Accounting localization involves modifying financial management systems to conform to specific local standards and legislation. Accounting module must be customized to meet the local tax legislation, reporting requirements, and financial practices.

Accounting localization encourages precise and compliant financial reporting by integrating features such as tax calculations and report formats that follow local accounting standards.

This customized strategy allows businesses to effectively manage their money while also meeting locally particular legal and regulatory constraints.

To understand Thailand’s financial market, one must be well-versed in local accounting standards and rules. These specific requirements are taken into account in the design of Odoo’s accounting localization for Thailand, which provides businesses with a customized solution for properly managing their finances.

Odoo 17 uses key features such as currency management, reporting requirements, and Thai tax law. This module streamlines the entire accounting process, increases financial reporting accuracy, and simplifies compliance by following the Thai accounting standards. This allows companies to focus on strategic-decision making and growth.

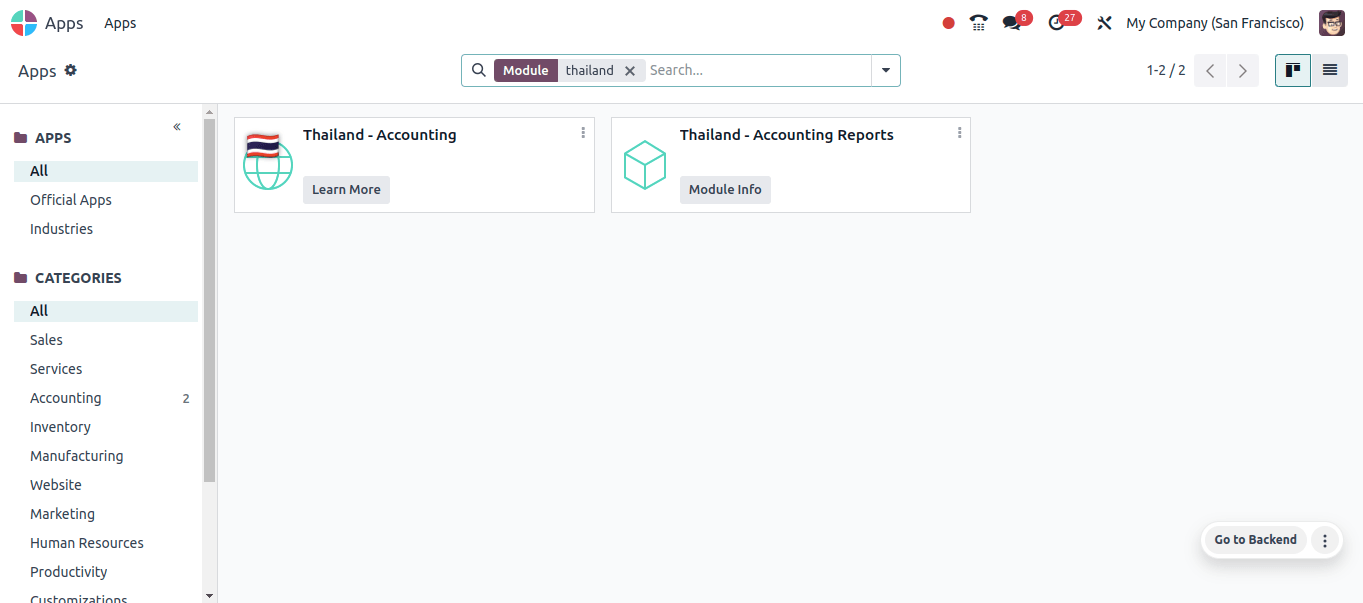

Thailand Accounting with Odoo 17

The first step is to set up Thailand Accounting Localization in Odoo 17. To accomplish this, browse to Apps and install the required modules.

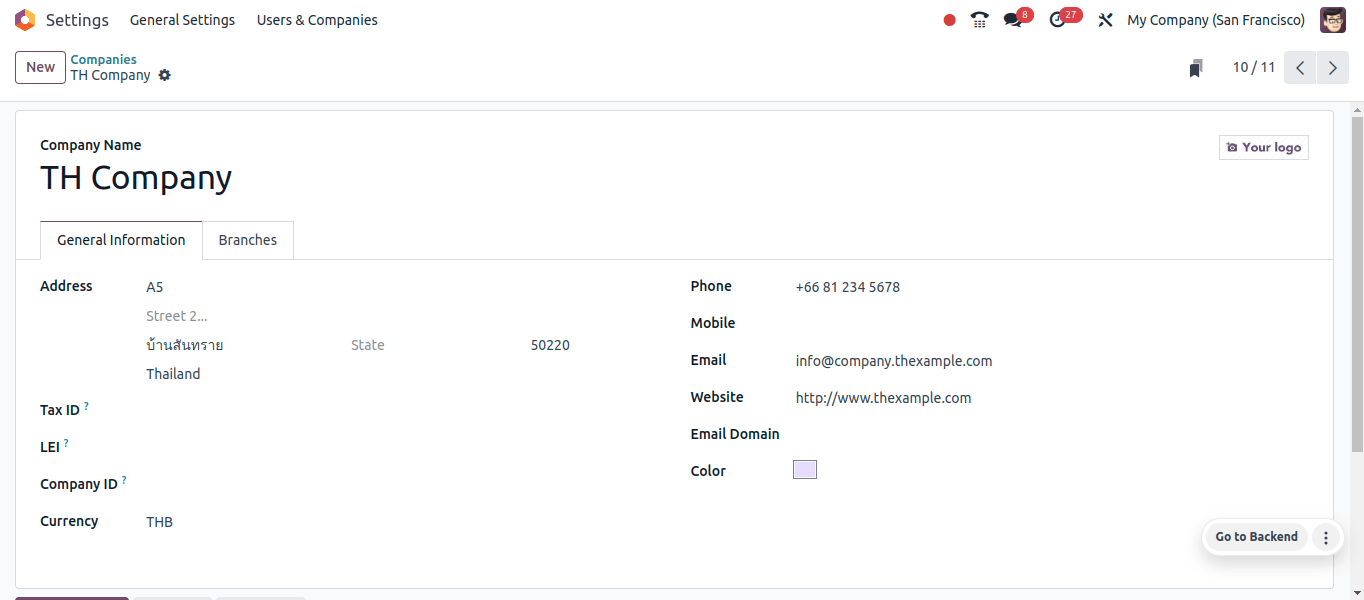

We must verify the company configuration; if it is not properly configured, we must create a new business with the proper company parameters.

To do so, go to Settings > Users and Companies > Companies and pick the firm to check from the List that appears.

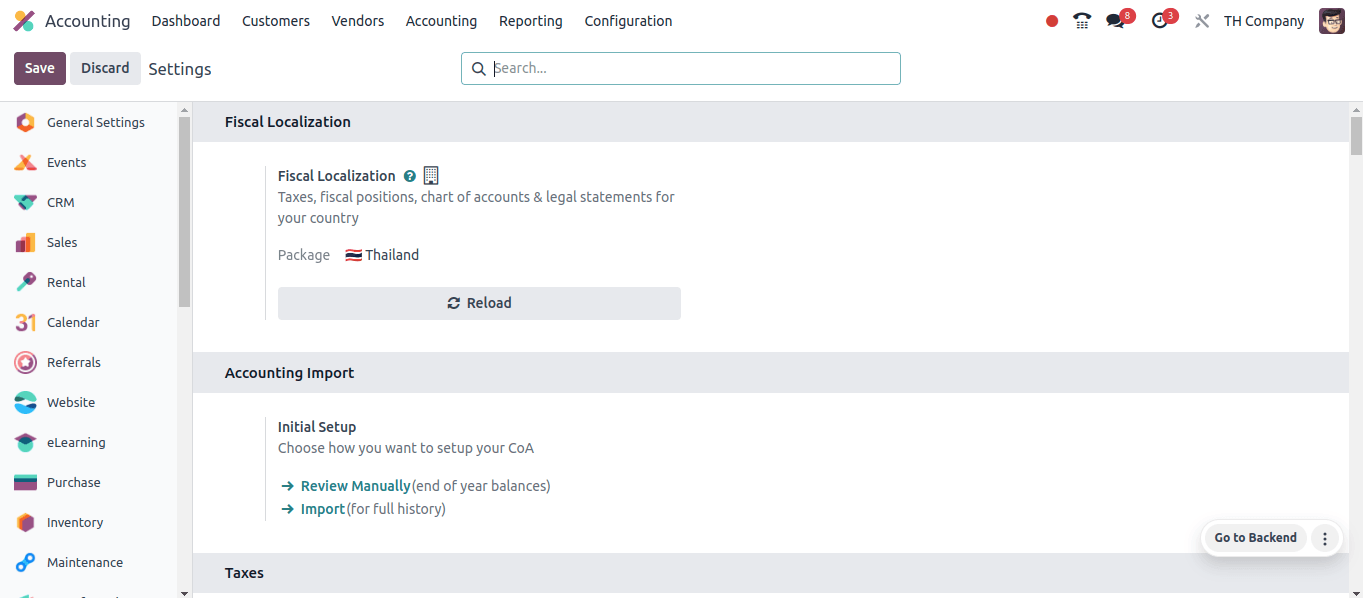

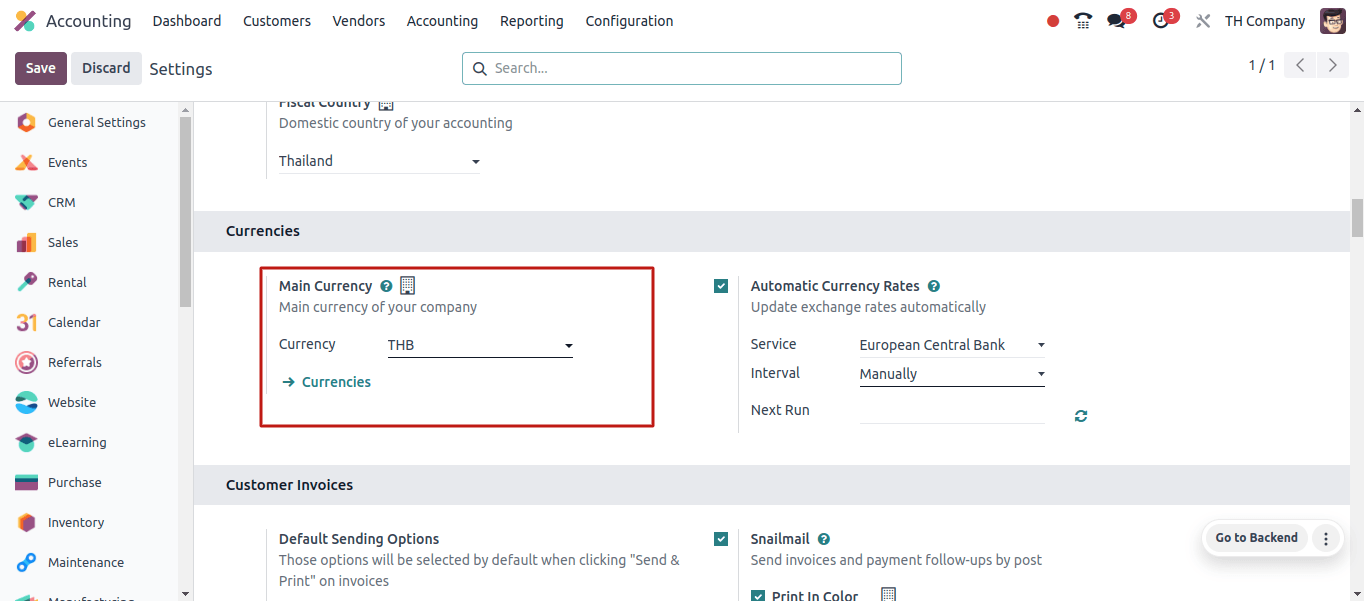

Once we have installed the localization modules and verified that the company setup is properly installed, we can examine the fiscal localization, main currency, and default taxes that are imposed after the localization.

To do this, go to Accounting > Configuration > Settings. Thailand has been selected for fiscal localization. As a result, it will govern how the nation’s taxes, fiscal positions, chart of accounts, and legal statements are organized.

Thai Baht (THB), the national currency of Thailand, will be used as the primary currency.

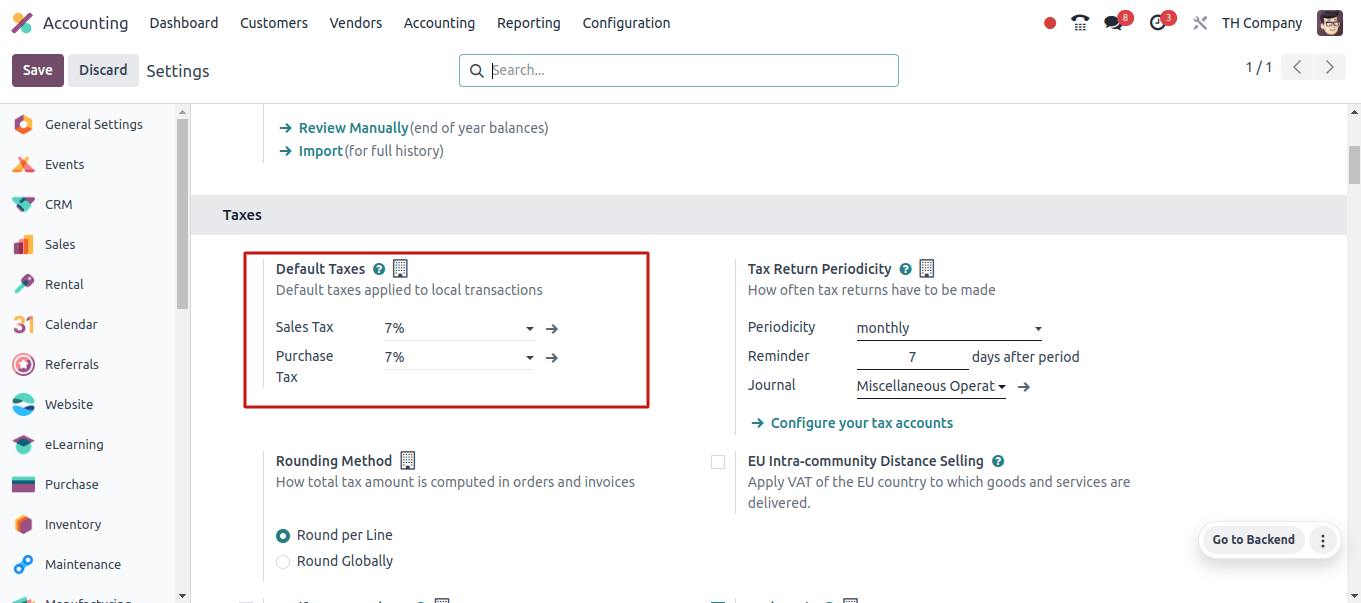

Default Taxes are the pre-set tax rates and laws that are automatically applied to transactions, such as sales and purchases, based on system configurations.

By ensuring that the right tax amounts are applied consistently, these default tax settings simplify the accounting process and reduce the need for manual adjustments. Here, the default taxes are added to the 7% sales and purchase tax.

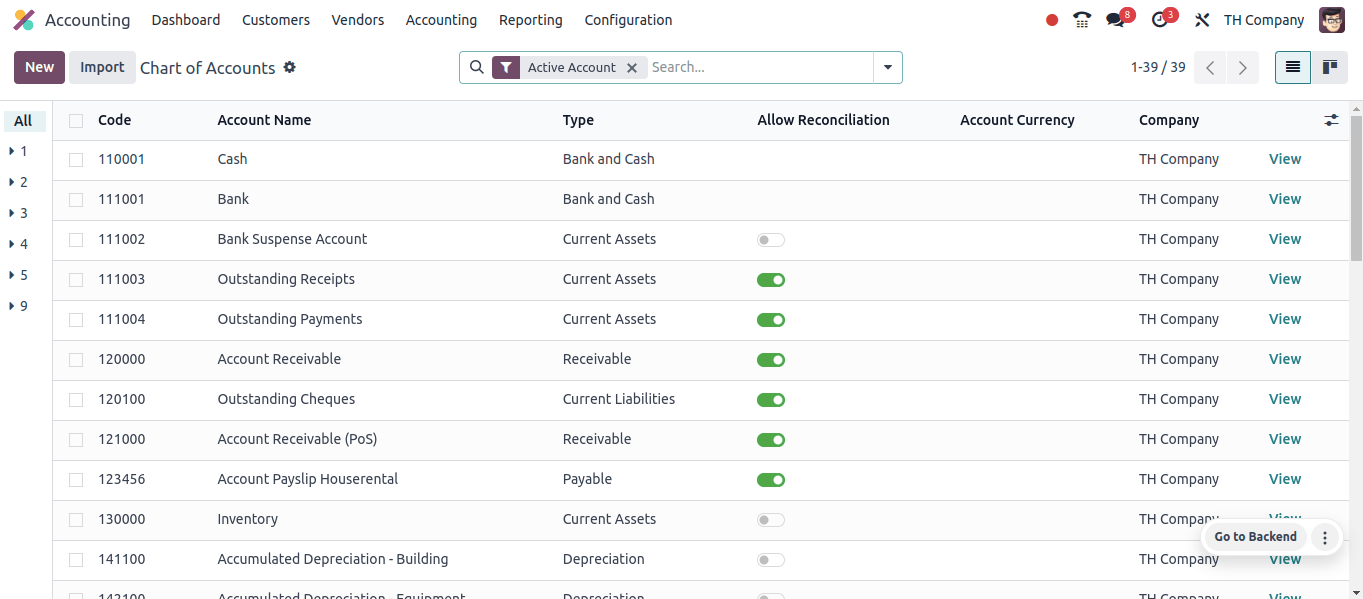

We can see all of the core charts of accounts, as well as some additional charts of accounts made specifically for this translation.

After installation, the chart of accounts and taxes will be immediately modified to reflect the localization. The chart of accounts serves as a framework for arranging and recording financial transactions, allowing for accurate and consistent financial reporting.

The Accrued Expenses account in the chart of accounts is used to record expenses incurred but not paid or invoiced by the end of the accounting quarter.

This account ensures that expenses are recorded in the relevant financial period, in accordance with Thai accounting standards and accrual accounting principles.

The Uninvoiced Receipts account in the Chart of Accounts is used to track monies received by the business for which invoices have yet to be issued.

This account manages and accounts for customer receipts prior to formal invoicing, guaranteeing accurate financial reporting and cash flow management.

Retained earnings are the portion of a company's profit that is held within the company rather than distributed as dividends to shareholders.

This account shows the accumulated profits and losses from the prior quarters, which are reinvested in the company or used to cover losses.

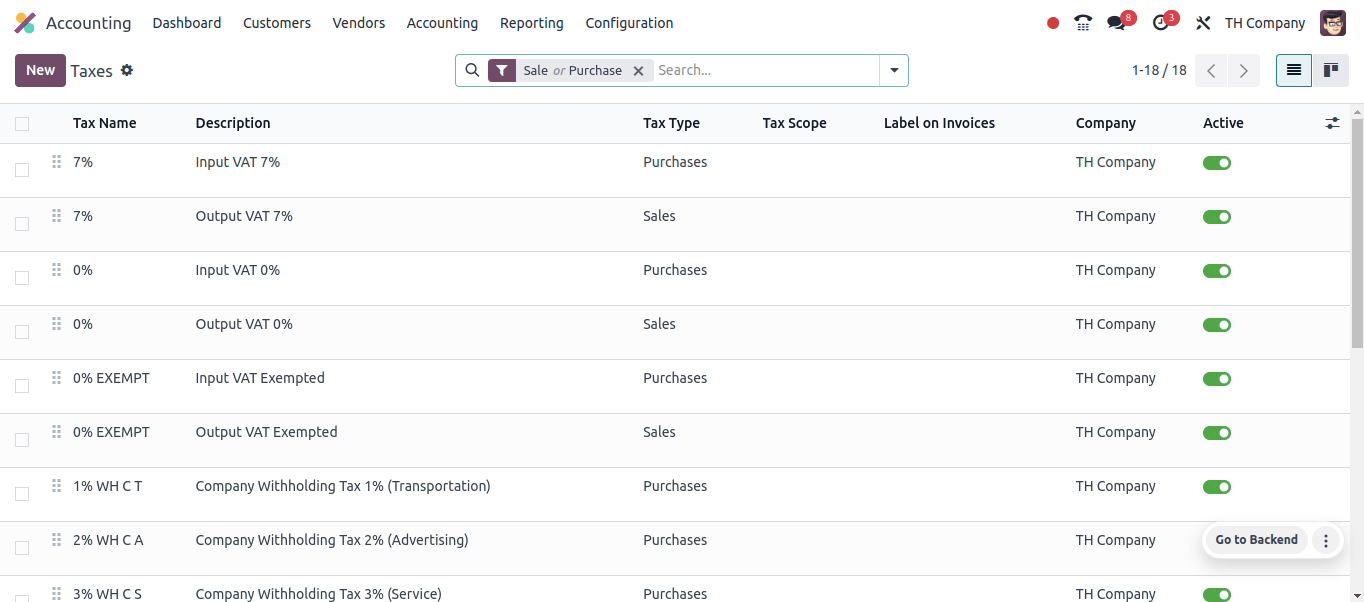

Similarly, there are various more charts of accounts in this translation that serve distinct purposes. Taxes are financial levies levied on sales and transactions in Odoo based on set rules and rates.

To ensure accurate application and reporting, the system automatically calculates and integrates these taxes into the overall accounting operation. This localization includes the following taxes:

* VAT 7%: It is designed to comply with Thailand’s Value added tax requirements. This tax rate is applied to sales and purchases to reflect Thailand’s regular VAT rate.

* VAT-exempted: Some transactions are exempt from Value Added Tax, which is used to manage such transactions. This configuration is required for effectively managing products or services classified as VAT-exempt under Thai tax legislation.

* Withholding tax: It is necessary to comply with Thai tax legislation. Withholding tax is a portion of a payment that businesses are required to withhold and send to tax authorities.

* Withholding income tax: The tax is withheld from payments made to persons or companies and remitted to the Thai Revenue Department. This ensures that income taxes are collected before the taxpayer receives it.

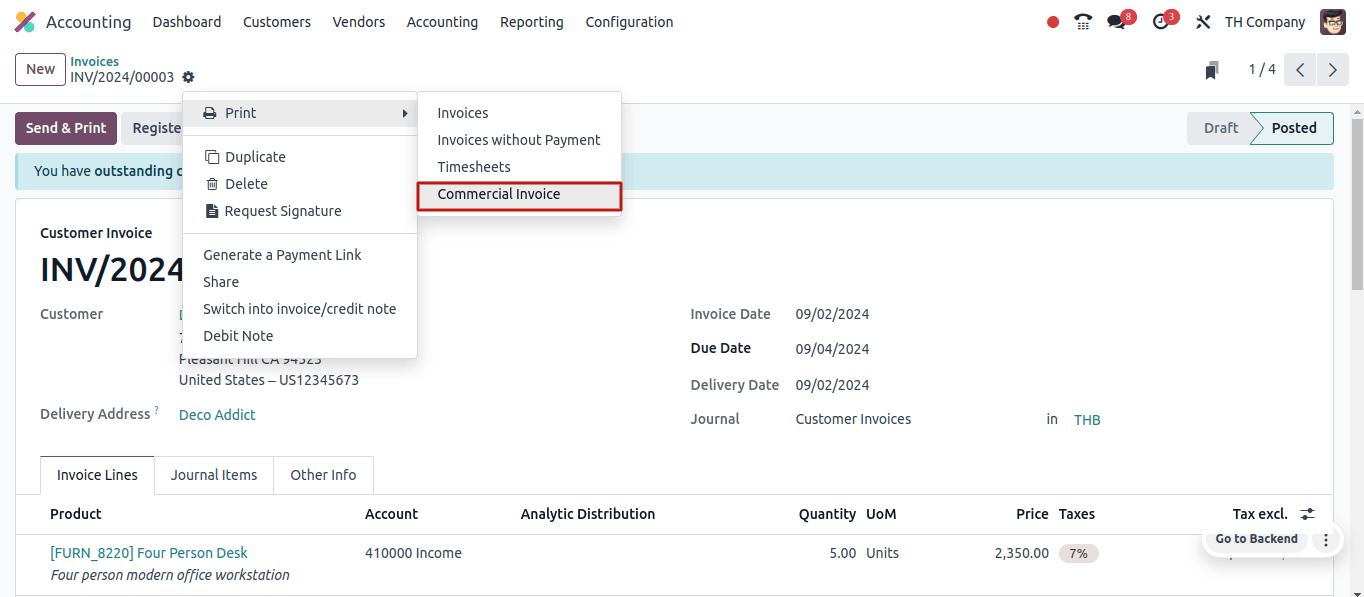

Additionally, this translation includes the option to print tax bills. We can opt to print normal or tax invoices as PDF reports.

To do so, click on Actions on the invoice, and then select Print, which will allow you to print the commercial invoice.

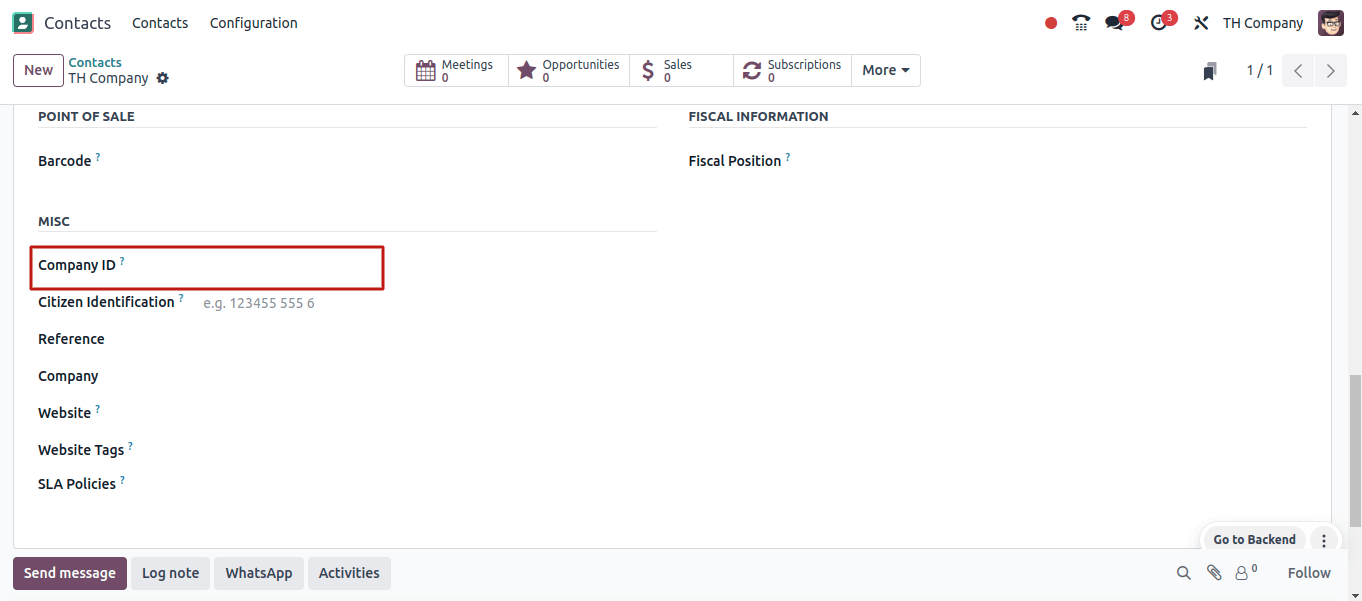

The contacts app can help us find a company's headquarters and branch numbers. Go to the Contacts module and open the company's contact form; under the Sales and Purchase tab, we can add the company ID. If the contact is a branch, enter the brand number; if it is the headquarters, leave the business ID blank.

PromptPay QR code on Invoices

Customers can use the bank’s mobile app that supports PromptPay to pay their bills by scanning the PromptPay QR code on their invoice. The QR code is generated using the invoice amount and one of the merchant details listed below:

- ID for an eWallet

- Tax ID for Merchants

- Mobile Phone Number

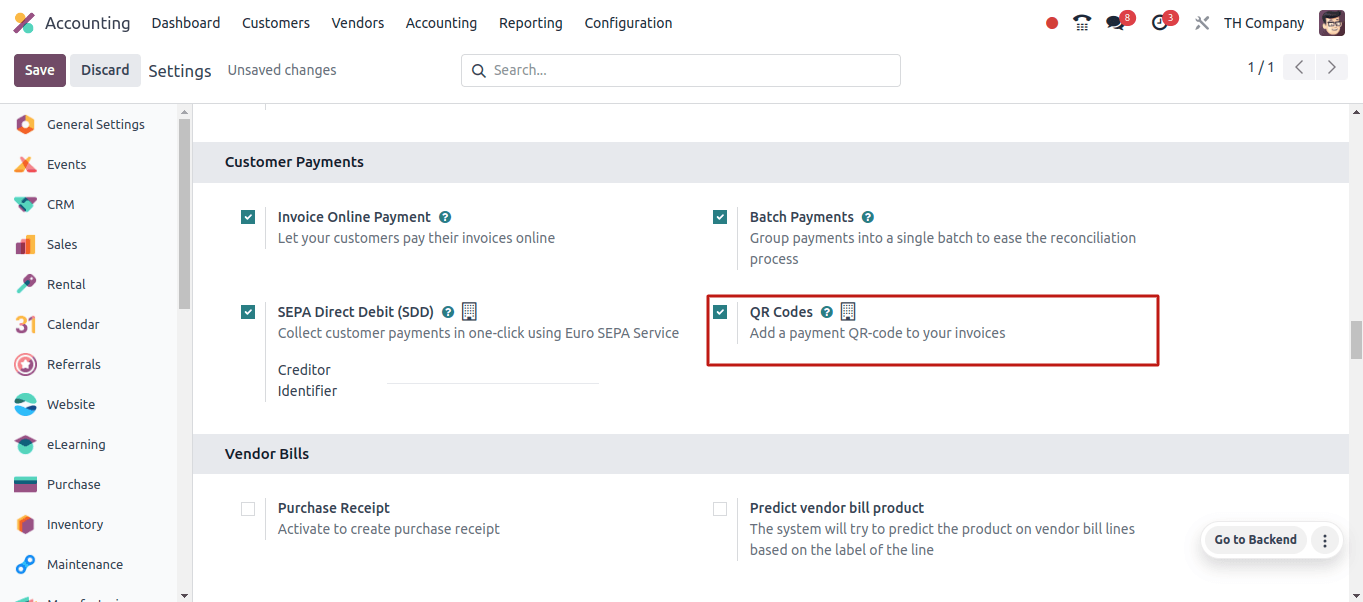

To activate this, we must first activate the QR code and then configure the PromptPay QR bank account. Go to Accounting > Configuration > Settings, and then activate QR codes under customer payments. Save the settings.

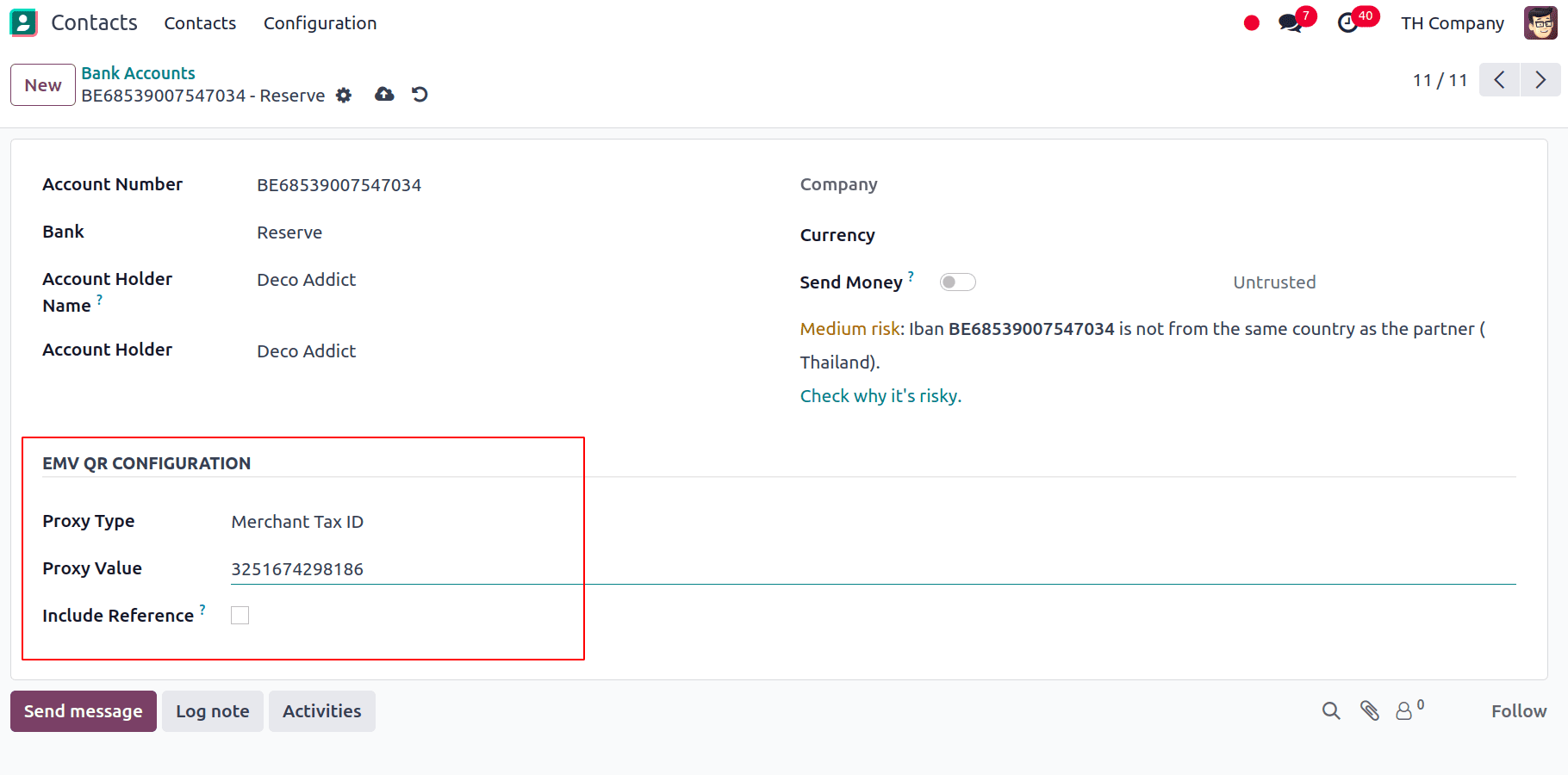

To configure the Promptpay QR bank account, go to contacts > configuration > bank accounts. Then, choose the bank account for which we want to activate PromptPay QR, and then specify the Proxy Type and Proxy Value fields.

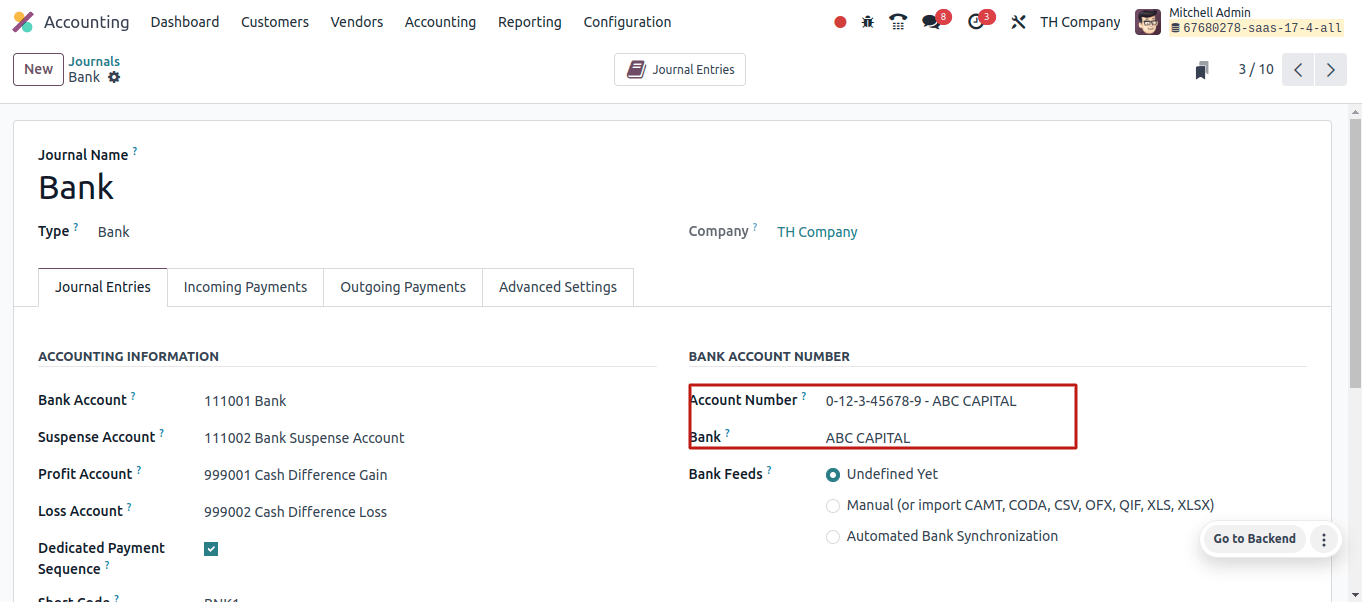

Now we can configure the bank journal by going to Accounting > configuration > journals and selecting the bank journal, then filling out the account number and bank fields on the journal entries tab.

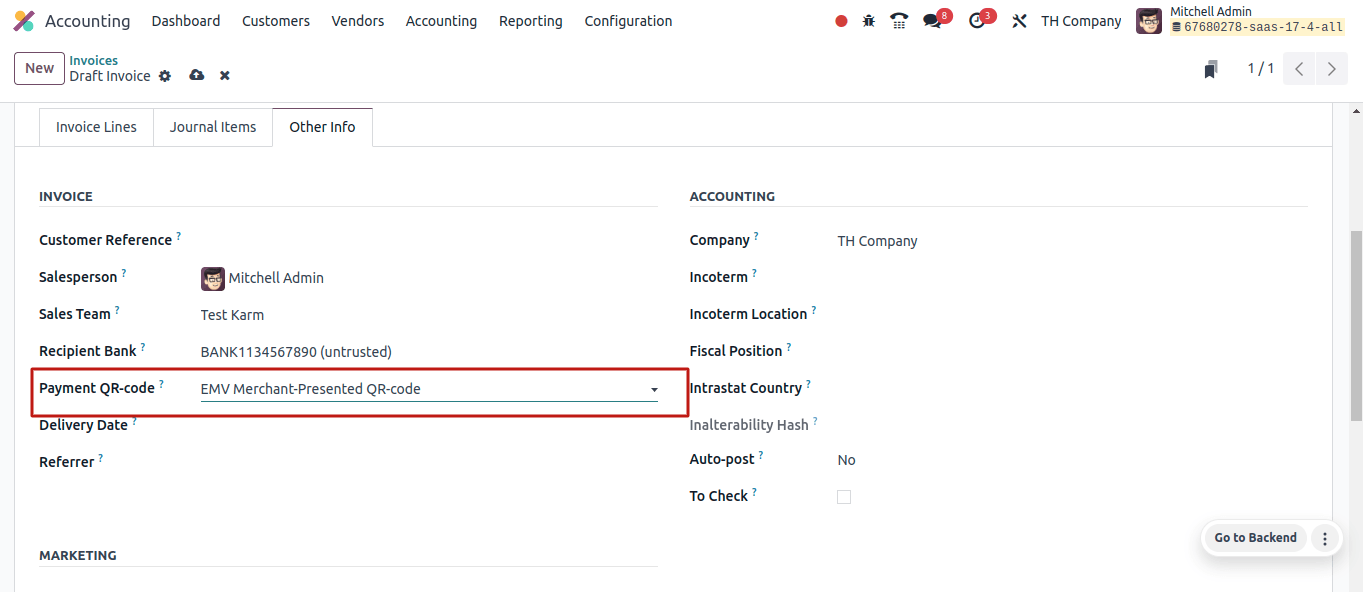

We can now issue invoices with the Promptpay QR code; to do so, generate a new invoice by visiting the other info page and selecting EMV Merchant-Presented QR-code under the Payment QR-code option. Select the option for an EMV merchant-presented QR code. Odoo uses this field to generate the PromptPay QR code, therefore make sure it is the same blank as you specified.

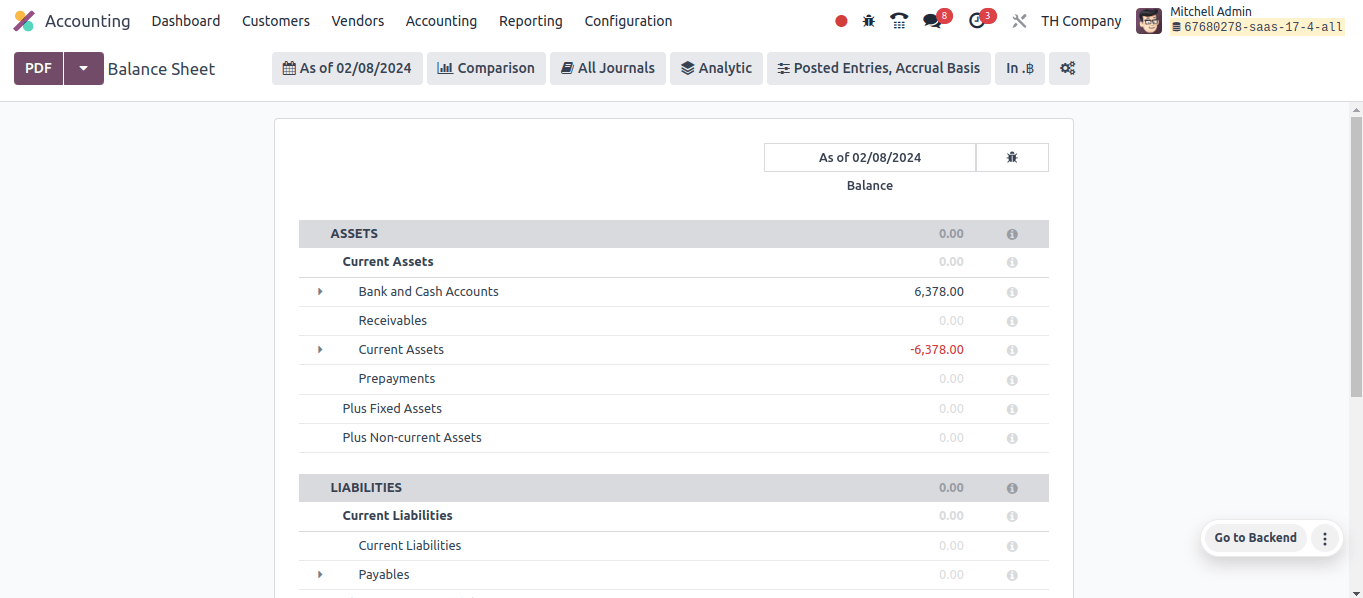

Now we may look at the reporting part, which contains the balance sheet, profit and loss report, and tax report.

A balance sheet shows an organization’s equity, liabilities, and assets, providing a clear snapshot of the company’s financial condition.

Assets are resources that a company or individual has that are commercially valuable and are expected to generate benefits in the future.

A key concept in financial accounting is that assets are frequently grouped according to their nature and purpose within the company. The amounts of money owed by a business to other people or businesses are referred to as its liabilities.

Liabilities are balance sheet entries that show how much the company owes to suppliers, creditors, lenders, and other entities. Equity refers to the amount of a company’s assets that remain after removing its obligations.

The assets section of the balance sheet contains bank and cash accounts, receivables, current assets, prepayments, fixed assets, non-current assets, and so on. The liabilities field of the balance sheet includes all payables, current liabilities, and non-current obligations.

The equity portion of the balance sheet includes the following: Current year unallocated earnings, current year earnings, current year allocated earnings, previous year unallocated earnings, and retained earnings.

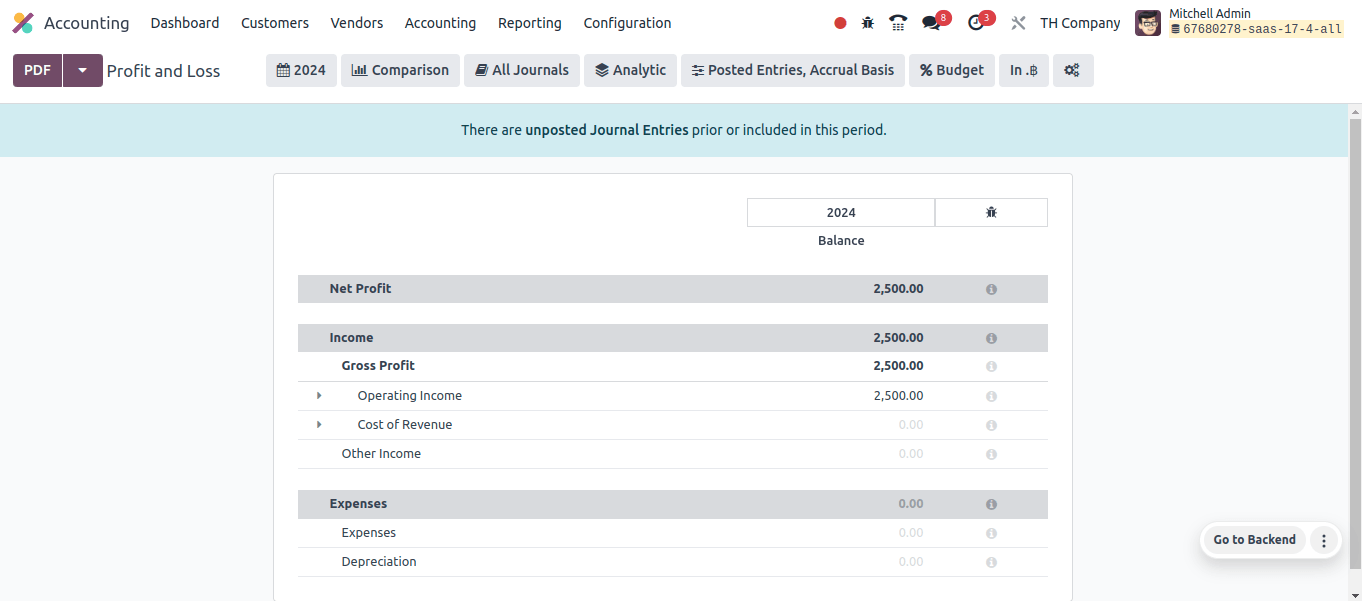

Profit and Loss: A profit and loss statement summarizes a company's payments, expenses, and net earnings or losses for a given time period. It provides an overview of the business's financial performance throughout that time period and is critical in establishing the enterprise's profitability.

Gross profit includes operating income, cost of revenue, and other income, while expenses and depreciation are shown under expenses, and other products are the key components of Thailand’s profit and loss report. Next, we’ll look at the tax report for the Thai company.

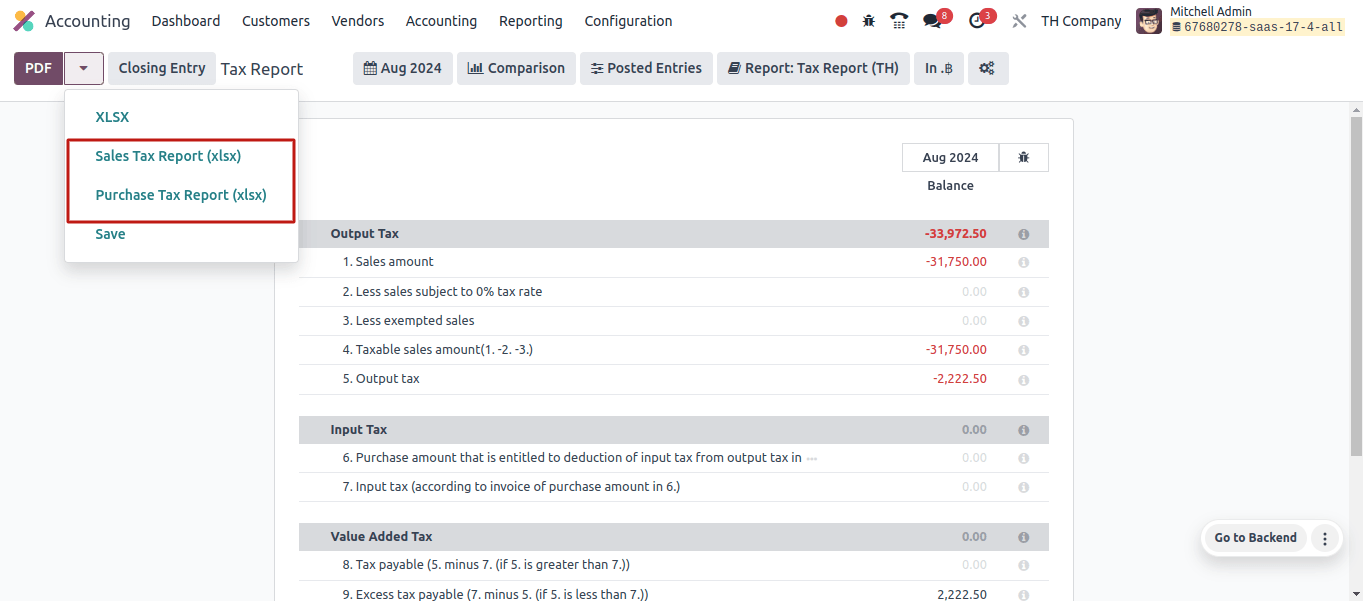

We can use the Tax Report to create Excel files for submitting VAT to Thailand's Revenue Department. To generate a sales and purchase tax report, select Accounting > Reporting > Tax Report.

After selecting a period or range of the tax report, choose purchase tax report (xlsx) for purchases and sales tax report (xlsx) for sales.

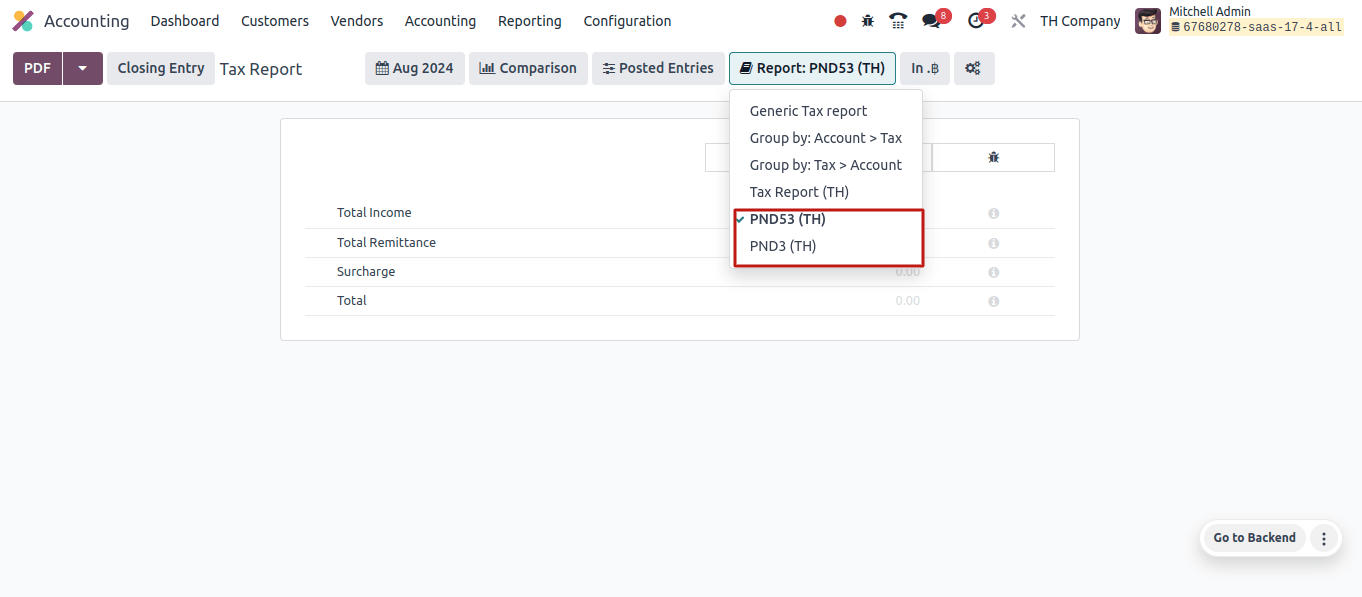

With the implementation of Thai localization, we now have PND53 (TH) and PND3(TH) tax reports in the Tax Reports section. PND report data presents the aggregated amounts of the relevant withholding company income tax returns (domestic) from vendor invoices.

In this blog, we’ve seen the modifications that occurred after we installed Thailand Accounting Localization. We may print the tax invoice locally, and it also includes a very important feature called Prompt-pay QR code on invoices, which allows consumers to pay their bills using a Promptpay-supported mobile application.

The localization makes it easier to comply with Thai tax regulations, increases financial reporting accuracy, and simplifies complex accounting operations. Businesses benefit from enhanced operational performance and a solid foundation for supervising their financial activities in Thailand as a result.