Accounting localization in Odoo 17 is a feature that adjusts the accounting module to reflect the specific norms, tax legislation, and financial reporting requirements of a given country.

When you set up Odoo 17, the accounting module will automatically try to discover your company’s country code. It attempts to install the proper localization module using this code.

Localization ensures that your accounting process follows regional legislation, reducing the potential for errors and fines. Saves time by automating tax computations, tax report creation, tax regulations, and pre-set-up accounts to decrease the potential for human error.

In this blog, we will look at the accounting localization for Australia in Odoo 17. To set accounting localization in Australia, we intend to form a new firm based in Australia.

Steps to Odoo 17 Handle Accounting Localization for Australia

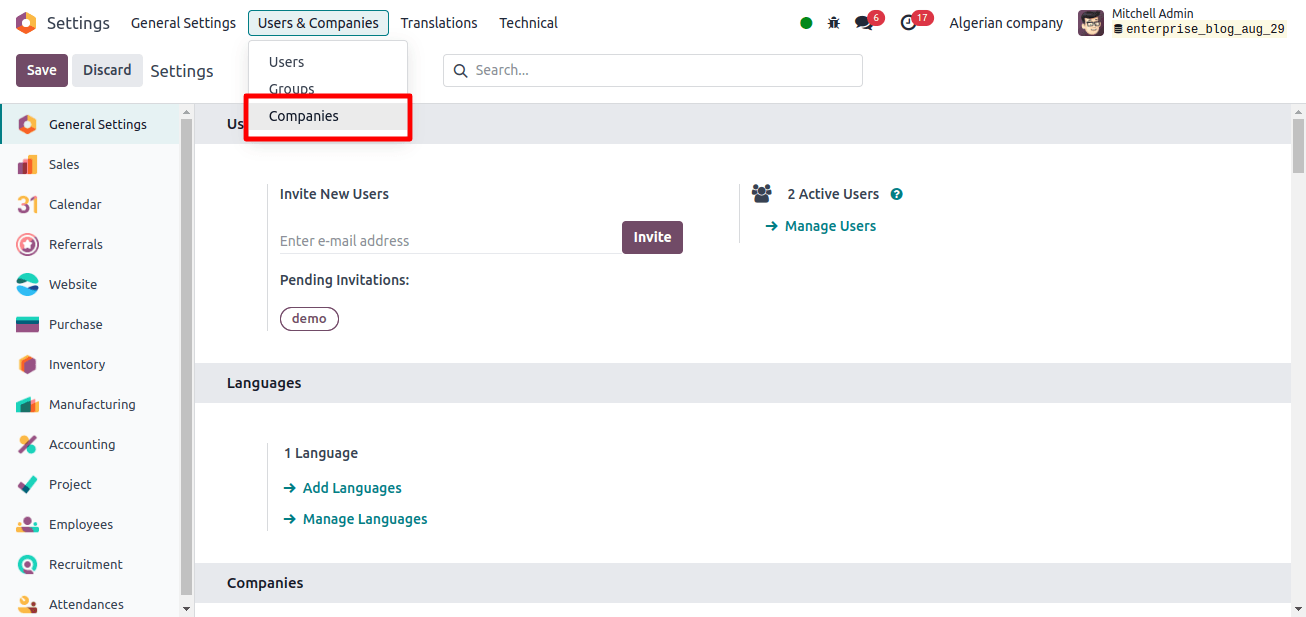

To create a new company, go to Odoo 17’s general settings. In settings, there is a users and companies menu, followed by companies sub-menu.

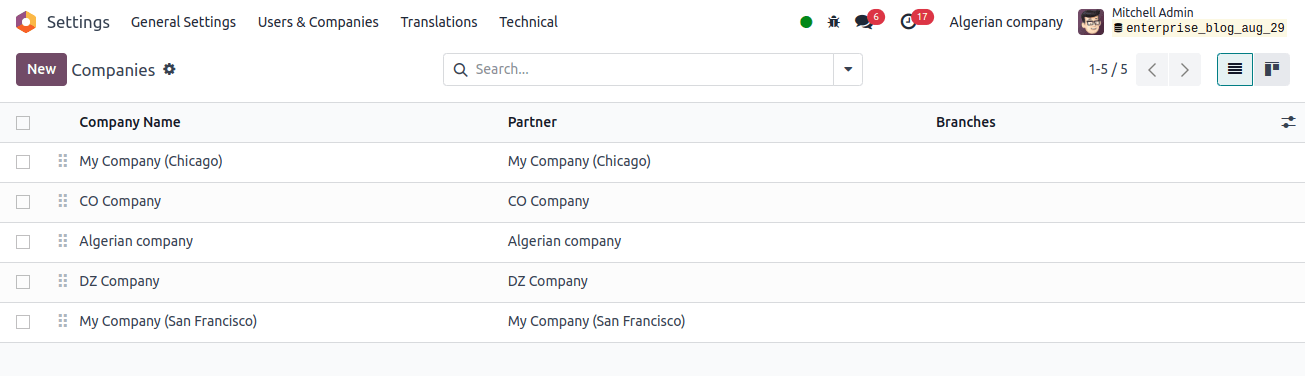

The company’s sub-menu displays a list of companies that operate in various countries. To start a new company, simply click the new button. When we click the new button, a form appears, where we can enter the business’s information.

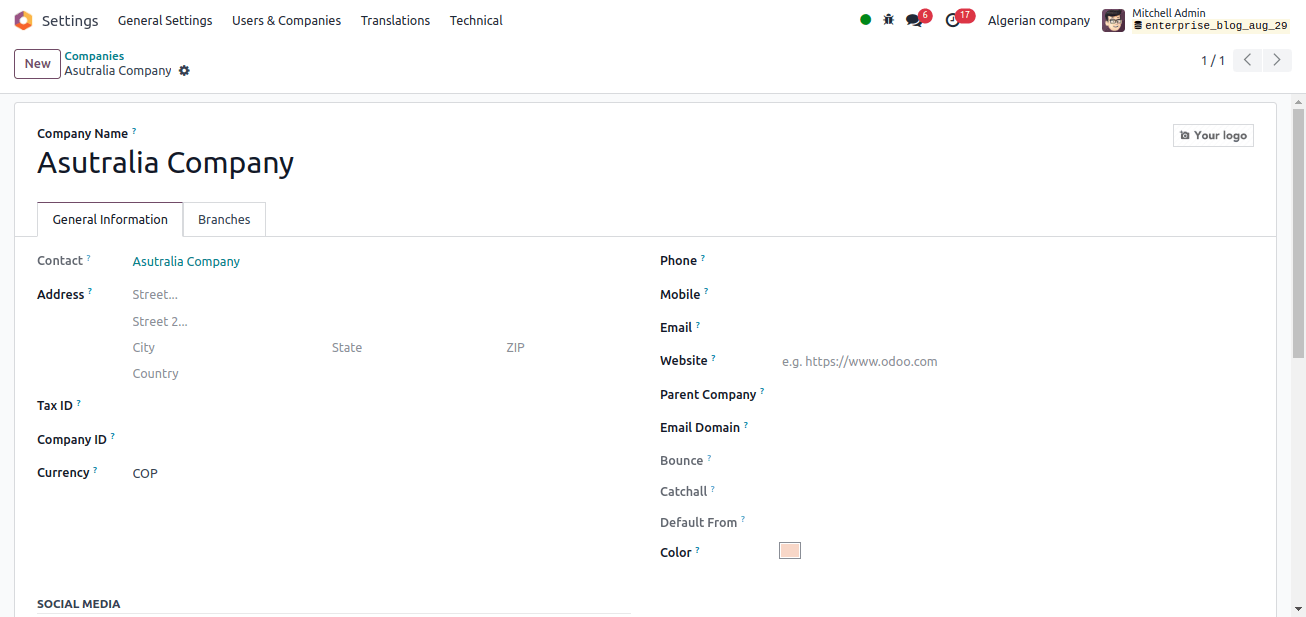

Provide the company’s name, address, ID, and any other relevant information. Click the save button to store the newly created company’s details.

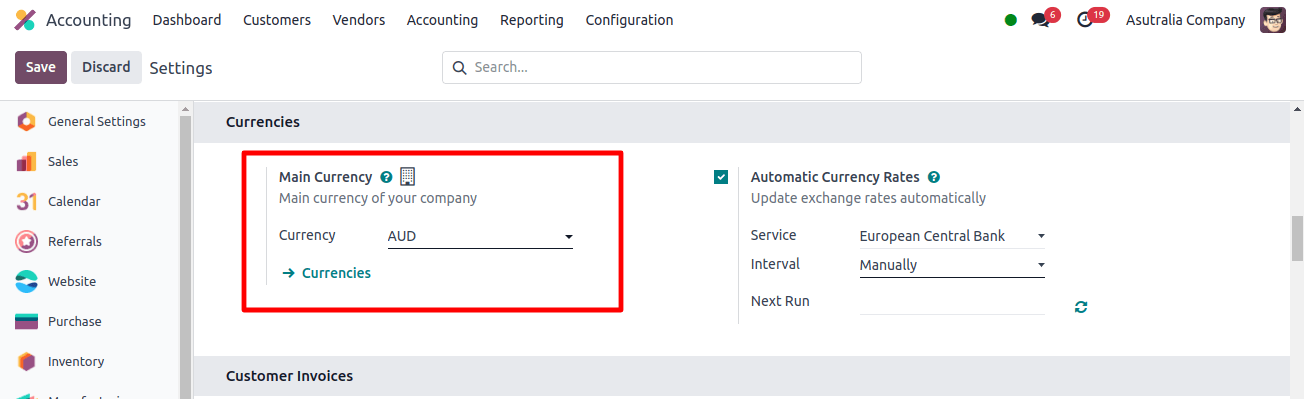

When we select a country for the business, Odoo will automatically set the currency, the Australian dollar (AUD).

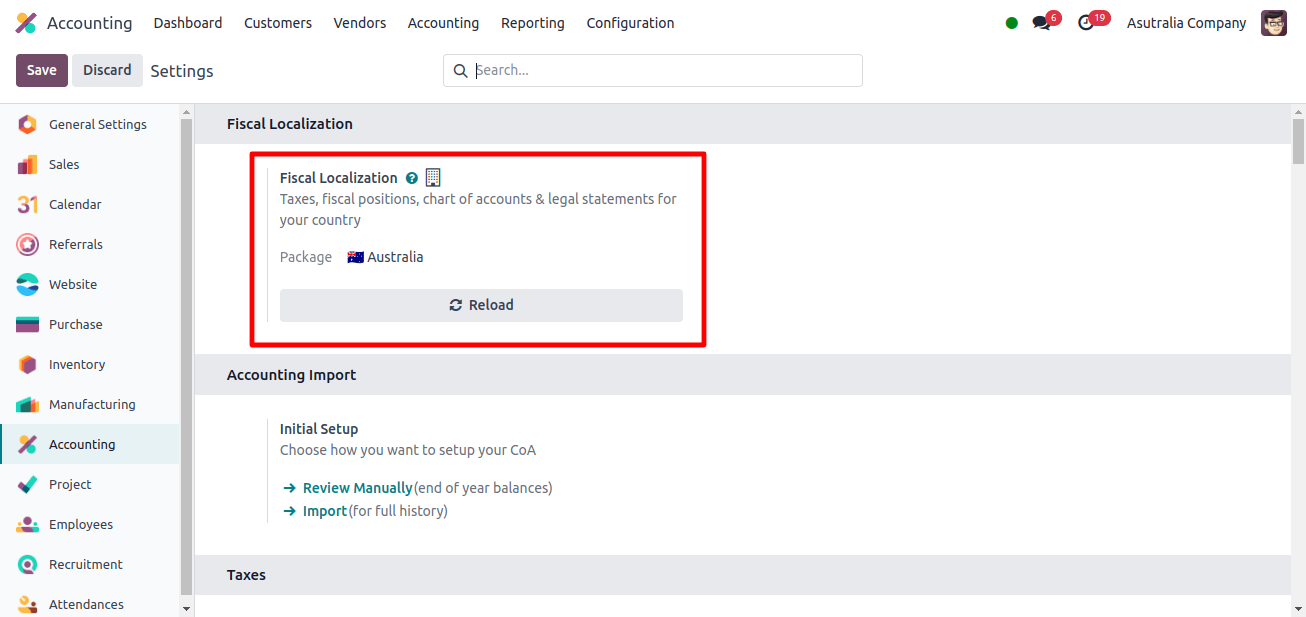

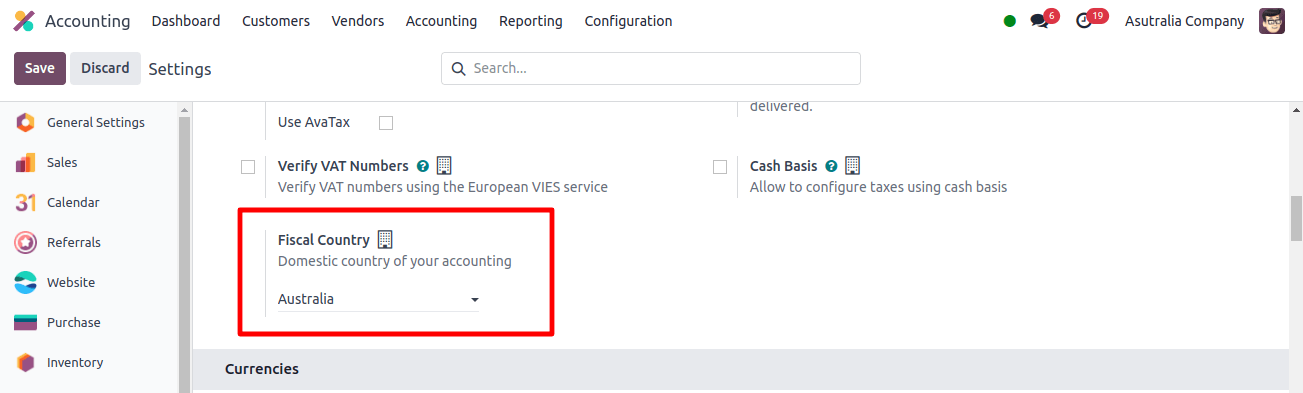

Then, go to the accounting program and select configuration settings. Set the package to Australia in the fiscal localization section and save the settings by clicking the save button.

Changes appeared when the Australian localization was configured in Odoo 17.

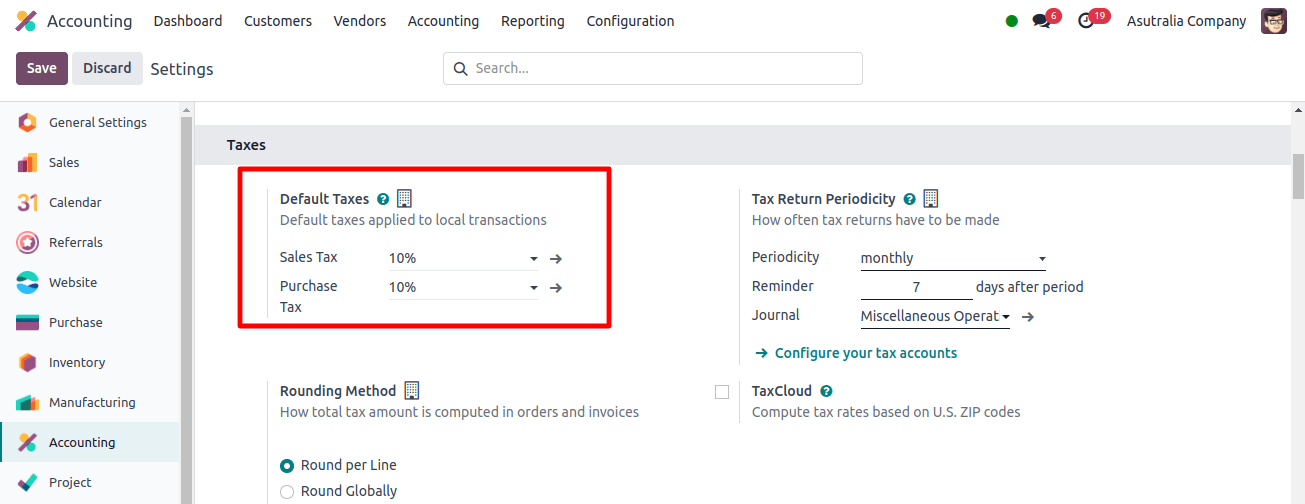

The default taxes can be modified in the configuration settings’ taxes section. So there is no need to explicitly configure the localization: When we set the package to Australia, Odoo 17 automatically sets the default tax that all Australian companies are assigned to use.

As shown in the image above, Odoo 17 has configured the default tax for Australian companies.

The following product is the currency. The setup settings allow us to specify a company’s main currency. We know that the Australian currency is the Australian dollar (AUD), and Odoo 17 configures the currency when we select a country for the company.

The fiscal country for the firm can be selected in the configuration settings. However, if we set up the right package for the company under the taxes field, Odoo 17 will configure the fiscal country automatically.

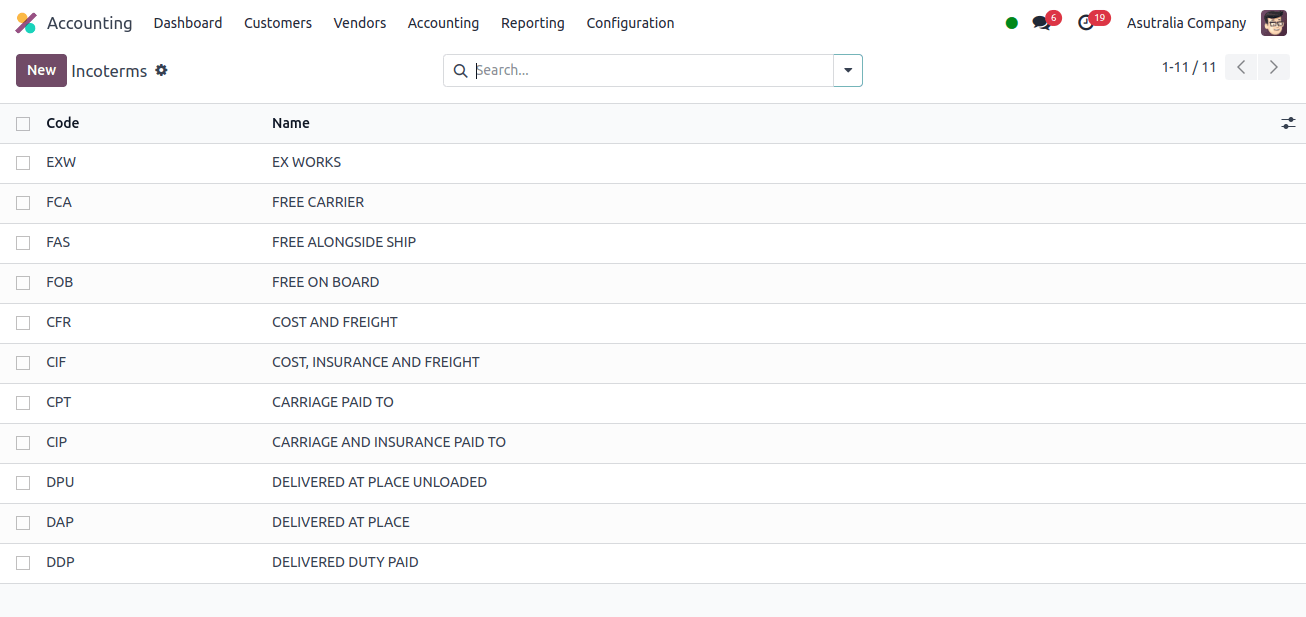

The obligations and responsibilities of buyers and sellers in cross-border trade transactions are defined by incoterms (International Commercial Terms) in Odoo 17.

These terms and conditions outline who is liable for what costs and responsibilities associated with product delivery and transportation.

These are the inconveniences that Australian companies can make use of.

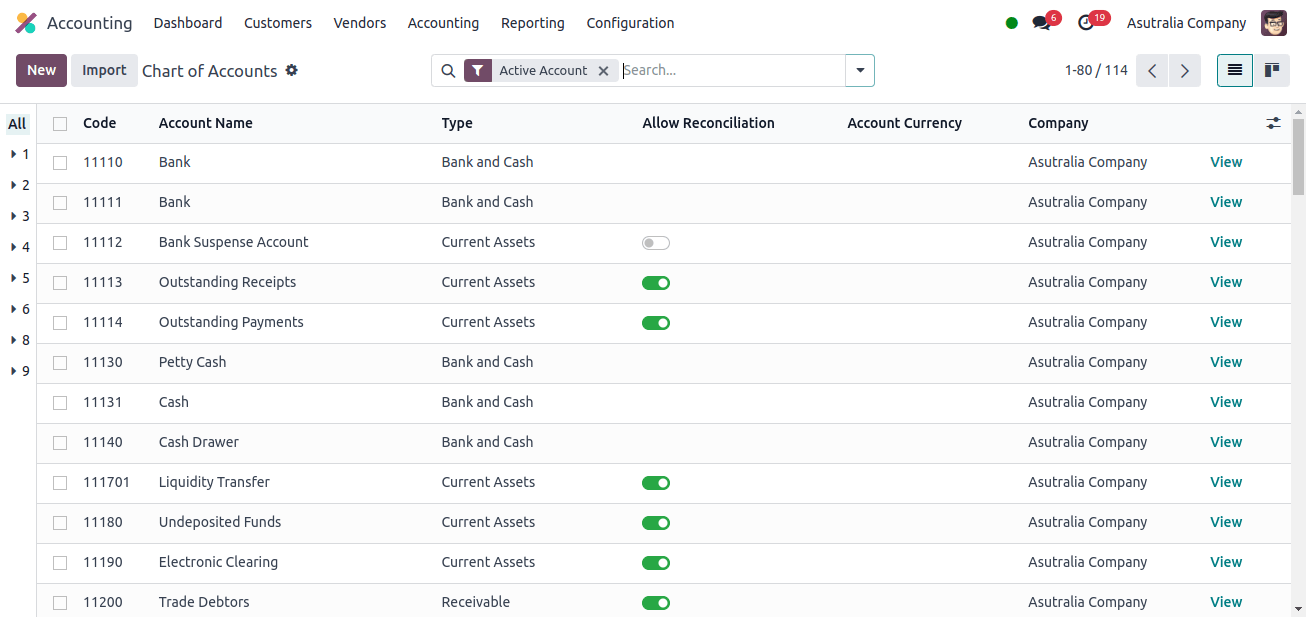

In Odoo 17, the chart of accounts organizes all general ledger (GL) accounts that a business needs to record financial transactions. It provides a structured way to categorize and organize financial data in preparation for reporting and analysis.

Accounts from various countries may differ. The image above shows the chart of accounts that Australian companies can use.

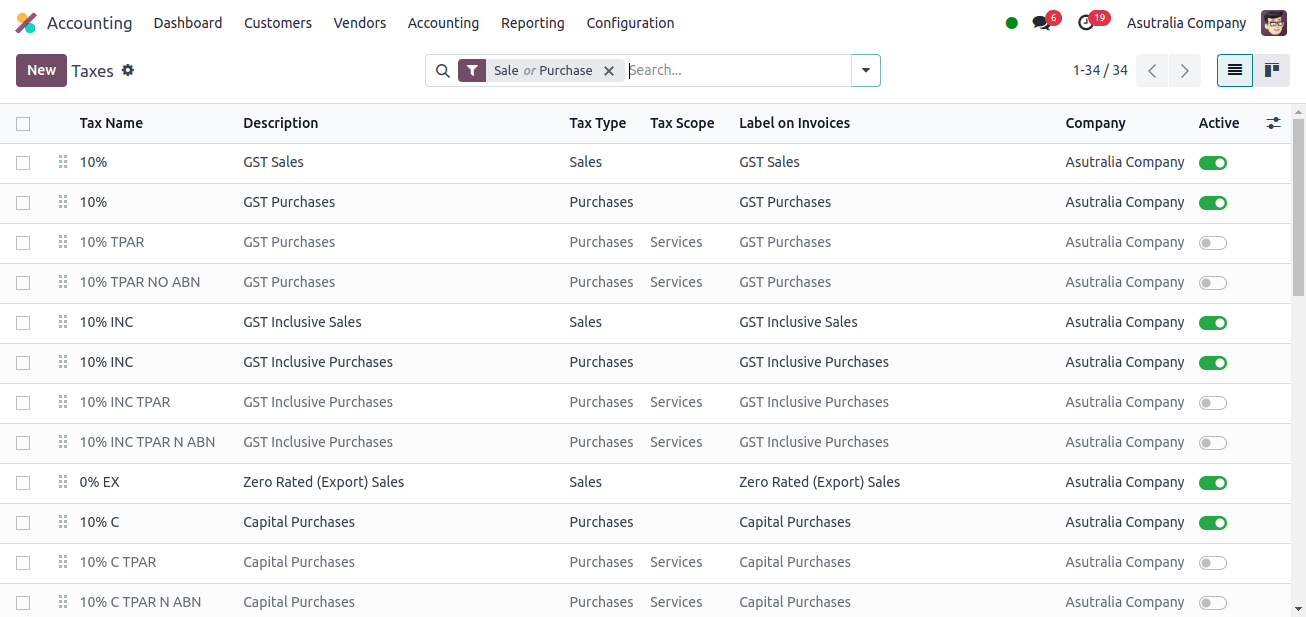

Taxes are managed by Odoo 17’s accounting and invoicing modules, and they are important for accurately computing tax obligations associated with sales and purchase activities.

Common taxes used in Australia include TPRA, ABN, and so on. The taxes used may vary depending on the product or service.

TPRA: This is a tax rate that applies to the income of temporary residents in Australia for the portion of the year they spend in the nation.

ABN: An ABN is a unique 11-digit number for companies and people registered for GST in Australia.

A fiscal position is a configuration setting in Odoo 17 that allows businesses to determine the taxes applied to sales and purchases based on specific characteristics such as customer or supplier location, product type, or company laws.

Companies with complex tax laws or those operating in multiple jurisdictions may find fiscal positions beneficial. The image shows the fiscal stance defined for Australian businesses.

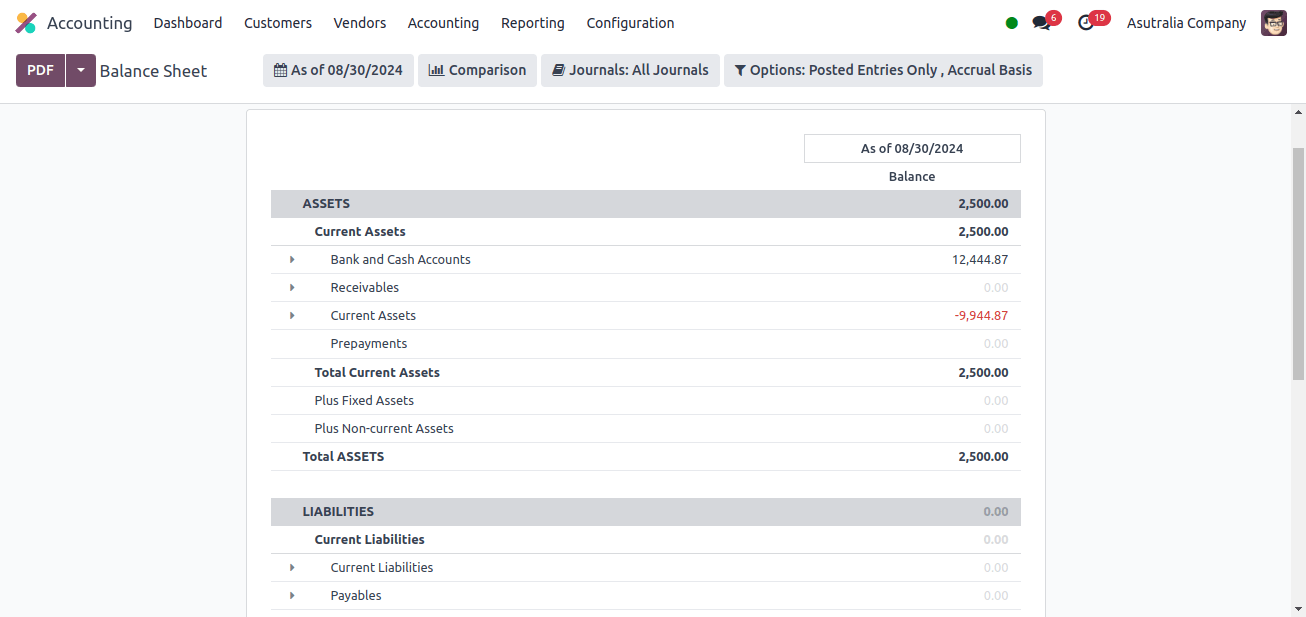

The balance sheet in Odoo 17 is a form of financial report that shows your company’s financial position as of a specific date. It works similarly to a scaled image, delivering a clear view of your company’s financial position at any time.

The image shows a balance sheet customized for Australian companies. In this situation, the company’s assets, equity, and liabilities are the primary focus.

Assets include current liabilities, bank and cash payments, receivables, and more. Liabilities comprise payables, current liabilities, and so on, whereas equity includes unallocated earnings, retained earnings, and so on.

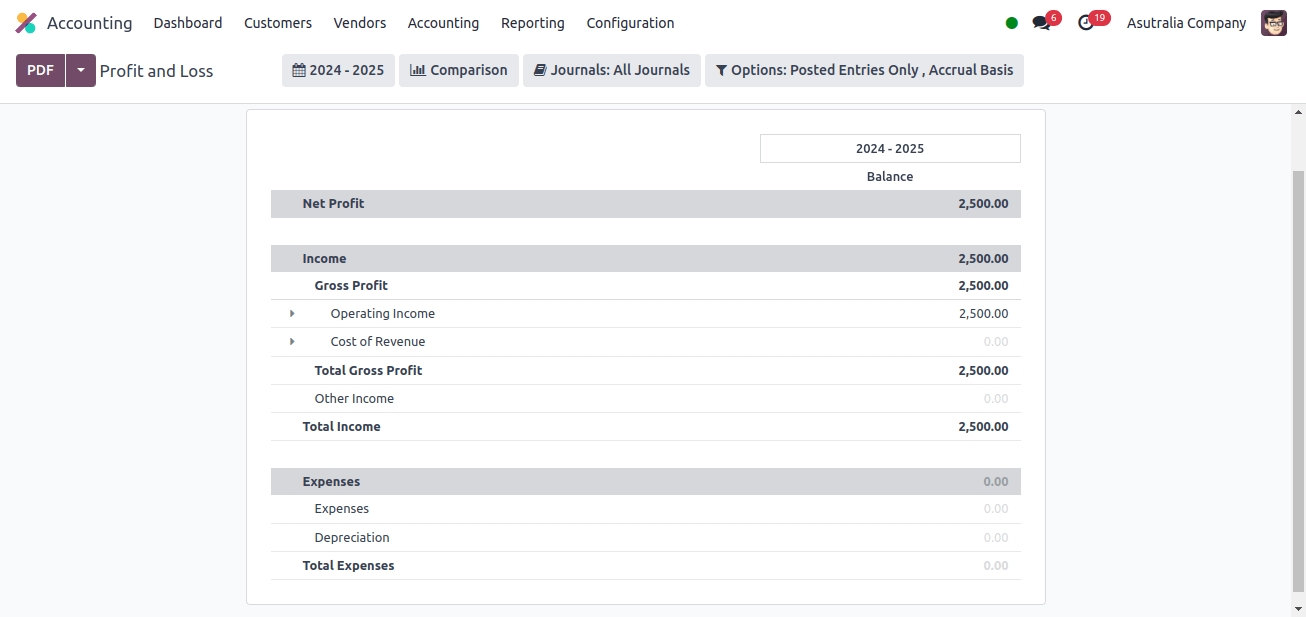

The profit and loss statement is an important financial document that offers an overview of your company’s earnings and expenses over a specific period. It indicates your overall profitability by indicating how much money your company made and spent throughout that period.

Income and expenses are the major terms in an Australian company’s profit and loss statement. Income will include operational costs, cost of revenue, and so on, while expenses will include expenses and depreciation.

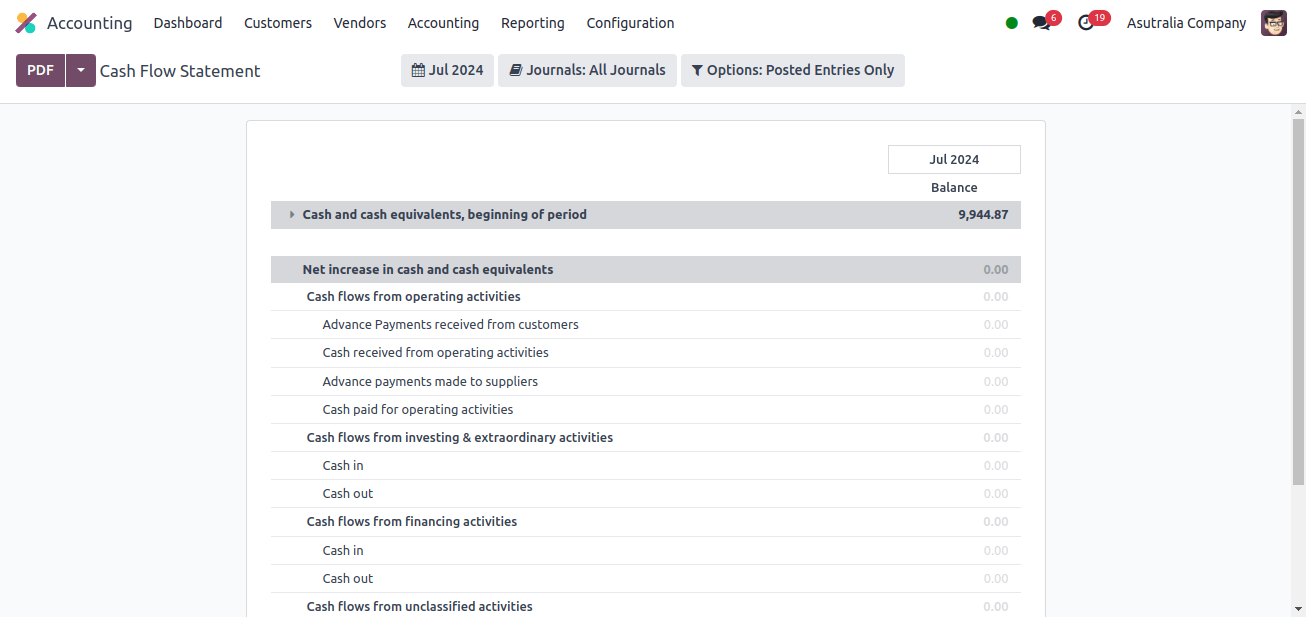

The cash flow statement, a financial report featured in the Odoo 17 accounting module, shows how cash traveled through your business during a specific period. It focuses on how cash inflows and outflows affect overall liquidity rather than simply representing profitability.

The next image shows cash flow statements used by Australian companies.

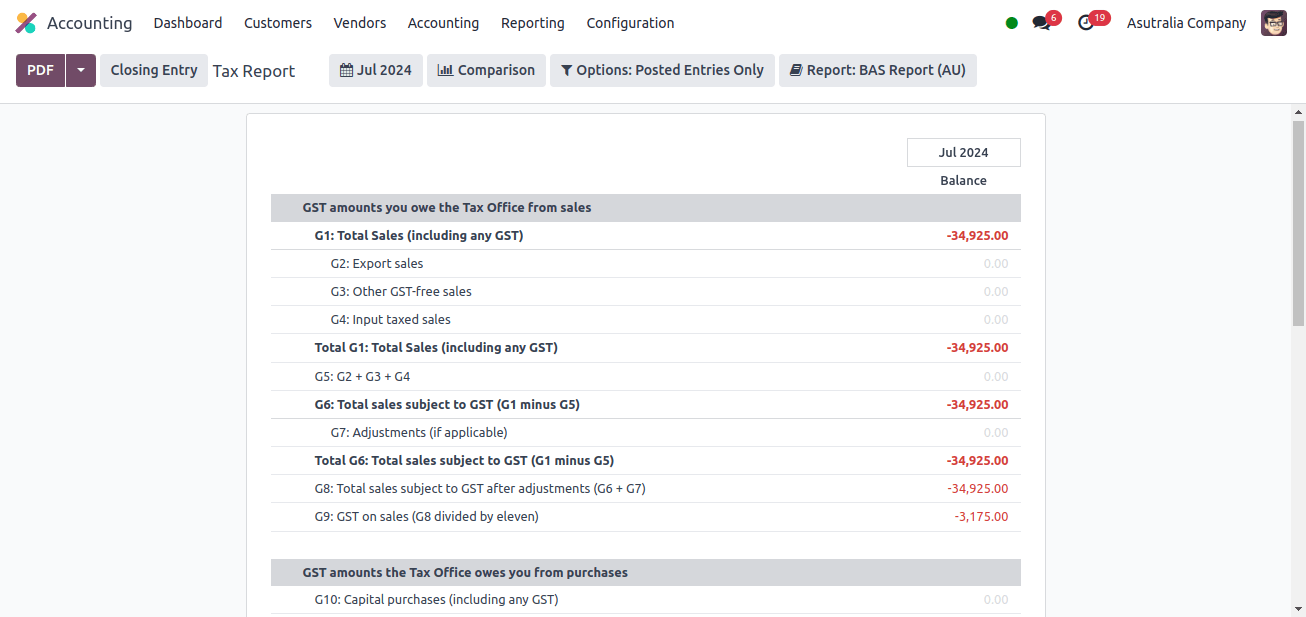

Tax reports in Odoo 17 are important for businesses to track their liabilities, file taxes correctly, and follow tax rules. The tax report of an Australian company covers export sales, other GST-free sales, input-taxed sales, non-capital purchases, capital purchases, and so on.

Export sales:

In general, GST does not apply to Australian export sales of goods and services. This means that your export invoices are GST-free and do not appear in the taxable sales portion of your Odoo GST report, also known as the BAS or Business Activity Statement.

Input-taxed sales:

Input-taxed sales refer to sales of goods or services that are not subject to GST.

Non-capital purchase:

Non-capital purchases are business expenses for ongoing operations that are not expected to be repaid within a single revenue cycle. These expenses are fully deductible in the tax year in which they are incurred.

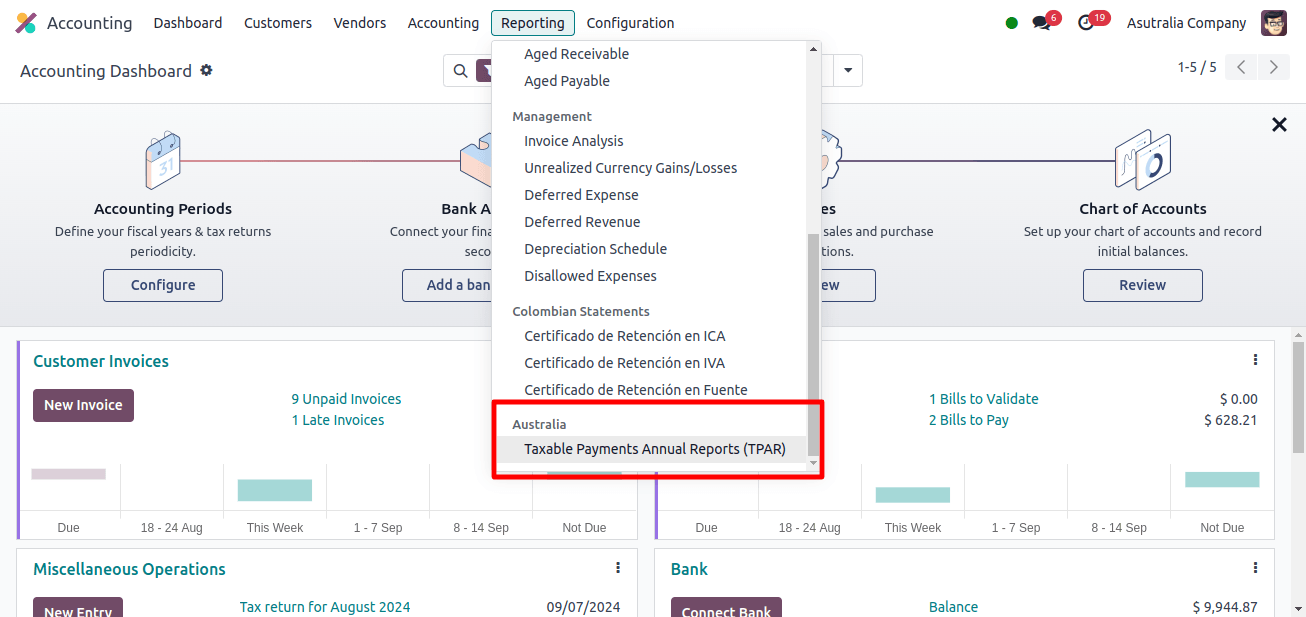

The accounting application’s Reporting menu includes an additional sub-menu for Taxable Payment Annual Reports (TPAR).

Taxable Payment Annual records (TPAR) describe the payments made to subcontractors or contractors over the fiscal year.

Companies that hire subcontractors must submit that ATO with this report. When we click this submenu, we can view all Taxable Payment Annual Reports.

The localization function for accounting operations in Odoo 17 provides a comprehensive solution adapted to the specific demands and rules of various countries. By including country-specific rules in Odoo 17, enterprises may increase compliance, streamline financial processes, and improve reporting accuracy.

Localization enables organizations to manage complex tax systems, conform to legal regulations, and obtain more financial performance data. Finally, Odoo 17’s accounting localization assures compliance with local financial requirements, promotes growth and longevity, and enables businesses to succeed in global marketplaces.