In New Zealand, effective financial accounting management requires following regional accounting standards. Odoo’s accounting localization for New Zealand is specifically designed to achieve these goals by integrating features relevant to the country’s financial procedures.

This localization ensures compliance with New Zealand accounting standards, financial reporting requirements, and tax legislation. Odoo helps New Zealand-based businesses manage their accounting tasks more effectively while following area rules by integrating features like GST administration, precise tax reporting, and enhanced financial reporting.

This specialized method boasts operational effectiveness while streamlining compliance, giving businesses a solid platform for managing their financial operations in New Zealand.

Accounting Localization for New Zealand in Odoo 17

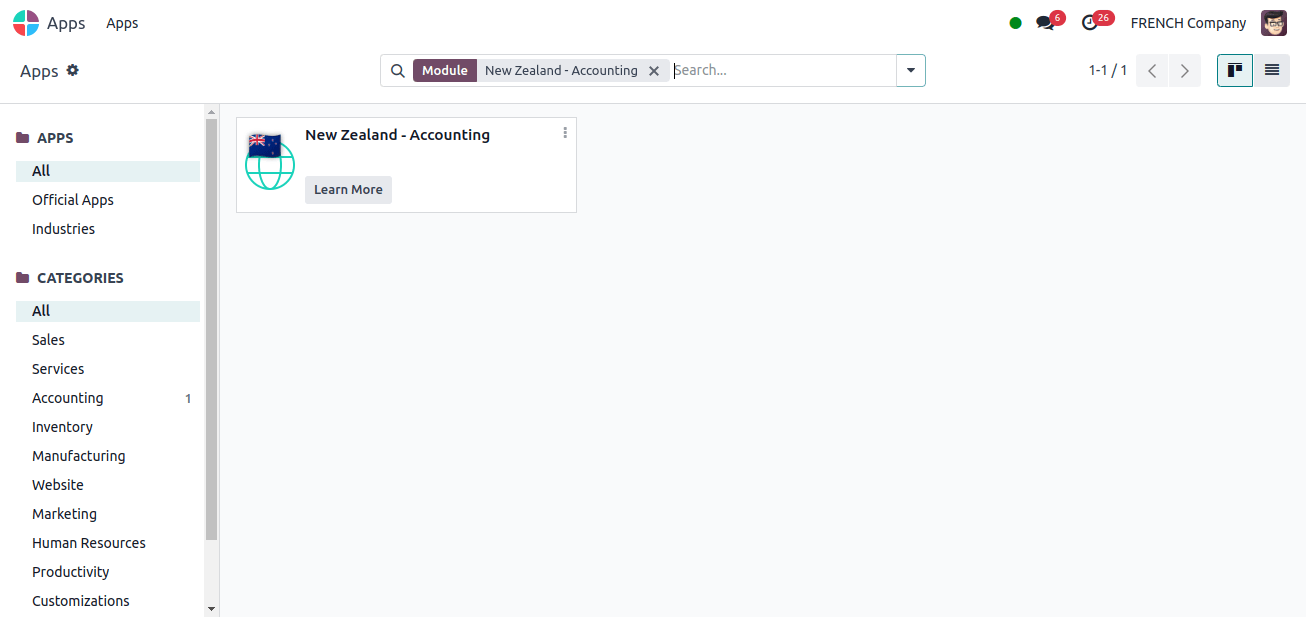

First, we must install the New Zealand Accounting localization system. To do so, browse to Apps and install the modules.

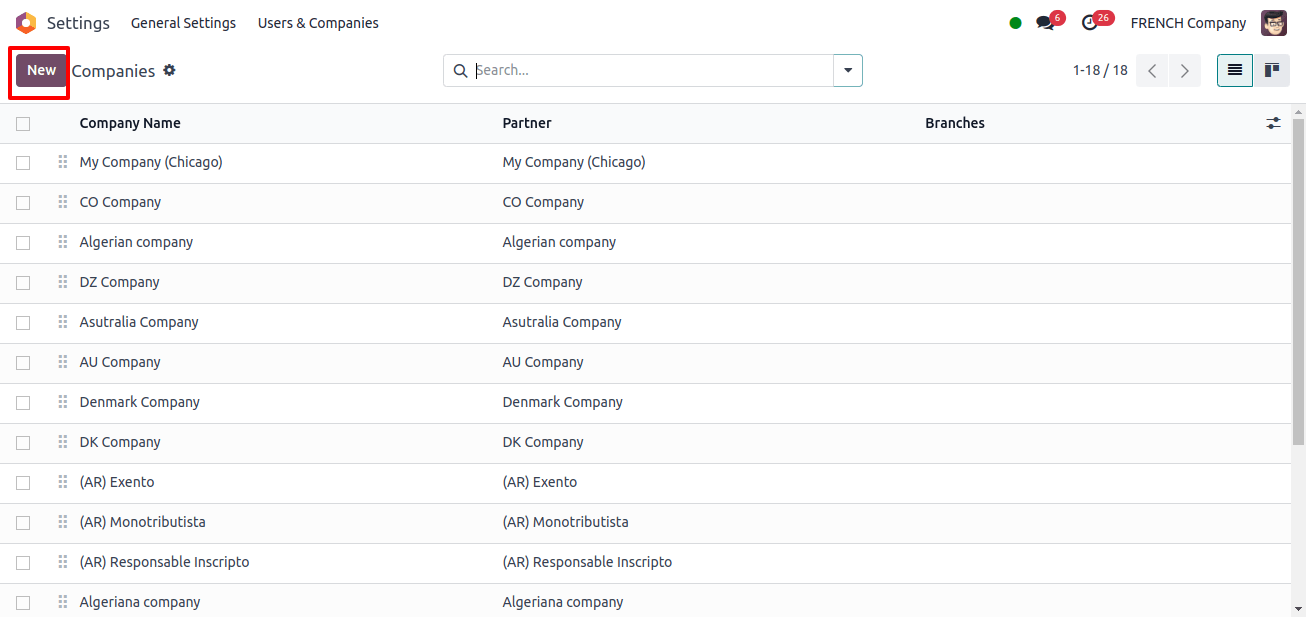

Then we must verify that the company setup is right, or we may start a new company with the correct information by clicking on the New button. Go to Settings > Users and Companies > Companies to get a list of all the companies that have already been configured.

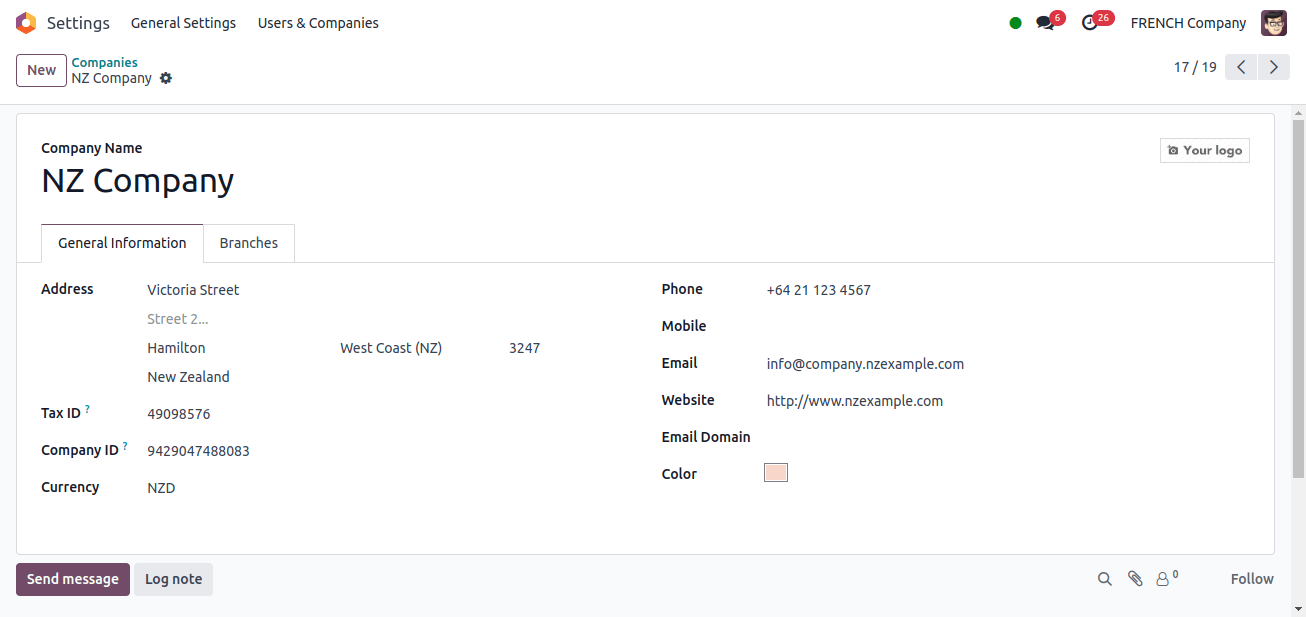

Select the company for which we want to check the company configuration, such as the Tax ID, Company ID, and Address, and ensure that it is properly configured.

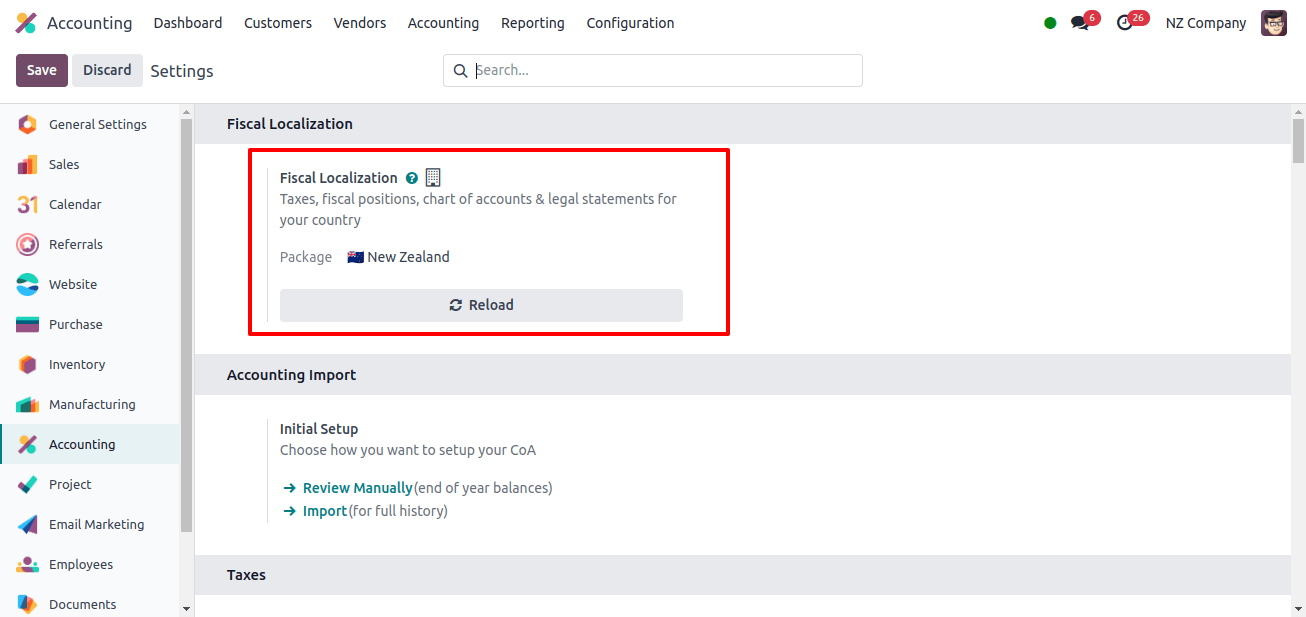

After installing the localization, the Fiscal Localization will be set to New Zealand in the Accounting module’s configuration settings.

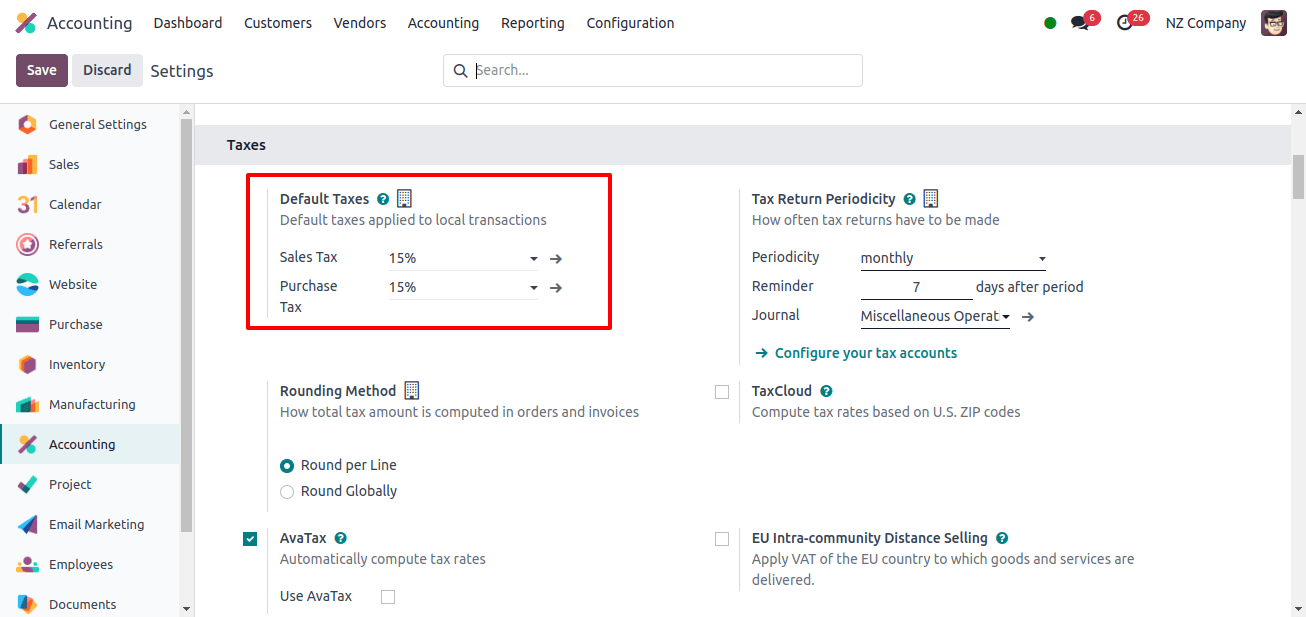

We can now analyze the default taxes and the standard currency for this translation. Default Taxes are predefined tax settings that, in compliance with applicable tax regulations, apply to transactions automatically.

These default taxes simplify accounting because the right tax rates are applied to invoices and purchase orders on a regular basis.

The default taxes include the Sales Tax and the Purchase Tax. Sales taxes are taxes levied on the sale of goods and services, and they are calculated and recorded throughout the invoicing process.

Here, they are set to 15%. Purchase taxes are taxes levied on the receipt of goods and services, which are recorded throughout the purchasing process and are set at 15%.

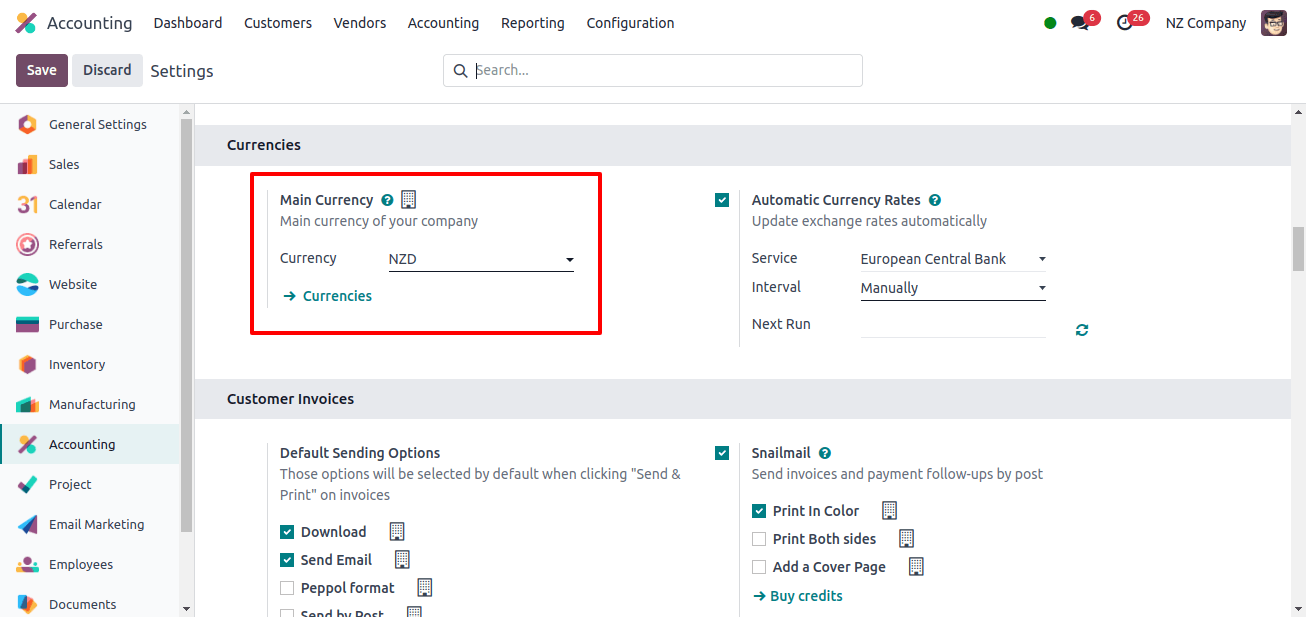

The Main Currency for this localization is set to the New Zealand dollar (NZD), the country’s national currency.

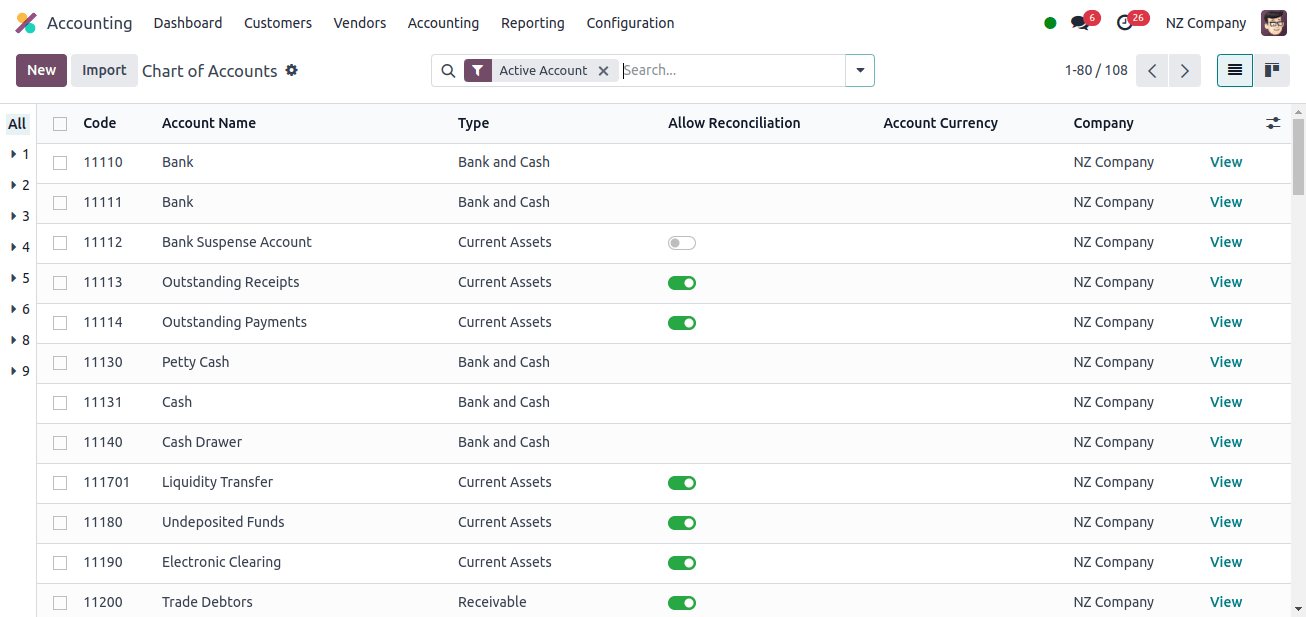

Chart of Accounts

In Odoo, the Chart of Accounts provides a structured framework for categorizing and organizing financial activities. It provides a complete inventory of all accounts used in the accounting system, such as revenue, expenses, equity, liabilities, and assets.

Each account is assigned a unique code and description, making it easy to precisely track and report financial transactions.

Odoo offers efficient financial administration and compliance with accounting standards by modifying the Chart of Accounts to meet specific business requirements, assisting businesses in maintaining clear and organized financial records.

This localization’s chart of accounts includes the following:

The Less Provision for Doubtful Debts account is used to record allowances for accounts receivable that are projected to become uncollectible. It reflects a decrease in the overall value of receivables, indicating an estimate of future losses owing to client defaults.

Businesses can better manage credit risk and show their financial condition by setting up a provision for questionable debts. This account ensures that financial statements reflect a realistic perspective of expected cash flows and promotes smart budgeting.

The Goods Shipped Not Invoiced account keeps track of the value of goods shipped to customers but for which invoices have yet to be issued. It serves as a temporary holding location, collecting income from shipping products before the formal invoicing process is complete.

Maintaining this account allows businesses to better manage and monitor sales transactions, ensuring that revenue is properly recorded and linked with shipping activity.

Odoo’s Freight Paid account is intended to record expenses linked to the shipping of products. This account tracks expenses related with product shipment, delivery, or managing, and includes them in the company’s operational expenses.

Tracking these charges allows businesses to better manage their logistics cost, analyze the impact on overall profitability, and assure correct financial reporting.

This account helps to retain clear insight over freight expenses and promotes effective cost management inside the financial module.

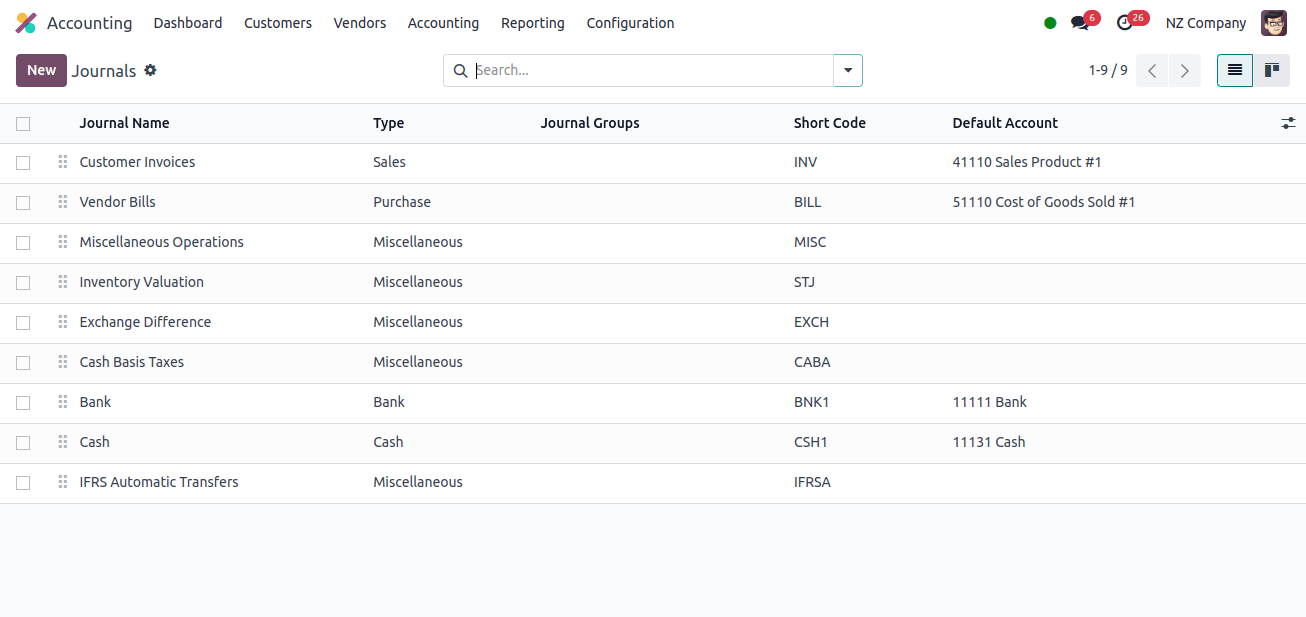

Journals

Journals are key components for recording and managing various forms of financial transactions. They serve as detailed records that register all accounting entries, ensuring that financial transactions are tracked in an organized and precise manner.

Each journal in Odoo relates to a specific type of transaction, such as sales, purchase, bank transactions, and journal entries.

Accounting localization for New Zealand includes all of the fundamental journals required for smooth accounting operations in the country, such as customer invoices, vendor bills, bank, cash, and so on, as well as the Exchange difference Journal, which monitors currency exchange rate fluctuations on foreign currency balances and transactions.

This diary tracks the profits or losses resulting from currency rate variations from the time a transaction is logged until it is settled or revalued.

The IFRS Automatic Transfers Journals in Odoo lets users define rules for when and how balance should be transferred between accounts. It improves operational efficiency by providing the application of IFRS standards to financial data.

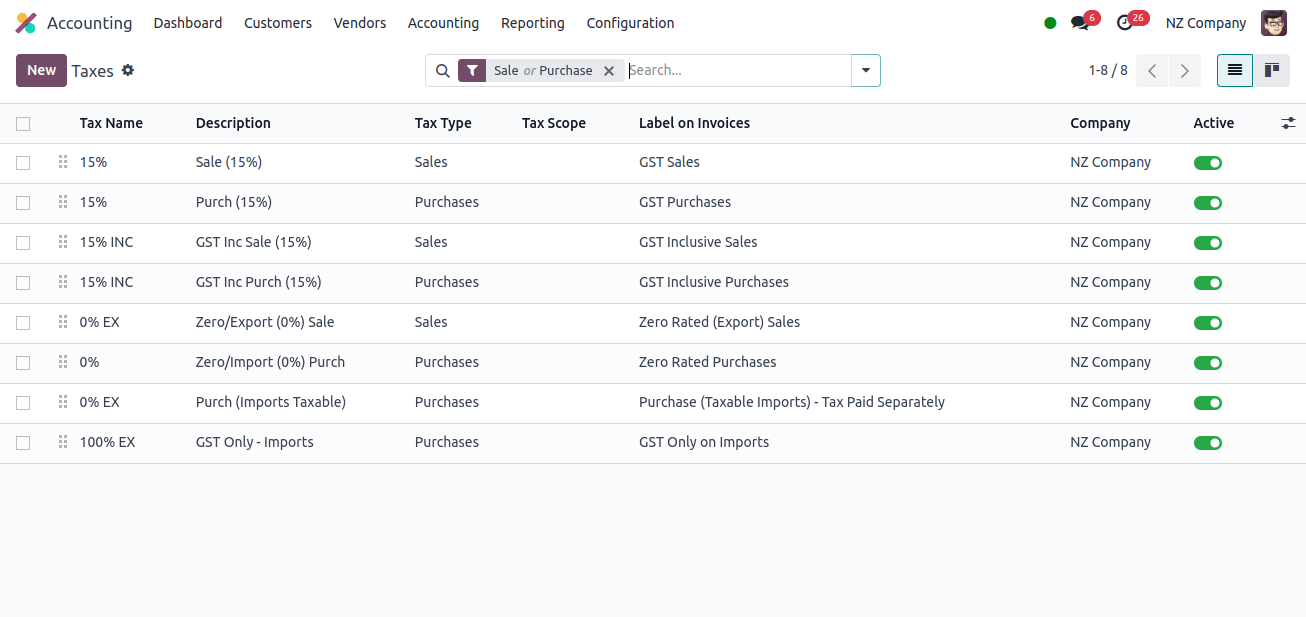

Taxes

Odoo’s New Zealand Accounting Localization includes the following taxes:

1. GST (Goods and Services Tax):

- GST is New Zealand’s primary consumption tax, and it is currently set at 15%.

- Odoo allows businesses to simply create and manage GST settings. This includes setting GST rates for various types of products and services, GST to sales transactions, and ensuring that GST amounts are correctly calculated on invoices and purchases.

2. GST Reporting:

- Odoo provides powerful features for creating GST reports that are customized to New Zealand’s needs.

- Businesses can generate GST returns on a regular basis (e.g., monthly, quarterly, or annually) directly from Odoo.

- The reports include details such as total sales, GST collected, GST paid on purchases, and the net GST liability or refund due to the tax authority.

Odoo allows you to customize tax codes and setups to meet your individual business needs and comply with New Zealand tax rules.

Taxes are imposed automatically based on preset tax rules and setups, reducing manual errors and saving time for accounting teams.

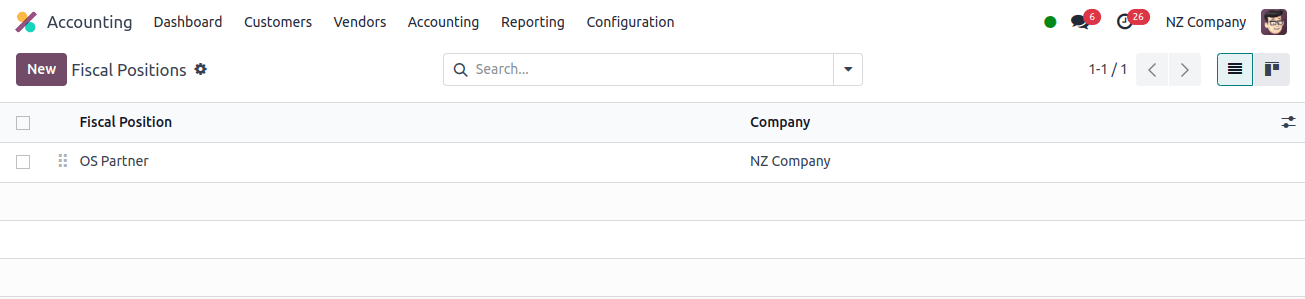

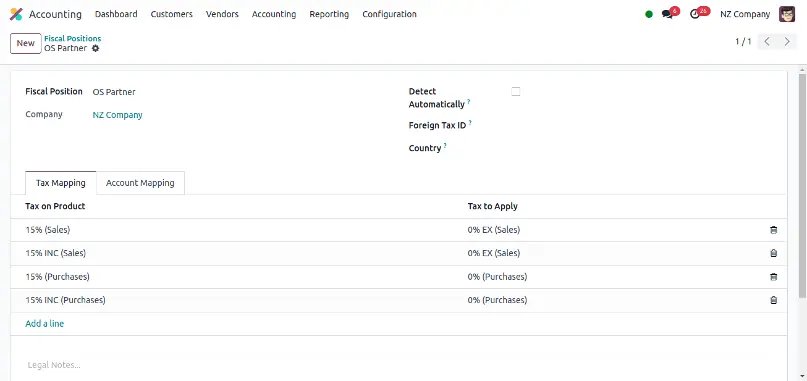

Fiscal Positions

In Odoo, a Fiscal Position defines the relationship between customer or supplier accounts and certain taxes depending on location or other criteria. It allows businesses to apply various tax regulations and accounts automatically depending on defined standards.

Fiscal Positions allows businesses to assign various tax rules and rates to specific customers or suppliers. Fiscal Positions in Odoo’s New Zealand accounting localization offers businesses an organized approach to tax management based on customer or supplier profiles.

Odoo helps with correct financial reporting and agreements while increasing tax administration efficiency by automating tax computations and ensuring regulatory compliance.

Partner Fiscal Position is the setup that connects customers or suppliers to preset tax regulations and accounting settings.

It allows businesses to apply alternative tax treatments, such as GST rates or exclusions, depending on the partner’s location, type of business, or other factors.

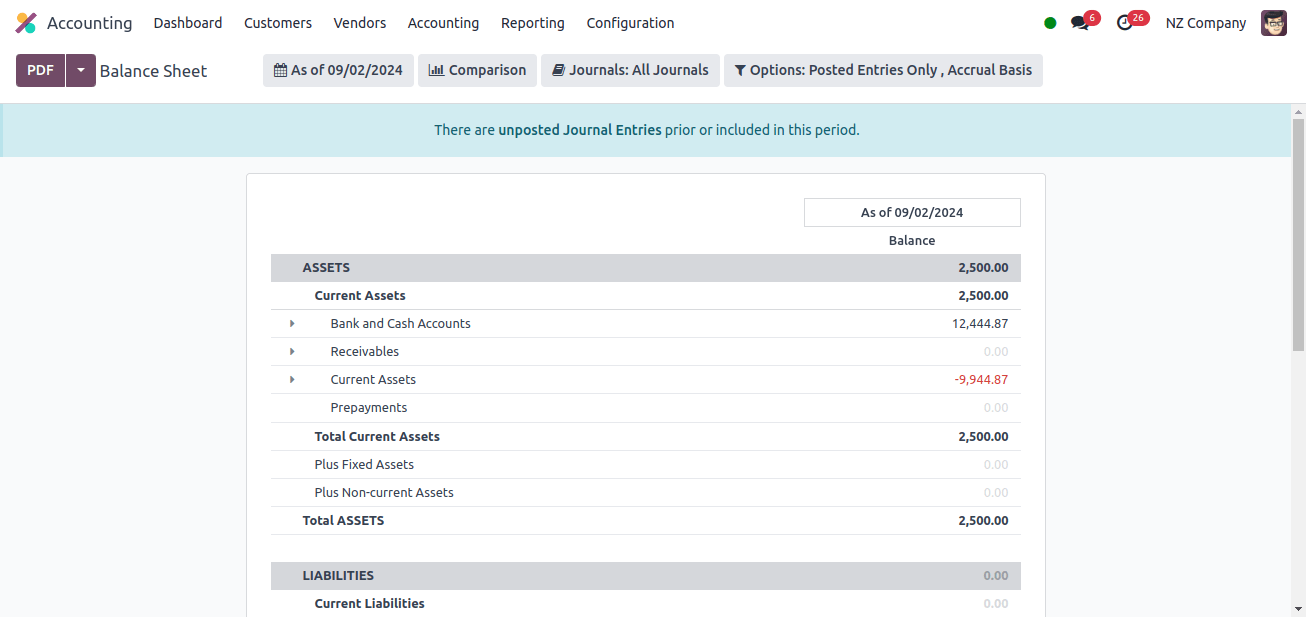

Balance Sheet

The Odoo balance sheet summarizes a company’s assets, liabilities, and equity as of a given date, typically the end of a reporting period (month, quarter, year, and so on).

Assets: This section lists the company’s whole assets base, including cash, inventories, accounts receivable, and fixed assets such as real estate, machinery, and equipment.

Liabilities: These contain all of the business’s debts, such as loans, accounts payable, and accumulated charges.

Equity: Following the deduction of obligations, equity represents the remaining stake in the company’s assets. Retained earnings, common shares, and other aspects such as contributed capital are all included.

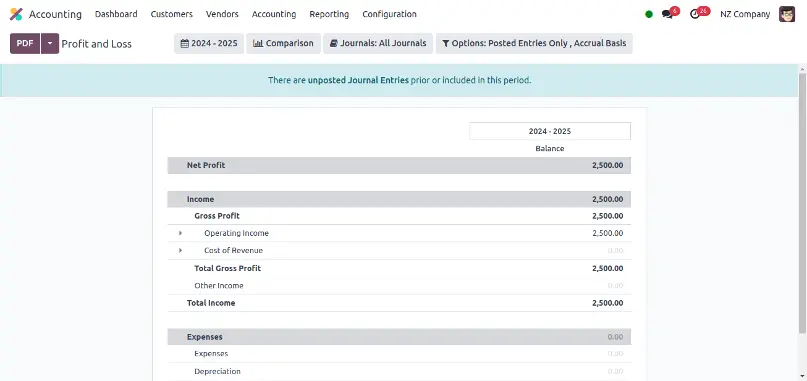

Profit and Loss Report

The Profit and Loss Report summarizes a company’s profits, costs, and net profit or loss during a specific time period, such as a month, quarter, or year.

The major goal of the P&L report in Odoo is to evaluate the profitability of the business activities during the reporting period.

It helps stakeholders understand if the company’s principal business operations generated a profit or a loss.

Odoo’s Profit and Loss report with New Zealand accounting localization is an important tool for organizations to track financial performance, evaluate profitability, and make educated decisions.

The efficiency of financial reporting and analysis is increased by its automatic features, real-time updates, and integration capabilities, which enhance overall business performance.

The report includes Net Profit, Income, and Expenses. Under Income, We can see the Gross Profit, Total Gross Profit, and Total Income. Under the Expenses field, you can view your total expenses.

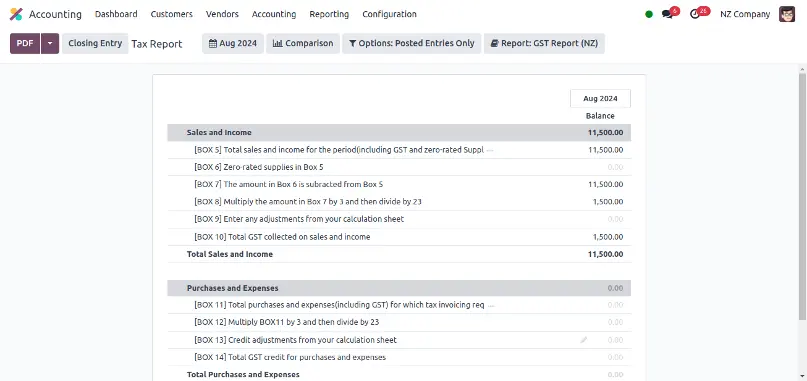

Tax Report

The major goal of the Tax Report is to assist businesses in meeting their tax compliance obligations. It ensures accurate tax calculations and reporting to government authorities by providing a comprehensive picture of all taxable activities.

It compiles and displays extensive information on taxes collected (output tax) and paid (input tax) for a specific reporting period. Its purpose is to promote proper tax reporting and compliance with New Zealand tax standards, particularly GST.

Odoo’s accounting localization for New Zealand includes powerful features and capabilities customized to meet the country’s specific accounting standards and tax legislation.

Some of the primary benefits of this localization include automated GST computation and reporting on transactions, which allows businesses to accurately track and comply with GST requirements.

Generate accurate accrual-based financial statements such as balance sheet and profit and loss reports. Tools for setting tax rules based on partner attributes and locations, allowing for more accurate tax application and reporting.

Businesses that use Odoo’s accounting localization for New Zealand can improve overall efficiency and support long-term growth in the New Zealand market by streamlining their financial operations, enhancing reporting accuracy, and conforming to local accounting standards.