What is Accounting Localization?

Accounting localization is a process to modify any program to comply with the unique tax laws, accounting standards, and regulations of a certain country in Odoo.

For establishing a localization, Odoo offers the Fiscal localization packages. These country-specific modules are put on your database and include pre-configured taxes, fiscal situations, charts of accounts, and legal statements.

Odoo 17's accounting functionality for localization decreases the possibility of errors in your accounting data and ensures that your accounting records comply with local accounting laws.

Also, while setting up Odoo accounting system it saves you time and effort. In this blog, we can explore the accounting localization in the case of Ireland in Odoo 17.

Localization for Ireland in Odoo 17

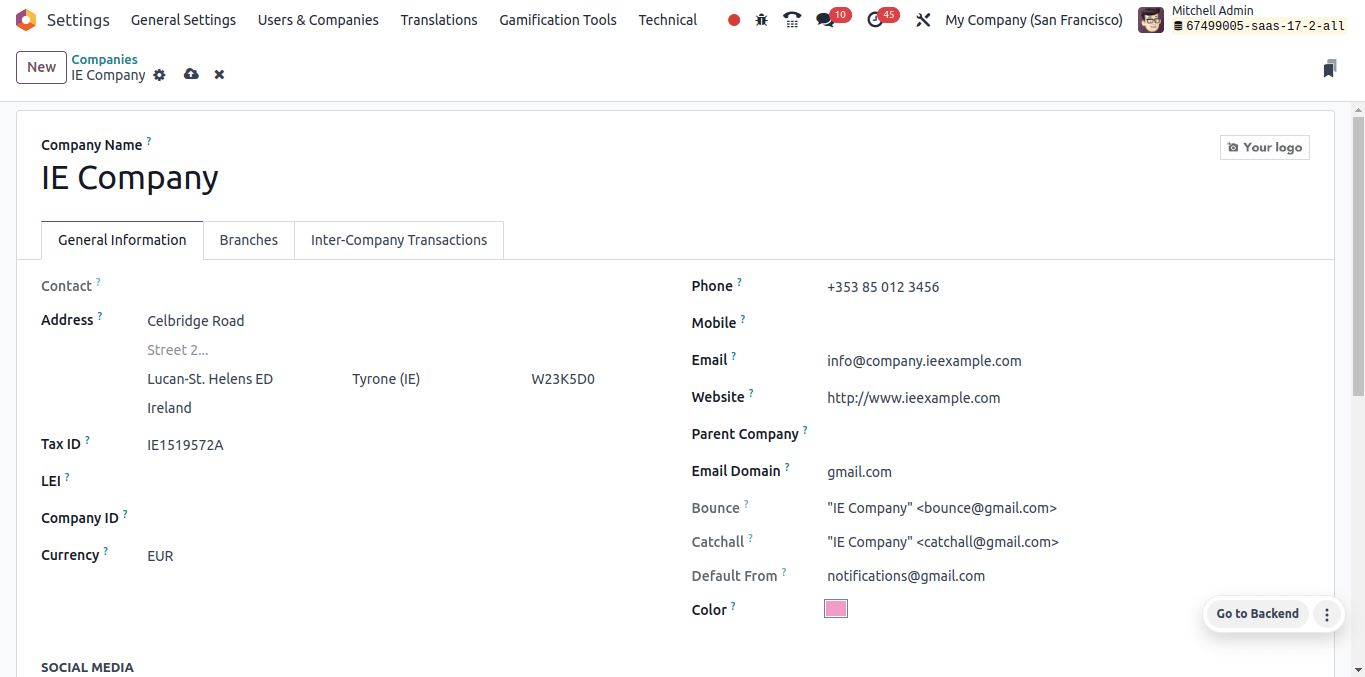

Here, we want to create a new business in Ireland and also require to set up a localization package for that company in Ireland. So the first step is to create a new Ireland-based company.

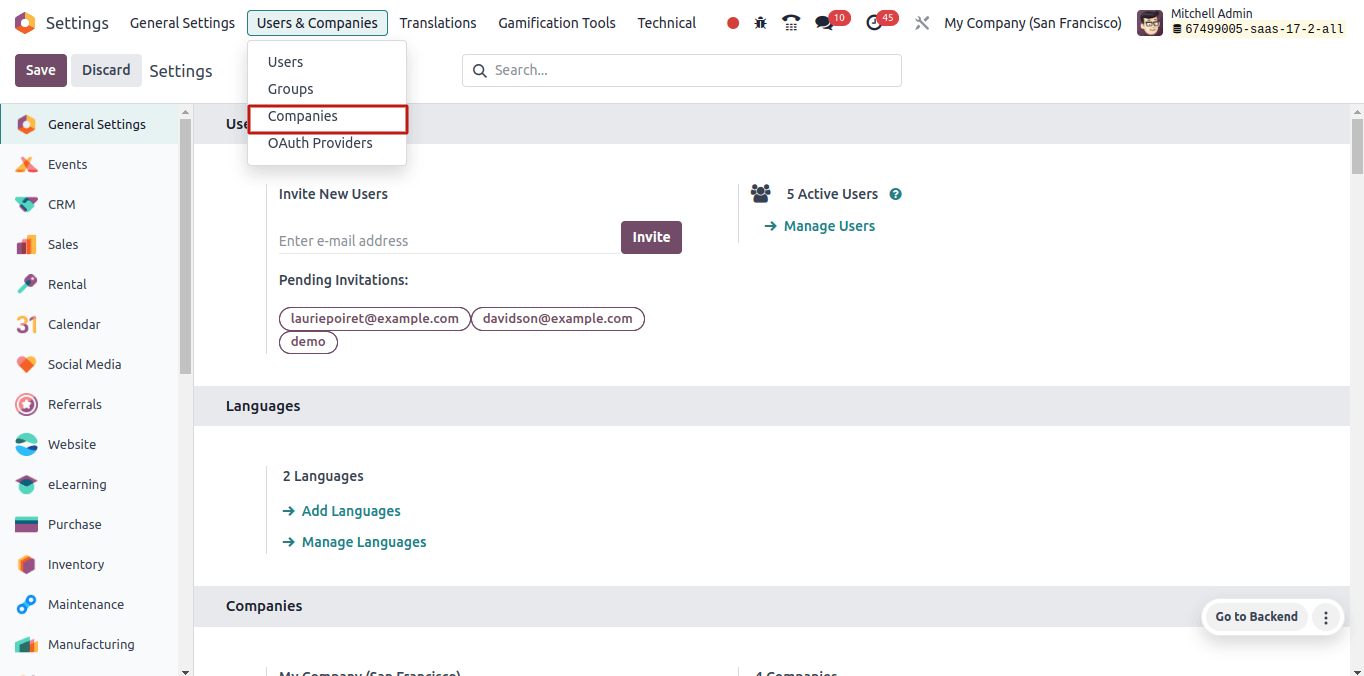

It’s easy to create a new company from Odoo using the General settings of Odoo. We can see the users and companies menu by clicking the General settings.

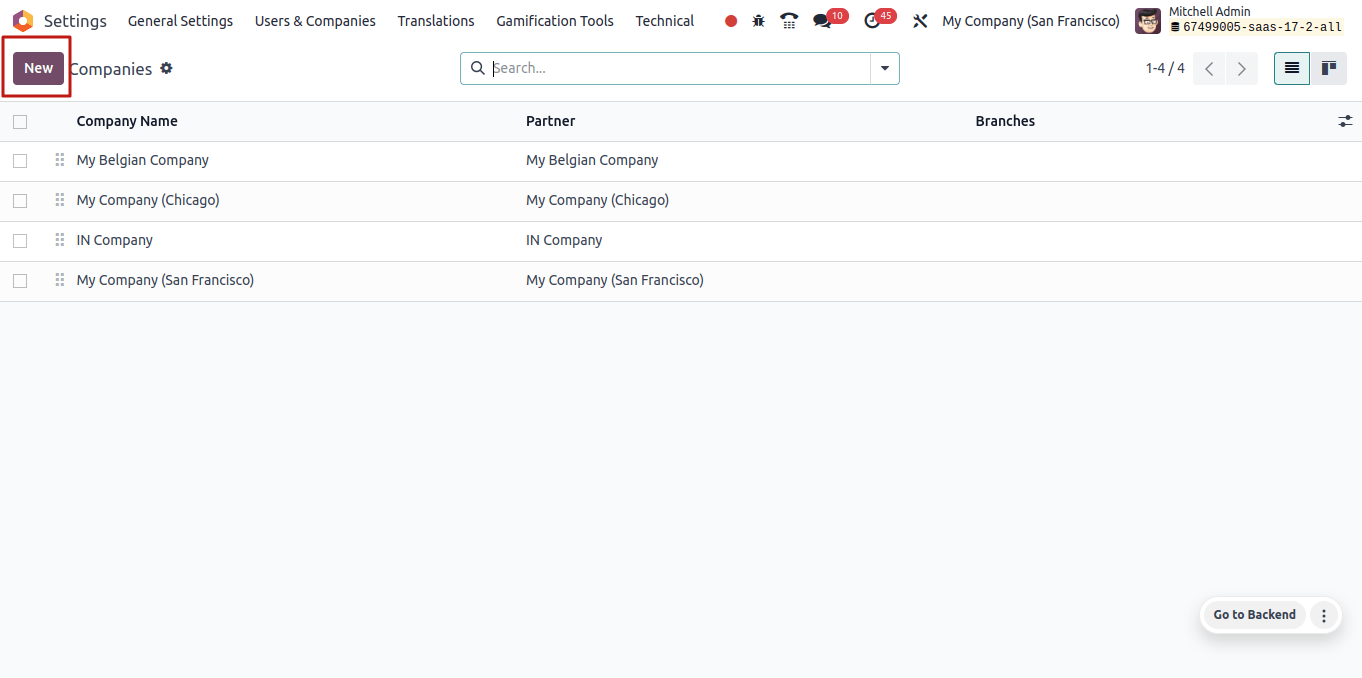

Under the users and companies, choose the companies sub-menu. Then it will provide a list of companies that are already registered, & from that page, we can click the New button to create the new company.

Here, Odoo will offer a form to fill out the details of the company that we are going to create. Fill the name and other required details about the company in that form.

As mentioned above, fill out the name of the company, address, Tax id, and the country. As we know Euro (EUR) is the currency used in Ireland and, here, when the country is set as Ireland, Odoo automatically adds the currency in the form of this company as Euro.

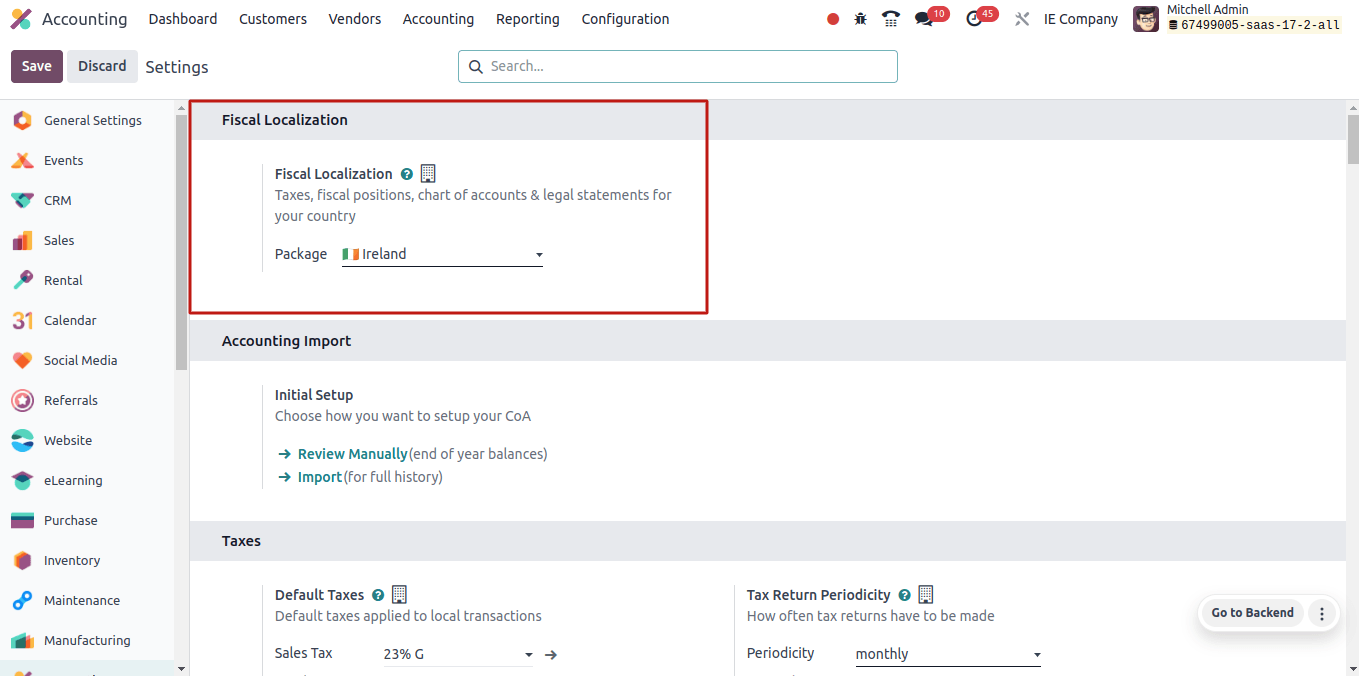

Once all the required details are added successfully, click the save button to save the details. The next step is to set the localization package for this company. Go to the Configuration > Settings of Accounting application.

Under the Fiscal localization section, we can set the company localization package. We established an Ireland-based company, so set the package to Ireland. This is the major step while configuring the country-specific localization.

Changes noticed while configuring the Irish localization

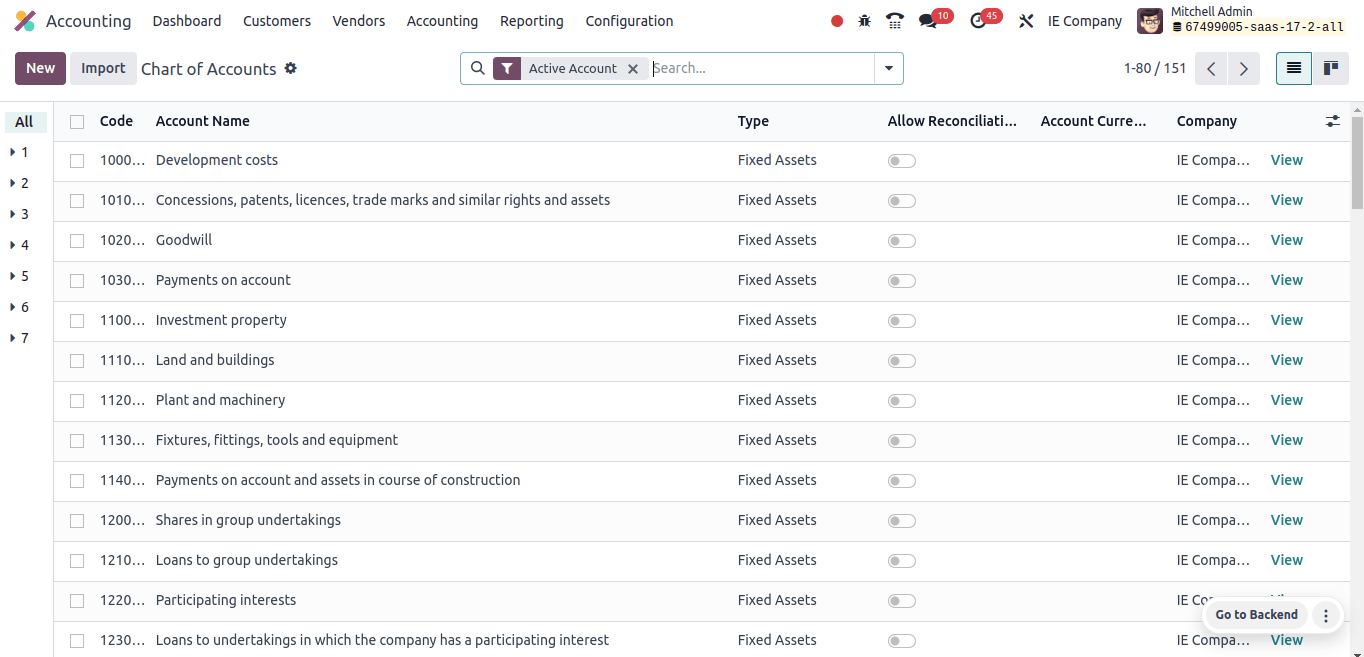

After adding the localization package, all prerequisites for the company including CoA, taxes, journals, and Fiscal positions were installed in the database.

Chart of accounts is the most important part of Odoo’s accounting system. It provides you with a clear view of the financial activities of your organization by giving you a systematic process to record your financial transactions.

Hence, every country has its own charts of accounts, that is the code and the name of the accounts may differ from country to country. The chart of accounts used by companies from Ireland is shown in the above image.

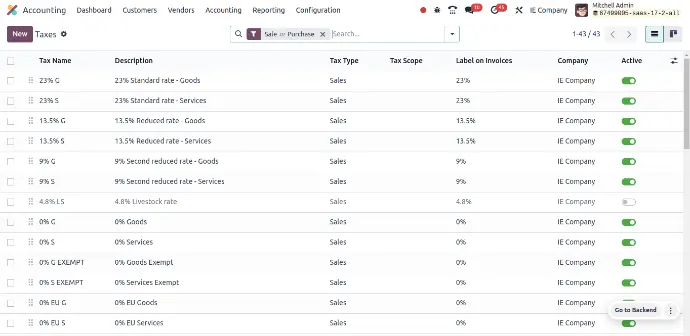

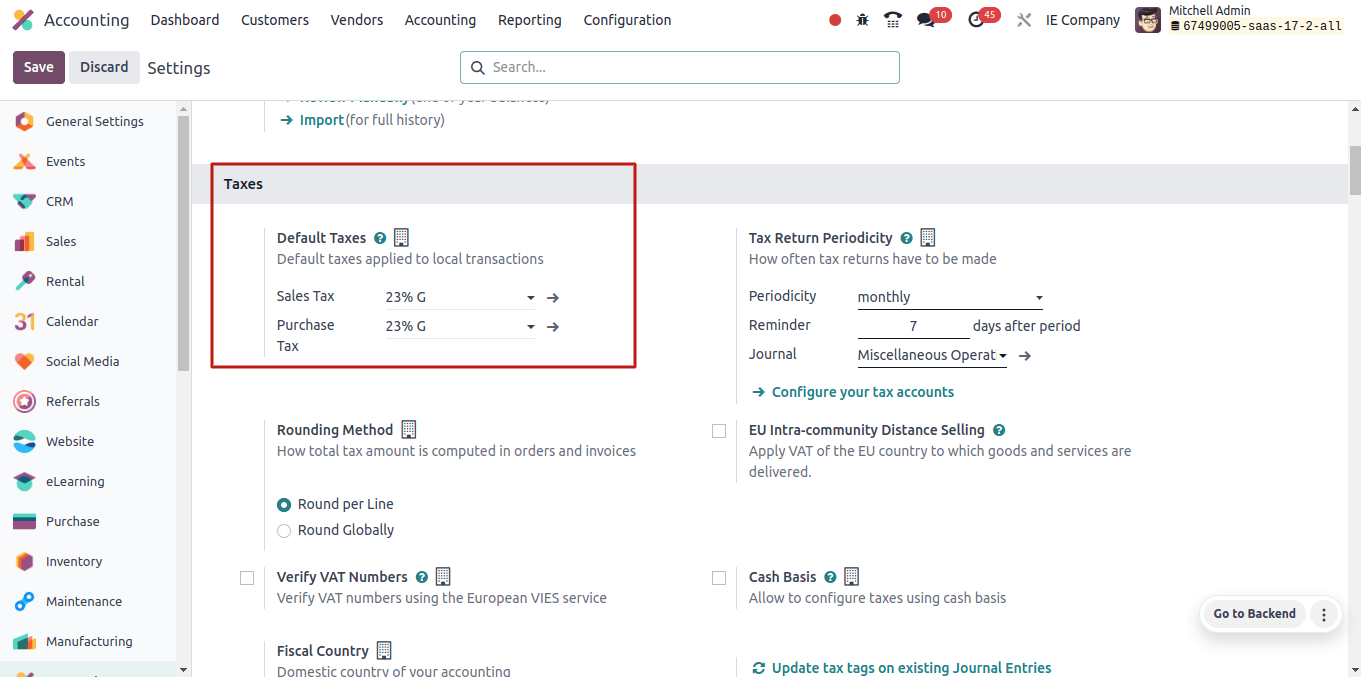

Every country uses its specific default taxes in the transactions. Default taxes are the predetermined tax rates when generating invoices, sales orders, and other financial documents.

Odoo provides you with Default sales tax and Default purchase taxes. The default sales taxes are applied to the products during sales in case those products don’t have any custom taxes and the default purchase taxes are applied when purchasing things that do not have any customs duties.

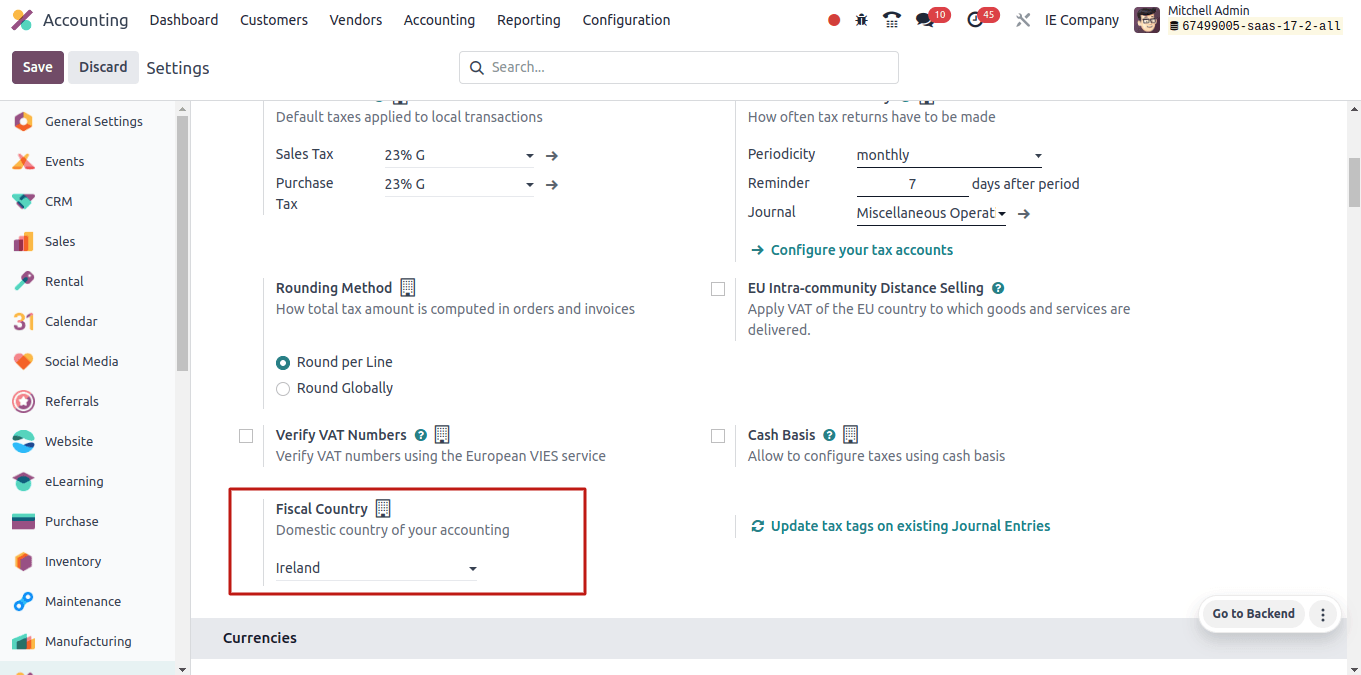

In the above image, we can see that the default sales taxes and the default purchase taxes are automatically added by Odoo when the localization package is set as Ireland. When we go down, there is a field to set the Fiscal country of the company.

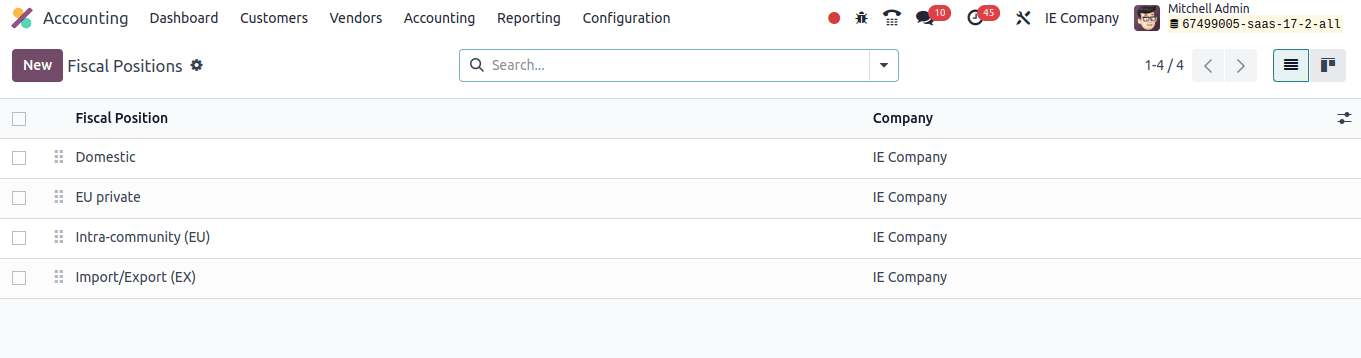

For managing complex tax situations or international transactions business can highly benefit from the use of fiscal positions in Odoo. They improve tax compliance, enhance precision, and reduce the effort required to manage your finances.

In the above image we can see the fiscal positions used by the companies in Ireland for accounts mapping and tax mapping.

Once we set the fiscal localization package as Ireland, Odoo automatically set the Fiscal country as Ireland.

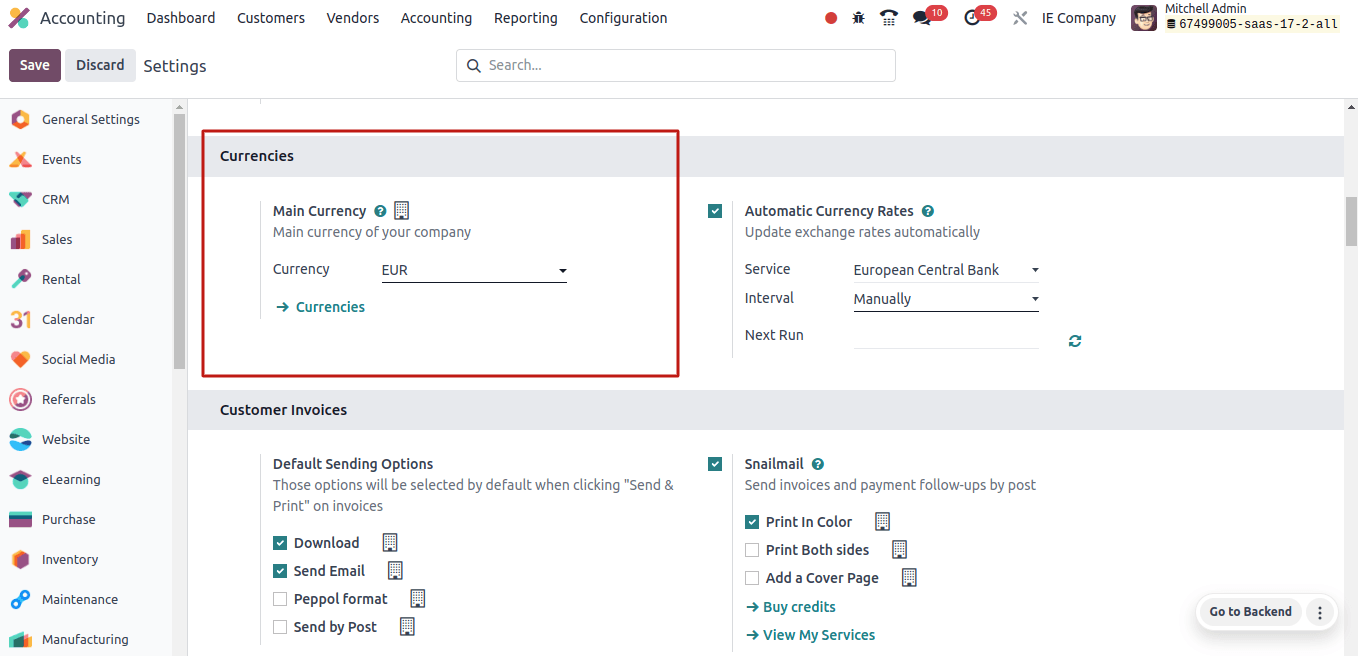

Now, we can see the main currency used by the country. Odoo allows you to set the main currency used by the companies. Here, we know the official currency used in Ireland is the Euro (EUR).

Go under the Currencies, for the Field Main Currency Odoo, we can set the main currency as the Euro.

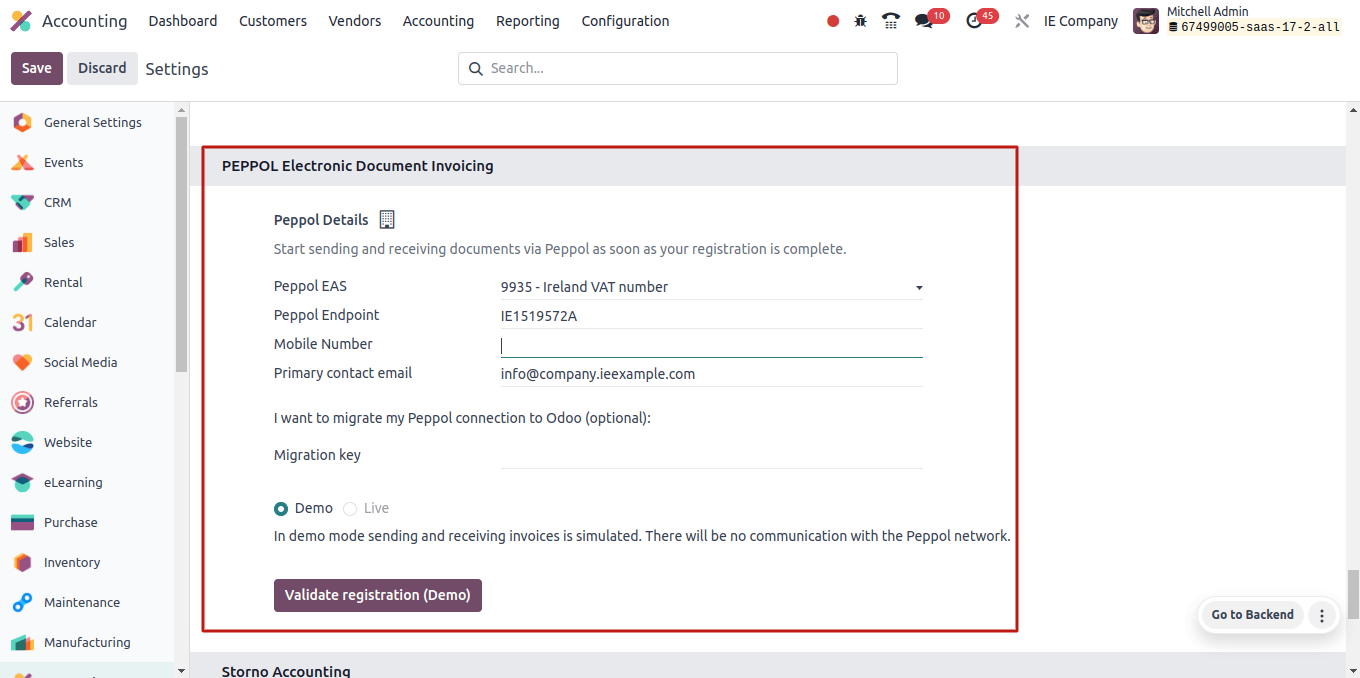

In Configuration > Settings, an extra section PEPPOL Electronic Document Invoicing section is added.

To electronically trade invoices with your trading partners over the Peppol network, you need to set up Peppol details.

Peppol stands for Pan-European Public Procurement Online, is a global e-invoicing platform that is used throughout Europe.

Under this field, we have to set Peppol details such as Peppol EAS, Peppol Endpoint, Phone number, primary contact email, etc.

Peppol EAS: It stands for Peppol Electronic Address Scheme. It’s an electronic document id and routing system, for purchase orders and invoices between businesses.

Peppol Endpoint: A Peppol Endpoint is a unique identification within the Peppol network that is used to exchange e-invoices in Odoo. It’s comparable to an email address but made especially for safe online billing.

After the registration is configured properly, validate registration to complete the registration process. Once the registration process has been completed, Odoo begins to send and receive documents through Peppol.

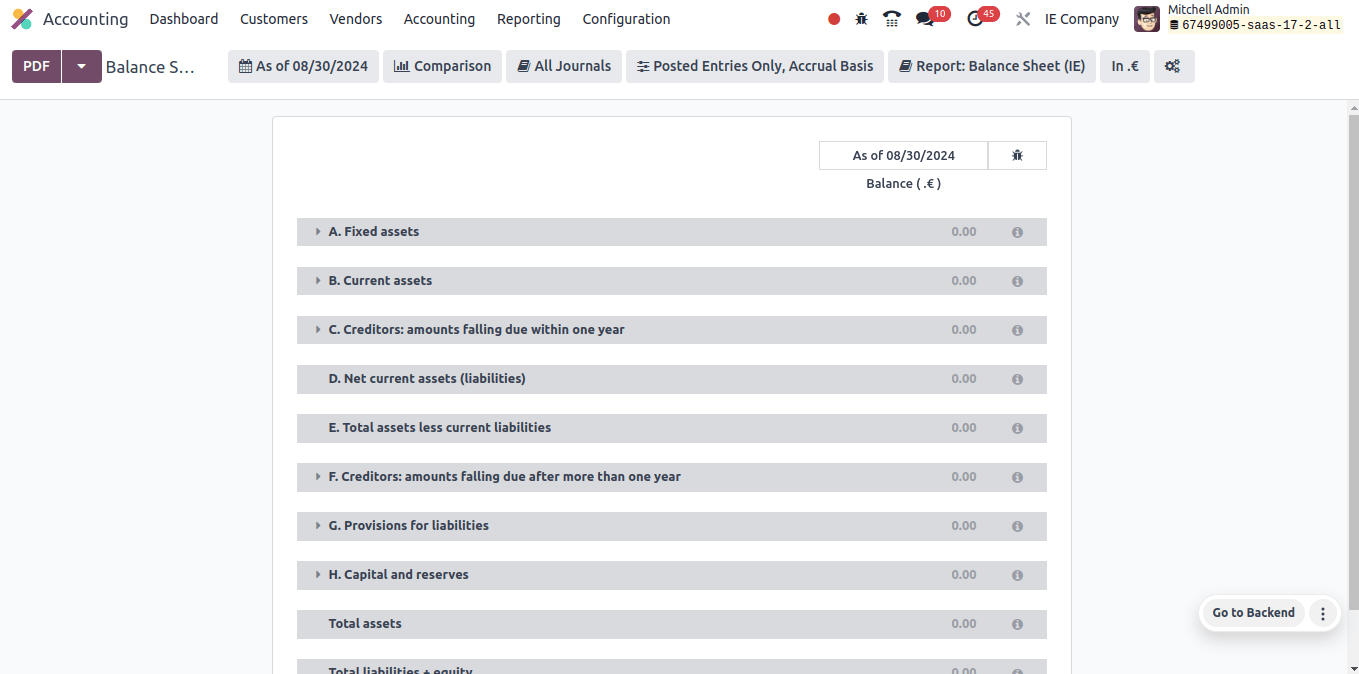

Now go to the Balance Sheet of the businesses in Ireland. Odoo balance sheet report shows the company’s financial status at a certain date is summarized, which divides financial information into three primary categories, Assets, Liabilities, and Equity.

Depending on how you set up your chart of accounts, each component of the Odoo balance sheet may further categorize accounts.

You can change the date range of the balance sheet report to look at the company’s financial status over time. Analyzing the balance sheet material in Odoo can reveal a lot about the company’s solvency, liquidity, and financial health.

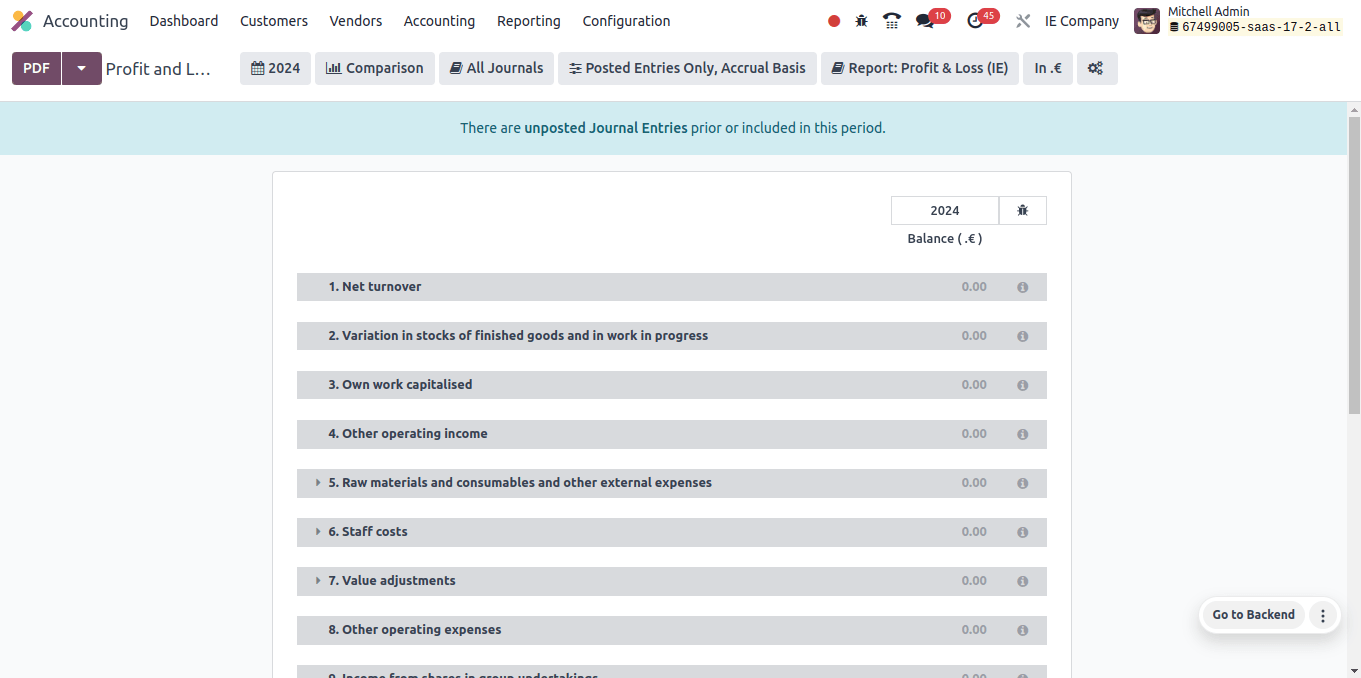

Odoo’s profit and loss report is an important document that provides an insight of a company’s success over time. In essence, it shows how much money the company earned (revenue) and spent (expenses) over a given time period.

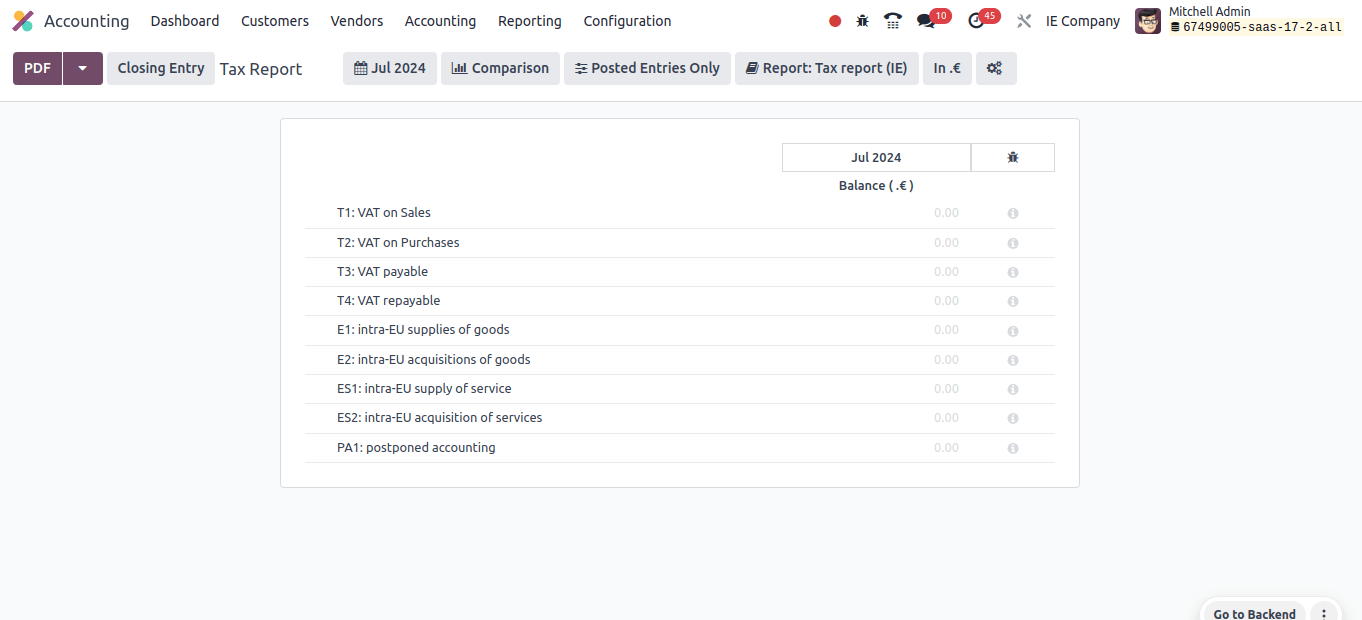

A tax report in Odoo is a document that provides an overview of your company’s tax-related operations during a specific time period. It supports you in understanding your tax responsibilities and ensures that you follow tax rules.

Companies in Ireland’s tax returns contain VAT on sales, VAT on purchases, VAT payable, VAT repaid, Intra-EU supply of goods, and so on.

VAT on Sales: This relates to how you manage Value added tax (VAT) on sales transactions for customers residing in Ireland.

This refers to how you manage Value Added Tax (VAT) on purchases made from vendors in Ireland.

VAT Payable: The amount of Value Added Tax that your company owes the Revenue Commissioners for a specific time period is known as VAT payable. This is normally shown as a liability account on the tax return.

Intra-EU supplies of goods: The sale and transfer of goods between two entities registered for VAT (Value Added Tax) within the European Union is known as an Intra-EU supply of goods.

So far, we have addressed the notable changes discovered during the configuration of the Irish localization.

We may conclude that the Irish localization of Odoo 17 ensures compliance with the difficult Irish tax rules. It also helps us to prepare financial reports that are easily understandable by Irish financial institutions and stakeholders while following the local standards.

Overall, Odoo 17’s accounting localization for Ireland offers a comprehensive solution for businesses conducting business in the region. It ensures adherence, streamlines operations, improves precision, and allows better financial decision-making.