Accounting localization allows Odoo, to provide accounting features that can be customized to specific countries. This means that Odoo 17’s accounting capabilities can be modified to comply with local laws, tax legislation, and reporting standards relevant to a country. We are currently building up the accounting localization for Algeria.

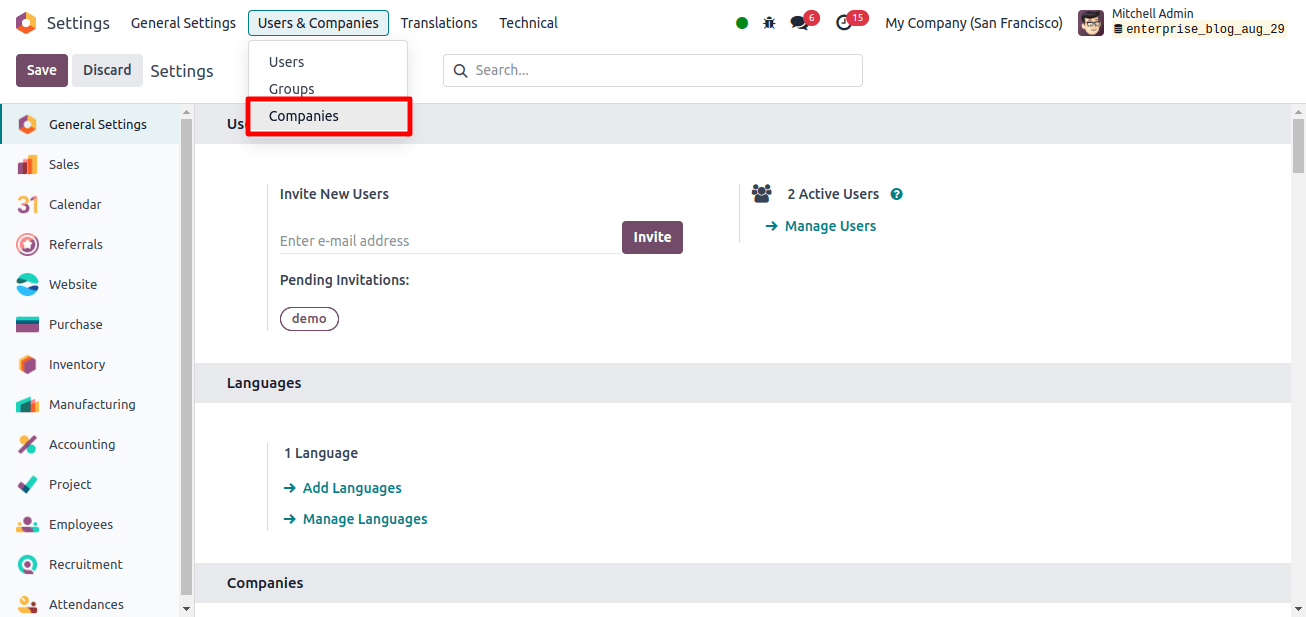

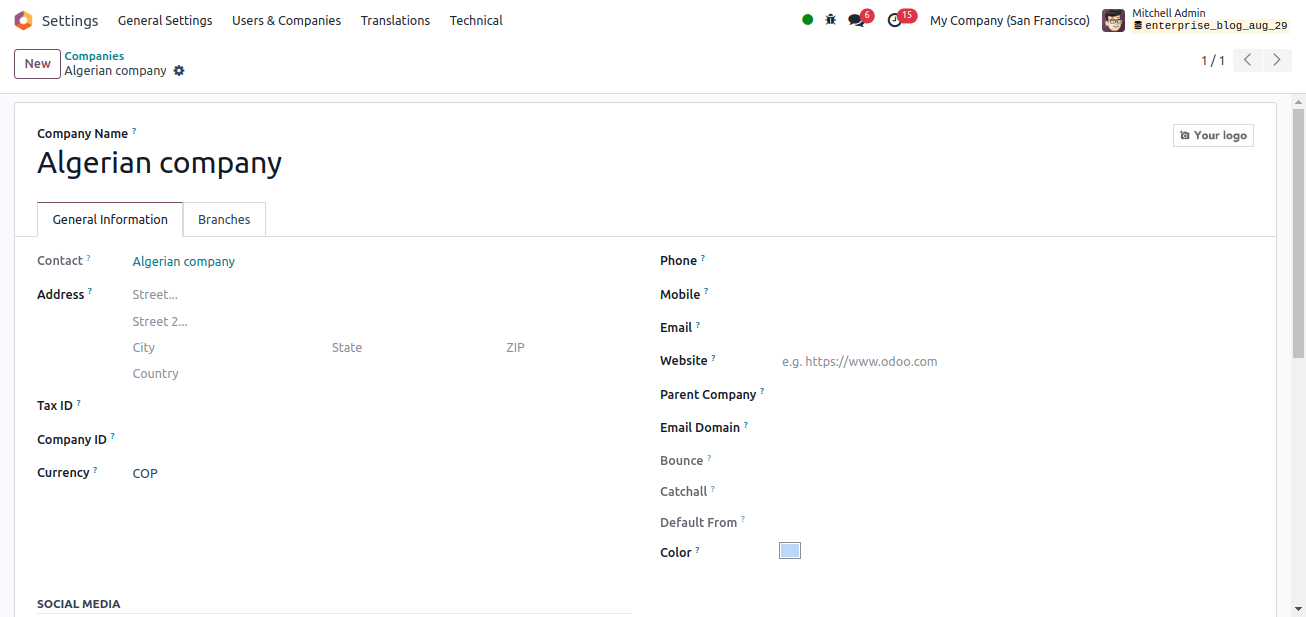

To set up country-specific localization for an Algerian company, we must first configure the Algerian company. To set this up, go to Odoo’s General Settings app and select the ‘Users & Companies’ tab. Under Users & Companies, select the ‘Companies’ submenu.

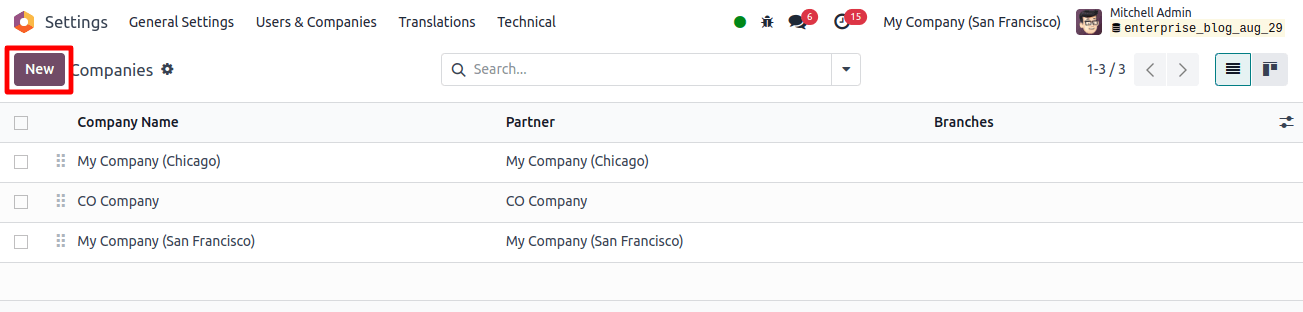

When you click on the ‘Companies’ sub-menu, a list of companies will appear. To start a new company, click the ‘New Button.’

There was a form where we could fill out company details such as the name, address, nation to which the company belongs, currency of that country, Tax ID, phone, email, website, and so on.

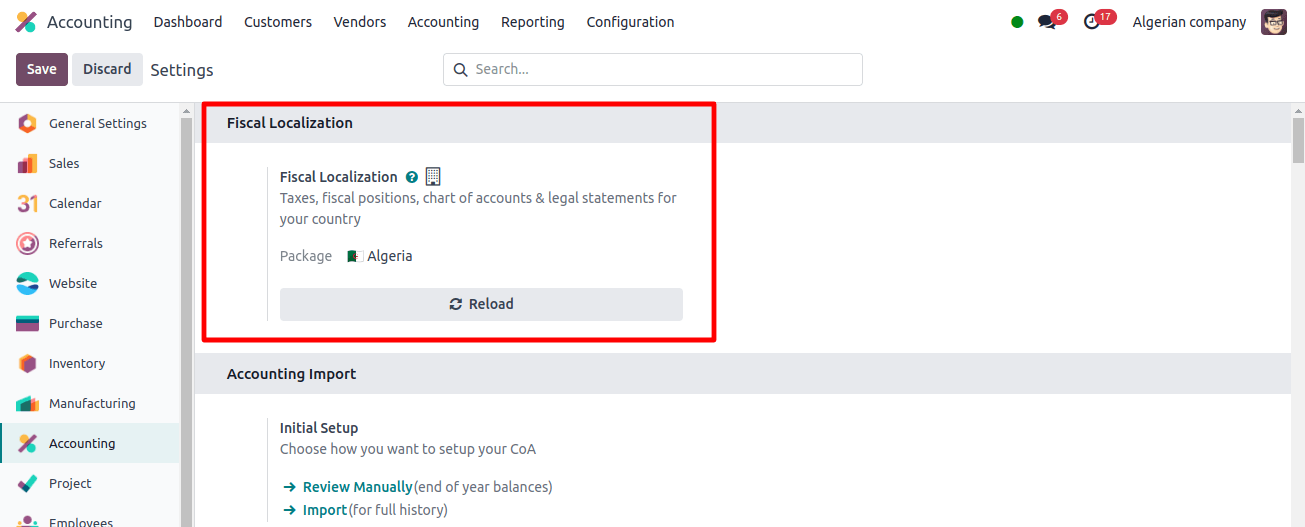

Then save the entire company details and return. The next step is to set up localization for Algeria. To set up Algerian localization, we can go to Odoo’s accounting application. Then select the Configuration > Settings sub-menu.

Under the ‘Fiscal Localization’ section, we may configure the package for the country, including tax, fiscal position, chart of accounts, and legal statements for the company. In the packages field, select ‘Algeria’ and click the save button to save your changes.

Changes occurred when Algerian localization was configured in Odoo 17

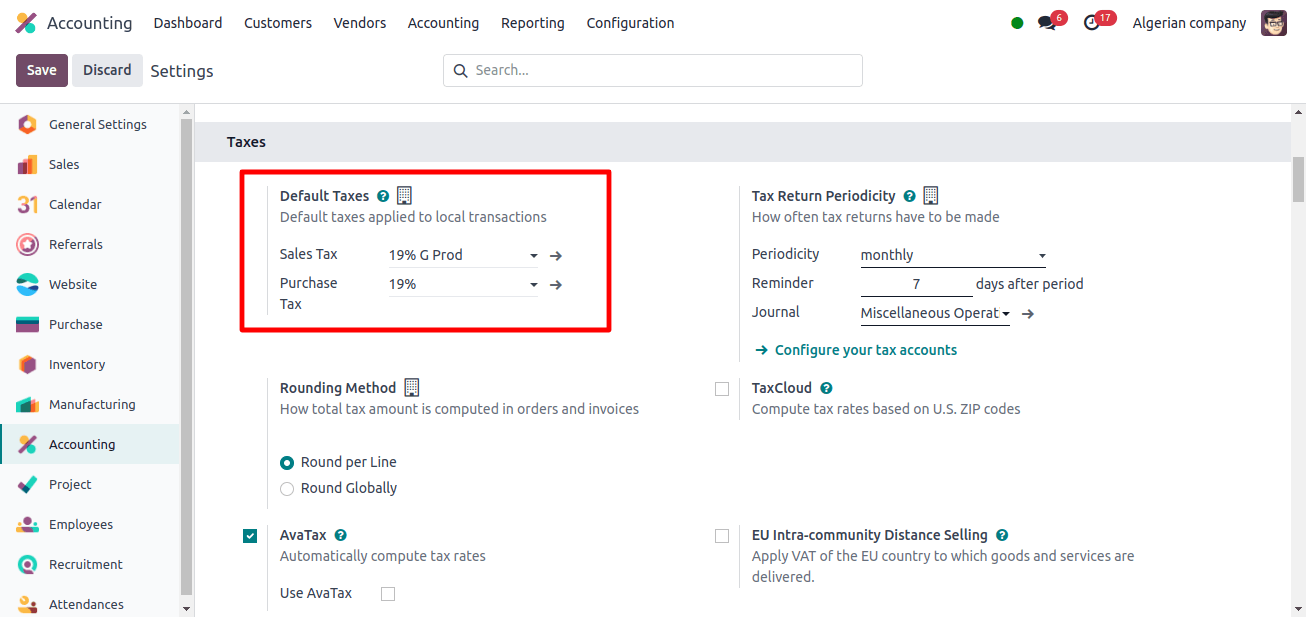

There will be several adjustments once an Algerian localization for a business has been configured. In the accounting application’s settings, we can see that the default sales and buy taxes have been modified, and a new tax was automatically configured using Odoo 17.

Next, we’ll look at how the tax is configured for the Algerian company. Choose the ‘Configurations’ option, which will have a ‘Taxes’ submenu. When we click on the taxes submenu, we will get a list of taxes. These are all the taxes that an Algerian business can use, or that business in Algeria can configure.

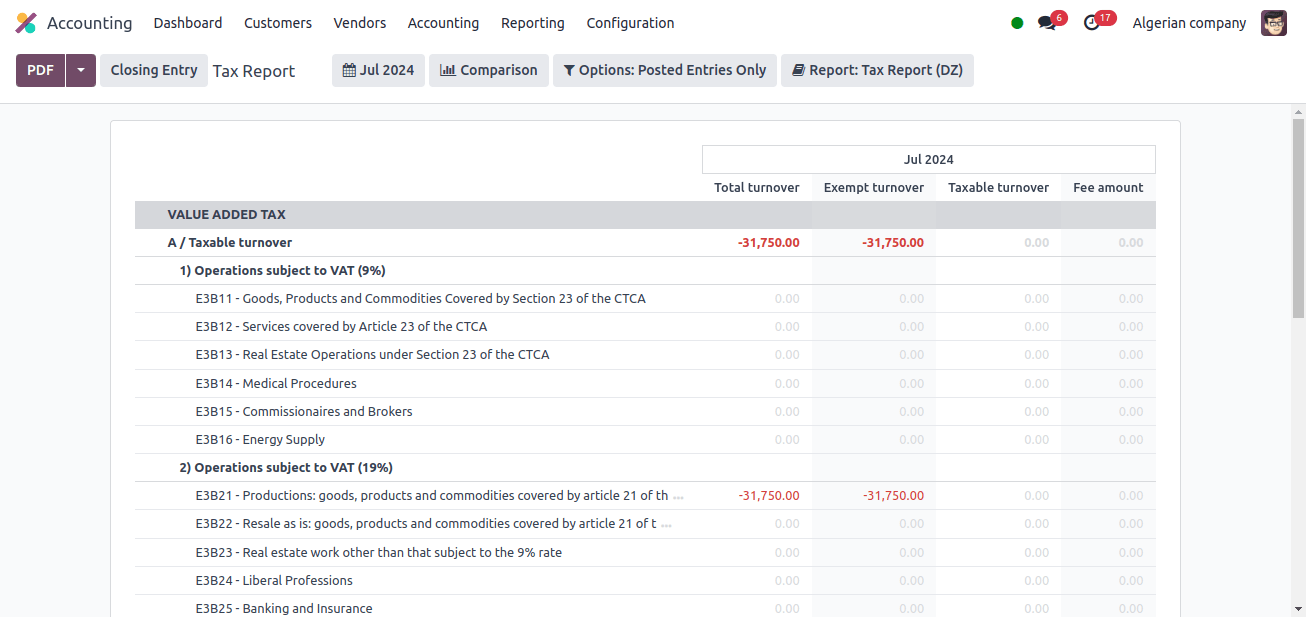

We can now look at the company’s tax report. There will be a Tax Report sub-option in the reporting menu. When we look at the report, we will see Taxes with various names.

The Tax Report shows a variety of tax types and amounts. Taxable turnover, operations subject to VAT, deductions to be made, totals to be recalled, and so on.

Taxable turnover: This refers to the total amount of money received from the sale of products or services subject to taxes. In essence, it is the sales figure used to calculate taxes such as VAT.

Operation subject to VAT: The total amount obtained from the sale of taxable products or services. In essence, it is the sales figure used to calculate taxes such as VAT.

Deduction to be made: These are the expenses that your business incurs and that the tax authorities allow you to deduct from your gross income. As a result, the amount of taxable income withheld from your taxes decreases.

Total to be recalled: Tax reports typically do not include ‘recalls,’ but instead focus on income and expenses that affect your tax liability.

We can also observe in the tax report that, according to the tax grid, every tax report line is recorded.

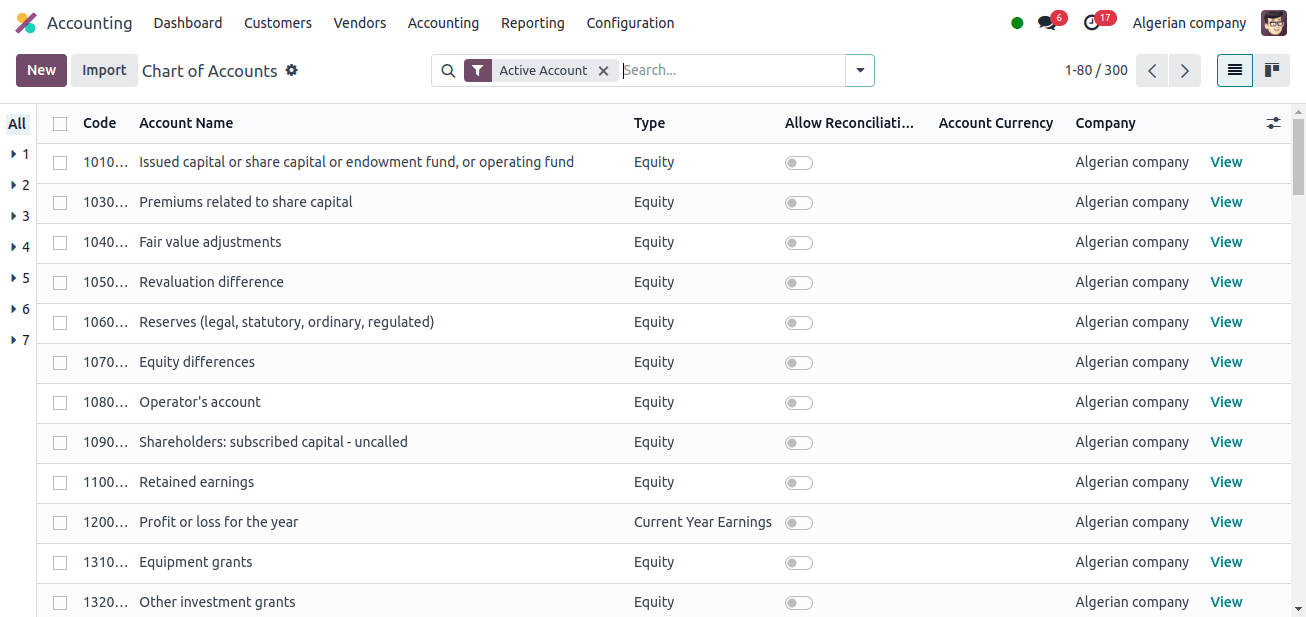

Then we can look at the charts of accounts used by all Algerian enterprises. There will be several types of accounts used by companies from various countries. Let’s look at the Algerian company’s chart of accounts.

The names of the accounts in this chart vary from those in other business charts from other nations. These are the accounts that are specifically designed for Algerian businesses.

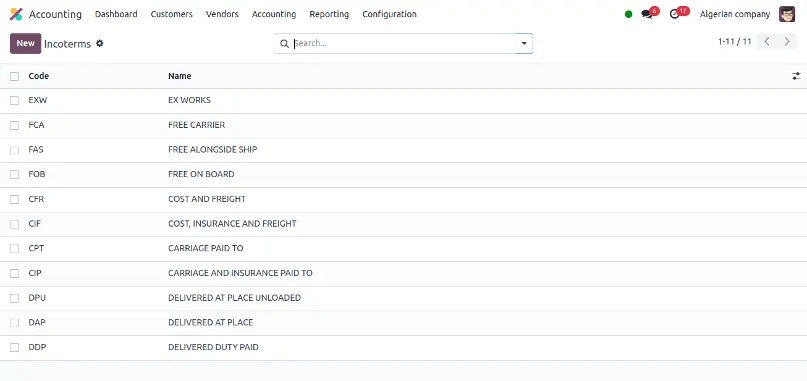

The following one is Incoterm. The International Chamber of Commerce (ICC) publishes Incoterm, a standardized set of principles that define the obligations of both buyers and sellers in international commercial transactions.

The Incoterm sub-menu is located under the configuration menu. Clicking on the Incoterms reveals the several Incoterms that are listed, which Algerian companies can use.

Under the Configuration menu, there is a Fiscal Position sub-menu; click on it. The fiscal stance governs the application of taxes and accounting on transactions.

In essence, it helps you adhere to the many accounting standards and tax requirements that apply in different jurisdictions.

The image above shows all of the Fiscal Positions established for Algerian businesses. Algerian businesses can now use these fiscal positions for their accounting processes.

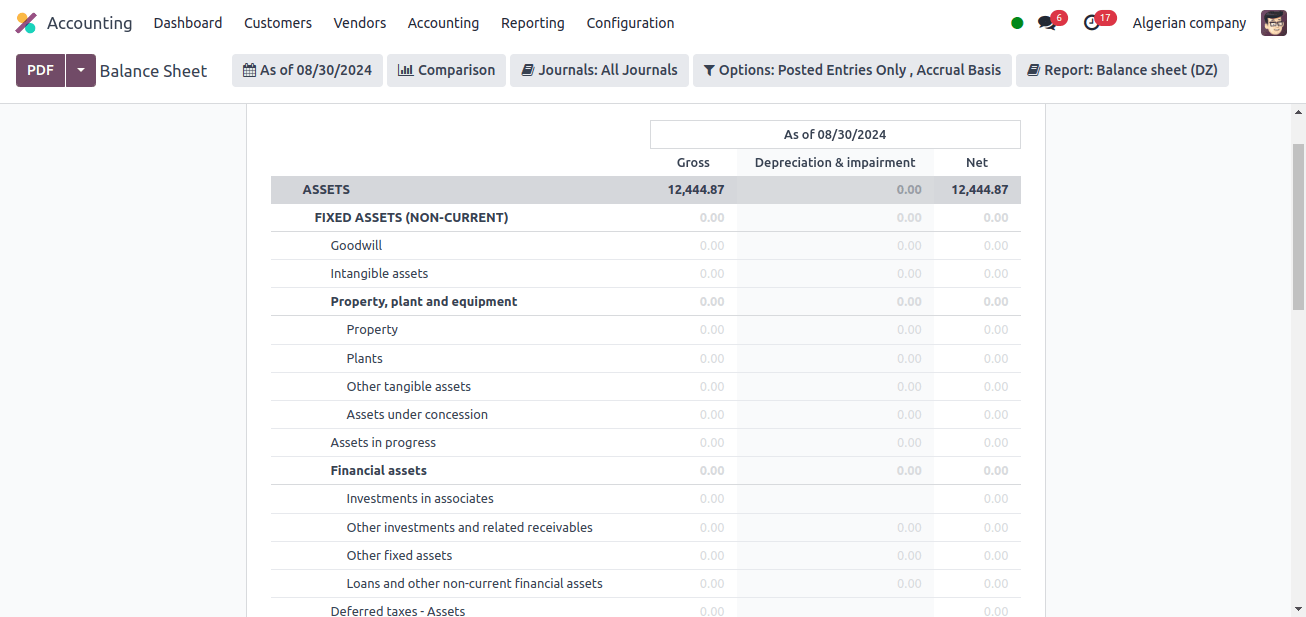

The primary terms on the Balance Sheet are assets and liabilities. However, for Algerian enterprises, assets are further classified as goodwill, intangible assets, tangible assets, property, plant and equipment assets, financial assets, current assets, receivables and similar usage, cash and cash equivalents, and so on.

The balance statements also include liabilities. Liabilities are again classified as equity, non-current liabilities, and current liabilities.

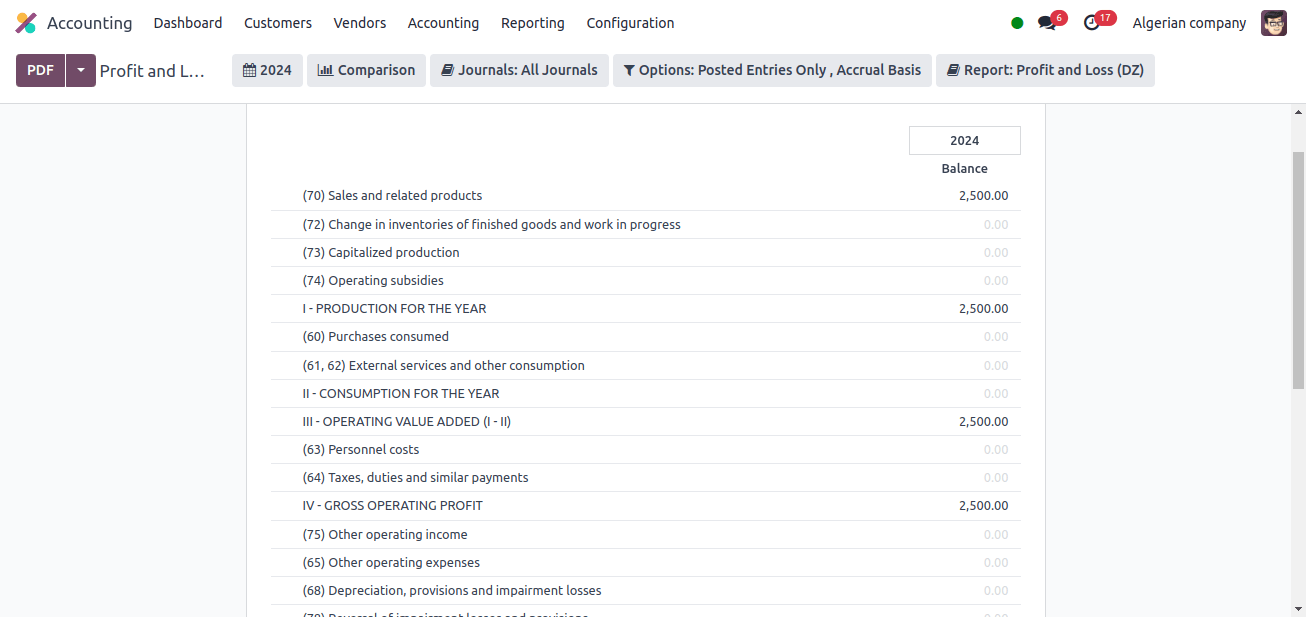

Then we may examine the profit and loss of Algerian enterprises, and all profits and losses are taken into account using these lists of accounts. Different accounts are used to represent different levels of profit and loss.

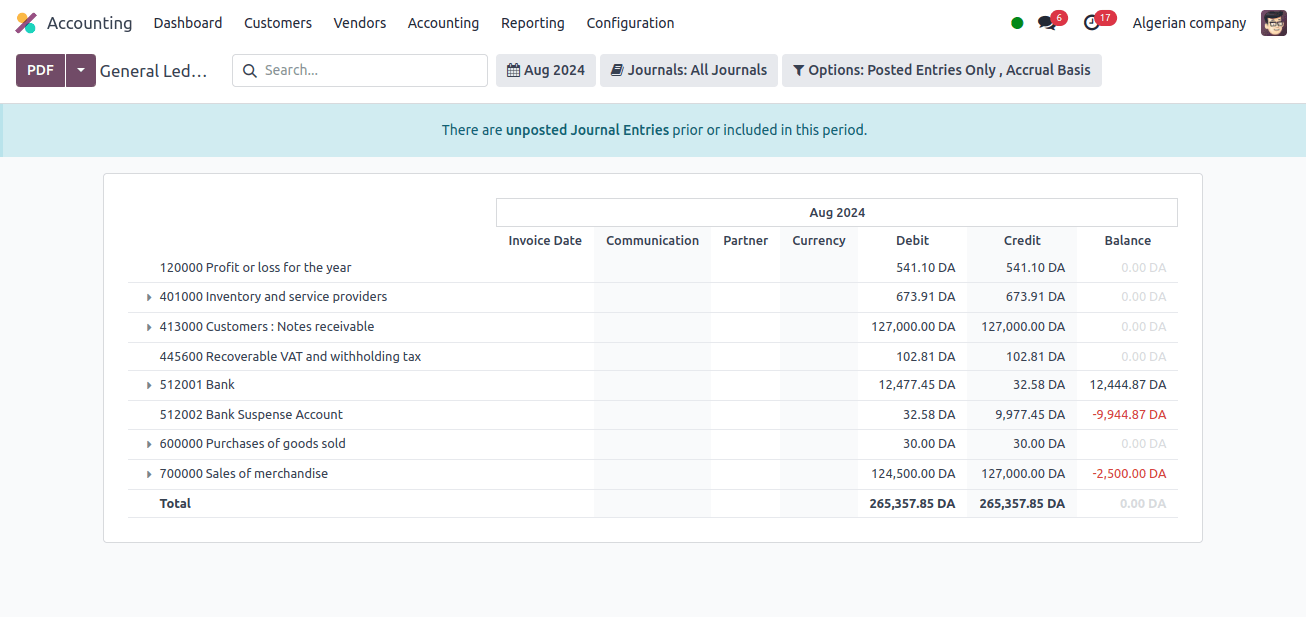

Now, we can view the Algerian company’s General Ledger by selecting the General Ledger sub-menu from the Reporting menu.

The General Ledger serves as a central repository for all of your financial transactions, providing a detailed view of every financial activity that occurs within your business. The general ledger that Algerian enterprises can use is fully offered.

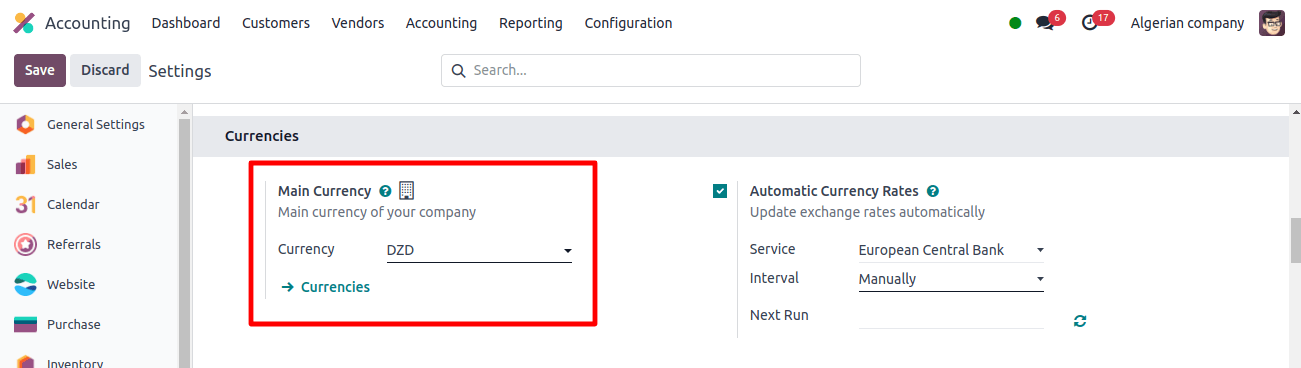

We know that the currency used in Algeria is the Algerian dinar, abbreviated as DZD, thus when we create the Algerian localization, the Algerian dinar should be the company’s principal currency.

In the Currencies section of Configuration > Settings, we can see that Odoo 17 has set the Algerian dinar (DZD) as its main currency.

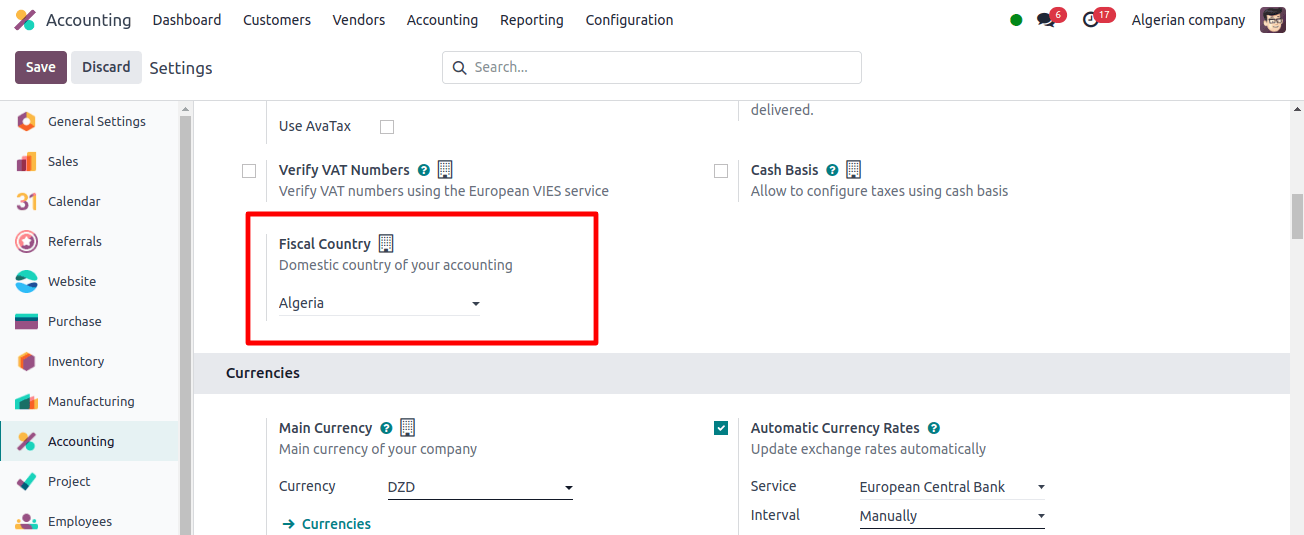

In the Taxes section, we discovered that the fiscal country is Algeria. Odoo 17 automatically configures the Fiscal country when we add a certain package. So, when we configure the package to ‘Algeria’, Odoo 17 will automatically set the fiscal country to Algeria.

The localization function in Odoo 17 for accounting operations provides a comprehensive solution that is customized to the specific requirements and legislation of various places.

Odoo 17 allows businesses to improve reporting accuracy, increase compliance, and streamline financial processes by adding country-specific standards.

Localization allows businesses to meet regulatory obligations, manage complex tax systems, and gain a better understanding of their financial performance.

Finally, Odoo 17’s accounting localization helps businesses to operate effectively in global markets while adhering to regional financial standards, providing growth and sustainability.