Ever wonder what Accounting Localization is? Well, it's the process of changing accounting software to fulfill the requirements of a specific country.

Accounting rules and norms varied widely across countries. Localization ensures that your accounting program meets these regional requirements.

Accounting localization helps to comply with local accounting and tax laws to avoid errors and fines, reduces manual labor and the possibility of errors by using predefined accounts and automating tax computations, simplified accounting process with features customized to a country’s specific requirements.

In this blog, we may learn about accounting localization and the modifications that occur when we set localization for Chile.

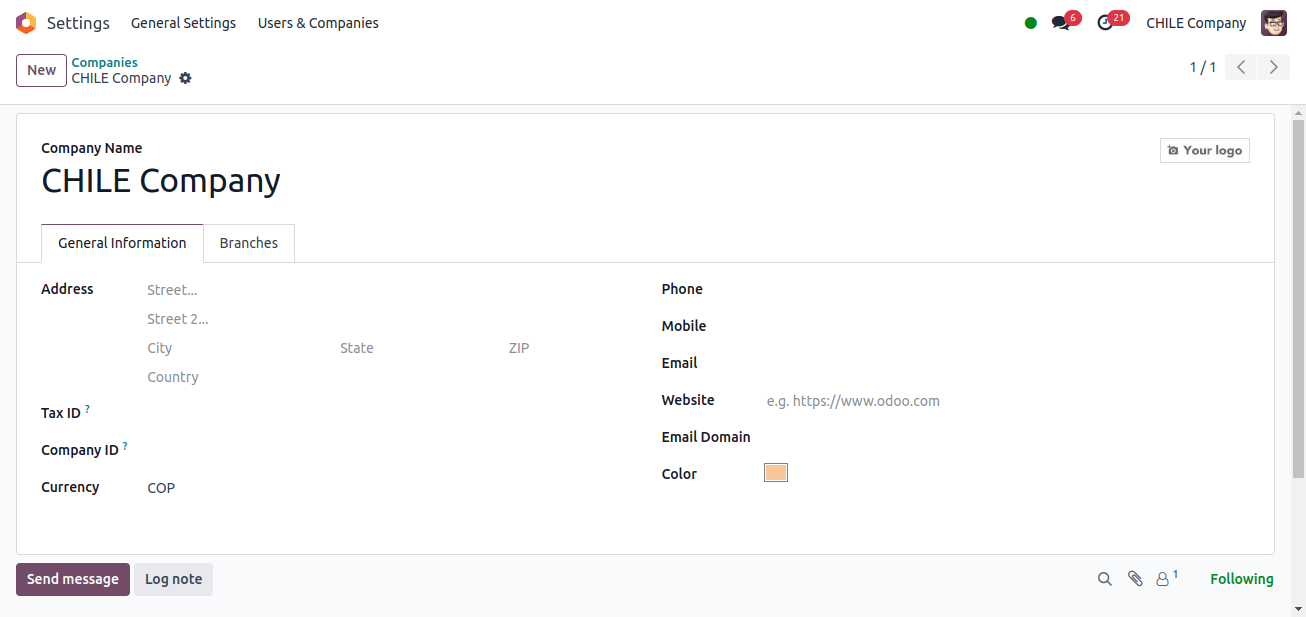

Before we can get into Chilean localization, we must first set up a new Chilean business. So, go to the Odoo application’s General settings.

Under the ‘Users & Companies’ menu, select the companies submenu. At that point, you will see a list of companies, and you can create new ones from the same window by clicking the ‘New’ option.

Provide the company’s address, country, and other information such as its VOES Number, IOSS Number, Intermediary Number, Taxpayer Type, DTE service provider, LEI, and so on.

VOES Number: Companies outside the European Union use VOES Numbers to use the Operation Support System (OSS).

IOSS Number: The EU implemented this technique to make it easier for online sellers who sell goods to EU clients for less than C150 to collect VAT.

Businesses operating in the EU or registered with IOSS can collect VAT at the point of sale rather than the country of destination, which speeds up the process.

Intermediary Number: Businesses outside the European Union use it to pay OSS tax on items imported into the EU via an intermediary.

Taxpayer type: In Chile, there are four basic groups of taxpayers: VAT-affected taxpayers, Fees receipt issuers (suppliers who issue fee receipts), end consumers, and foreigners.

DTE Service Provider: In Chilean accounting, DTE (Documento Tributario Electronico) service providers are businesses that offer DTE (Electronic Document Certification) services.

These DTE documents are required for a variety of Chilean accounting and tax processes.

LIE: Legal Entity Identifier (LEI), which uniquely identifies entities globally and is used to promote financial transparency.

When a business is founded, additional information can be entered via the contact application. The company’s fiscal condition can be entered in the accounting application’s sales and purchases field.

There is one more tab, electronic invoicing, where you can enter the DTE email address, which is used to send and receive the electronic invoice.

A delivery guide price field is also accessible, which is used to select the price of the goods that will be displayed in the delivery guide, if any.

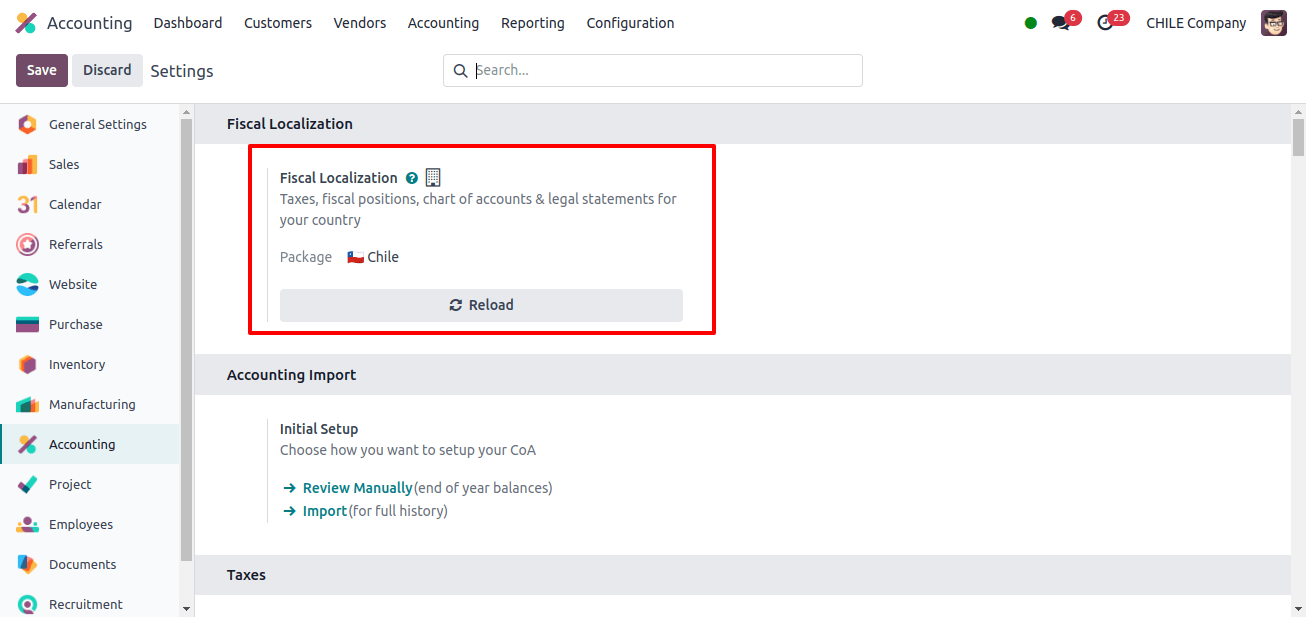

Then, after the information has been successfully entered into the database, go to the accounting program. You can specify a package for country localization under configuration > Settings.

Go to the accounting app’s configuration settings. Under the Fiscal Localization section, describe the company’s package as Chilean.

Changes made when accounting localization for Chile is configured in Odoo 17.

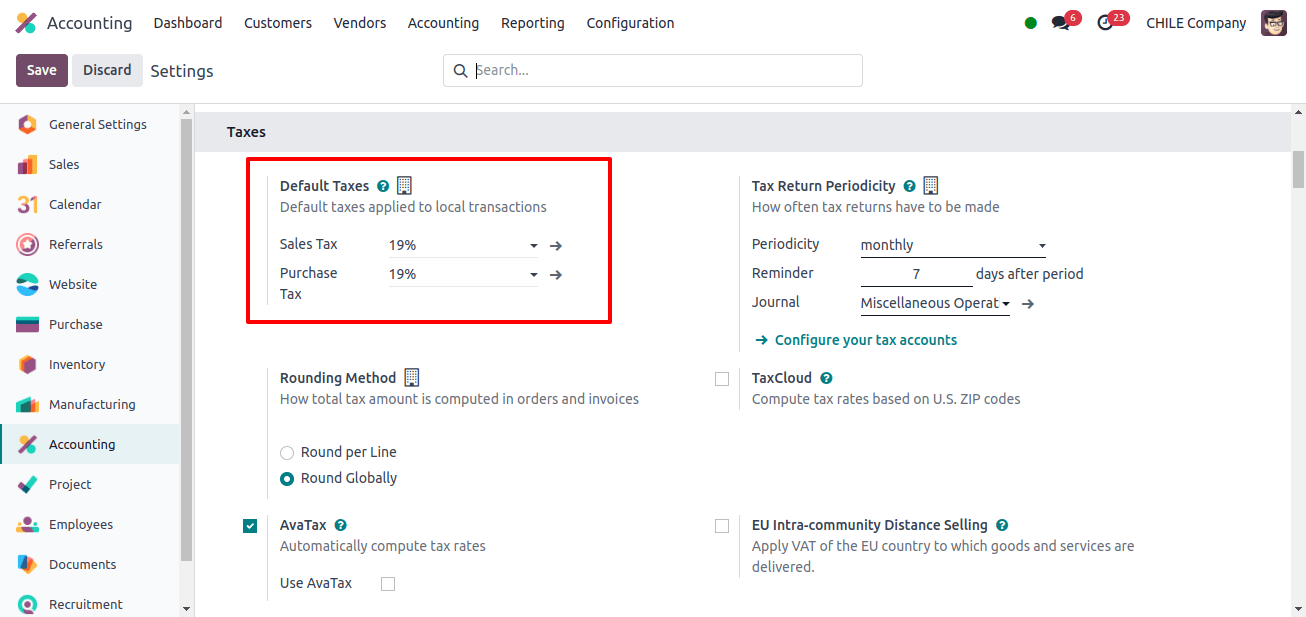

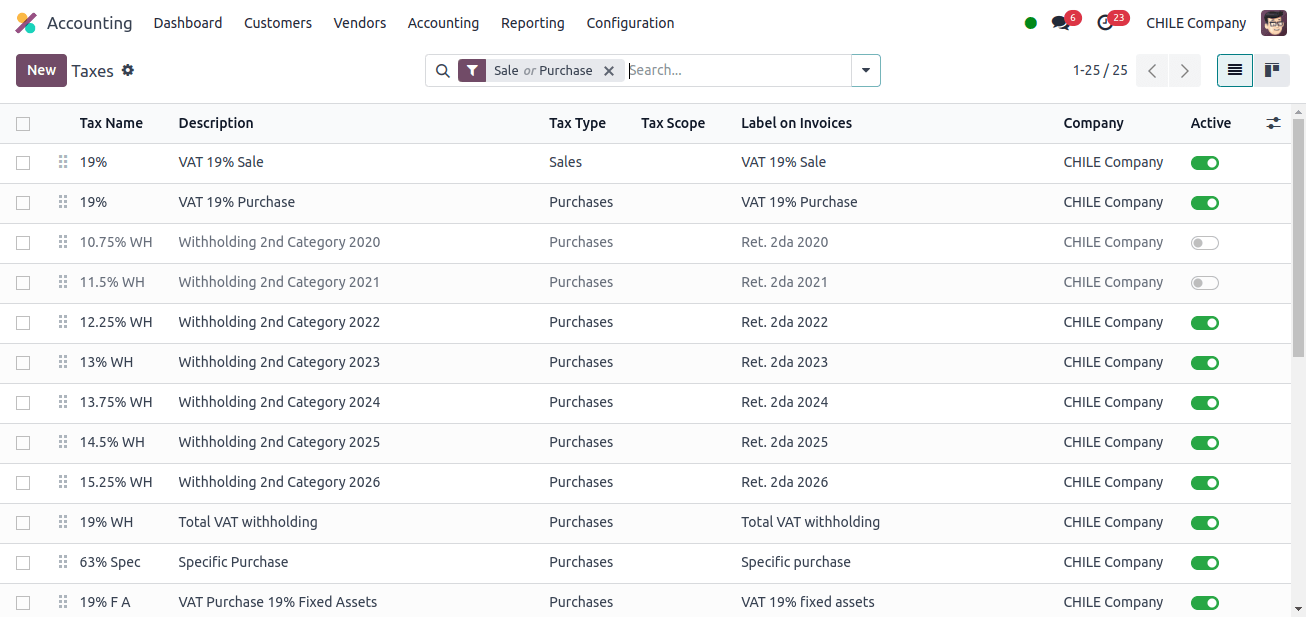

When the package is configured, the default tax for this business is automatically inserted and displayed in the Configuration > Settings under the Taxes section.

You can see that Odoo has configured the default tax for this company. Chilean enterprises apply a default sales and purchase tax of 19%.

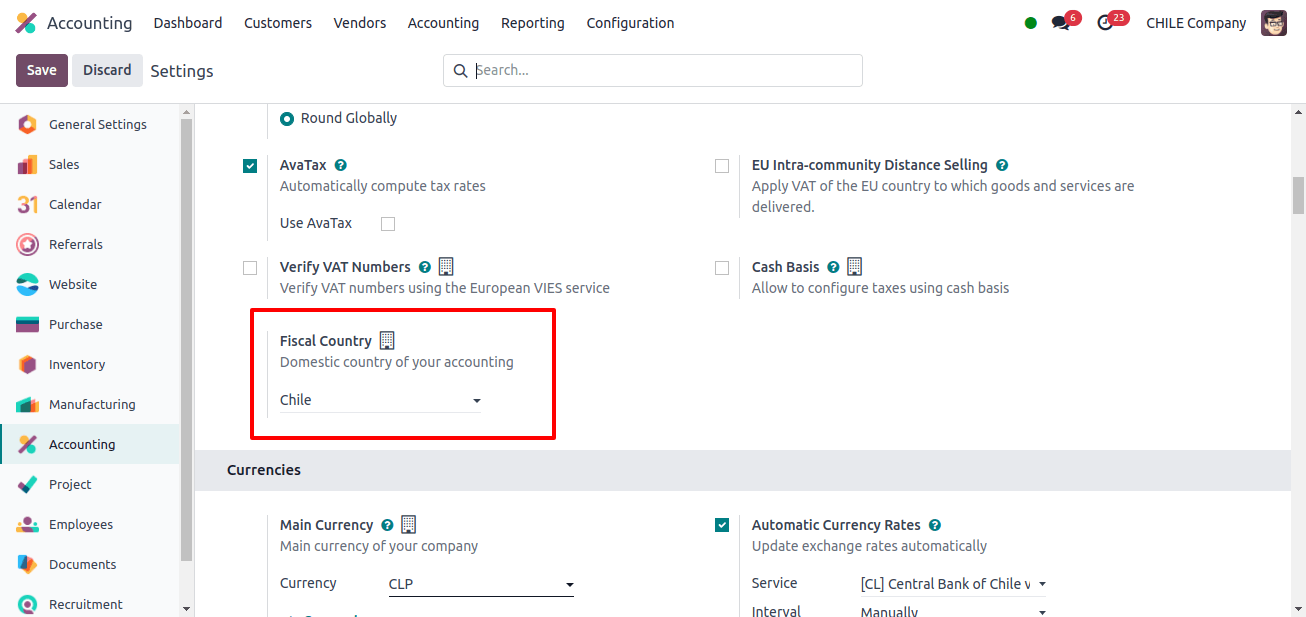

There is a Fiscal Country entry in the Taxes section. So, if the package is set to Chile, Odoo will set the fiscal country to Chile.

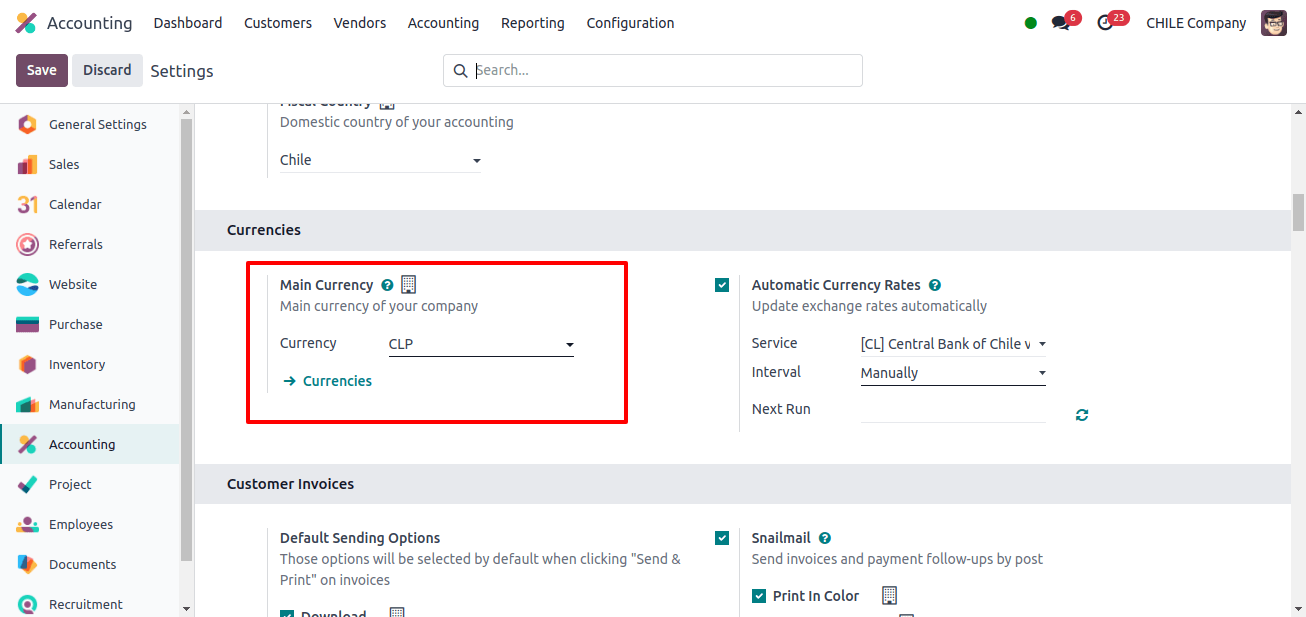

Furthermore, Odoo determines the principal currency for the organization based on the country of operation. The Chilean peso (CLP) is the currency in Chile, hence Odoo automatically configures it as the main currency, which can be accessed in the Currencies section after the company’s package has been configured.

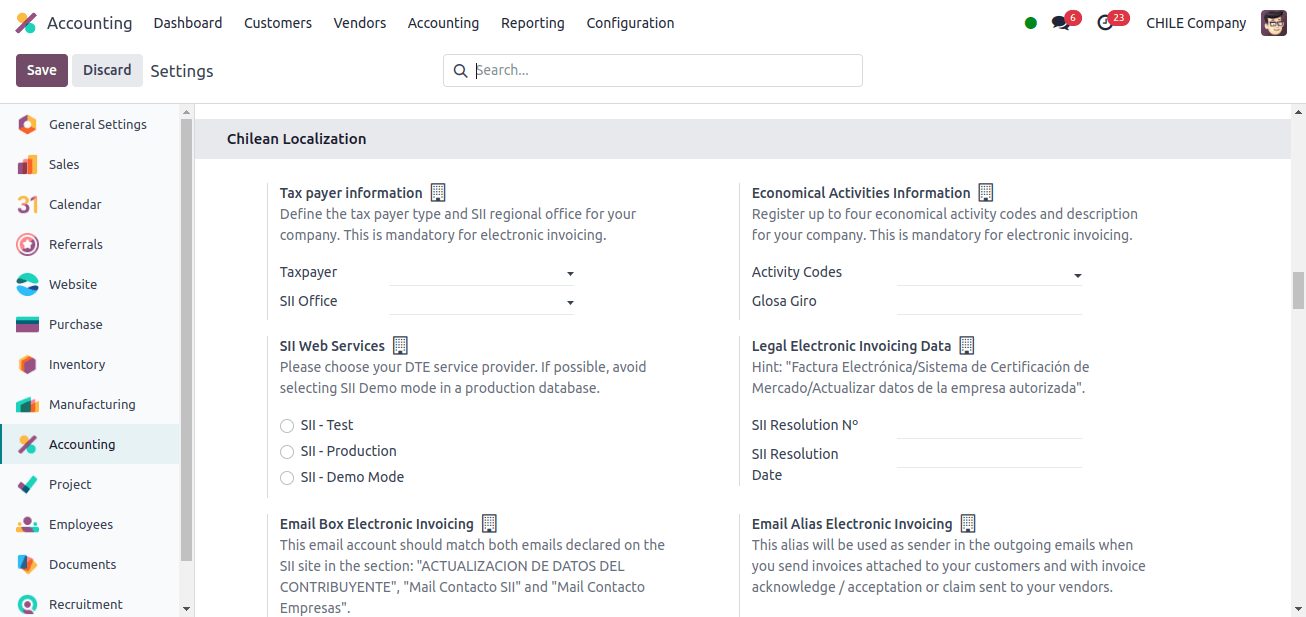

When the Chilean package is configured, an additional section called Chilean Localization is added to the Configuration -> Settings menu.

Under Taxpayer details, you can enter your company’s Tax Payer type and SII Regional office. The SII regional officer is a tax accounting professional with the Chilean Internal Revenue Service.

An SII officer is required to ensure your Odoo system complies with Chilean tax rules. The SII officer must be well-versed in Chilean tax laws, norms, and SII-established computerized invoicing standards.

This involves keeping track of any changes or additions to the regulations.

Chile’s Internal Revenue Service offers the SII web service. In Chilean accounting, it is a required tool for electronic invoicing.

It provides a link between the SII and your accounting software. You can choose the SII web service you require from the list.

In Chilean localization, DTE incoming mail refers to the system or email account that is specifically designed to receive electronic invoicing (DTEs) from suppliers or other firms with which you do business.

The DTE Incoming Email can be configured under the Email Box Electronic Invoicing field.

The signature certificate specifies an electronic certificate that is used to sign digital tax documents, specifically the Electronic Invoices (DTEs) that the Internal Revenue Service of Chile needs (SII).

Accounting software uses the proportional factor as a tool for allocating costs or other amounts proportionally over the course of a fiscal year. The proportional factor can be set in the Proportional Factor for Fiscal Year field.

Cash-related Activities Most likely, the data you created to describe your company’s accounting operations in Chile is referred to as information in Chilean accounting.

This information is required for proper tax filing and compliance with the Chilean Internal Revenue Service (SII). You can include SII resolution information in the Legal Electronic Invoicing Data field.

In the Email Alia Electronic Invoicing field, provide the email address used to issue the electronic invoice.

PPM for the fiscal year is a setup that specifies the estimated month within the fiscal year when a supplier invoice is expected to be paid.

The value for PMM can be found in the field PPM for the fiscal year.

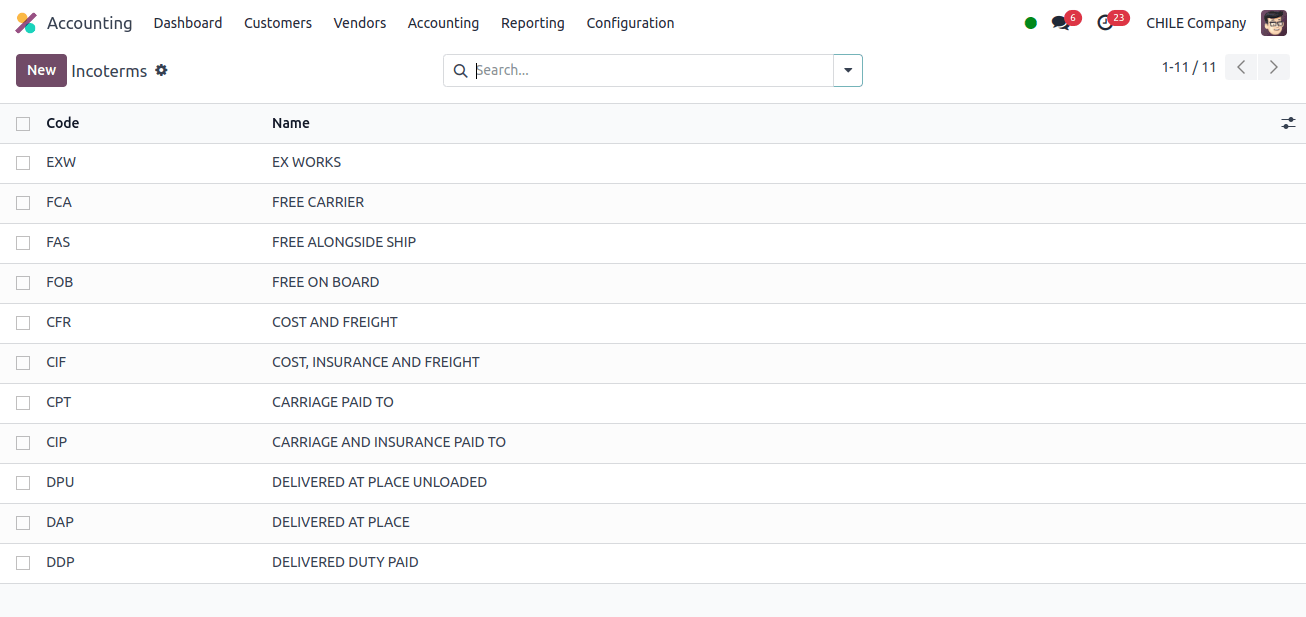

View the company’s incoterms by selecting the incoterms submenu from the setup menu. Theorem you will find the whole list of Incoterms that this company can use.

The International Commercial Terms are referred to by the name Incoterms. The International Chamber of Commerce (ICC) published a set of widely agreed guidelines defining the obligations of buyers and sellers in cross-border commercial transactions.

The Chilean company can use the incoterm shown in the image above.

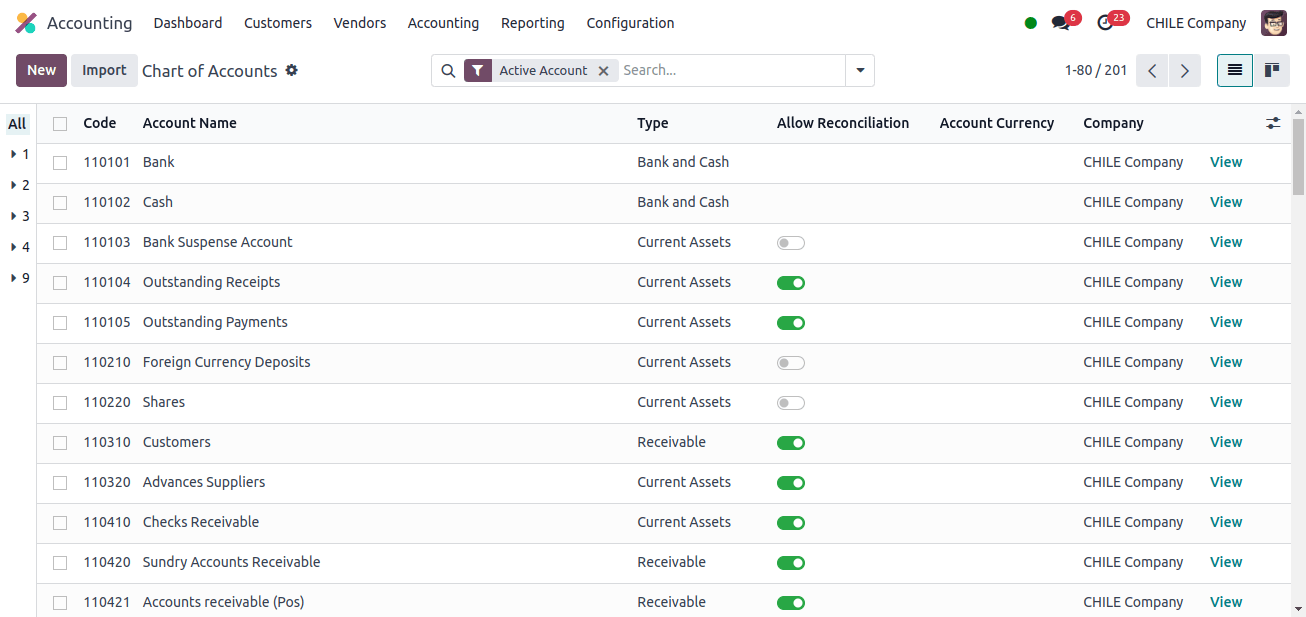

The following is the Chilan company’s Chart of Accounts. It is an important component of the accounting module.

It functions as a list that organizes all of the bank accounts you use to keep track of your business transactions.

It is simply a complete record of your income and expenses, indicating where your money is coming from and going.

The account names and codes are specified, and the Chilean corporation can use them for various business purposes.

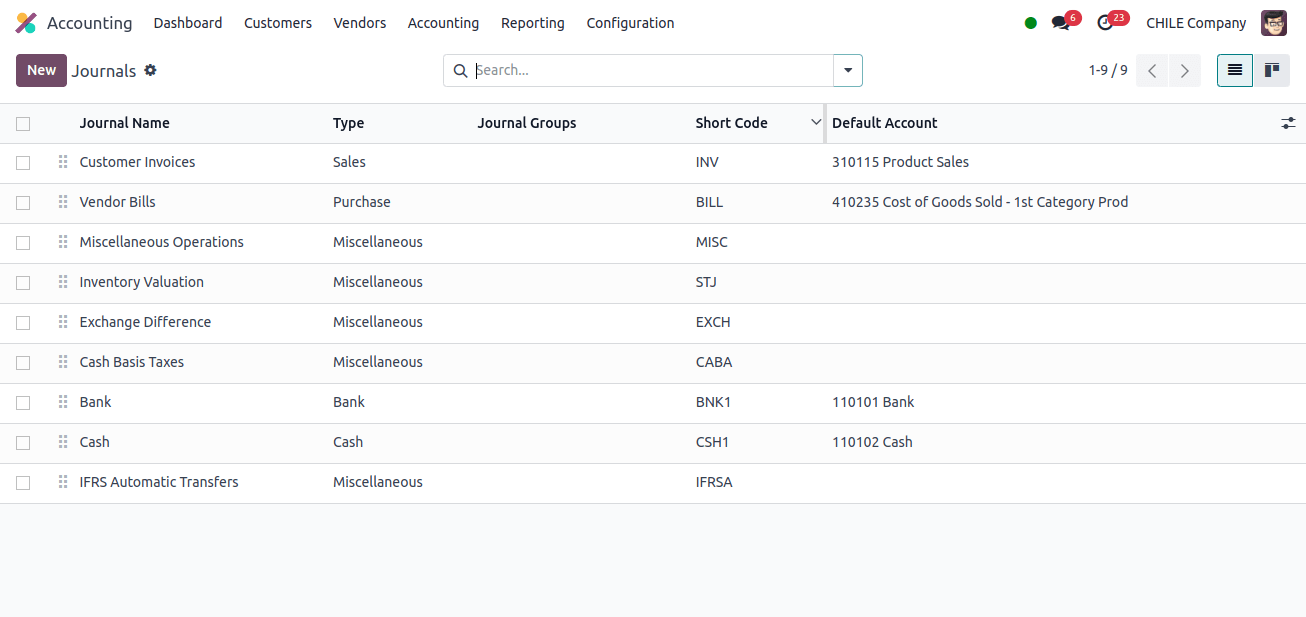

The Accounting application's 'Configuration' menu includes a 'Journals' submenu. When you click on Journals, you'll get a list of journals that the Chilean company can use.

In the journal list, you can see many journals that are used for different purposes.

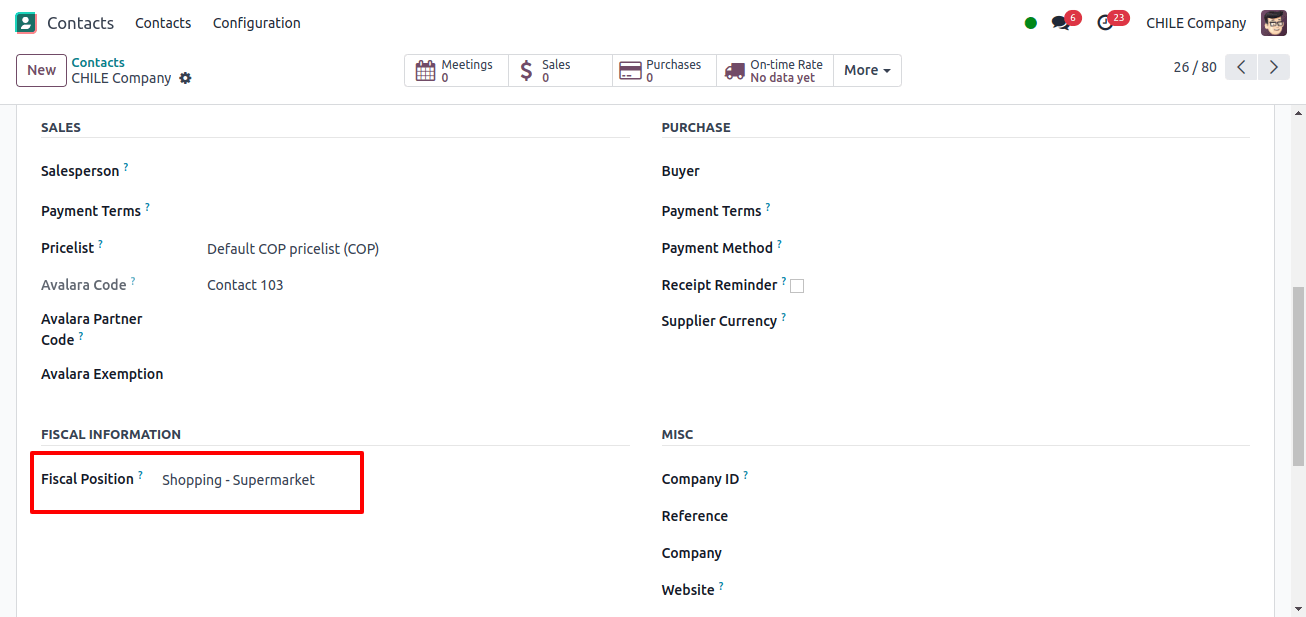

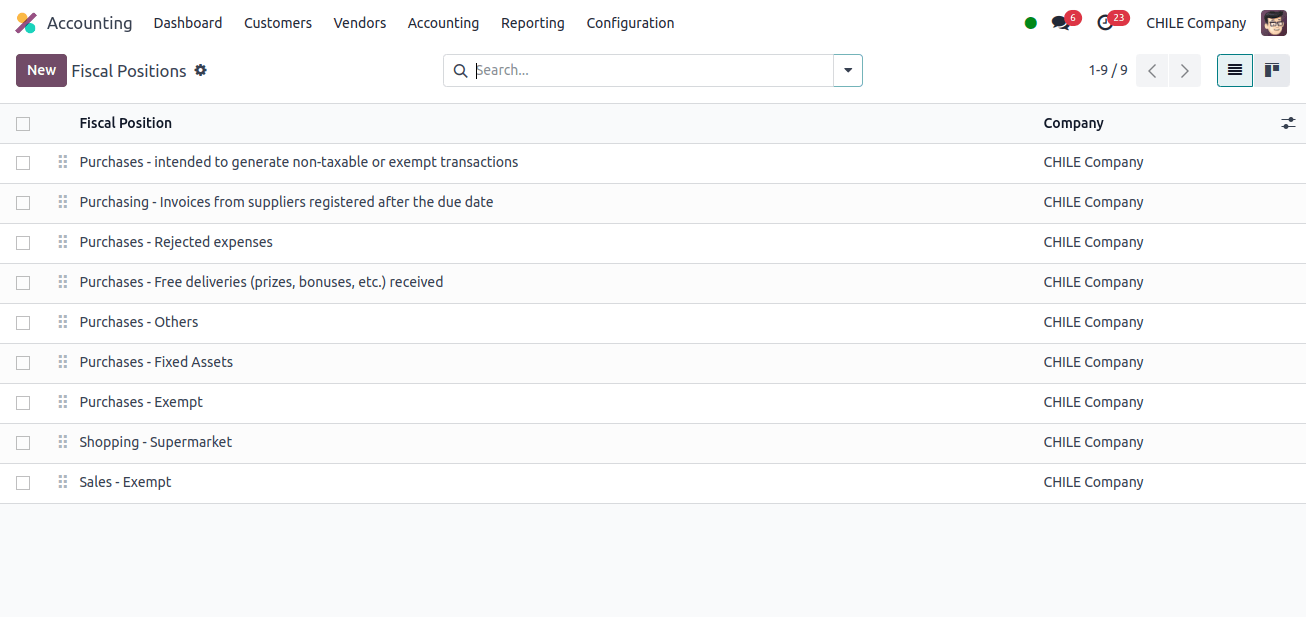

The fiscal position is a set of standards that determine how accounts and taxes are applied to specific activity. Select the 'Fiscal Position' sub-menu from the 'Configuration' menu.

In essence, it allows you to manage account mapping and tax repercussions based on a variety of criteria, including product category, business type, and customer region.

The screenshot below depicts the several positions that a Chilean corporation might utilize for their business purposes.

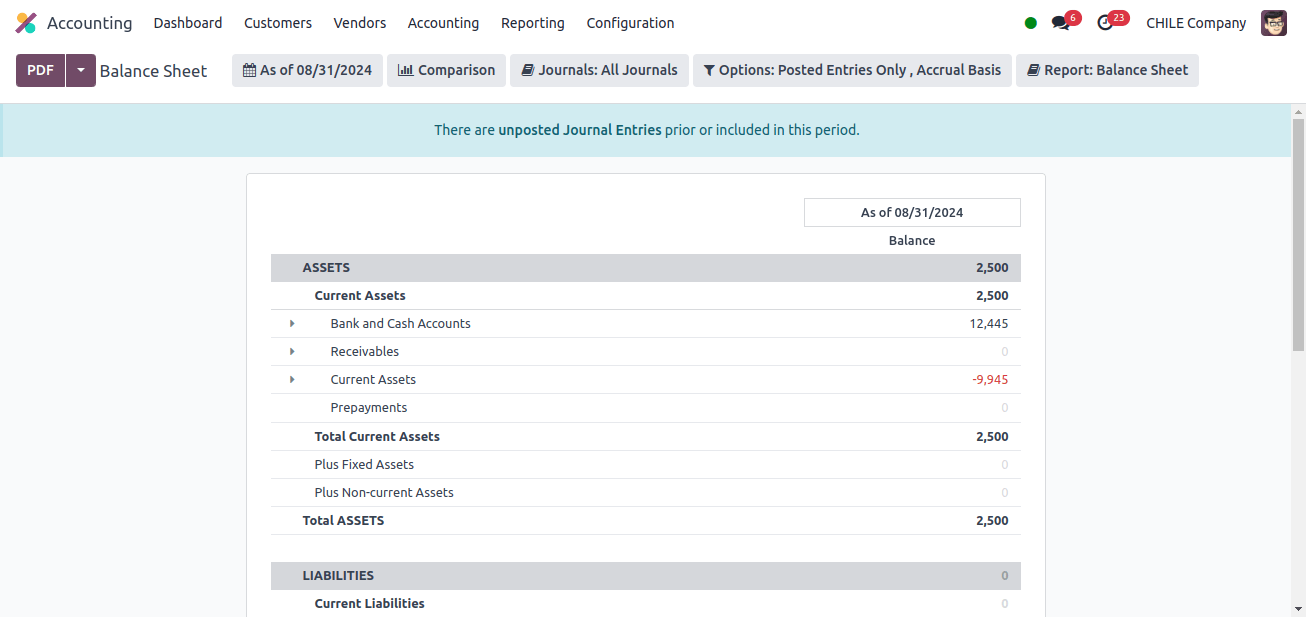

The Balance sheet in Odoo 17 is a type of financial report that you may build to get a rapid summary of your company's financial condition on a specific date.

It summarizes your company's assets (assets), liabilities (liabilities), and net value (equity). Navigate to the 'Balance Sheet' sub-menu inside the 'Configuration' menu.

A Chilean company's balance sheet may comprise a bank, bank suspense account, VAT, VAT Tax Credit, consulting income, and so on.

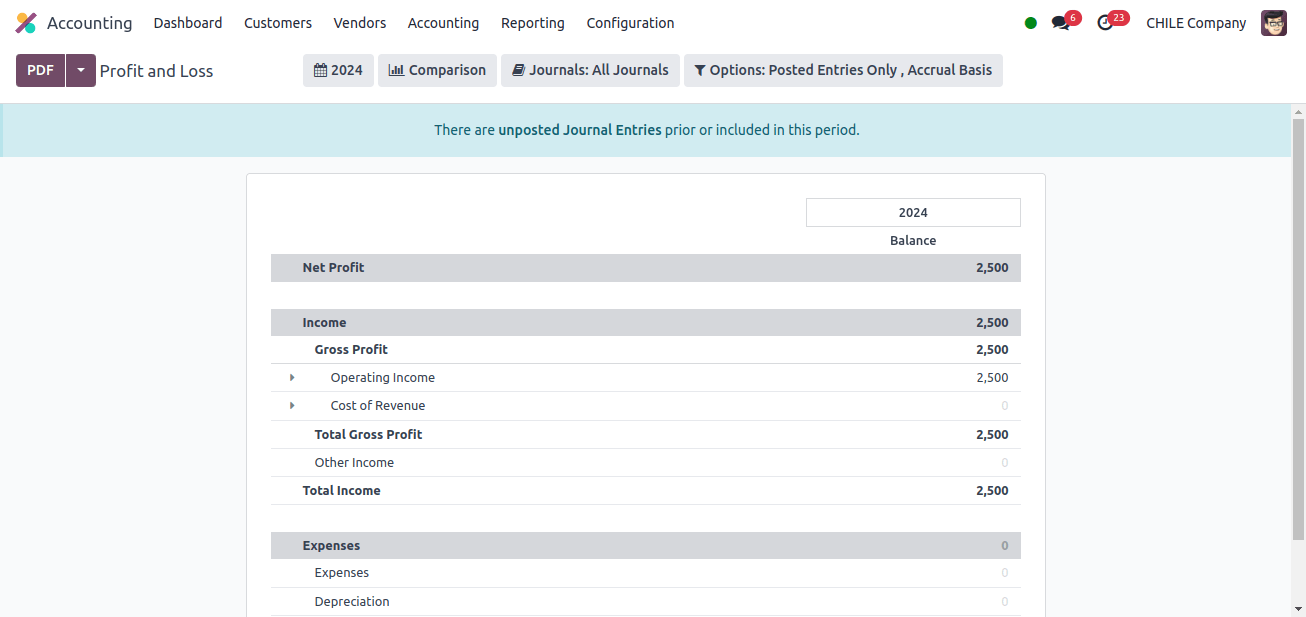

The profit and loss report comes next. The Chilean company's profit and loss report covers its income, expenses, and net profit.

Operating income, cost of revenue, other income, and so on are included as income, whereas expenses, depreciation, and so on are included as business expenses.

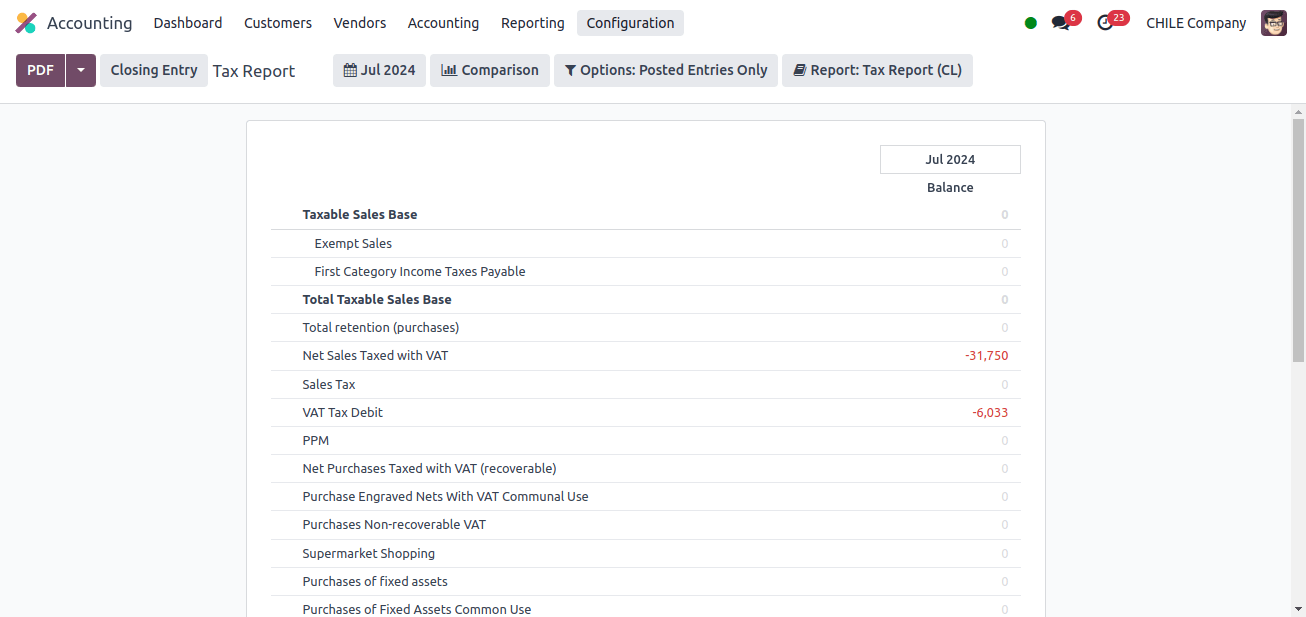

Next, review this company's tax report. Various entries are included to the tax report.

Exempt sales: This term refers to transactions that are exempt from Chile's value-added tax, or Impuesto al Valour Agregado (IVA) (VAT).

First category income tax payable: Depending on your taxable income, this is the projected income tax that your company owes the Chilean Internal Revenue Service (SII) for the reported period.

Total retention (purchases): This is the total of all of these amounts that have been subtracted for a specific tax period (month, quarter, or year) from your supplier invoices.

ILA Withholding Base (sales): This is the total sales amount that is considered in calculating the appropriate withholding amount for ILA.

These are some of the statistics used to illustrate Chilean firms' tax returns.

The Odoo Chilean localization highlights a number of distinguishing features. It provides all of the conveniences and features needed to operate and do business in Chile.

In this article, we explored localization for a Chilean firm to ensure that its accounting operations run well.