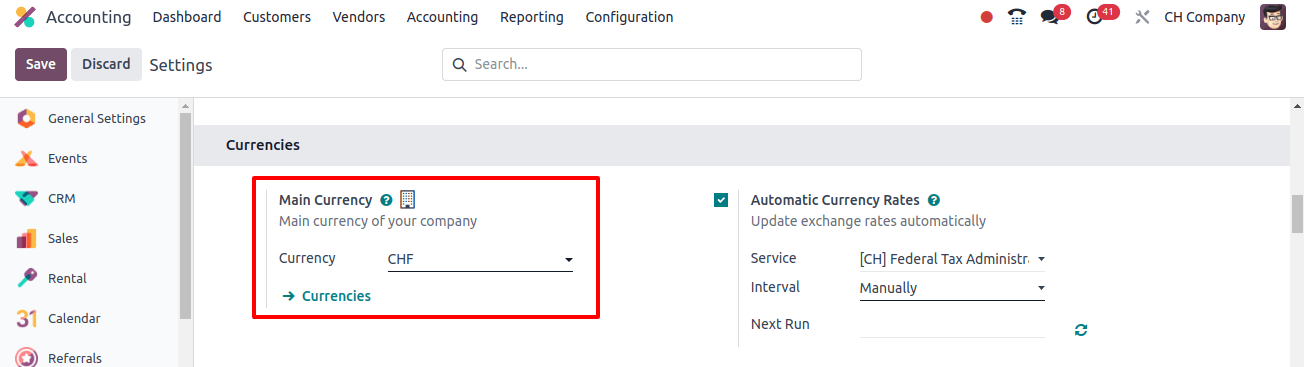

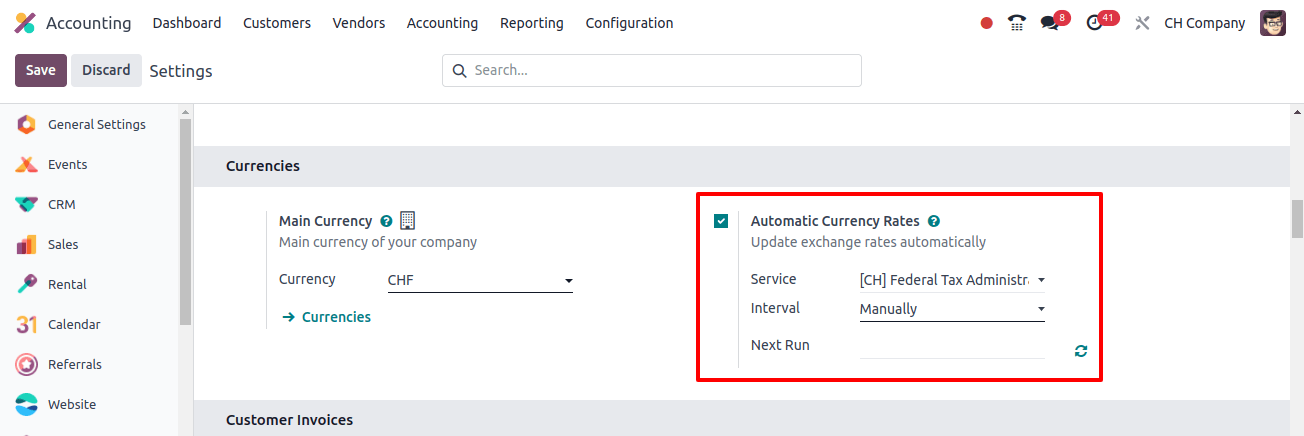

Also, under the Currencies section, the Main Currency for all company transactions will be set at the Swiss franc (CHF), Switzerland’s official currency.

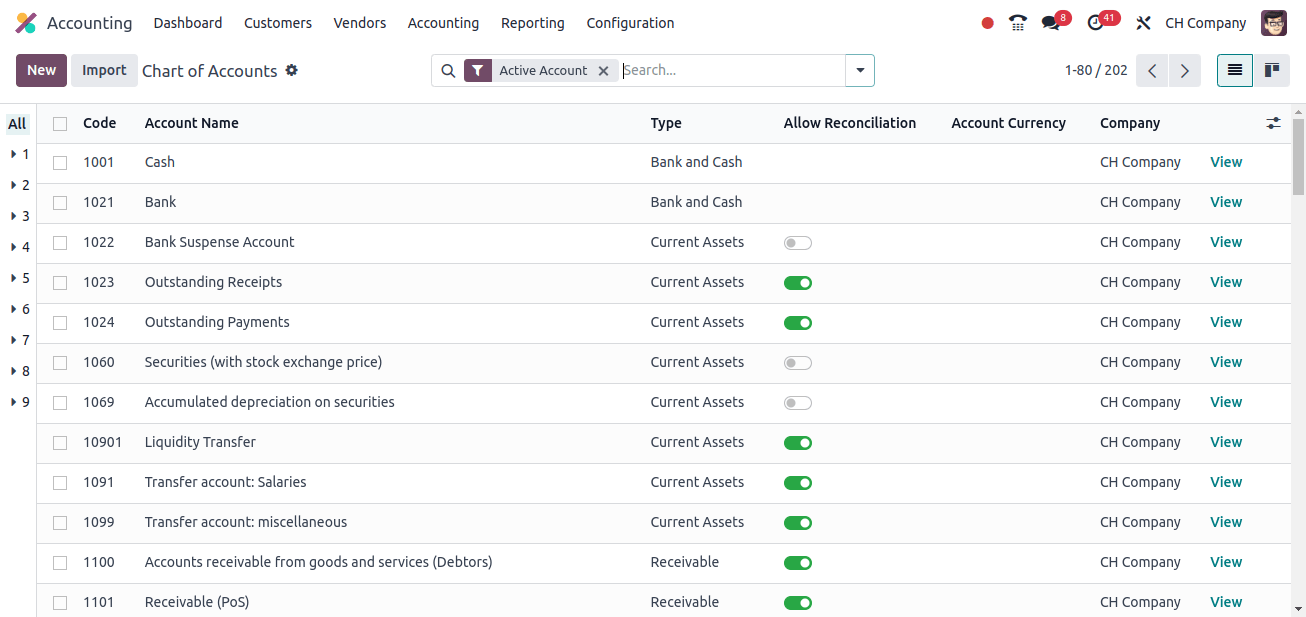

We can analyze the Chart of Accounts and Journals that are created with the installation of Switzerland Accounting localization.

* Chart of Accounts: The Chart of Accounts is an organized list of all financial accounts used by a company to record transactions. It categorizes accounts into assets, liability, income, and spending, establishing a foundation for systematic financial and management.

All of the fundamental Chart of Accounts are provided, as well as other accounts designed to make it easier to complete Swiss accounting activities such as input tax (VAT) receivable on investments and other operating expenses.

It is the VAT that a company pays on its purchases or expenses as receivable, which it may be able to reclaim from tax authorities. This account records VAT on purchases made for business reasons, including investments and operating costs.

The Downpayment on Raw Material account in the Chart of Accounts is used to track payments paid in advance for raw materials before they are received or involved.

A similar account is important for tracking and managing prepayments during the purchasing process, and there are multiple more accounts of similar type.

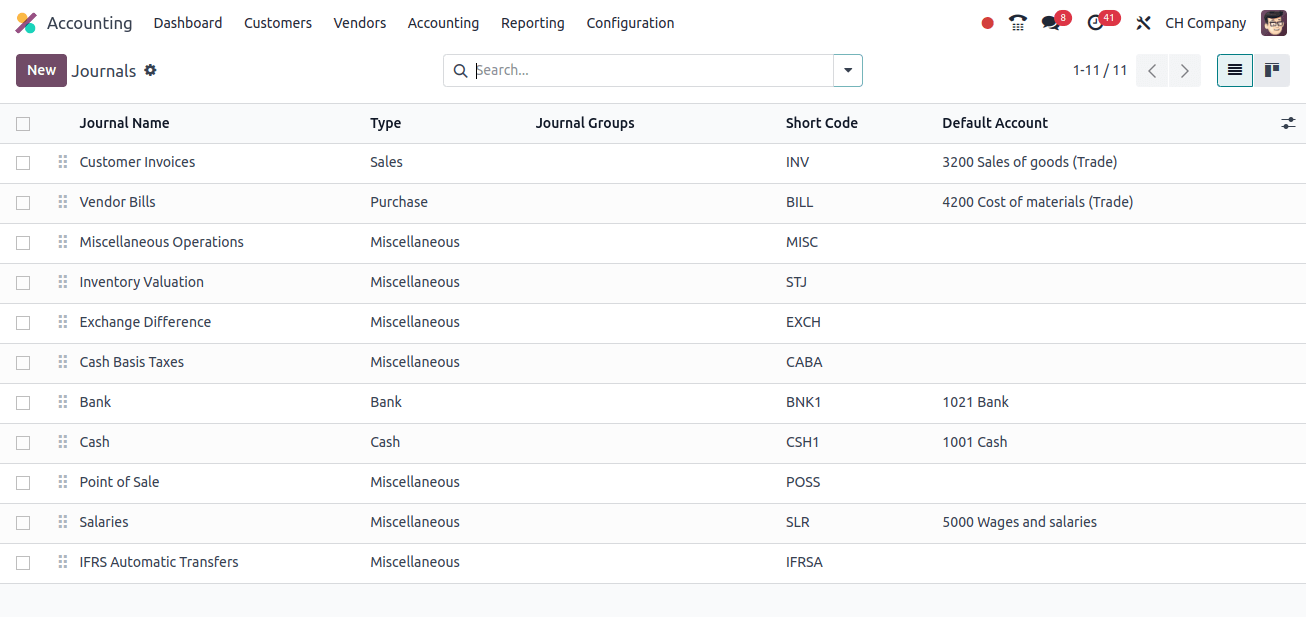

* Journals: In Odoo, journals are records that are used to categorize and track financial transactions. They categorize inputs into certain sorts, such as sales, purchases, or bank transactions. Salaries Journals are specialist journals that record and manage all employee salary transactional

This journal serves to ensure that payroll entries are properly documented and in accordance with the Swiss accounting standards. IFRS Automatic Transfers Journal manages and automates the process of transferring financial data and modifications in line with International Financial Reporting Standards (IFRS).

This Journal is especially beneficial for companies that must maintain compliance with IFRS accounting standards, which apply globally and in Switzerland for certain companies.

Key Features of Odoo 17 for Swiss Accounting

Efficient Management of ISR Payment Slips

In Switzerland, ISR (In-payment Slip with Reference Number) payment slips are commonly used for payment processing. Odoo 17 makes this process easier by allowing you to print ISR slips right from customer invoices. This is how it works.

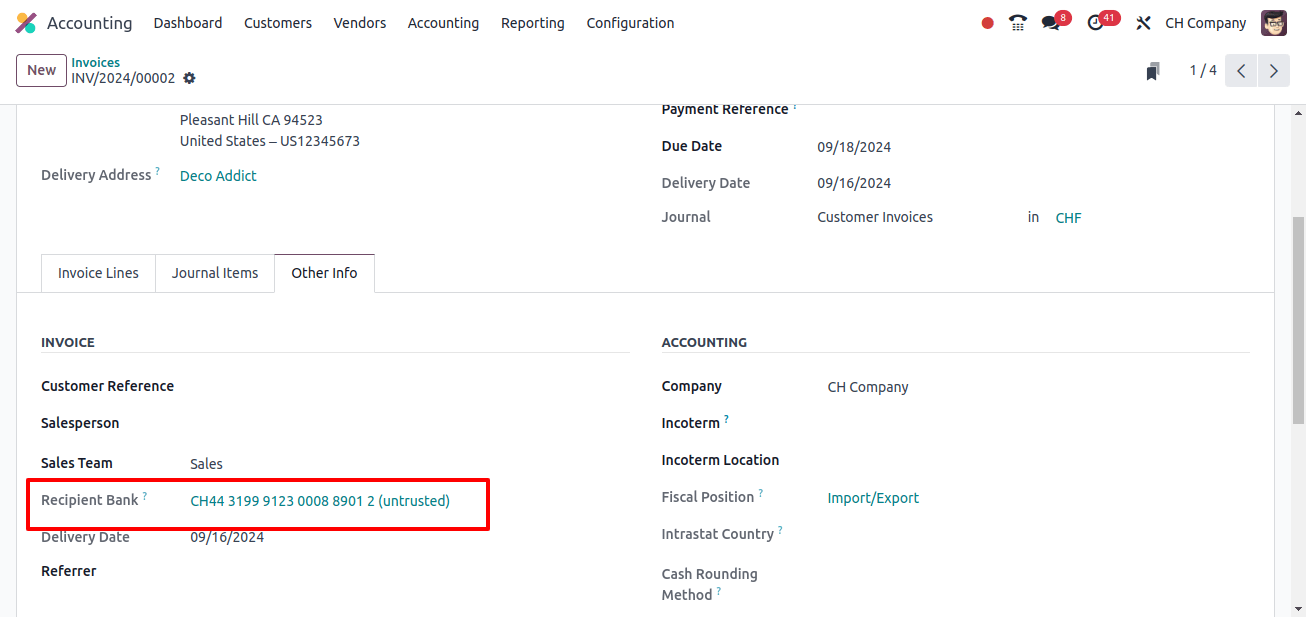

* Printing ISR Slips: On the customer invoices, there is a ‘Print ISR’ button. This tool allows us to create ISR slips for easier payment processing. This button will only appear if a bank is indicated on the invoice.

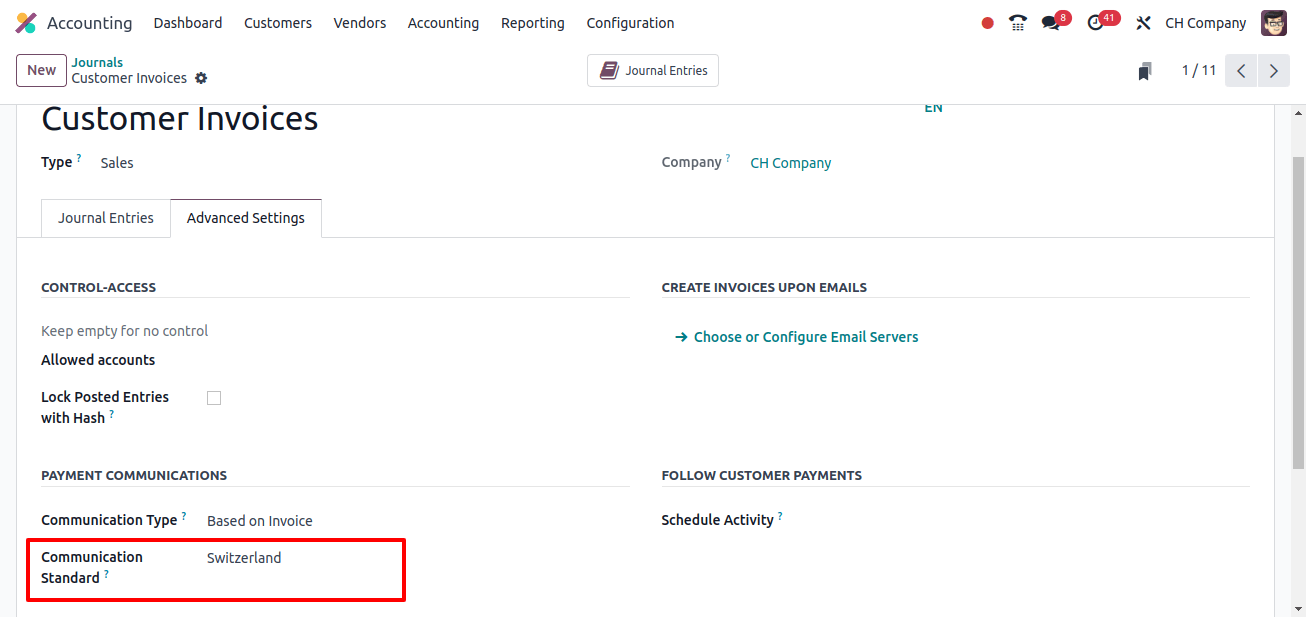

* Adding ISR References: To make reconciliation easier, we can use our ISR reference as a payment reference on invoices. Configure this by clicking to Accounting > Configuration > Journals, then selecting Customer Invoices and editing it.

Under the Advanced Settings tab, update the Communication Standard entry to ‘Switzerland’ and save your changes.

Currency Rate Updates and VAT Adjustments

1. Currency Rate Updates:

Odoo 17 interfaces with Switzerland’s Federal Tax management to keep currency rates up to date. Go to Accounting > Settings, then currencies, where we can select the preferred update service for proper currency translations.

2. VAT Rate Changes: On January 1, 2018, Switzerland enacted new VAT rates:

* Standard VAT Rate: Reduced from 8.0% to 7.7%.

* Reduced VAT Rate for Hotel Sector: Adjusted from 3.8% to 3.7%.

These changes influence how businesses record VAT on sales and purchases, thus we need to update our Odoo system to reflect the new rates.

* Check Your Odoo Version: Ensure that you are using Odoo 17 or later. For customers of version 11.1 or higher, VAT rate updates may already be integrated into their system.

* Update the Relevant Module: For earlier versions, you must update the ‘Switzerland - Accounting Reports’ module to reflect the new VAT rates.

* Create New Tax Entries: Instead of altering or removing old tax rates establish new tax entries with the amended VAT rate. This guarantees that old transactions are correct and compliant.

1. Purchase Taxes: Duplicate existing tax entries and set the rate to 7.7% for the standard rate and 3.7% for the lower rate. Adjust the labels and tax groups accordingly.

2. Sale Taxes: Similarly, make new sales tax entries with the modified rates. Make that the tax labels and VAT form tags are accurately assigned.

Example Tax Configurations:

* TVA 7.7% sur achat B&S (TN): 7.7%, Label: 7.7% achat, Tax Group: TVA 7.7%, Scope: Purchases

* TVA 3.7% sur achat B&S (TS): 3.7%, Label: 3.7% achat, Tax Group: TVA 3.7%, Scope: Purchases

PEPPOL Electronic Document Invoicing

PEPPOL Electronic Document Invoicing in Swiss localization improves the invoicing process by including the PEPPOL framework, which allows for seamless electronic document exchange between enterprises and authorities.

In Switzerland, this system ensures that local regulations are met by conforming to swiss-specific standards and document management standards. Odoo accounting software uses PEPPOL to automate the invoicing process, which reduces manual errors and processing time.

This integration not only promotes efficient transaction management, but it also aligns with Switzerland's digital document exchange rules, ensuring financial processes are accurate and transparent.

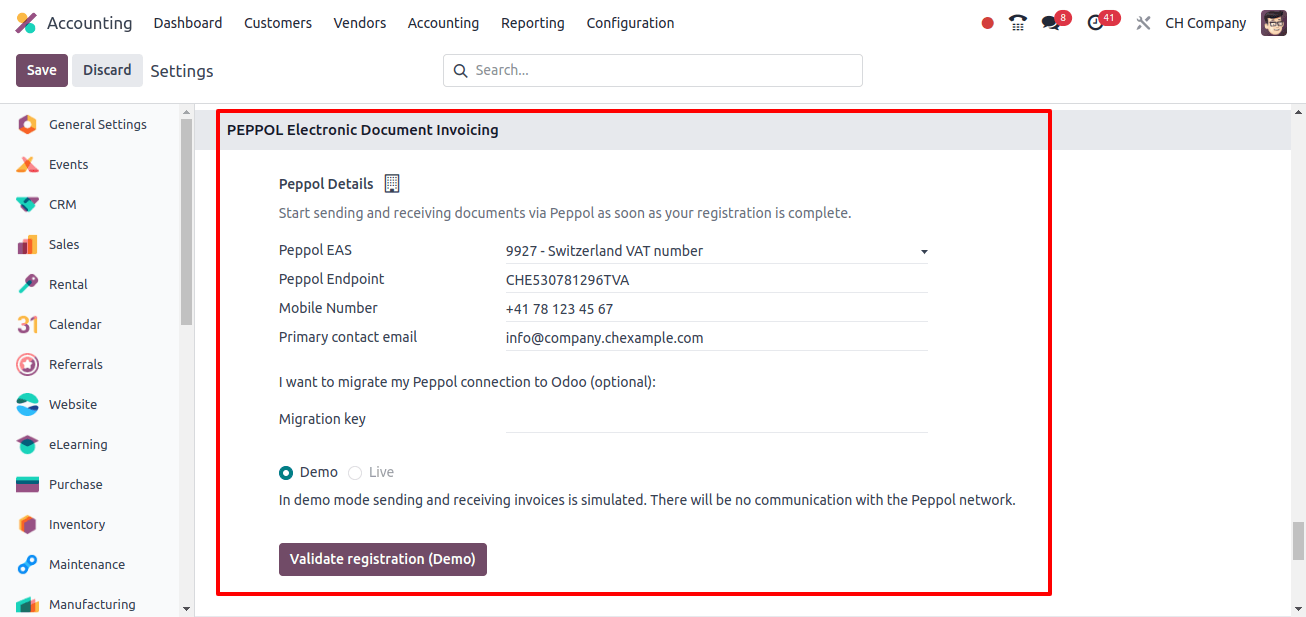

We may configure it by going to Accounting > Configuration > Settings, and there is a part for PEPPOL Electronic Document Invoicing, where we can register by entering our Peppol information and authenticating the registration.

* Peppol EAS: Peppol participants' electronic ‘address book’ is known as the Peppol Electronic Address Scheme. Each Peppol EAS identity is unique to each member of the network.

* Poppol Endpoint: Peppol is a global network that helps businesses transmit safe electronic invoices. Each member of the Peppol network is identified uniquely by its endpoint. This endpoint serves as an address, allowing other Peppol users to identify and submit invoices electronically.

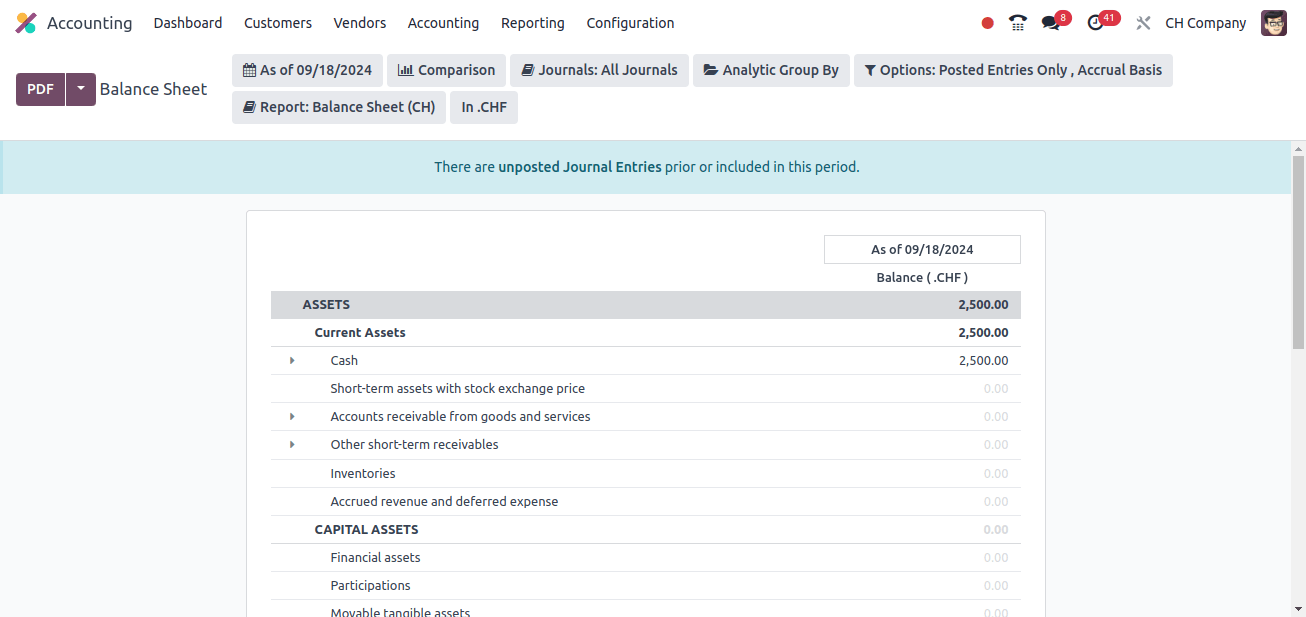

Balance Sheet

A balance sheet is a financial statement that details a company's assets, liabilities, and equity at a specific point in time. Its structure reflects the company's assets, liabilities, and equity—the remaining stake retained by the owners.

The balance sheet uses the basic accounting equation to verify that the business's financial situation is reported and balanced correctly. Odoo with Switzerland accounting localization customizes the balance sheet to satisfy Swiss financial reporting rules, assuring accuracy and compliance.

This localization modifies the conventional balance sheet format to reflect local accounting norms, such as asset and liability classifications and valuation guidelines.

Odoo's Swiss localization allows for precise tracking of assets, liabilities, and equity, giving businesses a clear, accurate picture of their financial situation. It combines local regulatory norms, including specific requirements for depreciation and financial reporting, to ensure that the balance sheet complies with Swiss statutory rules.

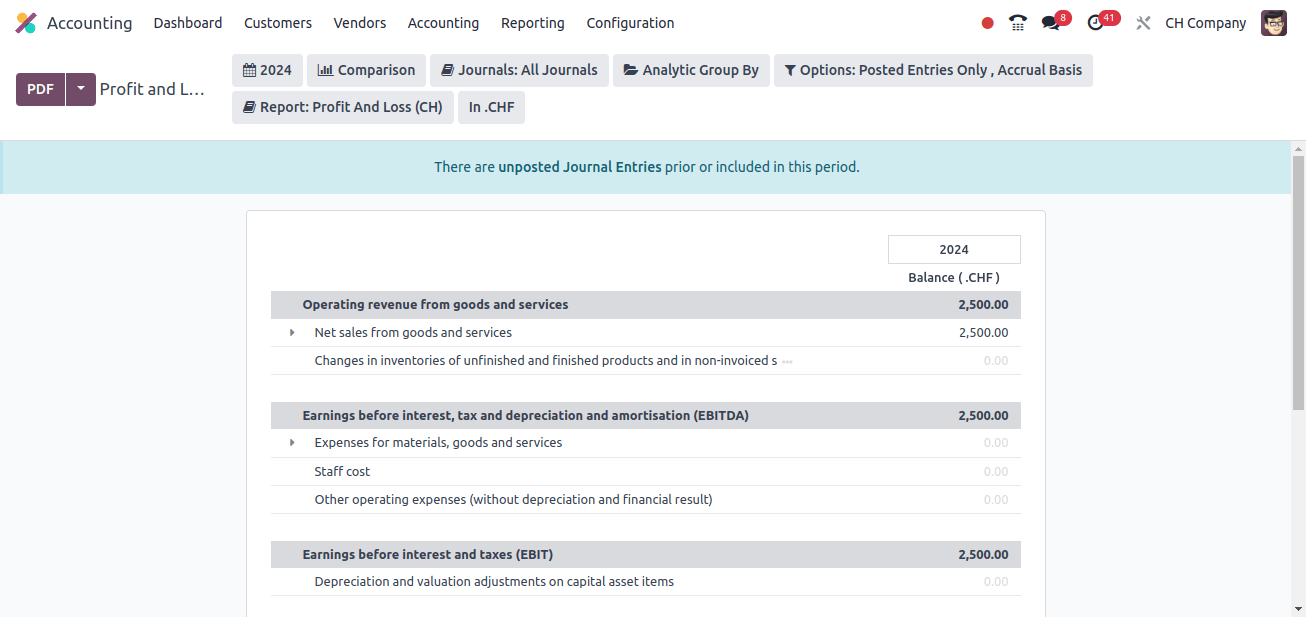

Profit and Loss Report

We may find the company's profit and loss statement under the Reporting Menu. A profit and loss statement summarizes a company's payments, expenses, and net earnings or losses for a given time period. It summarizes the company's financial performance during that period and is critical for determining how profitable the company is.

In Switzerland, operating revenue from products and services refers to the income created by a company's principal commercial operations. This revenue is critical in determining a company's financial health and performance.

Accurate accounting of this revenue is critical for complying with Swiss financial requirements and providing stakeholders with credible financial information. In addition, we can see Earnings before interest, tax, depreciation, and amortization (EBITDA), Earnings before interest and taxes (EBIT), Earnings before taxes (EBT), and Annual (net) profit or loss before taxes in the profit and loss statement.

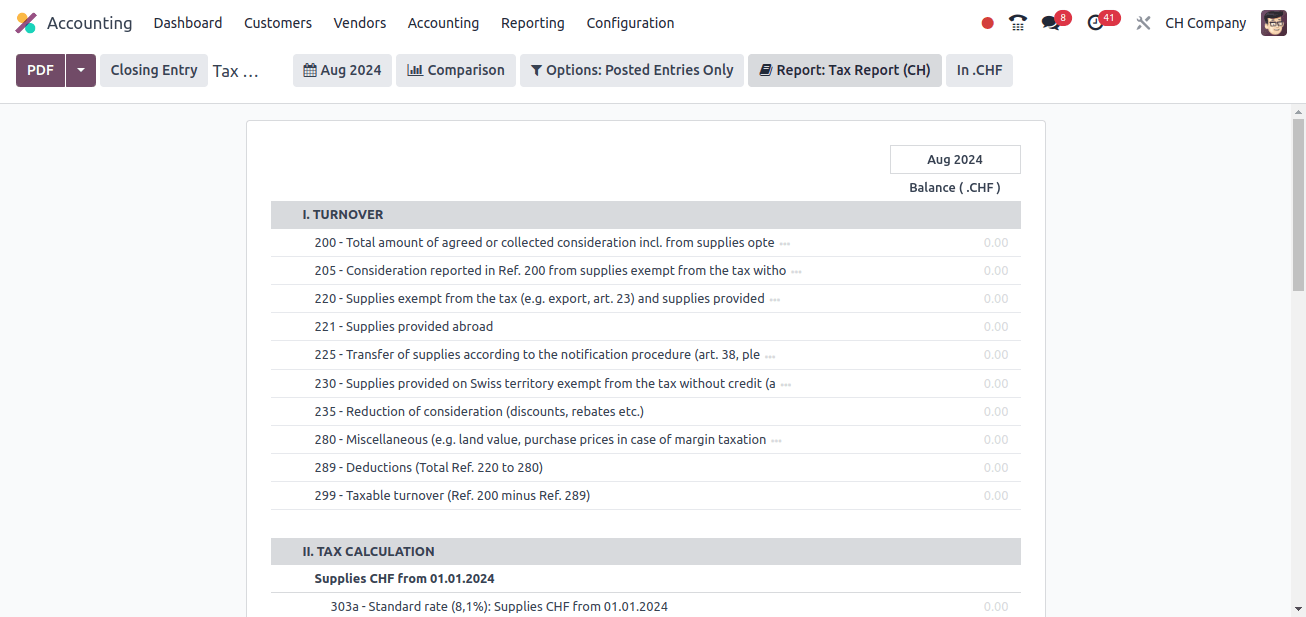

Tax Report

In Odoo Accounting, a tax report is a specialized financial record that provides a complete summary of a company's tax obligations and compliance status.

This report compiles information regarding taxes collected on sales and paid on purchases to show the company's tax position within a certain reporting period.

The tax report displays the Turnover, which is the total revenue generated by a company from its primary operations over a given time period. This statistic indicates the whole money generated by the sale of goods or services before deducting any expenses, taxes, or other costs.

Tax calculation is the thorough process of figuring how much tax a corporation or individual owes using numerous financial information and tax rules. This section of the report describes the method used to determine tax obligations and Other Cash Flows.

Finally, Odoo's Switzerland accounting localization provides a solid foundation for meeting Swiss firms' unique financial and legal requirements.

Odoo simplifies the financial management process for Swiss businesses by including features such as precise VAT calculations, thorough tax reporting, and compliance with local accounting requirements.

Localization enables proper transaction processing, simplifies tax filings, and adheres to Swiss accounting requirements, eventually improving operational efficiency and financial transparency.

With these features, organizations may successfully manage the complexity of Swiss accounting while employing Odoo's rich ERP functionalities to support growth and compliance.