Selling things across borders in Europe can be tricky with all the rules. Odoo 17, a business management software, can help! It has strong accounting features that make following these rules easier, saving you time and avoiding any issues.

Understanding EU Intra-Community Distance Selling

There are special tax rules in Europe when you sell things to other EU countries. These rules apply when you sell to regular people (not businesses) and the goods are delivered within the EU.

Here's why these rules exist:

- Fair taxes: The goal is to make sure the right amount of tax is paid in the right country.

- Prevent cheating: These rules help stop people from avoiding taxes altogether.

Odoo 17 can help you follow these rules easily, so you don't have to worry about making mistakes.

Here are a few things to consider when selling across borders in Europe:

Dispatched or Transported Goods

There are different ways to get your products to customers in other EU countries:

- You can hire a delivery company to take care of everything.

- You can use a delivery company but manage some of the shipping yourself.

- No matter how you ship, you need to approve it before it goes out.

Multiple Customers

Intra-community distance selling rules apply when you sell to certain types of customers in other EU countries, not just businesses. This includes:

- Organizations that don't pay taxes, like international groups.

- People who buy and resell used goods.

- Farmers who use special tax plans.

Online Sales

These EU distance selling rules also apply to online sales. This means you need to follow the rules for value-added tax (VAT) when you sell things online to other EU countries. Following these rules helps make sure the right amount of tax is collected.

How Odoo 17 helps you follow these EU distance selling rules for VAT.

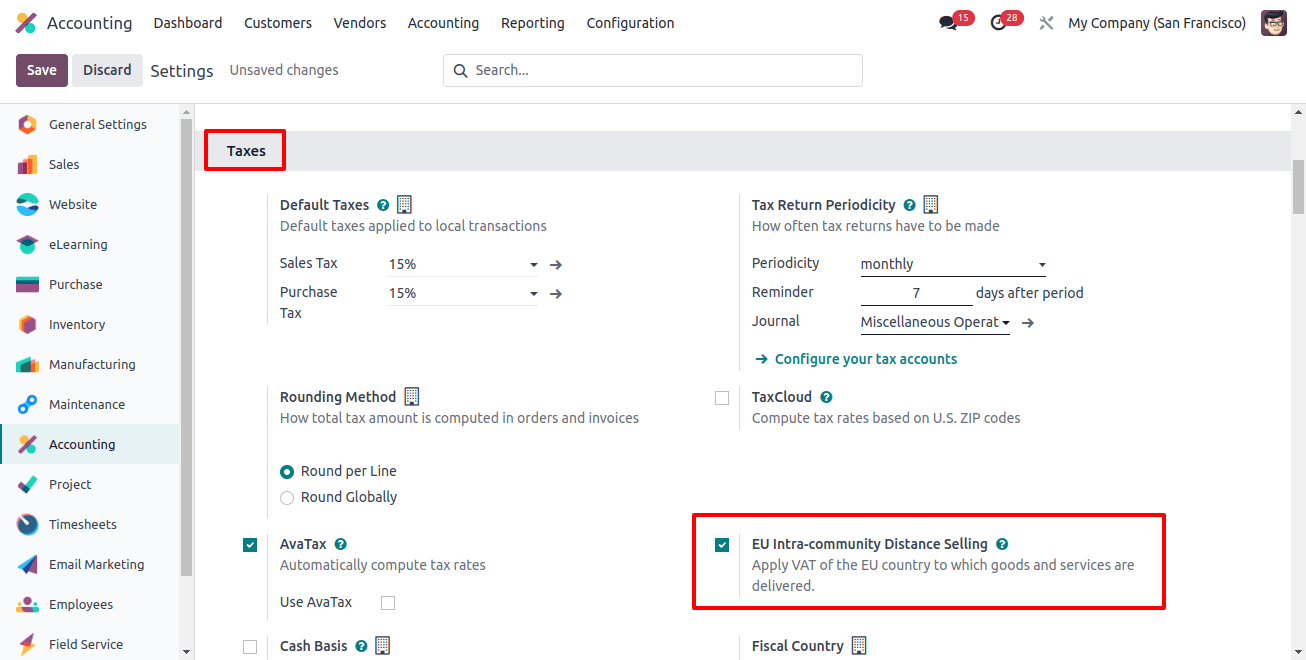

Odoo 17 has a powerful accounting feature that makes it easy. In your settings, Under "Configuration," you'll find a section for taxes. There's an option for EU distance selling - turn that on to get started.

This will help you calculate the right amount of tax for your sales across Europe.

In your Odoo 17 accounting settings, there's a section for taxes. There's also an option for EU distance selling. Turn that on to follow EU tax rules for sales across Europe. This makes managing taxes easier and helps you avoid mistakes.

Once you turn on EU distance selling, you can set the VAT rates for each EU country where you sell products or services. Don't forget to click "Save" to keep your changes.

Taxes and Fiscal Positions in each EU Member State in Odoo 17 Accounting

The European Union (EU) has 27 countries as members. These include Austria, Italy, Romania, and Poland. It's important to note that each EU country can have its own tax laws.

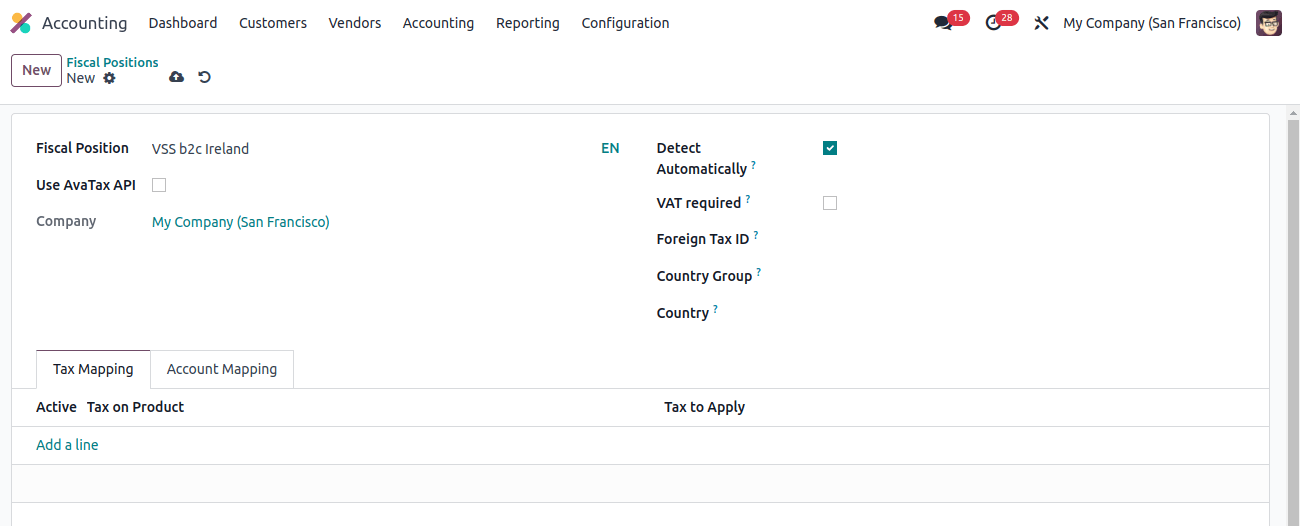

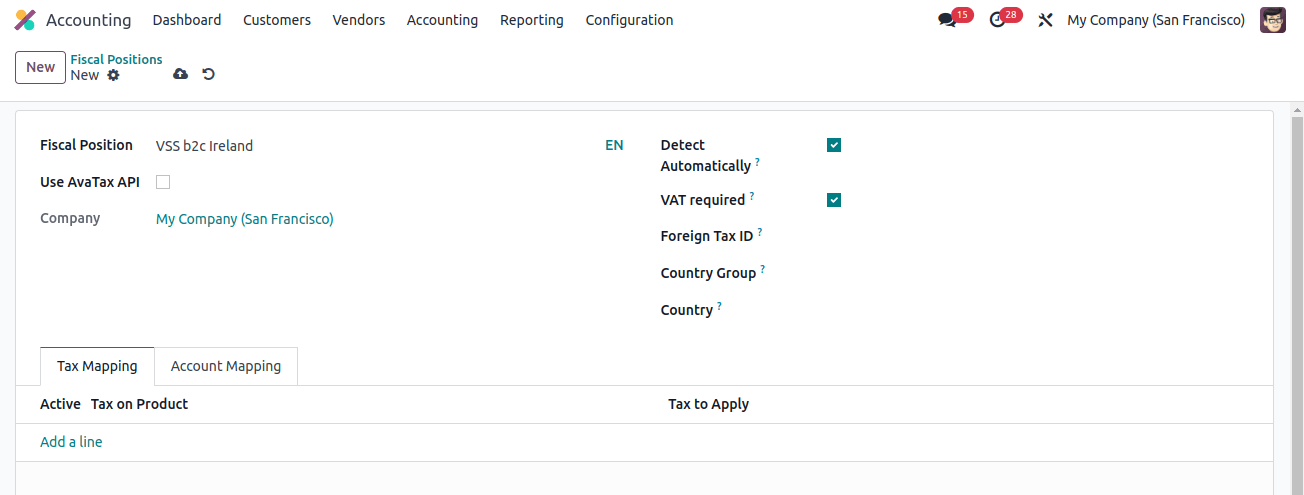

Odoo 17 can help you keep track of these different tax rules. In your settings, under "Configuration," there's a section called "Fiscal Positions." This section has information about the tax laws for each EU country. This helps you make sure you're following the right rules and avoid any problems.

How to see all the tax rules (fiscal positions) for different countries in Odoo 17

In your settings, under "Configuration," you'll find a section called "Fiscal Positions." This list shows you all the tax rules you've set up for different countries. You can easily see which company each rule applies to.

To set up a new tax rule for a country, click "Create" and choose the country. You can then set the VAT rate for that country. For example, if you sell things in Ireland, you can create a new rule for Ireland and set its VAT rate.

In the Screenshot, you can see a tax rule (fiscal position) called 'OSS B2C Ireland' for a specific company. To make things easier, you can choose 'Detect Automatically.' This way, Odoo will automatically use this tax rule whenever it applies.

Odoo also lets you add your company's VAT number and foreign tax ID (if your partner has one) for this rule.

Don't forget to click "Save" to keep your changes.

Odoo 17 makes managing EU sales taxes a breeze! Here's how:

- Automatic tax calculations: Odoo 17 does the math for you, so you don't have to worry about getting the numbers wrong.

- Tracks everything: Odoo 17 keeps an eye on important limits, so you'll know if anything needs your attention.

- Handles different currencies: Selling in euros one day and pounds the next? No problem!

- Easy reports: Get clear reports that make tax time a breeze.

- Checks VAT numbers: Odoo 17 can even double-check VAT numbers to avoid any issues.

With Odoo 17, you can focus on selling across Europe without worrying about complicated tax rules. This lets you grow your business and reach more customers!