Odoo 17 The accounting feature known as ‘Continental accounting’ records the cost of income at the point of purchase. Purchasing things or services will typically get charged.

These costs will be reported when the ledger’s expenses are produced. Despite adhering to GAAP accounting, preset accounts allow you to choose whether an account is credited or debited.

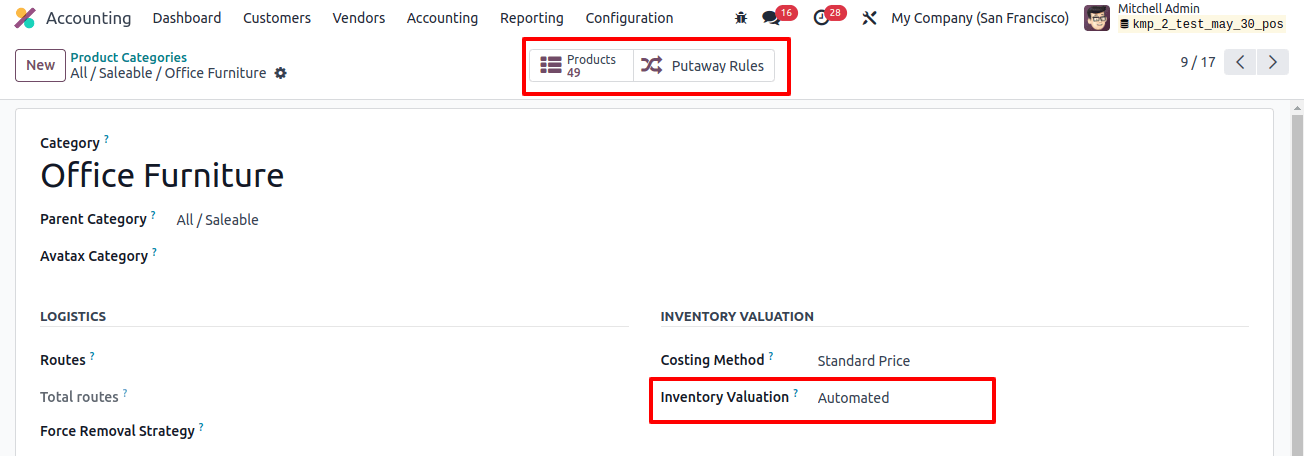

Let us now look at the influence of continental accounting on the ledgers. To investigate the stock journal impacts, consider a product category whose inventory valuation can be set to ‘Automated.’

Inventory valuation does not necessarily need to be automated; manual approaches are often acceptable.

This is dependent on how the businesses process. Businesses occasionally update their ERPs with quarterly or semi-annual stock value counts. When inventory valuation is ‘automated’, each stock entry is updated following the transaction.

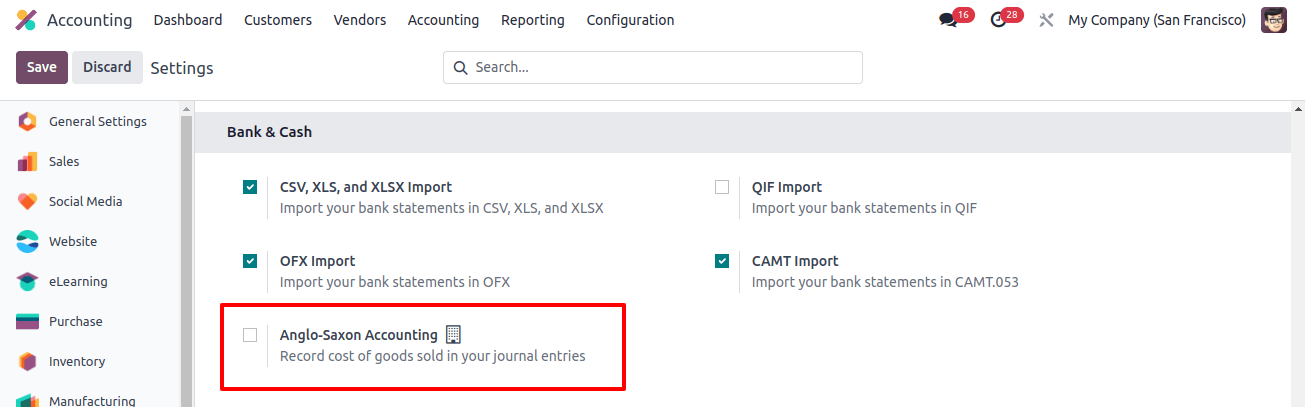

Before proceeding to continental accounting, we must validate that we are in that mode. To do so, allow developer mode, go to the accounting settings options, and uncheck ‘Anglo-Saxon Accounting.’

When "Anglo-Saxon" is disabled, it is assumed to be in continental accounting mode. Let us get started now. Look at the product category below, which contains 49 items and uses automatic inventory valuation.

The stock accounting features must be added because the inventory value is ‘Automated.’ The value of the incoming stock is noted in the stock input account.

E-stock value removed from inventory is recorded in the stock output account. The difference between stock in and out, or current stock value, will be included in the stock valuation.

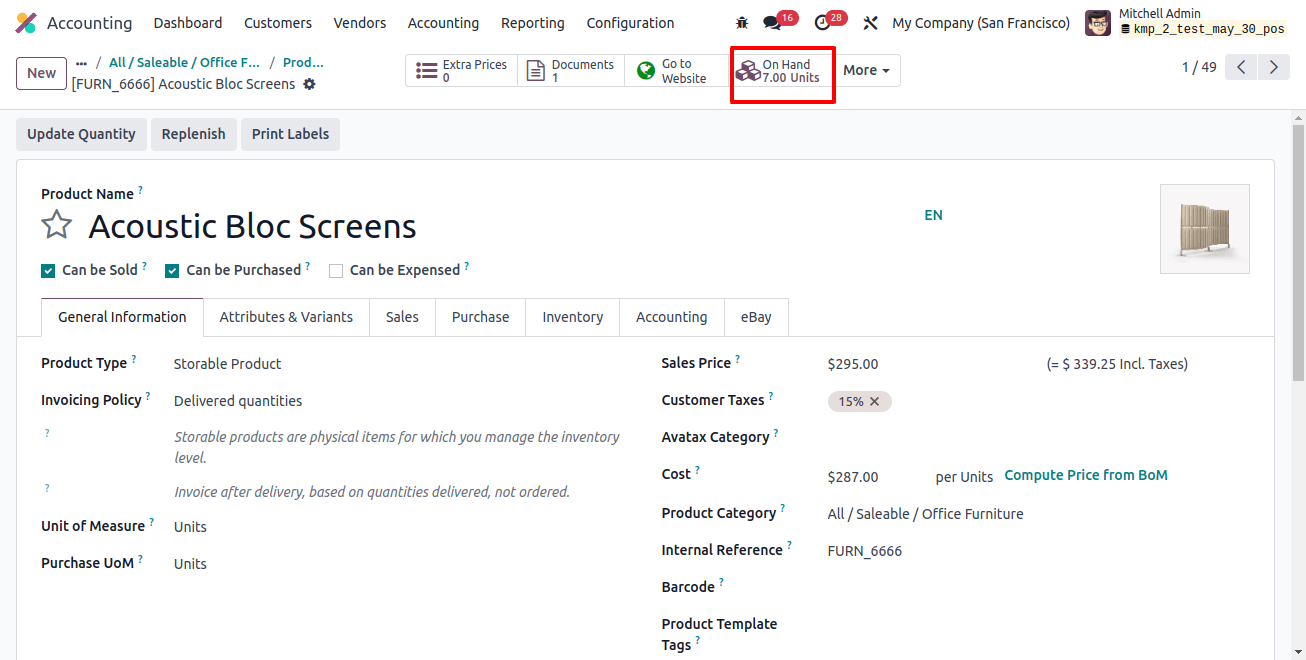

There are several costing strategies accessible, including standard, average cost, and first in, first out (FIFO). Consider a thing to buy from a vendor. At first, there was no stock available.

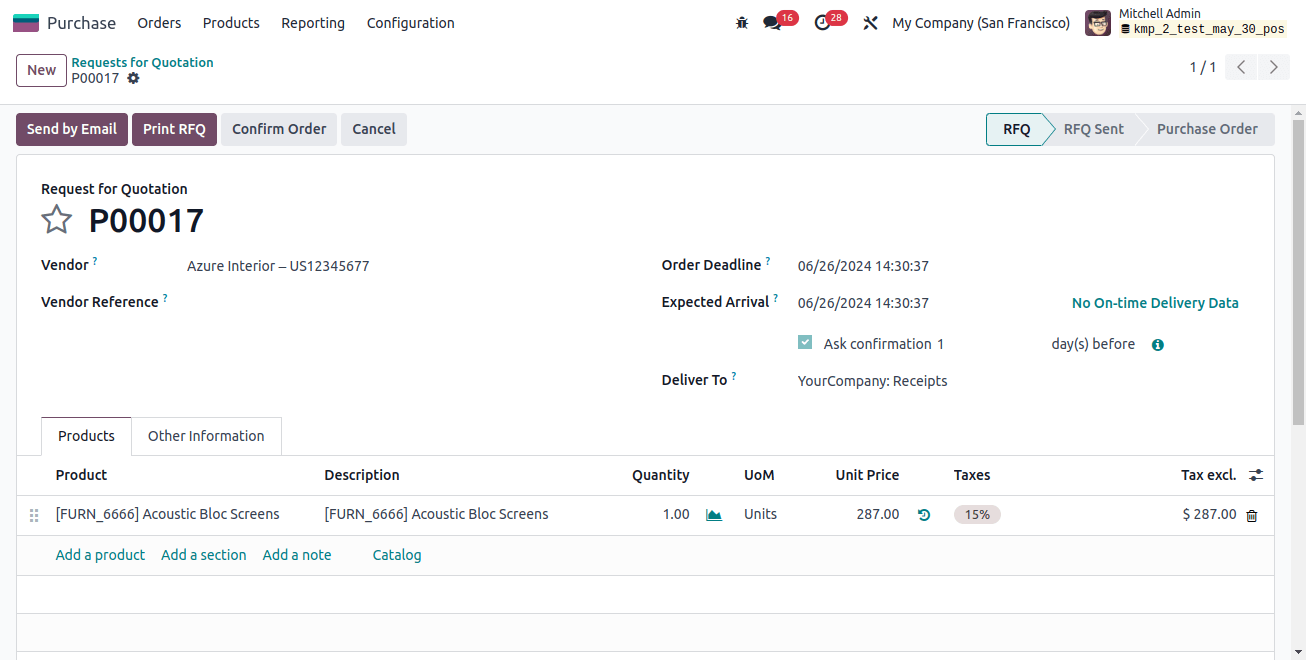

Now, focus on the product purchase process to see how the ledgers affect continental accounting.

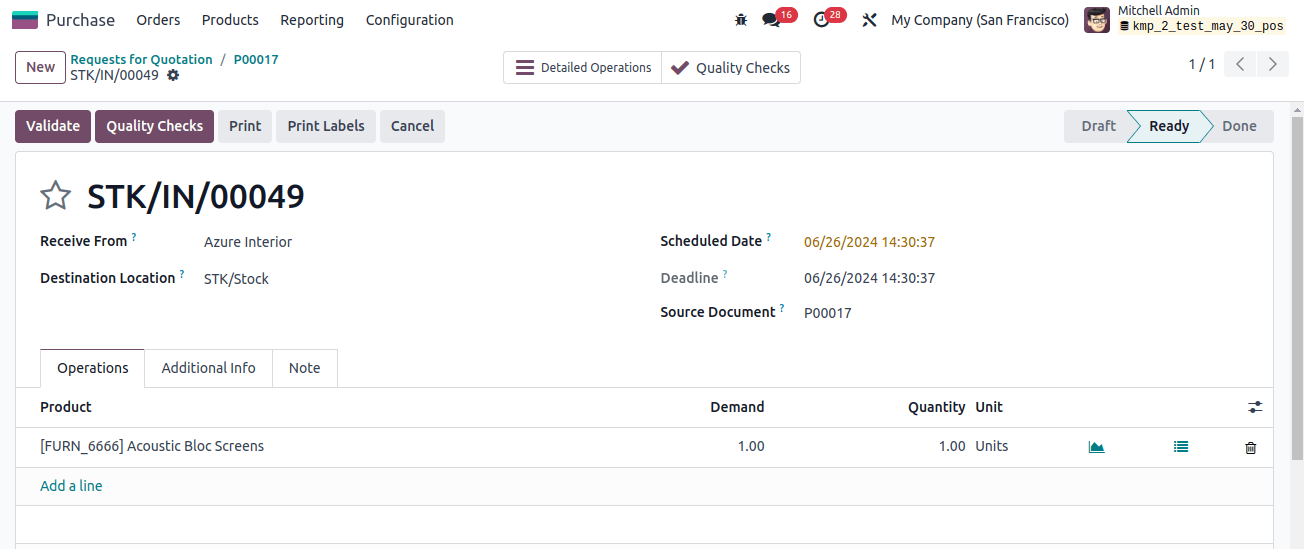

Purchase orders create a business document and have no bearing on accounts. The purchase receipt is the next step. Receiving merchandise has an impact on the stock accounts.

The input account will record the value of the stock upon receipt, boosting the stock’s worth at the same time. Let us now review the stock notebook.

The receiving stock’s attributes are considered a liability. When the obligation increases, the account will be credited according to the asset-liability chart.

As a result, the stock valuation account is debited, while the stock Interim received account is credited. A stock valuation account preserves an asset’s current value. As a result, the stock valuation account is debited when an asset appreciates.

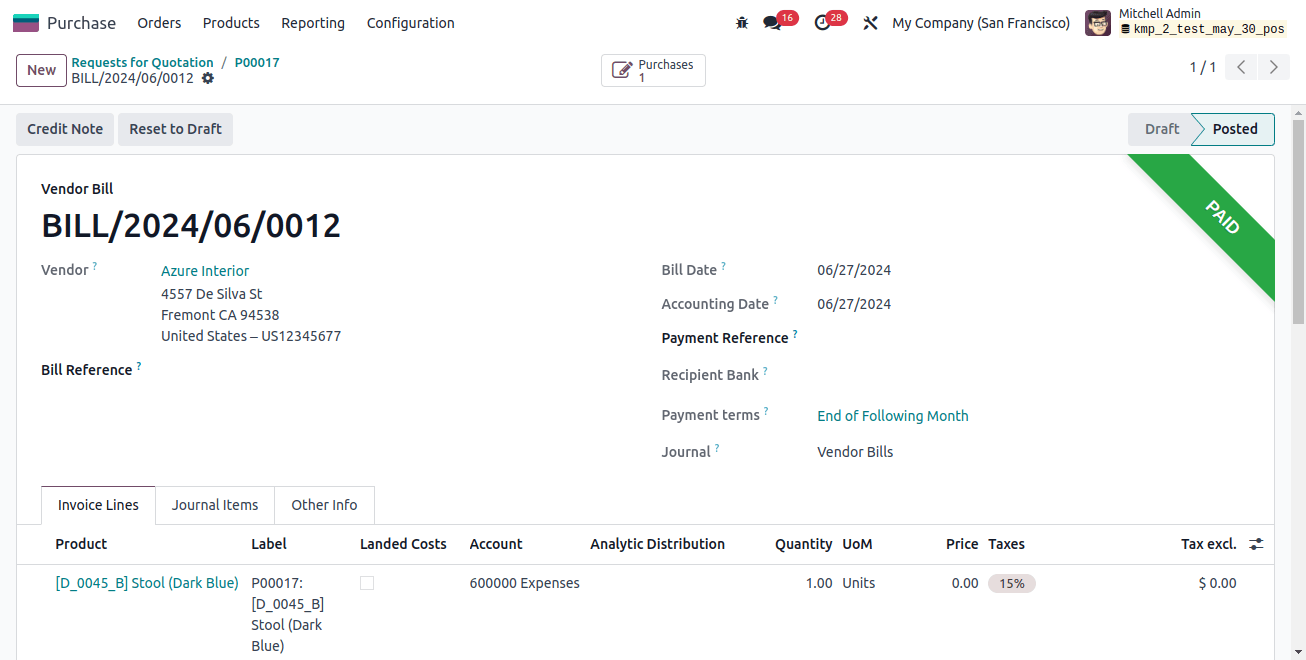

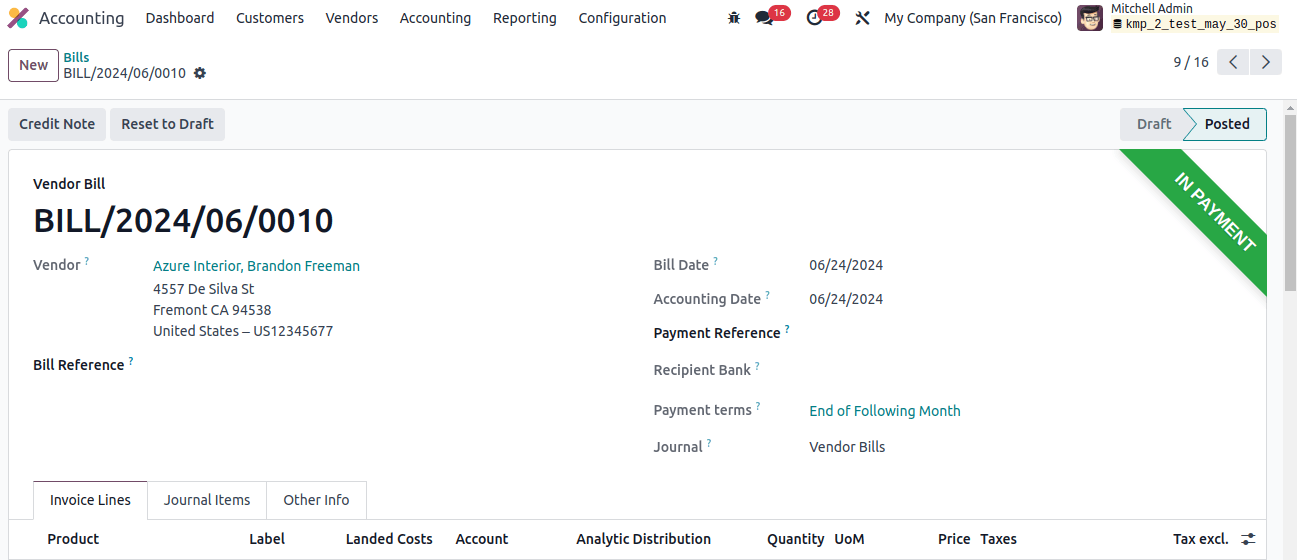

The ledger details, which reflect the debiting of the expense account and the crediting of the account payable, are displayed under the journal entries.

In this case, the company is responsible for paying the vendor (the account payable) while issuing a bill. Accounts payable are, by definition, liabilities, and the account is credited as the liability increases.

An acquisition account increases the company’s expenses, reflected in the expenditure account. As a result, expenses increase, and the account is charged.

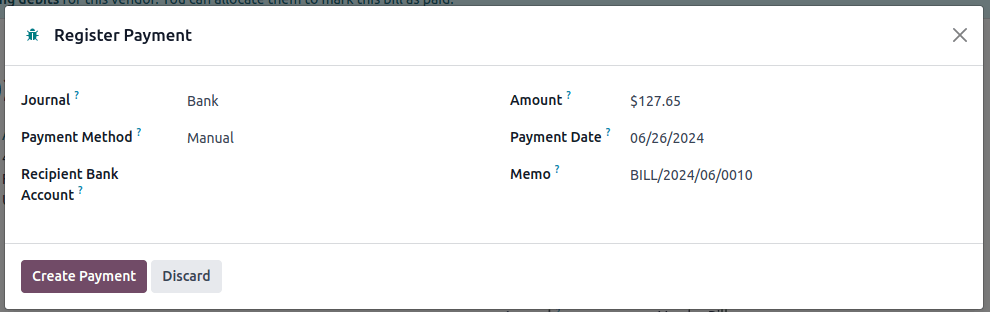

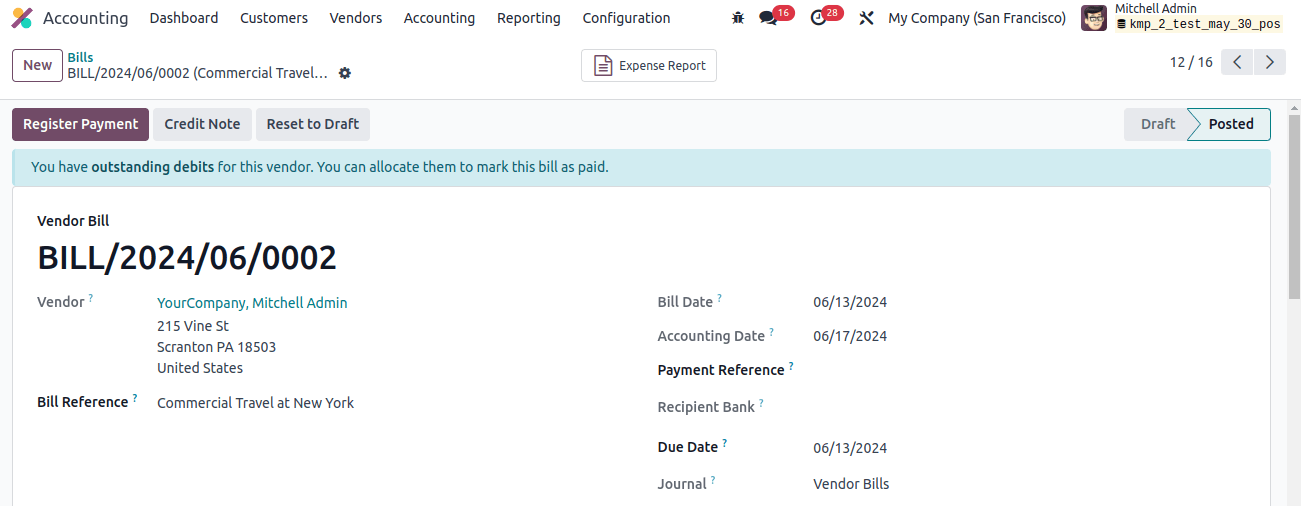

The current process for paying the vendor is by registration payment. When you click ‘Register Payment.’ a pop-up window will appear where you can select the payment journal and method. Accounts payable and overdue payments are reported in the payment journal entry created when the payment is made.

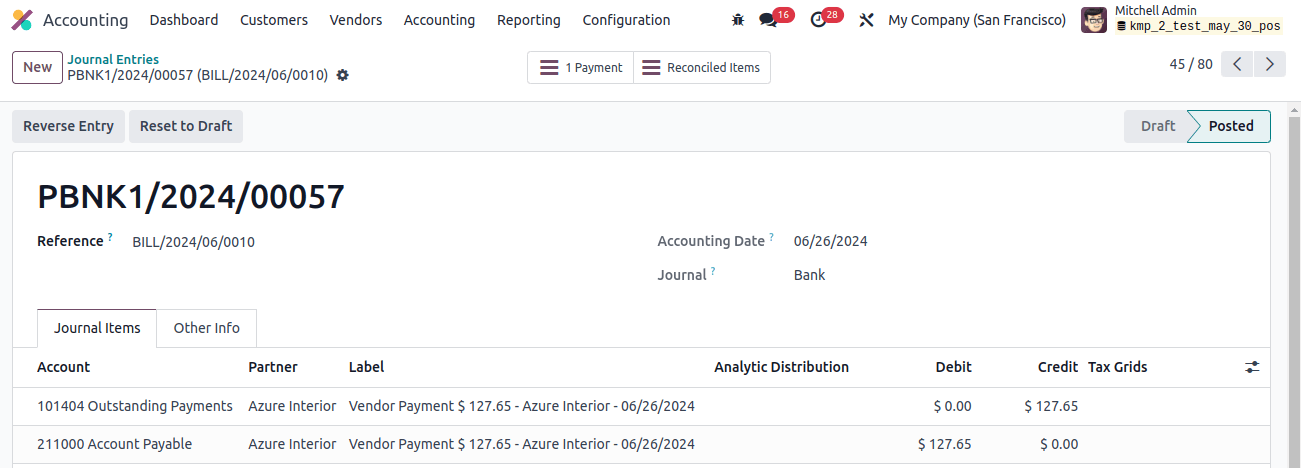

Review the journal entry for the payment. In this situation, unpaid revenues are credited while the account payable is debited.

The payable account is debited once the payment has been made and the liability has been reduced. This sum is then included in the overdue payments for reconciliation purposes. Unreconciled transactions will therefore be recorded in the account for illegal payments.

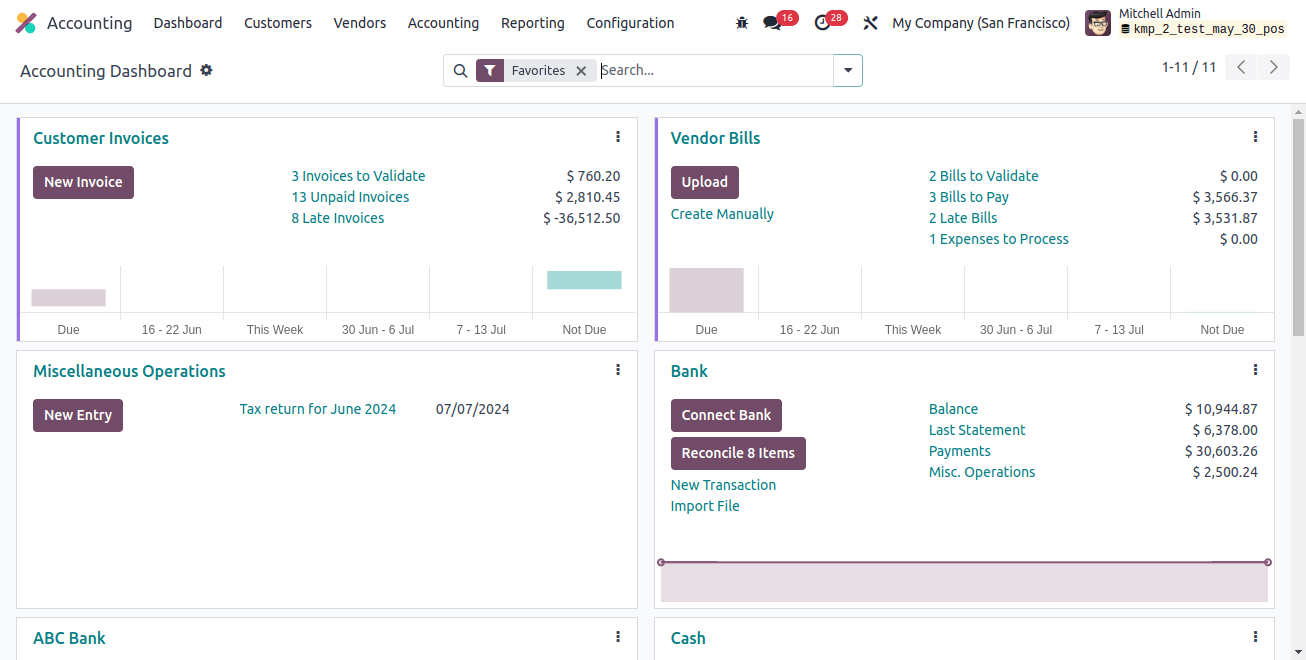

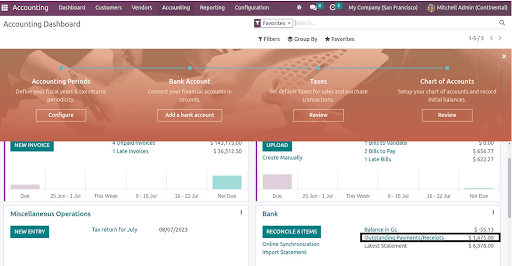

Outstanding payments in the bank Journal are now accessible on the accounting dashboard. It will be transferred to the bank, and the balance in GL will be updated once it has been reconciled with the bank statement.

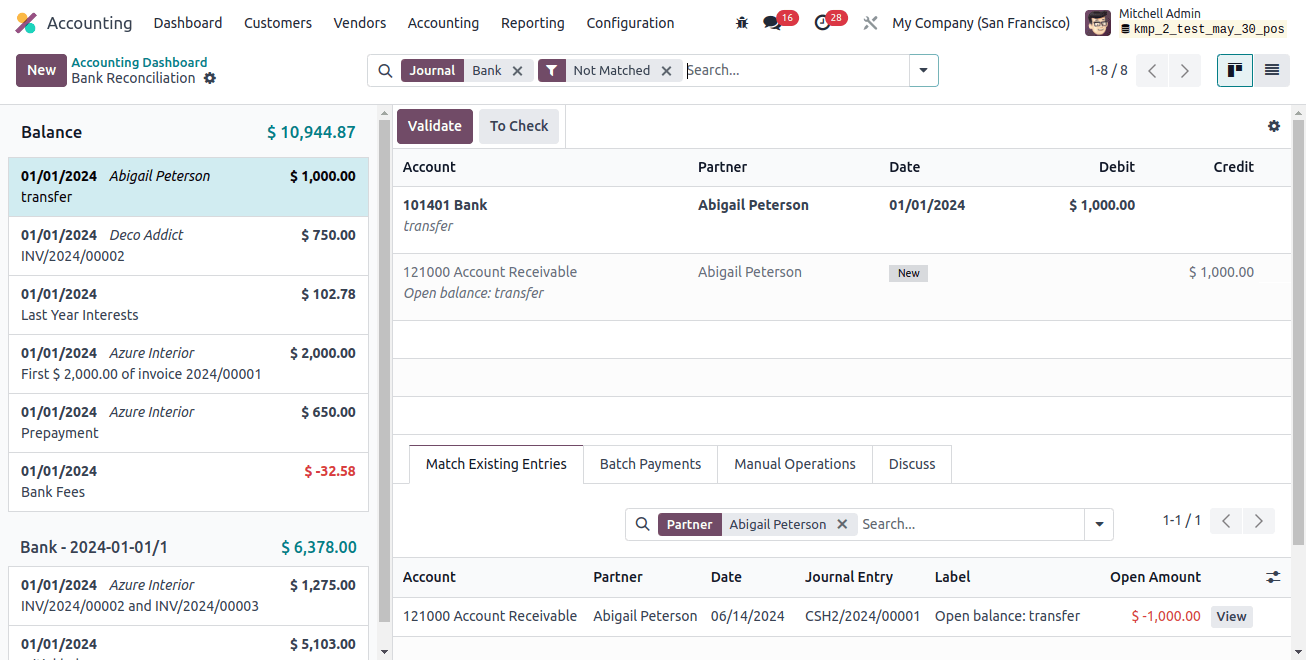

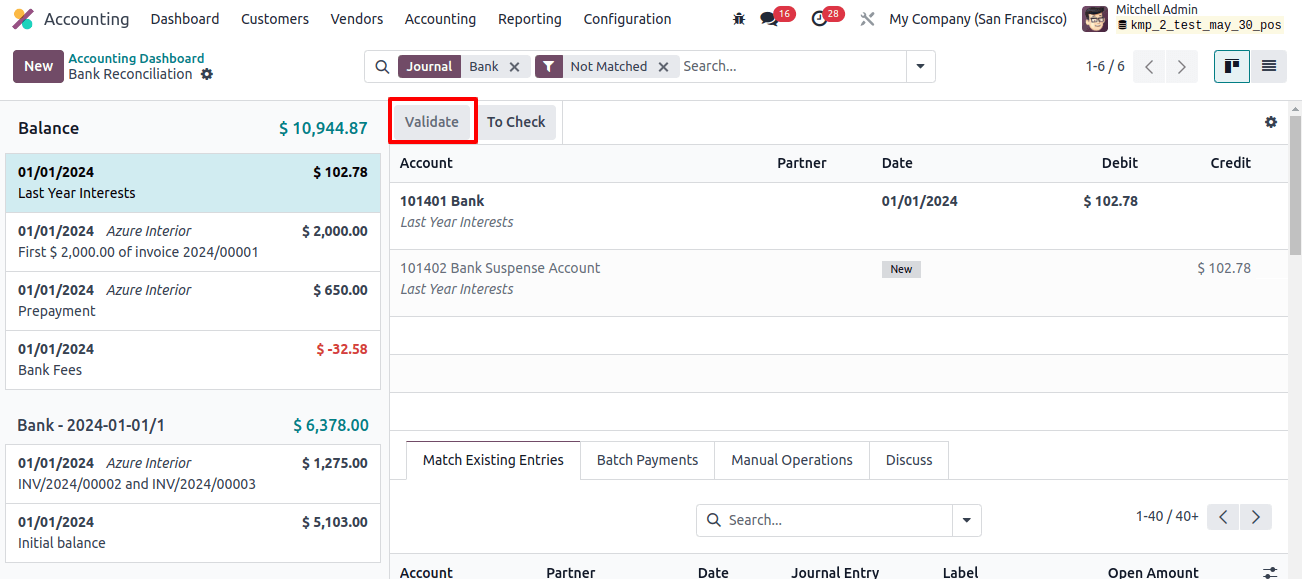

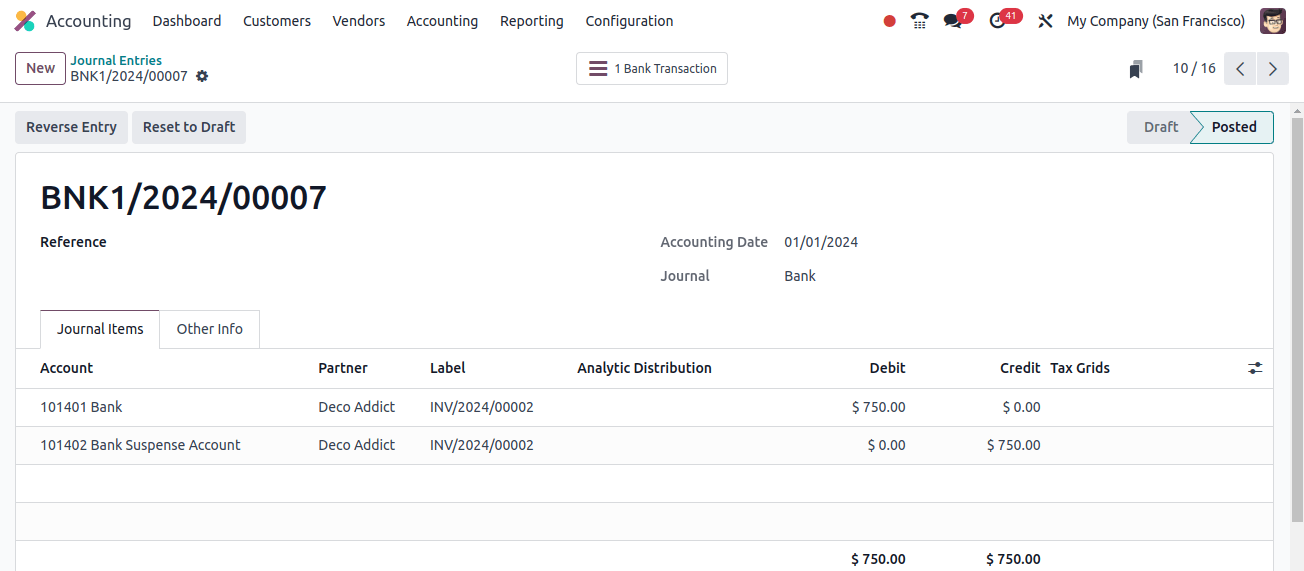

The bank statement retrieved must be compared to the payment. When bank statements are created, a new Journal entry for bank accounts and bank suspense accounts is generated. So let us update Odoo with a statement line.

You can reconcile the entries by selecting MATCH. It also retains the statement value for the bank suspense account until it finds the correct account to map with the bank. It has a corresponding Journal entry.

When discussing ledger posting, the bank gets credited. This suggests that the asset is dropping in this case because the vendor is being compensated. The suspense account, which is debited, is equal.

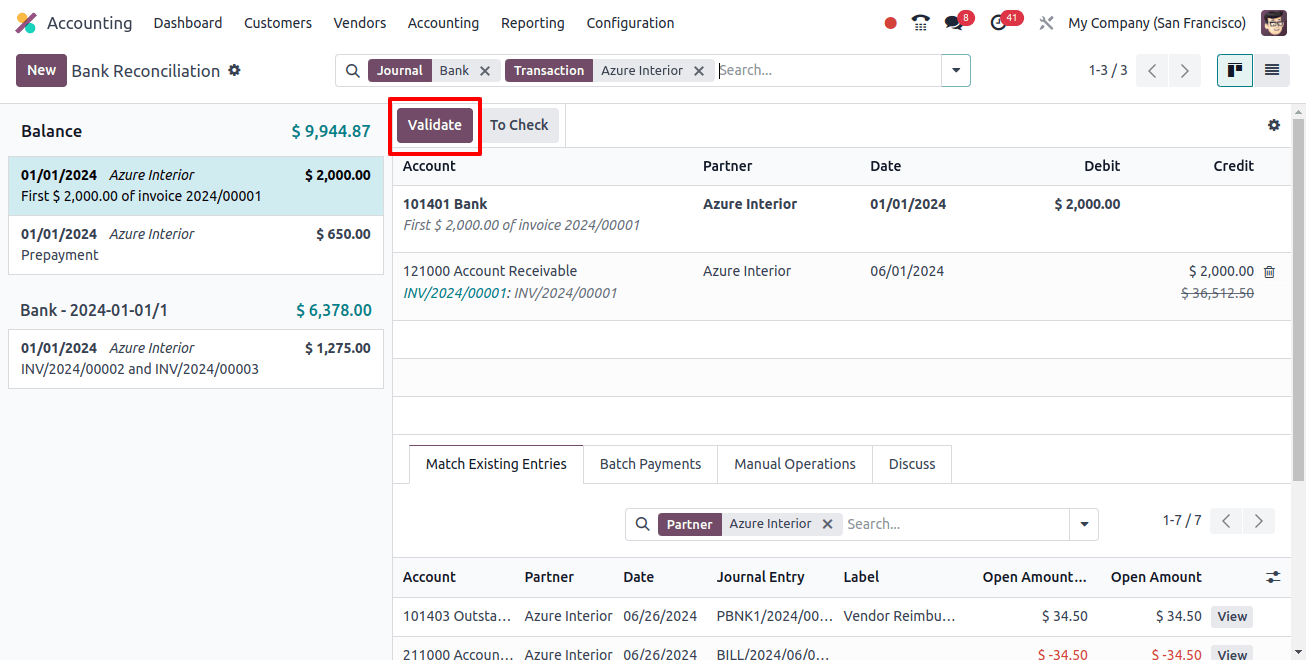

Let us now reconcile the payment with the line item on the bank statement. The VALIDATE option verifies the related elements.

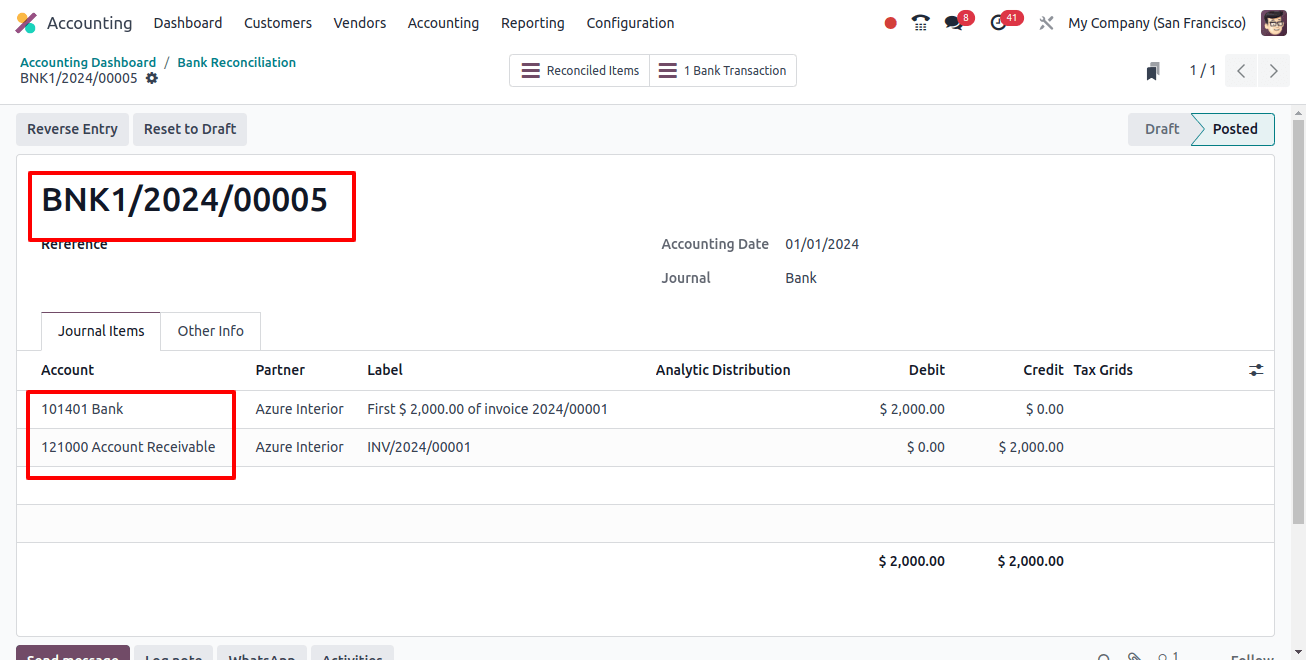

When reconciliation is completed, the money in the delayed payments is transferred to the bank account. As a result, the bank suspense account and outstanding payments will again be included in the Journal entry.

After reconciliation, the overdue payments account replaced the bank suspense account in this Journal entry. The bill’s status then changed to PAID.

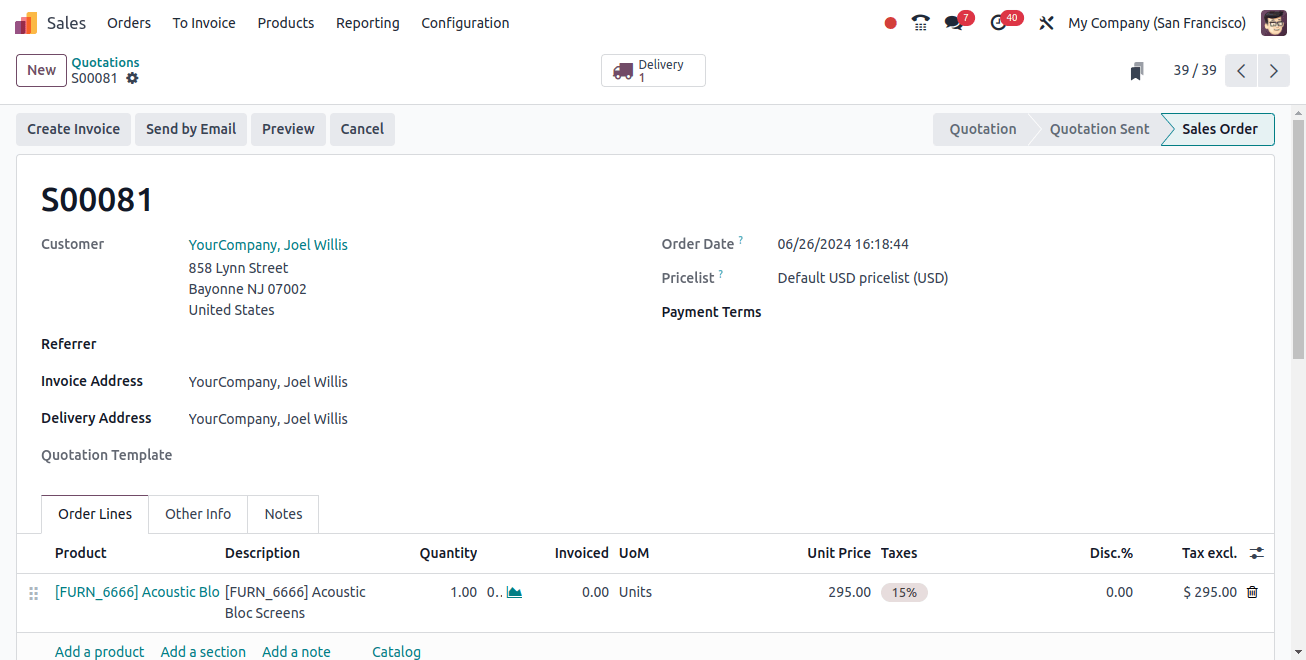

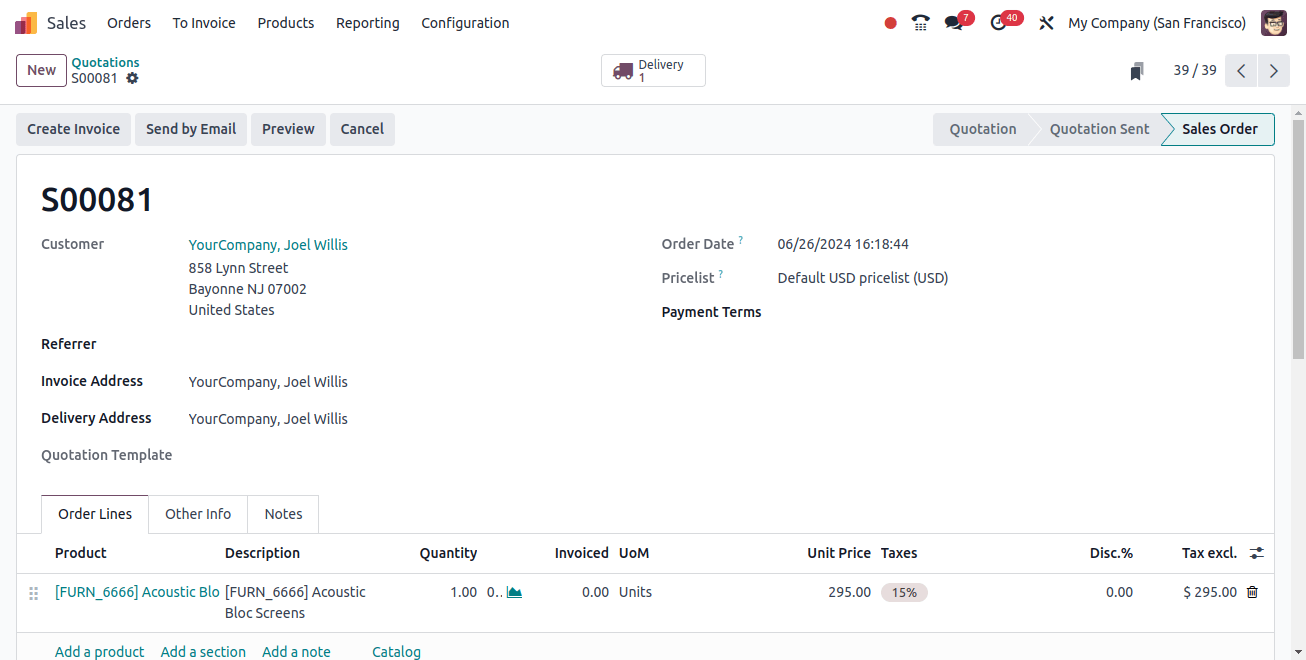

View the Sales operation presently, where some of the acquired products are sold.

Sales orders are an important business document that is not tied to finances and does not influence any ledgers. The next step is to deliver the things specified in the sales order.

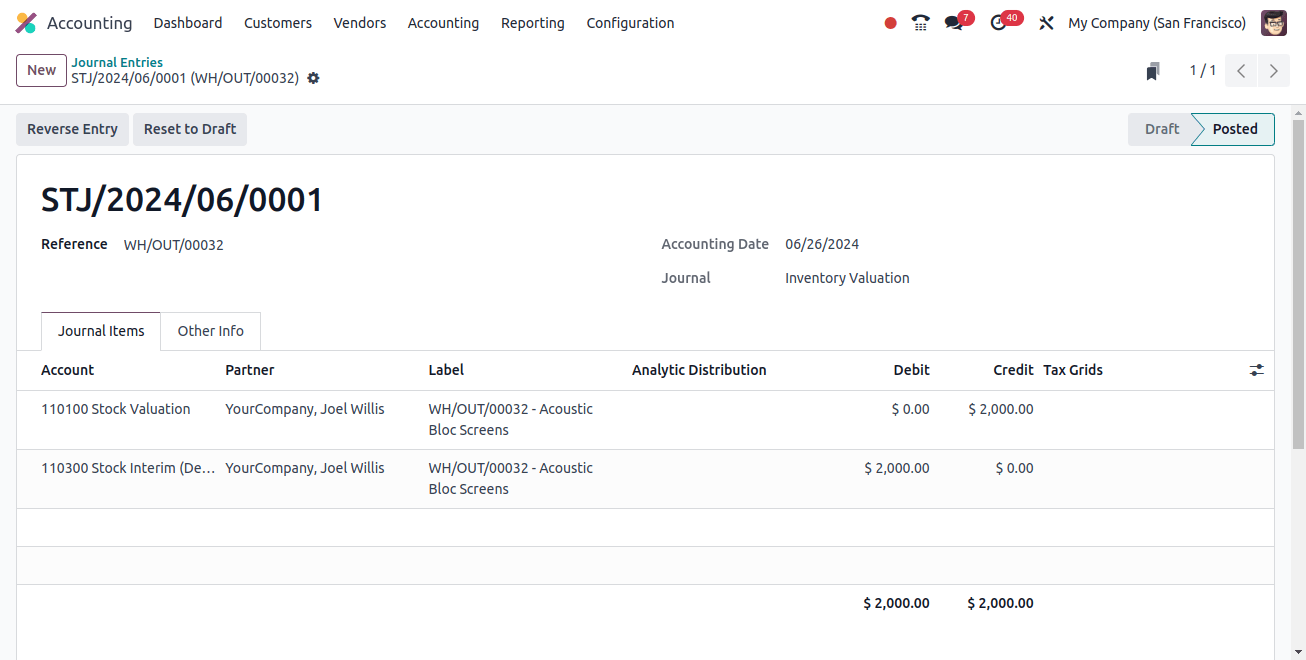

Goods delivery influences stock, which affects stock ledgers. When the items are delivered, the value of the supplied stock is recorded in the stock output account by the stock result record, lowering the value of the current stock. We should check the stock Journal at this time.

In this situation, reducing the stock results in a negative stock value, whilst decreasing the asset results in a credit to the stock valuation.

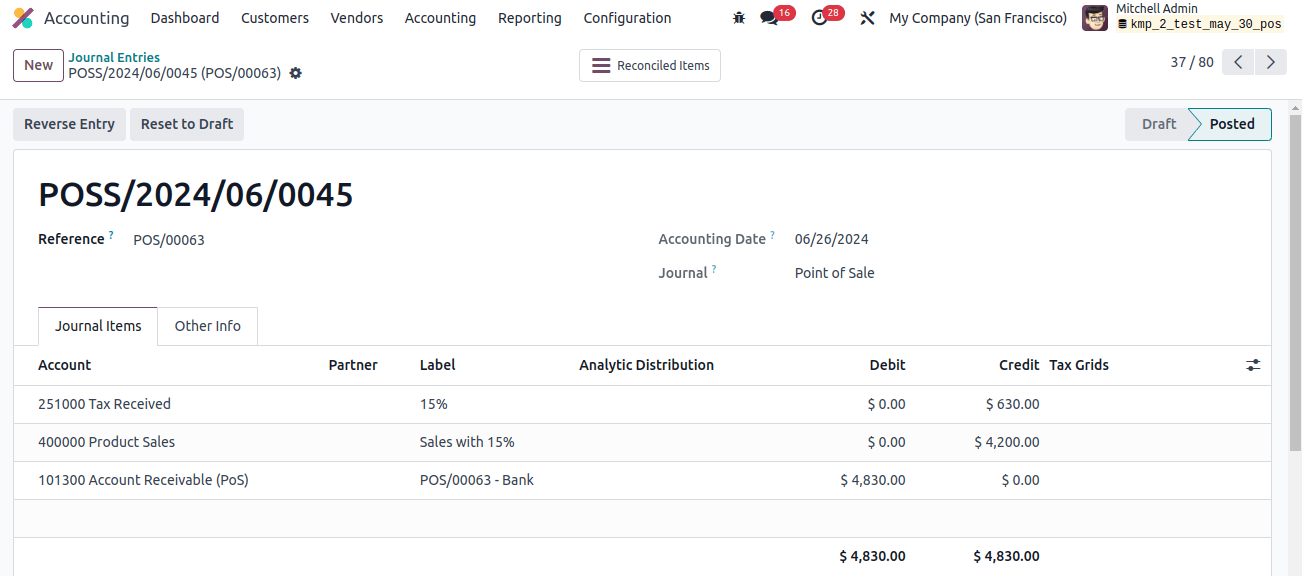

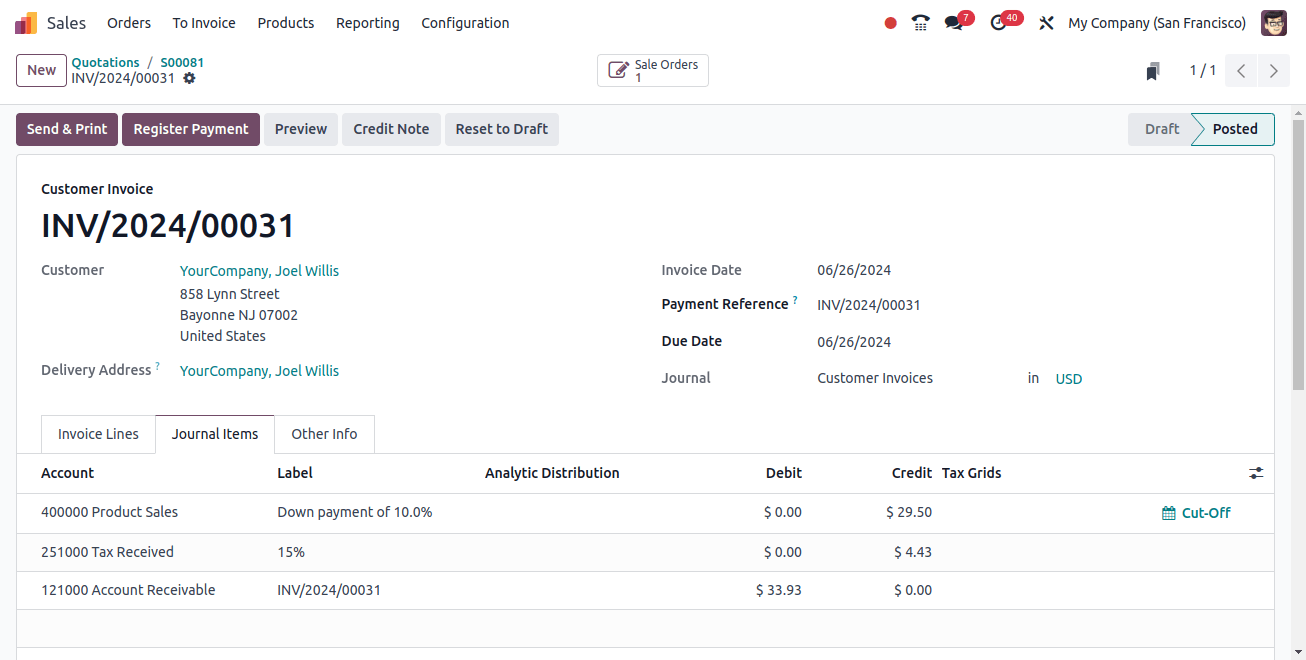

The second step is to generate an invoice on which the revenue will be recorded. The journal items tab shows the impacted ledgers.

This credit is applied to the income account ‘product sales.’ An income account’s nature is income, and it is credited when income increases during transactions. The funds that should have been received from the consumer are in the account receivable, which comes next. In this situation, the account receivable is viewed as an asset and debited as it grows.

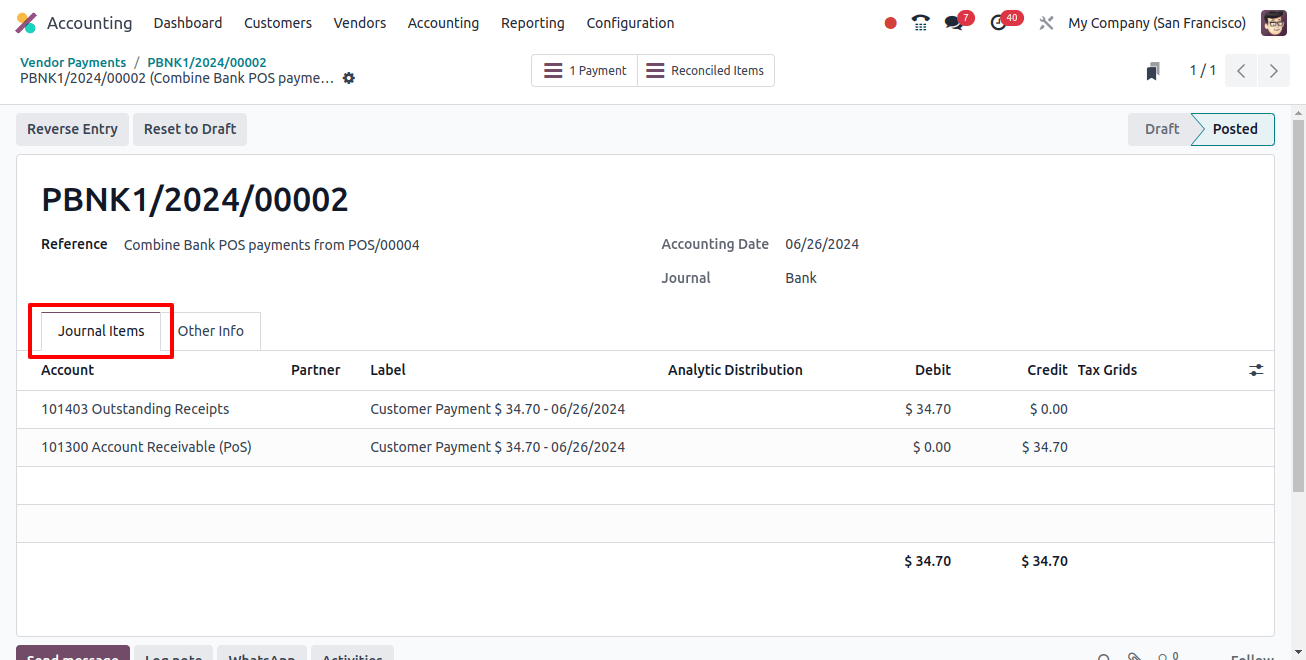

After collecting cash from a client, the cashier can add ‘register payment’ to Odoo 17. The received money will be transferred to overdue receipts in the resulting payment journal item.

The amount outstanding will decrease once payment is received. Account receivables are asset-based, and the account is credited as the assets diminish. The funds until reconciliation will be debited to the corresponding account ‘outstanding receipts.’

The next step is to either prepare and reconcile a bank statement or request one from the bank. Let's take the accounting dashboard and create a statement line. This time, the outstanding receipt amount will be displayed on the accounting dashboard alongside the bank journal.

When you generate a statement line, a corresponding journal entry is made between the bank account and the bank suspense account.

Because the consumer has placed funds into the company's bank account, the account is debited in this situation. As the asset increases and the account is debited, the amount in the bank account increases.

At this step, make sure the Odoo payment log matches the statement. The statement is checked by clicking the validate button, and the reconciliation is complete.

When you reread the journal entry, you will note that the late receipts account has taken the place of the bank suspense account.

As a result, the invoice's status changed to PAID.

We have now gone over the posting of ledger accounts at each stage of the buying and selling process. This has shown that the continental accounting expense is affected when the purchase bill is generated or when the charge is recorded.