What is Accounting localization in Odoo?

Accounting localization in Odoo is the process of customizing the Odoo ERP system’s accounting functionalities to the legal and regulatory frameworks that regulate finances in specific countries.

Odoo’s accounting features, such as tax settings, reporting formats, chart of accounts, and legal compliance capabilities, will be translated to meet the target country’s specific accounting rules and practices.

Odoo accounting module is more suited and user-friendly for companies operating in various countries. This allows accurate financial reporting and compliance with local laws and regulations.

Preconfigured tax codes, charts of accounts, and fiscal positions assure compliance with regional regulations while also removing data entry errors. This reduces the possibility of errors that may result in fines or financial irregularities.

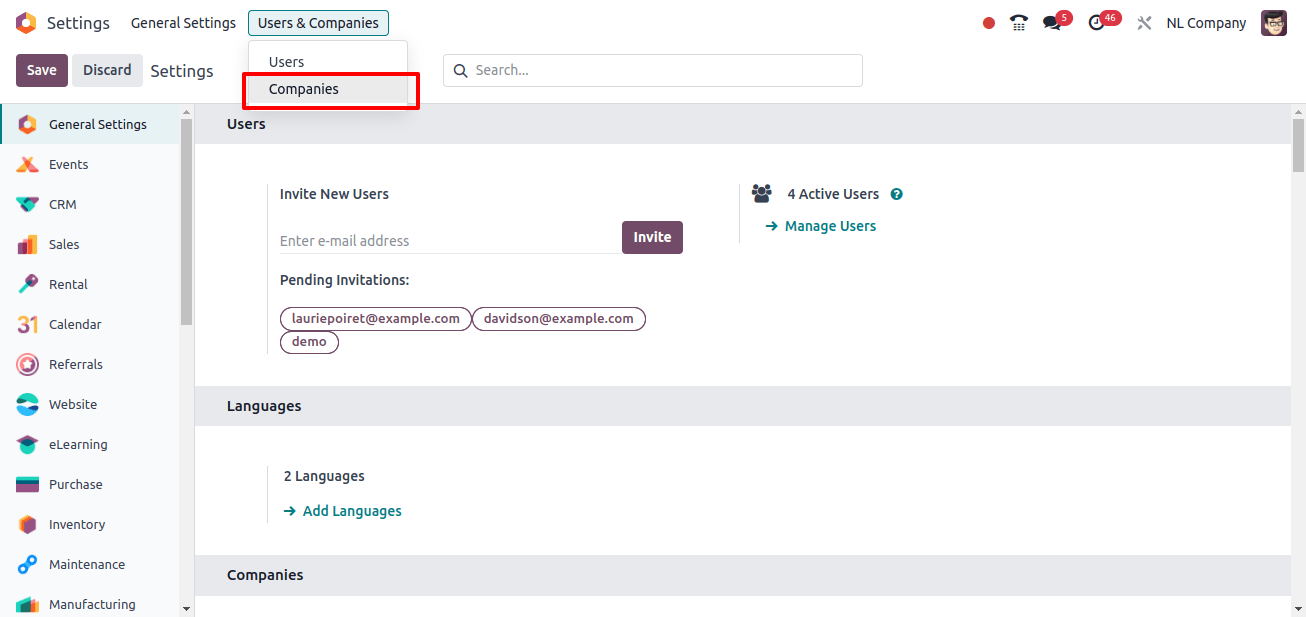

In this blog, we will address accounting localization for Hong Kong-based companies. So, in order to begin the accounting localization process, we must first find a Hong kong-based company. Move to Odoo’s General Settings and Select the Companies sub-menu under Users and Companies.

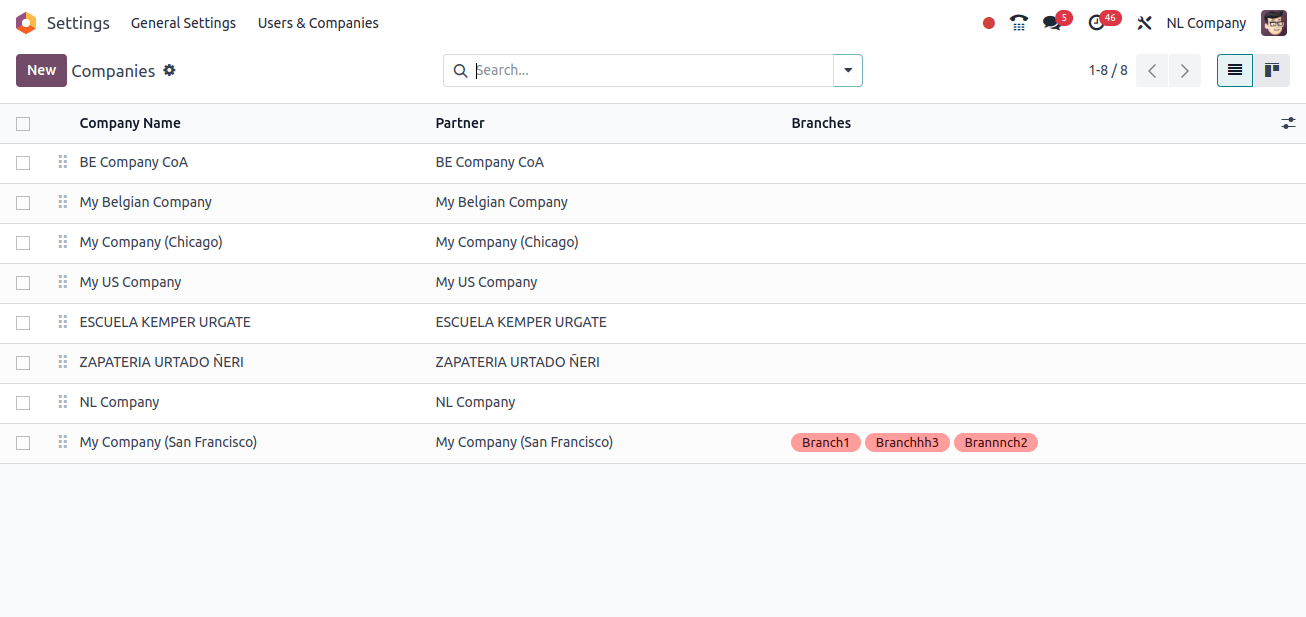

When we select the companies sub-menu, we see a list of already-created firms. There will be a New button on the page; click it to start a new company.

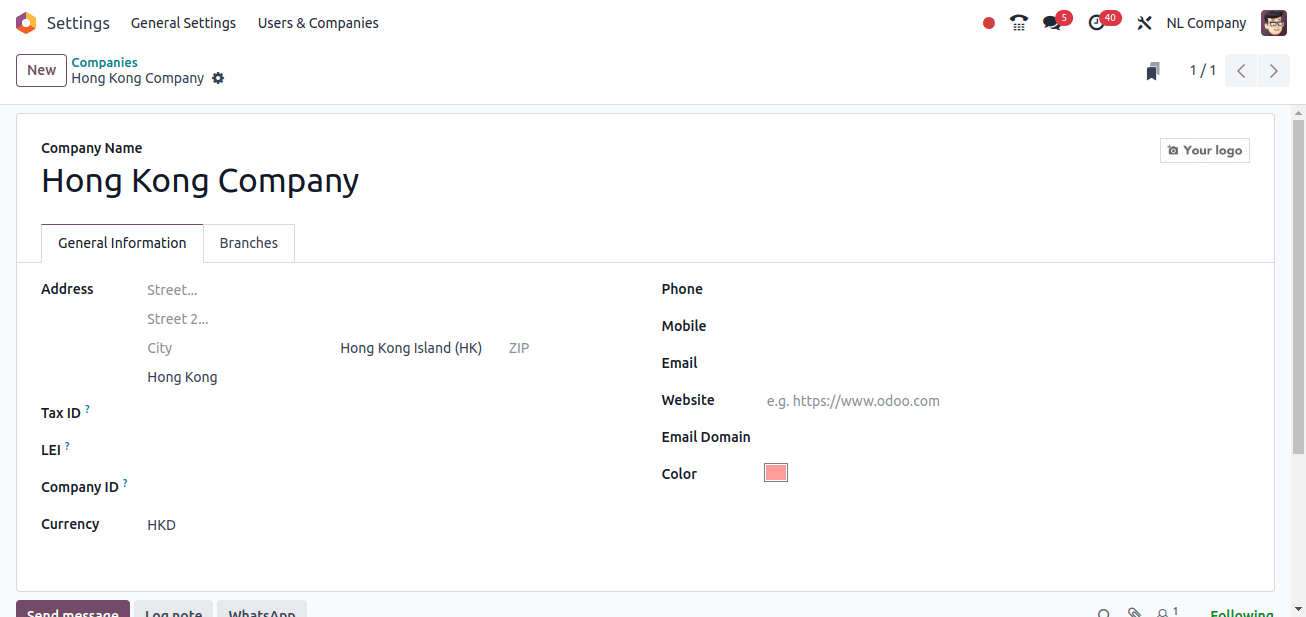

When we click the new button, a form will open, where we can enter all of the company's information. Provide the company's name, address, and the country to which it belongs, among other details. When the company's country is specified, Odoo will automatically configure the company's currency and preserve it.

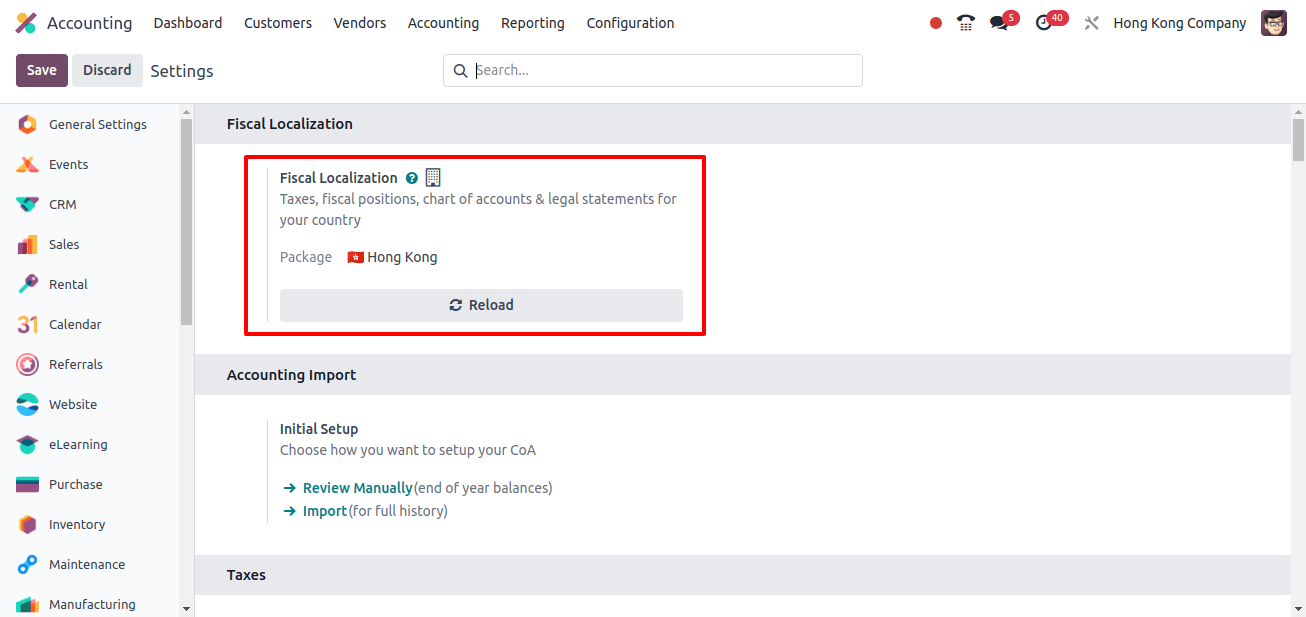

The next step is to set up a localization package for this newly formed company. To set up the localization package for this company, go to the Odoo Accounting application. Go to Configuration > Settings, and then select the Fiscal Localization option to set the localization package for this company. Here, we’ll set up the package as Hong Kong.

Let’s talk about the Odoo 17’s Hong Kong localization’s specialties.

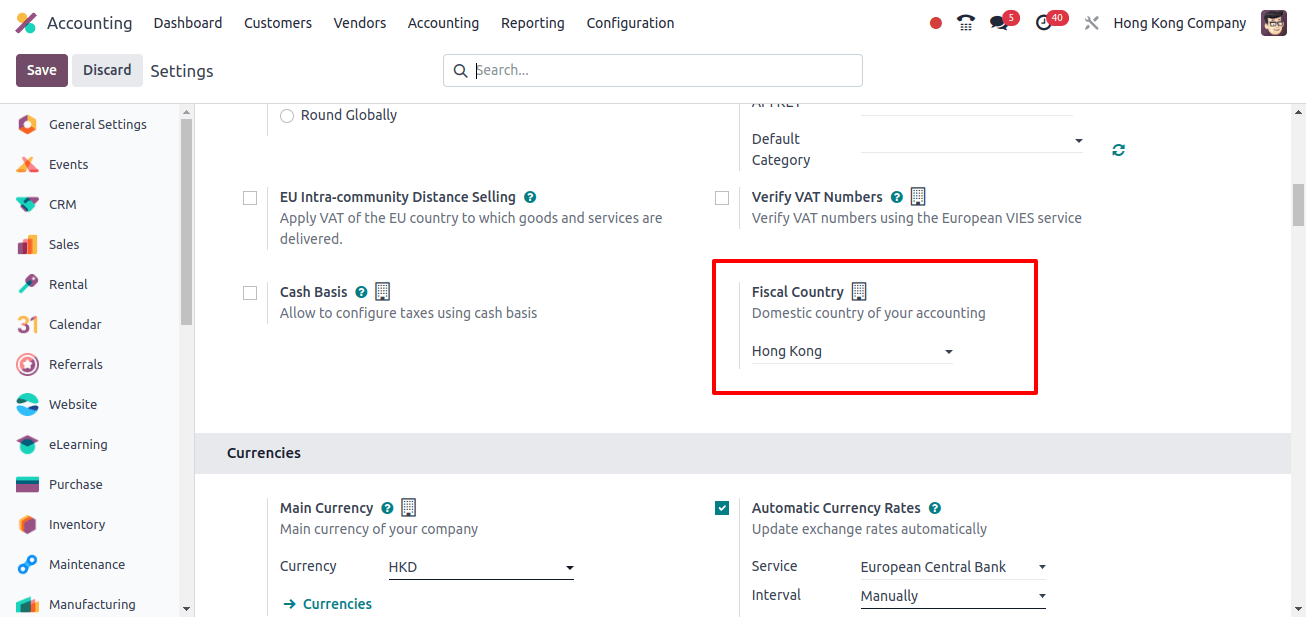

When you select Hong Kong as your fiscal localization package, a Fiscal Country field appears under the Taxes section. So, when the package is assigned to Hong Kong, Odoo automatically sets the company’s fiscal country to Hong Kong.

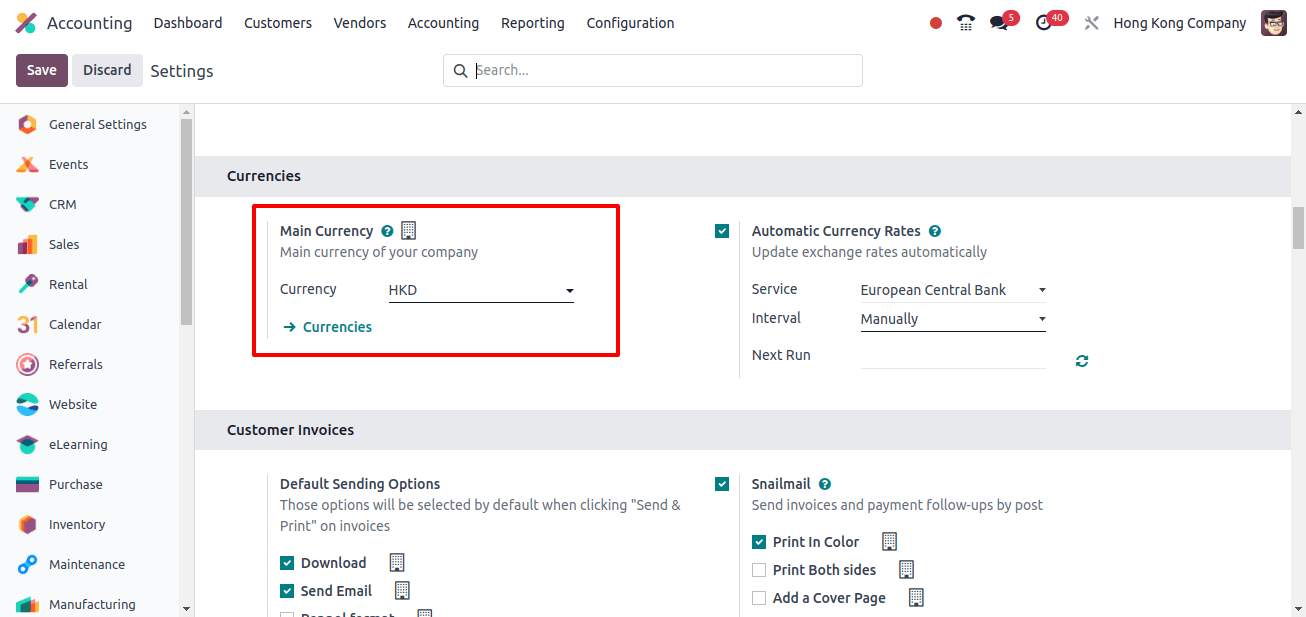

The money used by Hong Kong companies comes next. We know that the official currency used in Hong Kong is the Hong Kong Dollar (HKD), and here under the currencies section, we can see that Odoo automatically sets the currency for the company as Hong Kong Dollar (HKD) when the Localization package is saved .

Fiscal positions, charts of accounts, journals, taxes, and other financial documents serve as the foundation for a company’s accounts. When a localization package is properly created for a company, Odoo will automatically set all of these settings for that company.

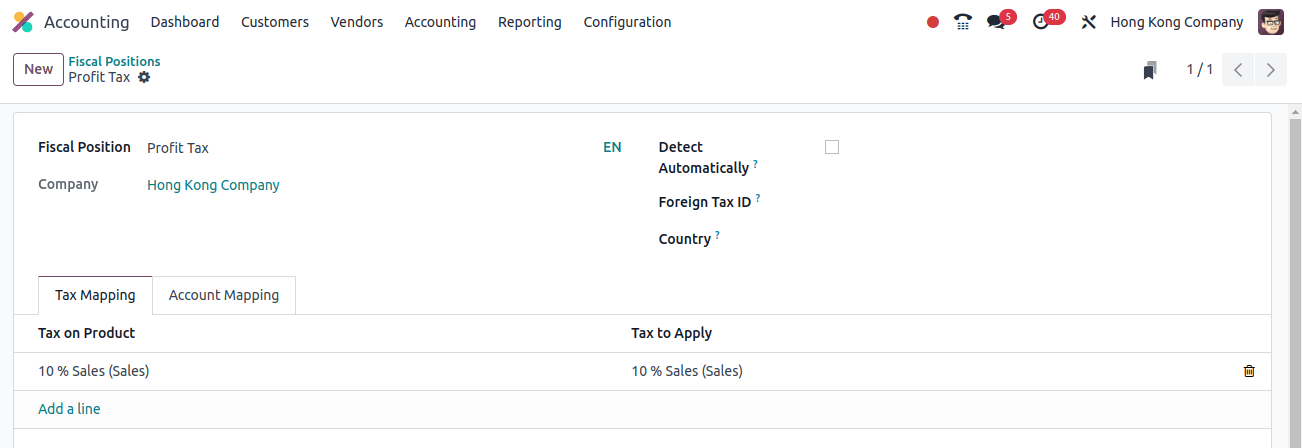

A fiscal position in Odoo 17 is a useful feature that allows you to automatically alter taxes and accounts based on specific features such as client location, type of business, or other relevant information.

This ensures accurate financial reporting and respect to tax rules. The Fiscal Position sub-menu can be found under the Configuration menu. And by pressing the New button, we may set a new fiscal position for the company.

A form will be available, and you can fill it up with information such as which accounts are mapped to which accounts and which taxes are mapped to which.

Moving on to the account mapping screen, we can map the account to our specifications and save the fiscal position that we have generated by clicking the save button.

When this fiscal position is applied to an invoice, the product’s tax will be mapped to the tax to apply, and the product’s account will be mapped to the account to use as indicated.

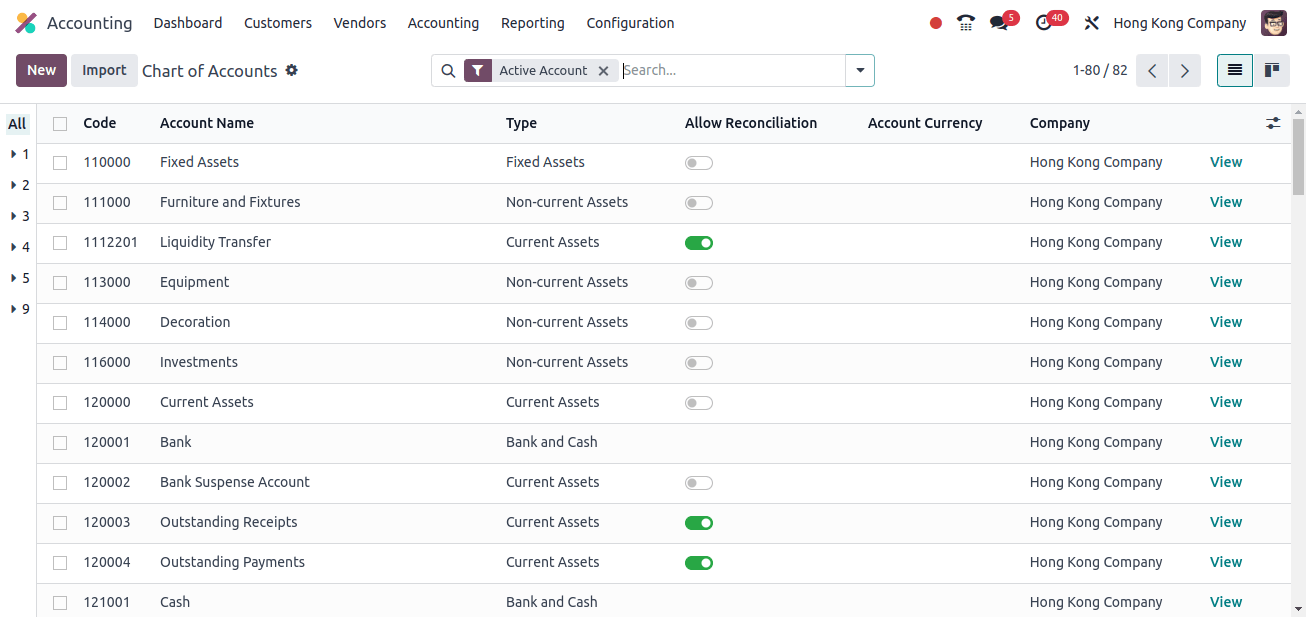

A chart of accounts is an organized list of all the financial accounts used to record and categorize corporate activities. It is the foundation for your accounting system, offering a clear picture of your financial situation.

The chart of accounts sub-menu is included in the setup menu, and it displays a list of accounts that a company can use for any reason.

Here, we can import or build a new chart of accounts for a business. With Odoo 17, we can develop a chart of accounts that is properly customized to your company’s unique demands and structure.

Odoo 17 has powerful tax administration tools that may assist companies manage diverse tax issues efficiently. Odoo offers many tax types (Sales, purchase, and adjustment) with unique rates, computation techniques (fixed, %, group), and applicability based on products and services.

The taxes sub-menu is located under the Configuration menu, and it contains all of the pre-configured tax options. However, Hong-kong has a national taxation system, which means that only income earned within Hong Kong is taxed. There is no idea of personal income tax, as in many other countries.

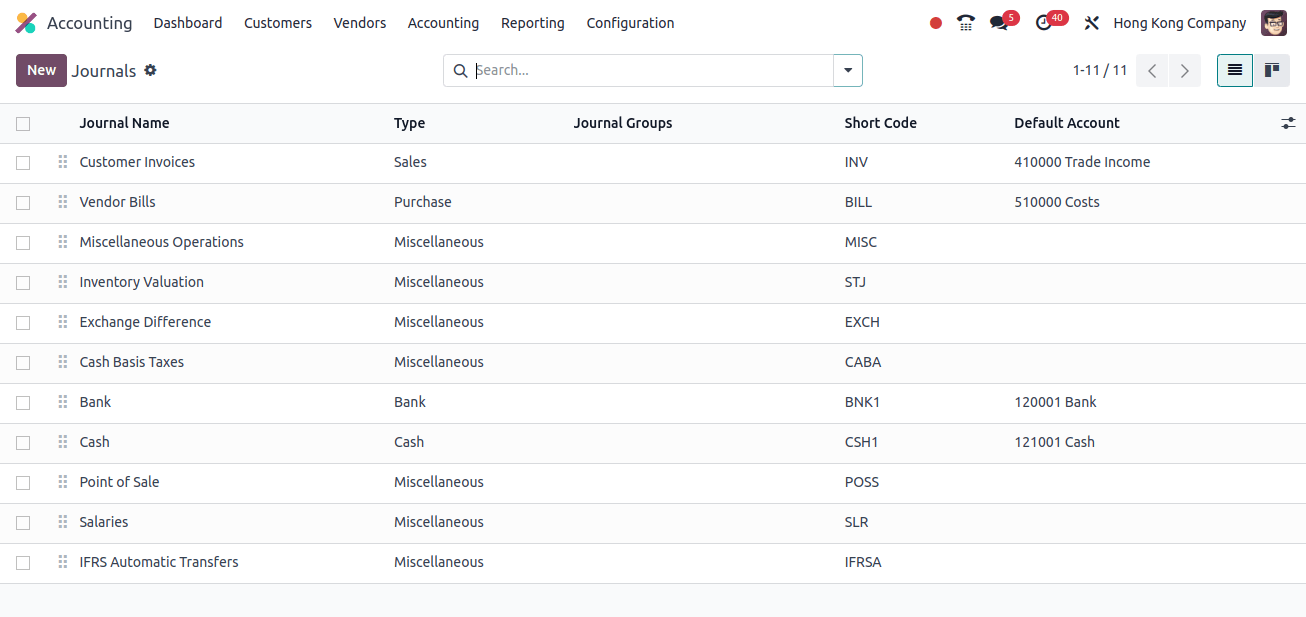

Odoo accounting journals are the foundation of your financial records. They are chronological records of your business transactions organized by category.

Each journal entry reflects a financial event, with connected debits and credits to balance the accounts. The journals are configured in the accounting program, and we can see a list of journals that the Hong Kong company can use.

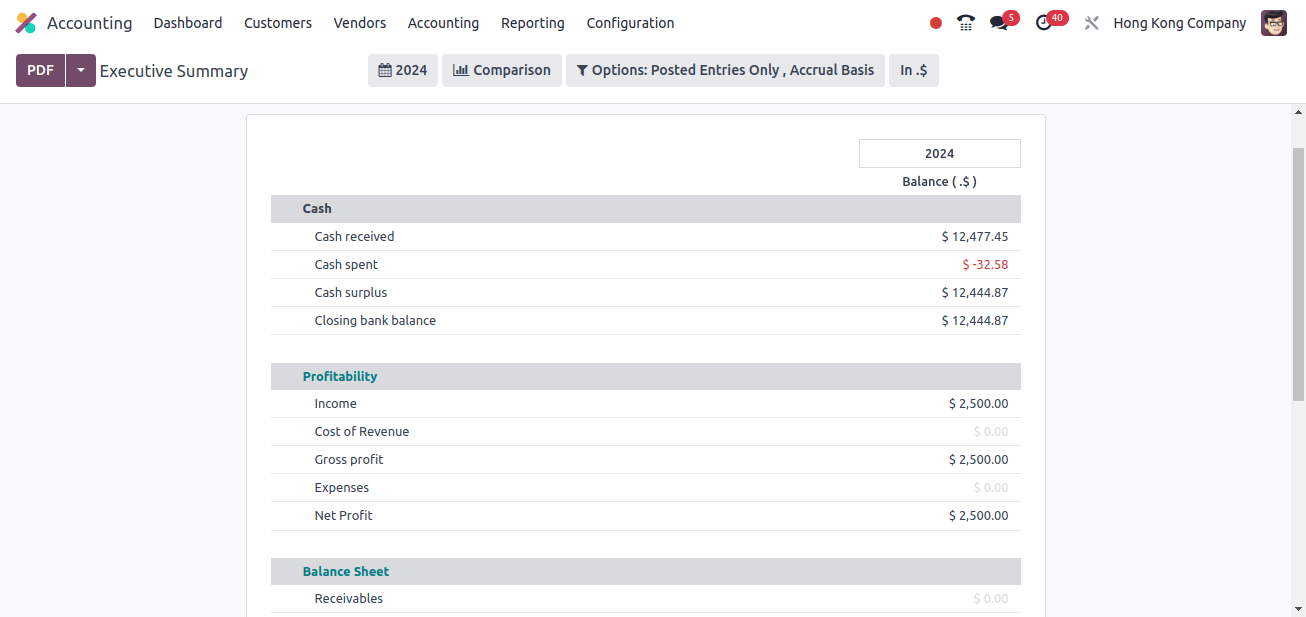

Moving on to the accounting application’s reporting menu, we can analyze the balance sheet, profit and loss statement, executive summary, tax report, and so on.

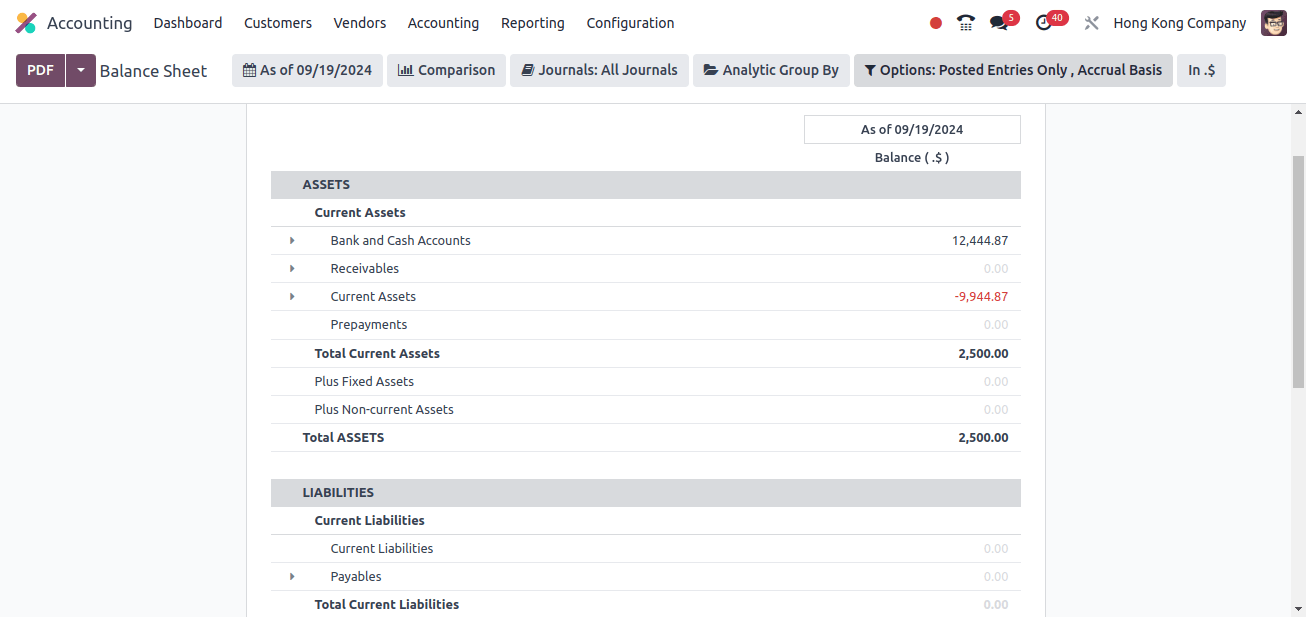

Balance sheet: A balance sheet is a financial statement that depicts a company’s financial health at a certain point in time. It gives an overview of the equity, liabilities, and assets of a corporation.

The asset, liabilities, and equity sections of the Hong Kong company’s balance sheet are labeled. This assets part includes current assets such as receivables, prepayments, bank and cash accounts, and so on.

The Liability section includes both current and non-current liabilities, as well as payables and other items. The Equity section includes unallocated earnings, current-year earnings, retained earnings, and so on.

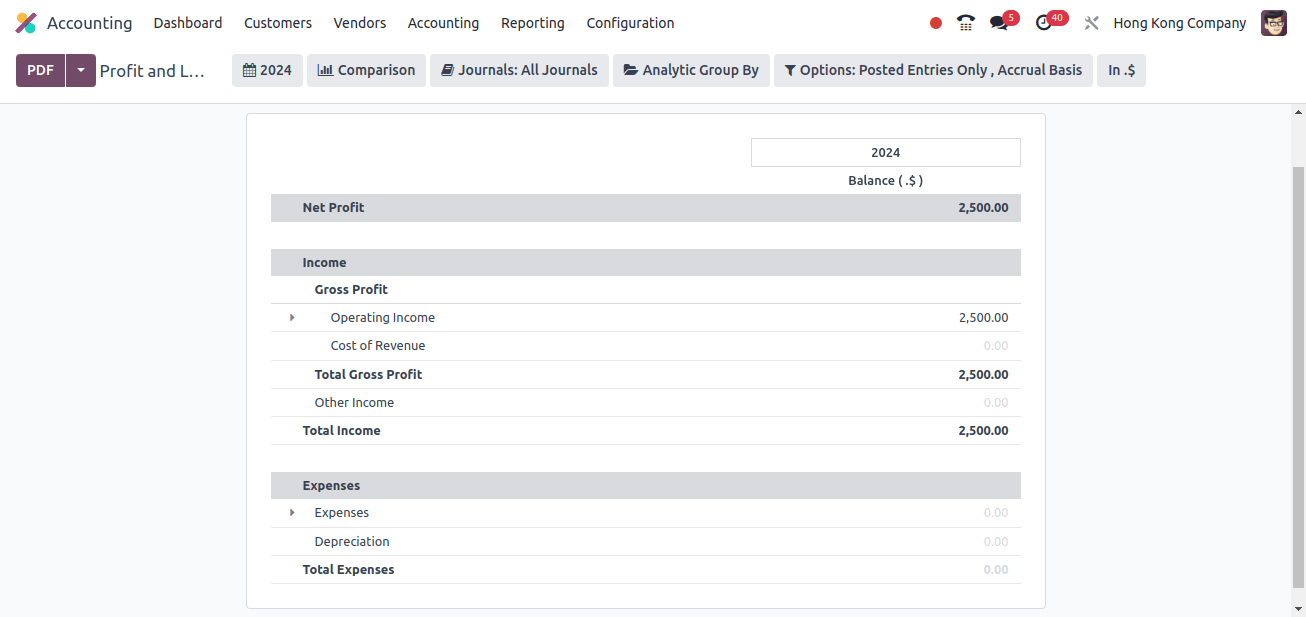

Odoo 17 offers a strong platform for creating complete profit and loss (P&L) reporting. This financial statement provides a comprehensive image of a company’s revenue, expenses, and overall profitability during a certain time period. The company’s profit and loss statement is available under the reporting option.

Profit and loss reports primarily comprise income and expenses. The income portion includes operating income, revenue costs, and gross profits. Expenses, depreciation, and other items can be found under the Expense section.

Odoo 17’s Executive Summary report is an effective tool for providing a high-level summary of your company’s financial status. It compiles key metrics from multiple financial reports into a single, simple format.

The profit and executive summary includes cash, profitability, balance sheet, performance, and positions. All of the income and costs from each section are included in the Executive Summary.

Finally, the Odoo 17 Hong Kong Accounting Localization provides a full and personalized solution for businesses operating in Hong Kong.

This localization ensures that businesses can manage their accounting processes efficiently while remaining compliant with local standards by using important features such as compliance with local tax regulations, support for the Hong Kong General Accepted Accounting Principles (HK GAAP), and integration with the Hong Kong Inland Revenue Department’s requirements.

How Can You Implement Accounting Localization for the Philippines in Odoo 17 ?