Accounting localization in Odoo refers to the process of customizing the accounting module to comply with a country’s specific tax laws, accounting standards, and legal reporting requirements. Odoo 17 includes country-specific modules called ‘Fiscal Localization Packages’.

Accounting localization ensures that your Odoo system adheres to your country’s specific tax legislation, reporting standards, and chart of accounts.

This reduces the potential for errors and fines while submitting taxes. Localization automates multiple accounting duties that are dependent on regional customs. This includes features such as:

- Pre-programmed tax calculations.

- Creating compliant invoices and reports.

- Integration with regional e-invoicing systems (If applicable).

Accounting localization helps your accounting team save time and money by automating tasks and adhering to local conventions.

They can shift their focus away from compliance assurance and manual data entry and onto more strategic responsibilities. In this blog, we will look at the localization elements of a company from Greece.

Localization for Greece in Odoo 17

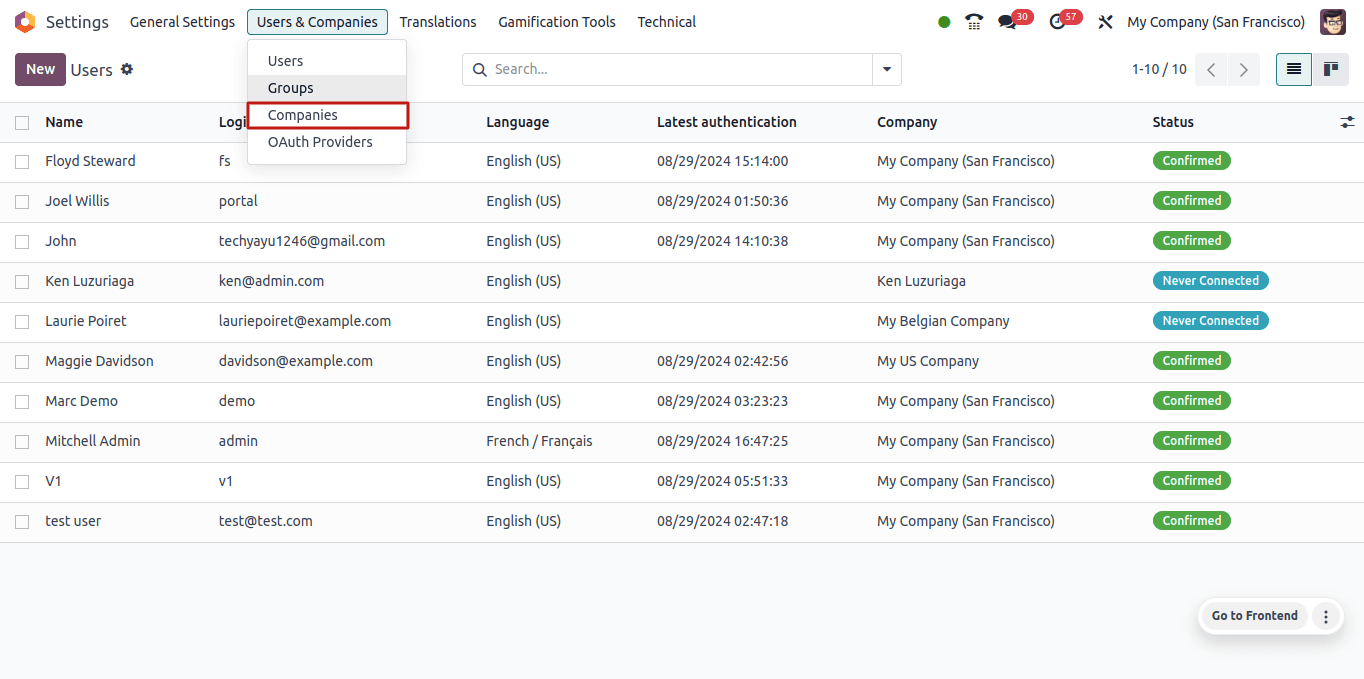

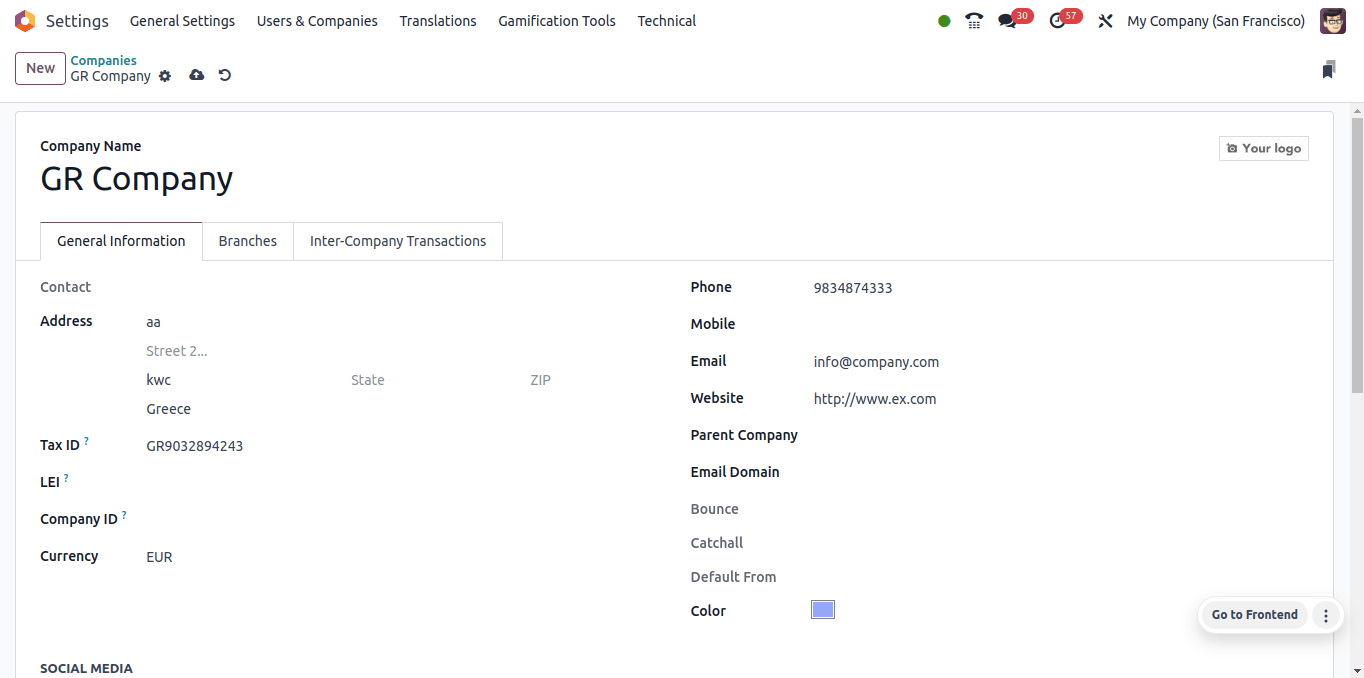

First, we must establish a Greek company to set up Odoo’s Greek localization. To achieve this, go to Odoo’s General Settings and select the Users & Companies option, followed by the Companies sub-menu.

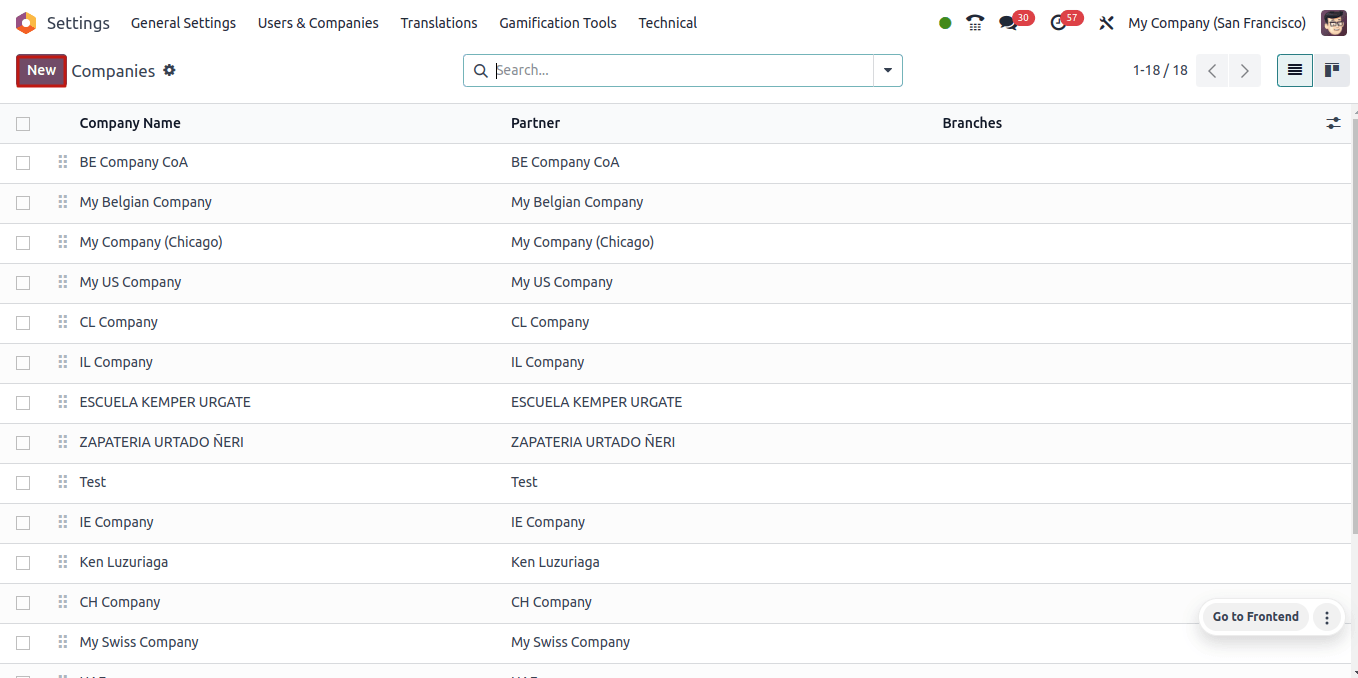

When we click the companies sub-menu, we can see all the companies that have previously been created, and we can create a new company by clicking the New button.

When we click the New button, we will be taken to a form where we can enter the information for the business we are going to create.

Once the firm’s details have been properly specified, click the save icon to save the company information. When the company’s nation is set to Greece, Odoo automatically sets the currency to Euro (EUR), which is the official currency of the country.

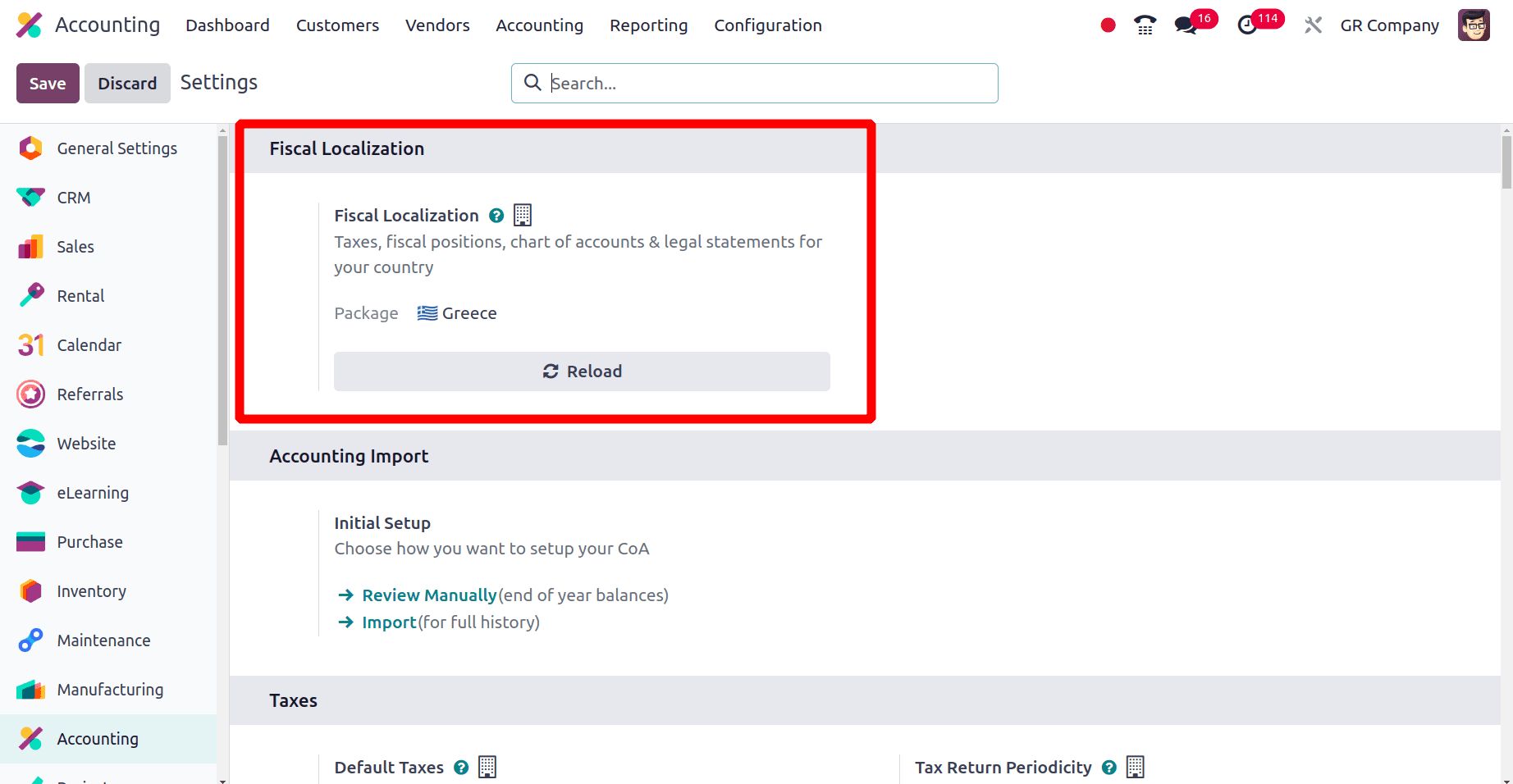

The next step is to create a localization package for this company. Go to the Accounting application in Odoo 17 and select Configuration> Settings. The localization package can be configured in the Fiscal Localization section. Choose the Greece bundle and save the configuration.

Modifications were identified during the Greece localization configuration.

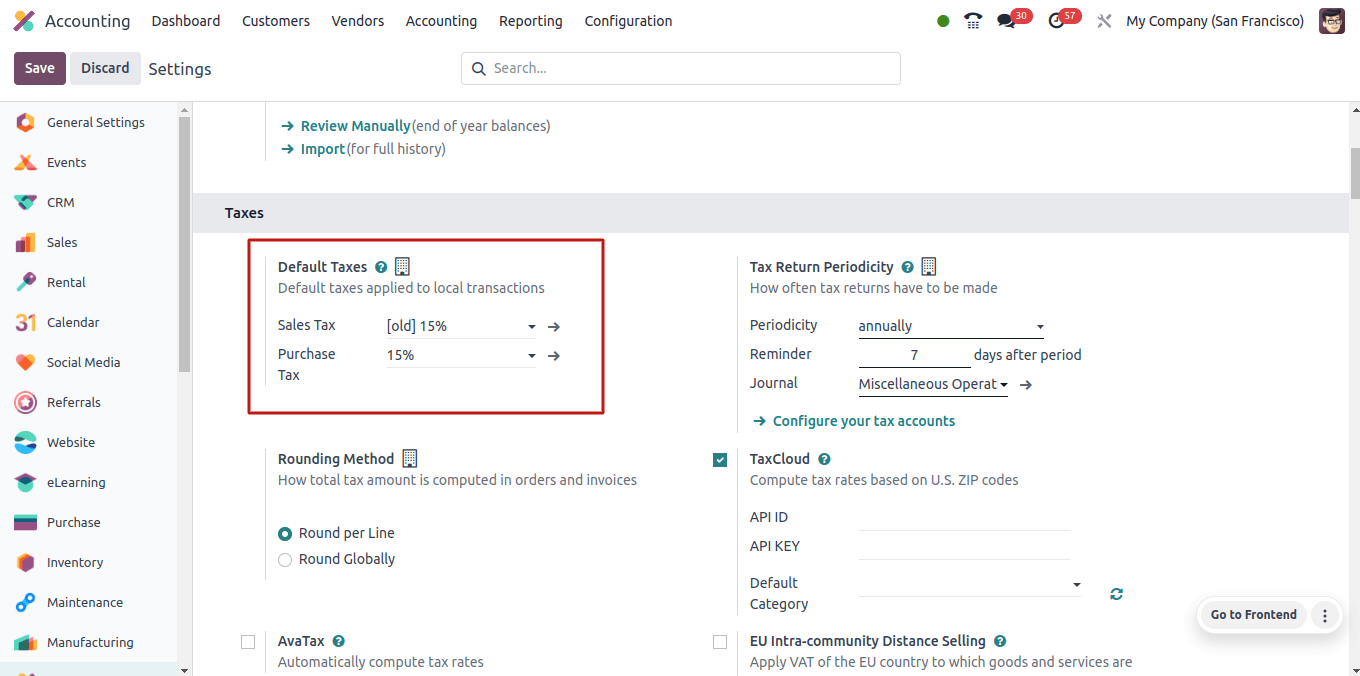

When the company’s localization is set to Greece, there will be several modifications. First, under the configuration settings, under the Taxes section, there is an option for updating the default tax.

Default taxes, or pre-existing tax rates, are automatically applied to invoices and bills. There will be default sales and purchase taxes.

Default Sales Tax:Odoo’s default sales tax is a predetermined tax rate that is automatically added to invoices you create for your customers.

Default purchase Tax: In Odoo, the default purchase tax is a predetermined tax rate automatically added to each bill you create for your clients.

According to the above image, the default sales and buy tax used by Greek companies is '24% G', hence this 24% G will be the tax automatically assigned to all sale and purchase orders.

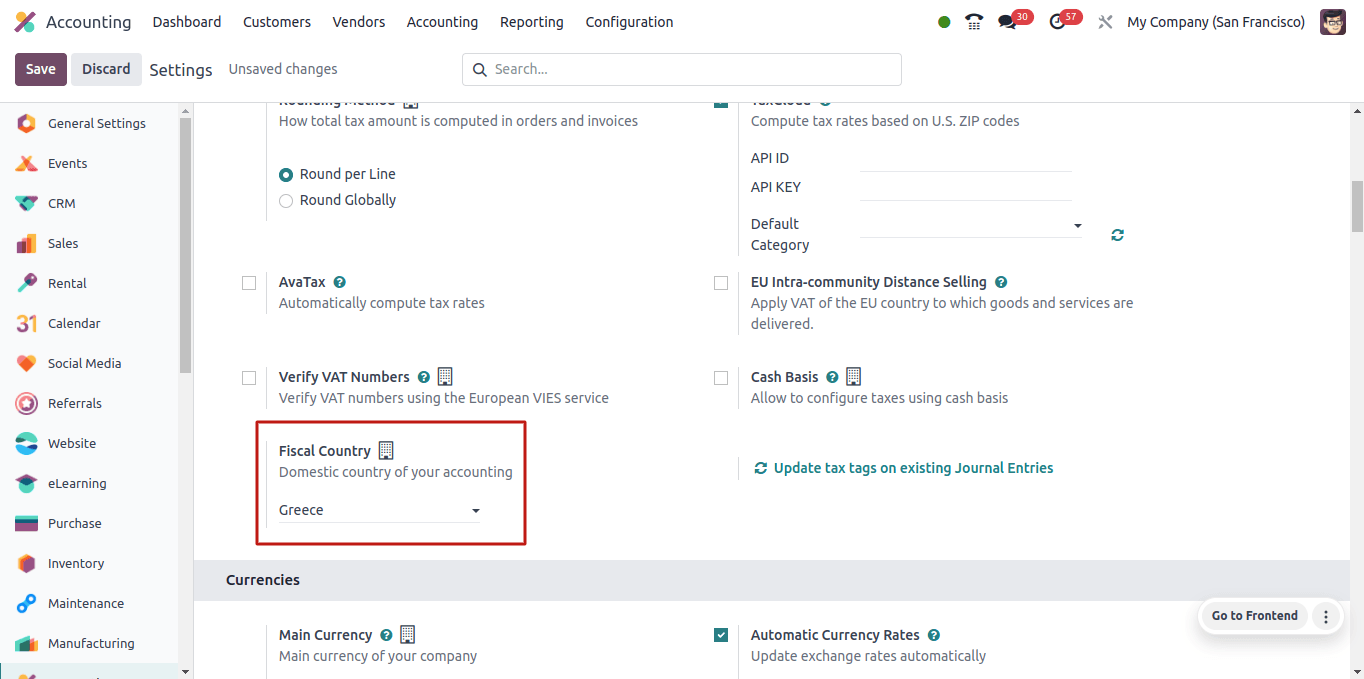

In this tax part, we can specify the fiscal country for this company. However, when the localization package is specified as Greece, Odoo automatically sets the fiscal country to Greece.

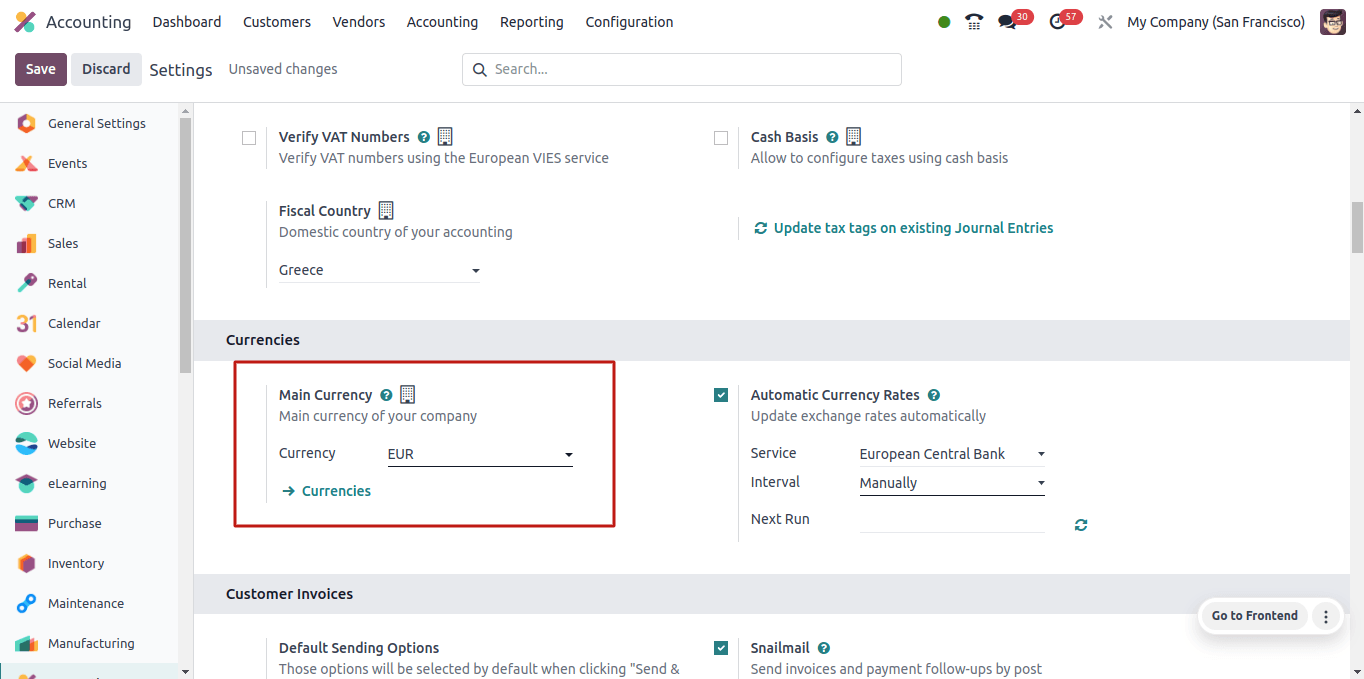

Under the currencies field, we may set the company’s main currency and activate alternative currencies. However, after we have set a core currency for the business, it will be used for all transactions within the organization.

We know that the major currency used in Greece is the Euro (EUR), and when we create the localization package for the nation, Odoo automatically sets the main currency for the company to the Euro (EUR).

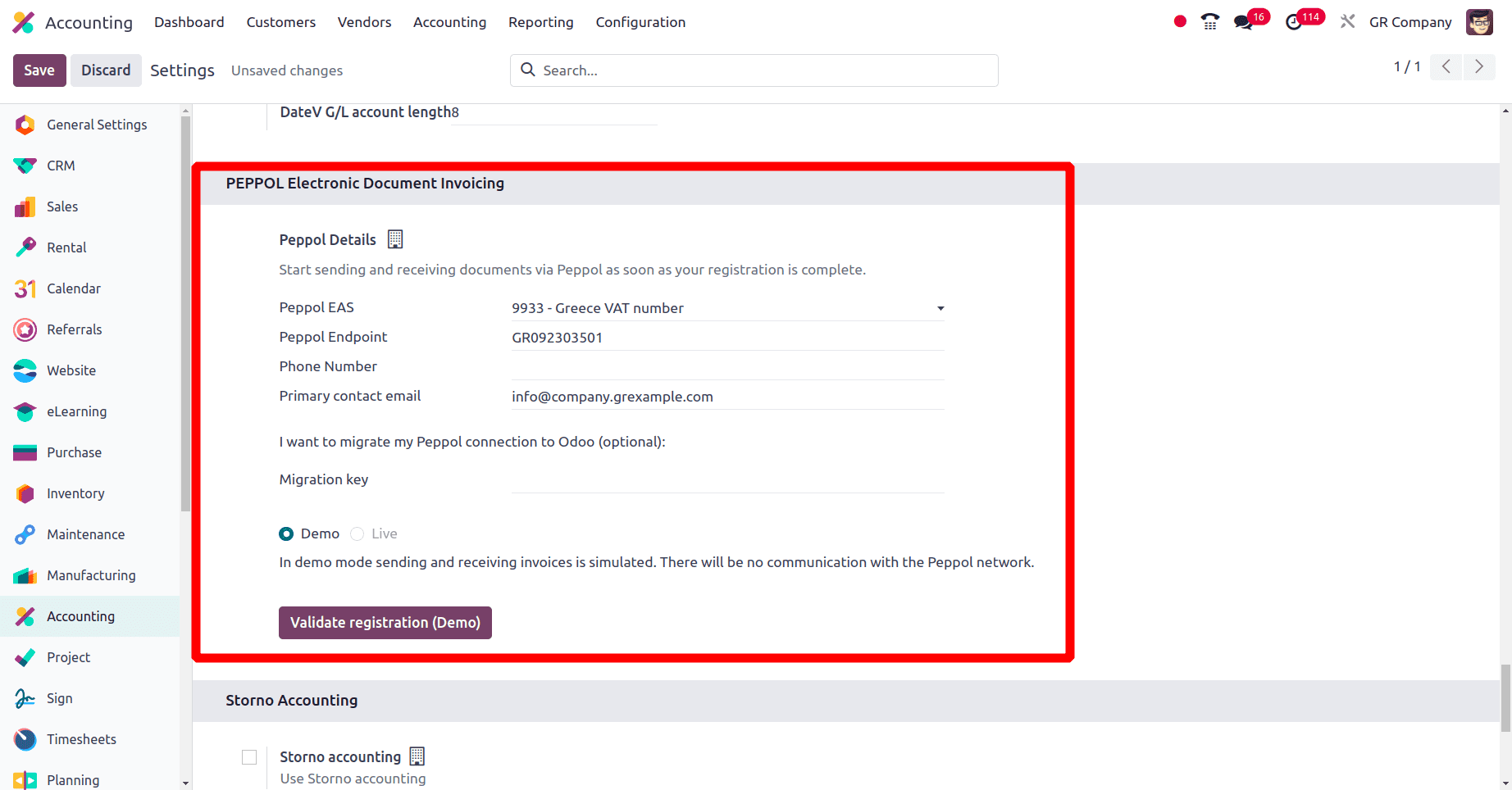

A new Extra section called ‘PEPPOL Electronic Document Invoicing’ has been added under Configuration> Settings. This section contains Peppol information such as the Peppol EAS, the Peppol Endpoint, the phone number, the primary contact email, and more.

peppol EAS:The Peppol Electronic Address Scheme acts as the participants’ electronic ‘address book’ at Peppol. The Peppol EAS identification uniquely identifies each member of the network.

Poppol Endpoint: Peppol is an international network that enables businesses to send secure electronic invoices. Every Peppol network member has a unique endpoint that identifies them. Other Peppol participants can find and send invoices online using this endpoint, which also serves as an address.

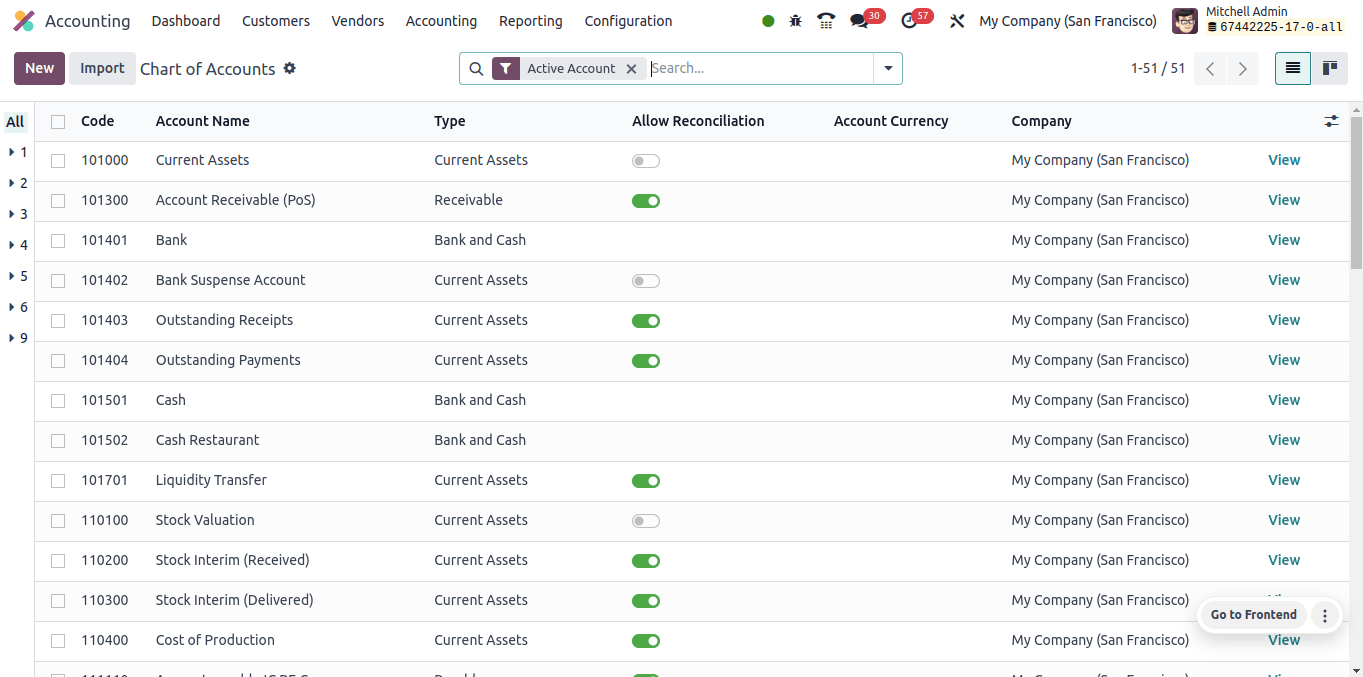

The charts of accounts used by Greek companies may differ. The chart of accounts (CoA) serves as the foundation for your entire accounting system. It organizes all of the financial accounts that you use to track your company’s finances.

The chart of accounts organizes all of your company’s financial activities. It provides a structured way to keep track of income, expenses, assets, liabilities, and equity.

The names and codes of the charts of accounts used by companies in each country may differ. The accompanying image shows the accounts used by Greek businesses.

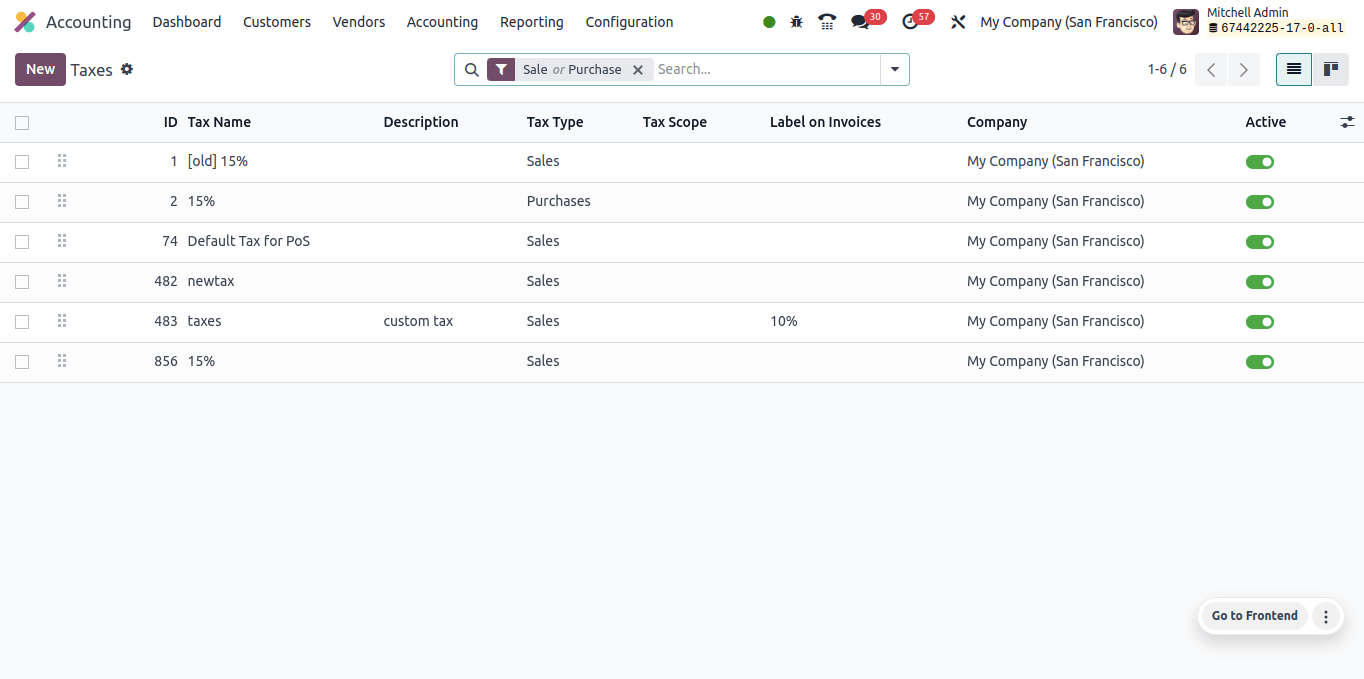

Click the taxes sub-menu under the configuration to view a list of sales and purchase taxes that Greek businesses can use.

The above image depicts the taxes that a Greek company can use. We can also add new taxes to this company by clicking the New button.

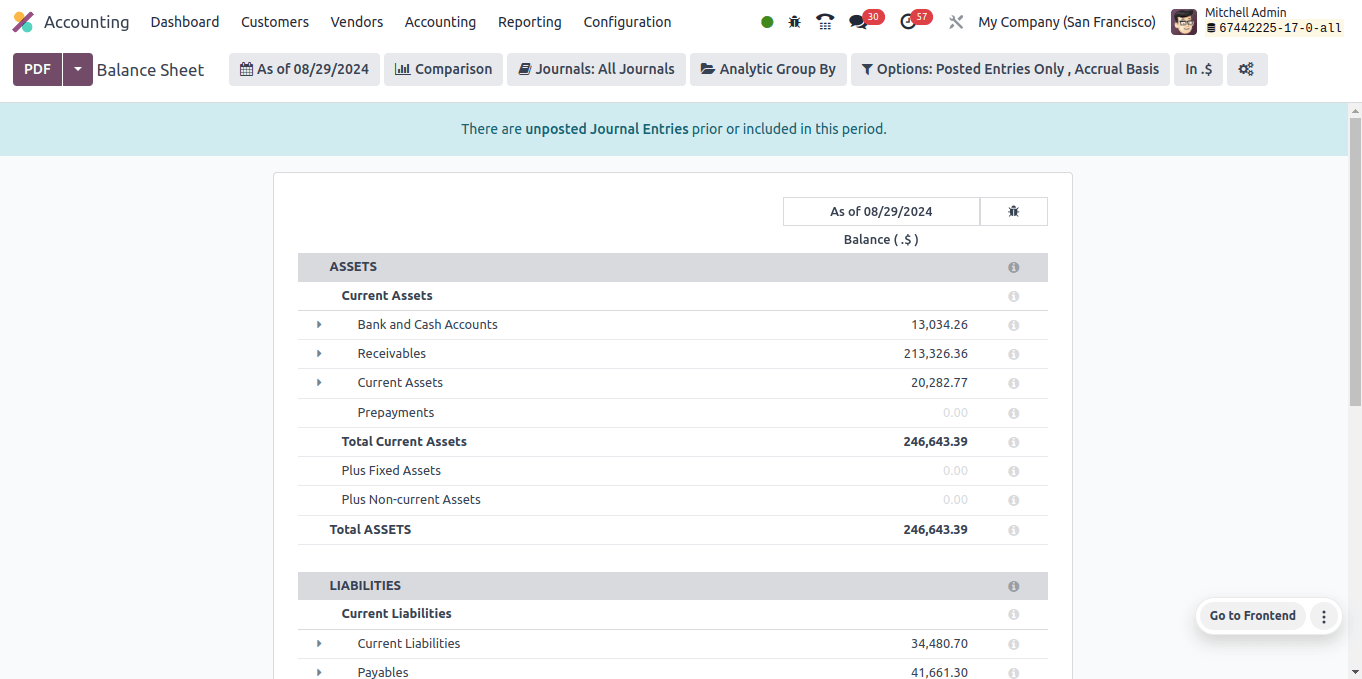

The company’s Balance Sheet for a certain period or day is available through the Reporting option.

Greek companies’ balance sheets include Tangible Fixed Assets, Intangible Fixed Assets, Financial Assets, Inventories, Financial Assets and Prepayments, Capital Paid Up, Provisions, Long-Term liabilities, and so on.

The balance sheet depicts your company’s financial position as of a specific date. It is not an income statement-style record of all transactions throughout time.

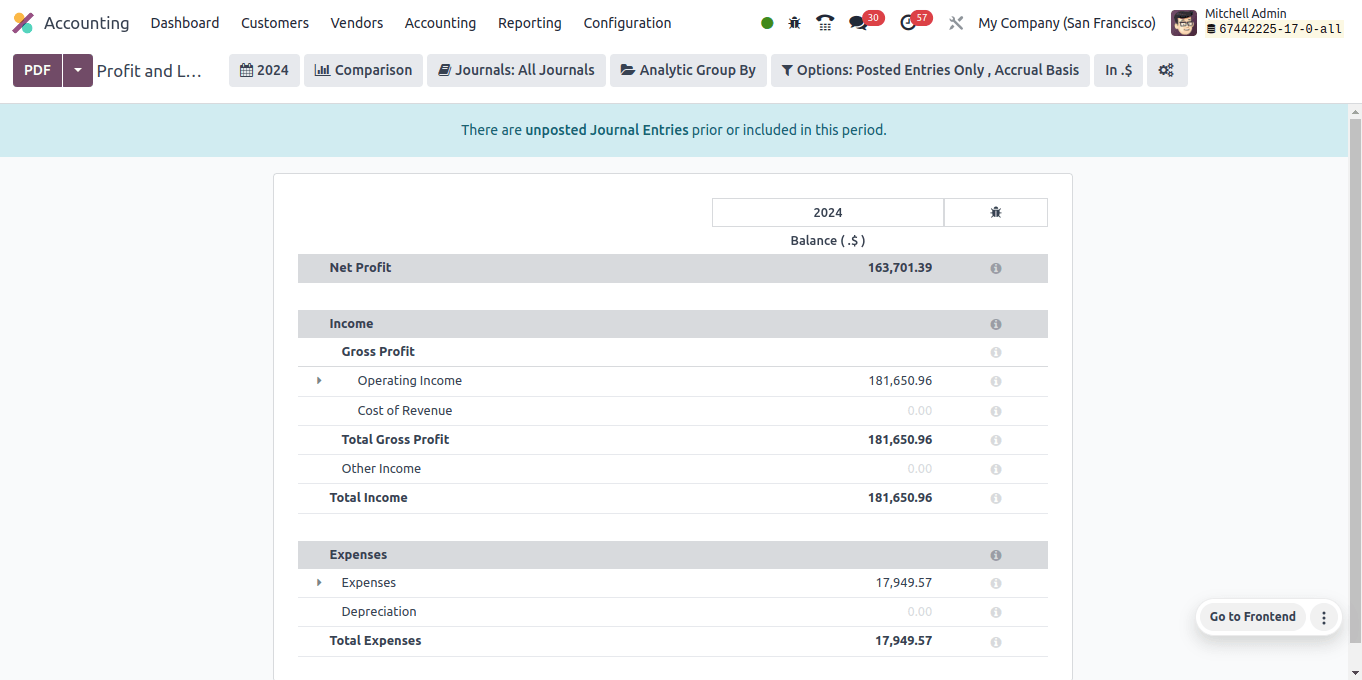

This company’s balance statement contains gross margin, other regular revenue, administrative expenses, asset impairment, investment revenue, and so on.

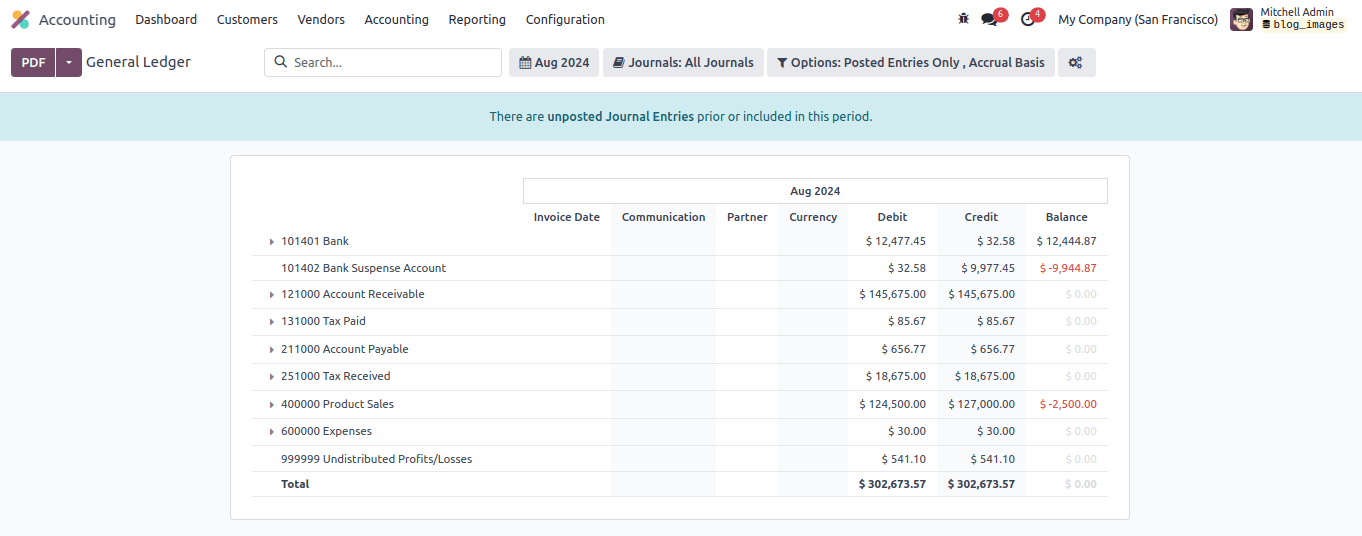

The General ledger in Odoo 17 keeps a detailed record of all financial transactions that occur in your company. The general ledger monitors all debit and credit transactions for each account in your chart of accounts.

Remember that debits and credits reflect the two sides of each financial transaction.

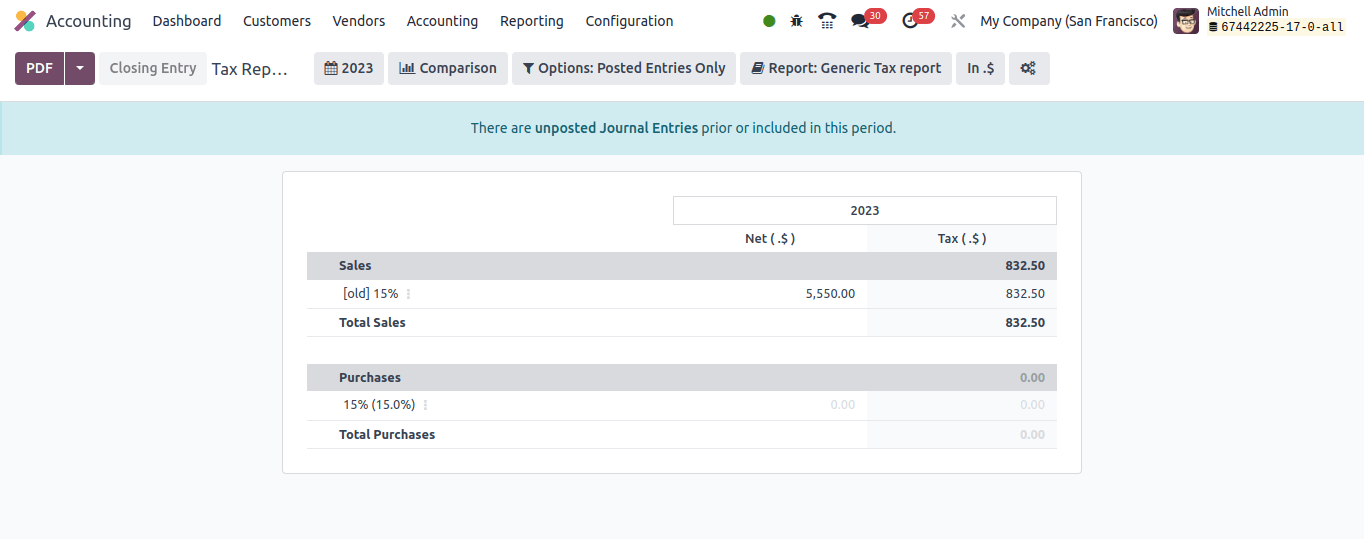

In the tax return of Greek companies, taxable input-input tax is the amount applied to the input tax total; a Deductible amount from the total input tax A table of tax settlements to be paid, deducted, or reimbursed has been added.

Taxable production is the total quantity of products or services supplied to clients during a certain tax period, minus any previously paid VAT.

International business operations are more common than ever in today’s interconnected business world. However, managing cash in multiple locations could be difficult.

Odoo 17’s localization capabilities provide an excellent tool for optimizing your foreign accounting. From ensuring local regulations are obeyed to automating tasks and enhancing productivity.