A fiscal period is a 12-month accounting period for a business that includes all transactions and dealings throughout the year. It streamlines tax and financial calculations and is frequently used to process financial statements and meet accounting commitments.

Companies frequently shut ledgers and accounts at year-end, making operations, ERP software, such as the Odoo 17 Accounting module, can help manage fiscal years and set business budgets fast.

The fiscal year, which normally begins on January 1 and ends on December 31, is important for a business to analyze invoices, balance sheets, revenues, and other financial data before issuing statements or closing the year.

This blog will explain the concept and capability of setting fiscal years and periods within the Odoo 17 Accounting Module.

Steps to Configure Fiscal Year in Odoo Accounting

Odoo 17 streamlines corporate administration using fiscal year terminology, making it easy to specify the end of the fiscal year based on the month or year.

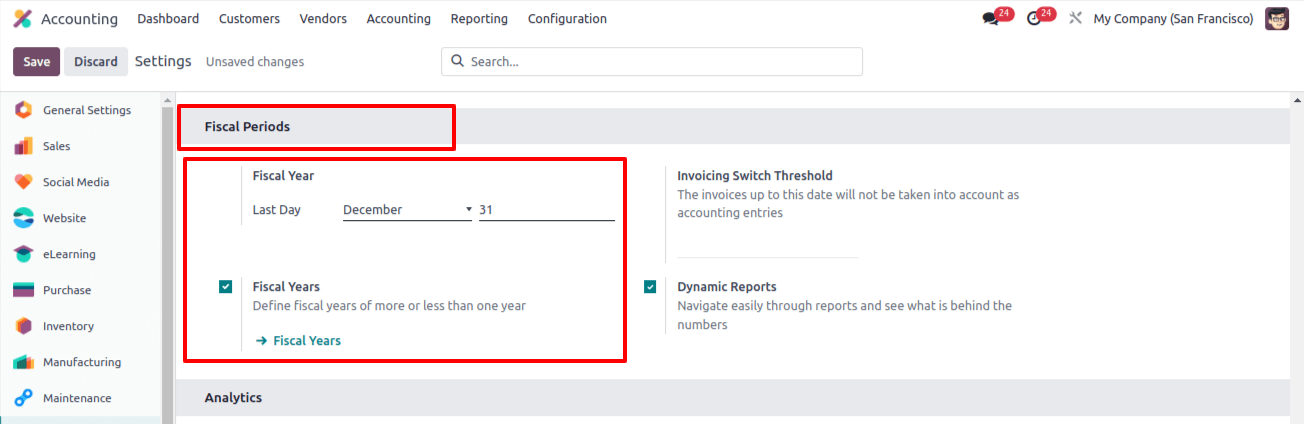

Users can update these dates in the Accounting module. Using the Settings menu in Configuration, users can enable the Fiscal Years field in the Fiscal Periods section.

The Fiscal Years feature allows users to set fiscal years as more or less than a year, and the last day option allows users to specify a fiscal year-end date, which is defaulted to December 31 and can be customized based on workflow. This will enable the Fiscal Year capability, as shown below.

After you’ve saved your changes, you can use the ‘Fiscal Years’ link to create or generate a new fiscal year, or you can go to the configuration tab’s fiscal year menu and choose the ‘New’ button.

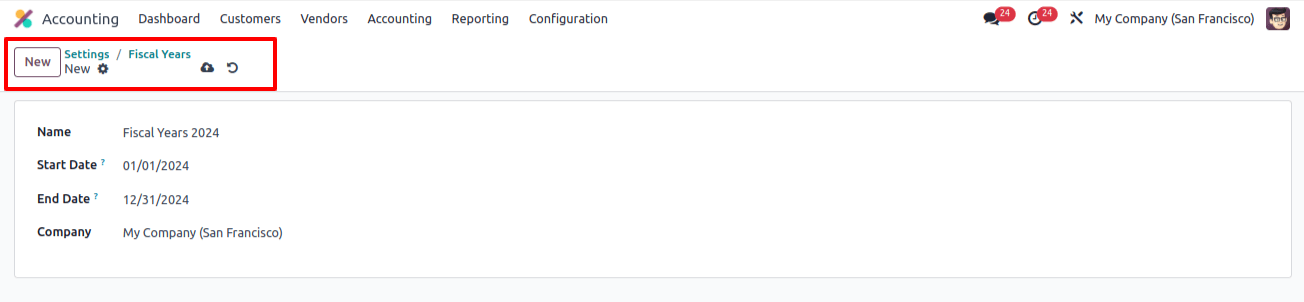

Fill in the fiscal year’s name, start date, end date, and company details as shown below within the fiscal year configuration view.

Here, I've generated a new fiscal year setting for 2023 and specified the start and end dates. Then, save the details by clicking the save button, and utilize the action menu to remove or duplicate the relevant record.

Finally, the data from your new fiscal year will remain in your Odoo Accounting database and be accessible through the 'Fiscal Years' dashboard for further activities.

Closing Fiscal Years

Users must authenticate revenues, validate vendor bills, and verify customer invoices to complete a fiscal year.

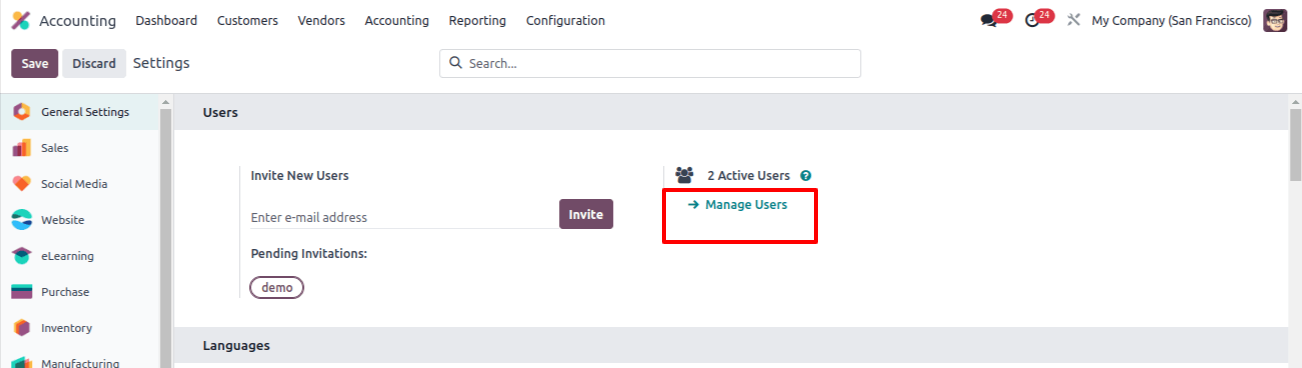

To achieve this, go to the Odoo 17 Settings Application, select 'General Settings,' and then click 'Manage Users' to modify rights. This ensures effective user administration.

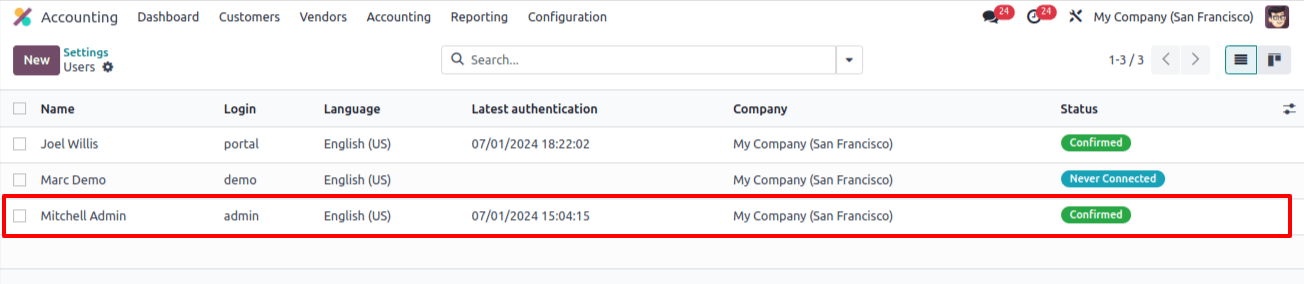

The user dashboard is accessible via the ‘Manage users’ dashboard, as seen below.

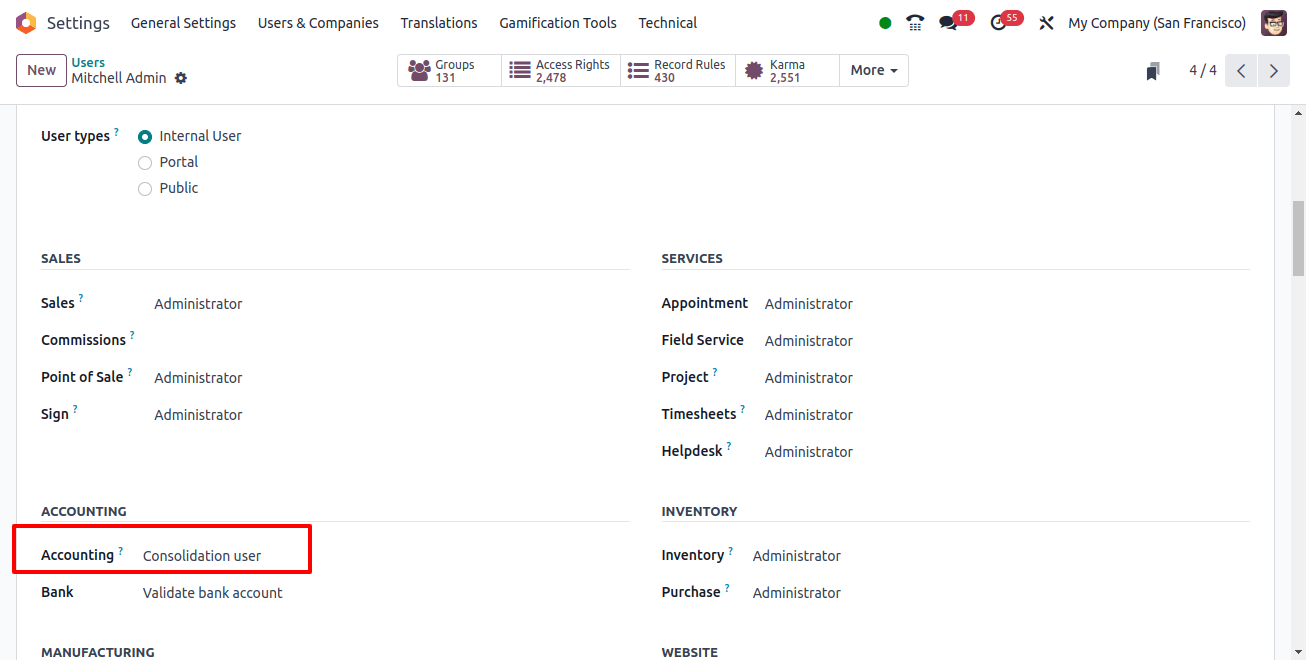

Get the user configuration form open. The 'ACCOUNTING' column appears on the 'Access Rights' tab of the Users window. As illustrated below, select the 'Consolidation user' from the Users window's 'Accounting' box.

Setting Fiscal Year Lock Dates

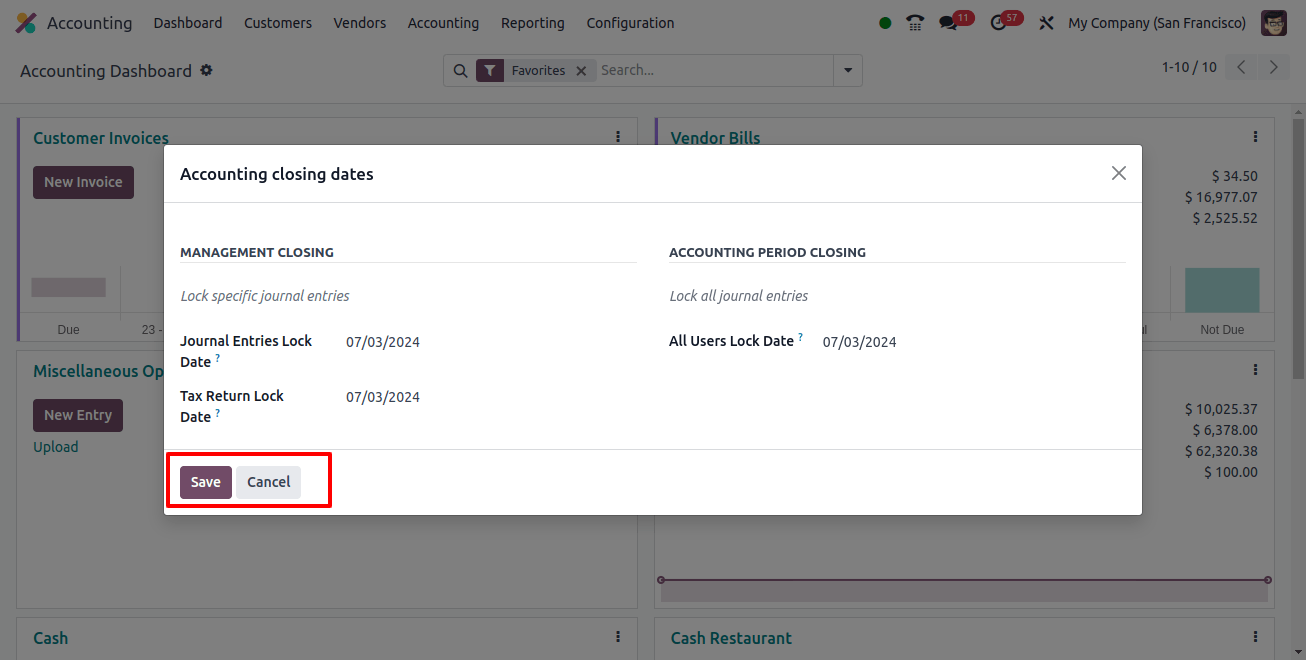

After customizing the user preferences, select the 'Lock Dates' option from the 'Actions' section of the 'Accounting' menu to finish the fiscal year.

This opens a window containing the MANAGEMENT CLOSING section. The journal entry lock date should be entered into the "Journal Entries Lock Date" column, as shown in the screenshot.

You can also provide a 'Tax Return Lock Date' and an 'All Users Lock Date' in the Accounting closure dates setup form. Save the dates by clicking the 'Save' button.

Balance Sheet Reports

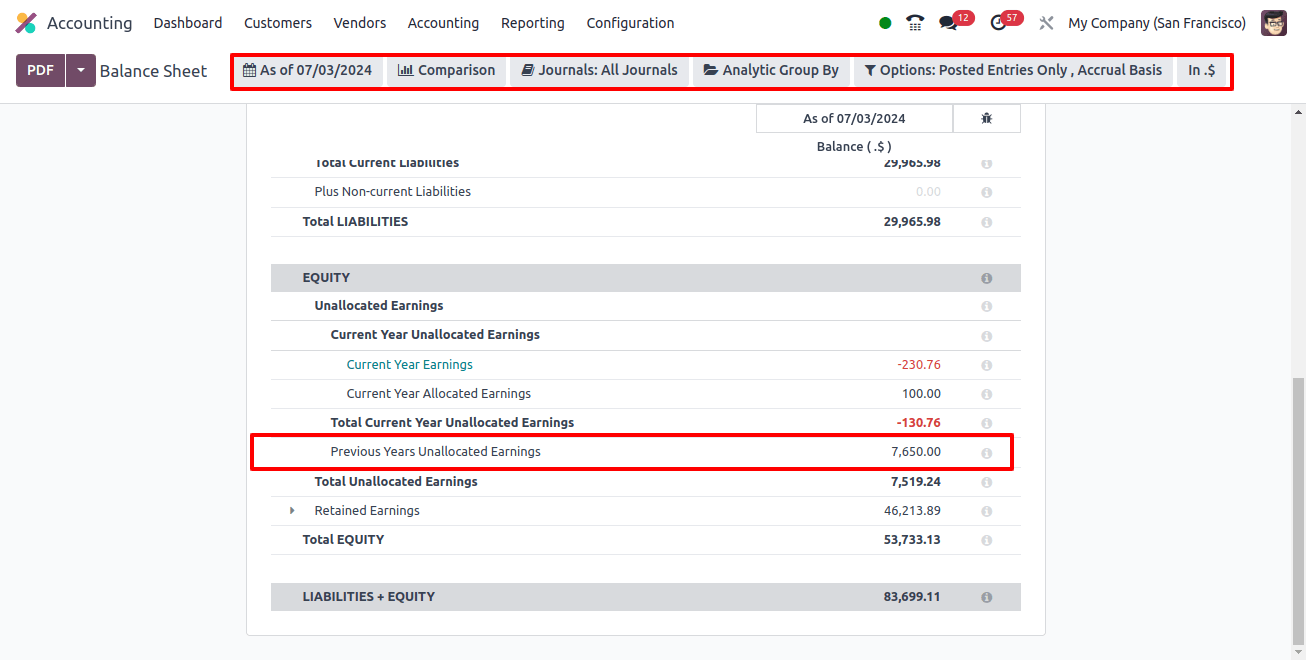

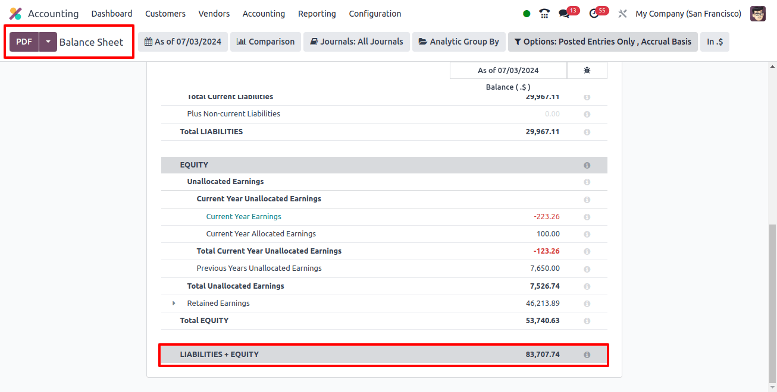

Users can use the 'Balance Sheet' option in the 'Reports' tab and filter by the projected fiscal year date, as shown in the image, to seek unallocated earnings before the fiscal year ends.

Unallocated earnings are reported in the EQUITY column of the balance sheet. Before the fiscal year ends, these earnings must be deducted or distributed.

Journal Entries

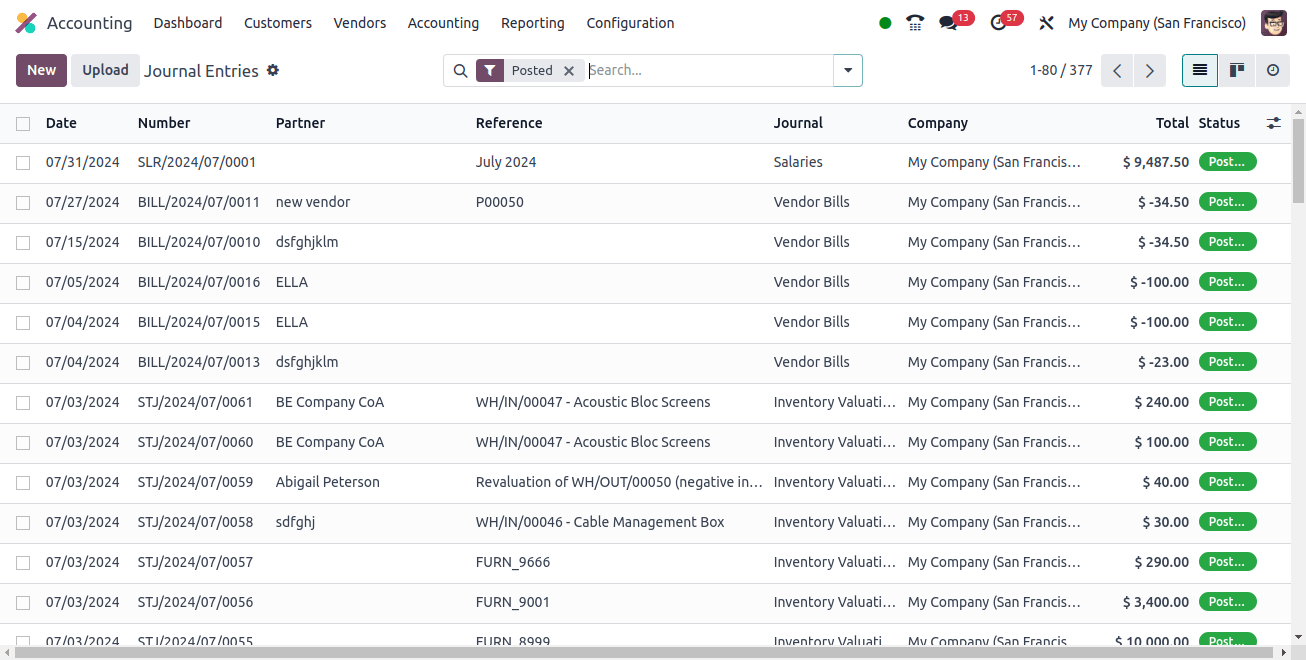

To create a new journal and distribute profits, go to the 'Accounting' tab and select the 'Journal Entries' option. As seen in the image below, you can view an index of all journal entries, including their date, number, partner, reference, journal, company, total, and status.

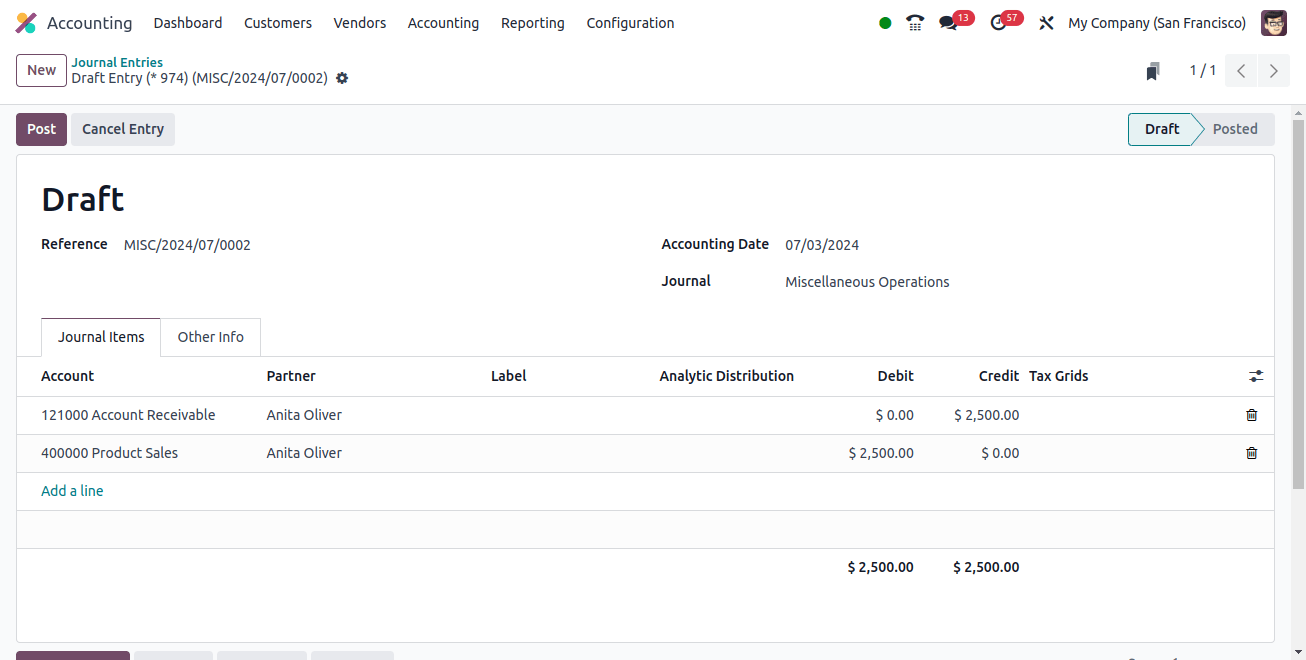

To create a new one, simply click the 'New' button. Enter the journal entry as a reference name in the 'Reference' section.

In the 'Journal' field, select Miscellaneous Operations, and in the 'Accounting Date' field, change the accounting date to the end of the fiscal year.

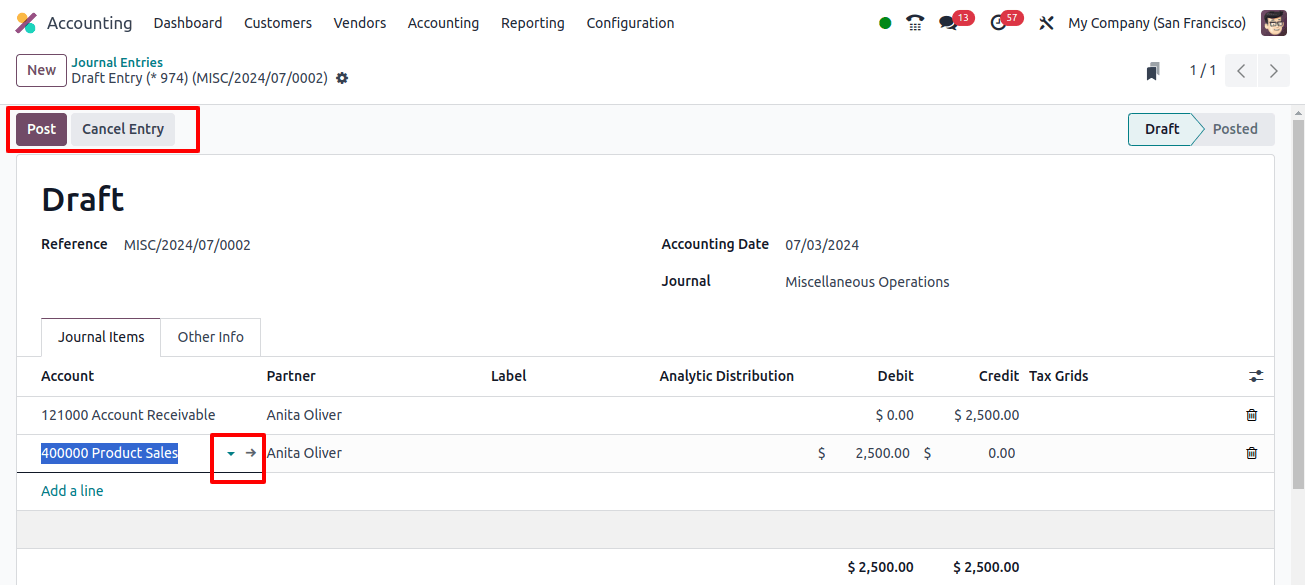

To add Account, Partner, Label, Debit, Credit, and Tax Grid data to the Journal Items tab, select the "Add a Line" button. As shown in the figure, credit $2500 from the Account Receivable Account to offset unallocated earnings and debit the Product Sales Account.

Related Post: How To Analyze Invoices & Product Margins in Odoo 17 Accounting

Clicking on the interlink in the "Add a Line" field.

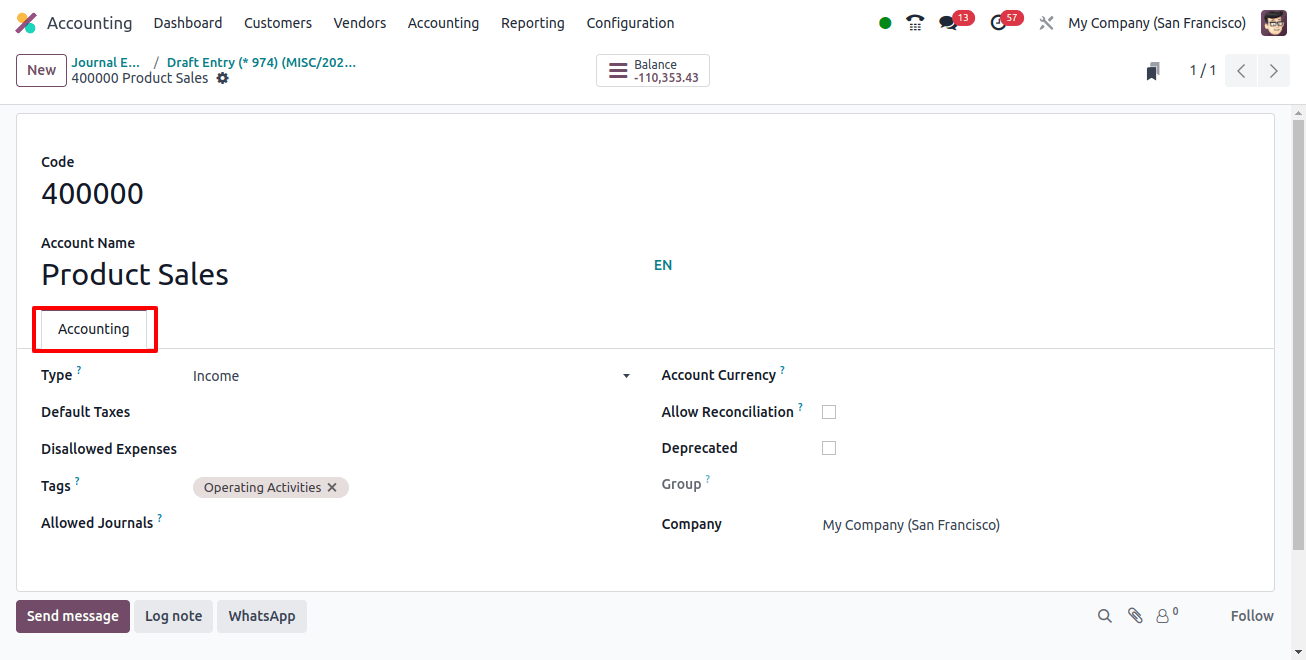

In the new form window, enter the report 'Code' from the Create Account window, as well as the 'Account Name' you want to offset an account against retained earnings.

This account type is used for two purposes: setting fiscal year guidelines and providing national-focused legal reports. Next, select an accounting type in the 'Type' section. By selecting "Equity," users can open an equity account.

You can also configure the Default Taxes, Disallowed Expenses, Tags, Allowed Journals, Account Currency, Allow Reconciliation, and Deprecated settings.

Following the storage of account information, the new account details show a credit line for the same amount. When you click the ‘post’ button, the journal entry is published with all of its details maintained.

Balance Sheet Reporting

Go to the 'Reports' page and select your balance statement. Your company's balance sheet shows its assets, liabilities, and equity as of a specific date.

The profit and loss statement is created in real-time to verify that the commencement date corresponds to the beginning of the fiscal year.

While all account balances should be zero at the time of production, a specific year-end closure entry is unnecessary.

These are the features of the Odoo 17 Accounting Module’s Fiscal Year and Fiscal Periods, as well as how to set dates.