What exactly is meant by accounting localization?

Accounting localization refers to adapting accounting practices to the regulations and culture of a certain country or region. It entails customizing your financial operations to local laws, currencies, and language so that your financial reports are accurate and meet local needs. This is important for companies operating in multiple countries to maintain compliance and prevent problems.

What are the benefits of Odoo 17 Accounting Localization?

Odoo 17’s localization capabilities help to ensure that accounting process follow the particular accounting and legislation of many countries, reducing the chance of legal issues and penalties.

By automatically applying local tax rules and rates, it simplifies tax computations and helps in accurate tax filing and reporting. Odoo 17’s support for different currencies and language allows businesses to manage transactions and reports in each location’s native currency and language.

It allows the examination and transmission of financial information as required by local authorities by generating financial reports that follow local reporting standards and formats.

How to set up localization packages in Odoo?

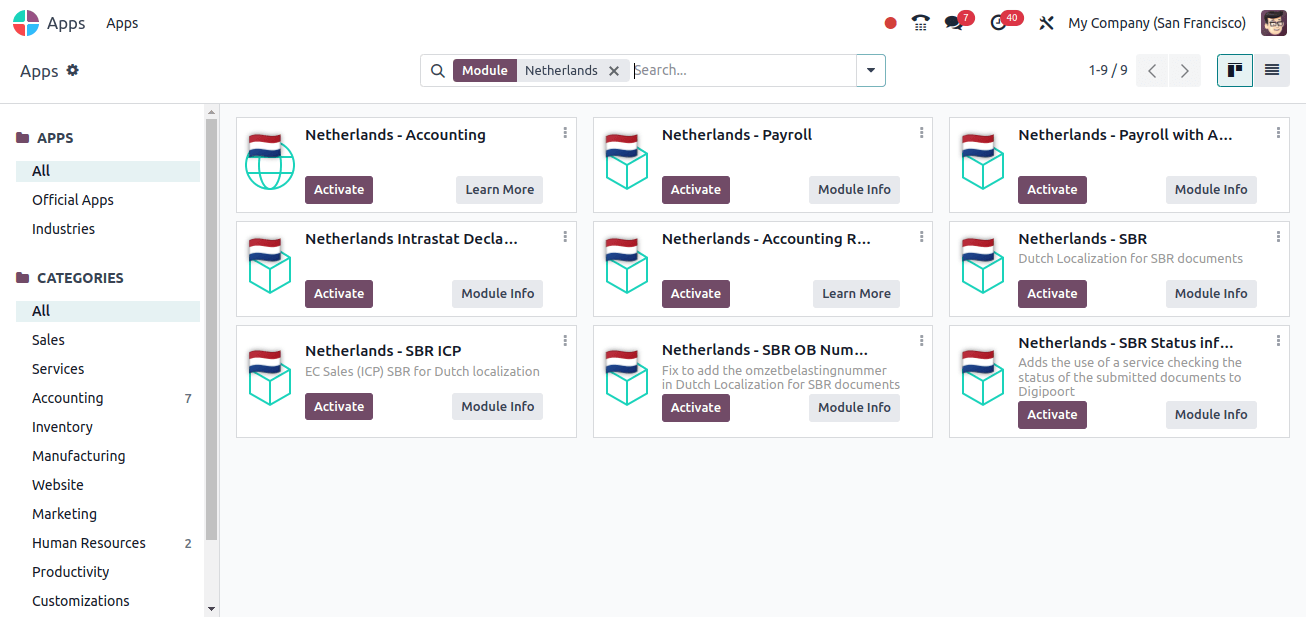

When you go to Odoo applications and remove the ‘apps’ filter, you can see the packages required to set the translation package for the Netherlands.

Simply activate all of these modules and move to Odoo’s general settings to form a new company in the Netherlands. So go to General > Settings, and you’ll discover a Users and Companies section. The Users and Companies menu includes a Companies sub-menu.

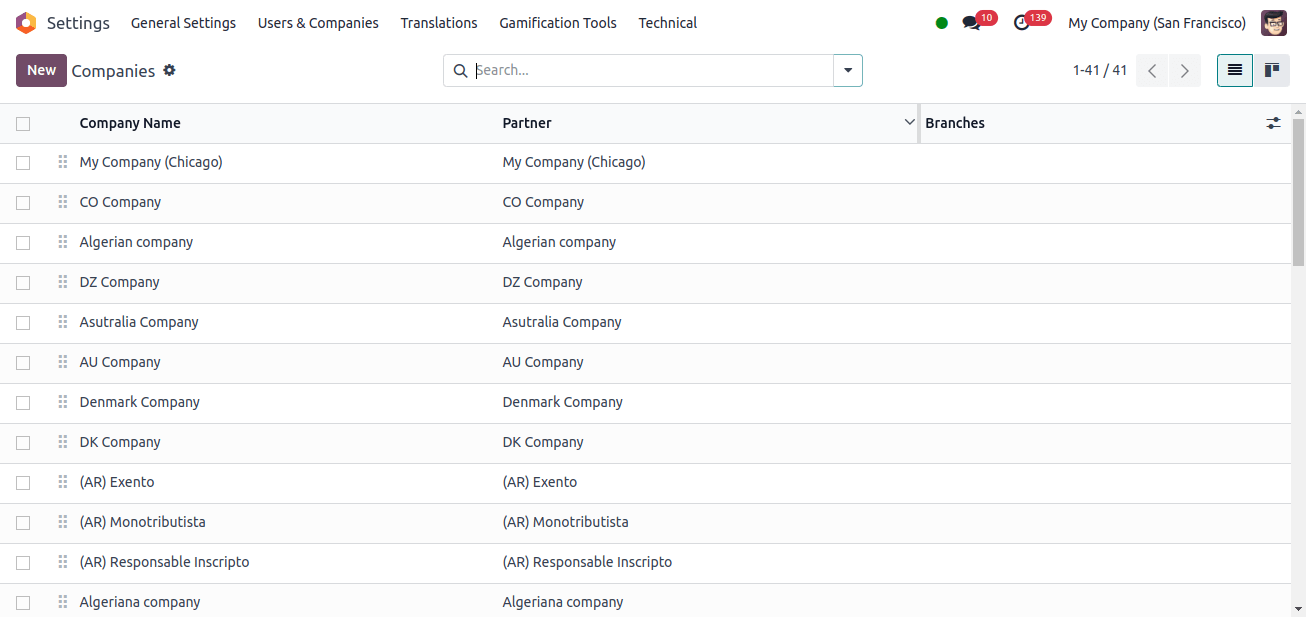

When you click the companies submenu, you will see a list of pre-created companies. By clicking the New button, you can start a new company.

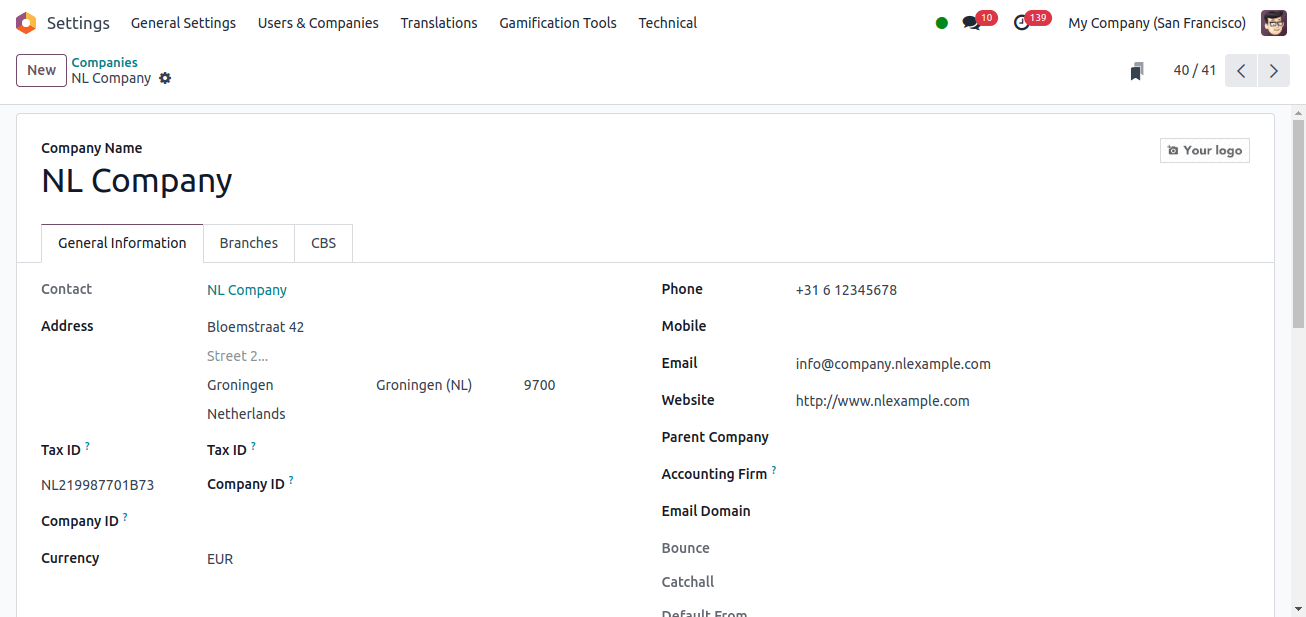

There will be a form where you can enter the company’s details. In this form, you can enter the company’s name, address, Tax ID, country of incorporation, and so forth. When we enter a country, Odoo will automatically add the country’s official currency to the form.

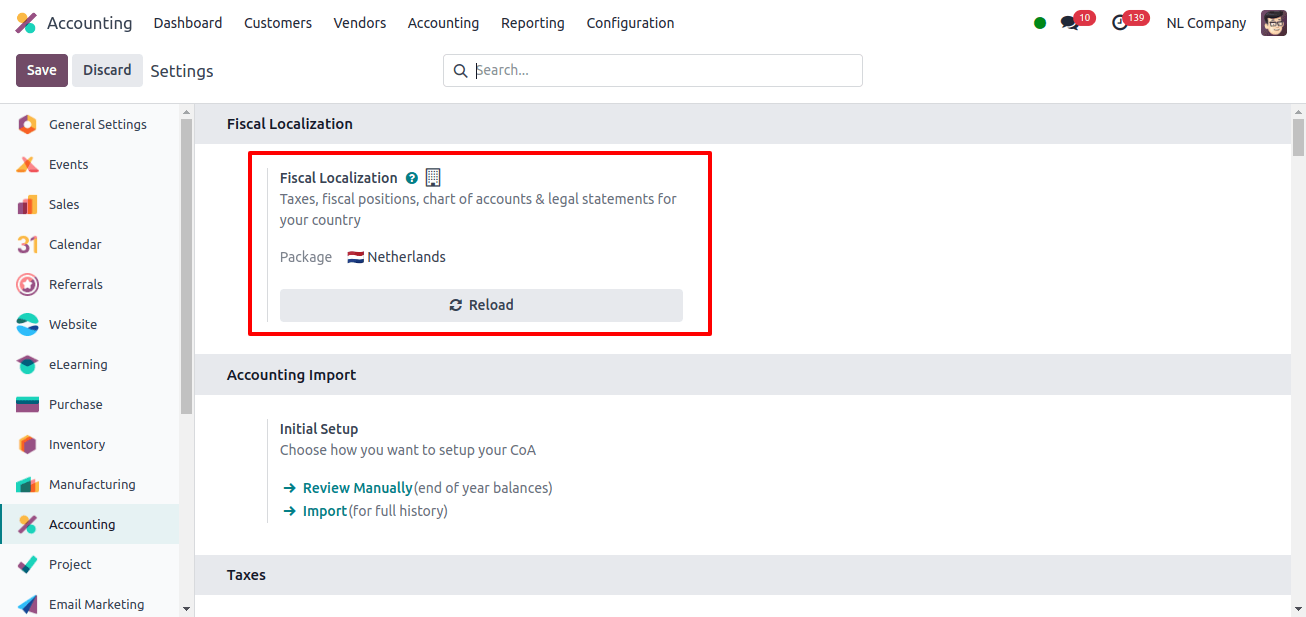

To become familiar with the capabilities of accounting localization for the Netherlands, we must first configure the Fiscal localization package for this company. Move to the Accounting application, then to Configuration > Settings, where you will see a fiscal localization section.

In this Fiscal localization part, we can set the Package to the Netherlands and save the adjustments.

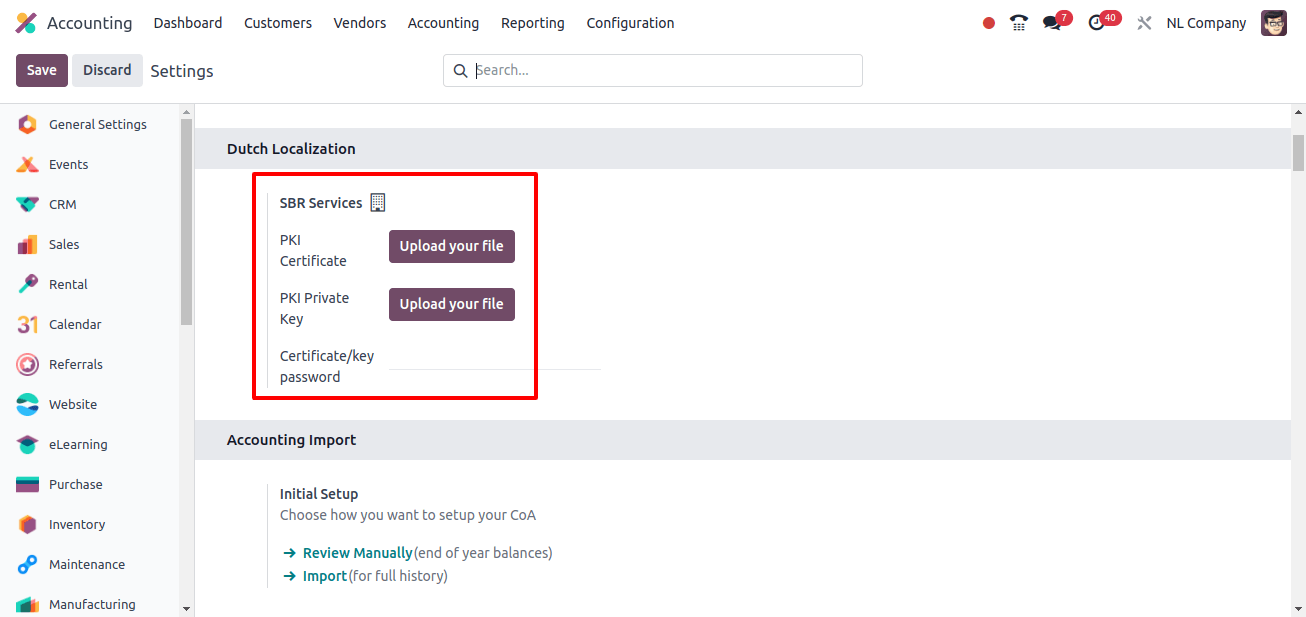

After configuring the Fiscal localization package, an additional field Dutch localization section is added to the Configuration > Options.

There is an option to upload the PKI certificate file, PKI private key, and certificate / Key password. SBR services stands for Standard Business Reporting Services, a framework for electronic communication between businesses and government authorities.

The term PKI refers to the public key structure, which is used to ensure data privacy and integrity, as well as to protect key email content. The PKI private key serves as the cornerstone for security in the PKI. It’s the secret component that allows safe connection and data security.

Odoo accounting localization includes automatic configuration of the Chart of Accounts, Journals, Fiscal Positions, and Taxes.

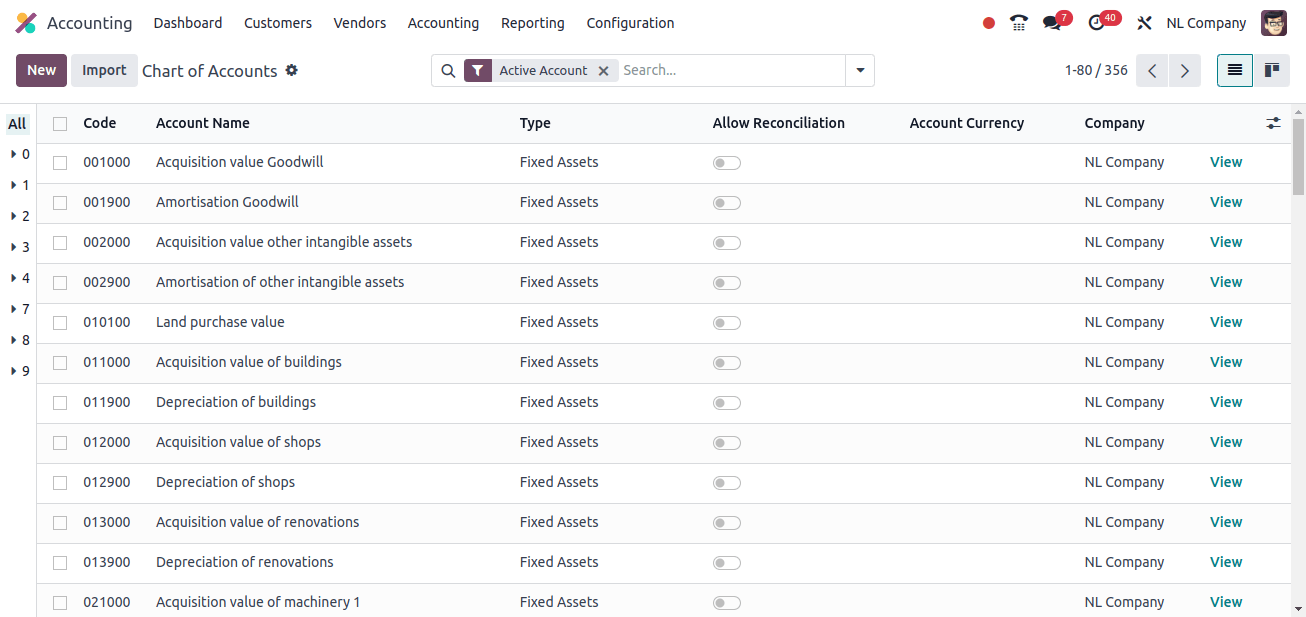

Chart of accounts

Odoo provides a pre-configured chart of accounts intended for businesses operating in the Netherlands. This chart of accounts follows Dutch accounting rules and legislation.

The Chart of Accounts submenu can be found under the Configuration menu. There is a preconfigured chart of accounts for the Netherlands-based company.

The chart of accounts used in different countries may differ according to the country’s criteria. The chart is intended to comply with local tax legislation, resulting in accurate VAT or GST calculations.

It includes the important accounts and structures to meet local financial reporting requirements. If your company requires additional charts of accounts, you can create new accounts by clicking the New button.

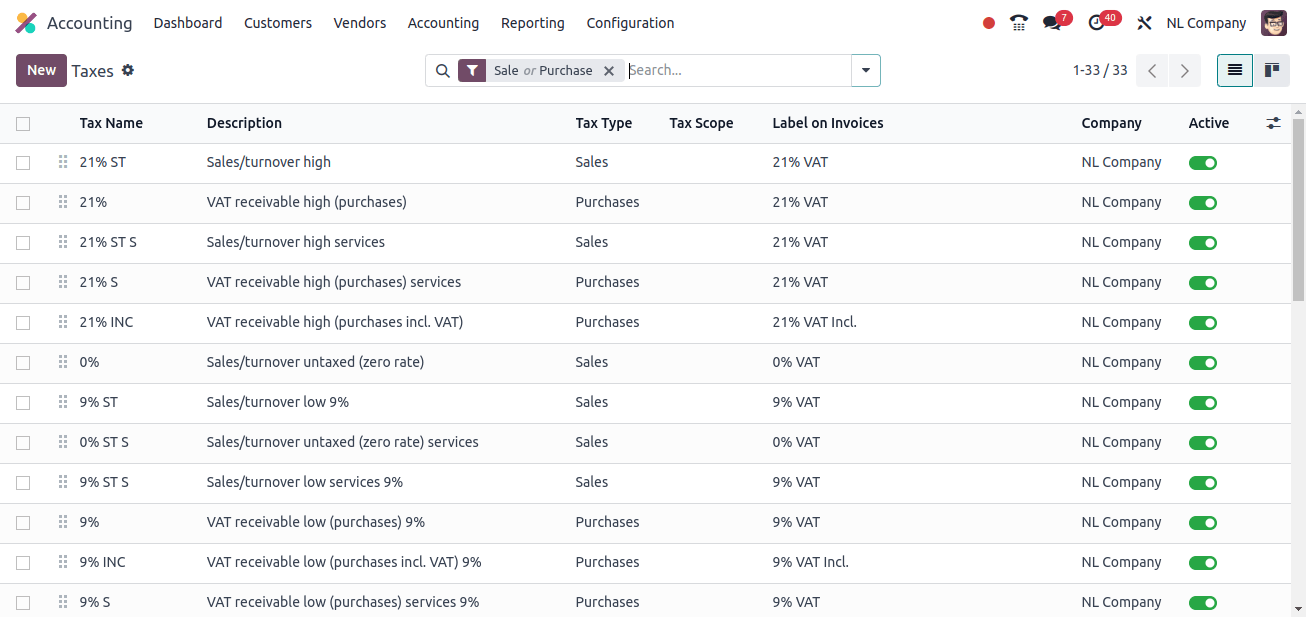

Taxes

Companies in the Netherlands charge value-added tax (VAT) on the transfer of goods and services. Odoo supports different VAT rates applicable in the Netherlands. There are two types of taxes: Sales tax and Purchase tax.

Taxes is a sub-menu in Configuration > Settings. When we select the taxes sub-menu, we will get a list of taxes that have already been configured.

We found the already-created taxes that the company can use. However, when selling or purchasing things, Odoo automatically adds taxes, which are known as the country’s default taxes.

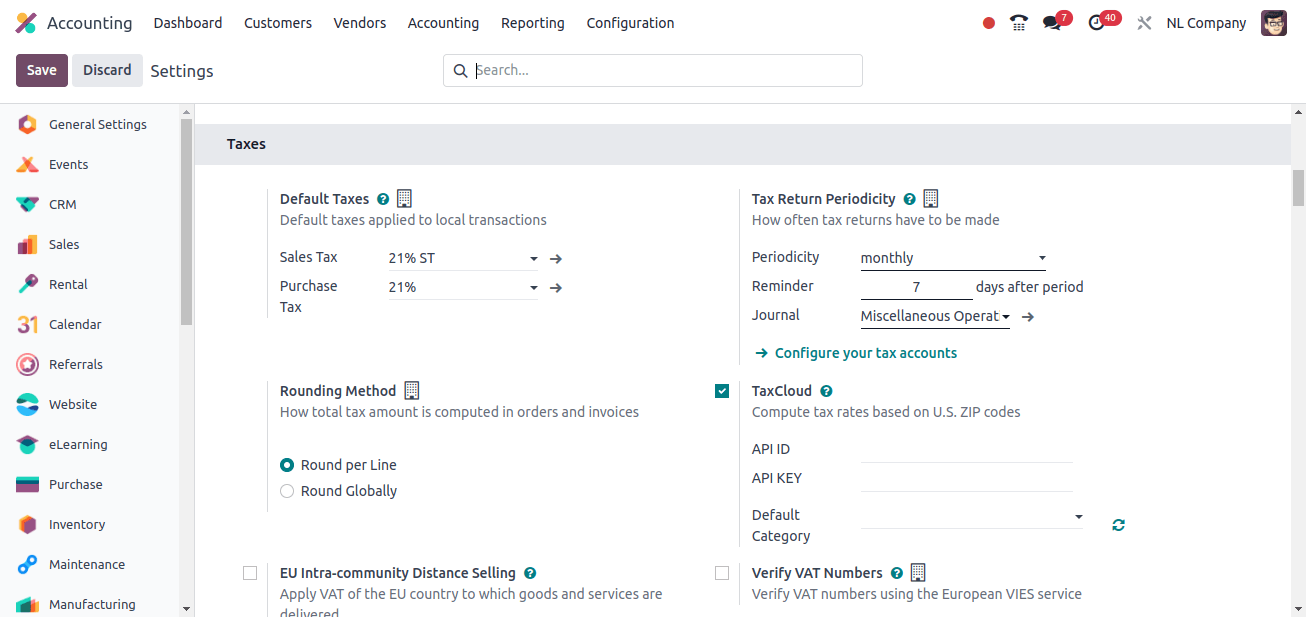

In Configuration > Settings, there is a section called Default taxes, where you can select two different taxes for the company: default sales tax and default purchase tax.

The screenshot above shows that Odoo adds one sales tax and one purchase tax when the localization package is defined and saved. All Dutch corporations may use these taxes as the default tax on transfers.

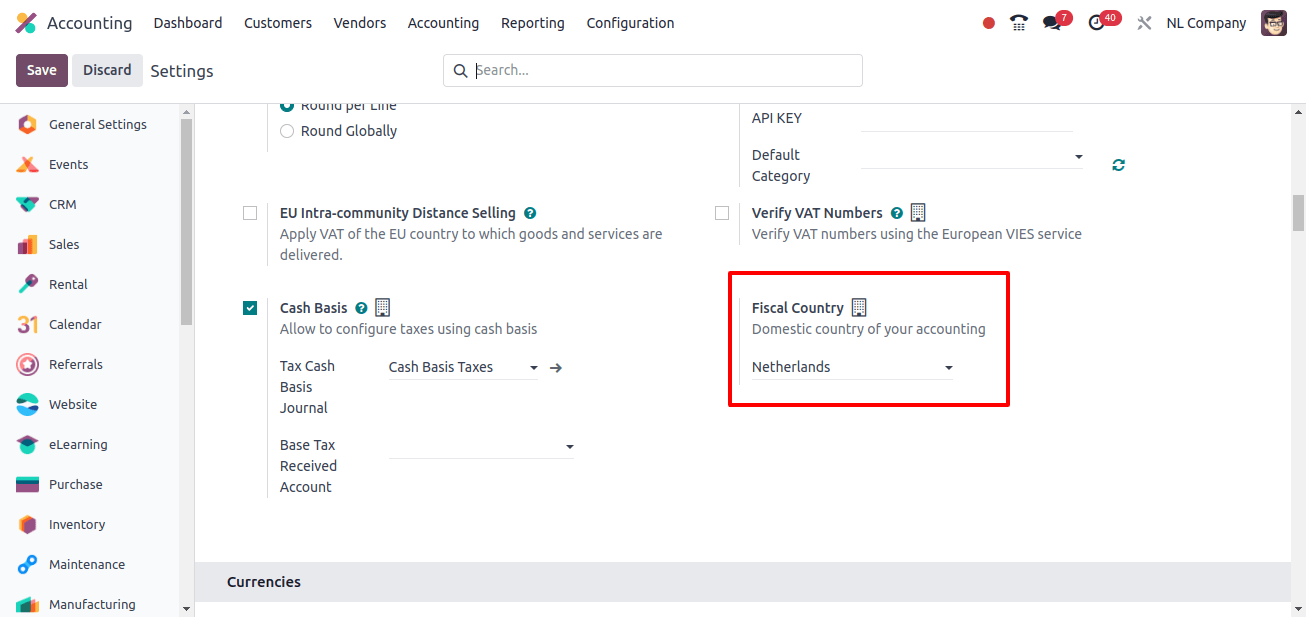

In the Taxes area of the setting > Settings, there is a field for providing the company's fiscal nation. We can set the fiscal country for the company here.

However, we can see that when the company's localization package is configured and saved, Odoo automatically changes the fiscal country to the Netherlands.

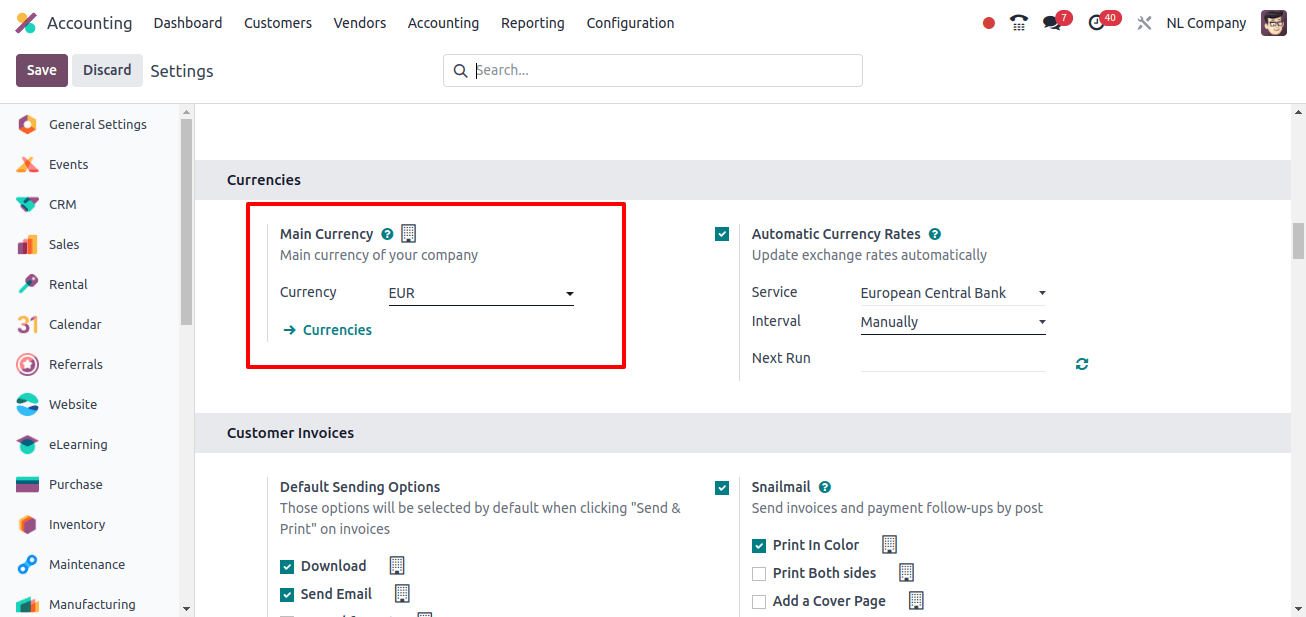

The following part is Currencies in Configuration > Settings. We know that the official currency in the Netherlands is Euro (EUR), and when we configure the localization package, Odoo automatically saves the main currency for the company as Euro (EUR).

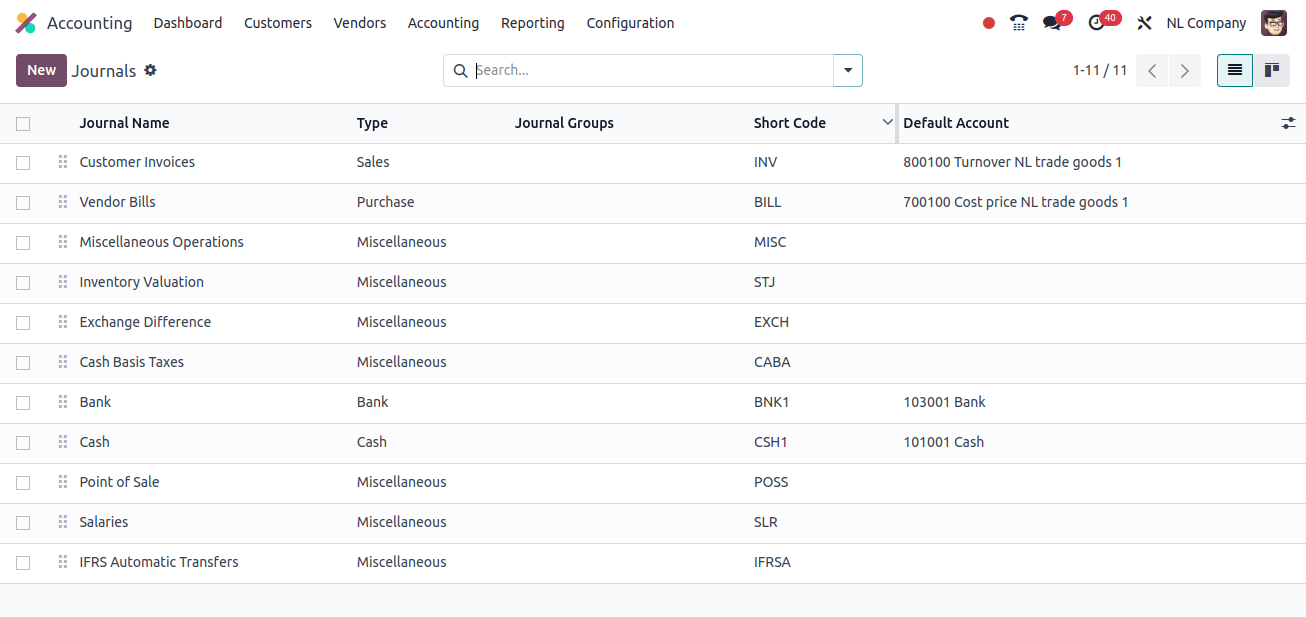

Journals

Journals are essentially records of financial transactions organized by date. They serve as the cornerstone for your accounting system, capturing all financial activities in your company. Under the setup menu, there is a journals sub-menu, and clicking on Journals will display all of the journals that have already been created for accounting entries.

There are five categories of journals: sales, purchase, bank, cash, and miscellaneous. Clicking the New option allows you to set up a new journal for the company. Journals can assist categorize and arrange financial transactions for better management. Transactions can be segregated to assist keep accurate financial records.

Fiscal position

A fiscal position in Odoo is a setup that specifies how taxes are applied to different sorts of transactions. It determines tax computations, such as input tax recovery and output tax calculation.

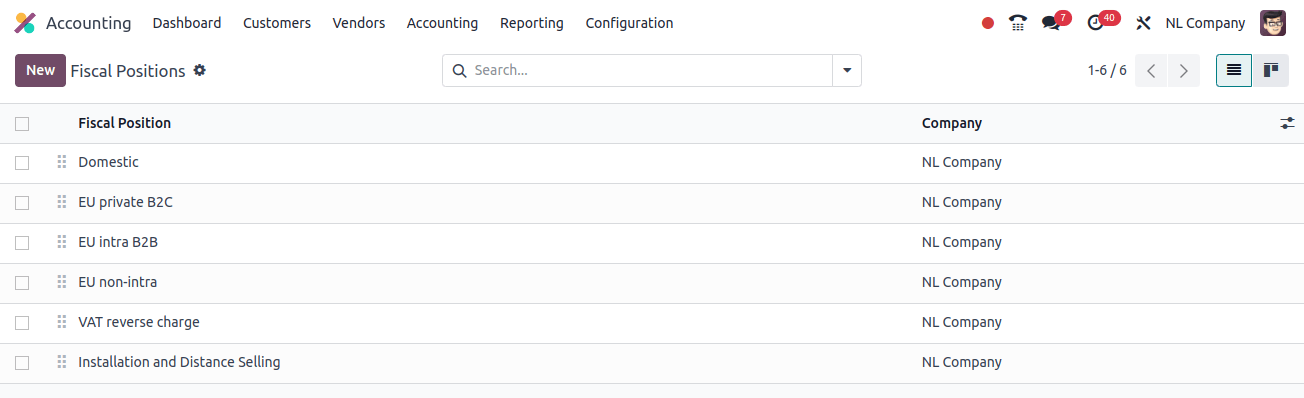

The fiscal position sub-menu can be found in the accounting application's Configuration > Settings. When we click on the Fiscal position sub-menu, we can see a selection of predefined fiscal positions for Dutch enterprises.

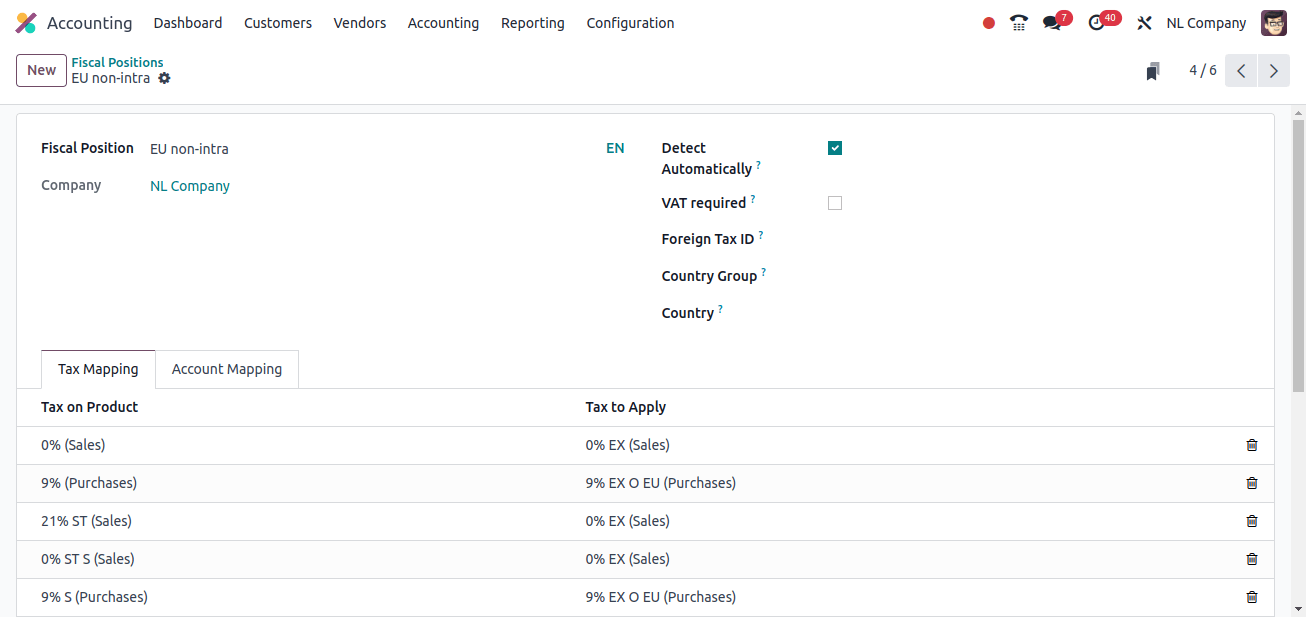

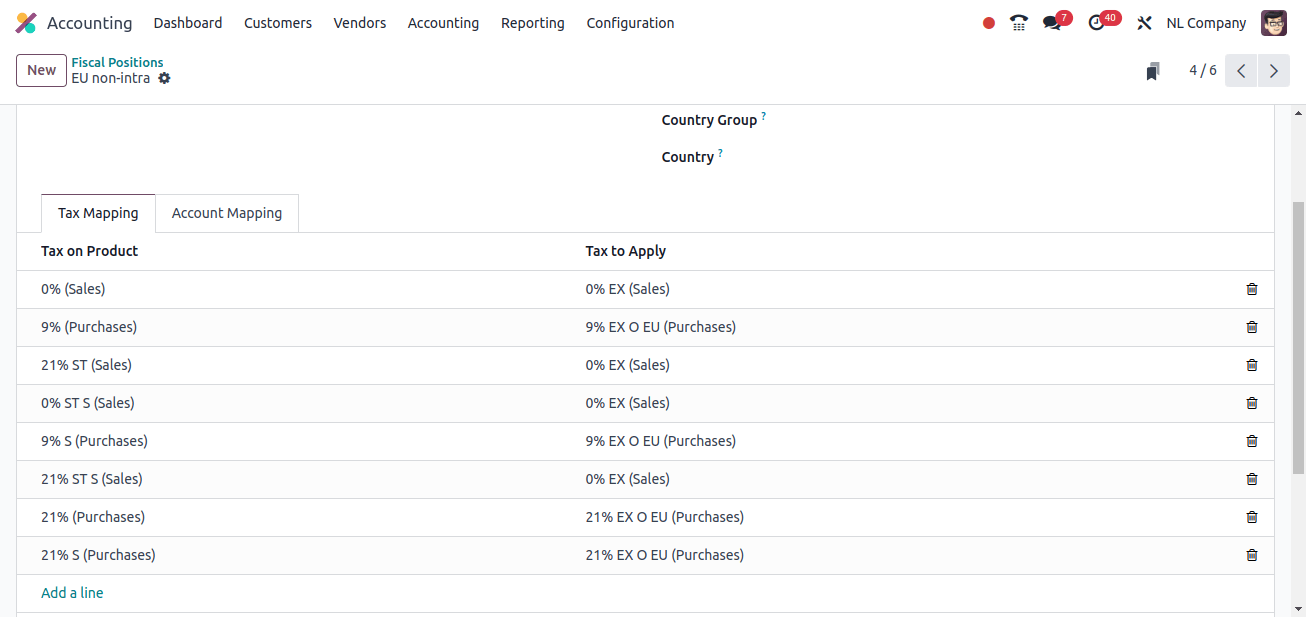

By selecting one of the fiscal positions from this list, we may view the mapped taxes and accounts for that fiscal position.

The Tax Mapping page lists all of the mapped taxes, as shown in the screenshot above.

Moving on to the account mapping tab, we can see a list of all mapped accounts, as well as the accounts from which they have been mapped.

When we create a localization package for a corporation in the Netherlands, the PEPPOL Electronic Document Invoicing option becomes available.

European Public Procurement Online. We can enable PEPPOL under Configuration > Settings. When the PEPPOL option is activated, Odoo allows us to send and receive invoices over the PEPPOL network.

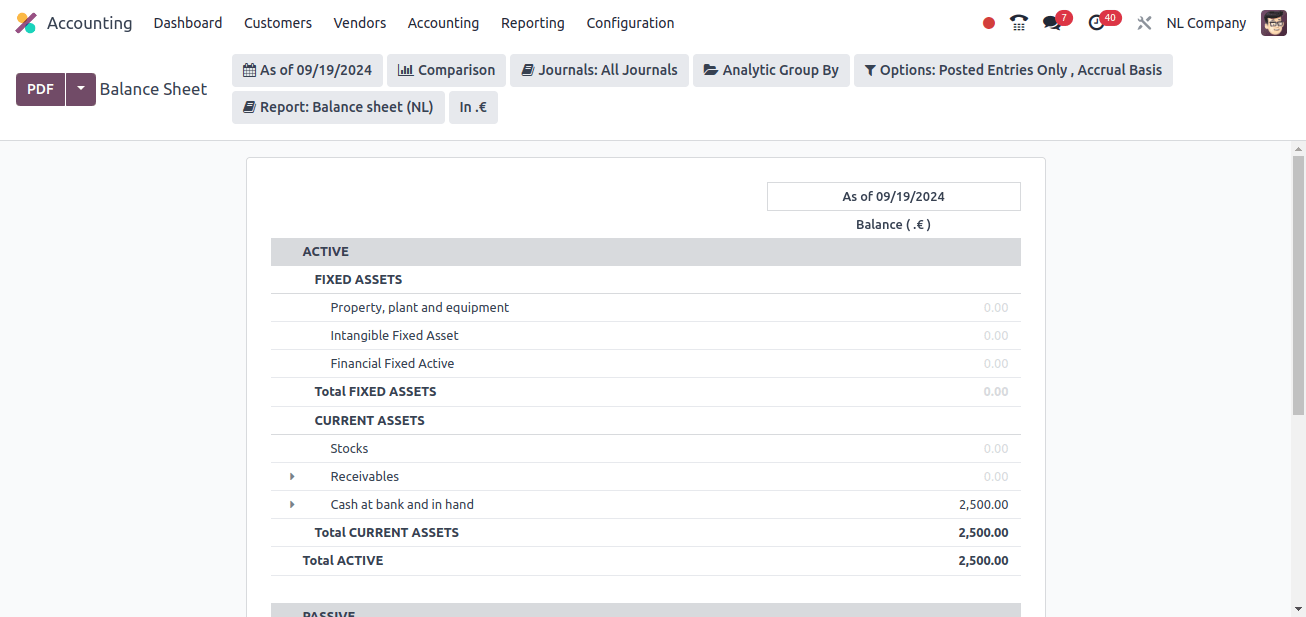

Moving on to the Reporting option, we can see the company's balance sheet, profit and loss report, cash flow statement, tax report, and so on, all of which assist us measure its growth.

Odoo's balance sheet provides a full perspective of a company's financial situation at a given point in time. It provides a picture of the company's assets, liabilities, and equity.

The balance sheets of Dutch corporations are usually classified into two categories: active and passive. The Active section of the balance sheet includes fixed assets, current assets, stocks, receivables, and so on, whereas the Passive section includes equity, claims, provisions, long-term liabilities, creditors, and so on.

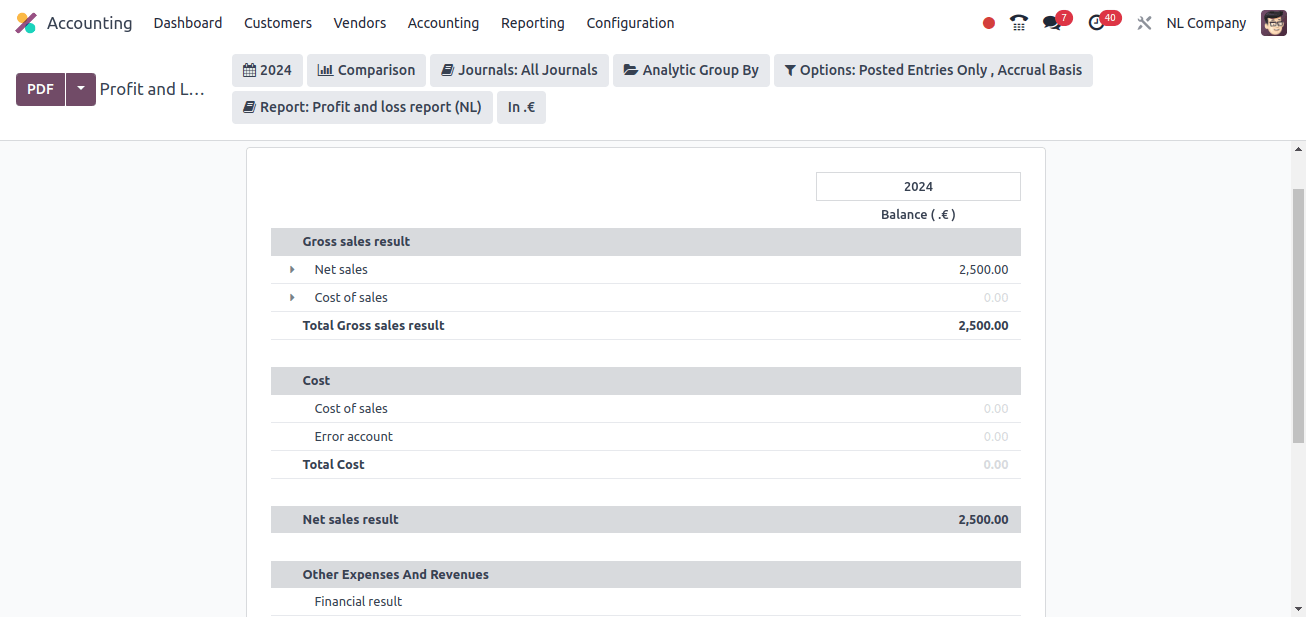

The company's profit and loss report comes next. The company's profit and loss statement is available under the reporting option.

The Odoo profit and loss report includes gross sales, net sales, cost of sales, net sale result, other costs and revenues, depreciation, other operating income, taxes, and so on.

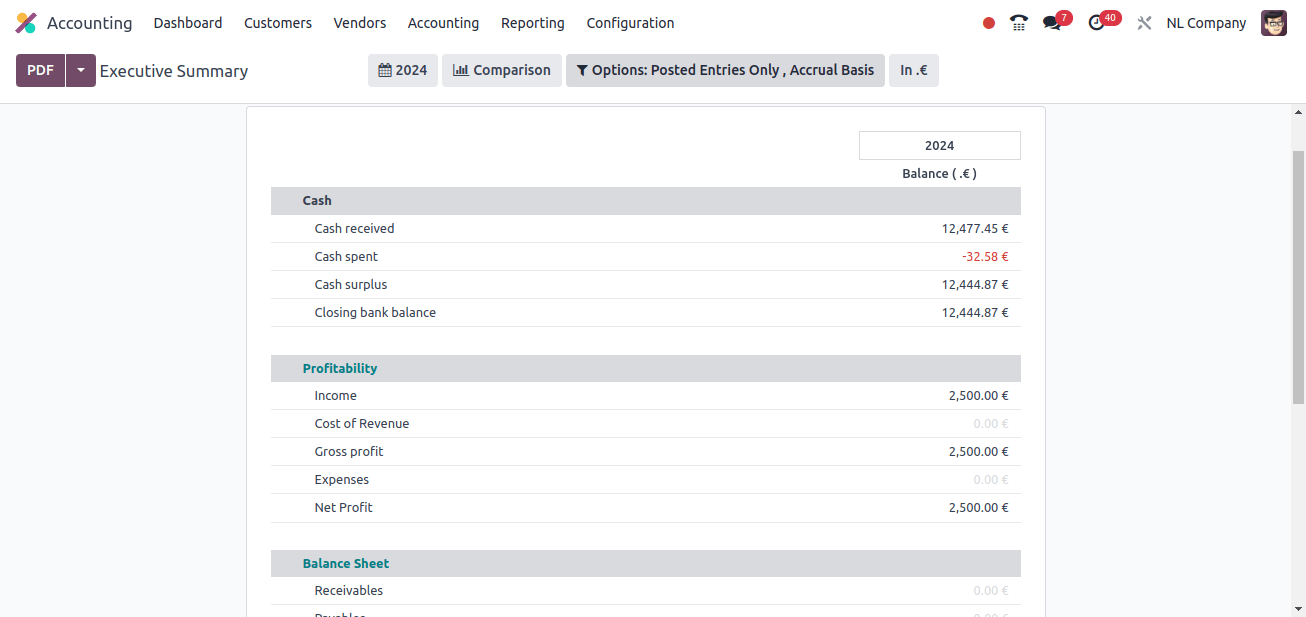

Finally, Odoo gives an executive summary.

The Executive Summary report is a valuable tool that provides a high-level summary of a company's financial performance. It combines crucial financial information into a single, easily readable format, making it invaluable to decision-makers. which The executive summary covers total information on cash, profitability, balance sheet, performance, position, and so on.

The Odoo 17 accounting localization for the Netherlands offers a robust and comprehensive solution for businesses operating in the Netherlands. Odoo's seamless integration with the country's complicated tax and accounting legislation allows firms to streamline their financial processes, increase efficiency, and ensure rule adherence.

Odoo's flexible features and simple interface, which are based on exact and up-to-date financial data, enable businesses to make sound decisions. Implementing Odoo for Netherlands accounting allows businesses to achieve a competitive advantage and focus on their core capabilities while leaving financial administration in the hands of experts.