Odoo ERP modules provide fiscal localization packages, which include a chart of accounts, per-configured taxes, legal declarations, and fiscal positions stored in a database. These modules make tax automation easier by allowing users from many countries to localize ERP commodities based on their regulations.

Odoo ERP improves localization features in modules such as Odoo 17 Accounting module, which simplifies electronic invoice storage, tax application, customer tax management, withholding taxes, credits, and book payments. Fiscal localization also makes it easier to integrate accounting transactions, provide different reports, and centralized organizational data.

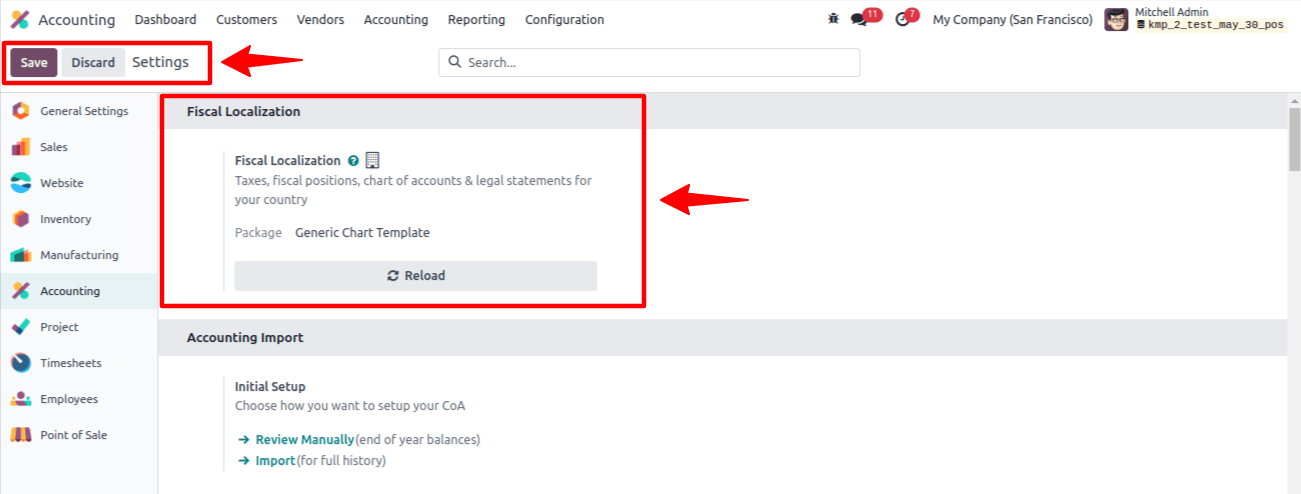

Activating Fiscal Localization

Fiscal Localization Packages are customized to modules created for specific countries to meet your fiscal management needs. They use preset taxes, fiscal positions, account charts, legal statements, certificate configurations, and other elements in your accounting system.

Odoo automatically installs a fiscal localization package for your business based on the country you select when building the database. To pick a package, go to the ‘Configuration’ menu and activate the ‘Fiscal Localization’ option from the ‘Settings’ window, then save the configuration changes.

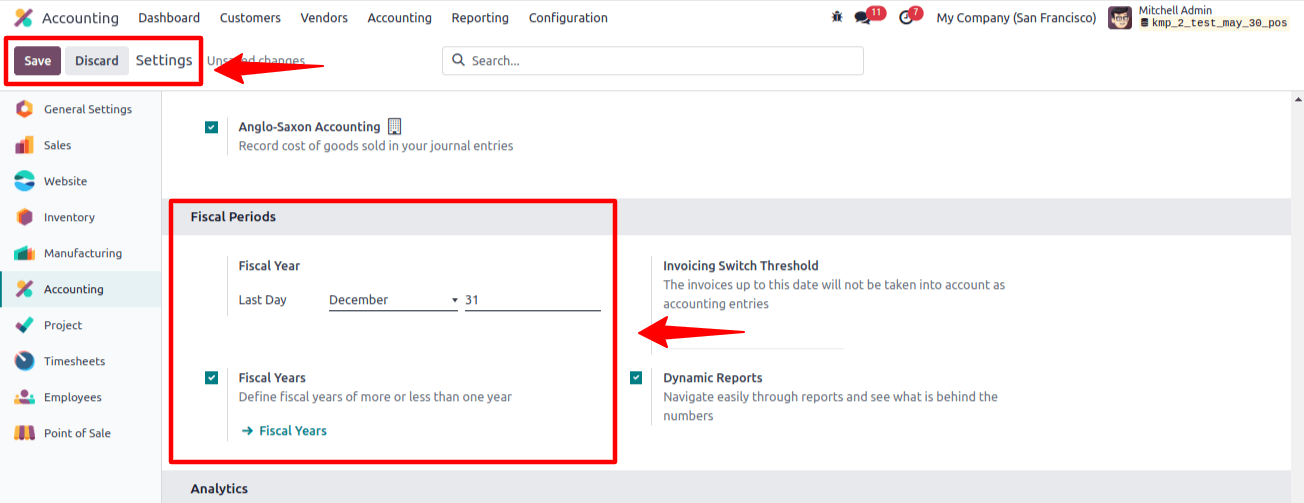

Configuring Fiscal Years

You can also access and enable the ‘Fiscal Year’ option in Odoo 17 Accounting by selecting the ‘Settings’ tab, as shown below.

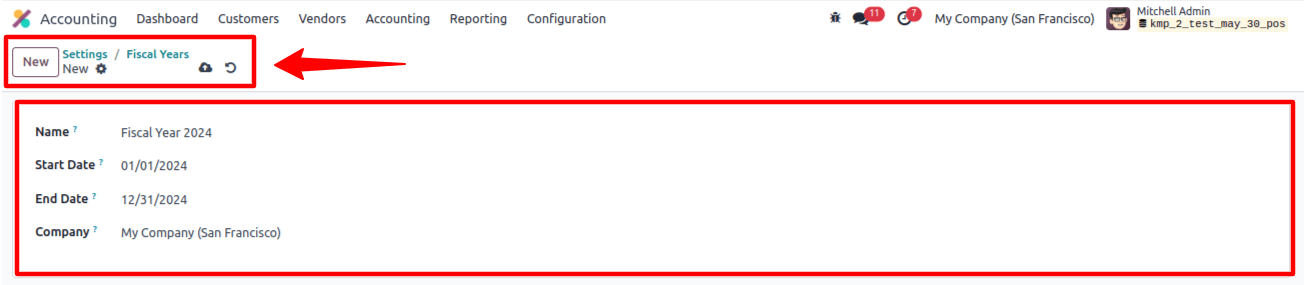

After activating the Fiscal Localization capabilities, select the ‘Fiscal Years’ option from the ‘Configuration’ menu drop-down list.

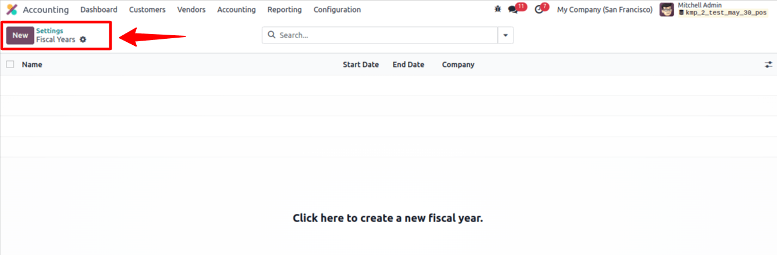

A company can easily create a fiscal year by clicking the ‘New’ option in the fiscal year dashboard window.

Enter the fiscal year’s names in the ‘Name’ column. Then, enter a ‘Start Date’ and ‘End Date’ for the relevant Fiscal year. Finally, select ‘Company’ and save the data by clicking the save button. Then proceed to the next phase.

Creating Fiscal Positions In Odoo

Users can simplify tax administration by using transaction accounts and defining rules for manual tax adaption when the fiscal position is based on a nation.

Partners may be assigned to these positions, which can be applied for manually or automatically. Accounting fiscal positions can be obtained via the ‘Fiscal Positions’ box on the ‘Configuration’ page.

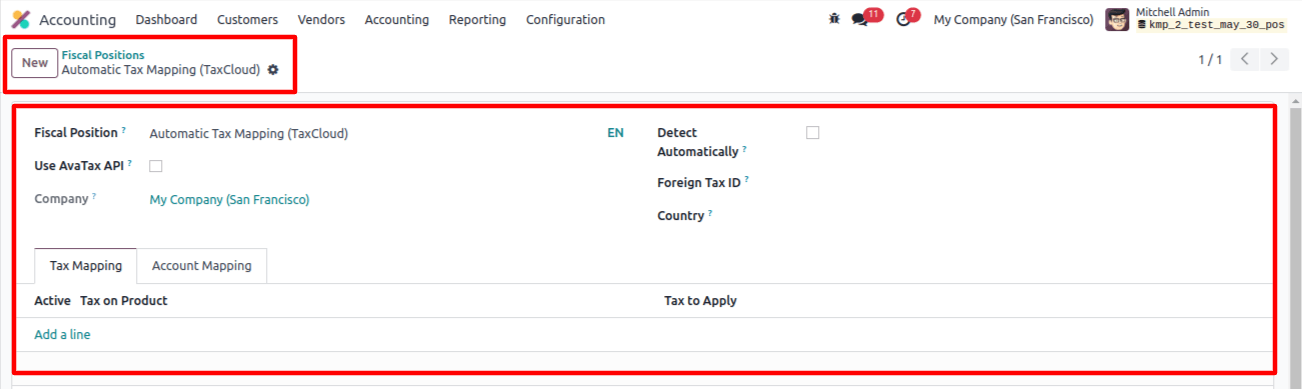

By selecting the ‘New’ icon, a new fiscal position can be created. The List view displays different entries for each fiscal position.

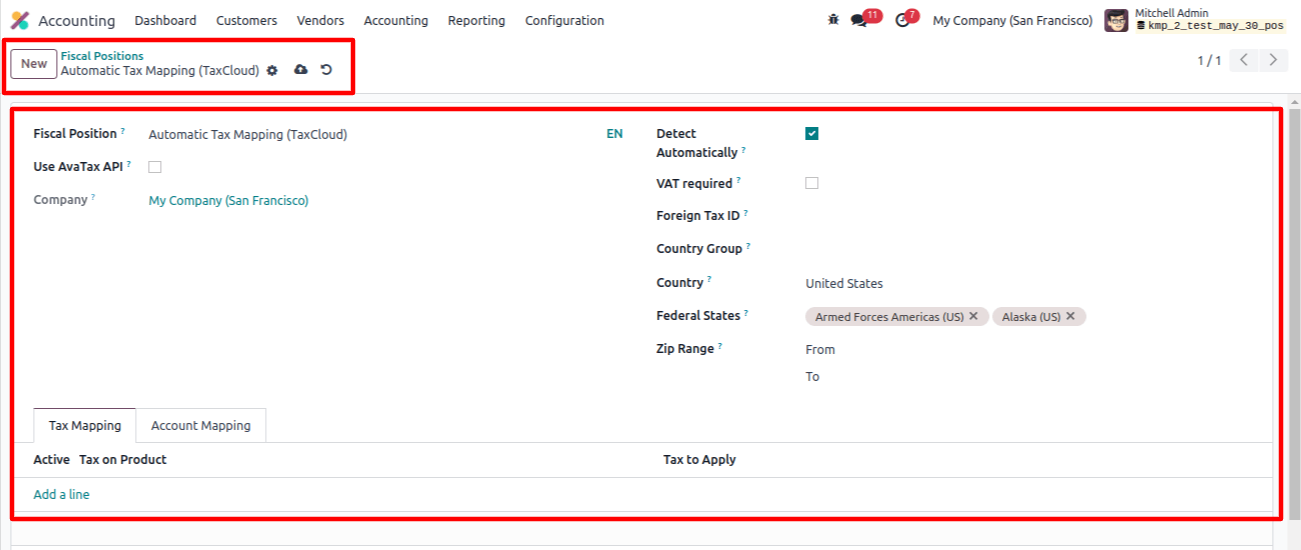

To configure taxes, users can select the ‘Use TaxCloud API’ option and provide their fiscal position name in Odoo 17’s ‘Fiscal Position’ field. They can also calculate taxes using the ‘Use Avatax API’ feature. To automatically identify the fiscal position, users can check the ‘Detect Automatically’ box and enter their company name in the ‘Company’ form.

Users can enter the tax ID associated with their company’s fiscal condition in the ‘Foreign Tax ID’ section. If the nation group is similar to the delivery ‘Country’, then we can include it in the ‘Country Group’ field. Users can enter a range count in the ZIP Range field, and the Federal states field returns the states based on the selected country/nation.

The ‘Add a line’ option in the ‘Tax Mapping’ tab area allows us to put the tax on a product as well as the Tax to Apply. Finally, in the Account Mapping area, users can create a product account. After applying the Fiscal Position information, we must manually save the data by selecting the save icon.

Related Post: Automate Tax Mapping with Odoo 17 Fiscal Positions

Fiscal Localization In Odoo

The fiscal localization package in Odoo is a nation-specific module that allows businesses to set up country statements and enables taxes. It is automatically deployed for each country, allowing Odoo to execute Accounting specific to that country.

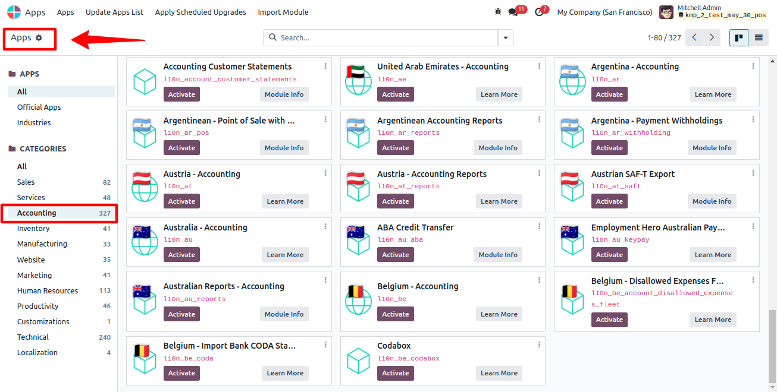

Users can download a specific nation package by selecting the Apps module in Odoo 17 and then the Accounting section in the Apps window. This will show a list of all the localization packages available to the user.

Explore the Fiscal Localization list on this dashboard to find the ideal solution for your company’s specific location and region.

Odoo’s fiscal localization improve tax management for firms in several jurisdictions by decreasing errors, increasing transparency, and improving operational efficiency and regulatory compliance.

In conclusion, this article has shown you how to properly install and use these capabilities to ensure compliance and streamline financial processes. Using Odoo Services can improve this process by providing specialized expertise and support to realize the benefits of fiscal localization in your accounting procedures.