Accounting localization in Odoo 17 refers to the ability to tailor the accounting module to conform with the laws and practices of specific nations. This can be done using fiscal localization packages.

Localization allows people from different countries to localize ERP commodities by national regulations. Because each country has unique tax rules, the localization option provides tax automation.

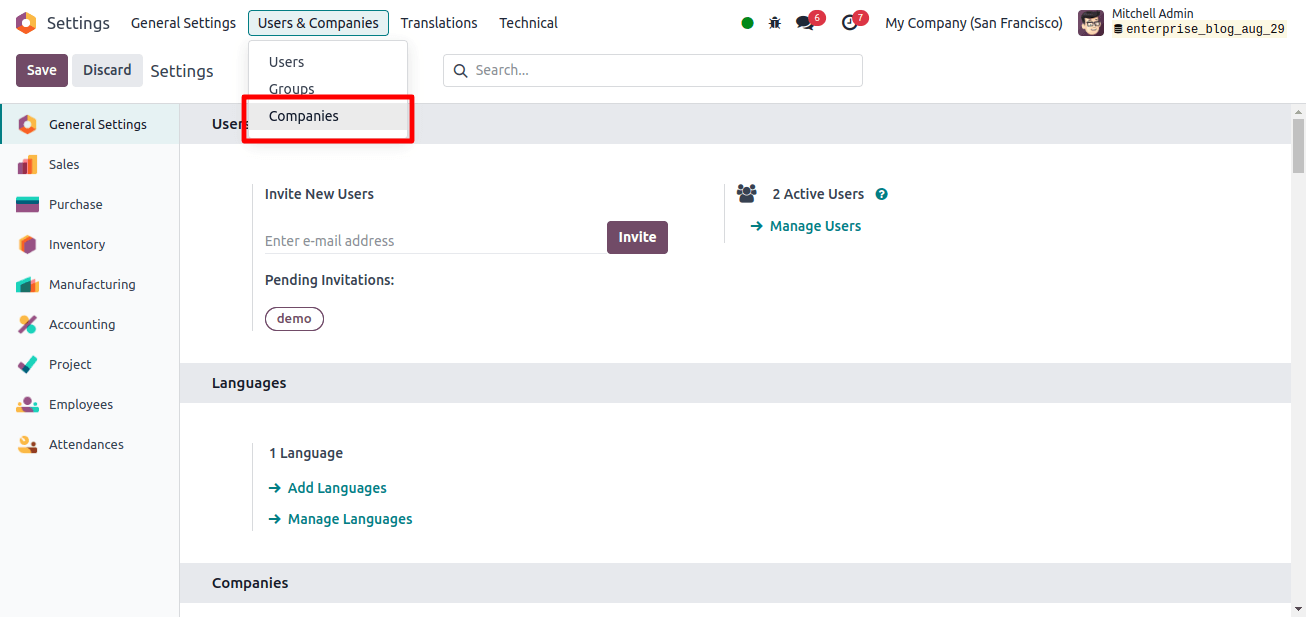

To set up localization for a corporation, first select a Colombian country. To set a nation, go to the users and companies menu in the general settings and choose the companies sub-menu.

There is a list of companies, and you can create new companies from the window by clicking the New button. Then you will be given a form to fill out with information about the company. Please include the company’s details like name, address, and the country to which it belongs.

Along with these features, you can submit further information about the company on this page. When we enter Colombia as the country, the form automatically configures the Colombian peso (COP) as the currency. After filling out these details, save the form, and the company will be successfully created.

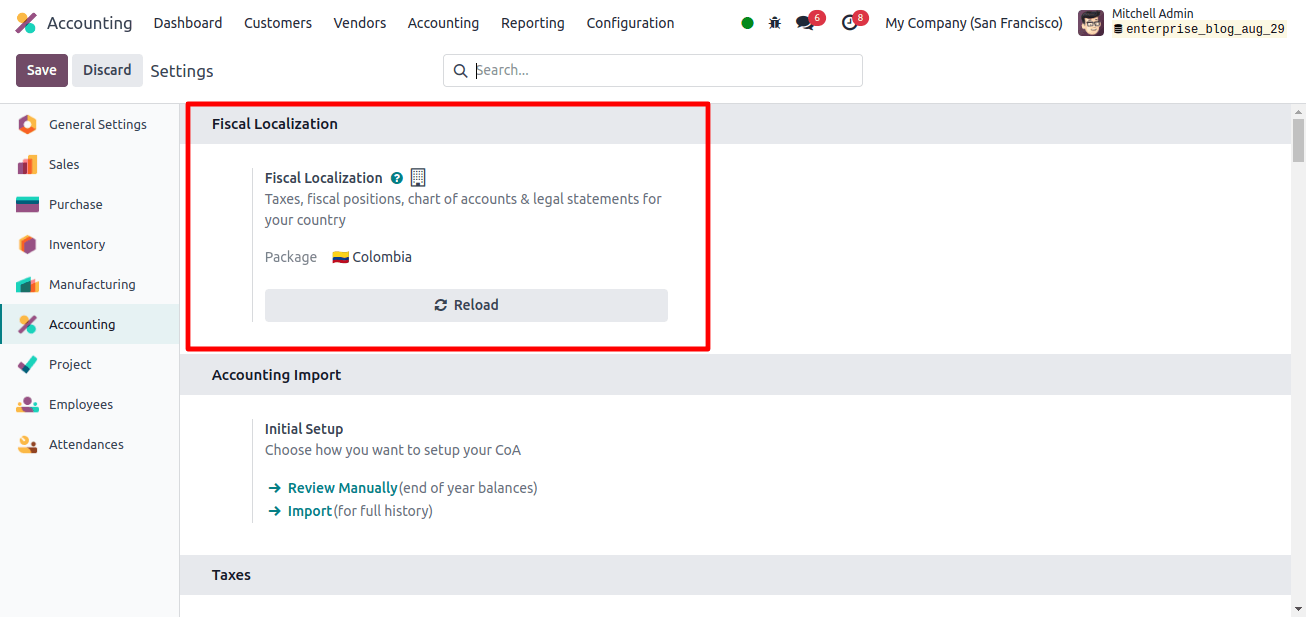

Setting up the company's localization is the next stage. Go to the Accounting application’s configuration options. In the configuration settings, under the fiscal localization field, enter the special localization for the Colombian nation in the package field and click the save button to save the package.

This feature ensures compliance with regional tax legislation and accounting standards. Odoo 17 localization modules typically include pre-configured copies of the tax laws, reports, and account charts that are specific to your nation. When compared to manually configuring your accounting system, this can help you save money and time.

Changes occurred when Colombian accounting localization was set up in Odoo 17.

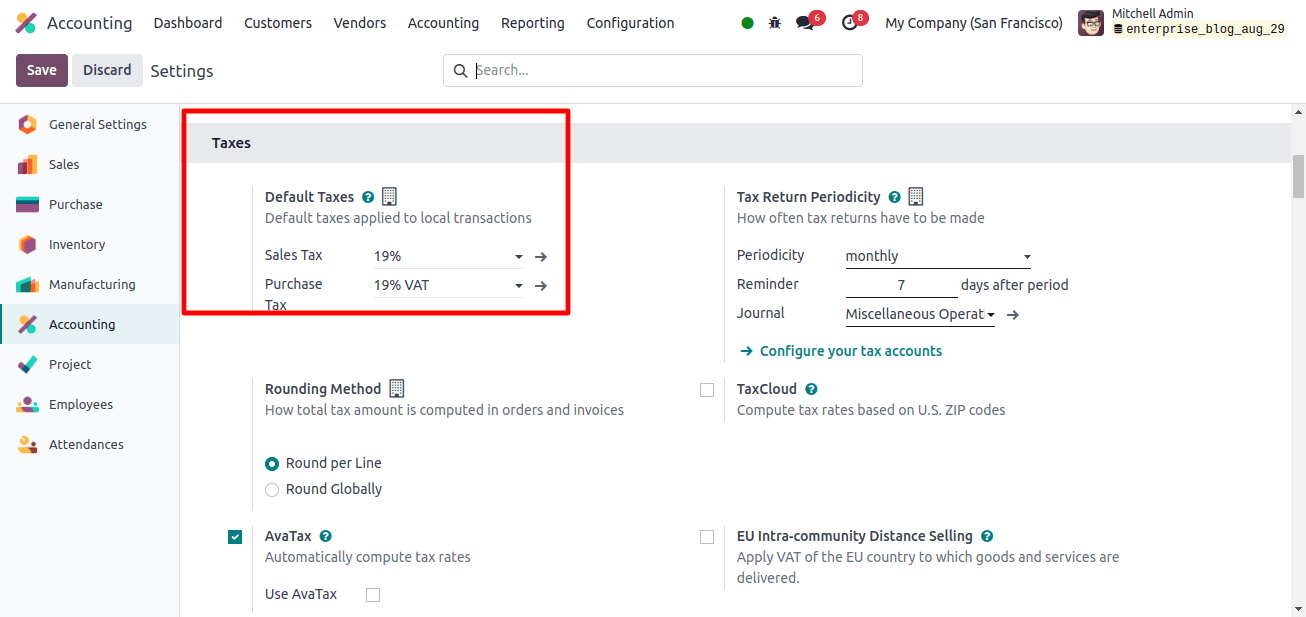

The Accounting application's Configuration settings allow you to specify your company's default tax. In Odoo 17, the default tax is automatically applied to sales or purchase transactions for a certain entity.

In the majority of cases, it ensures uniformity while saving time. When you create the package for the company, Odoo automatically sets the default tax for the company, which is used throughout the country in the default tax field of the configuration settings.

The image shows that the default sales tax in Colombia is 19%, as is the default purchase tax of 19% VAT.

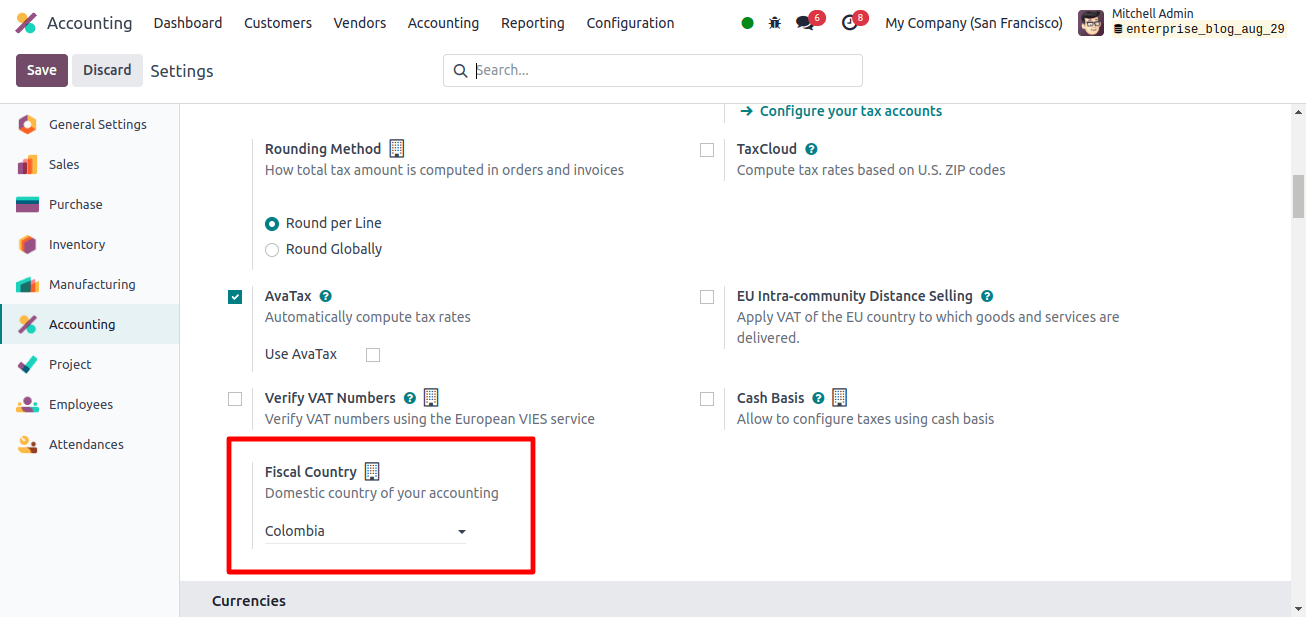

The following is the company’s fiscal country code. The configuration settings include a fiscal country field under the tax section.

So, when you create a particular package for Colombia, Odoo automatically sets the fiscal country to Colombia.

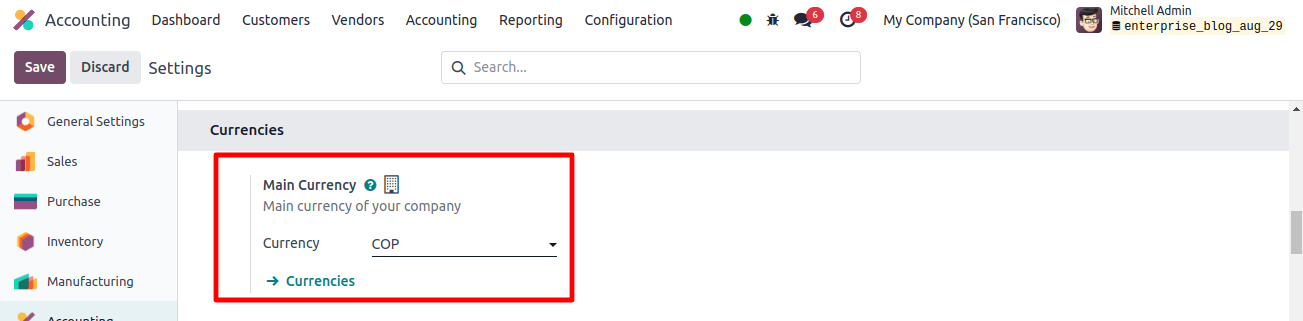

In the setup options, under the Currencies section, you can specify the principal currency used by the organization. The Colombian peso (COP) is the currency used in Colombia.

So, if you set the translation package to Colombia, you do not need to specify the major currency in the Configuration settings. Because Odoo automatically selects the Colombian peso (COP) as the principal currency.

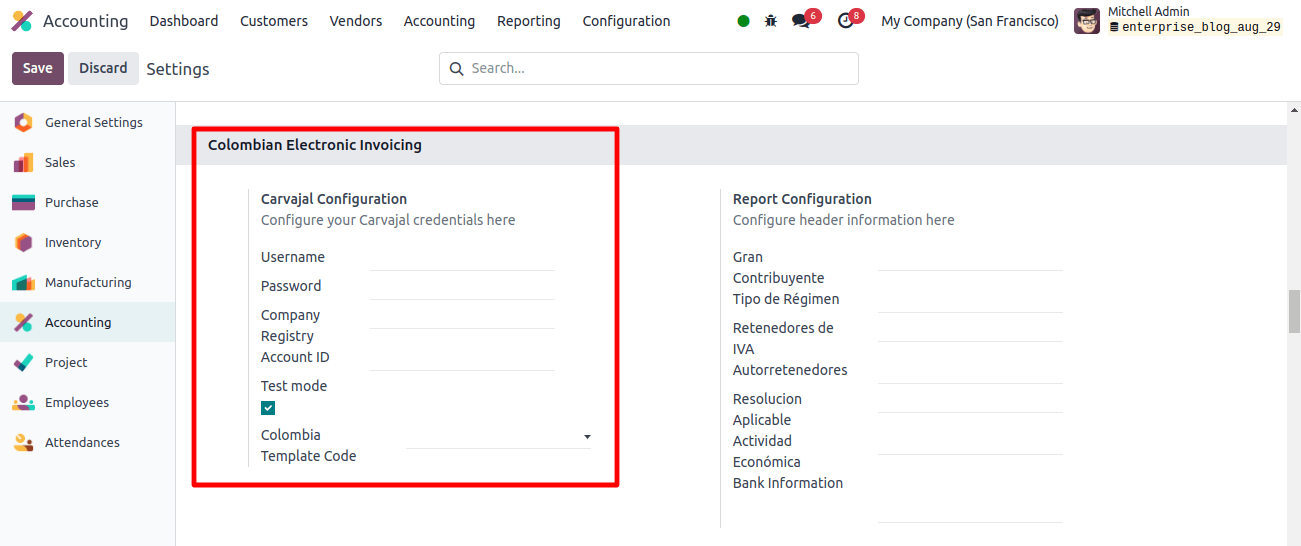

There is an additional section in the Configuration settings titled ‘Colombian Electronic Invoicing’. It addresses a few important fields to ensure that Colombian companies have effective and compliant invoice administration, ensuring compliance with the country’s e-invoicing requirements.

In this section, you can configure Carvajal credentials. The login credentials used to connect Odoo to Carvajal’s electronic invoicing service are known as Carvajal credentials.

With this service, Colombian companies can electronically invoice in conformity with DIAN (Dirección de Impuestos y Aduanas Nacionales) regulations. Take a look at the stages or workflow for electronic invoicing when Colombian localization is set up for a corporation.

* The sender generates the invoice.

* The electronic invoice provider creates the valid XML file. The electronic invoice provider generates the invoice electronic code (CUFE) using the electronic signature.

* DIAN validates electronic invoices after receiving notification from the source. They then approve or reject them. The electronic invoice provider generates a PDF invoice that includes a QR code.

* The acquirer receives the invoice from the electronic invoice provider. The acquirer sends an acknowledgment receipt and either approves or rejects the invoice. The sender downloads the PDF and XML as a.zip file.

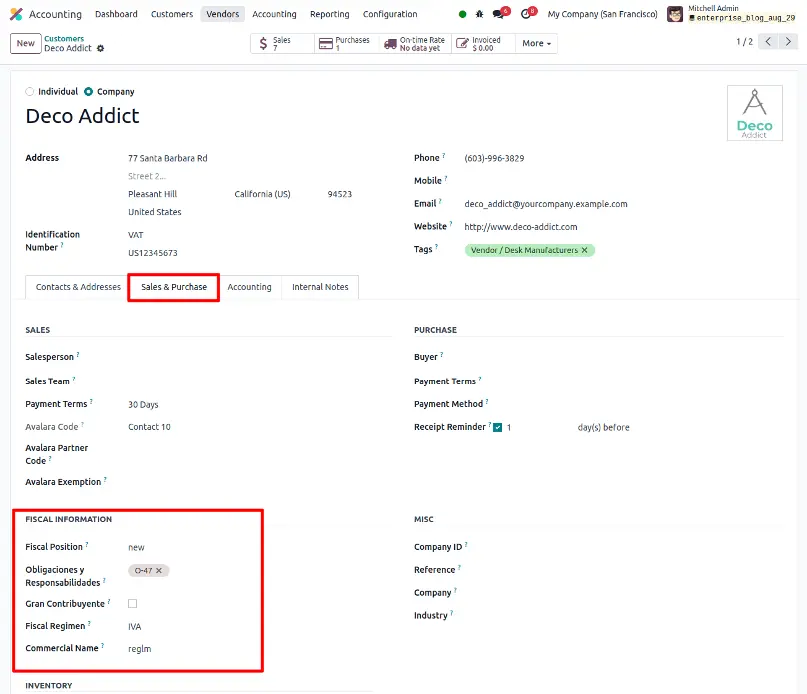

In the partner form’s sales and purchase tab, under the Fiscal Information section, set Fiscal Position, Obligation y responsabilidades, Gran Contribuyente, Fiscal Regimen, and Commercial Name.

In Odoo’s Colombian accounting localization, Obligaciones y Responsabilidades (Obligations and Responsibilities) refer to a company’s tax liability codes. These codes, defined by Colombia's tax administration, DIAN, identify a company’s tax liabilities.

* Gran Contribuyente, or "Large Contributor" in English, refers to a group of taxpayers in Colombia who are regarded to have made considerable contributions to the country’s tax revenue.

Gran Contribuyente enterprises face more stringent tax legislation and filing requirements than other taxpayer groups. This usually involves electronic invoicing and more frequent tax submissions.

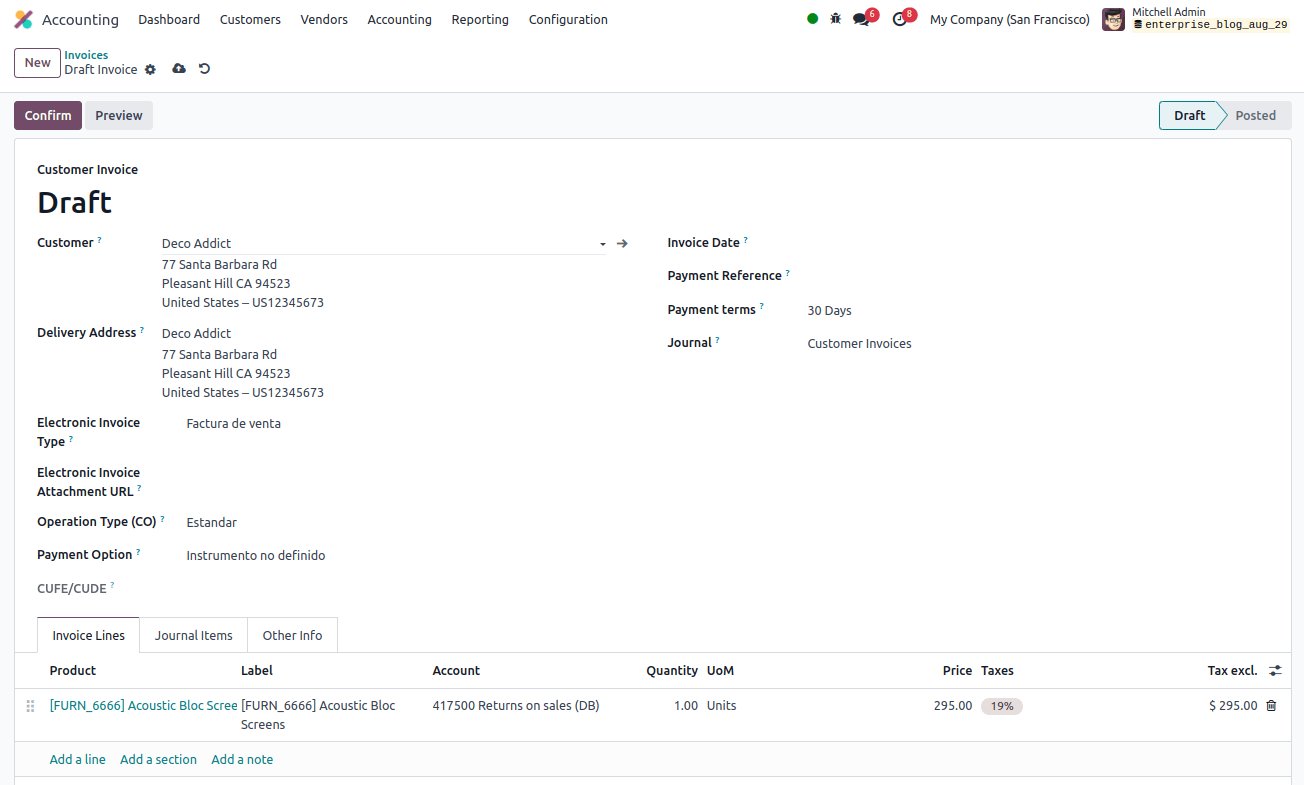

Then develop an invoice for this customer; when producing the invoice, you will see that extra fields are added to the invoice form.

The client invoice form includes fields such as Electronic Invoice Type, Electronic Invoice Attachment URL, Operation Type (CO), Payment Option, and so on.

* Electronic Invoice Type: The type of electronic invoice you are issuing is referred to as the "Electronic Invoice Type."

* Electronic Invoice Attachment URL: Enter any additional information in the URL form here, and it will be included in the invoice.

* Operation Type (CO): This relates to the type of transaction documented on the invoice. It’s a field on the invoice form that helps with the invoice’s classification for tax and accounting purposes.

* Payment Option: Describes the payment method the customer will use to settle the invoice amount.

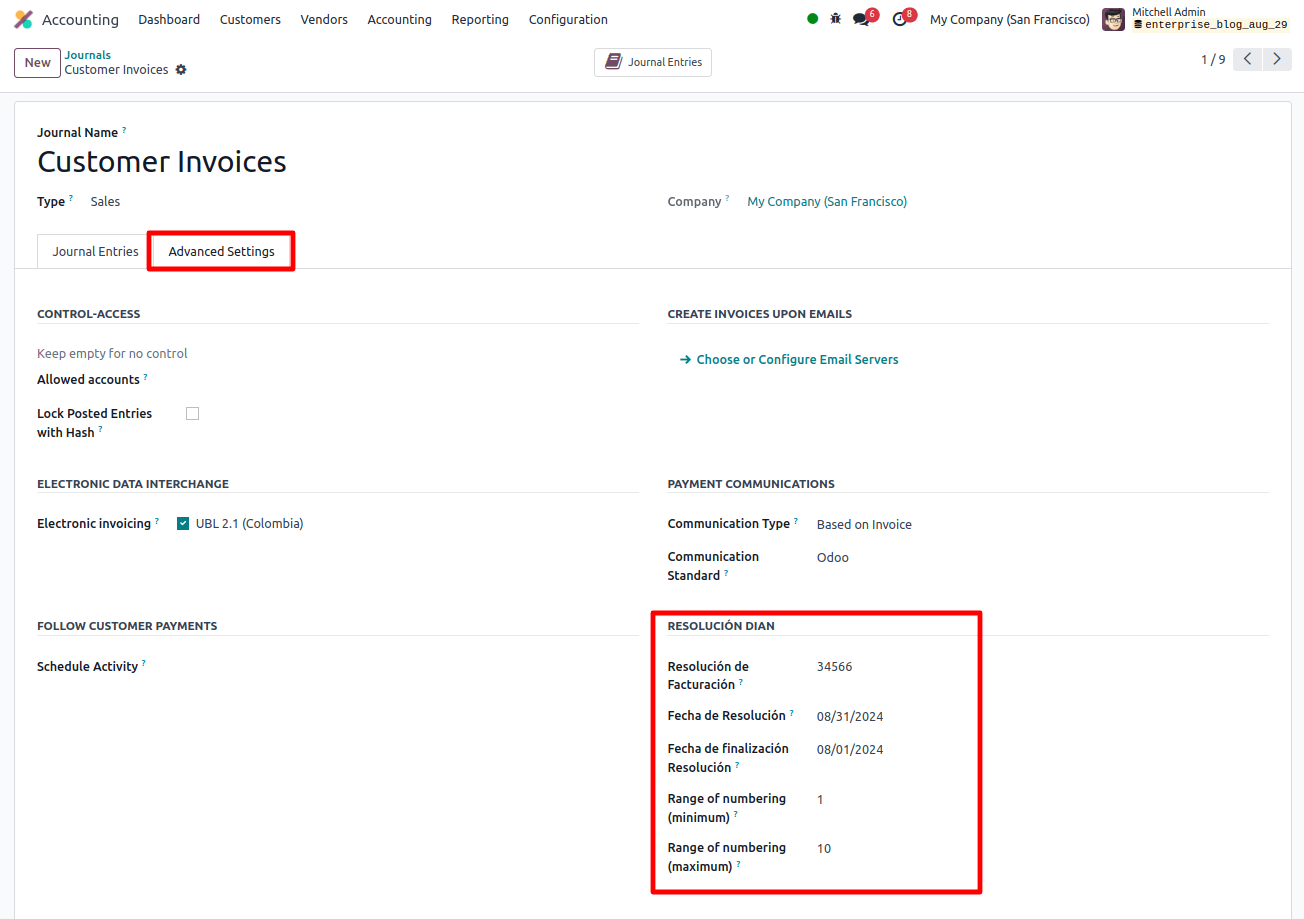

In the sales journal, under the Advanced Settings tab, there is an additional section RESOLUCIÓN DIAN, where you may set up the Resolución de Facturación, Fecha de Resolución, Fecha de finalización Resolución, and Range of numbering (minimum and maximum).

* "Resolución de Facturación" as opposed to "Invoicing Resolution" . It refers to the formal document issued by the Colombian National Directorate of Customs and Taxes (DIAN) allowing business permission to transmit electronic invoices.

* The "Fecha de Resolución" (Resolution Date) refers to the date the Colombian tax authorities issued a resolution that may be relevant to the invoice.

* Finalization Date The term "resolución" (expiration date of a resolution or authorization granted by the Colombian tax authority) refers to the day it expires.

* The range of numbering (minimum) represents the start of an invoice number sequence used for electronic invoicing. This design ensures individual identity for each invoice and helps in the maintenance of correct accounting records.

* A range of numbering (maximum) is a configuration that specifies the upper limit of a sequence used to create document reference numbers, such as invoice numbers.

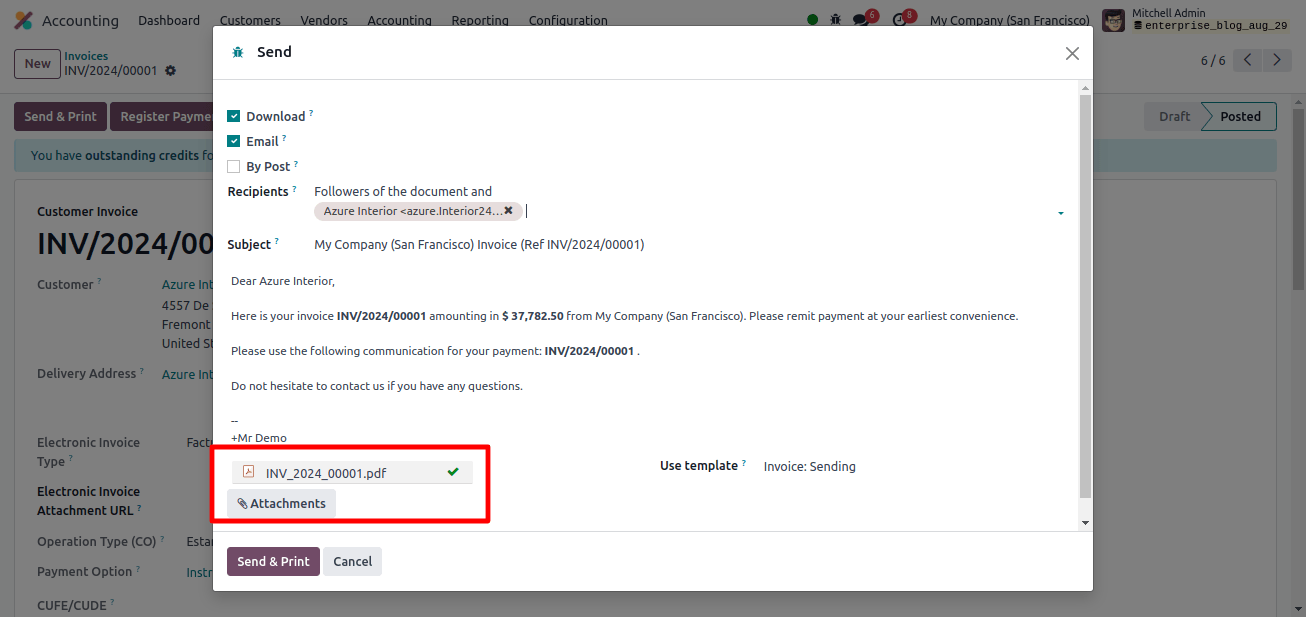

Once all of these details have been entered correctly, click the confirm button in the above invoice form and then click the send and Print’ button to send the invoice to the customer. There is a pop-up window that displays all of the details of the sending email.

There, we can see that both the XML and PDF files are attached to the invoice that was delivered to the customer. Click the send and print button, then finish the selling order by making the payment.

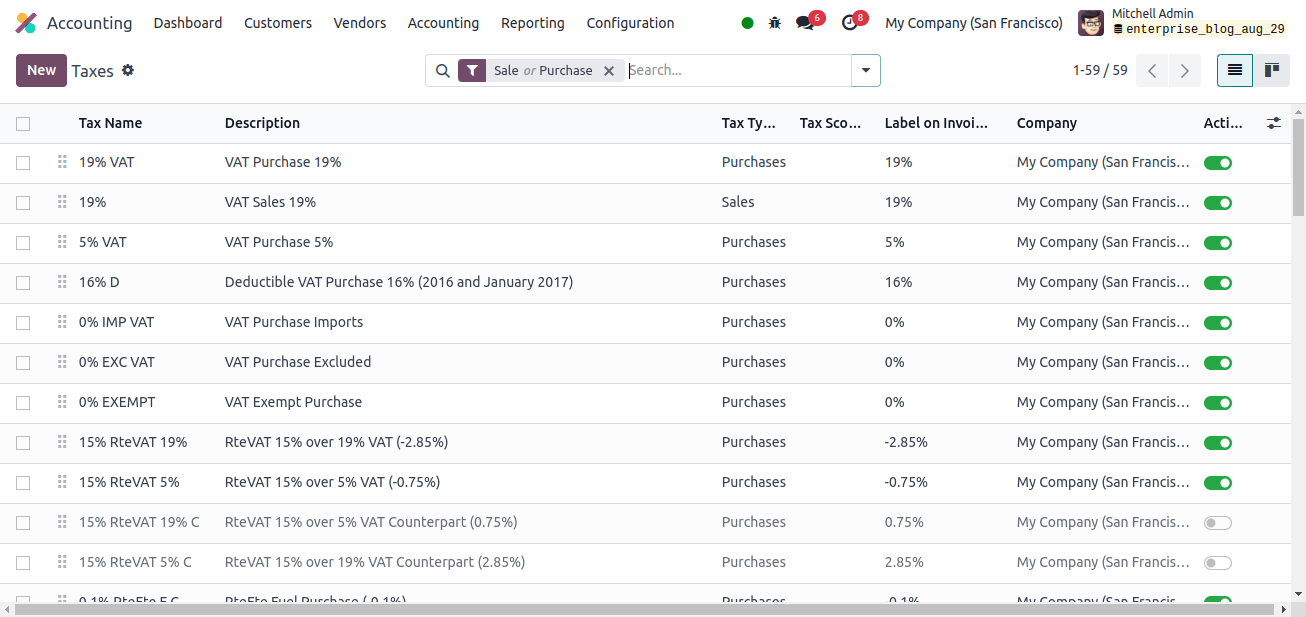

Next, under the Configuration menu, there is a Taxes submenu. When you click the Taxes sub-menu, you will see a list of taxes that any Colombian company can use for their business.

You can then go to the accounting application’s reporting option. There are other sub-menus, including balance sheets, profit and loss statements, cash flow statements, and tax reports.

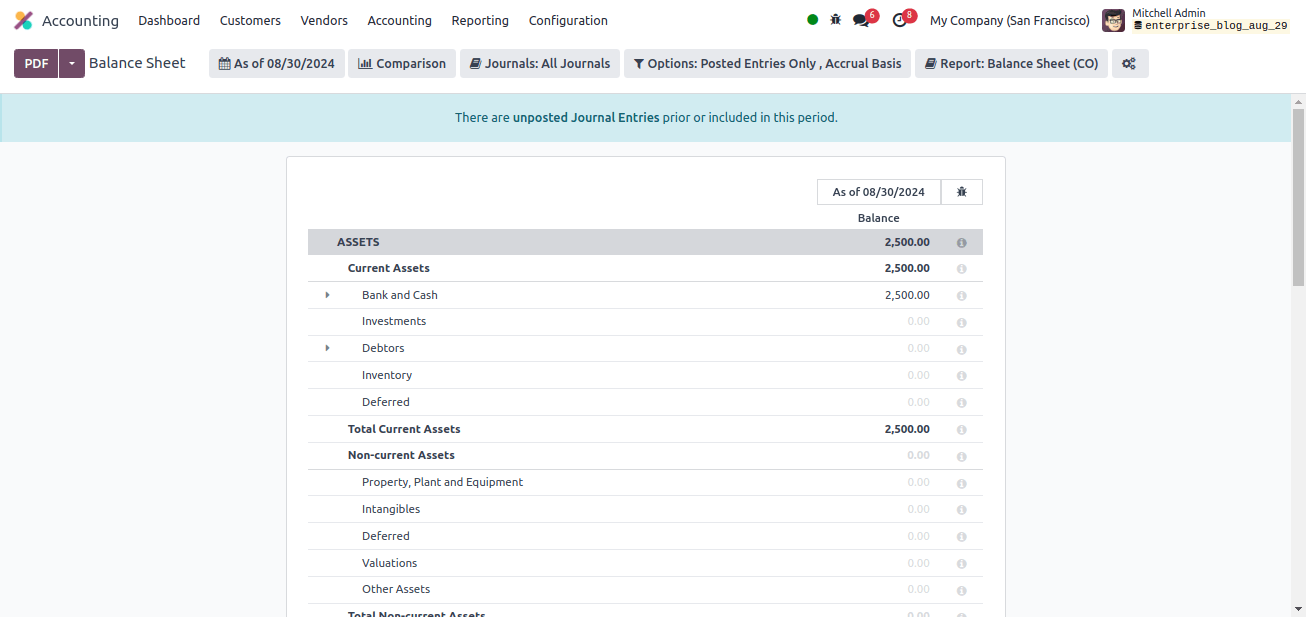

Take a peek at the balance sheet of the Colombian corporation. Select the Balance sheet sub-menu from the Reporting menu.

The balance sheet displays the business's assets, liabilities, and equity. Current and noncurrent assets are included in the Assets list, whereas current and noncurrent obligations are included in the company’s liabilities. The equity list on the balance sheets includes special capital, capital surplus, reserves, year-end results, and so on.

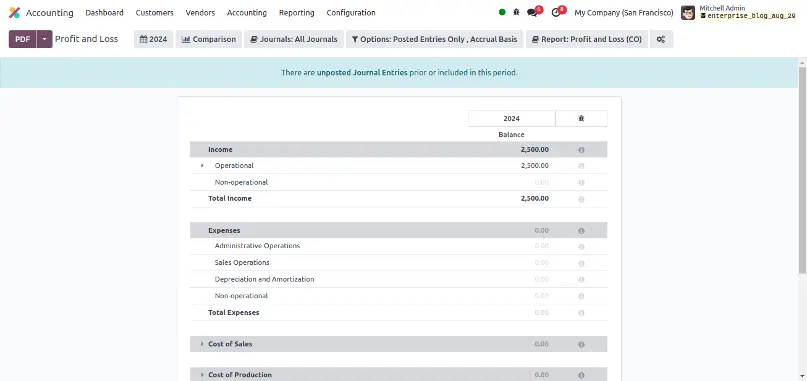

The following section discusses the company’s profit and loss. A Profit and Loss submenu can be found under the Reporting menu. Choose the profit and loss sub-menu, and a profit and loss list will appear.

This list includes the Colombian company’s profit and loss report. A Colombian company’s Profit and Loss report includes income, expenses, cost of selling, production, gain and loss, income tax, and net income.

Income includes both operating and non-operating income. The Expenses comprise administrative and sales operations, depreciation and amortization, and non-operational costs.

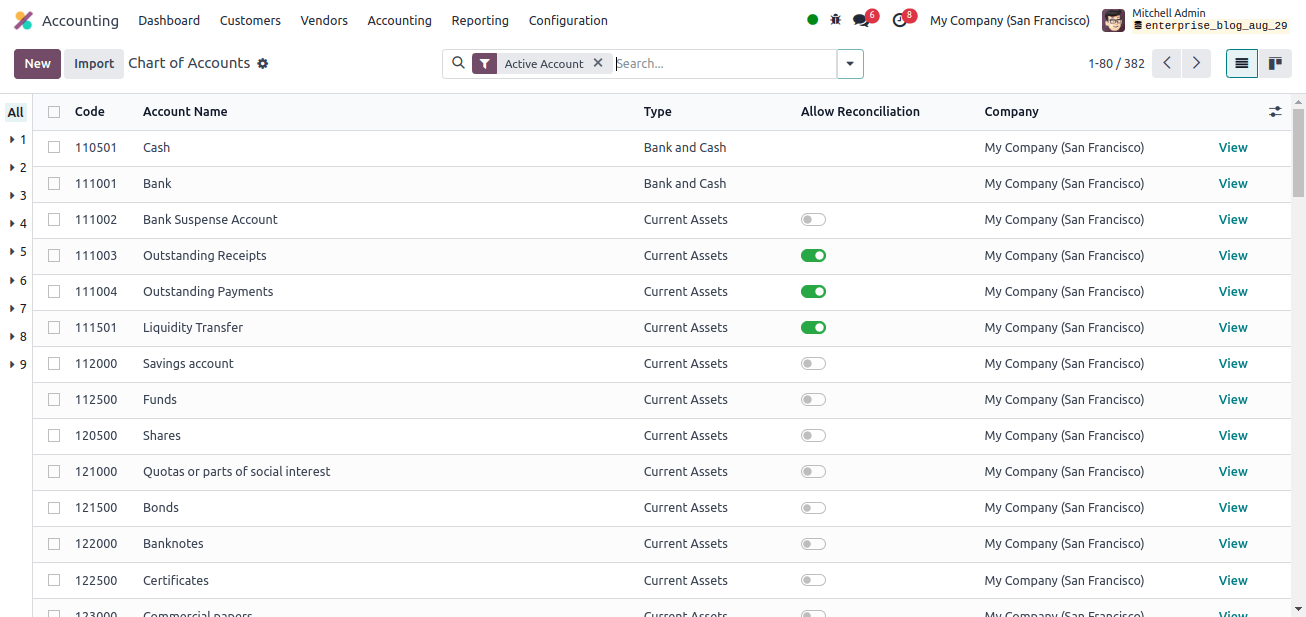

The chart of accounts serves as the foundation for tracking your financial activities. It acts as a list of all the accounts used by your Odoo accounting system to categorize your company’s financial activity.

First, select the accounting application’s configuration menu, followed by the Chart of Accounts sub-menu. There you will find a list of charts of accounts that Colombian firms might use.

The image above shows the accounts available to Colombian enterprises, which can be used for a variety of purposes.

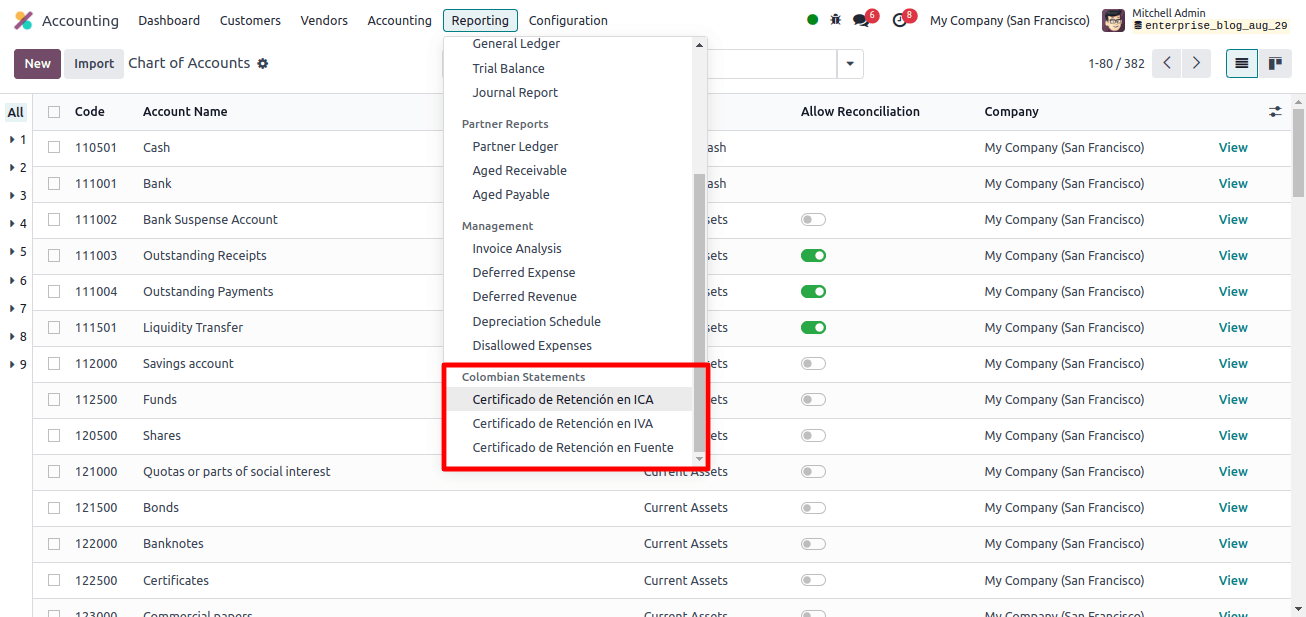

The accounting application’s Reporting menu now includes a new area called 'Colombian Statements', which includes sections for ‘Certificado de Retención in ICA', 'Certificado de Retención en IVA', and 'Certificado de Retención en Fuente'.

* Certificado de Retención en ICA: It is a certificate of withholding for Colombia's Industry and Commerce (ICA) tax collected from vendors. It is issued to vendors as an official document advising them of the amount of ICA tax withheld from their payments.

* Certificado de Retención en IVA: It is an official record that attests to the amount of VAT withheld from suppliers. It details the VAT withheld from their transactions and serves as an official document for both the seller and the company.

* Certificado de Retención en Fuente: It is a report that details the withholding taxes collected from payments made to vendors, suppliers, or other entities. Income tax, value-added tax (IVA), and other applicable taxes are typically levied on these deductions.

Odoo 17's localization tool for accounting operations offers a comprehensive solution that is adapted to the specific needs and legislation of numerous countries.

Country-specific requirements in Odoo 17, enterprises may improve reporting accuracy, increase compliance, and streamline financial reporting.

Localization allows businesses to manage complex tax systems, comply with legal rules, and get more financial performance information.

Finally, Odoo 17's accounting localization assures compliance with local financial requirements, promotes growth and longevity, and enables businesses to thrive in global marketplaces.