Various businesses localize their accounting systems according to the country in which they operate. Odoo 17 allows for cross-national localization. To ensure precise interactions with taxes and other legal matters, we should adjust the company's accounting to the proper localization.

Thus, we will discuss Odoo 17’s Accounting Localization for Singapore in this blog. Accounting localization in Singapore includes all of the accounting components needed by a company operating in Singapore. When we install a country’s localization, the tax and account charts are automatically generated.

Odoo provides great accounting localization tools that are geared to match individual regional norms and regulatory requirements. Odoo's accounting localization module helps businesses navigate tax legislation, financial reporting requirements, and currency difficulties, giving them the tools they need to streamline operations and adhere to local financial norms.

Effective accounting localization in Odoo goes beyond basic compliance; it enables firms to optimize financial operations, increase transparency, and reduce the risks associated with regulatory non-compliance.

Accounting localization promotes adaptable and scalable business management solutions by smoothly interacting with other Odoo modules such as invoicing, inventory, and sales.

First, we may go to Apps and install the Modules needed to install the Singapore accounting localization in Odoo.

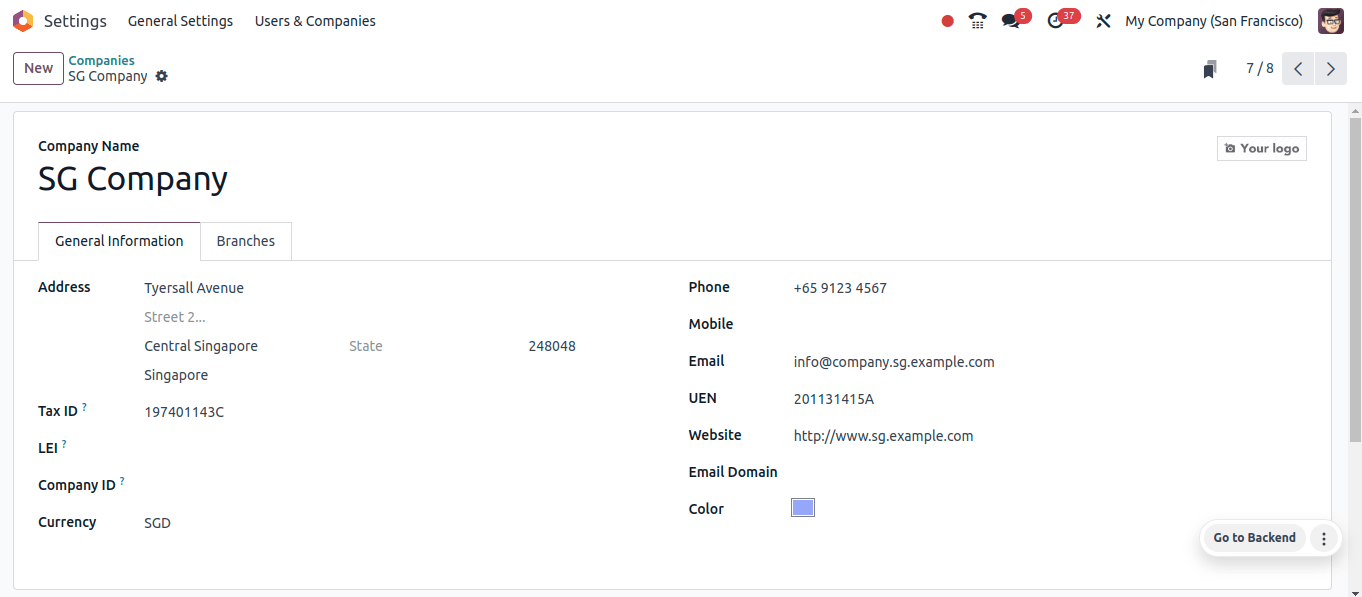

To ensure accurate data and functioning inside Odoo, review the existing company settings or establish a new company profile if needed.

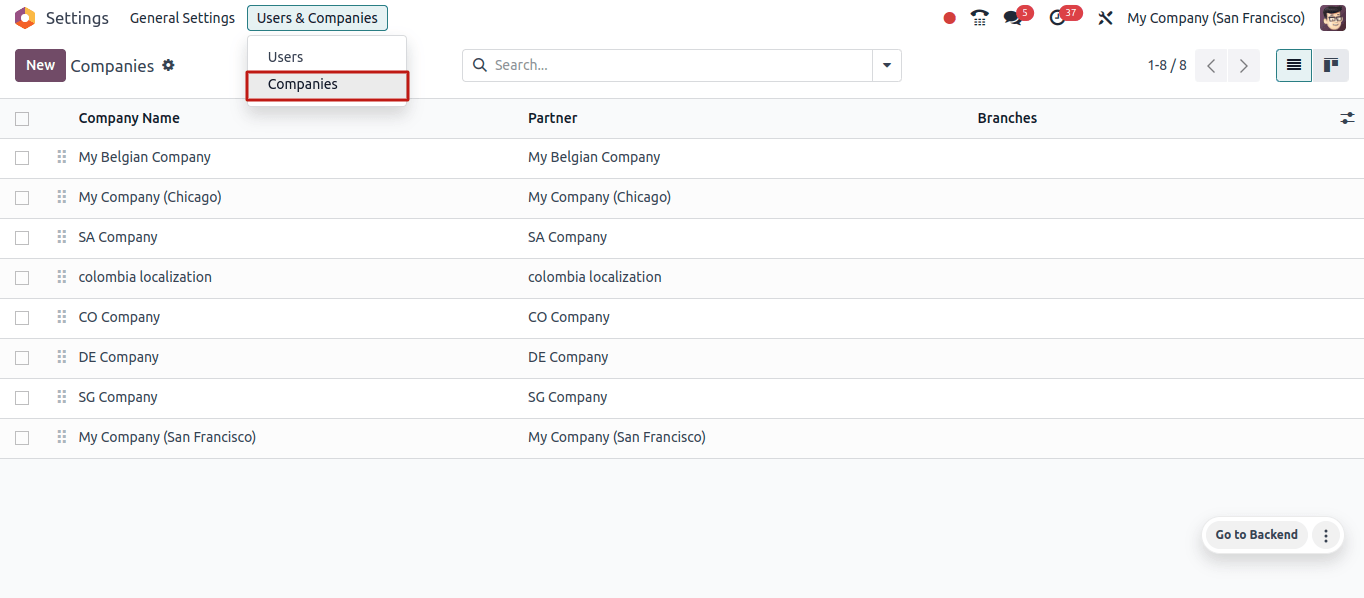

This setup establishes critical information about your business. Navigate to Odoo's Settings menu. From there, navigate to the "Users and Companies" section and pick "Companies".

This will display a list of all firms that are currently configured in your Odoo instance, allowing us to select a company and determine whether or not it is correctly configured.

If necessary, we can form a new firm and set it with proper nation details for that country's accounting localization.

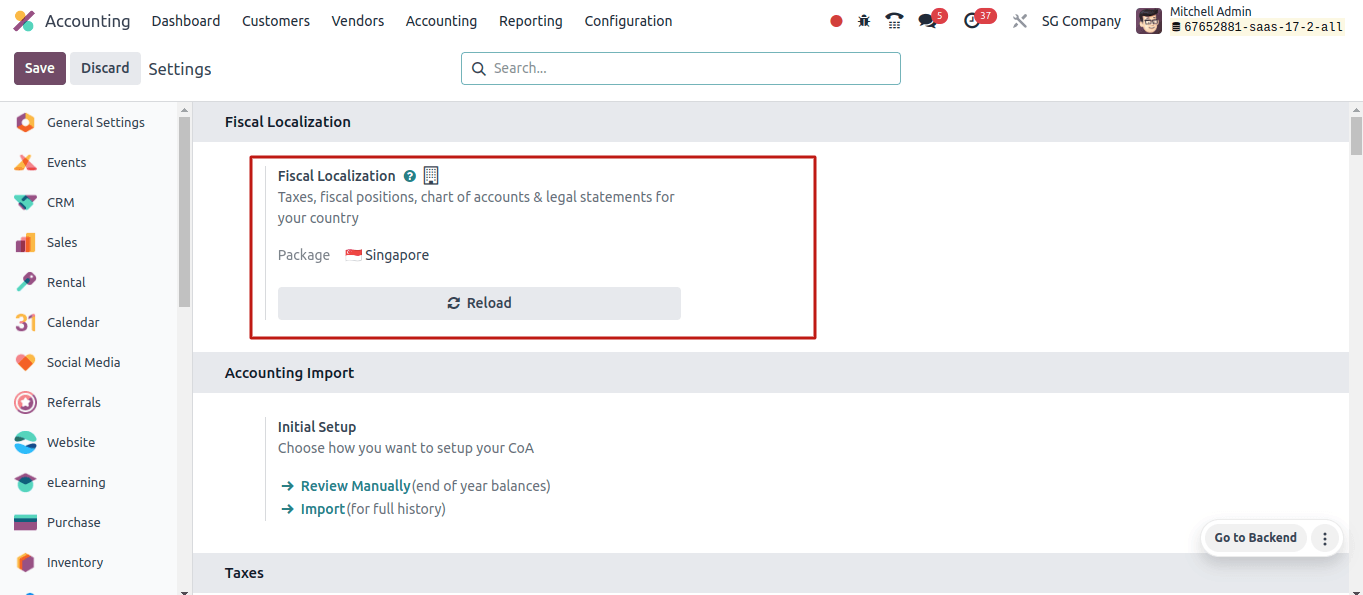

The Accounting module's Configuration > Settings shows that the fiscal localization will be set to Singapore.

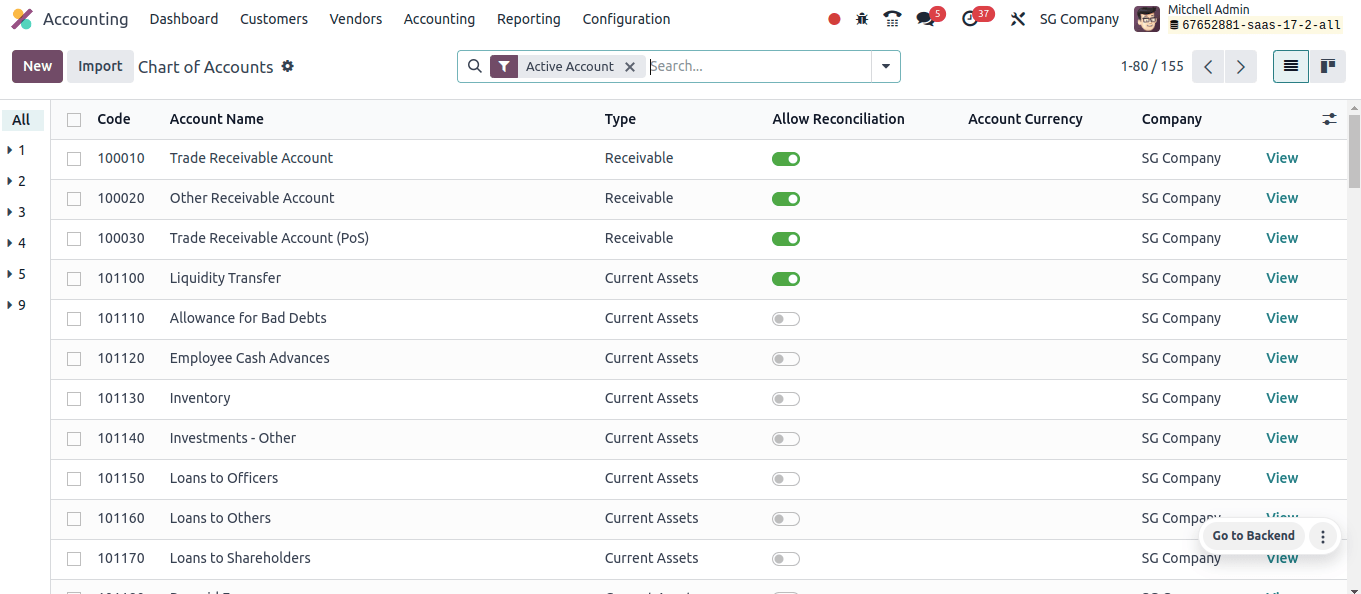

Charts of Accounts

Every financial activity in Odoo, from sales invoices to expenditure payments, is assigned to a distinct account in the chart of accounts. This ensures that your financial transactions are meticulously monitored and categorized.

When we install the Singapore localization, we also install the Chart of Accounts required to document the country's financial transactions.

There are different Chart of Accounts that are included for Singapore localization, such as Trade Receivable Account, which plays a crucial role in managing your sales transactions and ensuring accurate financial reporting under Singaporean accounting standards, Allowance for Bad Debts, which plays a critical role in managing the potential risk of uncollectible customer receivables and ensuring accurate financial reporting, Employee Cash Advance Account, which serves a specific purpose in managing short-term loans provided to employees and ensuring proper accounting treatment under Singaporean regulations, and a number of additional Chart of Accounts have been added especially for this translation.

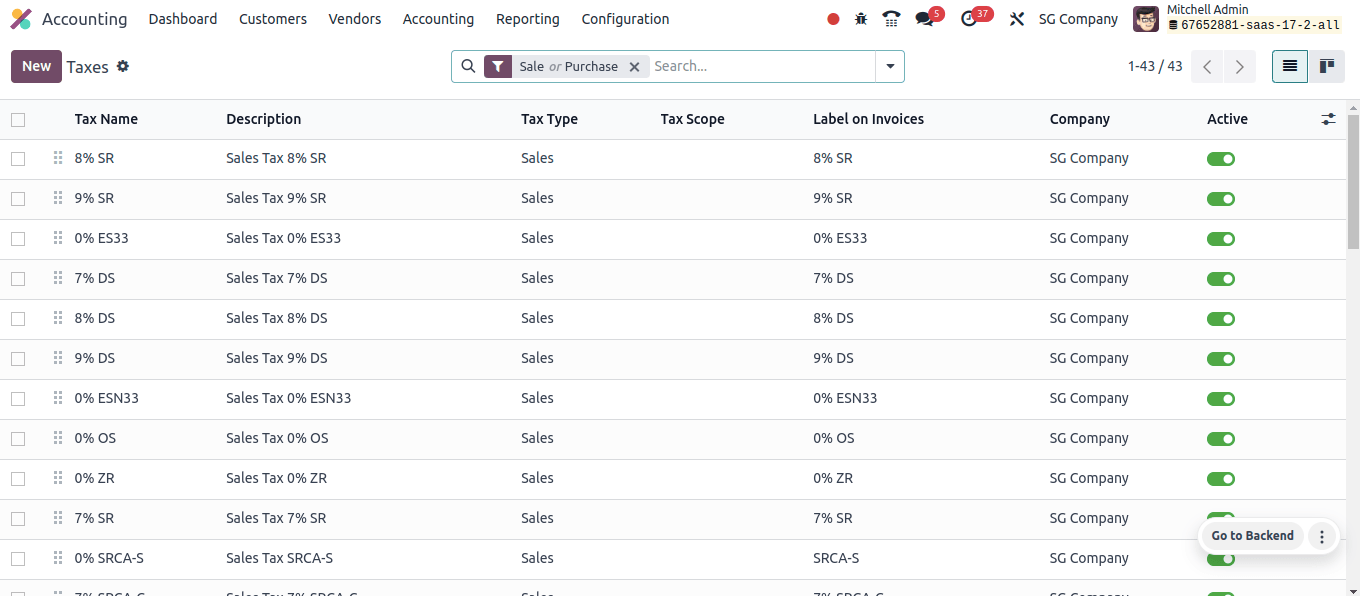

Taxes

Odoo automates tax computations based on vendor location and product type, reducing manual errors and maintaining compliance.

Within Odoo's Taxes, you may set up different sales and purchase taxes with their own rates and conditions.

This automation saves you time, reduces errors, and ensures that tax is applied correctly for each transaction, simplifying tax management and financial reporting.

The taxes related to the Singapore accounting localization will be pre-loaded in the Accounting Module when it is installed.

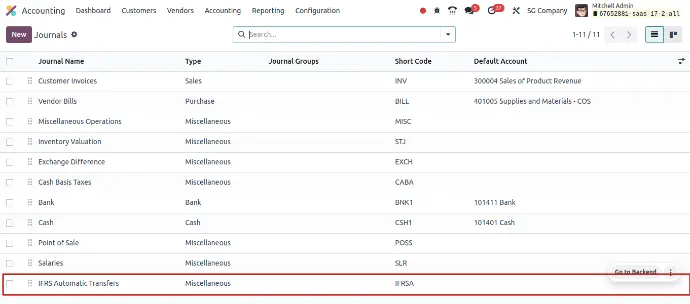

Journals

Journals are used to record all financial transactions and serve as the foundation for your accounting system, resulting in an ordered record of all financial activity. Journals in Singapore localization mostly include all of the core journals as well as IFRS Automatic Transfers.

Automatic transfers for IFRS-related transactions must include compliant journal entries to ensure correct accounting in compliance with IFRS.This may entail employing specialized accounts required by the applicable IFRS standard.

Invoices

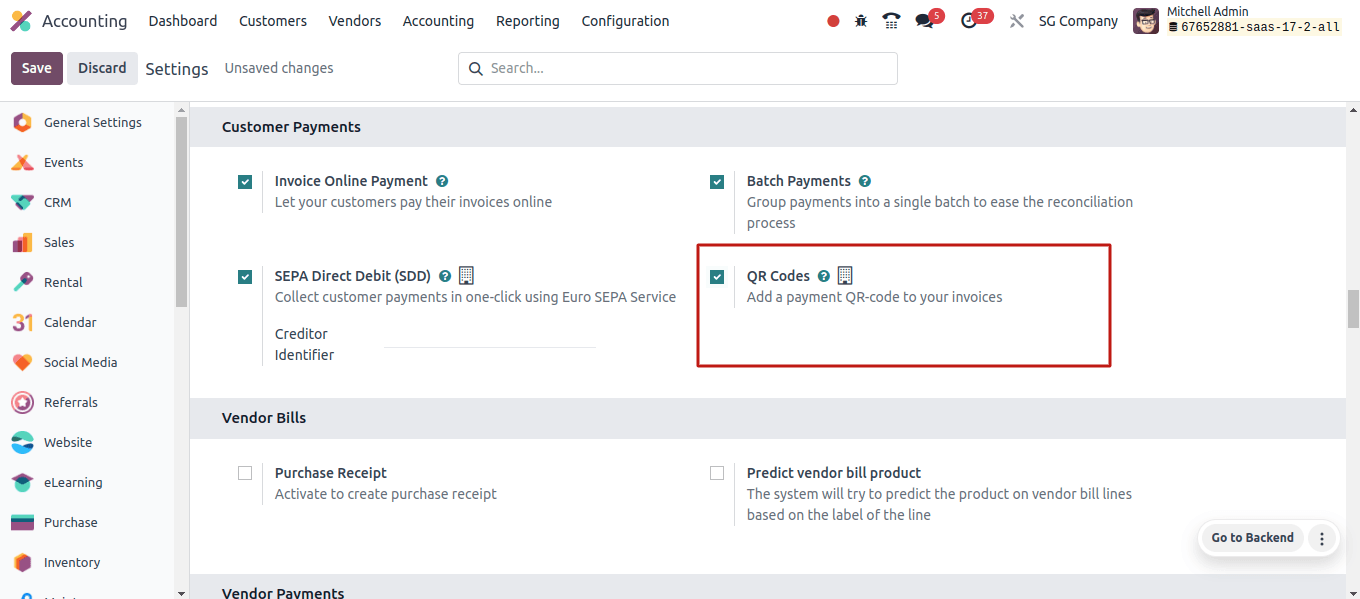

With Singapore localization, we can include Pay Now QR codes on invoices. PayNow is a payment service platform that allows customers to make immediate domestic payments in Singapore dollars to individuals and businesses using internet and mobile banking.

To accomplish this, we must first activate the QR code capability. To do so, go to Accounting > Configuration > Settings, and then enable the QR codes option under Customer Payments.

By selecting the option, we will be able to add QR codes to invoices, allowing clients to make payments online and via mobile banking. To use the QR code feature, we must first configure our account.

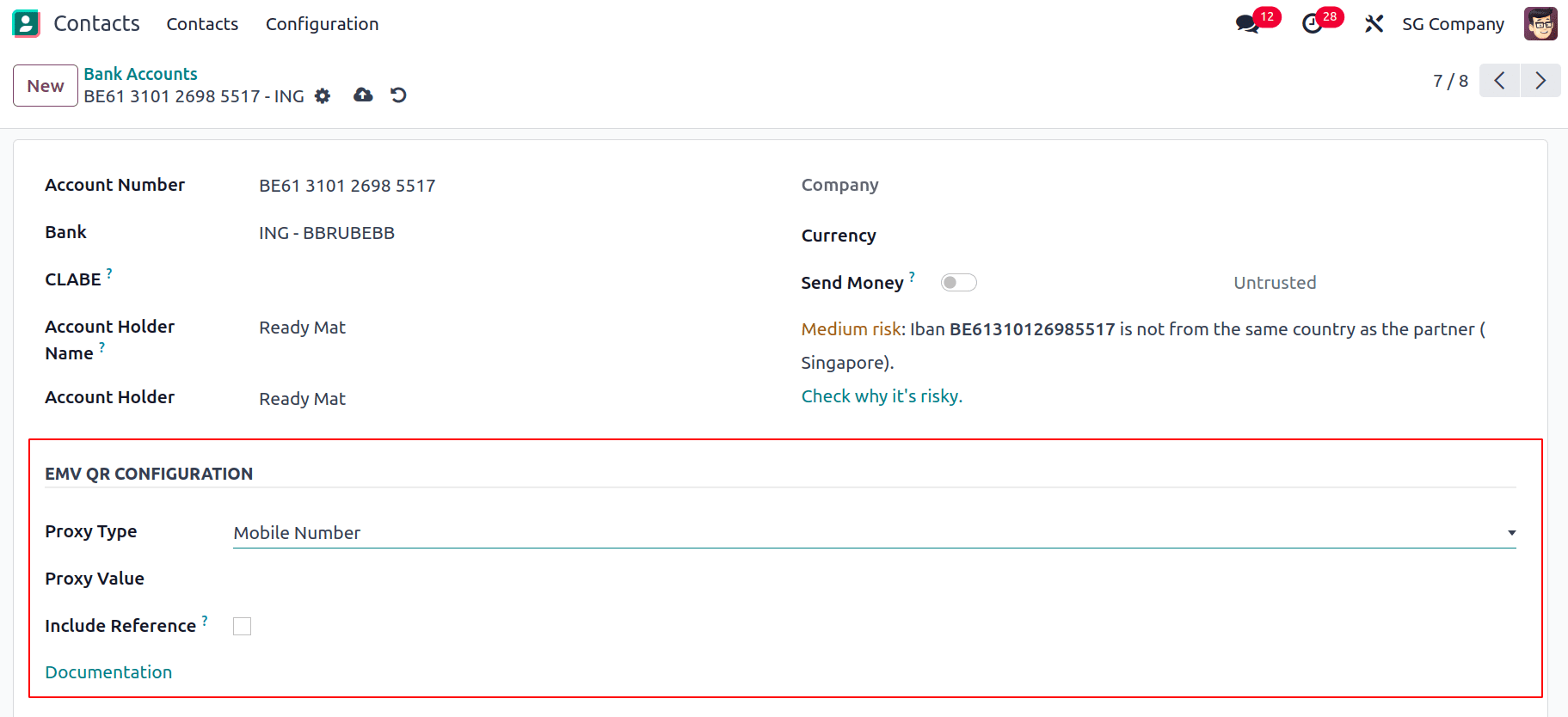

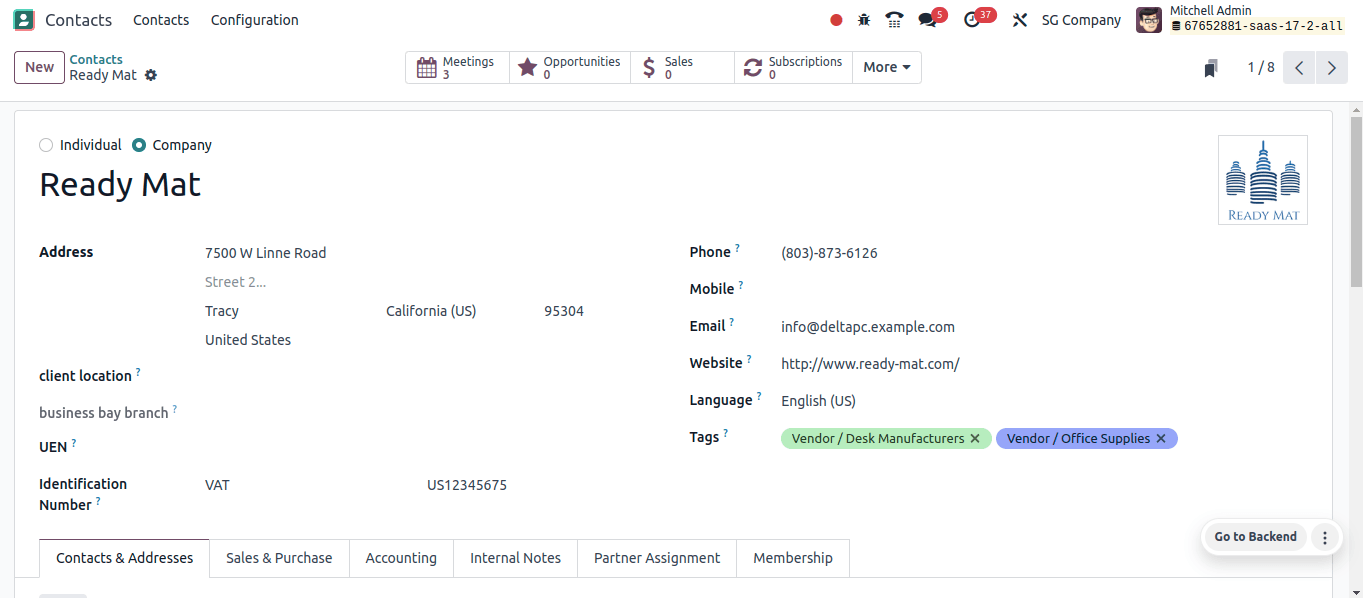

For that, go to Contacts > Configuration > Bank Accounts. Choose the bank account for which we want to enable PayNow, then define the Proxy Type and Proxy Value.

The add Reference checkbox can be used to add the invoice number in the QR code. To configure the Proxy Type and Proxy Value for the bank account, the account holder's Country must be set to Singapore on the contact form.

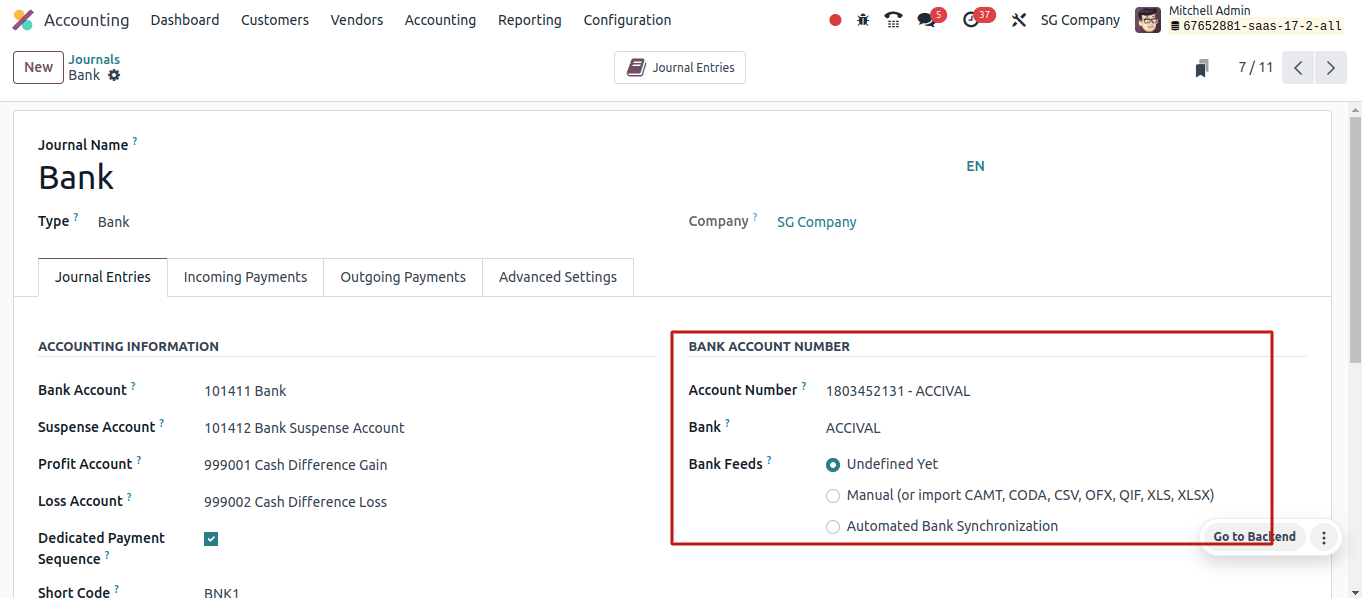

Then we must enter the account number and bank in the Bank Journal. Navigate to Accounting > Configuration > Journals and pick Bank Journal; from there, we may add these facts.

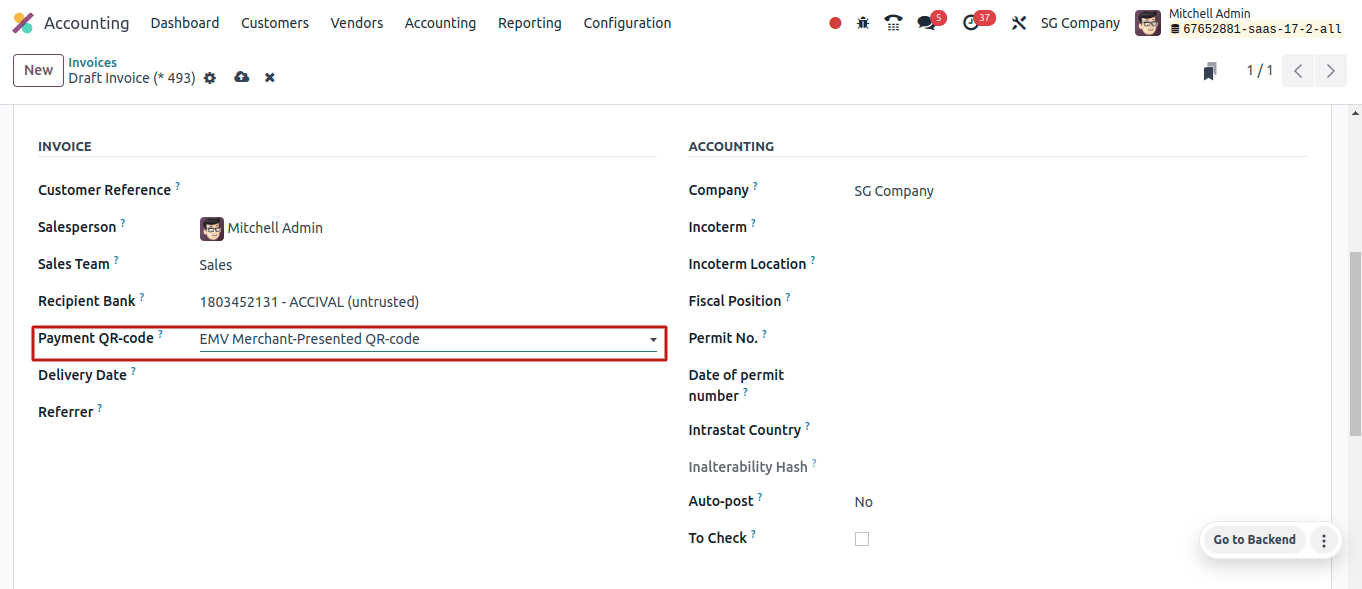

Then we may enter the Payment QR code in the invoice's other information tab.

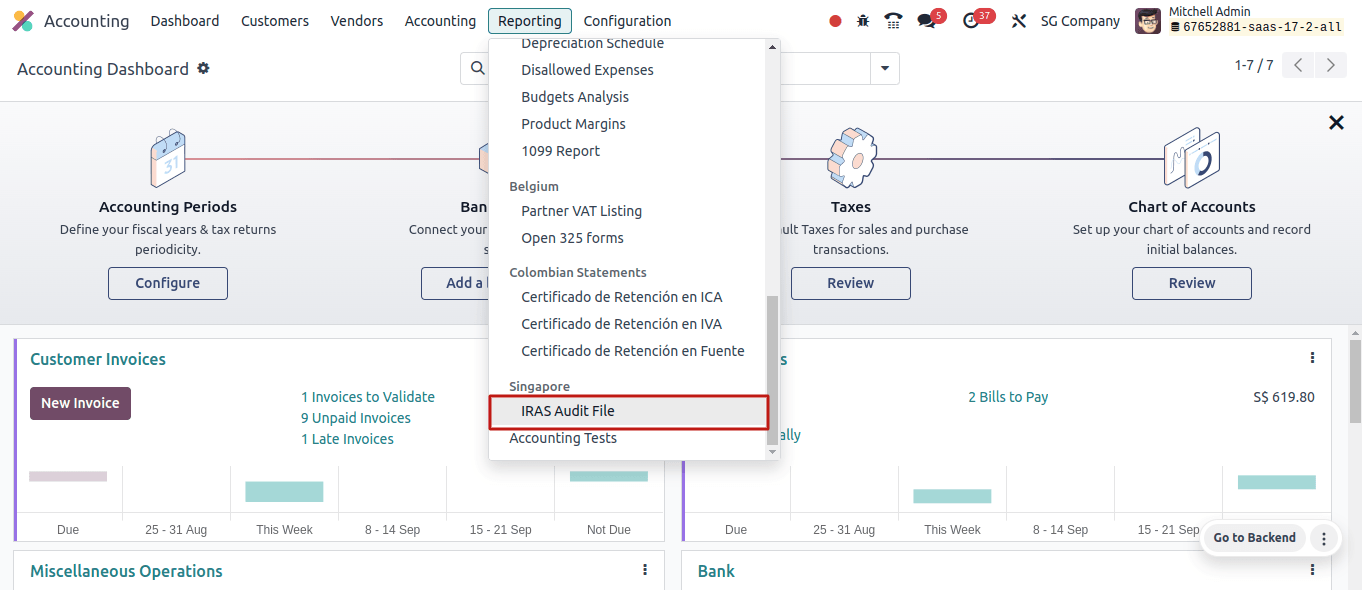

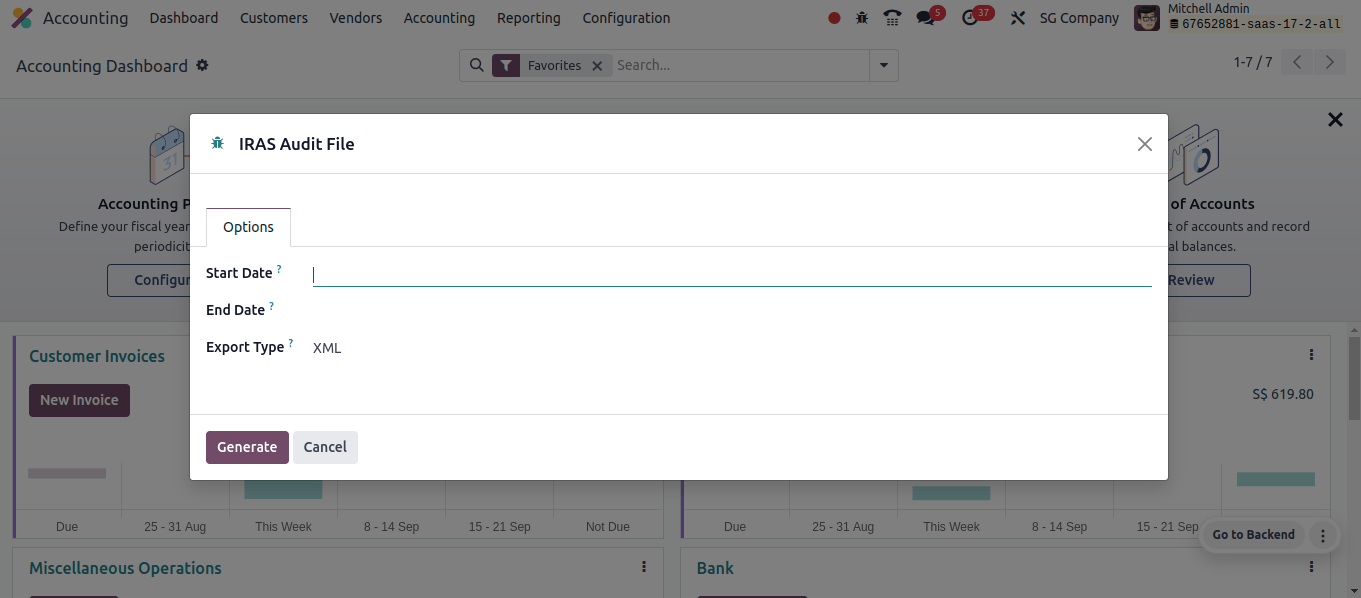

IRAS Audit File

The IRAS Audit File (IAF) is a structured file format used by Singaporean enterprises to submit precise financial data during audits undertaken by the Inland Revenue Authority of Singapore (IRAS).

This file format is specifically designed to make the auditing process easier by providing auditors with consistent access to extensive and accurate financial information.

We must specify the start and end dates, as well as the export type.

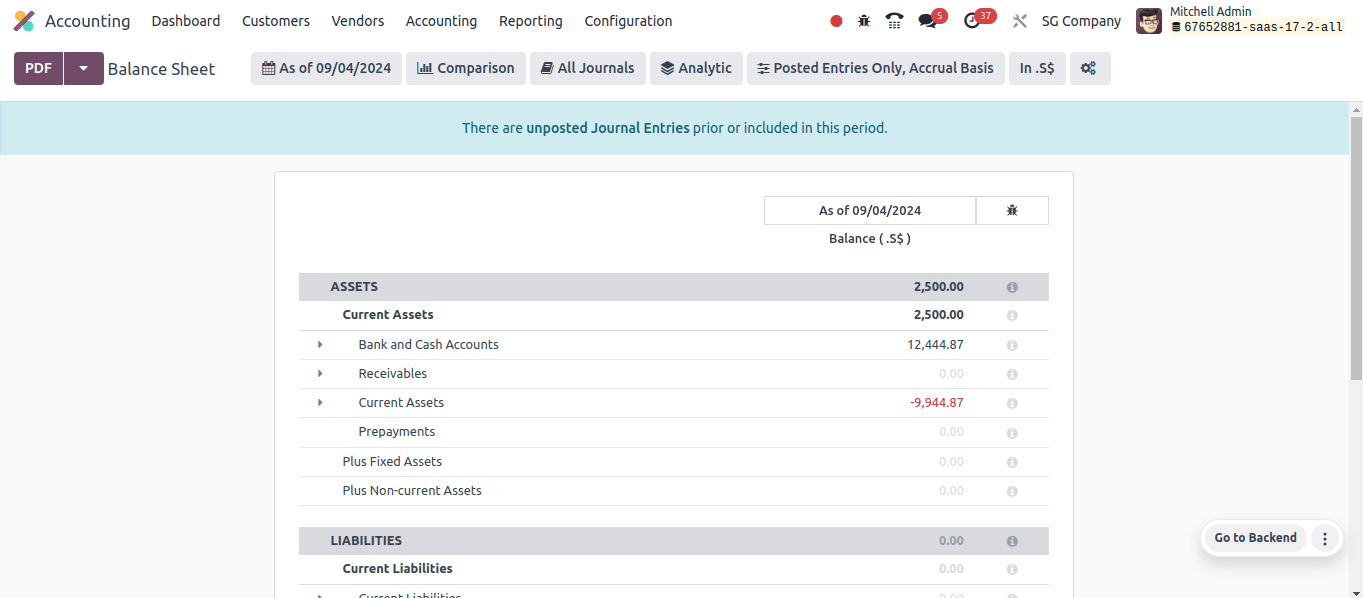

Balance Sheet

A balance sheet in Odoo accounting is a summary of a company's assets, liabilities, and equity at a given point in time. With the implementation of Singapore Accounting localization, the balance sheet reflects the company's assets, liabilities, and equity at the time.

Assets are resources that a firm owns that are commercially valuable and are expected to generate future advantages. Assets, a key concept in financial accounting, are frequently grouped according to their type and purpose within the firm.

In the assets section, we can see bank and cash accounts, receivables, current assets, and so on, along with their values. Financial commitments or debts due by a company to third parties are known as liabilities.

Liabilities are balance sheet entries that show the amounts owed by the company to lenders, suppliers, creditors, and other entities. Current liabilities and payables can be displayed together with their respective values in the Liabilities section.

Equity refers to the fraction of a company's assets that remain after deducting obligations. Unallocated Earnings, current year unallocated earnings, and other information will be available in the equity.

It is a crucial area of the balance sheet that gives information about the entity's performance and financial status, as well as the shareholders' ownership positions.

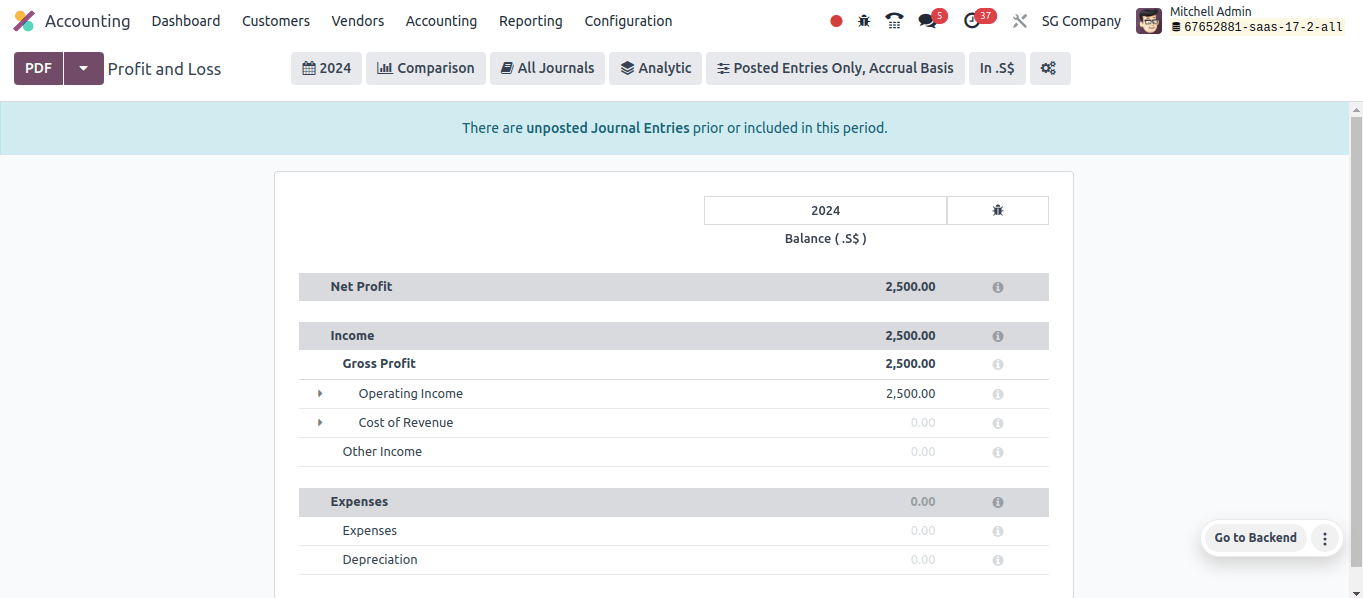

Profit and Loss

In Odoo accounting, the Profit and Loss report summarizes revenues, expenses, and net profit (or loss) for a certain time period. The profit and loss report shows the company's net profit, income, and expenses.

Under income, we can see Gross Profit, Operating Income, Cost of Revenue, and Other Income. We'll also see Expenses and Depreciation in the Expenses section.

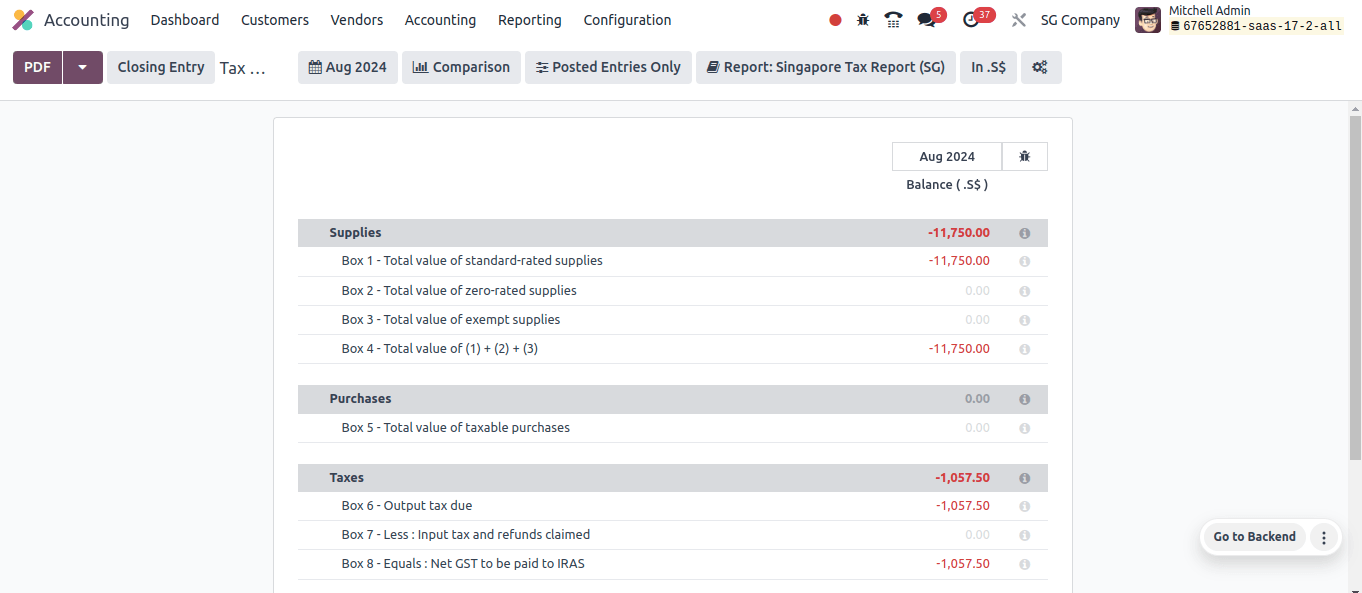

Tax Report

In Odoo accounting with Singapore localization, the tax report is critical since it summarizes significant financial data required for Singaporean tax compliance. It enables firms to precisely compute GST earned from sales, GST paid on purchases, and other tax liabilities.

This report assists companies in complying with Singapore’s tax requirements while also providing important information for financial planning, budgeting, and decision-making.

It also provides a credible record for audits, encouraging transparency and accuracy in financial reporting while protecting businesses from potential fines for improper tax filings.

In this blog, we discussed the Singapore Accounting Localization in Odoo 17. Adopting Singapore accounting localization practices, such as using the IRAS Audit File (IAF), is critical for organizations in the region.

These approaches not only simplify financial reporting processes, but they also improve compliance with local regulatory requirements. Adopting these standards allows organizations to effectively handle audits, reduce administrative complications, and build a more transparent financial climate.

Finally, integrating Singapore accounting localization not only assures legal compliance, but also sets a solid platform for long-term growth and operational efficiency in the competitive Singapore market.