Maintaining current and detailed financial records is important for running a successful business. Having precise data allows us to determine whether the company is profitable.

Accounting allows businesses to maintain an organized system for recording all financial activities and analyzing income, expenses, assets, and liabilities.

This financial data lets you see a comprehensive picture of the company’s overall economic health and make informed decisions to maintain or improve it.

In Odoo 17, the chart of accounts is a list of all the accounts used to record financial transactions. Accounts are often divided into categories and subcategories.

All accounting transactions are recorded in accounting journals. Businesses may appropriately maintain and organize their accounting information by using journals properly. In Odoo, we have taxes to manage the taxation aspect of business transactions.

Importing a chart of accounts, journals, and taxes can be extremely valuable for companies that want to optimize their data input operations or migrate data from another system. Importing data allows us to add many data records quickly and efficiently, saving time over manual entry.

In this article, we’ll look at how to import the chart of accounts, journals, and taxes into the Odoo 17 database.

Importing Chart of Account in Odoo 17

A chart of accounts is a list of all the accounts that are used to record financial transactions in a company’s general ledger. It often has a hierarchical structure, with accounts divided into categories and subcategories.

To import the chart of accounts, first download the import template. After downloading, you can modify the template before uploading it to the Odoo database.

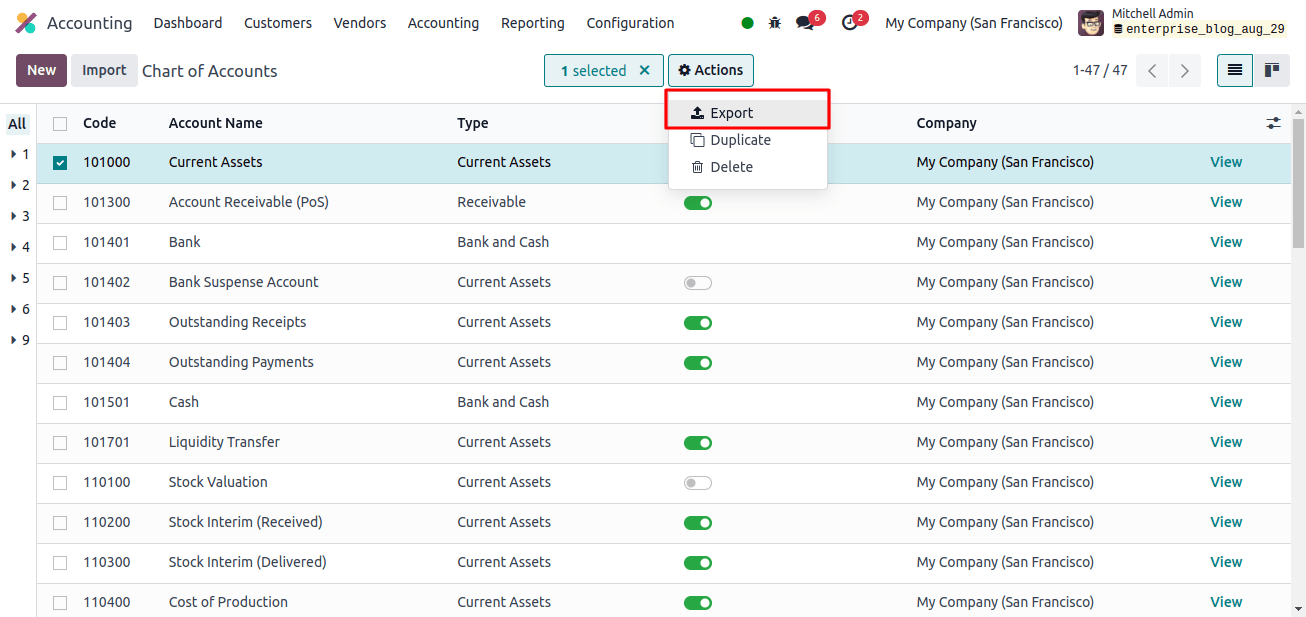

To obtain the required template, we must first go to the accounting application. What about configuration? Chart of accounts. Select a chart of account records and then click the Actions button to get the export option.

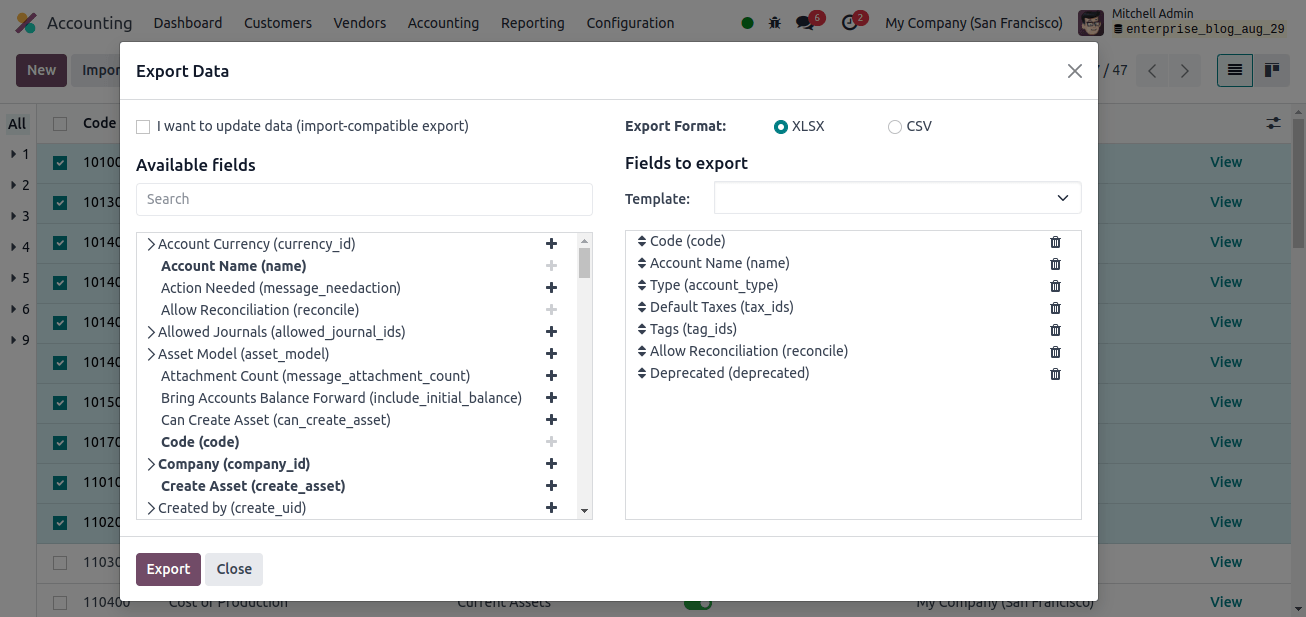

When you click export, a new window appears with the available fields on the left and the fields to export on the right.

By clicking on the Add icon, we can select the fields that we wish to export and add them to the export field. A name can be given to the template to save it, and this template can be used several times while exporting data.

There is also an option called I want to update data (import-compatible export). If we select this option, only fields that can be imported will be displayed.

If we wish to change any existing data, we may add an external ID field to the file exporting to identify which data needs to be modified.

When we import the data, Odoo assigns the field to the unique ID provided. When the field is unchecked, all fields are displayed, not only those that can be imported, providing you with a much wider range of field selections.

We can export in two formats :.csv and .xlsx. To reveal more sub-field possibilities for each field, click the > (right arrow) button, then use the search bar to select specific fields.

We may also drag and drop fields to arrange them in the desired order in the exported file, and we can delete superfluous fields using the trash icon.

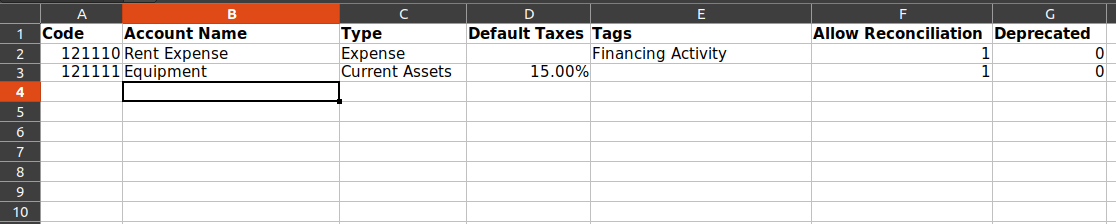

We can add the following fields to the export:

Code: In this field, we can enter the unique code provided to each account for identifying purposes.

Account name: The account’s name helps to define its purpose or nature.

Type: Account types include assets, liabilities, expenses, revenue, and equity.

Default taxes: Specifies whether default taxes should be applied to account transactions.

Tags: Tags are used to categorize and filter content in the account.

Allow Reconciliation: This field allows us to declare whether the account is reconcilable or not. It is a boolean field; we can return 1 if it is reconcilable, otherwise 0.

Deprecated: This is likewise a boolean field in which we can enter 1 if the account should be kept inactive and 0 otherwise.

After selecting all the fields to export, click the export button to export the template. Also, change the template to meet your specific needs.

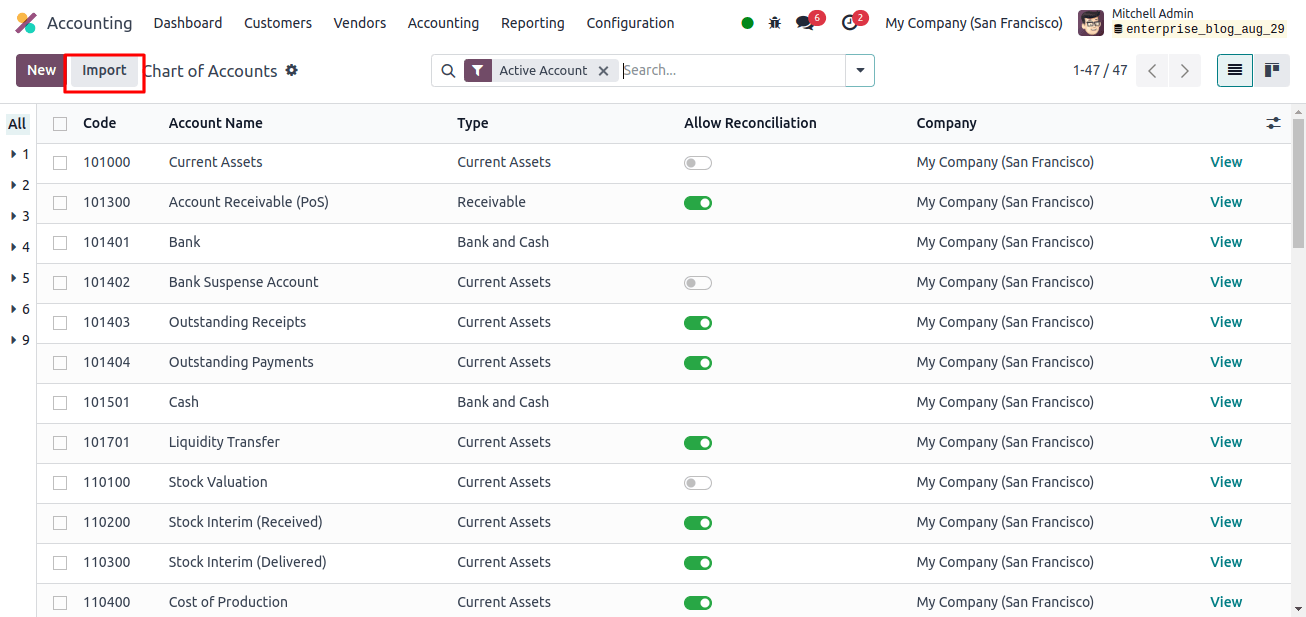

After customizing the CoA template spreadsheet, we may return to the website and click the Import button in the upper left corner.

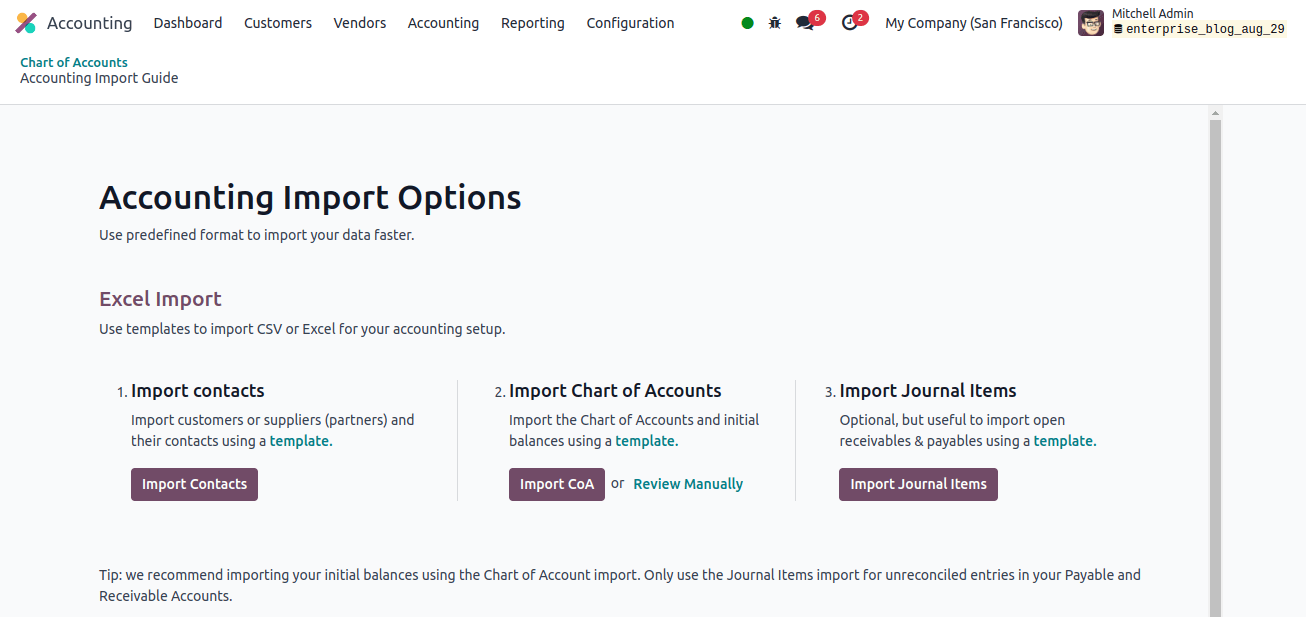

We have the opportunity to import the certificate of authorization. Click on it.

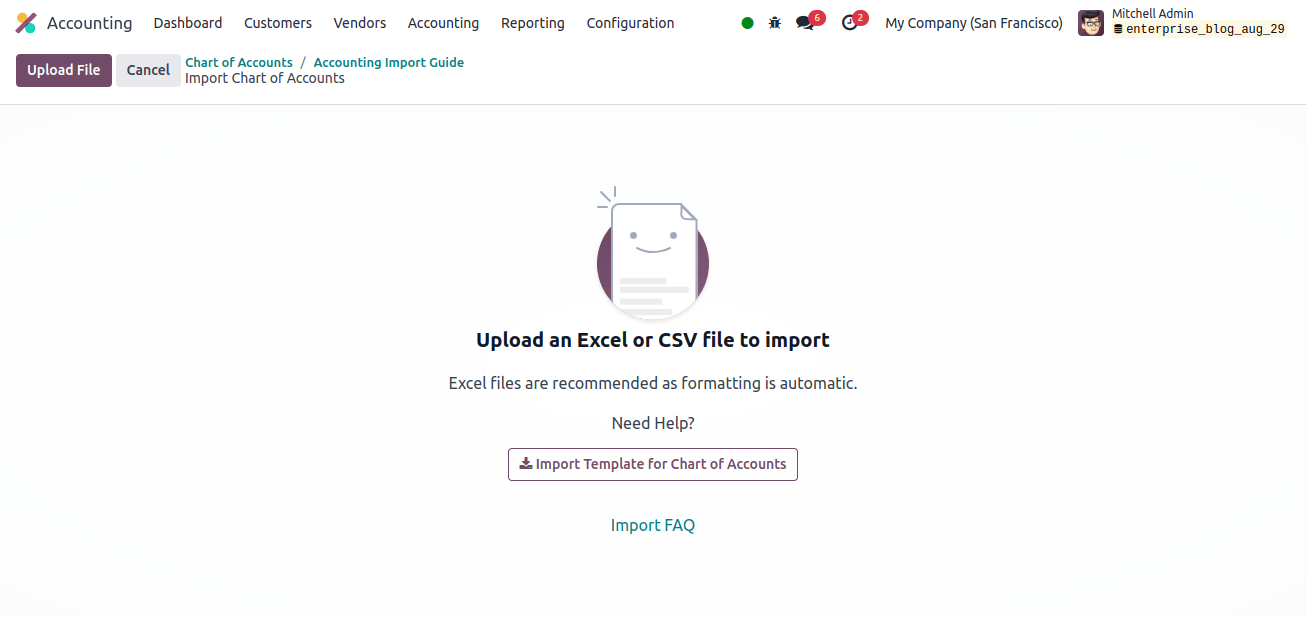

A new window emerges, with an option labeled upload file to upload the file from our system at the top left.

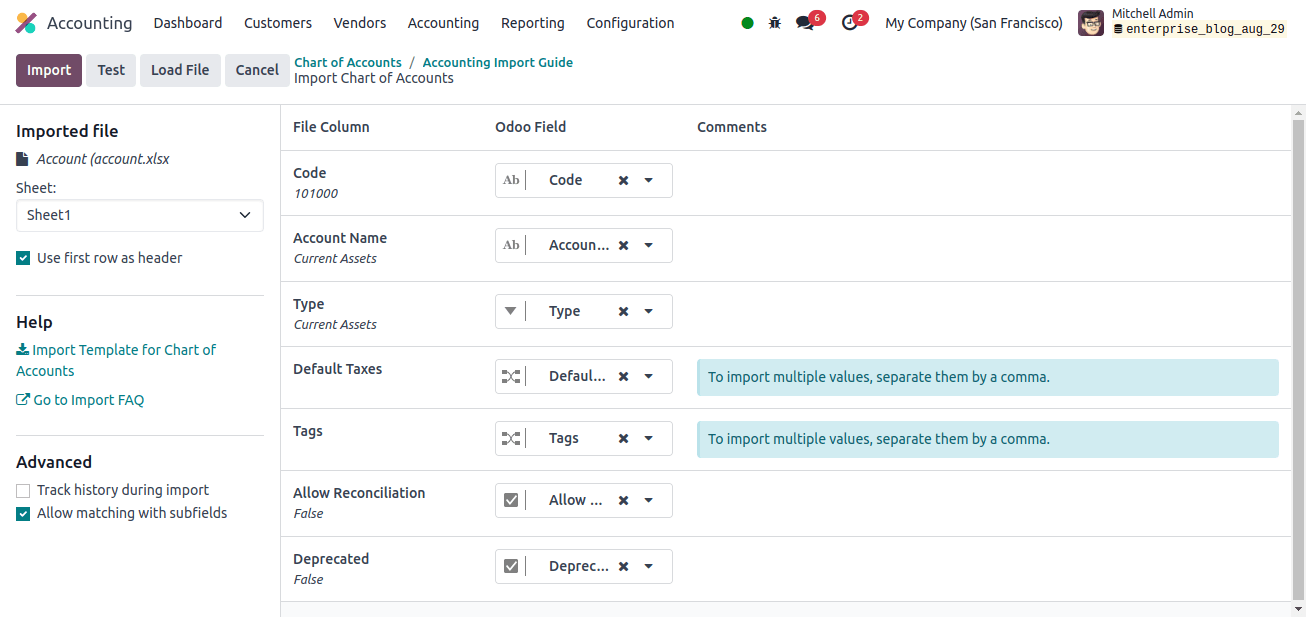

After uploading the file, a page with all of the elements of the newly configured vendor template spreadsheet, including the file column, Odoo field, and comments, appears.

From this page, we may manually assign the file column to the Odoo Field if necessary, and then click the test button in the upper-left corner to ensure that all columns and fields are properly aligned.

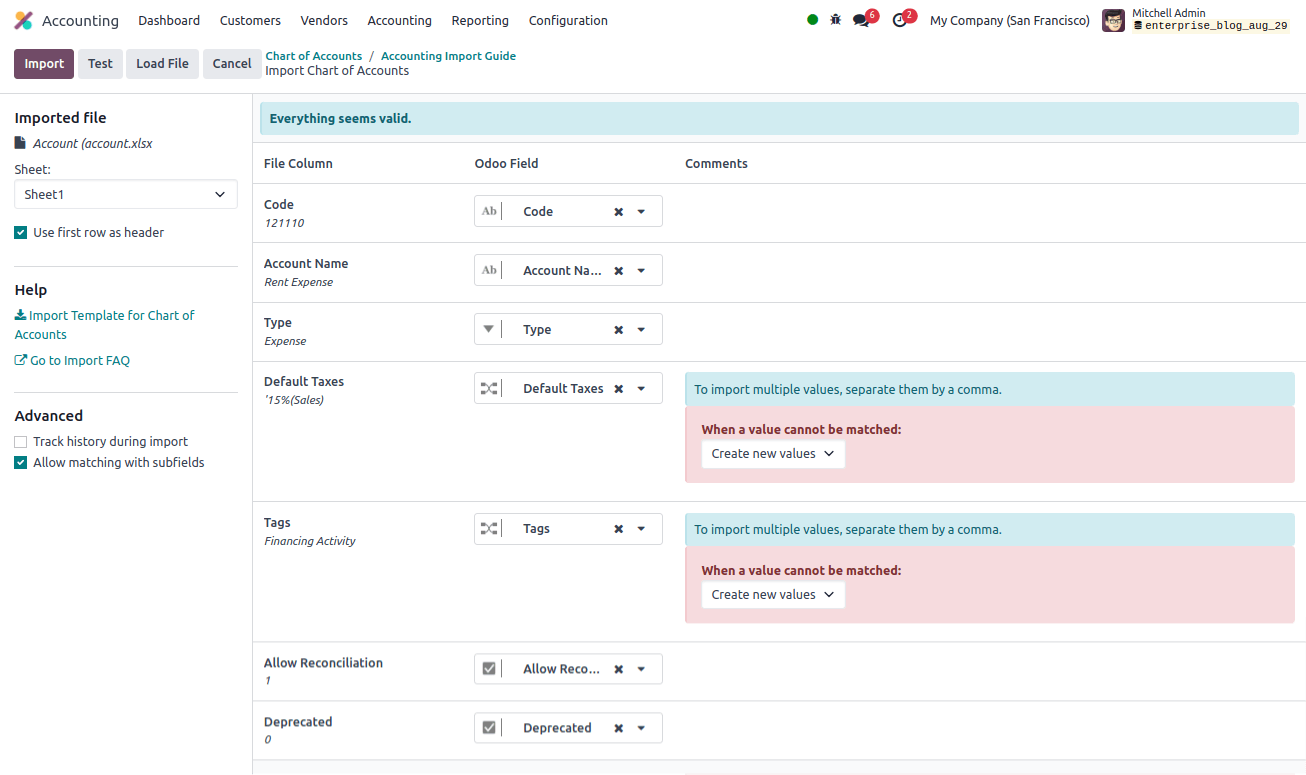

If everything is applied correctly, a blue banner appears at the top of the page, telling the user that everything appears valid.

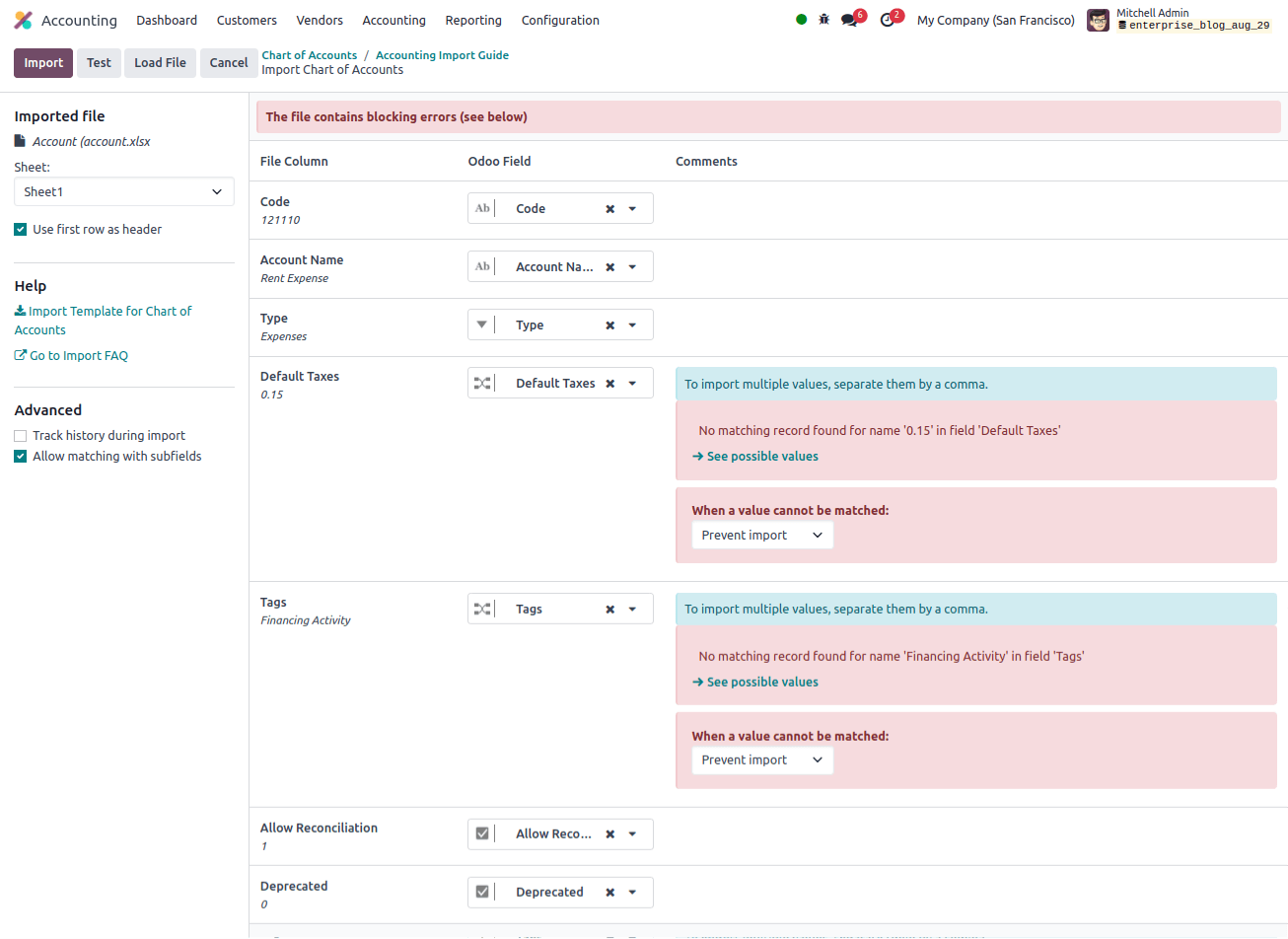

If any errors prohibit the records from being imported, a red banner will appear at the top of the page, along with advice on where to find and correct the individual errors.

In the image below, we see a red banner with an error message. We set the account type to costs, and the error message says that the value cost was not found in the selected type.

So, when a value cannot be matched, we may manually set the value from the drop-down menu, and we can set the default taxes field to ‘generate new values’ before clicking the test button.

If all problems are corrected, we will receive the message ‘Everything appears valid.’ Then, click the import option to import the records.

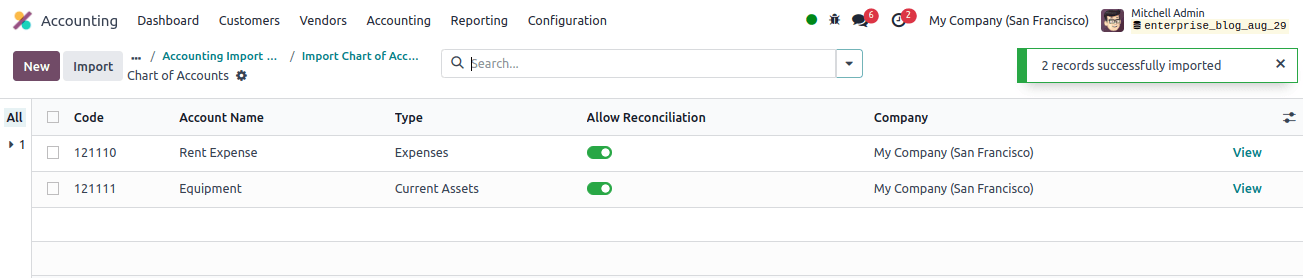

When the records are imported, a notice appears in the upper-right corner indicating how many charts of accounts records were successfully imported.

Importing Journals in Odoo 17

In Odoo, all accounting transactions are recorded in accounting journals. Each journal serves a specific purpose while also assisting with the efficient management of financial activities.

Odoo categorizes journals into five categories based on transaction type: sales, purchases, cash, bank, and miscellaneous.

We can use sales for client invoices, buy for vendor bills, bank and cash for payments, and a miscellaneous journal for other unspecified processes.

To import Journals, we first need to obtain the journal's import template. After downloading, you can modify and tweak the template before uploading it to the Odoo database.

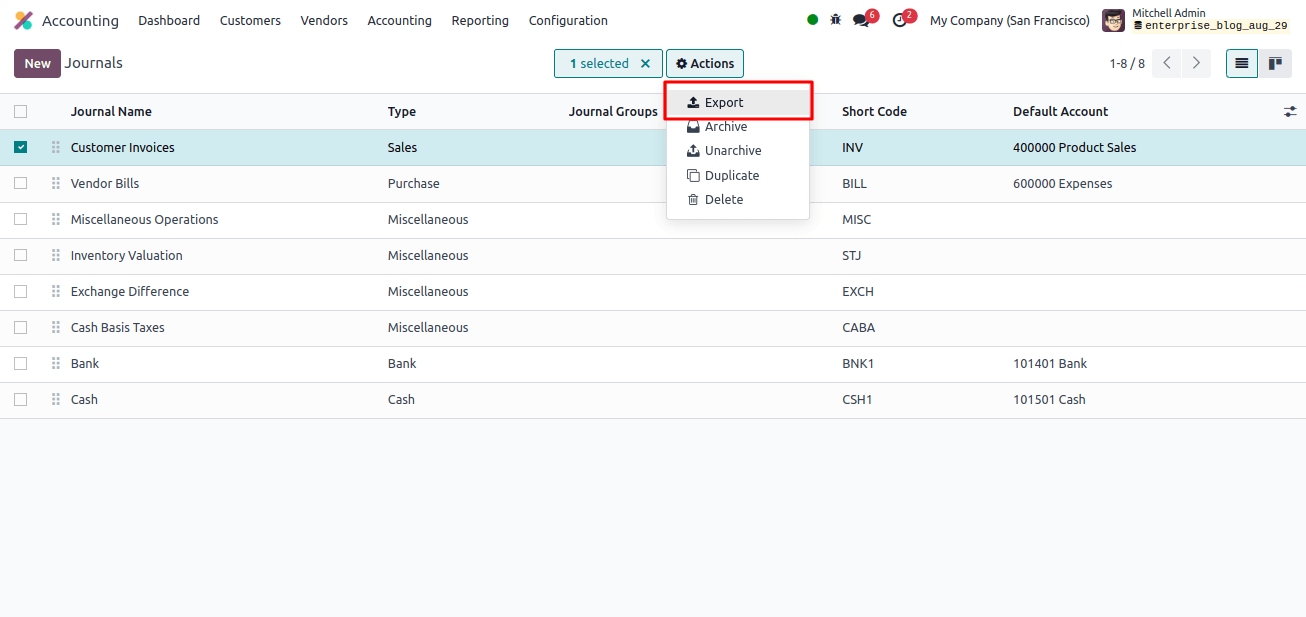

To obtain the right import template in Odoo 17, we must first go to the accounting application. Journals. On the journals page, select a record to export, then click the Actions icon to show the export option.

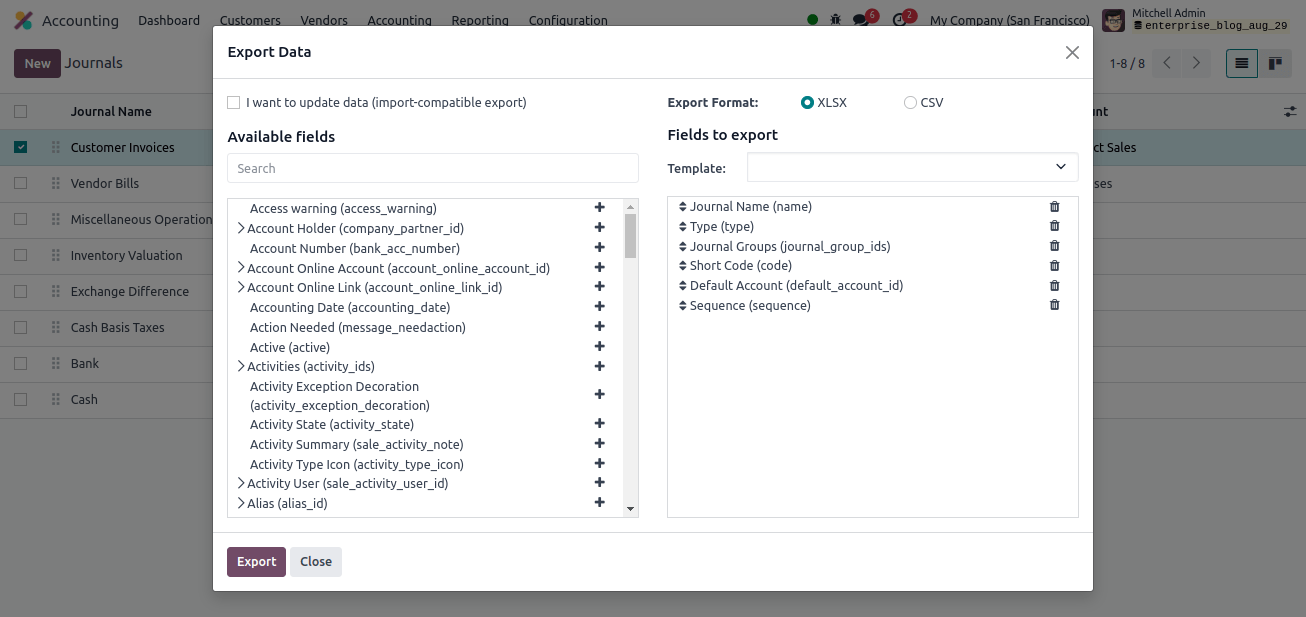

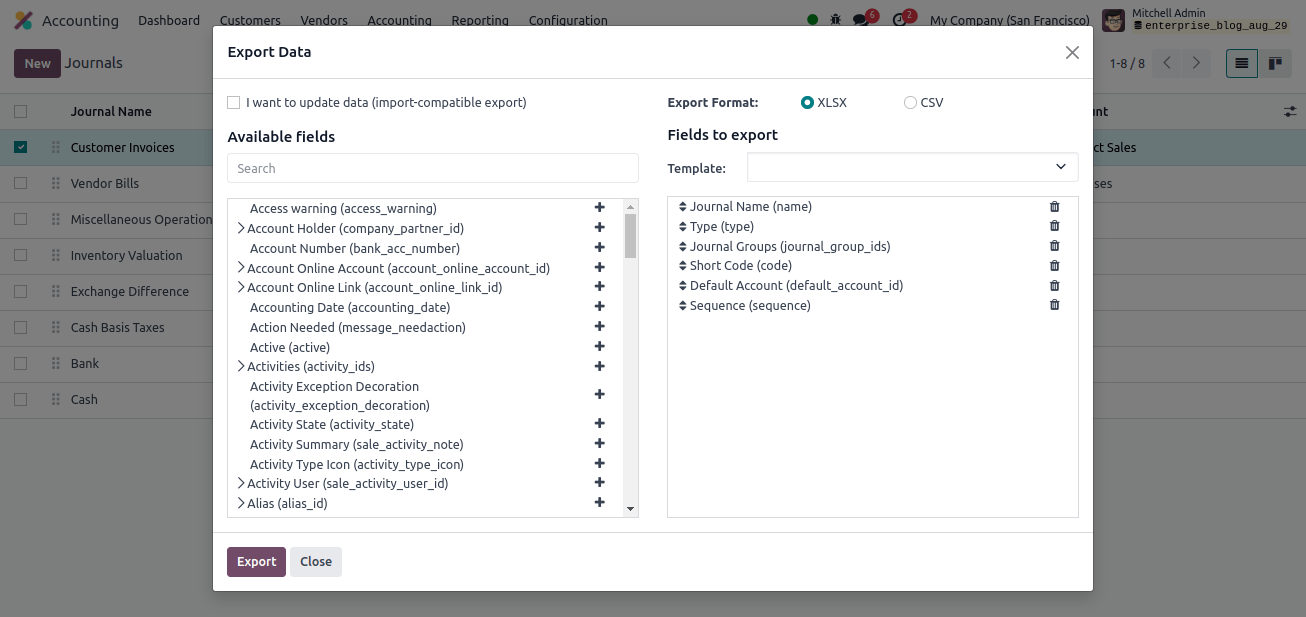

When you click export, a new window emerges, with available fields on the left and exportable fields on the right. By clicking on the Add icon, we can select the fields that we wish to export and add them to the export field.

A name can be given to the template so that it can be saved and reused if the data is exported several times.

There is also an option called I want to update data (import-compatible export). If we select that option, just the fields that can be imported are displayed.

If we wish to change any existing data, we may add an external ID field to the file we’re exporting to specify which data needs to be updated, and when we import the data, Odoo maps the fields to the unique ID provided.

When the field is unchecked, all fields are displayed, not only those that can be imported, providing you with a much wider range of field selections.

We can export in two formats: .csv and .xlsx. To reveal more sub-field possibilities for each field, click the > (right arrow) button, then use the search bar to select specific fields.

We can also move the fields into the desired order in the generated file and delete unneeded fields by clicking the trash sign.

Here, we are adding the following fields:

Journal Name: Display the name of the journal.

Type: This field allows us to specify the type of journal as sales, purchase, cash, bank, or miscellaneous.

Journal Groups: It is used to organize journals according to their purpose or function.

Shortcode: The shortcode for the journal.

Default Account: It is the default journal posting account for all transactions recorded in the Journal.

Sequence: Every journal has a predetermined sequence for numbering transaction documents. It specifies the sequence in which the papers will be numbered.

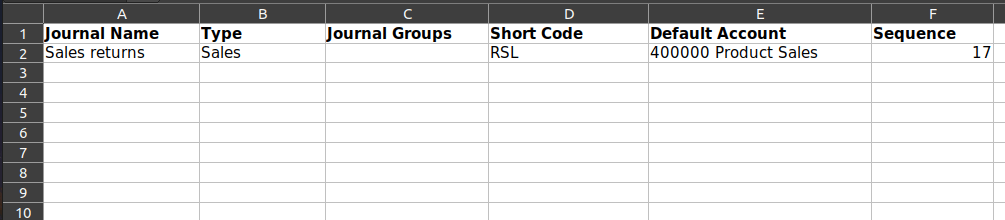

After adding all the fields to export, click the export button to export the template and adjust it as needed.

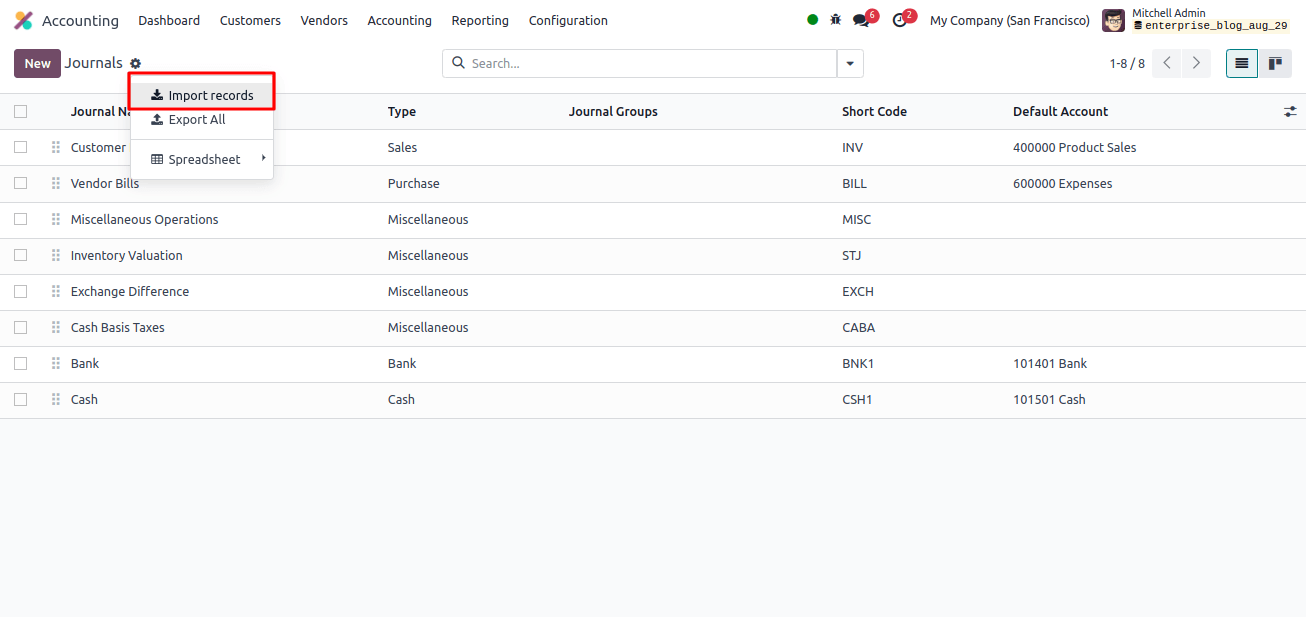

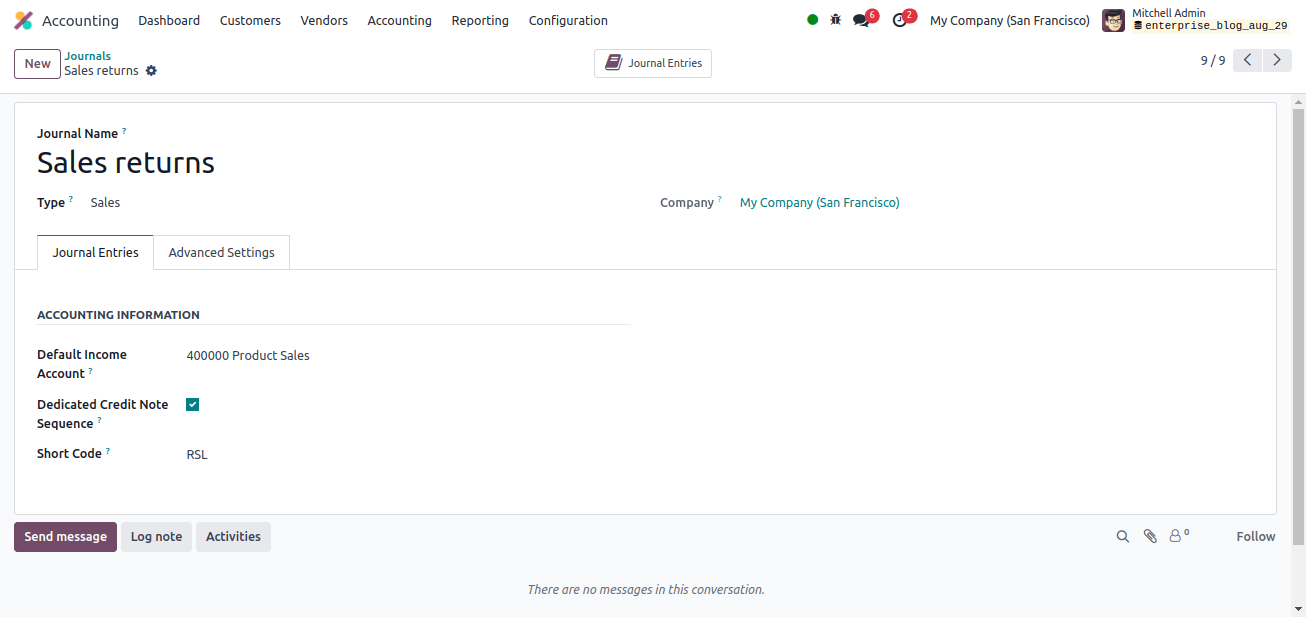

After we’ve customized the journal template spreadsheet, we can return to the journals page and click the gear icon. In the upper left corner, then select import records.

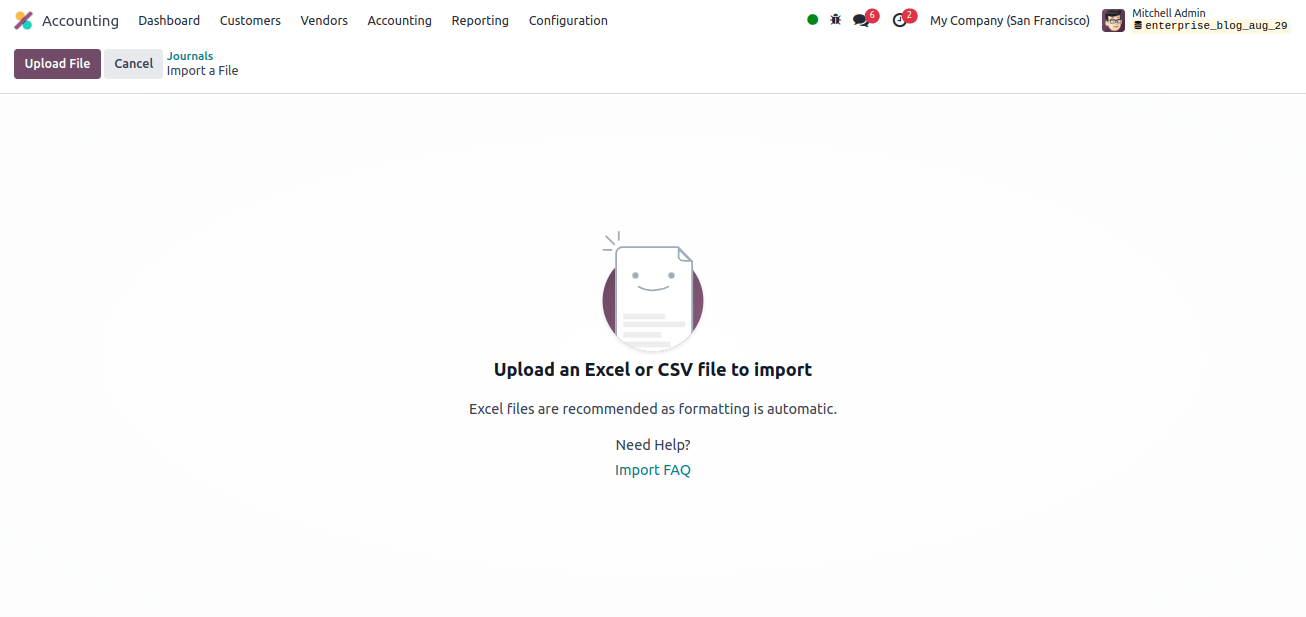

At the top left, we have the opportunity to upload a file from our system.

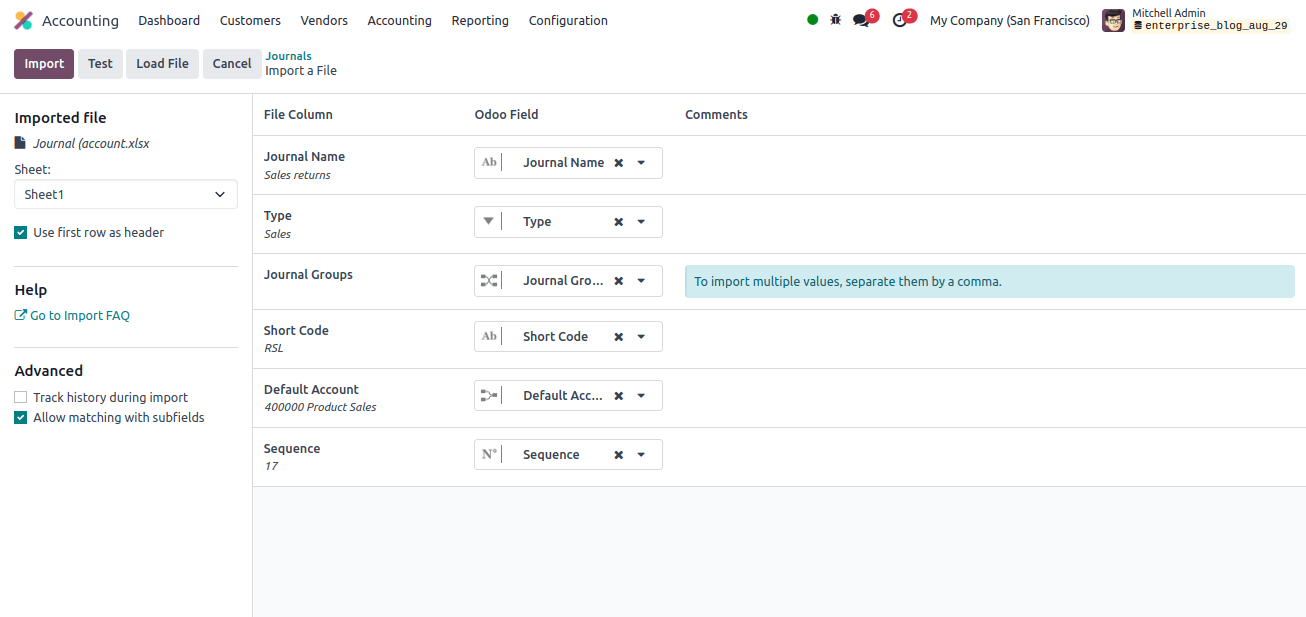

After uploading the file, a page with all of the elements of the newly configured vendor template spreadsheet, including the file column, Odoo field, and comments, appears.

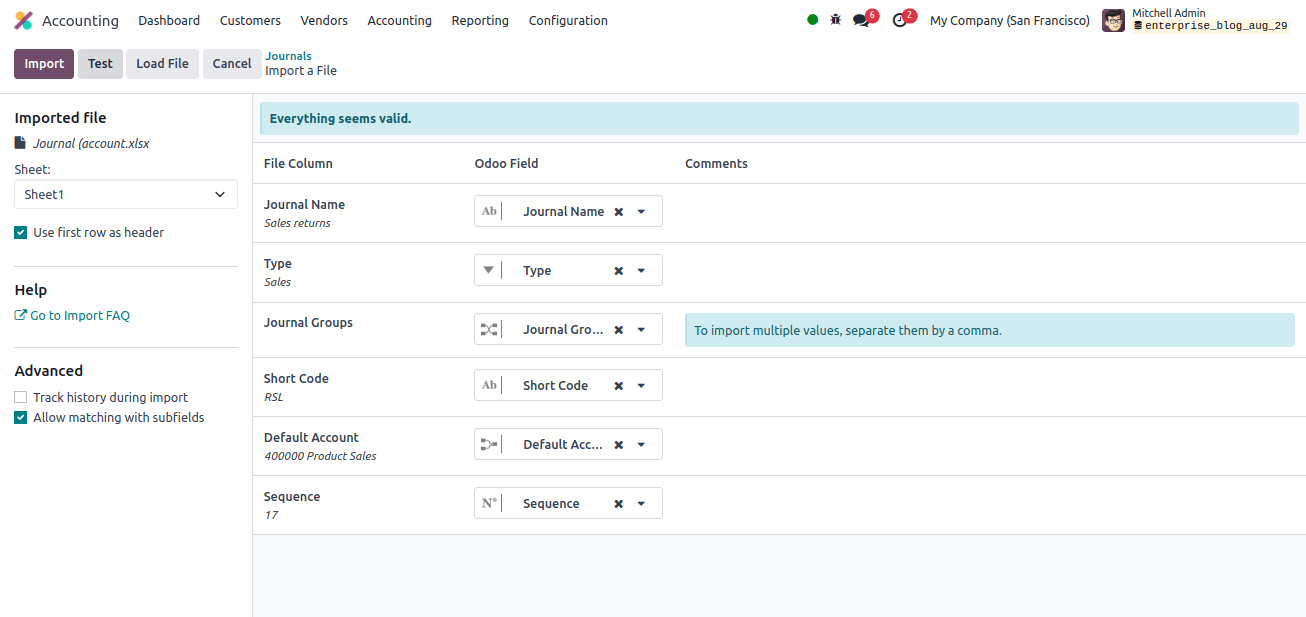

From this page, we may manually assign the file column to the Odoo Field if necessary, and then click the test button in the upper-left corner to ensure that all columns and fields are properly aligned. If everything is applied correctly, a blue banner appears at the top of the page, telling the user that everything appears valid.

If any errors prohibit the records from being imported, a red banner will appear at the top of the page, along with advice on where to find and correct the individual errors.

Once all the mistakes have been corrected, we may click the test button and import to the entities.

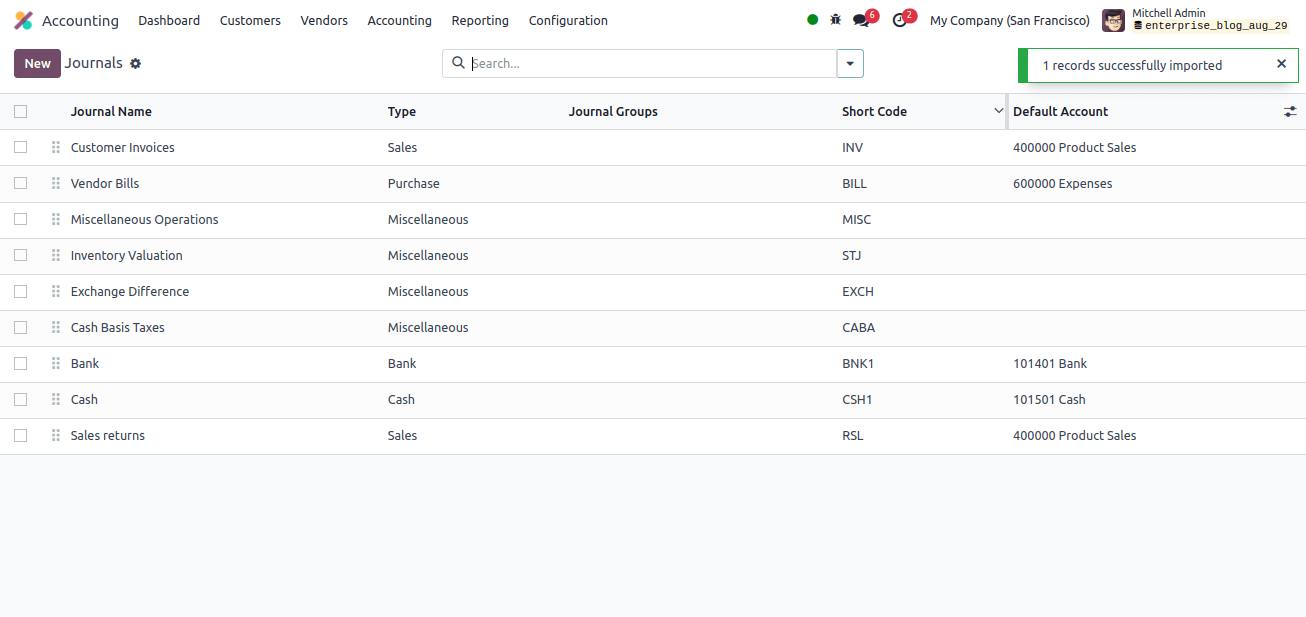

When the reports are imported, a notice appears in the upper right corner showing how many journal records were successfully imported.

The newly imported journal can now be seen, accessed, and edited from the journals page.

Importing Taxes in Odoo 17

Odoo includes taxes to manage all aspects of a business’s taxation. There are various types of taxes, and their applications vary greatly based on the location of the business. Odoo includes a variety of tax computation methods to ensure proper recording.

To import Taxes, we first need to download the tax import template. After downloading, you can modify and tweak the template before uploading it to the Odoo database.

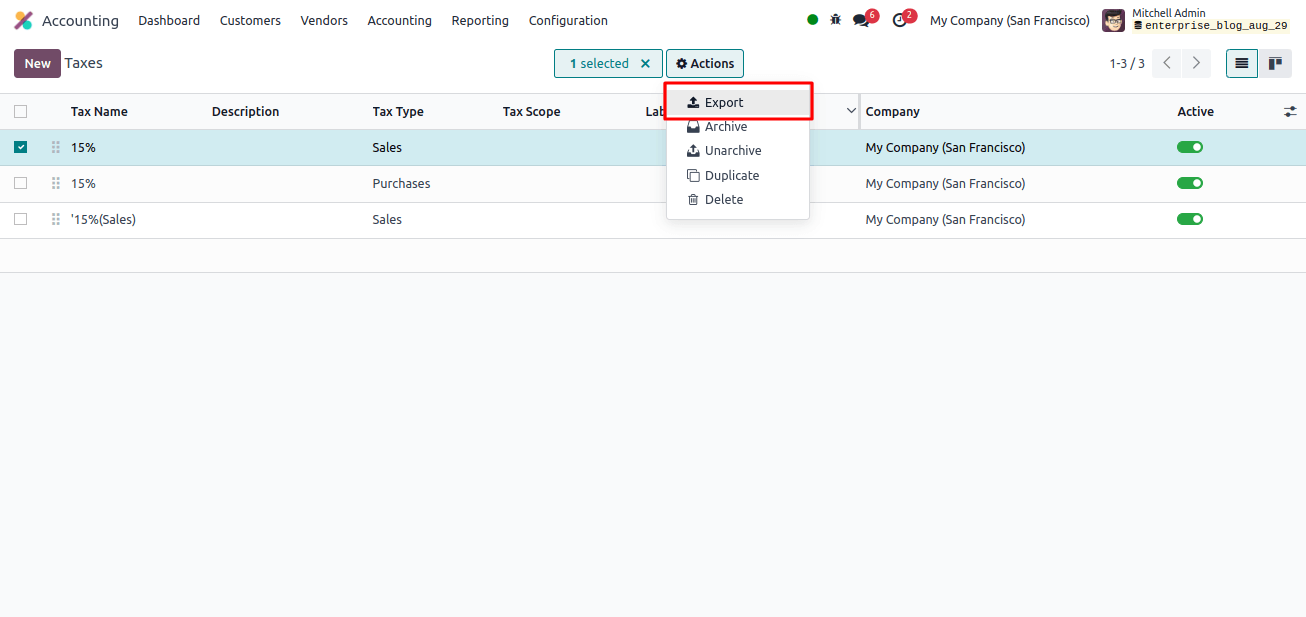

To import taxes in Odoo 17, do we first need to navigate to the Accounting application? What about configuration? Taxes. On the Taxes page, choose a record to export, then click the Actions button to show the export option.

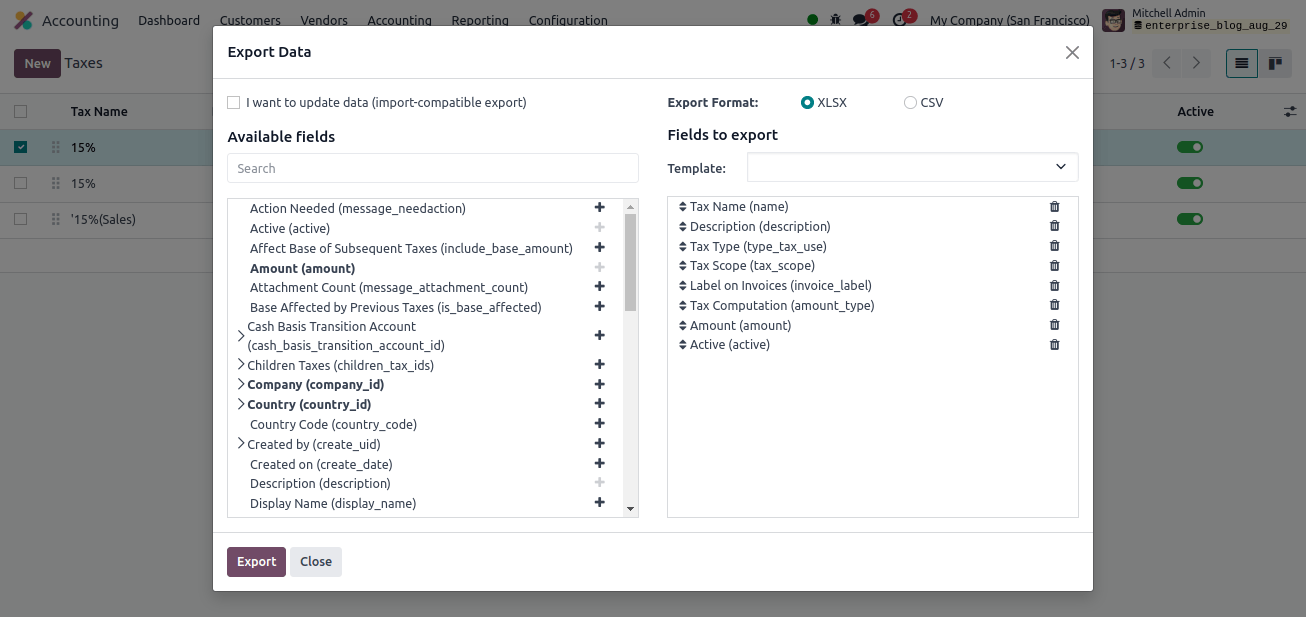

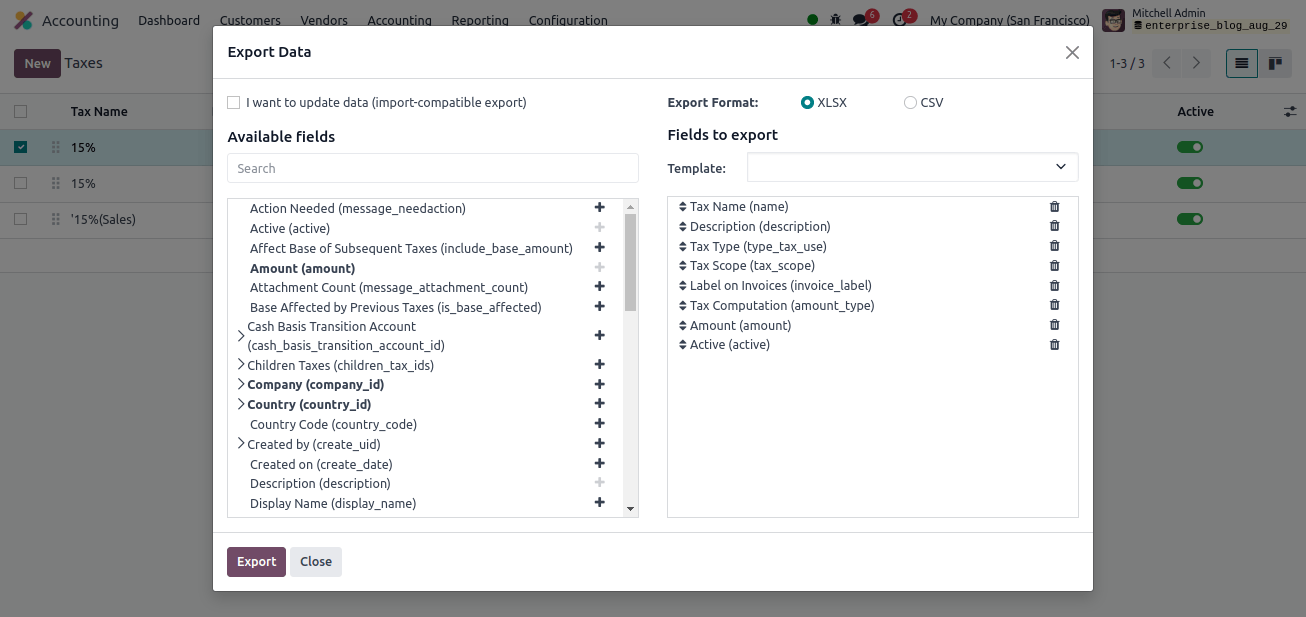

When you click Export, a new window will open, with available fields on the left and exportable fields on the right. The accessible fields list all that can be added to the template we are exporting.

Clicking the plus symbol in the area of the available field allows us to add the fields we wish to export to the ‘fields to export’ section.

A name can be given to the template to save it, and this template can be used several times while exporting data.

There is also an option called I want to update data (import-compatible export). If we select that option, just the fields that can be imported are displayed.

If we wish to change any existing data, we add an extra field called external ID to the file we’re exporting to identify the data that needs to be updated, and when we import the data, Odoo maps the field to the unique ID we gave.

When the box is left unchecked, all fields are displayed, not only those that can be imported, giving you a much larger number of field selections.

We can export in two formats: .csv and .xlsx. To reveal more sub-field possibilities for each field, click the > (right arrow) button, then use the search bar to select specific fields. We can also drag the fields into the desired order in the generated file and delete unnecessary fields using the trash button.

Here, we add the following fields:

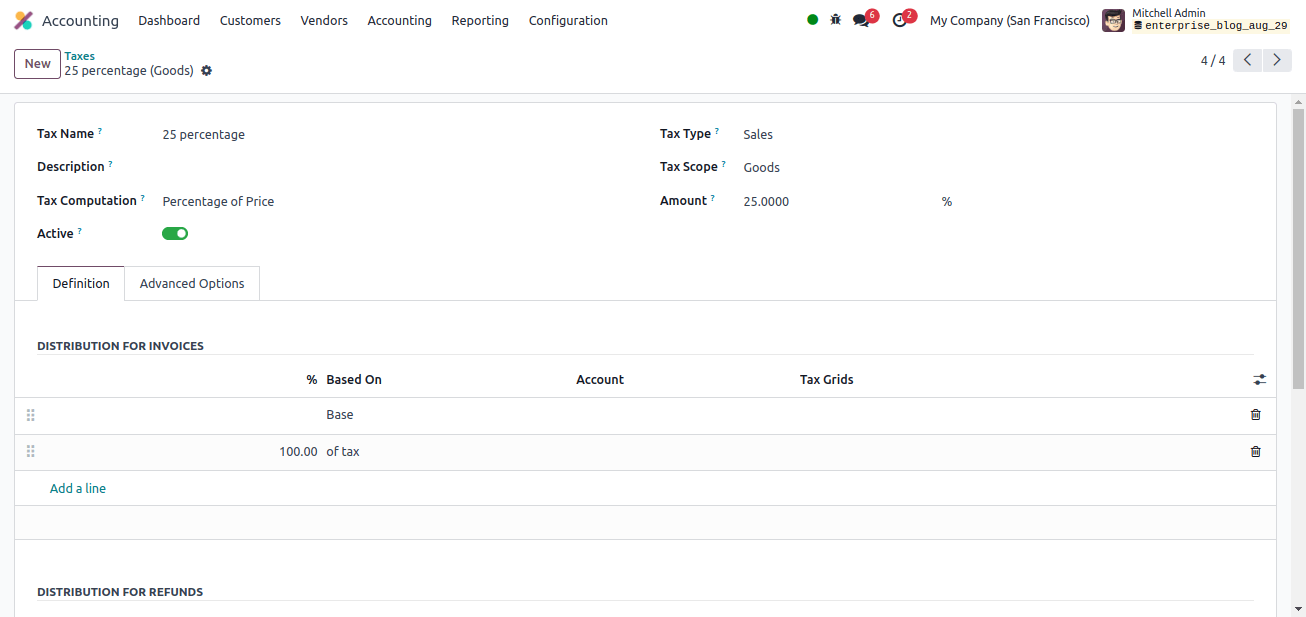

Tax name: Refers to the name of the tax we are creating.

Description: The description must be provided for taxes.

Tax type: It refers to the classification of a tax, such as sales or purchases, based on its purpose or nature.

Tax scope: We can limit the usage of taxes to certain types of products, such as goods or services.

Label on invoices: The invoice will include descriptive text or names linked with each tax.

Tax computation: It refers to the process of computing transactions based on predefined rules.

Amount: It shows the entire amount of tax calculated and imploded on transactions.

Active: This field specifies if the record is active or inactive.

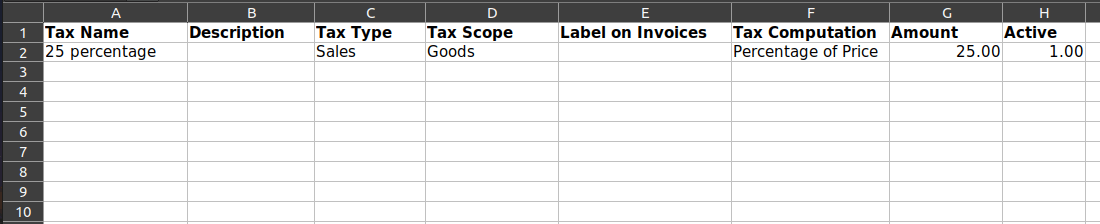

After selecting all the fields to export, click the export button to export the template. Also, change the template to meet your specific needs.

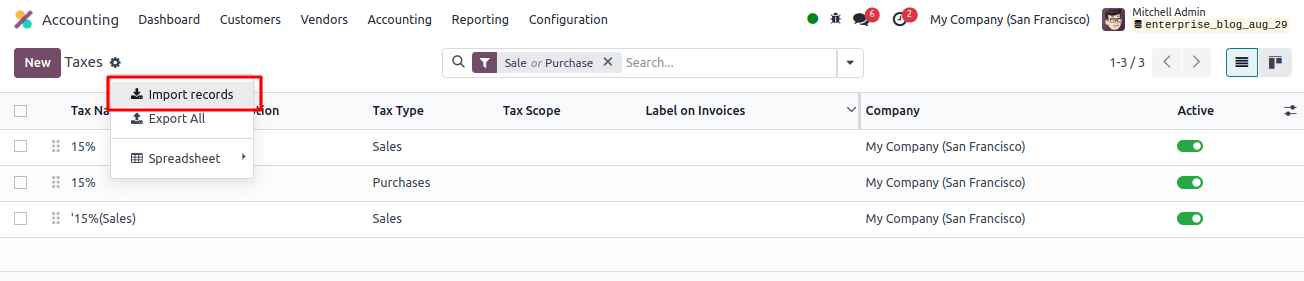

After we’ve customized the taxes template spreadsheet, we can return to the taxes page and click the gear button. In the upper left corner, then select import records.

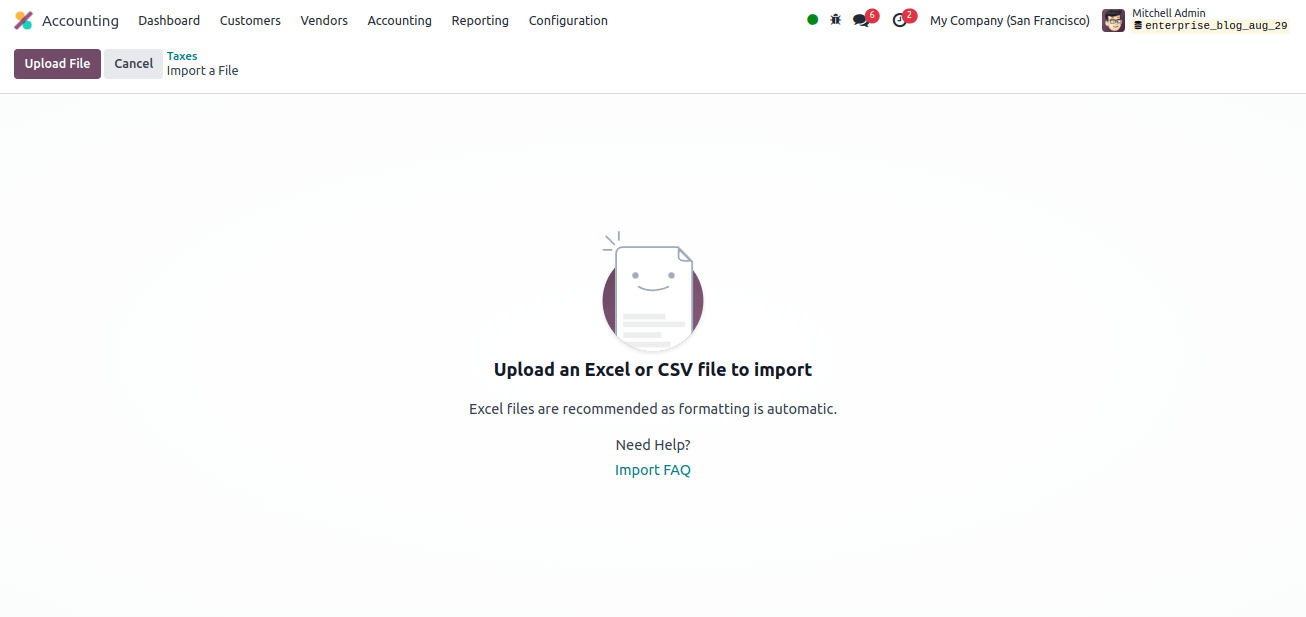

At the top left, we can upload a file from our system.

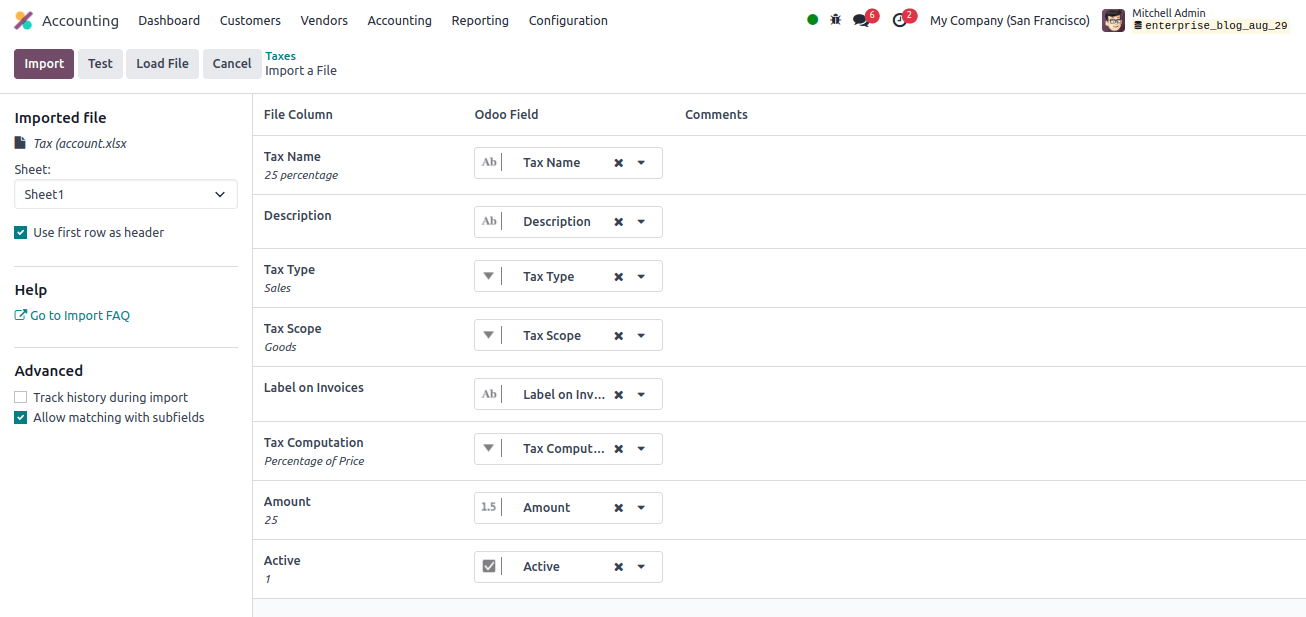

After uploading the file, a page with all of the elements of the newly configured vendor template spreadsheet, including the file column, Odoo Field, and Comments, appears.

From this page, we may manually assign the file column to the Odoo field if required, and then click the test button in the upper-left corner to ensure that all columns and fields are properly aligned.

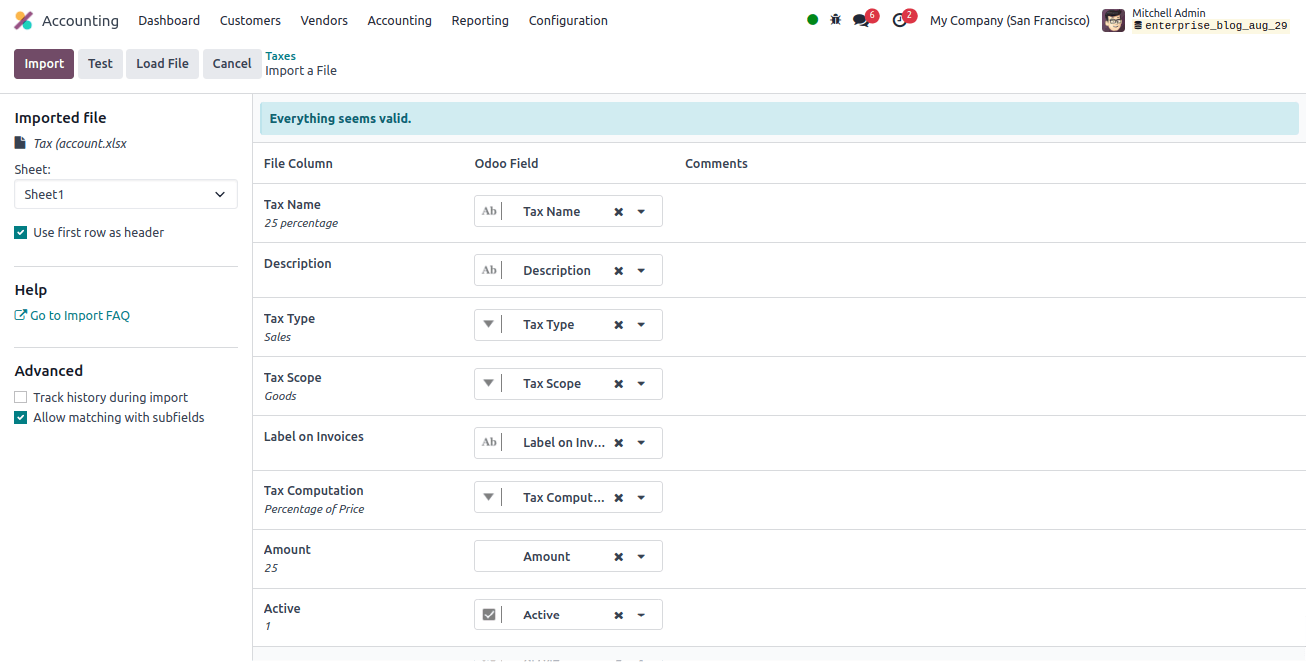

If everything is applied properly, a blue banner appears at the top of the page, telling the user that everything appears valid.

If any errors prohibit the records from being imported, a red banner will appear at the top of the page, along with advice on where to find and correct the individual errors.

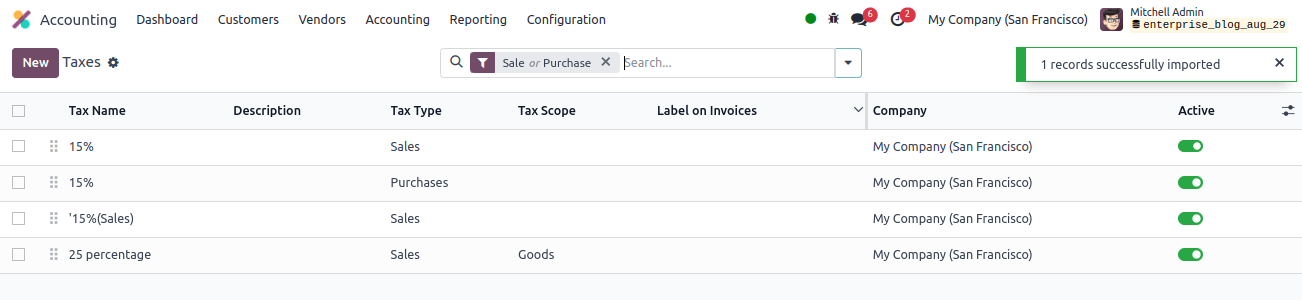

Once all of the mistakes have been fixed, we may click the test button and then the import button to import the entries. When the records are imported, a notice appears in the upper-right corner informing the user of the number of customers who were successfully imported.

We can now view all newly imported Taxes and update them from the Taxes page.

So far, we have seen the import of Charts of Accounts, journals, and Taxes into Odoo 17. The import feature in Odoo 17 makes it easy to add multiple records to the database.

Rather than manually importing bulk data into the Odoo database, we may do so all at once using the import option in Odoo 17.