Accounting Localization in Odoo 17

Different countries will have their own set of tax laws, accounting standards, legal reporting duties, and so on, which may differ. Accounting localization in Odoo is the process of customizing accounting modules to reflect the unique characteristics of each nation.

The main feature of Odoo 17 is the introduction of country-specific accounting localization modules known as ‘Fiscal Localization Packages.’ Odoo’s fiscal localization packages are designed to comply with each country’s specific tax laws, accounting systems, and legal reporting duties.

This reduces the likelihood of errors and fines by ensuring that your accounting practices are compliant. Tax computations and reporting are automated using predefined components including fiscal events, charts of accounts, and tax groups.

Instead of manually creating your accounting system from the start, this saves you time and effort. Tax computations are done automatically, which reduces the chance of human error in applying the right rates and codes to transactions.

This creates a more accurate financial figure. Localization can help you save money on accounting costs and resources by improving the accounting process and reducing issues. Odoo’s translation features allow you to manage your finances consistently across different regions if your company operates in multiple countries.

Odoo’s accounting module supports multiple currency transactions. Localization can help even more by ensuring that foreign exchange rates and taxes are managed correctly for international transactions.

We will go over every feature of Odoo accounting localization for Kazakhstan in Odoo 17 in this blog post.

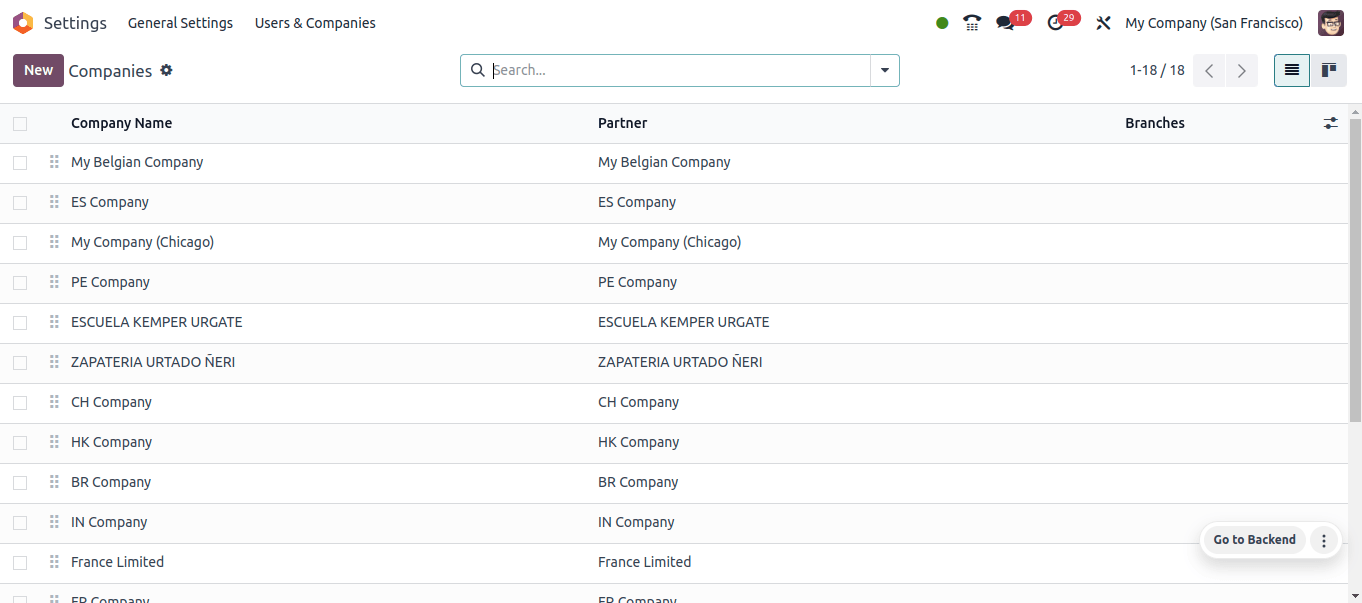

To set up the localization for Kazakhstan, we must create a new company. Odoo 17 allows us to form a new company via Odoo’s general settings. Go to the Odoo application’s General settings and pick the companies sub-menu from the users and companies menu.

Then you’ll see a list of companies that have already been created using Odoo. By choosing the New button, Odoo opens a form where you can enter all of the facts about the company you want to configure.

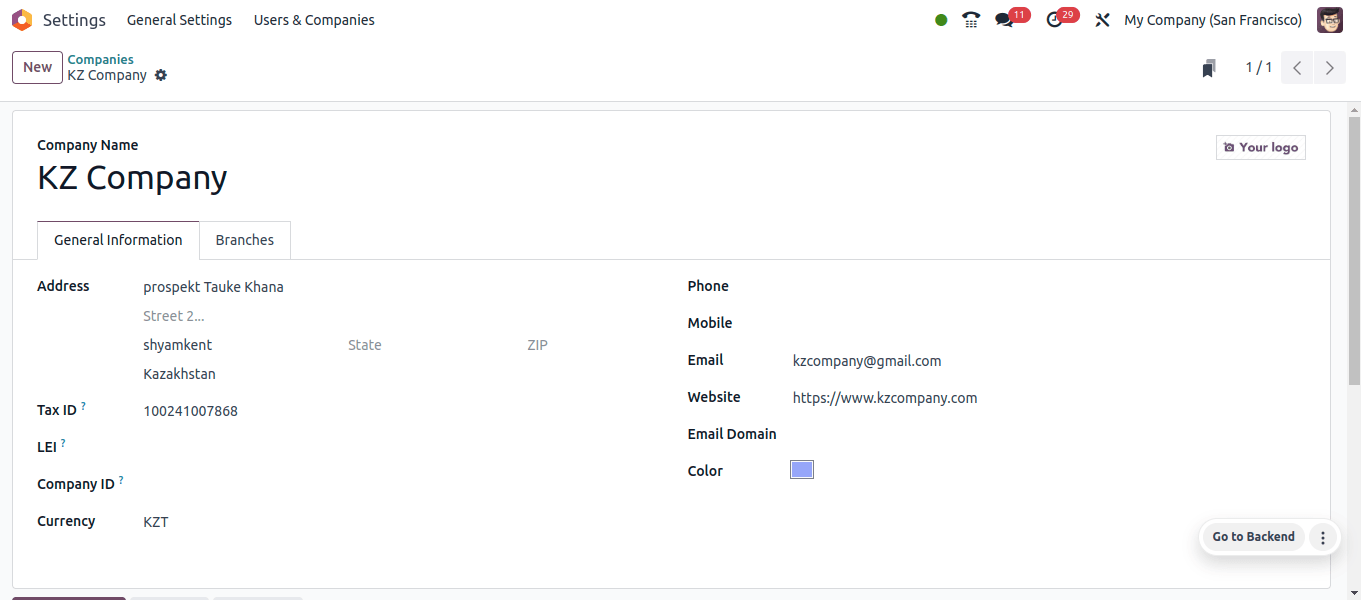

Provide the company’s name, address, the country to which it belongs, and its tax ID.

Odoo automatically configures the currency in the company registration form as the official currency, ‘Kazakhstani tenge’, when the nation is set to Kazakhstan.

After the new company setups have been properly completed, let us discuss the variations in this company’s finances.

Variations created when localization for Kazakhstan is configured.

The key configuration of Odoo 17 accounts include the Fiscal Position of Accounts, Chart of Accounts, Taxes, Journals, and so on, so we’ll start with these Odoo features.

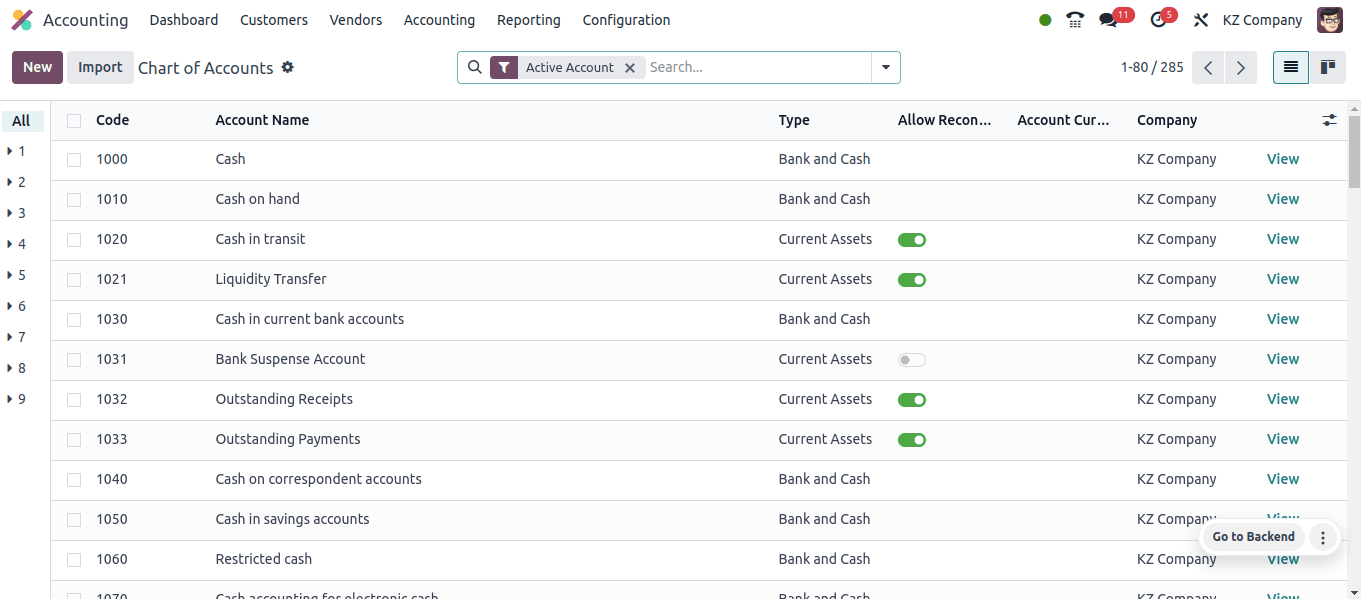

Chart of Accounts

Any accounting system, including Odoo, is based on a chart of accounts (COA). It is a comprehensive list of all the bank accounts used to categorize your business activities.

Consider it your financial data’s filing cabinet, with each account acting as a designated folder.

The above image depicts the chart of accounts used by Kazakhstan-based enterprises. This field displays the account code, account name, account type, currency used by this company, and other information. Account names and codes may differ between companies.

By pressing the ‘New’ button, we may generate a new Chart of Accounts for this organization. The Chart of Accounts categorizes all of your financial accounts, including income, expenses, assets, liabilities, and equity.

This classification allows you to more efficiently monitor your company’s money flow.

Taxes

To put it simply, taxes are required fees imposed by governments. They are typically a proportion of your salary, the cost of the goods and services you buy, or the value of your home.

Tax money helps to fund government initiatives and services such as road development, park maintenance, and social security.

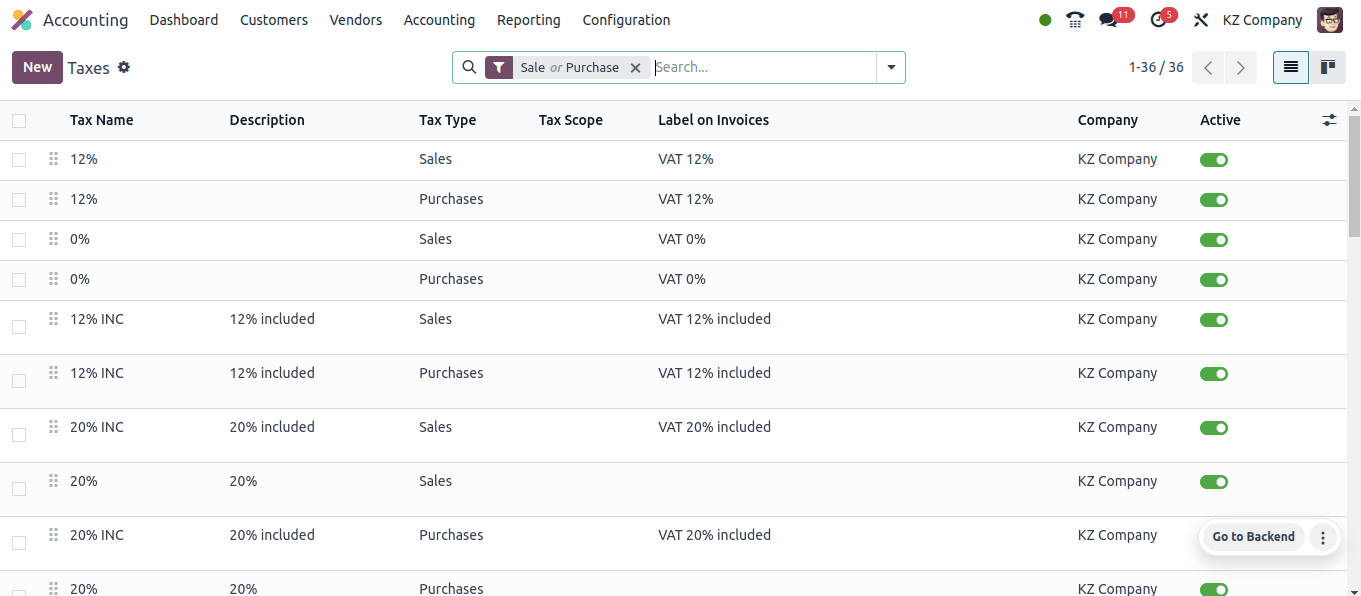

In Odoo, you can define many taxes, including their name, rate, and method of calculation. The Accounting application’s taxes sub-menu, located under the setup menu, contains a list of all the taxes for this company.

Taxes are classified into two types: Sales tax and purchase tax. Sales taxes are used for sale orders, while purchase taxes are applied to purchase orders. The taxes page displays the various taxes, as well as their details and tax types.

We can also create new taxes for this company by selecting the ‘New’ option. Each country has its own default tax that applies to all of its products and services.

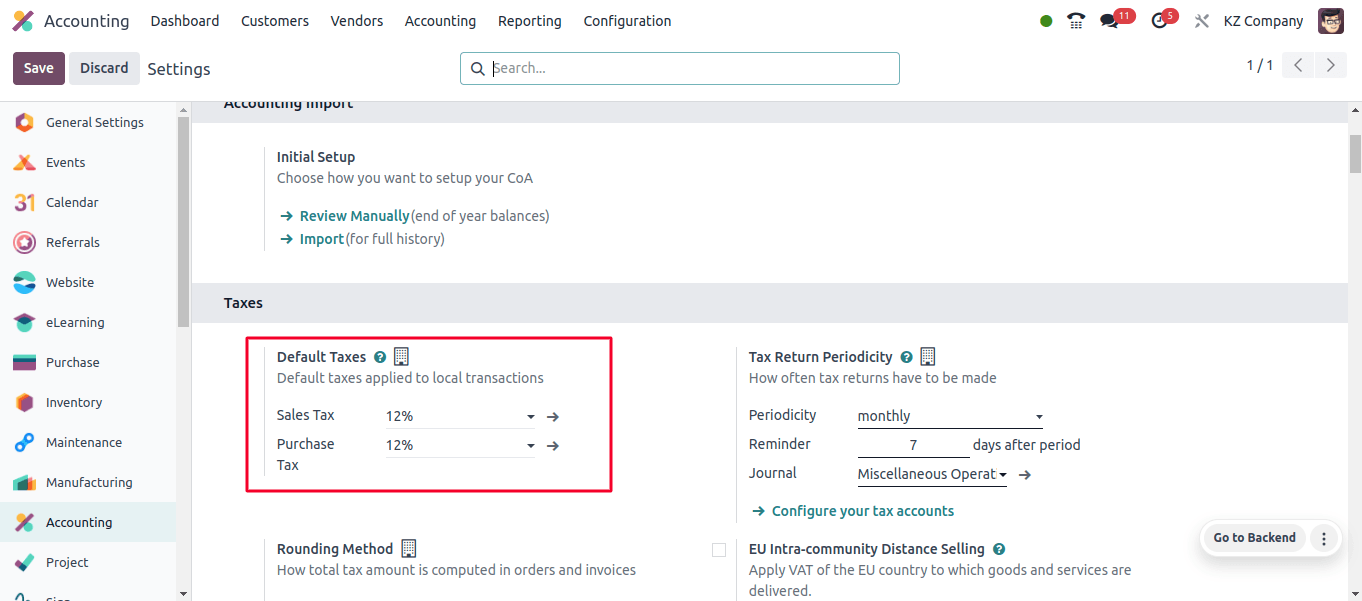

Odoo may be aware of the default tax in Kazakhstan, so it automatically sets it for the company. When you go to the Accounting application’s Configuration options, you will see a tax field.

In the Texas field, you can specify the default sales tax and purchase tax for this company. However, when we set the company’s localization package to kazakhstan, Odoo automatically sets the company’s default taxes.

This image shows that Odoo has automatically set the default Sales Taxes and Default Purchase Taxes for this company at 12%.

Journals

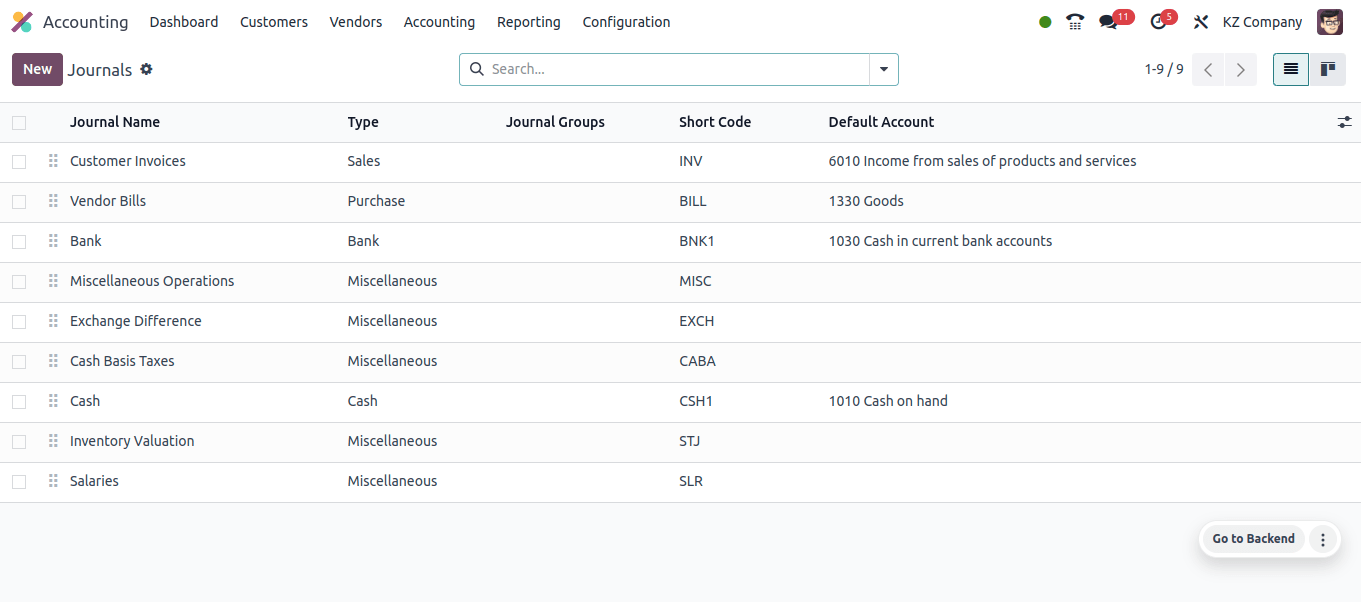

The fundamental components of accounting journals are used to document financial transactions. They function as a type of accounting record keeping, with all financial transactions recorded.

Journals record the who, what, when, and amount of each transaction. They maintain a clear history of financial transactions by categorizing products according to dates.

Several journals categorize transactions based on their type, such as the sales journal, purchase journal, cash journal, bank journal, general journal, and so on.

* Sales Journal: Records the sale of products or services.

* Purchase Journals: Keep track of purchases made from merchants.

* Cash journals: Overseas cash receipts and disbursements.

* Bank journals: Specifically for banking transactions.

* Miscellaneous Journal: Used for miscellaneous entries that do not fit into other categories.

The accompanying image depicts the journals used by kazakhstan-based companies. The list includes the Journal’s name, type, shortcode, and other information.

Fiscal Position

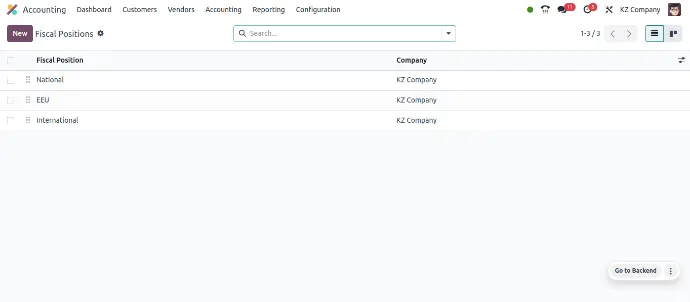

A fiscal position is a set of criteria that transactions use to automatically apply the necessary taxes and accounts. Companies who manage complex tax processes or operate in multiple locations will benefit greatly from this.

The list above shows the primary fiscal positions used by Kazakhstani companies. Fiscal positions, based on preset rules, ensure that the necessary taxes and accounts are automatically applied to transactions.

Fiscal positions save time and effort by automating tax computations and account mapping, which would otherwise require manual configuration for each transaction. This improves the efficiency of your accounting process.

Notable changes while configuring the Kazakhstan localization package.

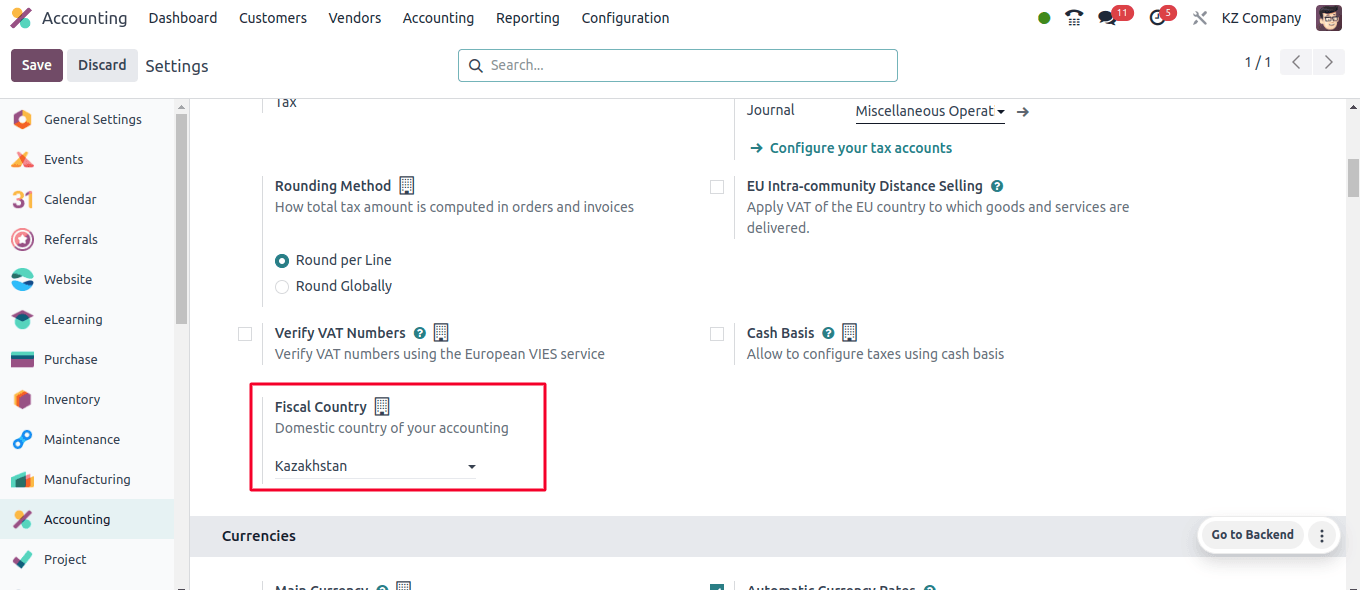

Then we may go to the Accounting application’s Configuration settings. We can see that under the Taxes field, we have the opportunity to specify the Fiscal Country for this company.

When we set Kazakhstan as the company’s localization package, Odoo also sets Kazakhstan as the fiscal country.

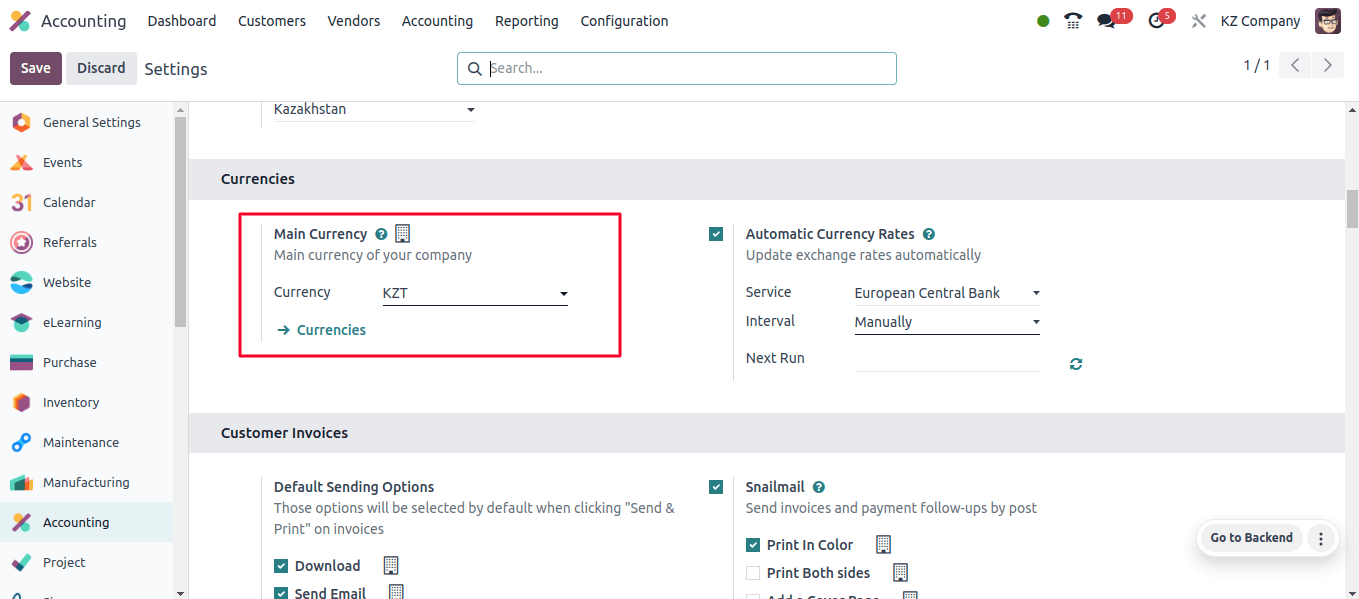

The next is the country’s official currency. Odoo uses the official currency as the primary currency. We know that Kazakhstan’s official currency is the Kazakhstani tenge (KZT).

When the localization package is configured to kazakhstan, Odoo will automatically set the company’s main currency to Kazakhstani tenge (KZT).

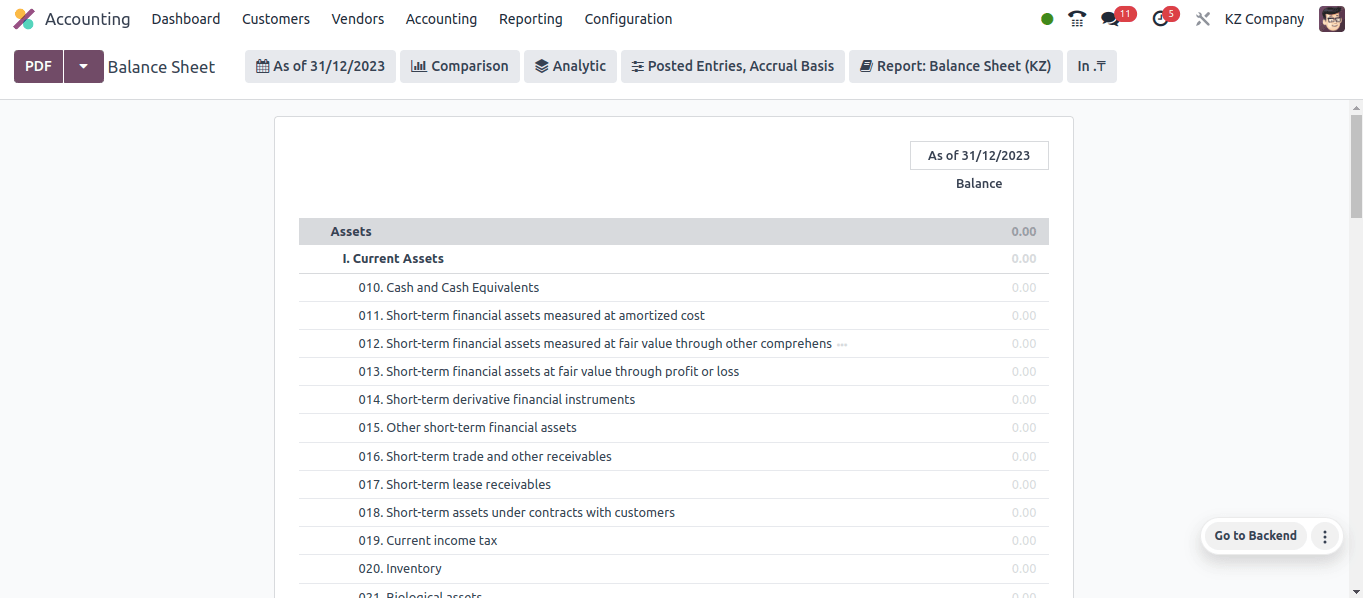

Next, we can go to the accounting application’s reporting menu. The company’s balance sheet is available through the reporting option.

A balance sheet summarizes a company’s finances as of a specific date, whereas an income statement assesses a performance over time. It serves as a company’s net worth statement.

It provides a rapid snapshot of a company’s financial position on a specific day. It works similarly to a financial statement, showing the assets, liabilities, and the difference, which indicates the owner’s claim (equity).

Looking at these components allows you to analyze the company’s overall financial stability, health, and ability to meet its responsibilities.

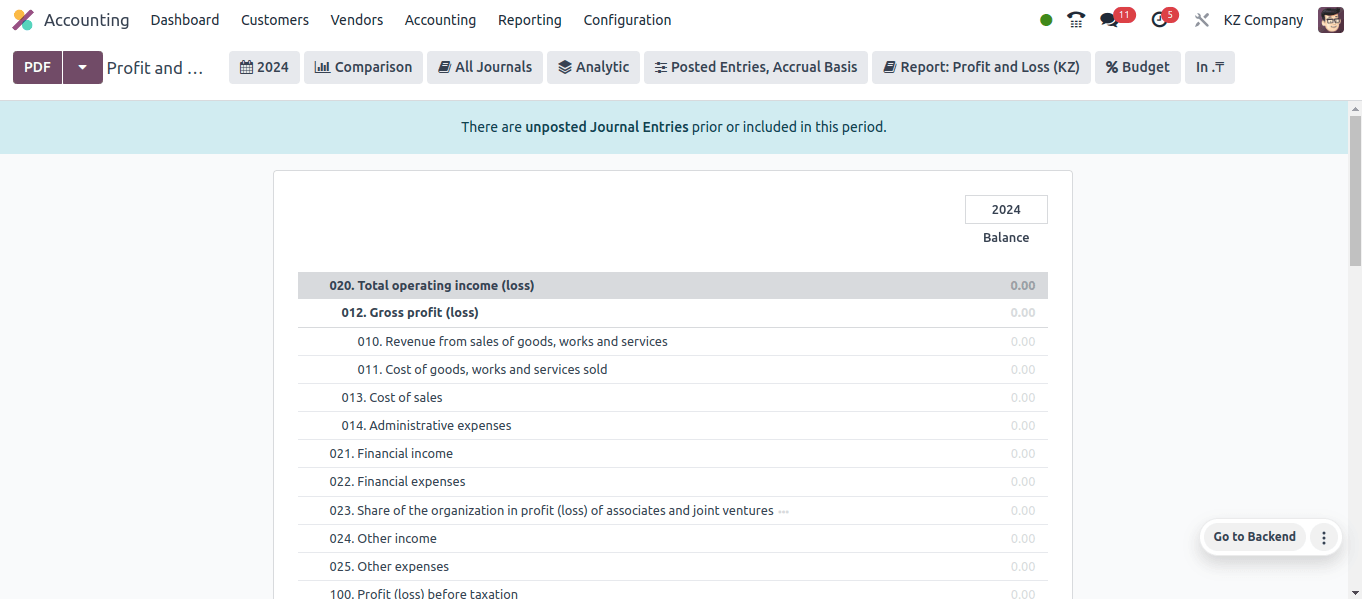

The following is the company’s profit and loss statement. When we select the profit and loss report sub-menu, the entire profit and loss report for this company will be displayed.

Odoo connects with other modules, like sales and inventory, to automatically input important data into the profit and loss report, reducing manual data entry and errors.

With a few clicks, you can generate P & L reports for several time periods and customize them by department, date range, or product line. When compared to manually preparing reports, this saves time and effort.

Kazakhstani companies’ profit and loss statements comprise revenue from sales of goods, work, and services, cost of sales, administrative expenses, financial income, financial expenses, other income, other expense, profit (loss) before taxes, income tax expense, and so on.

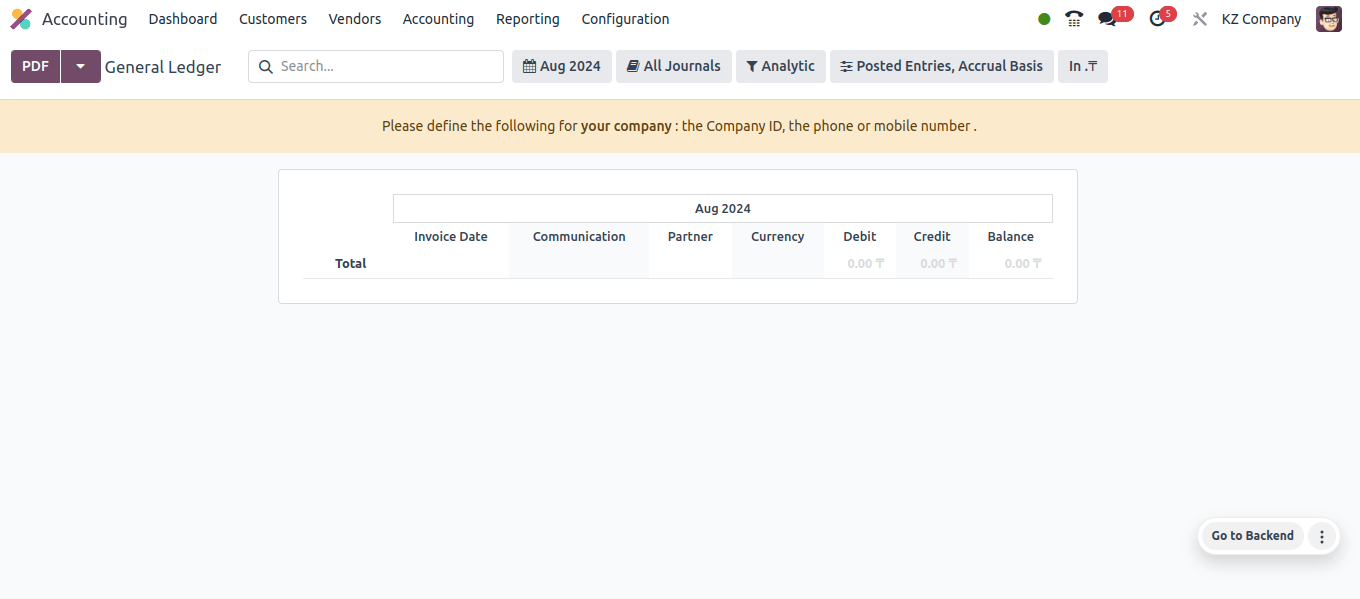

A general ledger is a master set of accounts that summarizes all of a company’s financial transactions. It serves as a consolidated method for keeping track of your company’s financial transactions.

Individual accounts that classify the number of financial transactions comprise the General Ledger. Typically, these accounts represent revenue, expenses, equity, liabilities, and assets.

This company’s general ledger includes cash in current bank accounts, bank suspense accounts, goods, value-added tax, and payables to suppliers and contractors.

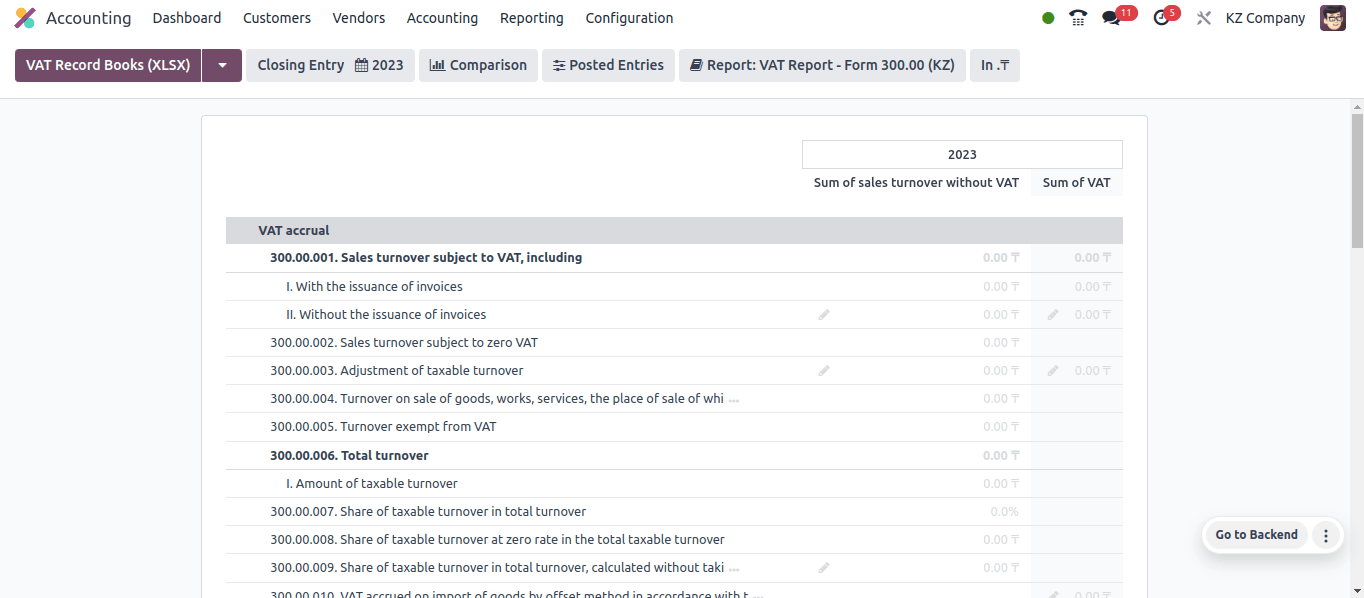

Odoo’s biggest contribution is the Odoo Tax Report. A Tax Report sub-option is included in the Reporting menu. When you click the Tax Report sub-menu, the company’s complete Tax Report will be displayed.

VAT accrual, Sale turnover subject to VAT, including total turnover, amount of VAT to be credited, VAT calculations for the VAT period, and so on are all contained in the company’s tax report.

Odoo automatically populates tax reports with necessary data by interacting with other modules like sales and purchases. This reduces errors and the need for manual data entry.

Odoo offers a variety of pre-configured tax reports that comply with regional laws. This ensures that the reports you create are accurate for your location while also saving time.

Automation and preconfigured reports help to reduce errors in tax reporting and computations.

In this blog, we covered the accounting localization aspects of a Kazakhstan company in Odoo 17. Odoo 17 provides a solid accounting solution with an easy-to-use interface, numerous features, and integrated Kazakhstan localization for enterprises in Kazakhstan.

Easily manage Kazakhstani taxes by using automated accounting and pre-configured tax reports. Make sure to observe local regulations to avoid fines. Save time by automating time-consuming tasks such as data entry and report creation for your accounting team. Simplify accounting operations to boost productivity.