Accounting localization in Odoo is important for businesses that operate in multiple locations since it guarantees that financial processes comply with local legislation and standards. This localization adjusts Odoo’s powerful accounting system to specific tax laws, reporting requirements, and economic standards in several countries.

Businesses that integrate local accounting regulations benefit from more accurate financial reporting and a lower risk of errors. Effective accounting localization not only improves operational efficiency but also increases the trustworthiness of economic data, allowing businesses to make smart decisions and maintain regulatory compliance across several jurisdictions.

Odoo’s accounting localization for Vietnam is customized to the unique financial and regulatory requirements of Vietnamese companies.

This localization module includes important features that comply with Vietnamese accounting standards and tax rules, allowing businesses to conduct their financial operations efficiently and as per accounting standards.

Odoo streamlines Vietnamese accounting operations by providing all the functions required for VAT computations, financial reporting, and statutory compliance. This allows businesses to reduce their accounting operations, increase accuracy, and achieve overall operational efficiency.

Vietnam Accounting with Odoo 17

Odoo 17's Vietnam localization module makes it simple to comply with regional tax and accounting rules. Installing the Vietnamese localization is the initial step in configuring the Vietnamese accounting localization.

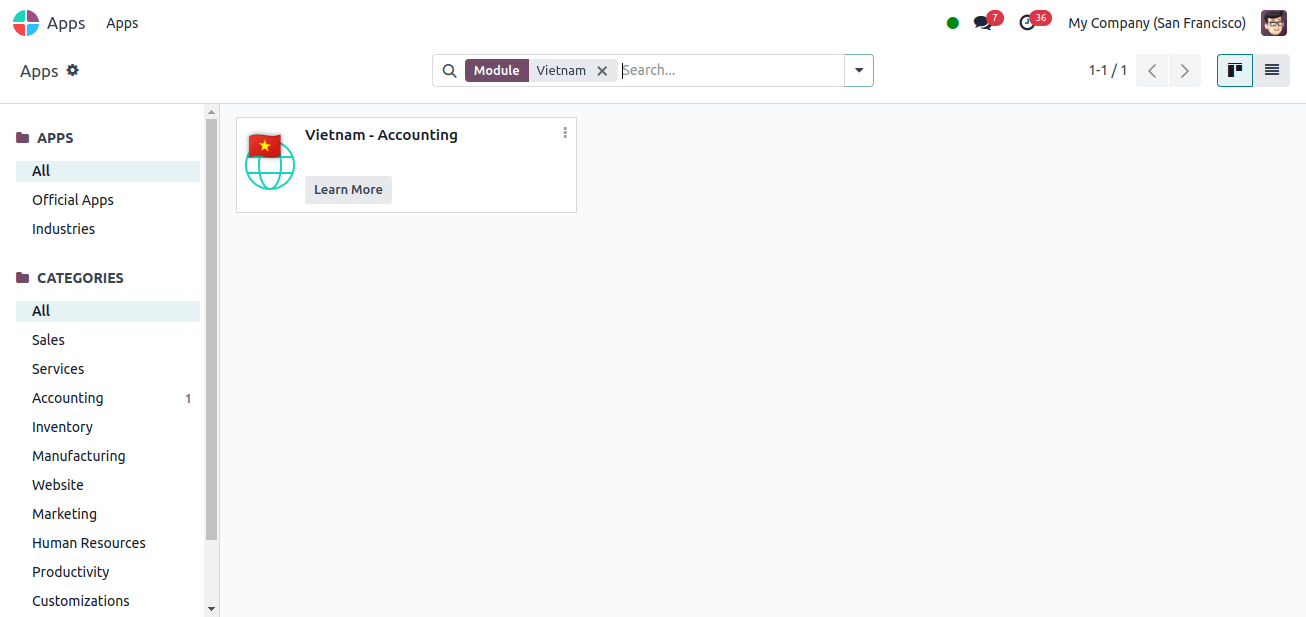

To accomplish this, go to Apps and install the modules required for Vietnam's accounting translation.

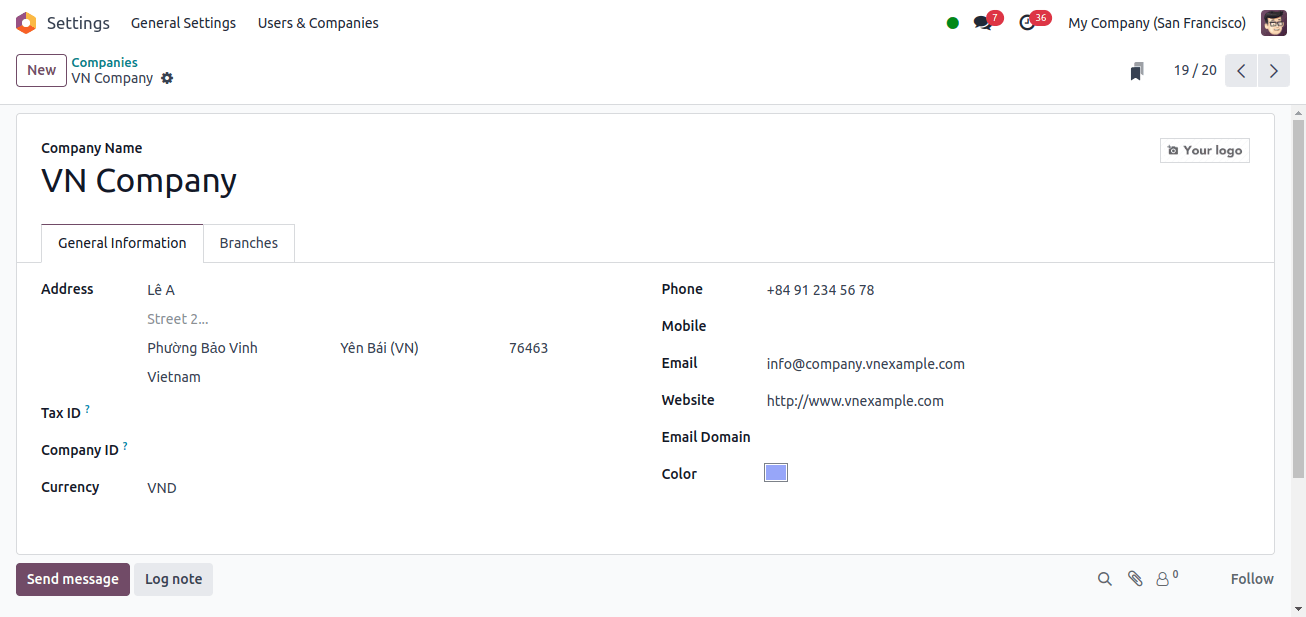

Verifying the current business setup is important for ensuring accurate data and functionality in Odoo; If required, we can create a new company with the required information. This setting establishes the key information about your company.

Go to Settings > Users & Companies > Companies. Choose the company whose configuration we want to check from the list.

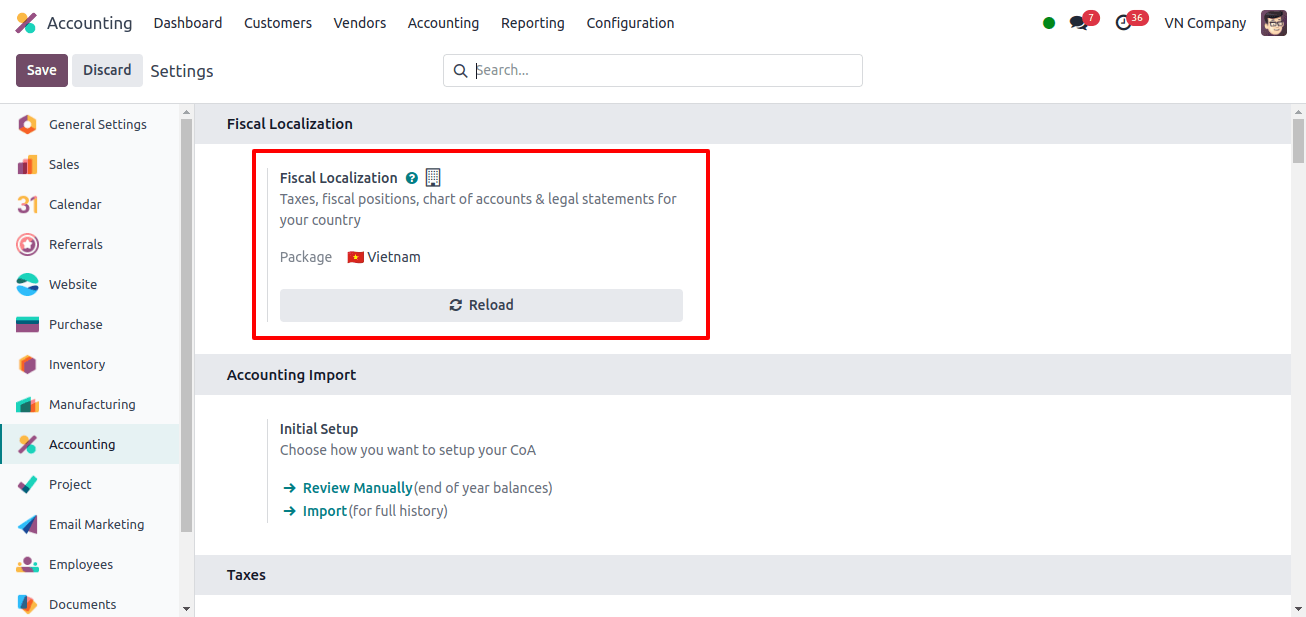

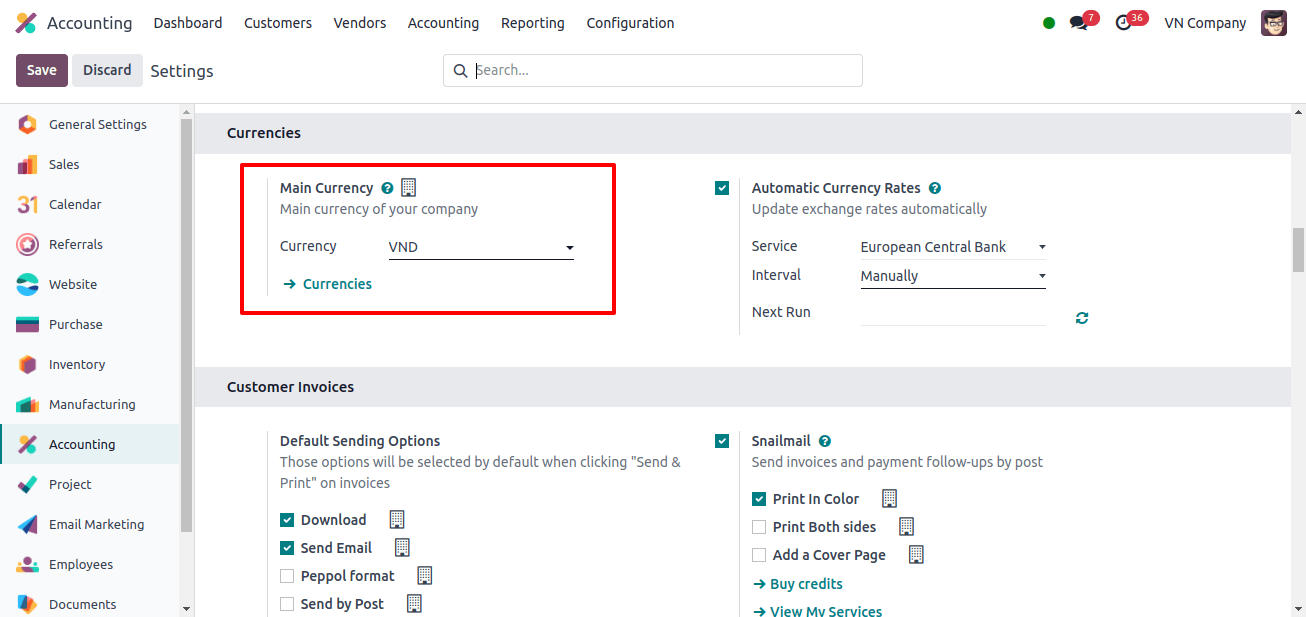

We can now go to Accounting > Configuration > Settings to check the changes performed for this localization after installing Vietnam localization and validating the accuracy of the company information.

By navigating to Accounting > Configuration > Settings, we can see that Vietnam will be chosen as the fiscal localization.

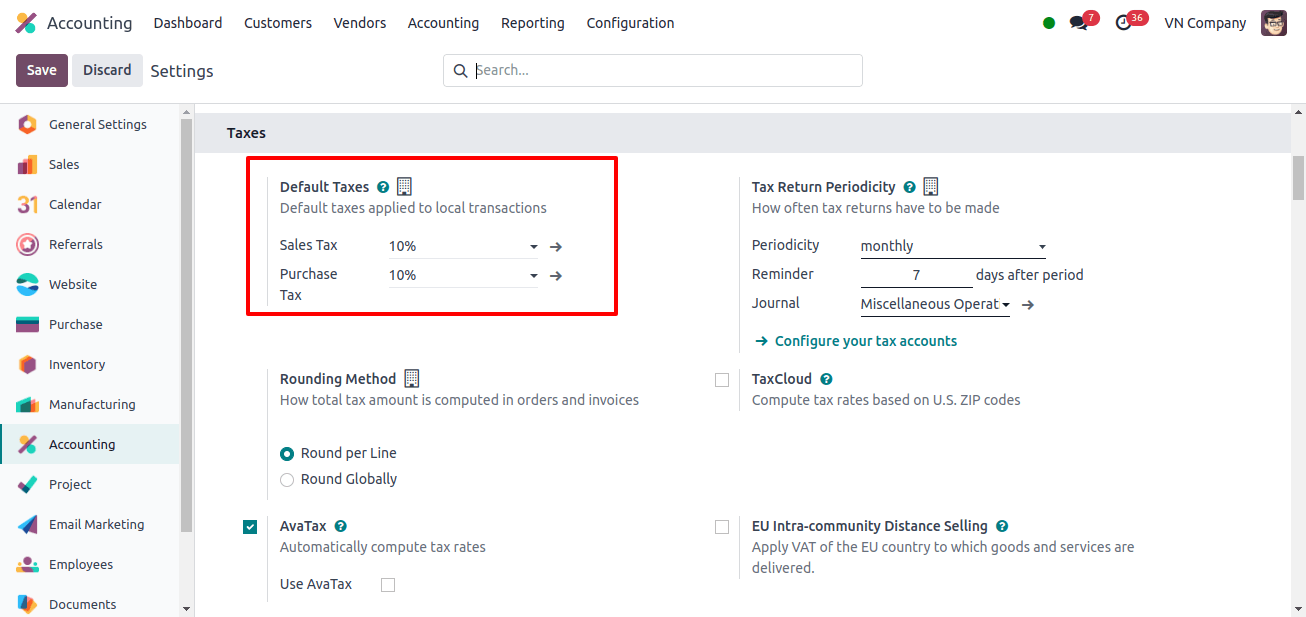

Default taxes in Odoo are established tax settings that make it possible to manage sales and purchases in the system. These default taxes are set up to automatically apply the correct tax rates to transactions depending on established parameters such as product type, customer location, or transaction type.

For Vietnam Localization, we can observe that the default tax rate is 10% sales and purchase tax. Settings default ensures consistency in tax calculation, simplifies invoicing processes, and improves financial reporting accuracy.

The main currency will be set to Vietnam’s official currency, the Vietnamese dong (VND).

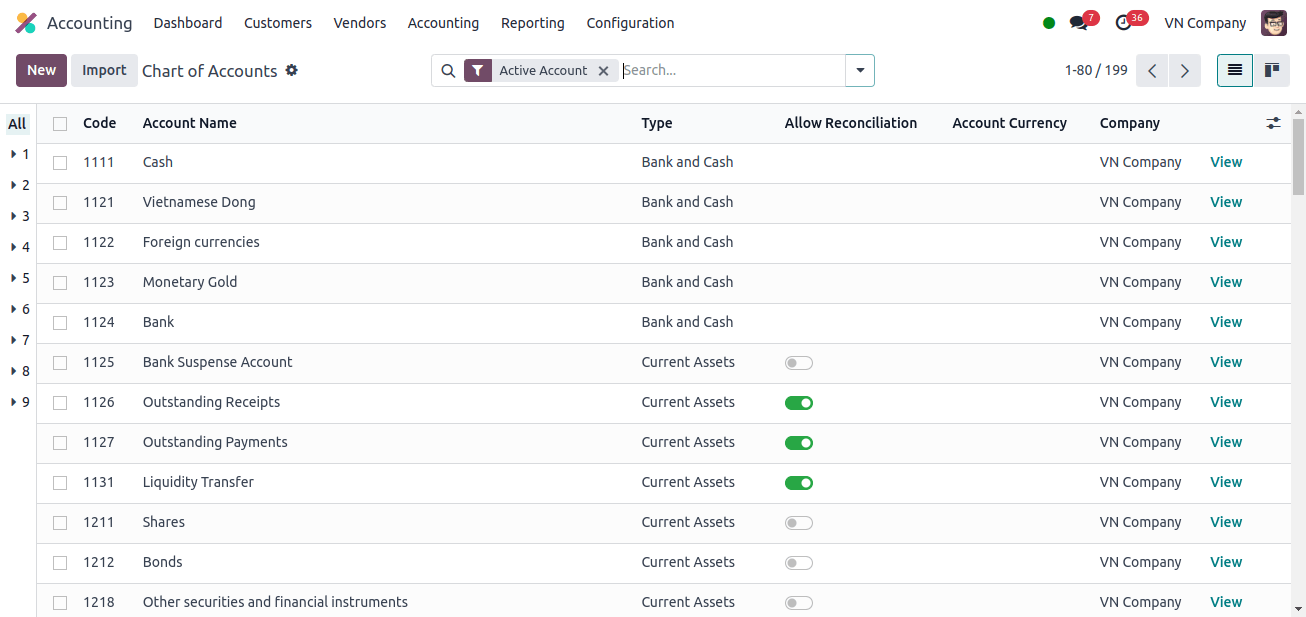

Chart of Accounts

Odoo’s Chart of Accounts (COA) organizes and categorizes all financial transactions. It guarantees that accurate financial data is collected and reported to the accounting system.

The COA provides transparency and successful financial management through a systematic framework for categorizing assets, liabilities, revenue, and expenses.

The Chart of Accounts for Vietnam accounting localization includes a few new accounts, such as Monetary Gold, which is used to categorize and track investments in gold held as financial assets.

This account type is specifically created to manage and record the value of gold, a monetary asset different from other investments or physical goods.

Working Capital Provided to Sub-Units is used to track and manage finance assigned to an organization’s subsidiary units or divisions. This account tracks the working capital allocated to various sub-units to meet operational requirements.

Other accounts with Vietnam accounting localization have been added to the Chart of Accounts to ensure the seamless operation of the company.

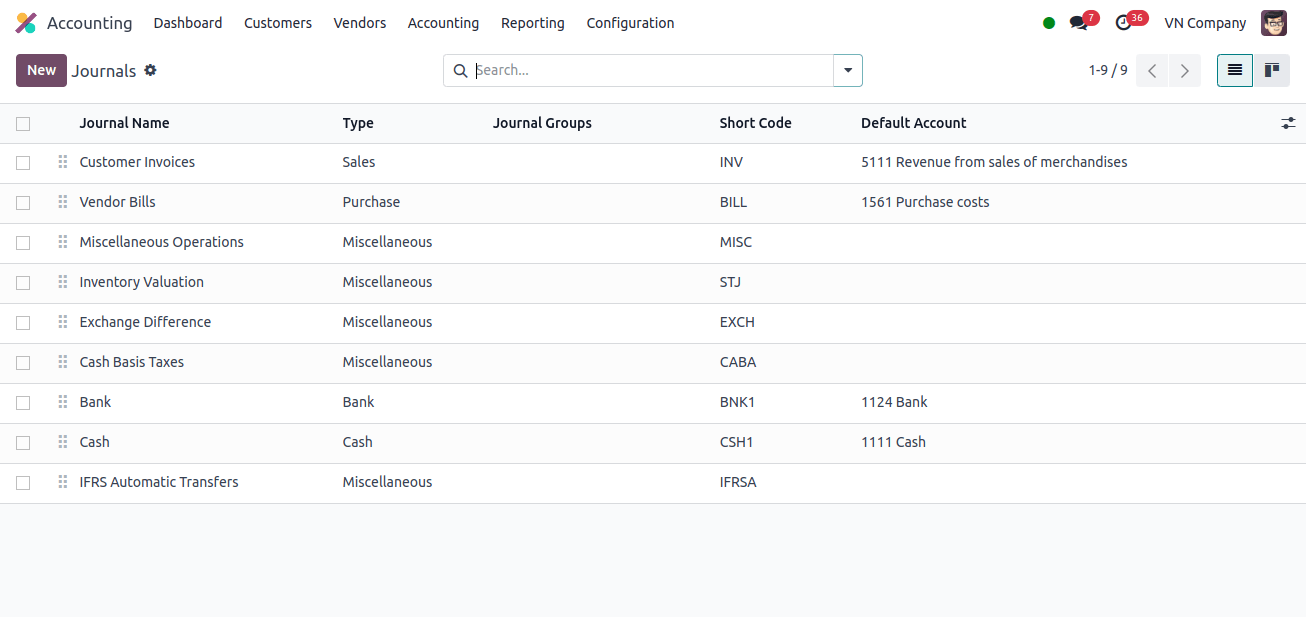

Journals

Odoo journals are important for maintaining detailed and organized financial records. They are the primary tools for accurately recording all transactions, such as purchases, sales, and expenses.

Businesses that categorize transactions into particular journals can ensure accurate bookkeeping and streamlined financial reporting. Journals make it easier to manage and verify transactions, help with accounting standards compliance, and provide a clear audit trail.

This business structure improves financial data quality and streamlines the reconciliation process, making it easier to manage and analyze financial performance.

The journals in Odoo with Vietnamese accounting localization contain all of the standard journals as well as the Exchange Different Journal, which is important for accurately tracking and recording currency variations in transactions.

This journal manages and chronicles the effects of exchange rate fluctuations on financial transactions and balances, ensuring that the value of foreign currency assets and liabilities is accurately recorded in the financial statements.

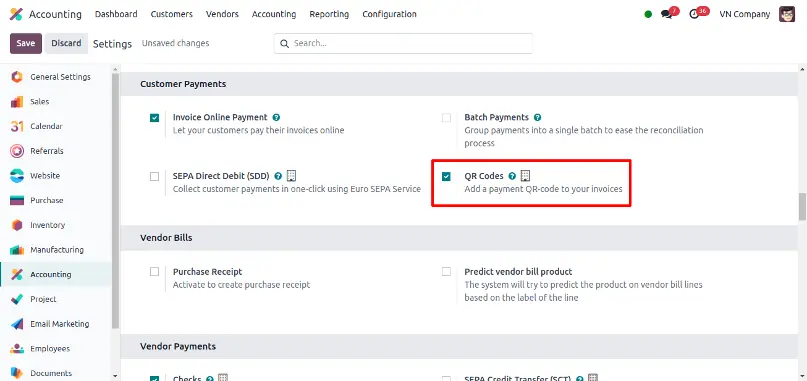

QR Banking Code to Invoices

Vietnamese QR banking allows consumers to use the internet and mobile banking to transmit finance domestically to individuals and businesses in Vietnamese dong.

To achieve this, we may add QR codes to the invoices. To do so, head to Accounting > Configuration > Settings > and under the customer payments section, we have the QR codes option accessible, which can enable and save.

Then we must configure the bank account using a QR banking account configuration.

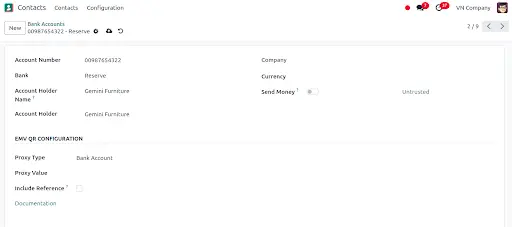

Go to the Contacts module and choose the bank account you want to enable Vietnamese QR banking under Configuration > Bank Accounts.

On the bank, we can enter the Bank Identifier Code. Next, select the Proxy Type and enter the Proxy Value Box based on your Choice. Also, ensure the account holder’s country is set to Vietnam.

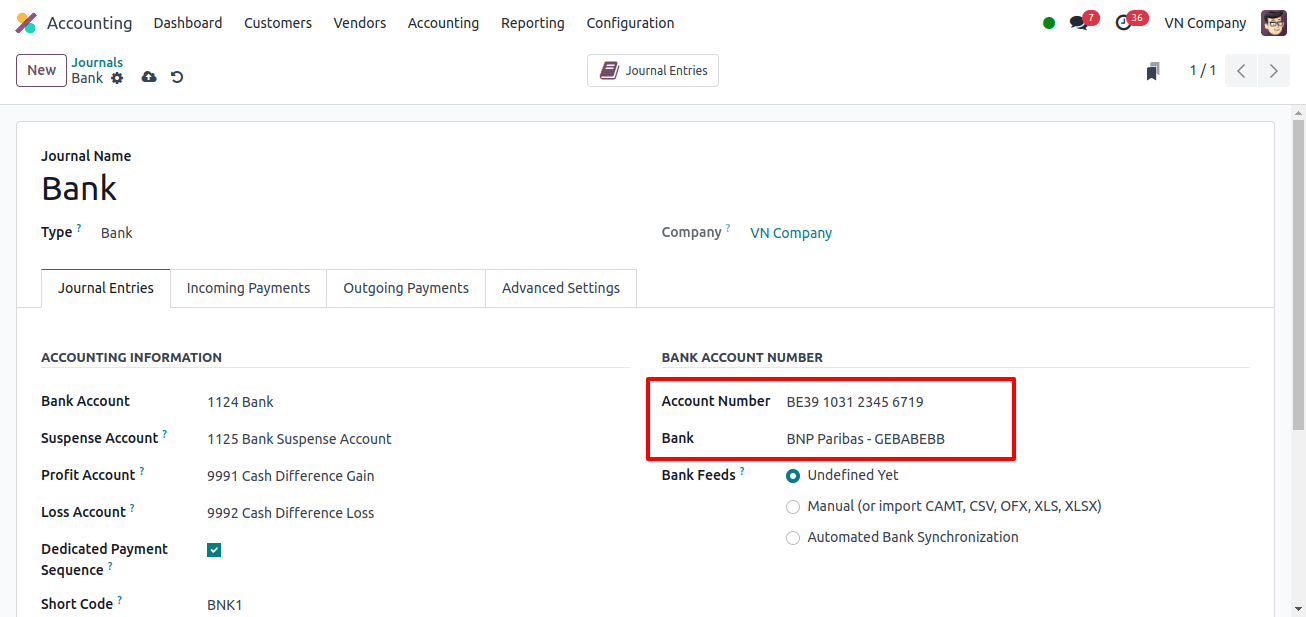

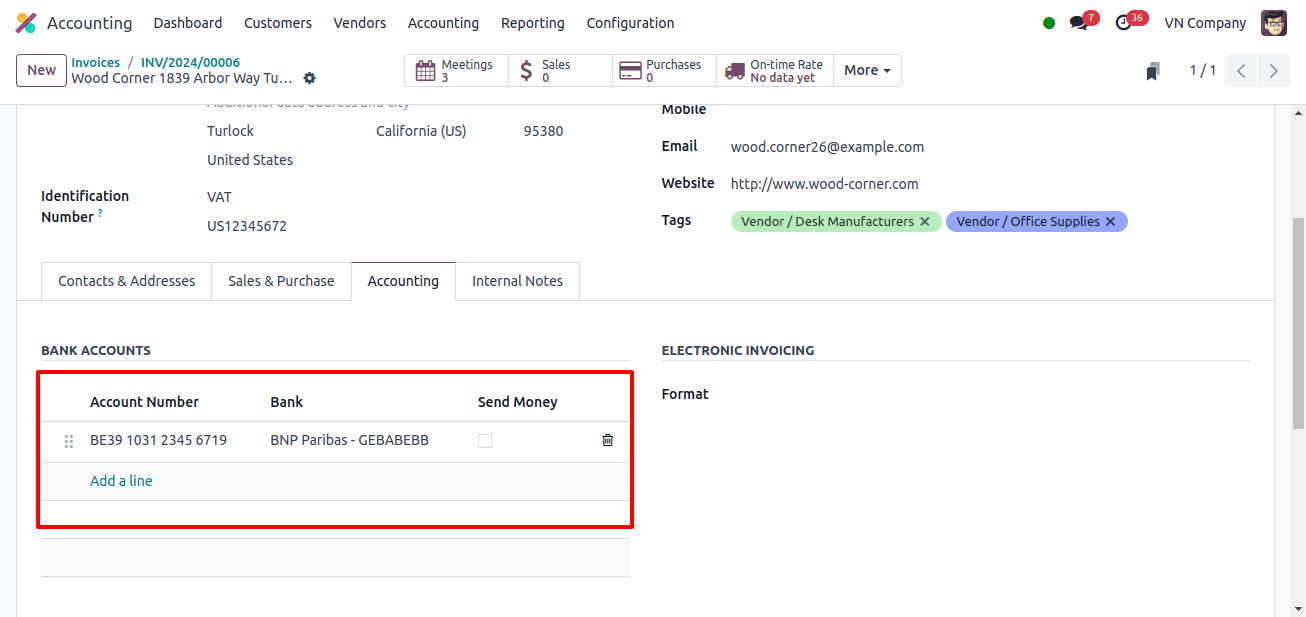

Now we can set up the bank journal by going to Accounting > Configuration > Journals and entering the Account Number and Bank under the Journal Entries Column.

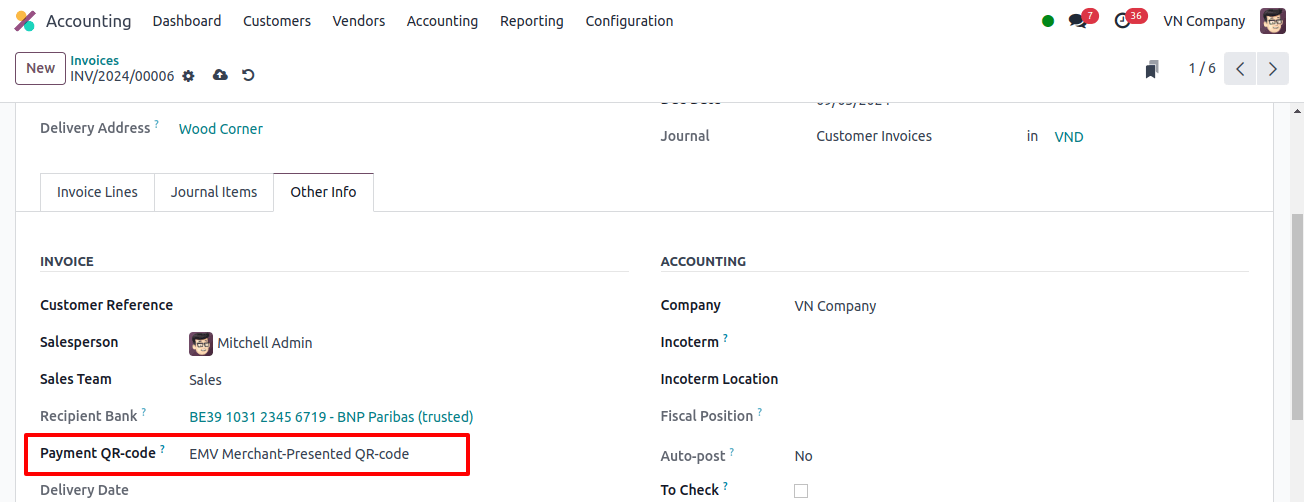

We can now put Vietnamese QR banking QR codes on invoices. When creating a new invoice and visiting the other Info tab, select the EMV Merchant-Presented QR-code under the Payment QR-code option.

We must ensure that the recipient bank is the same as the one you have selected, as this field is required to build the Vietnamese QR banking QR code.

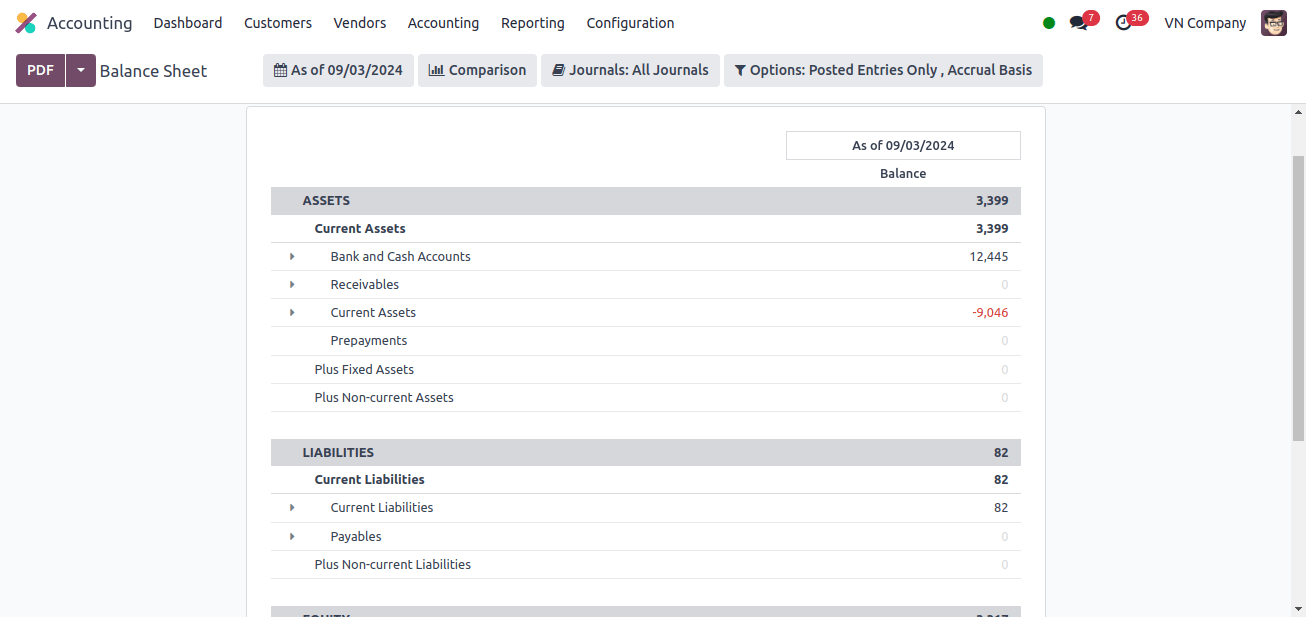

Balance Sheet

The balance sheet is an important financial statement that summarizes a company’s financial position at a given time. The presentation of equity, liabilities, and assets provides a full picture of the company’s holdings and debts.

The balance sheet is important for assessing financial health, monitoring performance, and making informed business decisions. We can look at the assets, which are the company’s resources such as cash, inventories, and real estate, that have the potential to provide future financial rewards.

We may view current assets under assets and liabilities, which indicate the debts and liabilities that the company must clear, such as loans, accounts payable, and accumulated expenses. This allows you to view your current liabilities.

Accurate liability monitoring and reporting in Odoo provide insights into the company’s financial commitments and ability to satisfy them, as well as Equity, which reflects the owners’ investment in the business and includes retained earnings, capital contributions, and shareholder equity. In the equity field, we can obtain a full report on unallocated earnings as well as unallocated earnings for the current fiscal year.

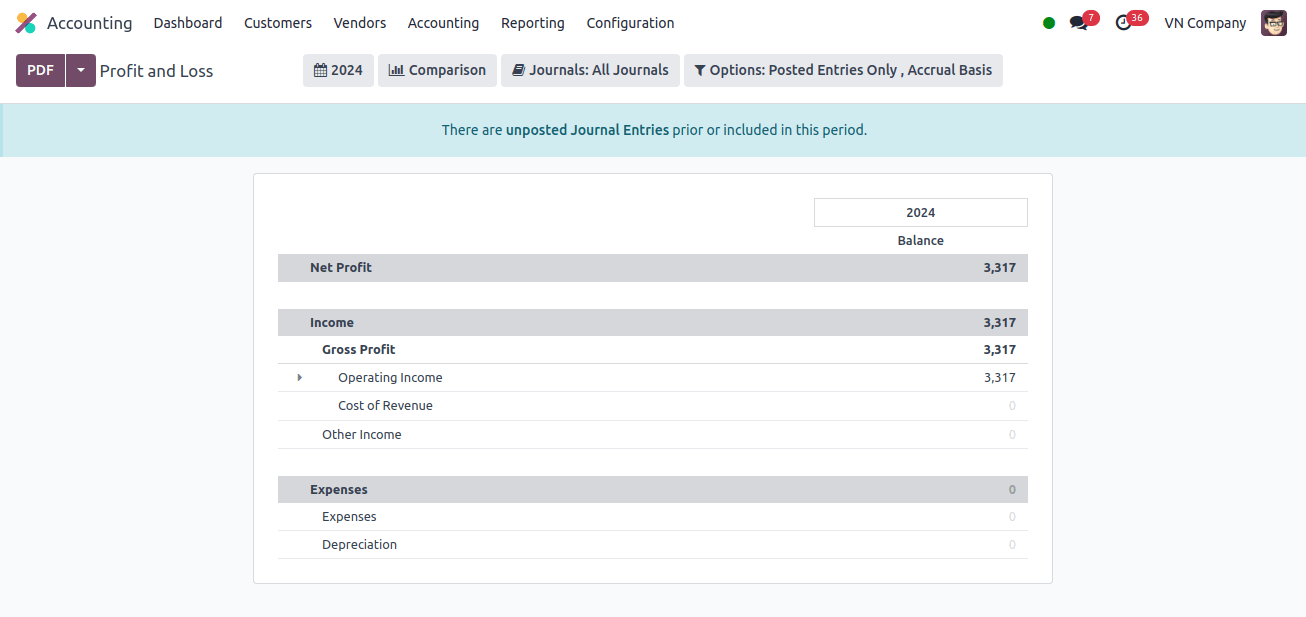

Profit and Loss Report

Odoo’s Profit and Loss (P&L) report provides a detailed breakdown of a company’s financial performance over a specific period. It reports on the company’s profitability and operational efficiency by breaking down sales, costs, and profits or losses.

The profit and loss statement summarizes income and expenses, allowing businesses to assess their financial report, follow performance trends, and make wise decisions.

We have three categories: net profit, income, and expenses. The gross profit, which is the difference between total revenue and the cost of goods sold (COGS), is shown in both the report and the income section.

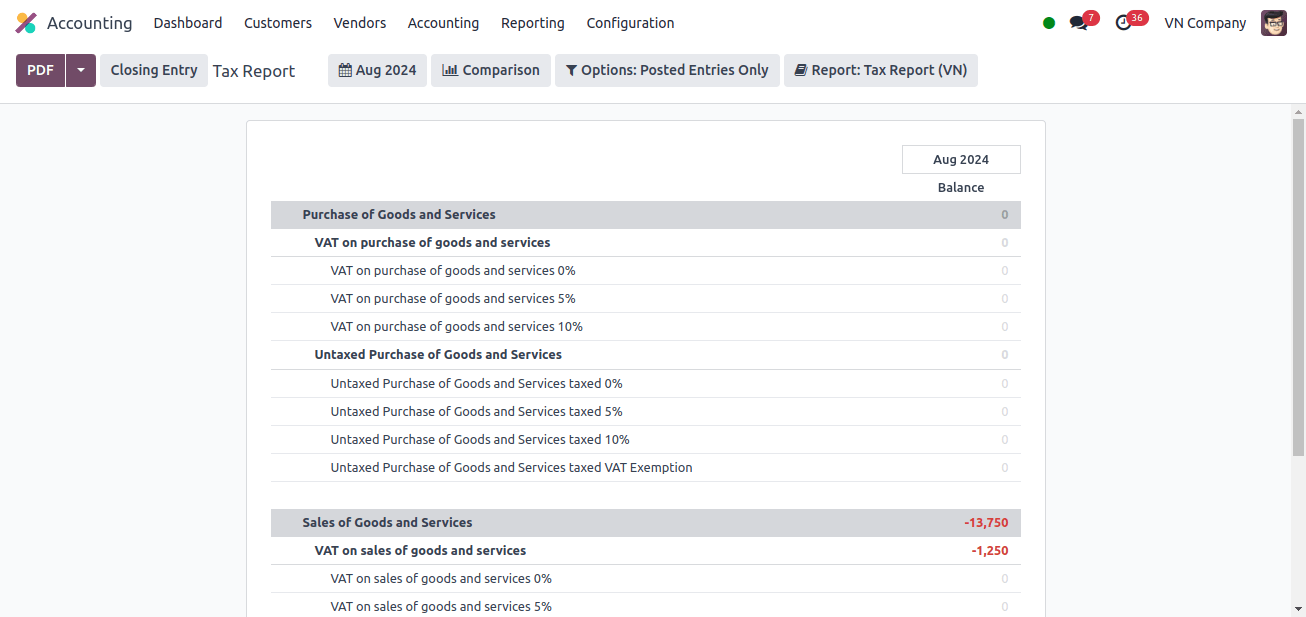

Tax Report

This report offers a thorough analysis of taxes collected and paid, including VAT, which is required for proper tax reporting and submission. It contains local tax rules and rates, allowing for more precise computations of VAT liabilities and refunds.

The tax report also assists businesses in generating important documentation for tax authorities, which simplifies the filing process and ensures compliance with local tax rules.

Odoo’s Vietnam localization automates tax administration, reduces error risk, and promotes effective regulatory compliance.

We may see the Purchase of Goods and Services report, which records the specifics of VAT on acquired goods and services, including the input tax that can be claimed as a credit against their VAT liability.

It gives a detailed explanation of VAT amounts paid on various purchases, ensuring correct reporting of input tax credits. Similarly, the sales of goods and services section describes the VAT collected on sales transactions, including relevant rates and total amounts.

It categorizes sales by type and applies the correct VAT rates to guarantee that output tax is accurately reported. The report gives a full overview of VAT responsibilities related to sales, allowing for the right documentation and submission to Vietnamese tax authorities.

Thus, Odoo’s accounting localization for Vietnam offers a strong choice that is customized to meet Vietnam’s specific legal and financial requirements.

We can see that with Vietnam localization, clients may perform QR banking on invoices; QR banking allows customers to complete transactions quickly, reducing the need to manually enter payment or account information.

This optimized approach reduces transaction time. This localization provides timely and compliant tax filings, ensures correct and efficient transaction administration, and provides useful information about financial performance.

Related Post: