The most recent version of the Odoo 17 accounting module includes a comprehensive set of features and powerful tools to assist you in managing all accounting activities.

Manual labor and financial management errors can be reduced by implementing Odoo ERP software accounting solutions. Proper use of the accounting module will improve the efficiency of your business's financial management.

Odoo 17 allows you to integrate the accounting module with other major database modules such as sales, purchase, POS, payroll, and others to help you do accounting tasks more efficiently.

The system’s workflow can continue uninterrupted thanks to this integration option. Also, it would make it easier for the company to manage and perform multiple accounting tasks on the same platform.

Odoo 17 offers a variety of invoice creation options. The technology allows you to create customer invoices either automatically or manually. Odoo automates the creation of invoices based on the module and actions you perform.

When you create a sales order in the sales module, you will receive a draft customer invoice once confirmed.

In this case, you only need to approve the draft invoice and complete the payment process. As sales orders are confirmed, invoices are automatically prepared.

Odoo also allows you to manually create customer invoices as needed. These invoices will be tracked and documented using the Odoo Accounting module’s Invoices menu.

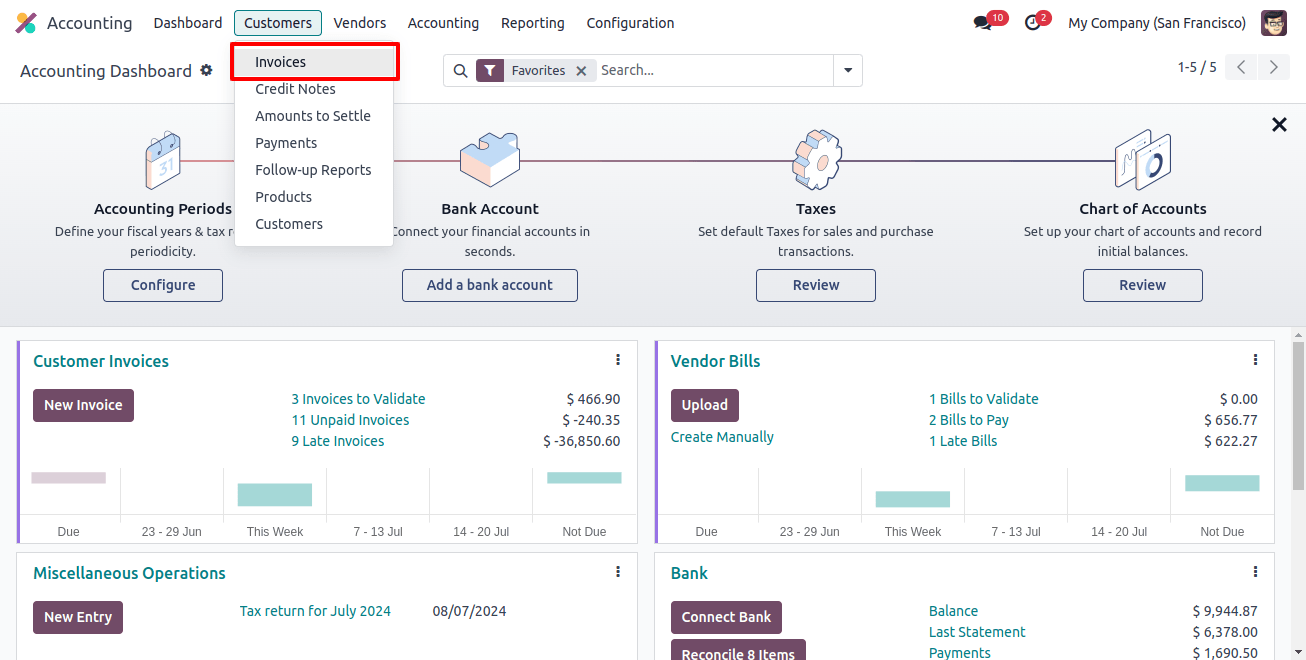

To reach this menu, click on the customer menu in the Accounting module and then click the Invoices option from the drop-down menu.

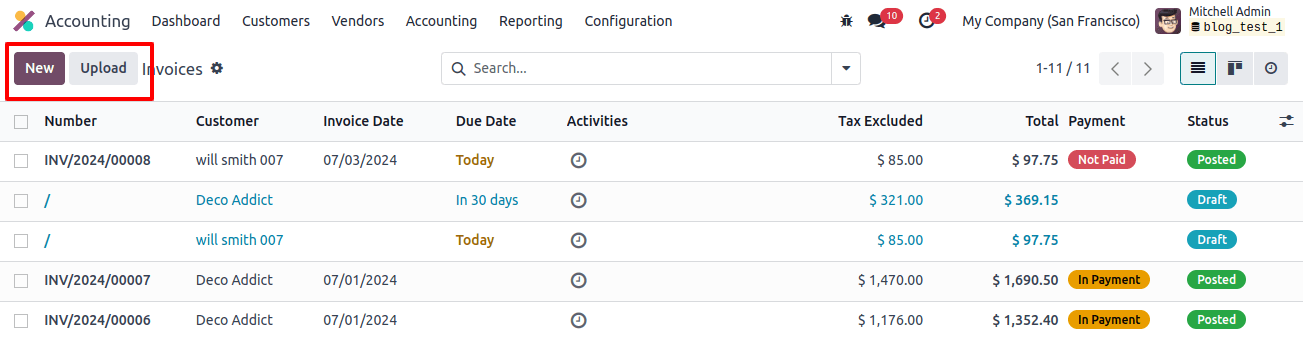

The image above shows a list of invoices generated for various operations across modules. The platform’s listview displays each invoice’s number, customer, invoice date, due date, activities, tax excluded, total, total in currency, payment status, and status.

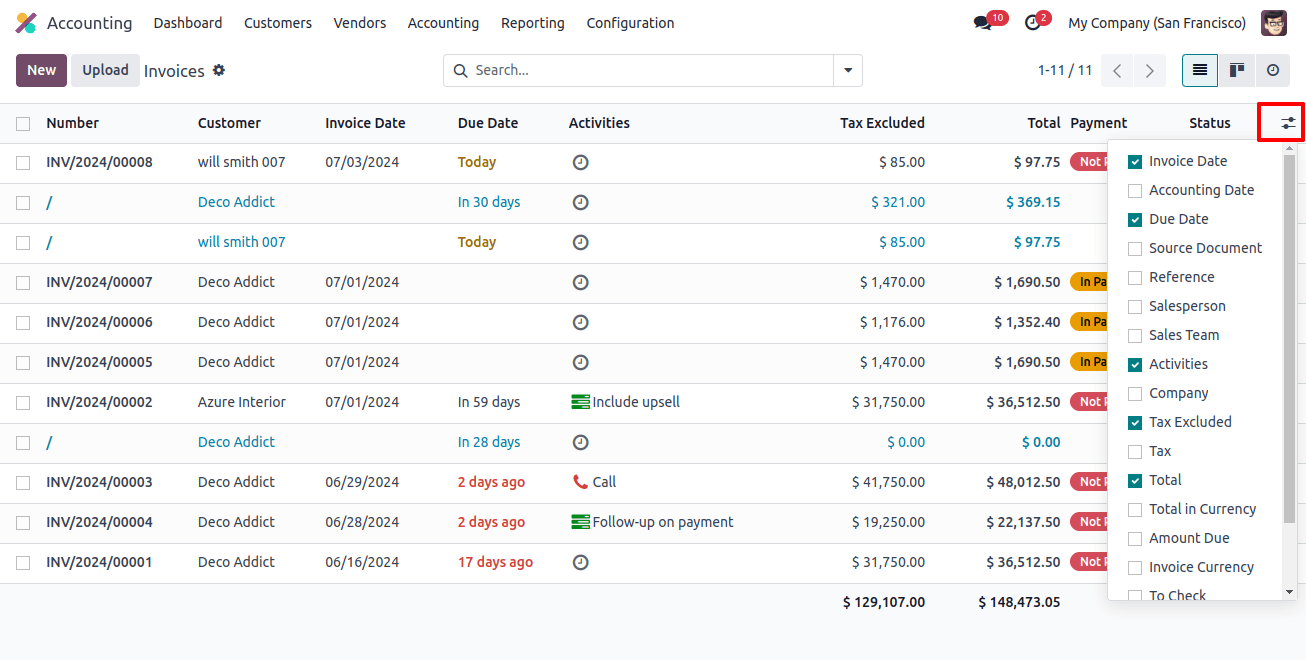

Use the highlighted icon next to the status box, as shown below, to add more information about the customer invoice to the list view that is now available.

This list includes the following fields that you can enable: To check, payment status, electronic invoicing, salesperson, sales team, activities, company, tax excluded, tax total, total in currency, the amount due, invoice currency, and date of invoice.

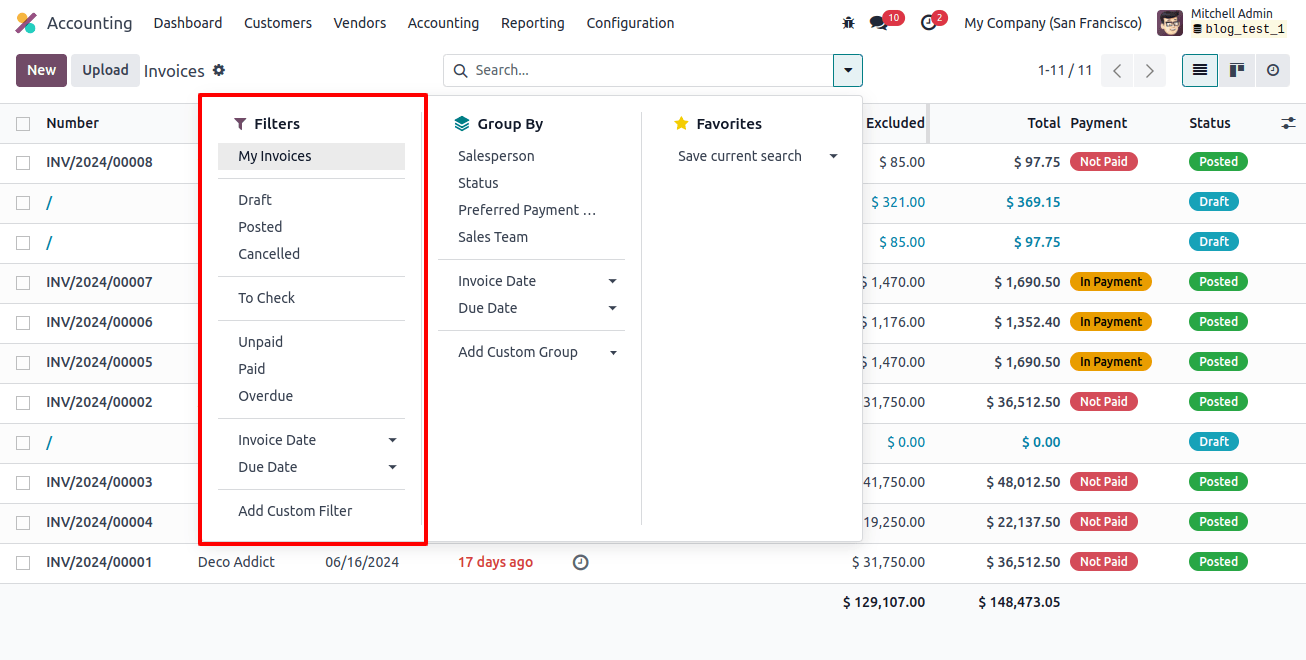

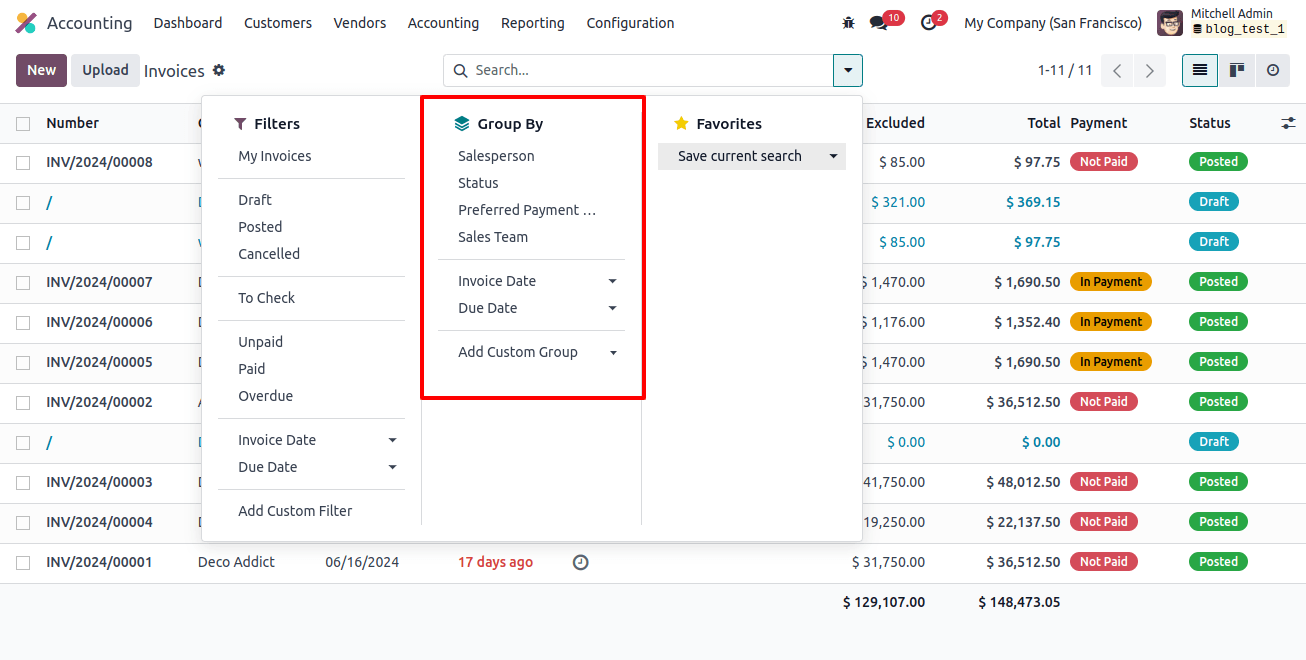

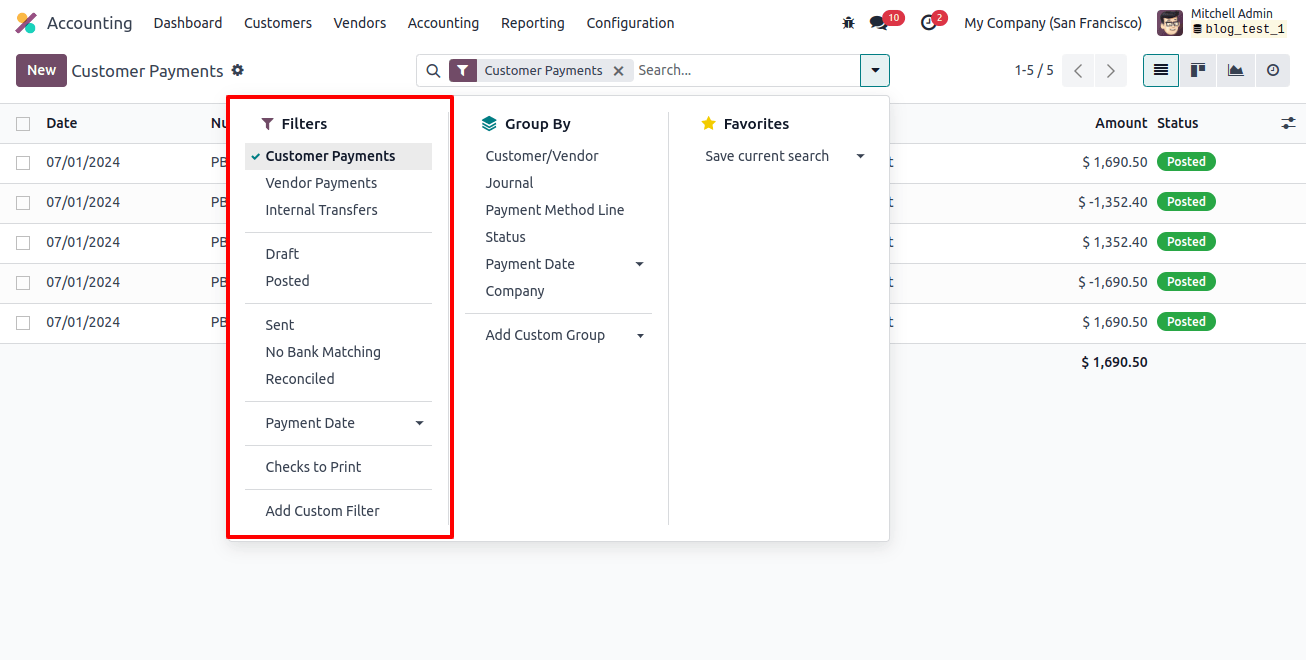

You can filter bills by My bills, draft, posted, canceled, to check, unpaid, paid, past due, invoice date, and due date using the default filters. The add custom filter option allows you to create custom invoicing filters.

Under the Group By area, you can group by salesperson, status, sales team, electronic invoicing state, preferred payment method, invoice date, due date, and referrer. To add custom group options, click the Add Custom Group button.

An invoice can be uploaded to the module by clicking the upload button, as seen in the image below. To manually create a new invoice, click the new button. This will send you to the window where you can generate a new invoice, as seen below.

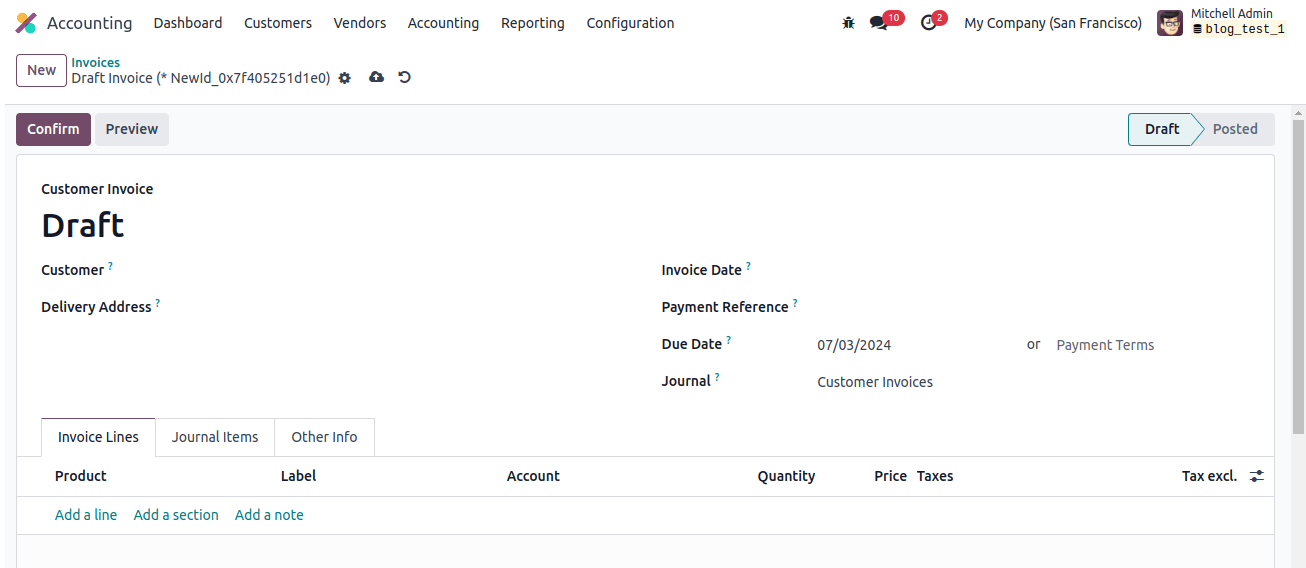

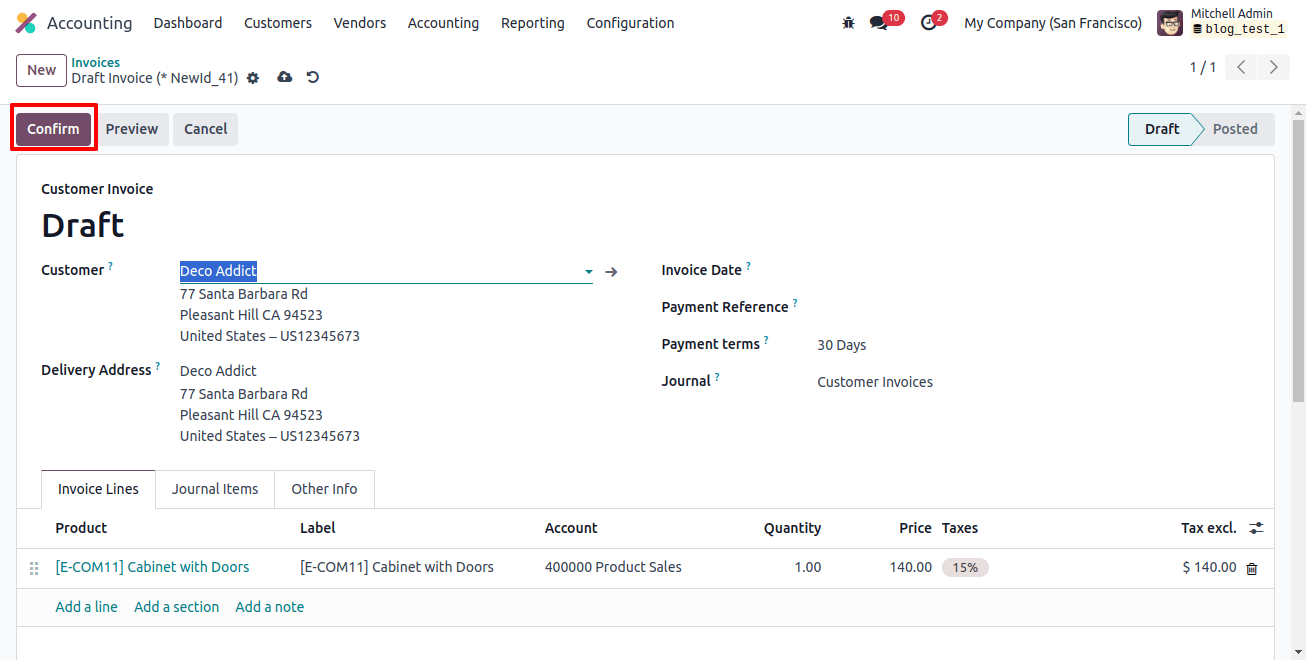

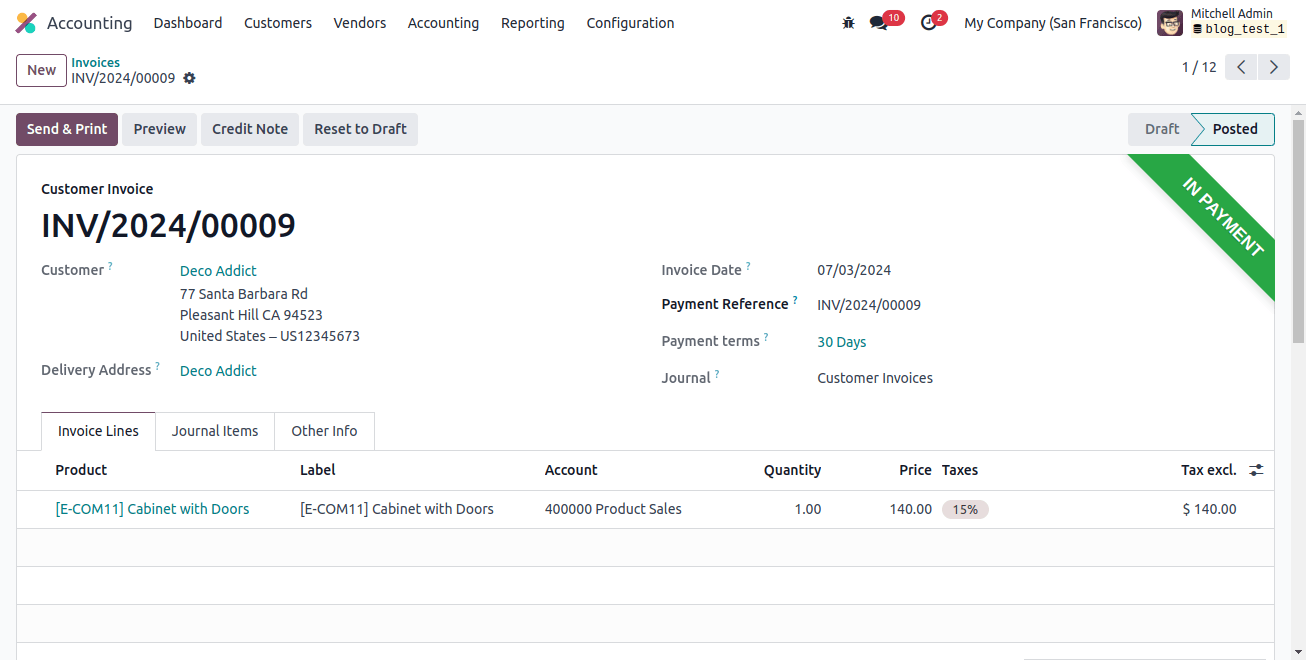

Let’s learn how to use this window to generate a draft invoice. In the customer and delivery address fields, enter the customer ID and current delivery address fields, respectively.

Setting an invoice date and mentioning the payment reference to be used on journal entries in the proper fields is important. According to the settings, the applicable payment term will appear in the invoice automatically after the client ID is entered.

If not, specify the Due Date, by which the buyer must pay the invoice. Choose the relevant Journal in the Invoice’s related field.

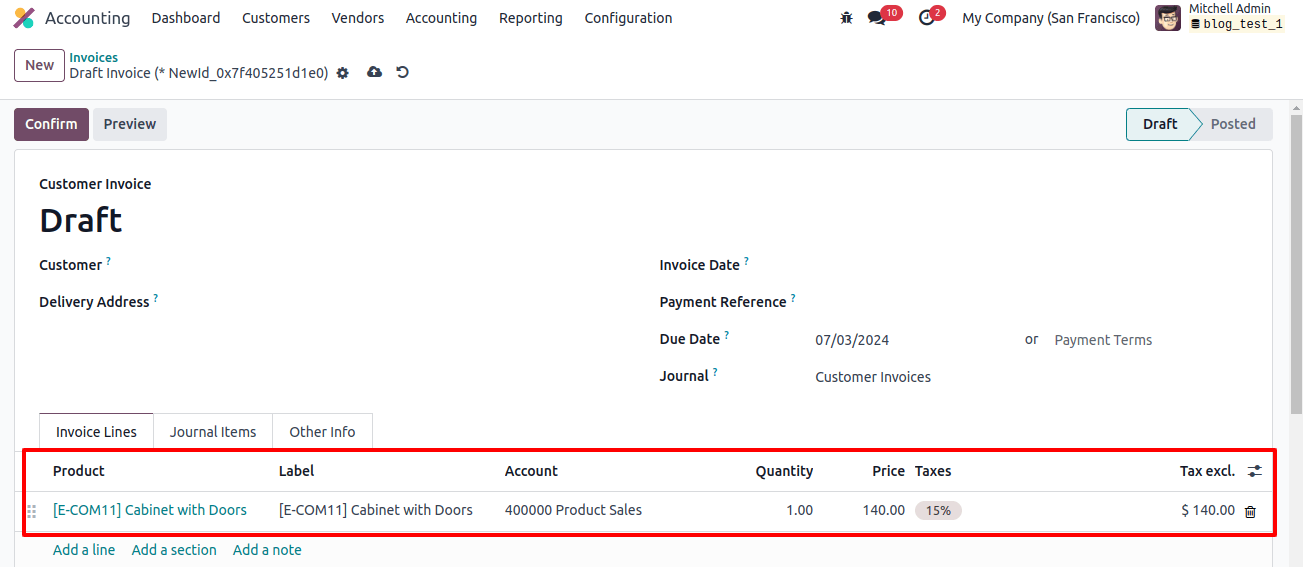

The window will feature three additional tabs: Journal Item, Other Info, and Invoice Line. You can use the Add a Line button on the Invoice Lines tab to mention each product in the list separately.

Product, label, account, analytics, quantity, unit of measure, price, taxes, and subtotal can all be entered here. When invoices are generated automatically from sales orders, the products indicated in the order line are presented on the invoice line.

After adding products, the invoice’s untaxed amount, taxes, and the total can be seen under the invoice line.

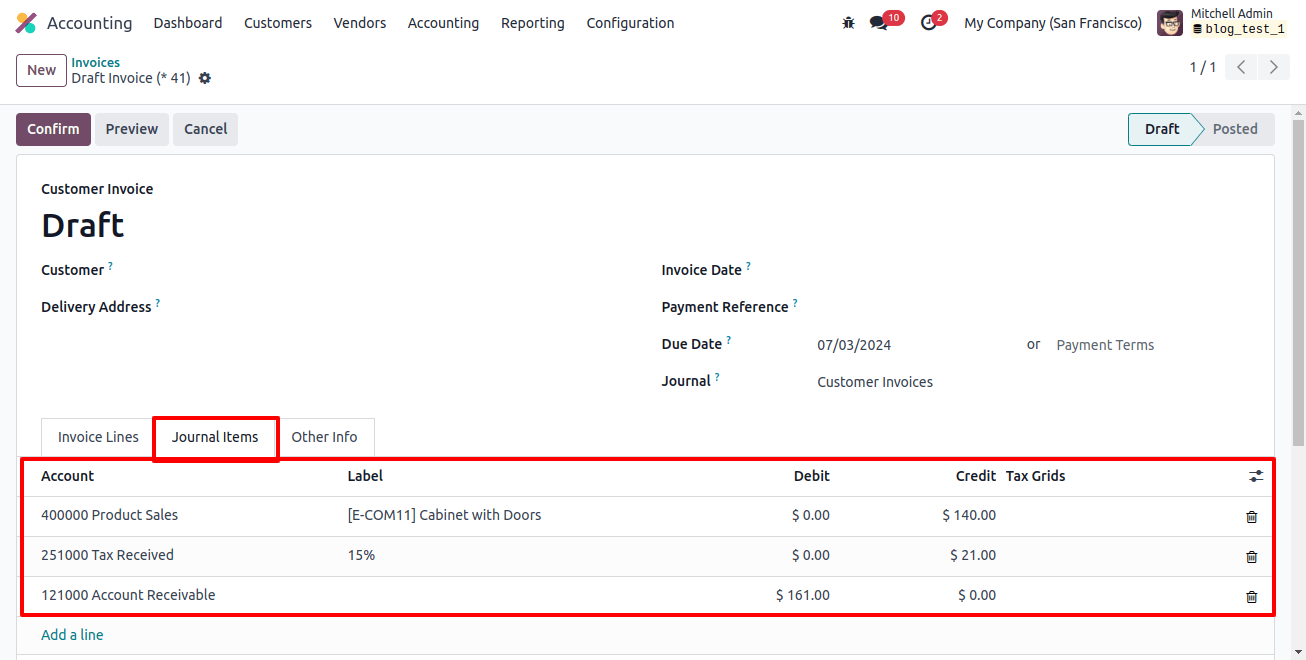

The Journal Items page displays the corresponding journal items for the products you specified in the invoice line, as well as information from the Account, Label, Origin, Reference, Analytic, Debit, Credit, and Tax Grids.

One can be removed from the journal entries by clicking the delete symbol, and another can be added by clicking the Add a Line button.

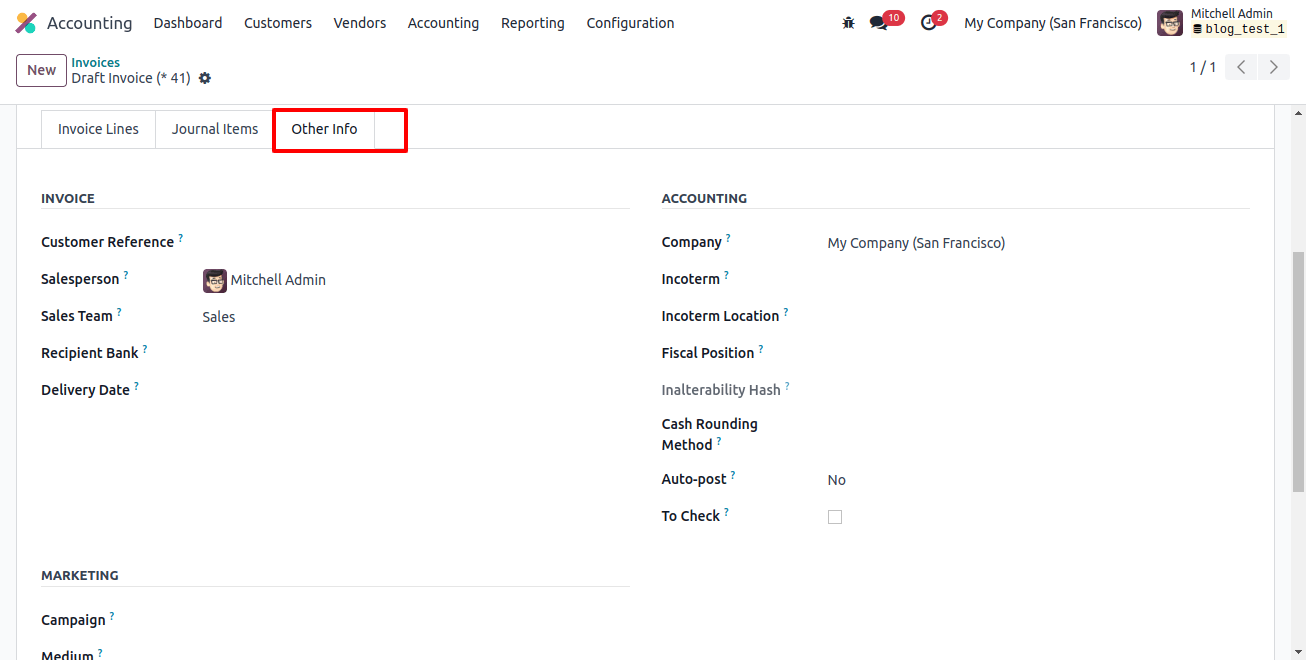

The other info option allows you to enter the invoice’s accounting and invoicing information. The customer reference can be entered into the invoice field.

By providing their IDs in the designated fields, this invoice can be assigned to a certain salesperson or team. The recipient bank box allows you to select the recipient bank account number, which will be used to pay the invoice. If you received any referrals for this sale, enter their ID in the referrer field.

In the marketing field, indicate the campaign, medium, and source for this invoice. You can enter your firm ID into the accounting firm field.

Indicate in the appropriate spaces the Intrastat Country (Arrival Country), Inalterability Hash, Fiscal Position to change taxes and accounts for individual clients or sales orders/invoices, and Incoterms used for international transactions.

You may have this entry posted automatically by selecting a time frame from the Auto Post box. In the Auto Post Until section, you can define the date this recurring move will be posted. If you prefer to do it manually, use the No option in the Auto Post field.

To signal that the move should be checked again, activate the To check field.

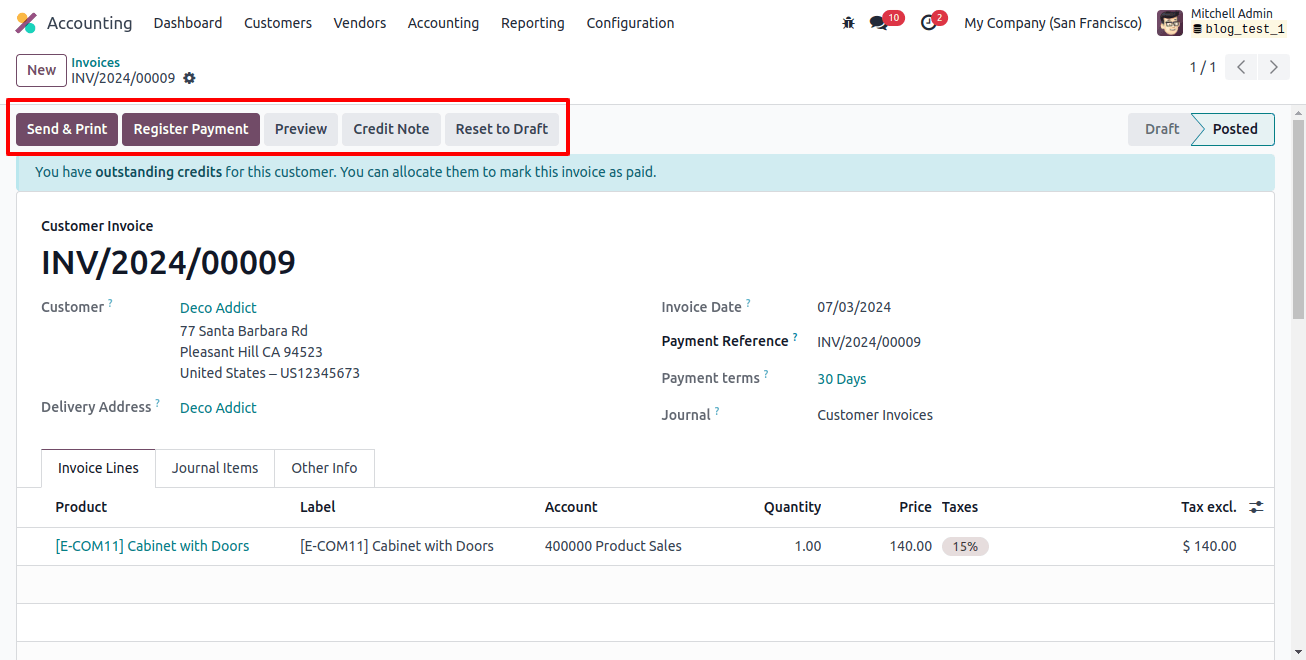

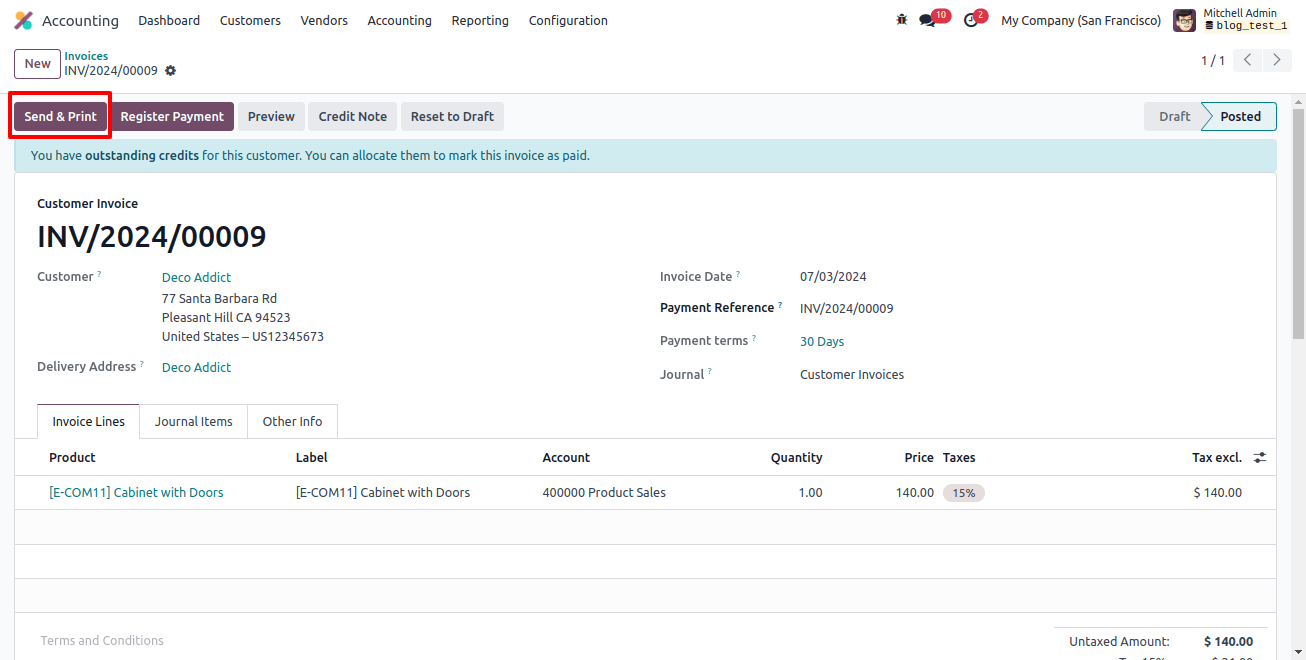

The draft invoice is now completed. When you click the confirm button, the invoice changes from draft to posted, indicating that it has been confirmed.

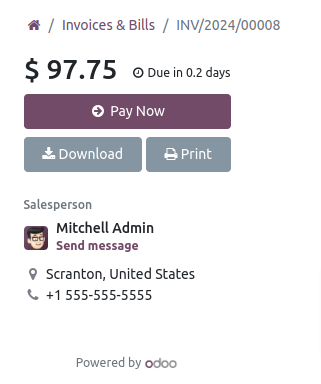

The invoice is now confirmed. Use the Reset To Draft button to revert a confirmed invoice to draft status. Click the Preview button to see the invoice as if it were a client.

The invoice preview from the customer portal will be presented on this page, allowing users to analyze the invoice and choose an easy payment option. You can download, print, and contact the appropriate salesperson from this page.

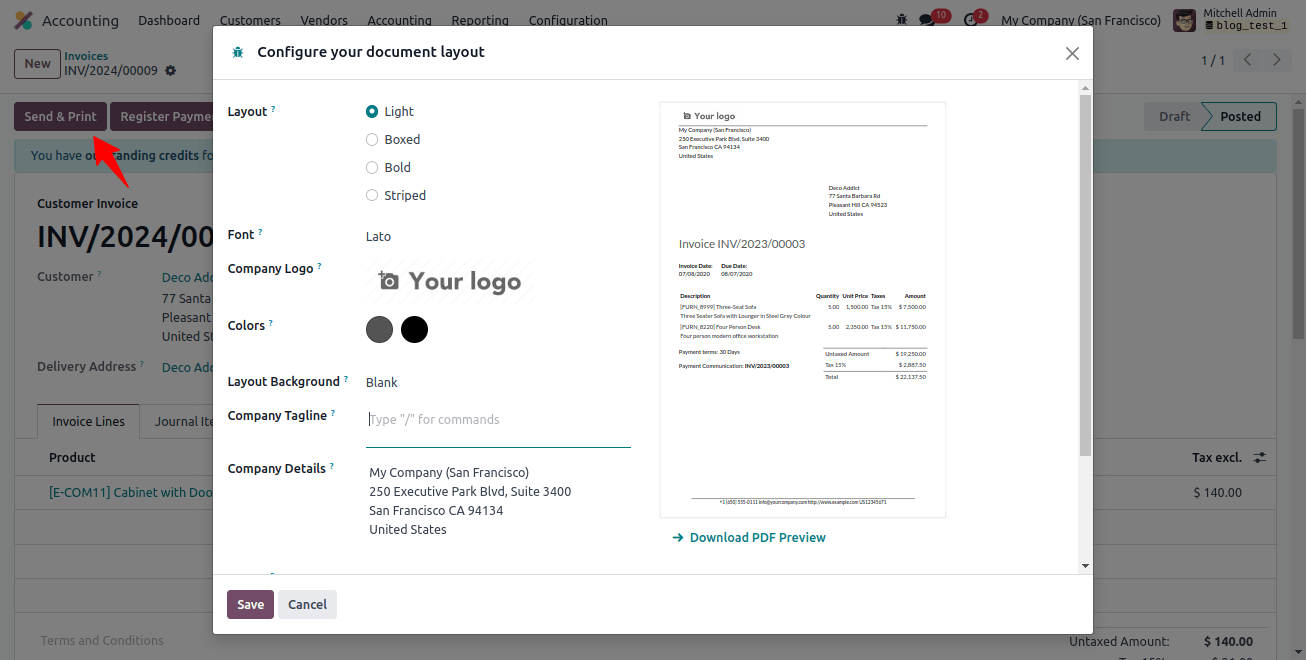

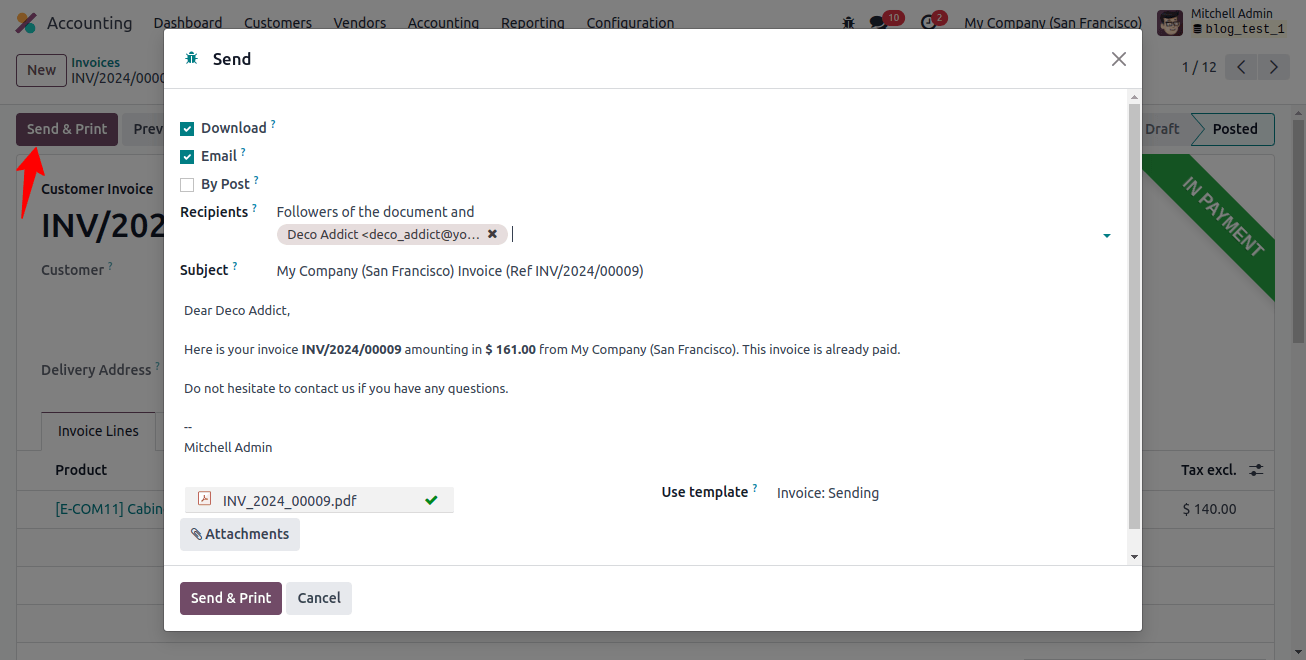

You can send the invoice to the customer by selecting the Send & Print option. When you click this button, an automatic email will be generated, as seen below, allowing you to customize the subject line and add recipients to the list.

Once the invoice is linked to your email, you can click the Send button. After receiving the mail, the customer can analyze the information and pay the invoice.

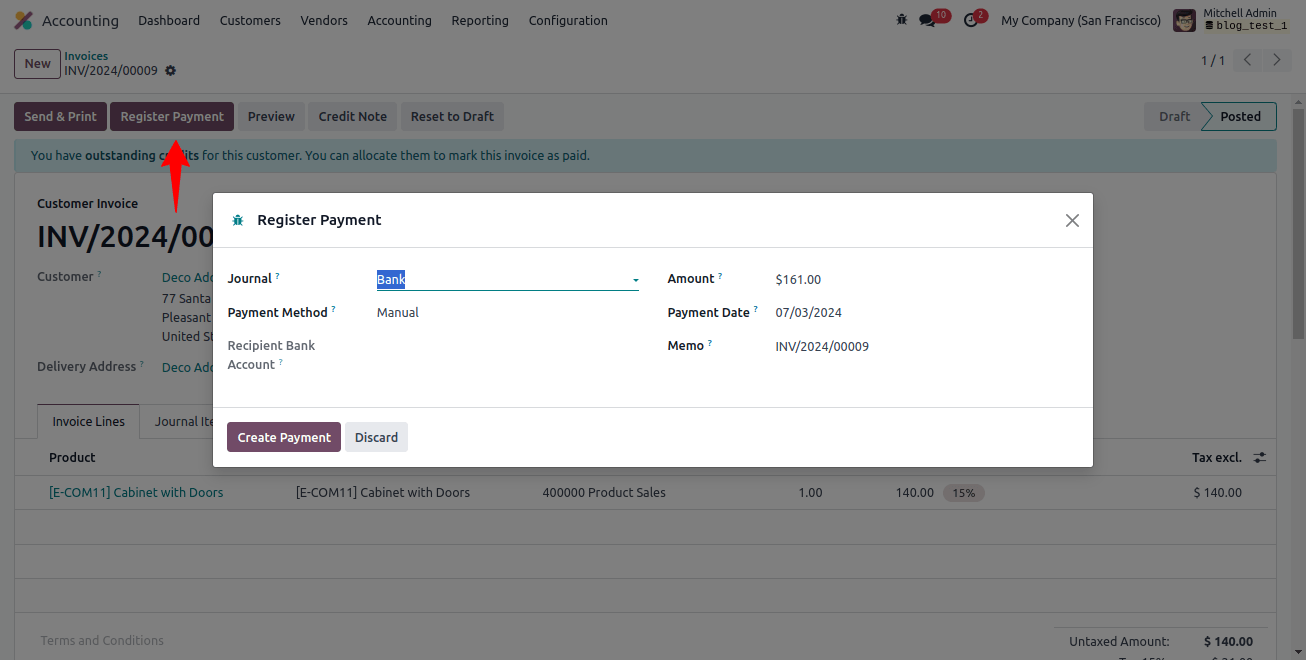

The customer's payment can be registered by clicking the Register Payment button. Odoo opens a pop-up window to check the payment registration data.

As seen in the image above, the window will show the Journal, Payment Method, Recipient Bank Account, Amount, Payment Date, and Memo. Tap the "Create Payment" button.

At this moment, payment registration can be completed. The invoice's status changes to Paid as soon as the customer makes payment.

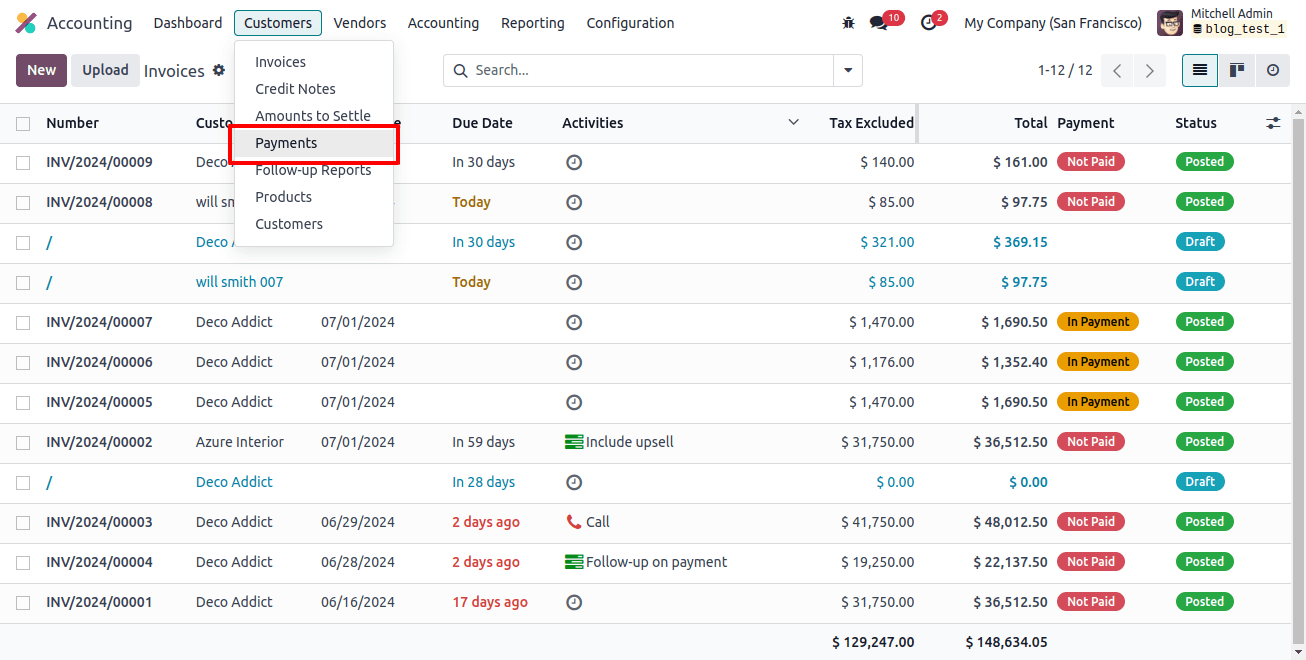

In the Odoo Accounting module, select the Payments option from the Customers menu to examine the payment history for various client invoices. The date, number, journal, payment type, partner, batch payment, amount, and status are all shown in the preview.

You will have access to the List, Kanban, and Graph views, which can be used as needed.

Checks to print. The user will see the default filters: SDD CORE, SDD B2B, Revoked SDD Mandate, Draft, Posted, Sent, Bank Matched, Reconciled, Not Reconciled, Payment Date, and Vendor and Customer Payments.

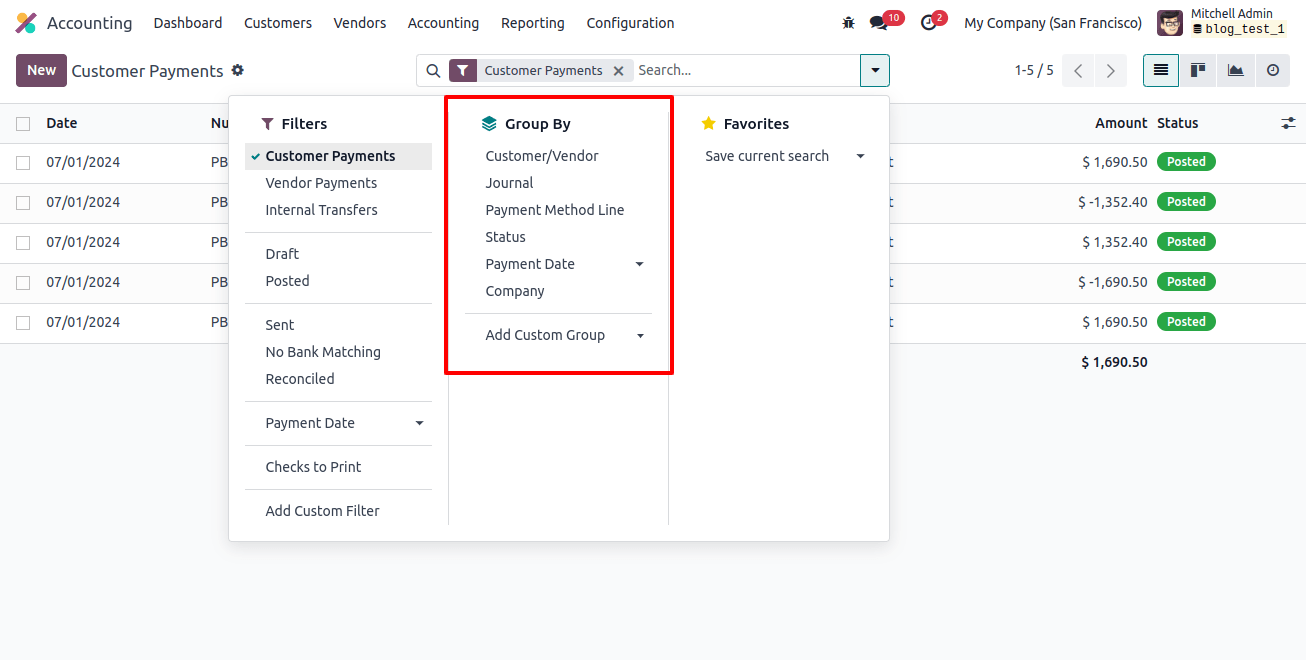

This platform's default grouping options are Customer/Vendor, Journal, Payment Method Line, Batch Payments, Status, Payment Date, Currency, and Company. To create a new payment record, select the New button.

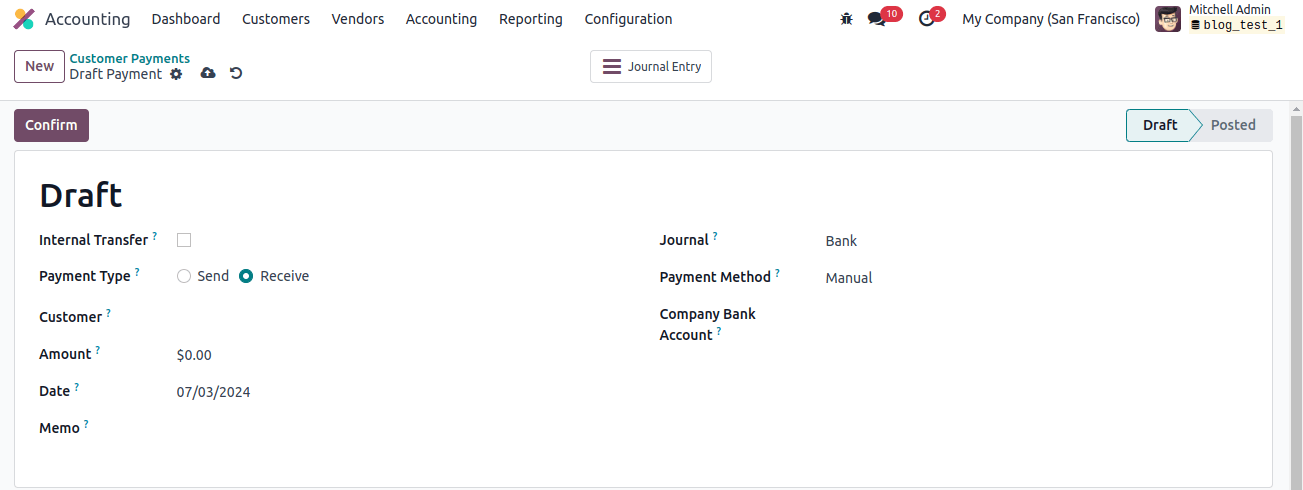

Activating the Internal Transfer box allows you to make any internal transfer payments. Internal transfers are fund transfers that occur between accounts within a business.

You can select Receive as the Payment Type because this is a customer payment. When paying a merchant, the payment method Send is used. You can insert the client ID into the designated field.

You can input the following information in the appropriate fields: Amount, Date, Payment Memo, Journal to record the payment, Payment Method, and Company Bank Account.

The consumer has several payment methods, including manual, payment providers, cheque, batch deposit, SEPA credit transfer, and SEPA Direct Debit.

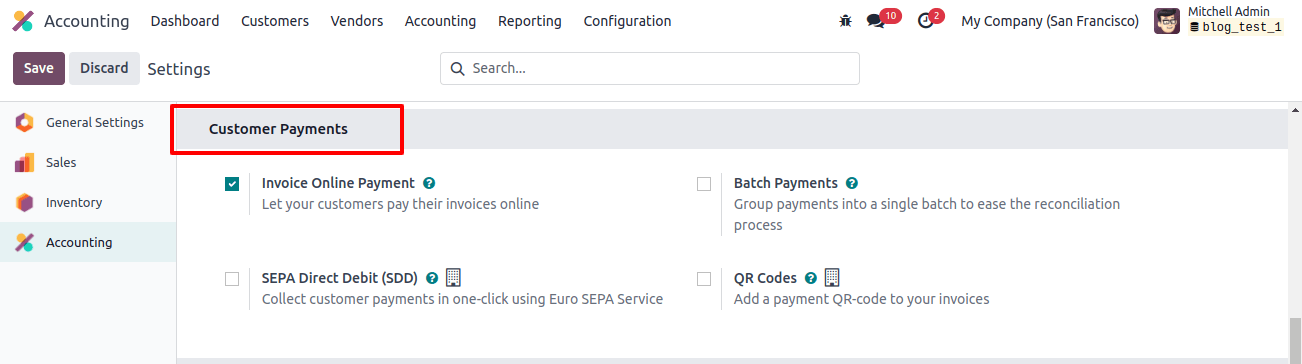

Now that we're focusing on online payments, do you need to travel to Accounting? What about configuration? What about the settings? Customer Payments, select Invoice Online Payment and then click Save to activate it, as seen in the screenshot below.

Once the invoice has been issued, select Send & Print to email it to the customer.

An email with a link to the invoice on their customer site will be sent to them, as shown in the image below.

They can choose their preferred payment provider by clicking Pay Now.

Once the consumer has completed the payment, utilize the Payment Matching smart button to add it to the relevant customer's outstanding invoices. This button displays all of the customer's open bills. An invoice for the same amount can be chosen from the list and reconciled.

The payment can be marked as sent using the mark as a sent option and returned to draft status using the Reset to Draft button. This is how you will proceed with online payments in the Odoo 17 accounting module.