Odoo’s accounting module is designed to accommodate a range of financial accounting localization. Effective management of accounting localization demands a deep understanding of the program’s capabilities as well as the particular regulatory requirements of different countries.

By giving a summary of its features and how they help businesses move to the complexities of local accounting standards, this blog aims to make sense of Odoo’s approach to accounting localization challenges.

When entering new markets, firms must adapt to local accounting standards as a key component of their operational success. Odoo’s accounting module provides businesses operating in Morocco with a solid platform for meeting these localization requirements.

Specific rules and regulations in Morocco’s financial climate might be challenging for businesses unfamiliar with the local standards. The Moroccan localization of Odoo’s accounting is meant to make it easier to follow these rules and keep operations running smoothly.

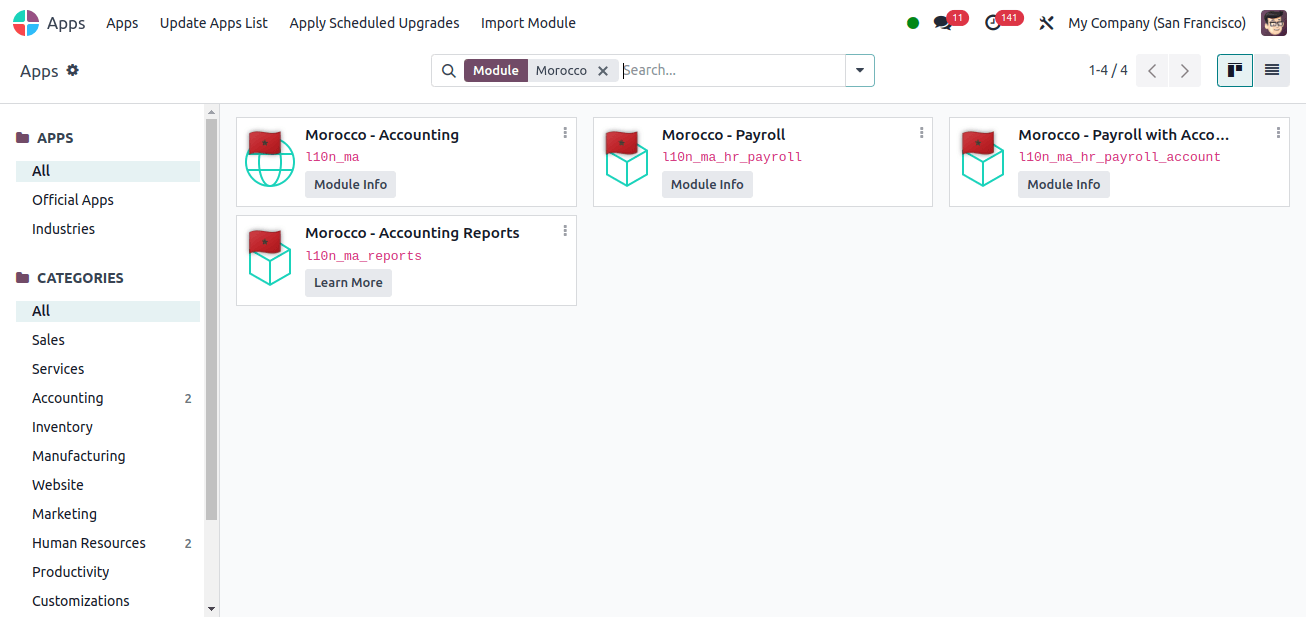

The first step in localization is to install the required modules so that we can access Apps and search. Install all required modules.

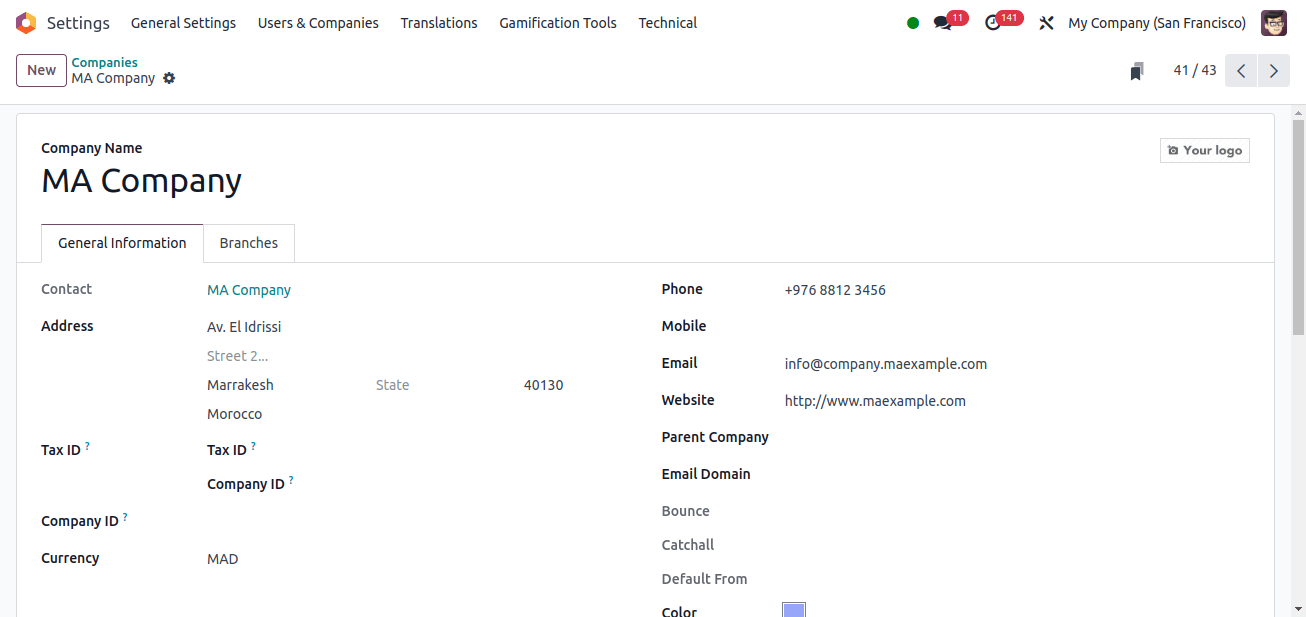

Now we can go to Settings > Users and Companies > Companies and choose the firm for which we want to review the configuration from the list.

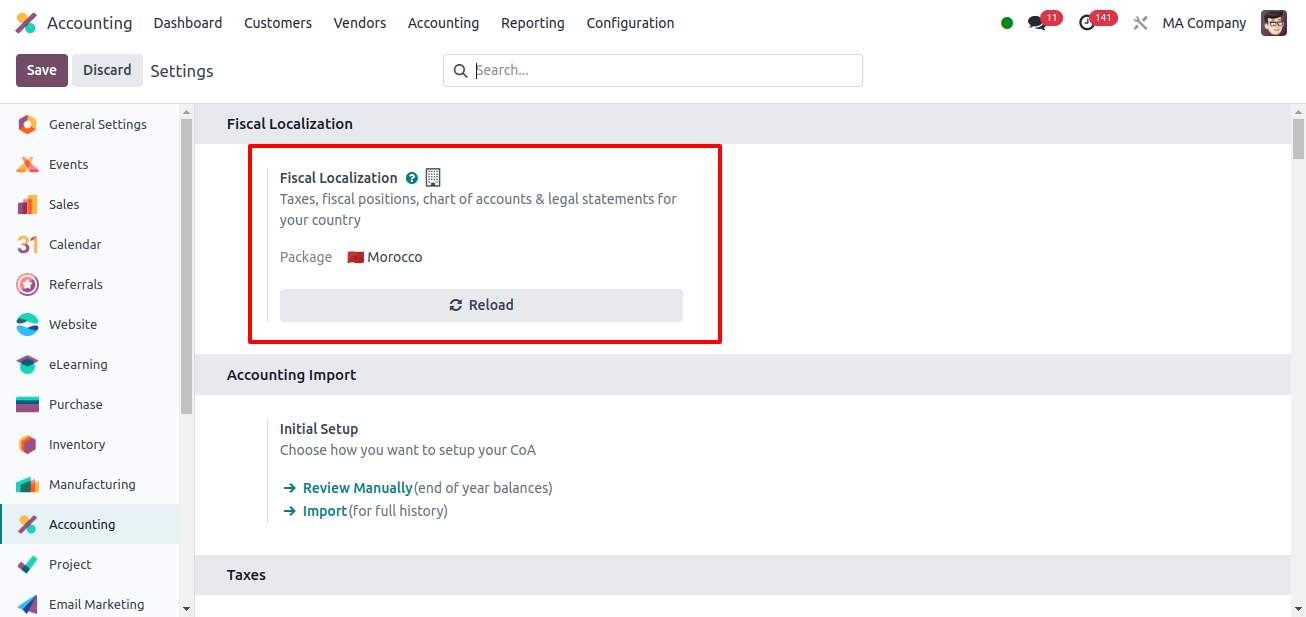

Now let’s check at the Fiscal Localization settings for this localization. Go to Accounting > Configuration > Settings and check the fiscal localization, which will be set to Morocco.

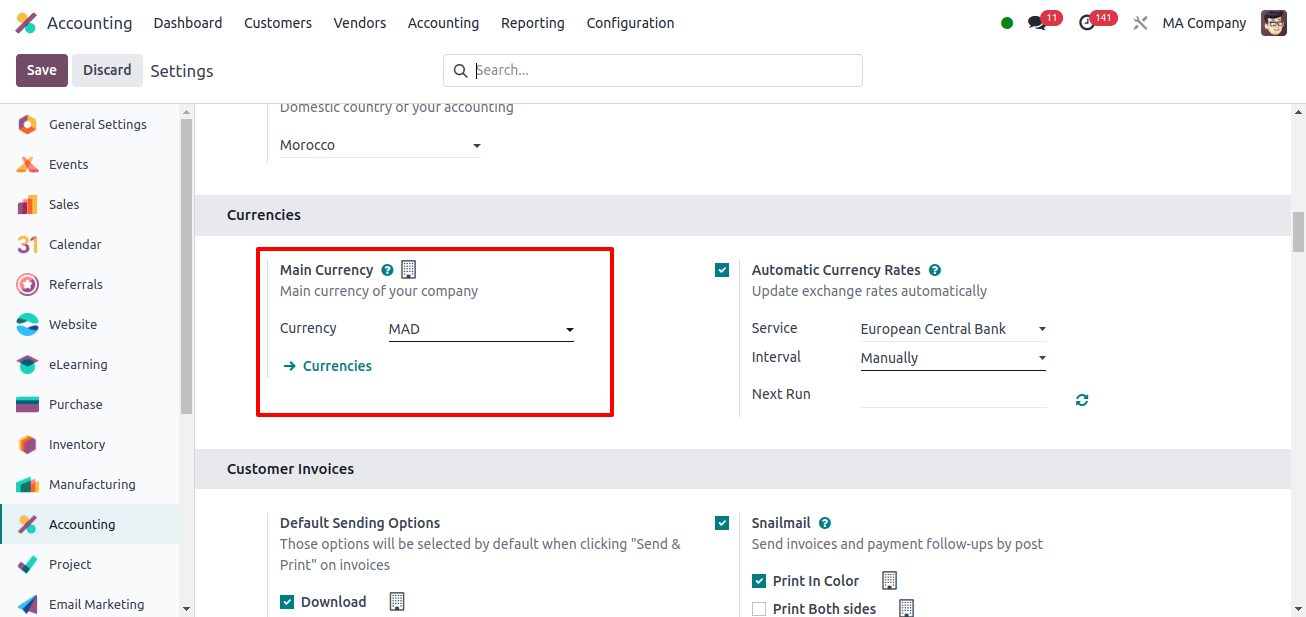

The setup settings specify the main currency with which all company transactions are carried out. Since we installed the localization modules, it will be predefined as the country’s official currency. It will be set to the Moroccan dirham (MAD).

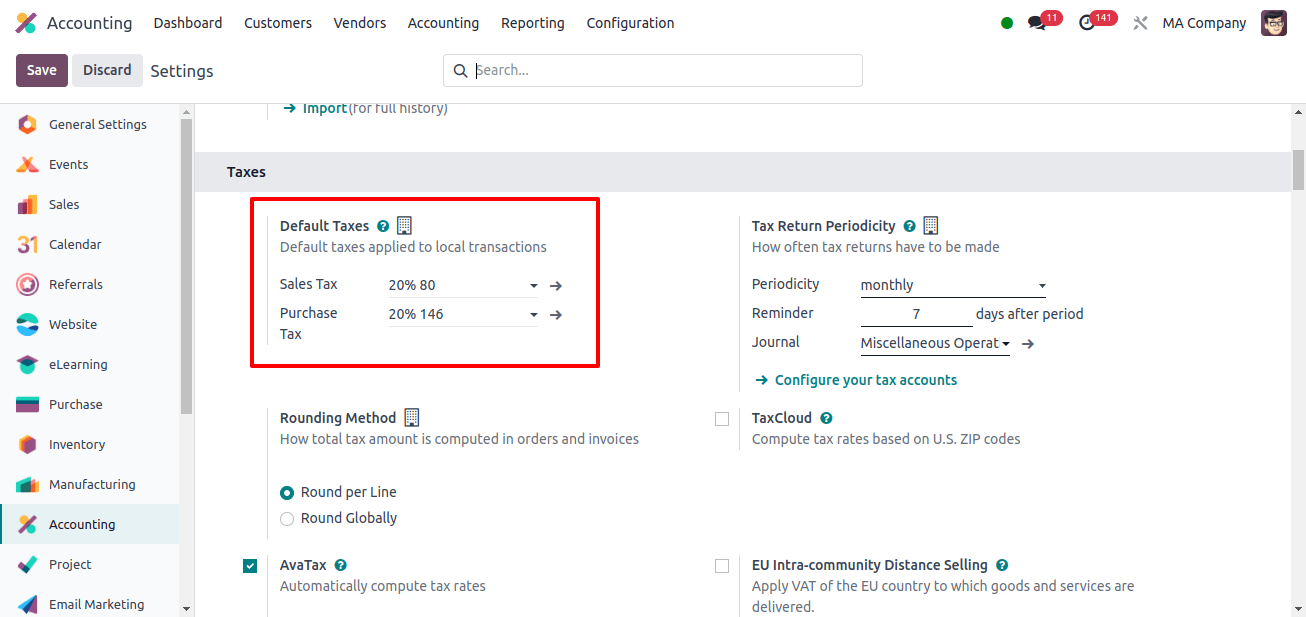

We may also specify which taxes should be used by default for company transactions. Default taxes are critical to efficiently automating and regulating the taxing process.

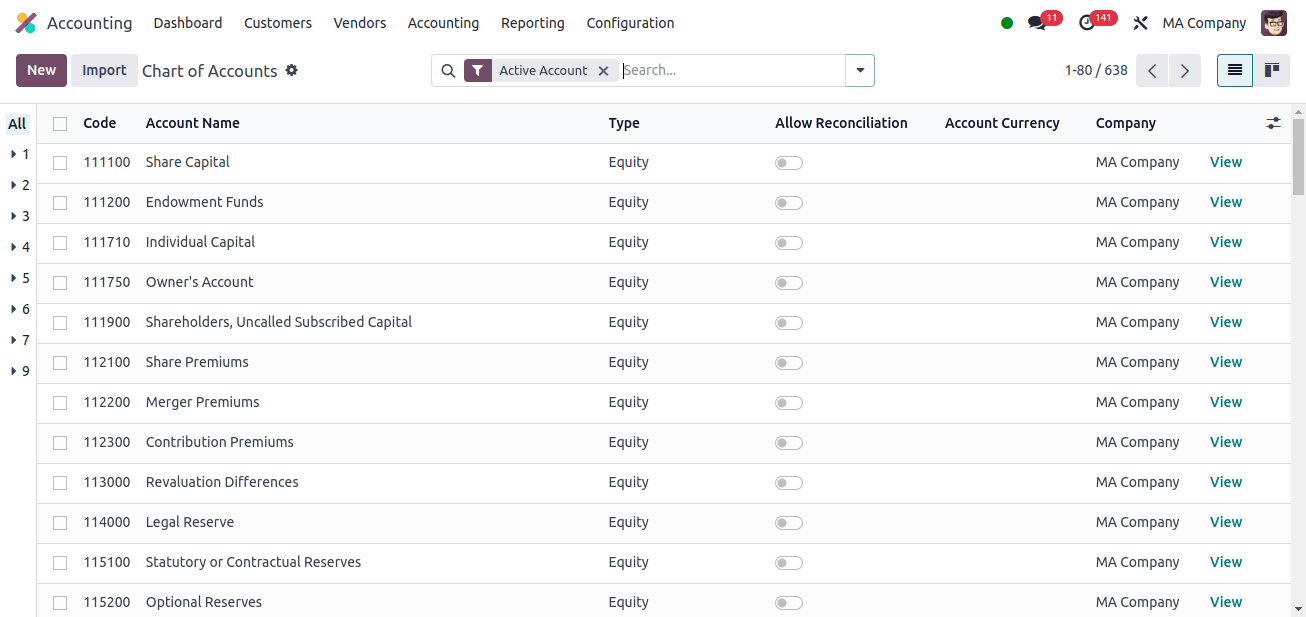

Chart of Accounts

The chart of accounts in Odoo 17 allows a company to record transactions and manage financial data by providing a systematic listing of all financial accounts. It is designed to categorize and organize accounts into primary groups, such as revenue, expenses, equity, liabilities, and assets.

This hierarchical structure facilitates accurate financial reporting and analysis since each financial transaction is properly documented in its appropriate account.

In financial management, a chart of accounts is flexible and precise because it can be adjusted to match the unique demands of each company. The accounts are set up to comply with Moroccan financial reporting rules.

Includes accounts for Moroccan taxes such as Income Tax (IT) and Value Added Tax (VAT). Adheres to the Moroccan chart of accounts structure, allowing financial transactions to be accurately classified. Allows the creation of customized accounts to satisfy specific business needs while adhering to regulatory standards.

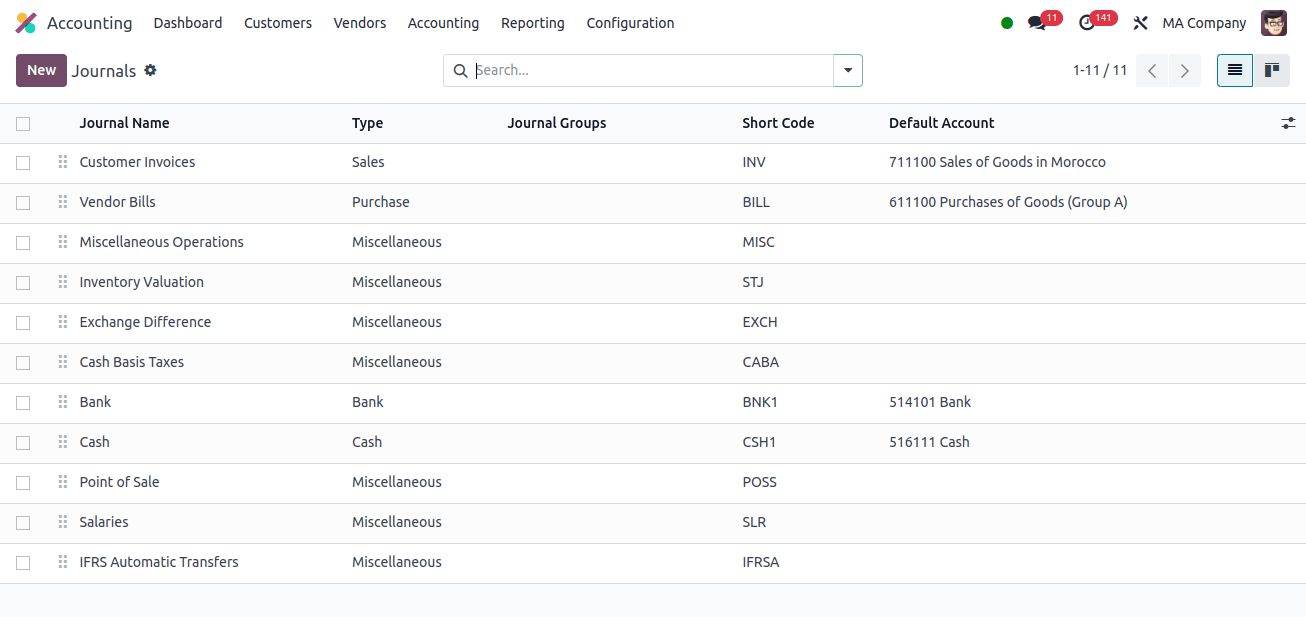

Journals

Journals are an integral part of Odoo's financial transaction recording and management system. They serve as comprehensive records of all accounting entries within each transaction category (for example, sales, purchases, and bank activities). In Odoo, each journal stores transaction details and ensures that inputs are constantly sent to the correct account.

This provides an orderly and visible view of a company's financial activity, assisting with the maintenance of accurate financial records and effective bookkeeping. It also includes common journal layouts for general entries, cash, bank transactions, sales, and purchases. Tax calculations and records, such as TVA, are generated automatically based on transaction data.

Checks to ensure that journal entries are posted to the correct accounts in compliance with the Moroccan chart of accounts. Allows the production of unique journal entries to fulfill specific business requirements.

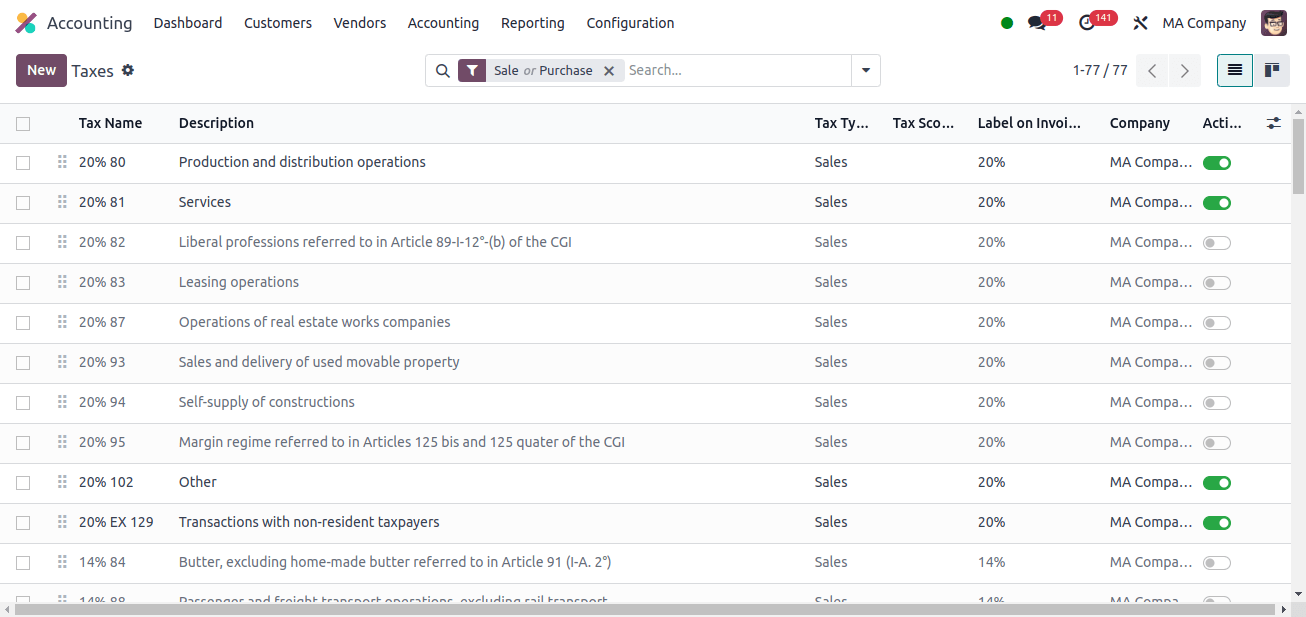

Taxes

Taxation is used in Odoo 17 to regulate and enforce various tax rates and rules on financial transactions. The tax configuration allows businesses to set tax types, rates, and jurisdictions, ensuring that sales and purchases are taxed correctly in compliance with area legislation.

Odoo automates tax computations and reporting, which helps firms maintain accurate financial records and facilitates compliance. Odoo's Moroccan localization has strong tax administration tools. It administers a number of Moroccan taxes, including VAT.

We can produce tax returns that comply with Moroccan tax legislation. Managing tax certificates and registrations is critical, and we can quickly incorporate tax data into financial statements.

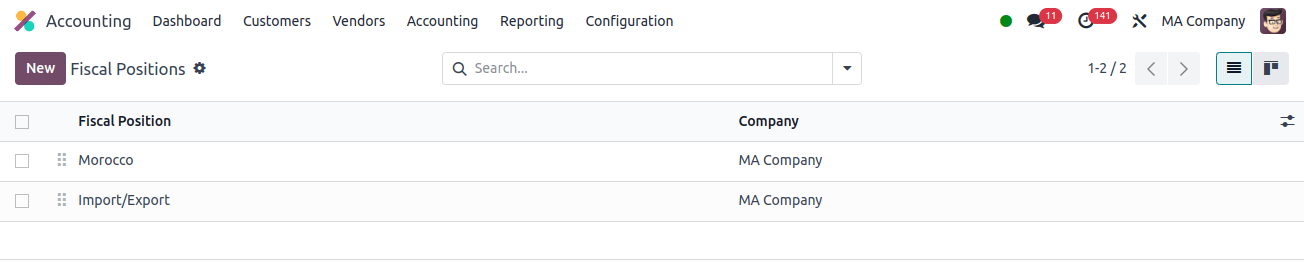

Fiscal Position

In Odoo, fiscal position is a crucial notion, particularly when working with multiple countries or regions with distinct tax regulations. Moroccan localization ensures correct accounting and taxation in compliance with Moroccan rules.

Fiscal positions contribute to the implementation of suitable tax laws and rates in accordance with Moroccan localization criteria. The installation of the Moroccan localization module creates two pre-defined fiscal positions.

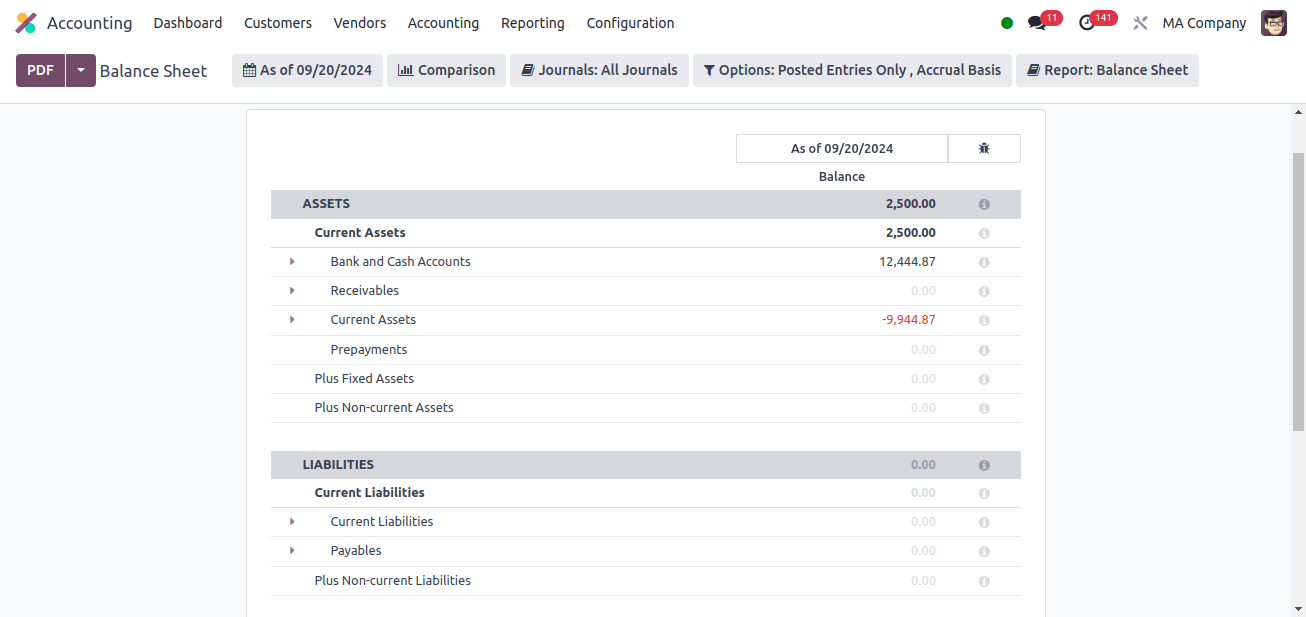

Balance Sheet

The balance sheet in Odoo indicates a company's financial state as of a certain date. It outlines the company's equity, liabilities, and assets to provide insight into the company's financial health. Odoo's automated process for constructing balance sheets from recorded accounts and transactions allows for accurate and up-to-date financial reporting and analysis.

The format and contents of the balance sheet correspond with Morocco's regional laws. Balances are displayed using the Moroccan Dirham (MAD).

To ensure accurate account classification, the chart of accounts is designed to support Moroccan accounting norms. incorporates accounts for Moroccan tax provisions, such as deferred taxes. Allows for the Arabic translation of report content and account names as needed.

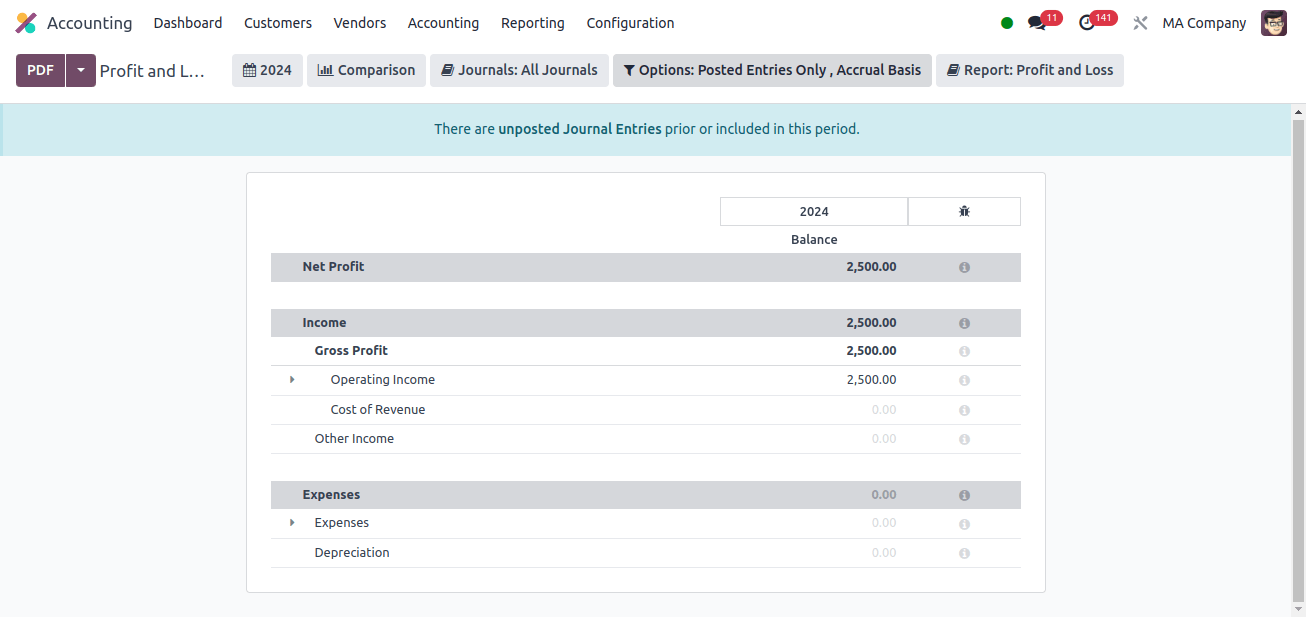

Profit and Loss Report

The income statement, also known as the profit and loss report in Odoo, provides a detailed account of a company's financial performance during a specific time period.

It summarizes earnings and operational success by integrating sales, costs, and net income. This report is generated using transaction data and accounting entries to help businesses examine their financial performance and make educated decisions.

The report's content and format are consistent with local legislation. Integrating with Moroccan tax legislation to ensure accurate tax estimates. Moroccan Dirham (MAD) is used to represent all amounts. Users can configure the report to highlight specific revenue and spending categories.

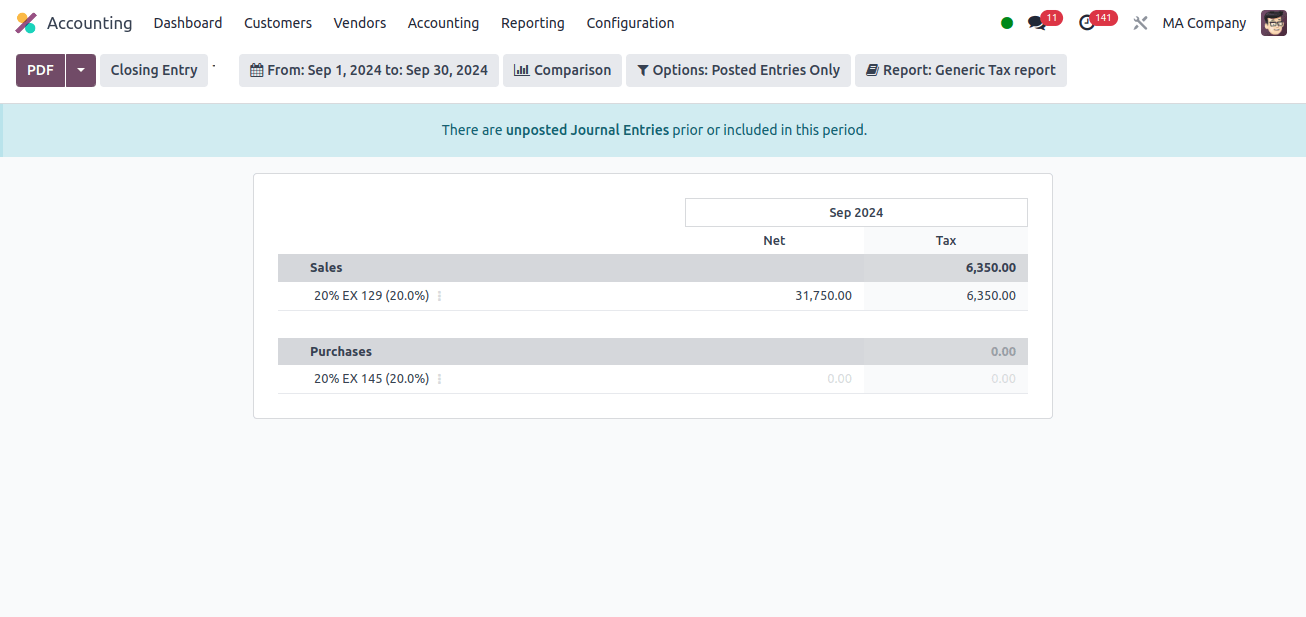

Tax Report

Odoo's tax report aggregates and presents full data on taxes collected and paid over a specific time period. It helps accurate tax reporting and compliance by providing a full view of tax responsibilities, such as VAT, sales tax, and other applicable taxes. The report is created using transactional data and tax setups to assure regulatory compliance and ease the tax return filing procedure.

As a result, we can conclude that Odoo's accounting localization for Morocco is a viable alternative for businesses operating in the country.

Odoo simplifies complex accounting procedures and ensures compliance with Moroccan legislation by providing pre-configured charts of accounts, tax templates, and compliant financial reports.

Businesses may maintain accurate financial records while focusing on their core strengths thanks to automated calculations and improved operations.

Moroccan businesses may now make educated decisions based on reliable financial data owing to Odoo's localization, which fosters overall business success and growth.

Why Is Odoo 17 the Best Choice for Accounting Localization in Spain?