Odoo accounting localization is important for managing financial management with local business processes and legal requirements.

It ensures that the accounting system complies with local currency restrictions, reporting needs, and tax laws, all of which are important for the accuracy and smooth running of the business.

Odoo helps businesses streamline their accounting process, reduce errors, and maintain transparency by including localized features such as specific tax computations, reporting formats, and regulatory requirements.

This personalized technique streamlines financial processes, allowing for strategic planning and informed decision-making while following local standards.

Understanding and following local financial rules is important for firms in various markets. Odoo’s accounting localization for Romania provides a customized solution to the country’s specific accounting and tax requirements.

This translation integrates Romanian financial standards directly into Odoo’s ERP system, giving businesses options for precise VAT calculations, compliant financial reporting, and following local accounting standards.

Odoo improves operational efficiency, simplifies financial management, and guarantees that businesses comply with Romanian financial laws and standards by customizing functionality to Romanian regulatory frameworks.

Installation of the localization

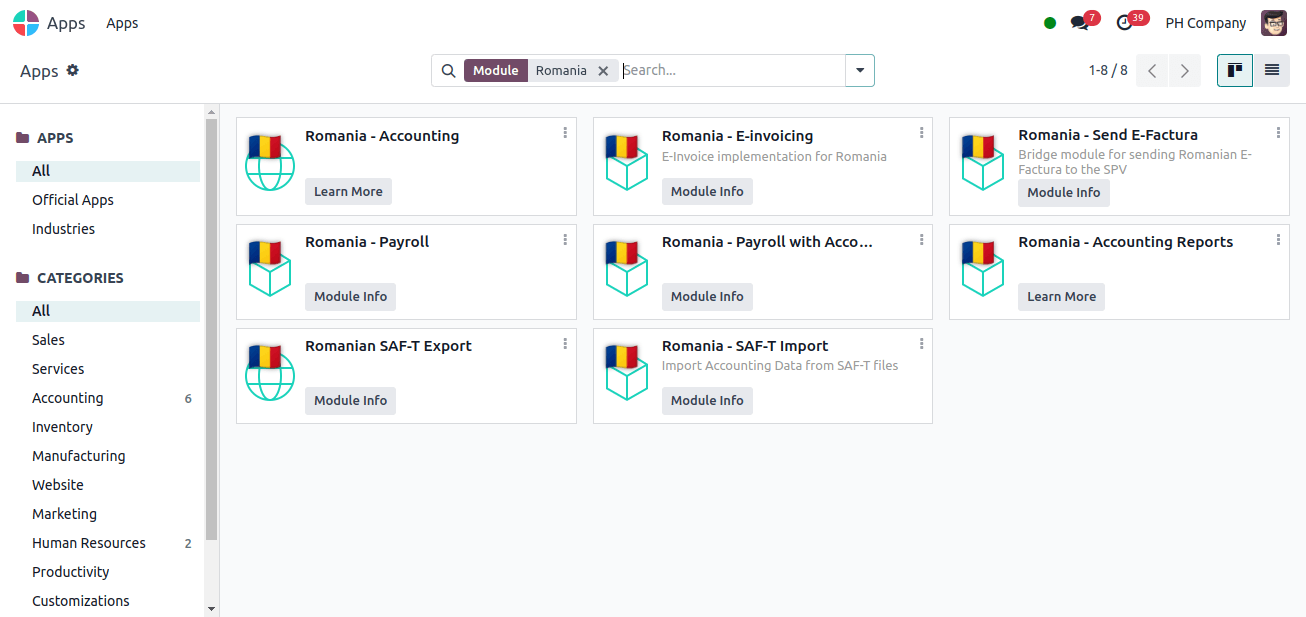

We may acquire Romanian accounting localization in Odoo 17 in two ways: install the accounting localization modules or select Romania as the nation when building the database. Go to Apps, search for Romania localization modules, and install the ones you need.

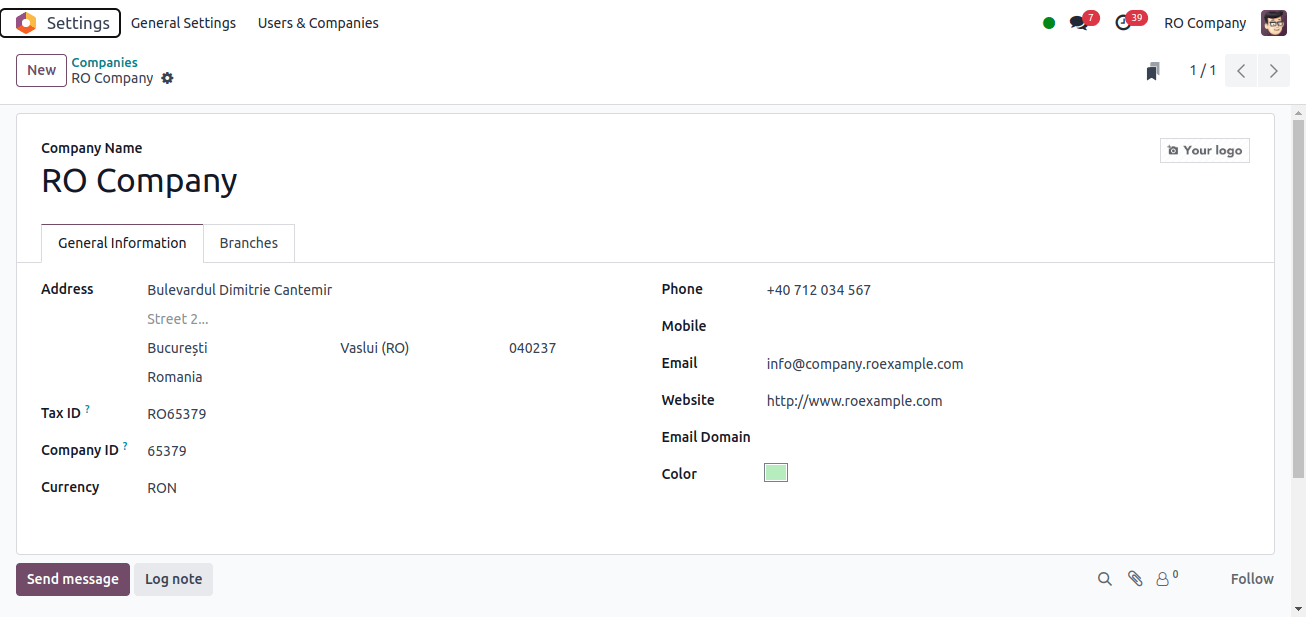

Configuring the Company

After installing the modules, we must verify that the company setup is correct; for this, navigate to Settings > Users and Companies > Companies. Choose the firm and verify the configuration. Check the Country, City, and Telephone Number fields, then in the Company ID area, enter your company's CUI number (or, for overseas firms, CIF number) without the RO prefix (for example, 18547290).

If your firm is registered for VAT in Romania, provide its Tax ID number (for example, RO18547290) in the Tax ID area. If the company is not VAT-registered in Romania, you must not submit its Tax ID.

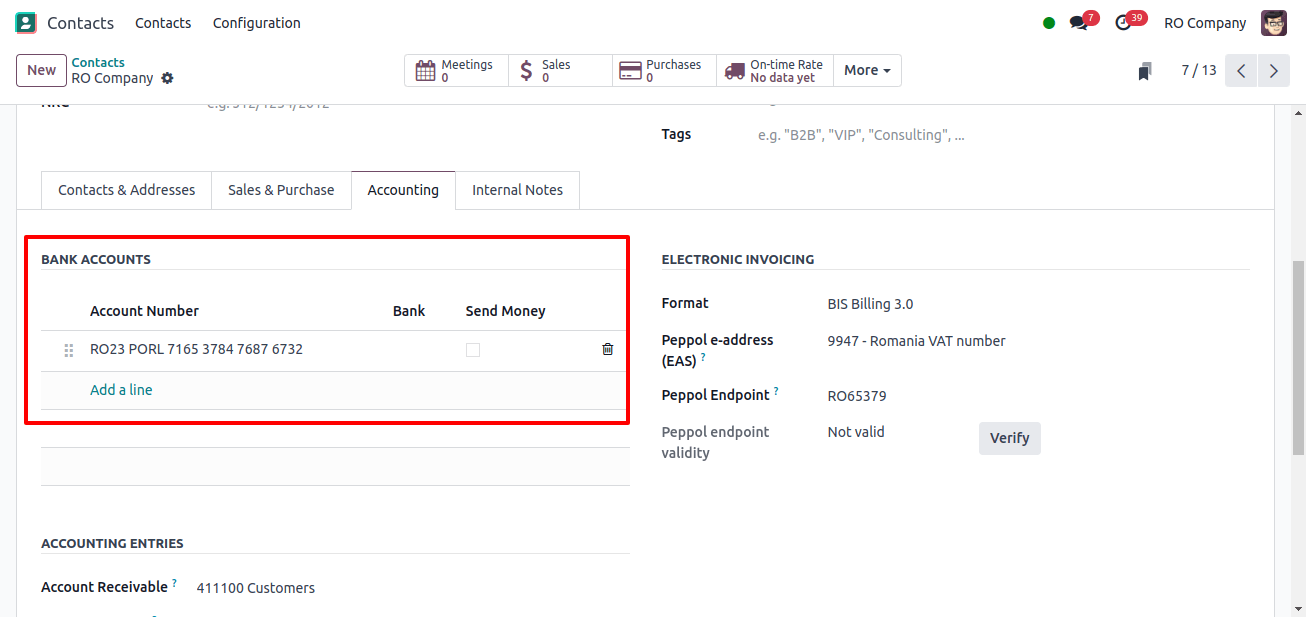

In addition, from the contacts module in the accounting tab, enter the bank account number for the company’s contact.

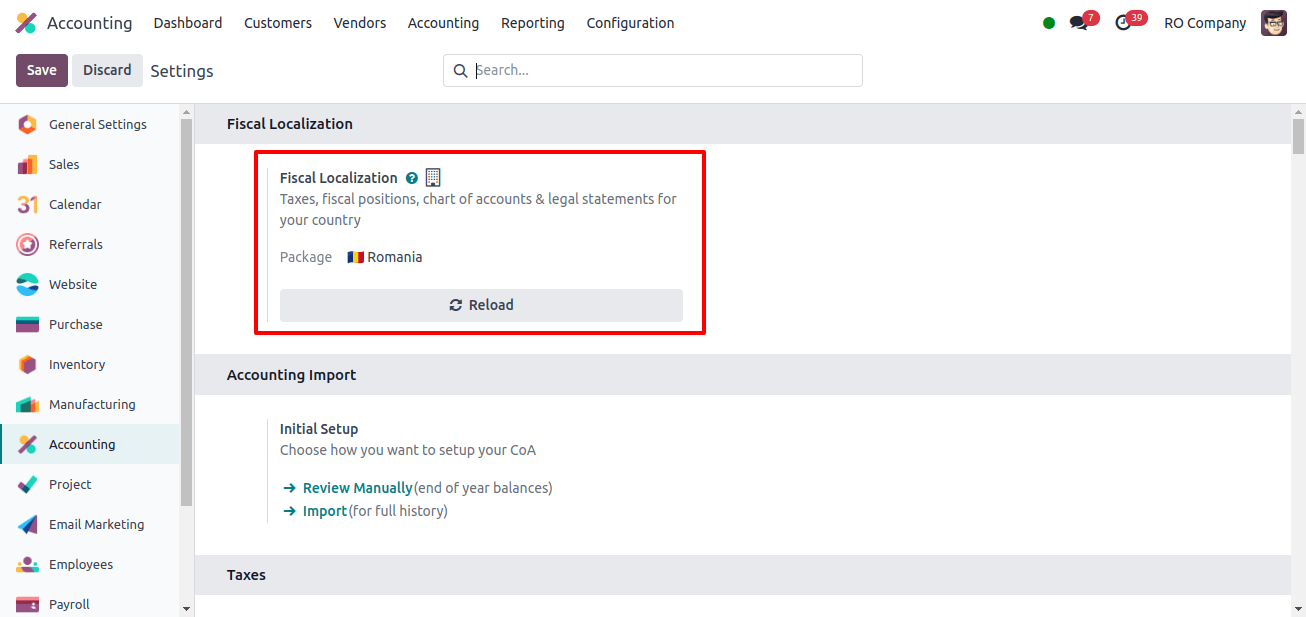

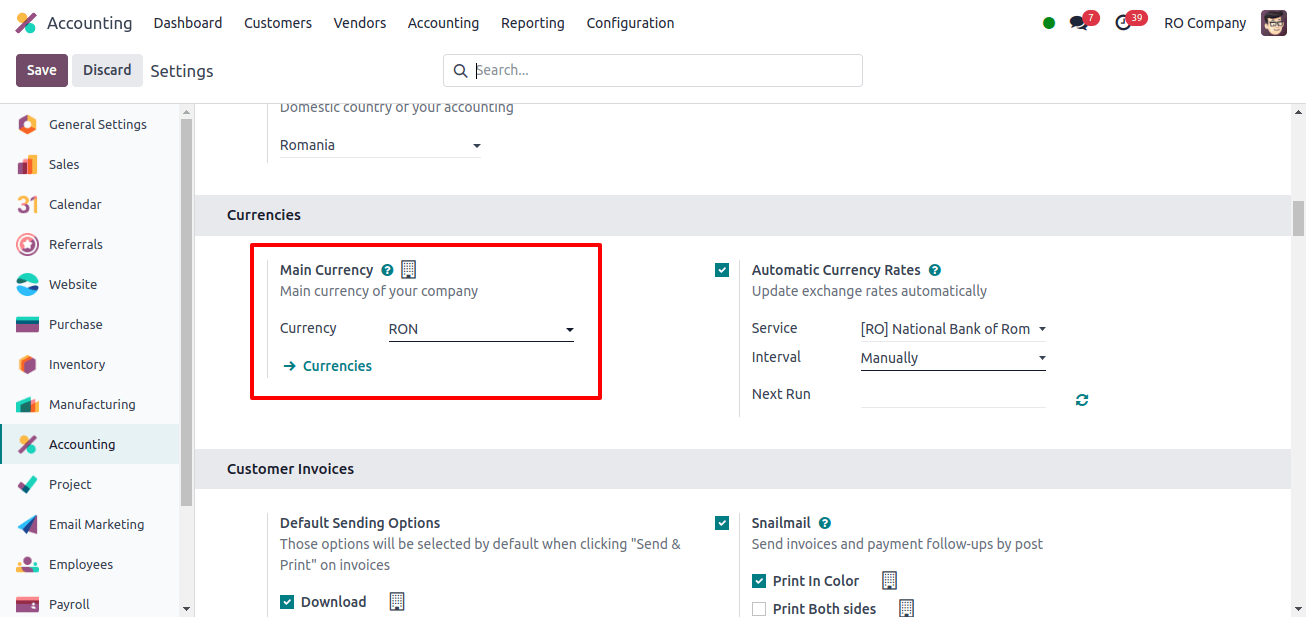

After checking that the company is properly configured, we can navigate to Accounting > Configuration > Settings and verify that the Fiscal localization is set for this localization. It'll be put in Romania.

The principal currency will be the Romanian leu (RON), Romania's official currency.

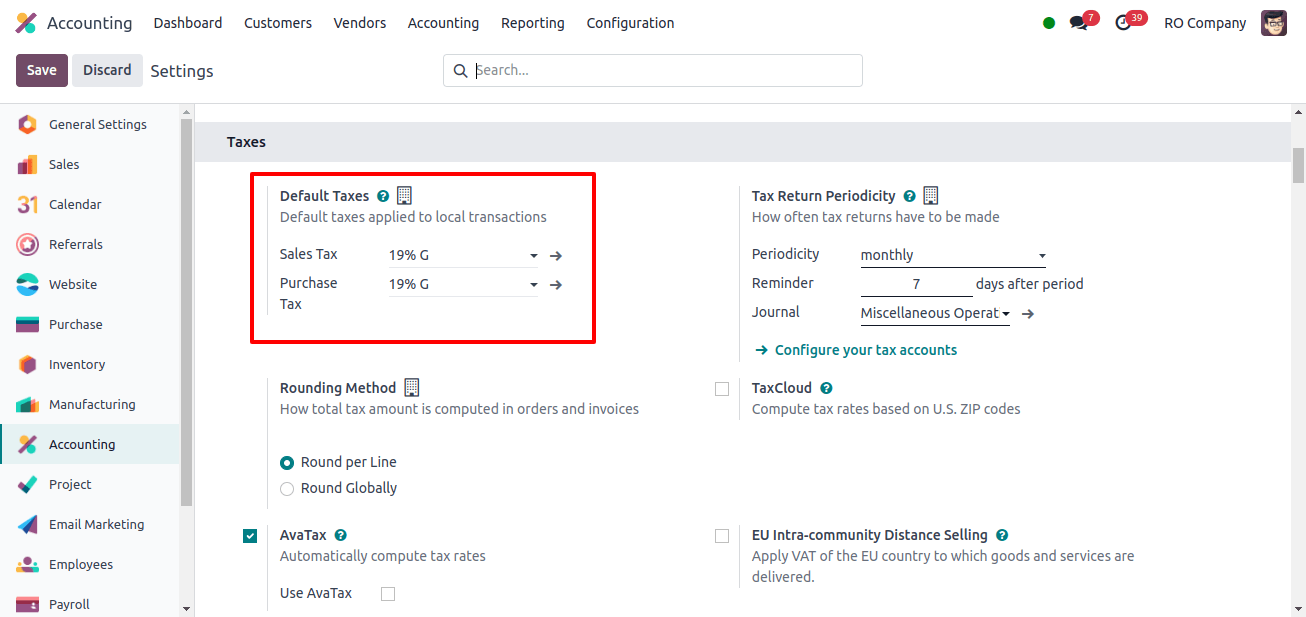

When we install the Romania localization, the default tax in the accounting module’s configuration settings will be configured, ensuring that correct tax rates are automatically applied to transactions, decreasing the chance of manual errors and increasing consistency.

Default taxes simplify the invoicing process by pre-configuring tax codes for various items and services, improving accuracy in financial reporting and tax calculations. The Sales and Purchase Tax rate is set to 19% G.

Chart of Accounts

The chart of accounts in Odoo accounting is a systematic framework that organizes a company’s financial accounts. It provides the recording and reporting of financial activities by categorizing accounts into assets, liabilities, equity, revenues, and expenses.

The chart of accounts includes the Merger/Division premiums, which are intended to track the premiums or adjustments related to business mergers or divisions.

These premiums are frequently documented in accounts set aside for unusual earnings or losses arising from such restructuring actions. Then there are the provisions for litigation accounts, which track the projected costs of legal disputes such as lawsuits or legal claims filed against the companies.

This provision is a recognized responsibility that anticipates and accounts for anticipated cash outflows from legal problems. Similarly, additional accounts were added to the chart of accounts when we implemented the Romanian localization.

For the Romanian tax authorities to set up a file receivable with Romania's accounting localization, the chart of accounts must be identical to an official chart of accounts.

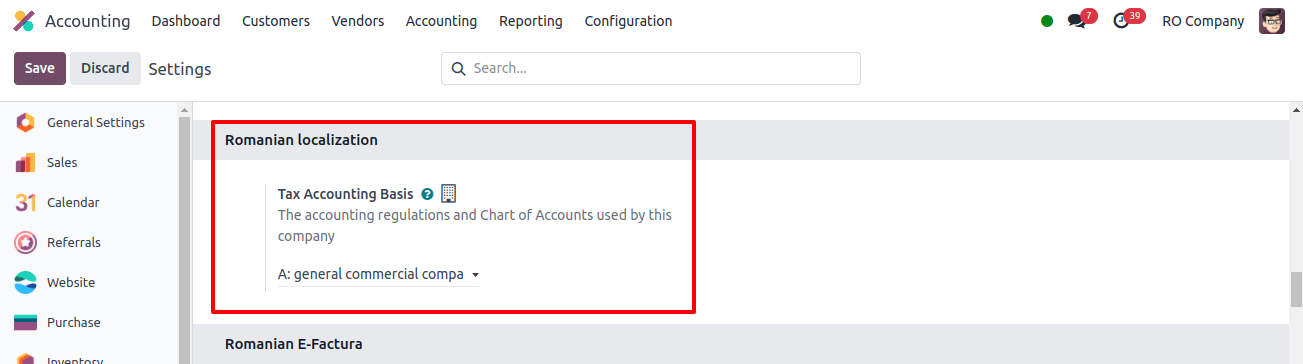

In the Romanian localization section of Settings -> Accounting, change the Tax accounting basis to match the company’s chart of accounts and accounting principles.

We must set the Tax Accounting basis, which is under Romanian Localization, in the accounting module’s configuration settings so that the accounting basics and chart of accounts used by the company are reflected.

Journals

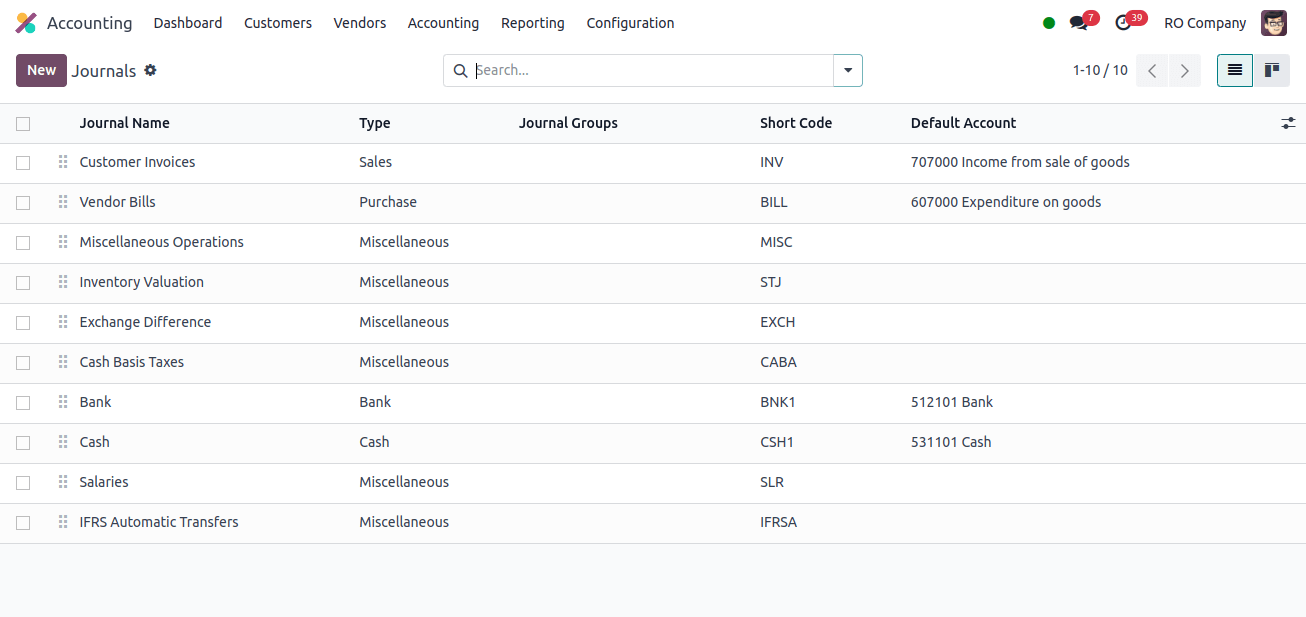

Journal document and organize financial transactions. They serve as thorough records that record, categorize, and track transactions such as sales, purchase, bank, and currency. Each journal in Odoo may be customized to individual transaction types and accounting requirements, ensuring reliable financial data management.

Journals help in setting up a clear audit trail, streamlining reconciliation operations, and supporting complete financial reporting, making them an important component of keeping organized and compliant accounting records.

Along with all core journals, the Romania accounting localization now includes Exchange Difference and IFRS Automatic Transfers. The exchange difference journal tracks and records the impact of exchange rate movements on financial transactions and balances.

It helps in the maintenance of correct accounting records, provides compliance with financial reporting regulations, and provides insights into the financial effects of currency fluctuations by tracking exchange rate disparities.

Odoo’s IFRS Automatic Transfers Journal allows users to define rules for when and how balances should be transferred between accounts.

This automation reduces the potential for financial transaction failures while also reducing the need for manual labor. It enhances financial operations by streamlining and applying IFRS standards to financial transactions.

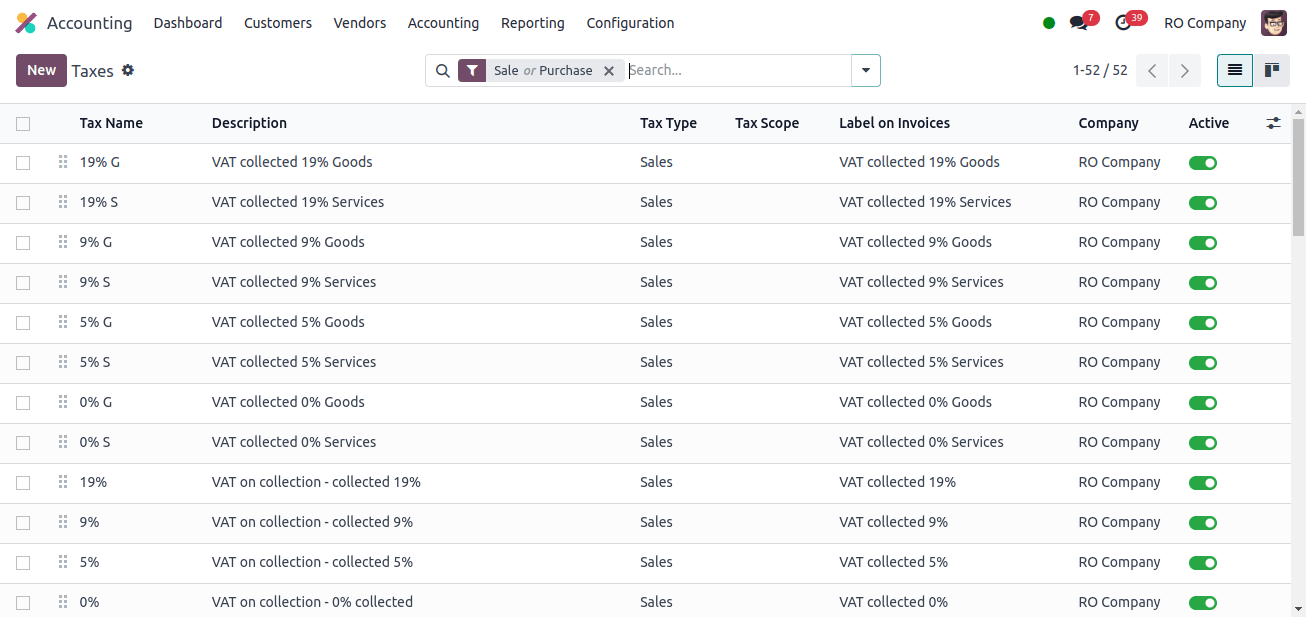

Taxes

Taxes in Odoo make it easier to handle and calculate taxes for different types of transactions. It automates tax calculations using established tax rates and procedures, ensuring that taxes are applied correctly on sales and purchases.

On each tax, you must include the Romanian SAF-T Tax Code (6-digit number) and Romanian SAF-T Tax Type (3-digit number). This has already been completed for the taxes included in Odoo by default.

To do this, go to Accounting > Configuration > Taxes, choose the tax to be altered, then click the Advanced Options tab input the tax code, and type.

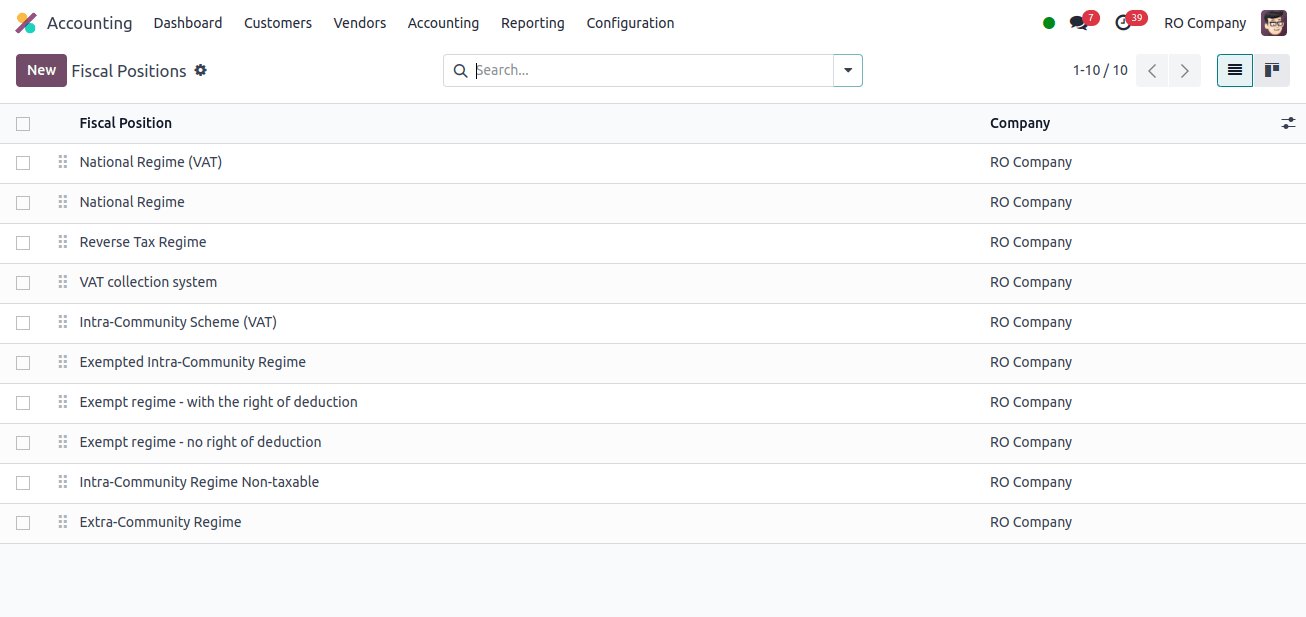

Fiscal Positions

The fiscal position feature in Odoo’s Romanian localization is important for managing taxes and financial transactions by regional standards.

The use of fiscal positions in Odoo makes it easier to implement the proper tax rates and accounting standards based on the customer’s location or type of goods or services being sold.

When creating or changing fiscal positions, users can transfer taxes from one position to another. This guarantees that invoices and sales orders accurately reflect the VAT rates specified by Romanian tax law.

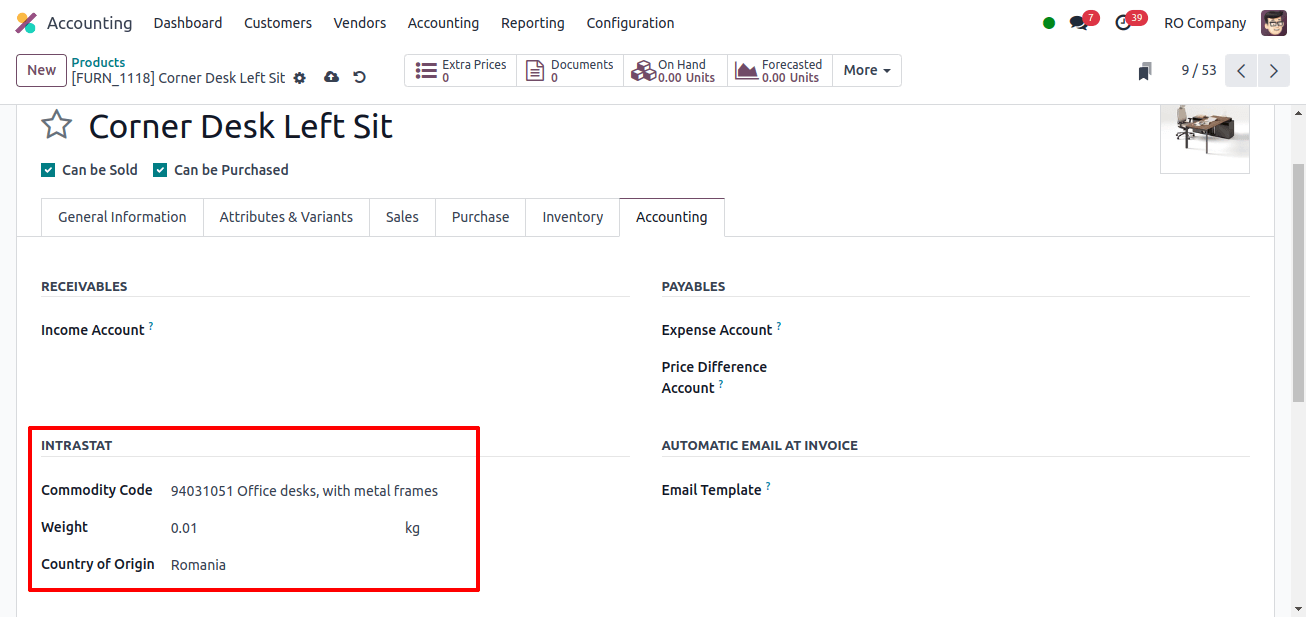

Products

According to Romanian law, the intrastat Code (Cod NC) needs to be set up on the product for certain kinds of goods transactions, such as transactions involving import and export, purchases and deliveries of food items that are liable to a lower VAT rate, Intrastat reporting is applied to intra community movements, purchases and supplies susceptible to a reverse VAT charge at the municipal level, based on the Code of NC, and transactions involving products that are subject to excise duties, which are set up by the Cod NC.

If no Intrastat Code is specified, a non-service product will use the default code "0". To configure the Intrastat Codes, navigate to Accounting > Customers > Products, select a product, and then choose a commodities code from the Accounting tab.

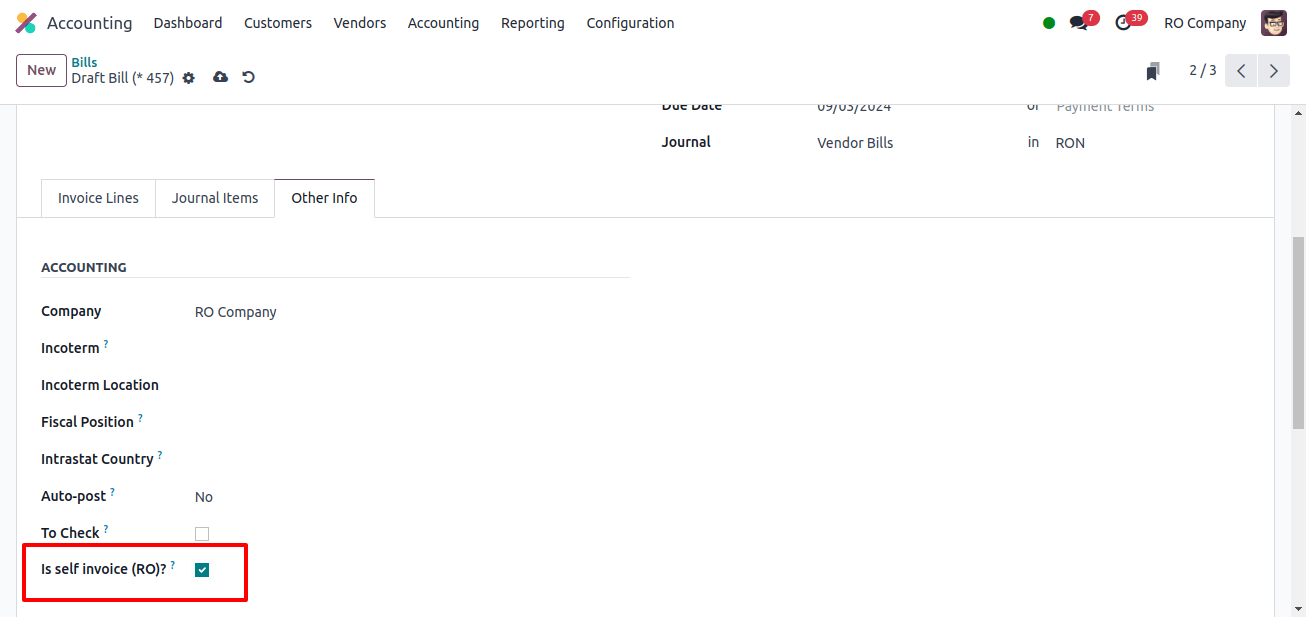

Vendor Bill

For any vendor bill that is a self-invoice (i.e., if we do not receive an invoice document from a supplier, we can issue a vendor bill ourselves), you must check the self-invoice (RO). Checkbox on the other info tab.

D.406 Declaration

To export the XML for the D.406 declaration in Odoo, follow these steps.

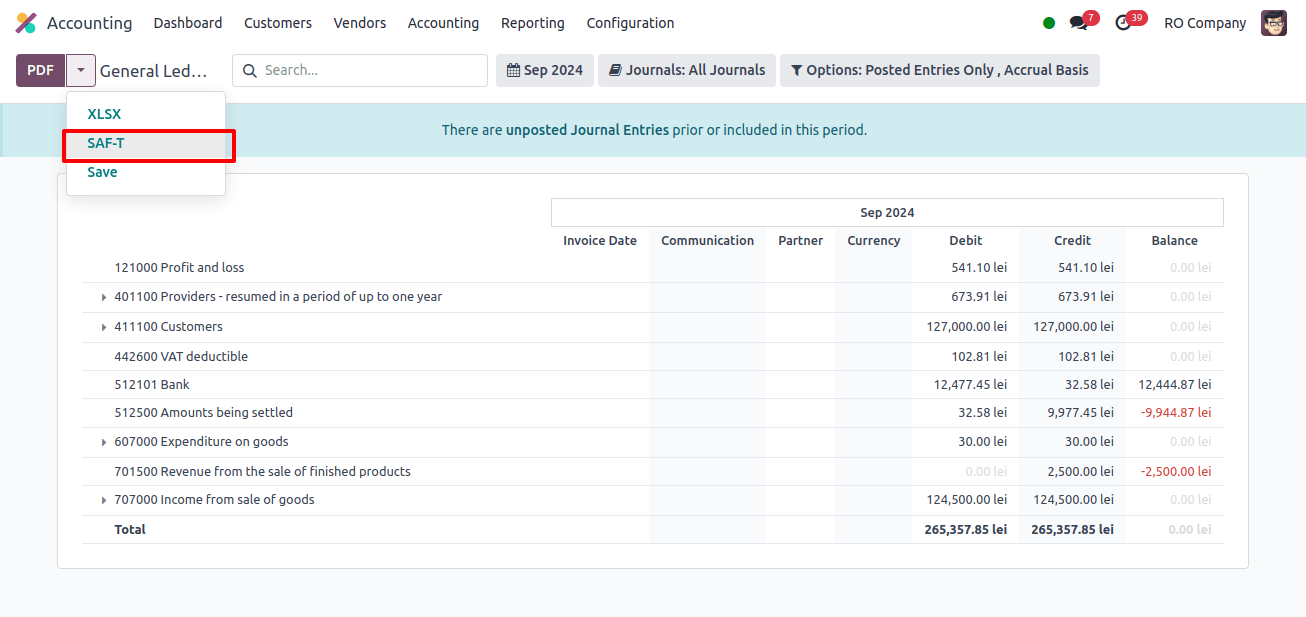

1. Export XML:

Go to Accounting > Reports > General Ledger. Click SAF-T to export the D.406 XML declaration.

2. Validate and Sign XML:

- Download and run the DUKIntegrator validation program from the Romanian Tax Agency's website.

- Open DUKIntegrator, select the resulting XML file and then choose Validare + creare PDF to create an unsigned PDF or Validare + creare PDF semnat to create a signed PDF.

3. Error Handling:

- If the XML file contains errors, DUKIntegrator will create an error report. Correct these errors before submitting the report to the Romanian Tax Agency.

- This method validates and signs the XML declaration file to confirm that it complies with Romanian tax reporting regulations.

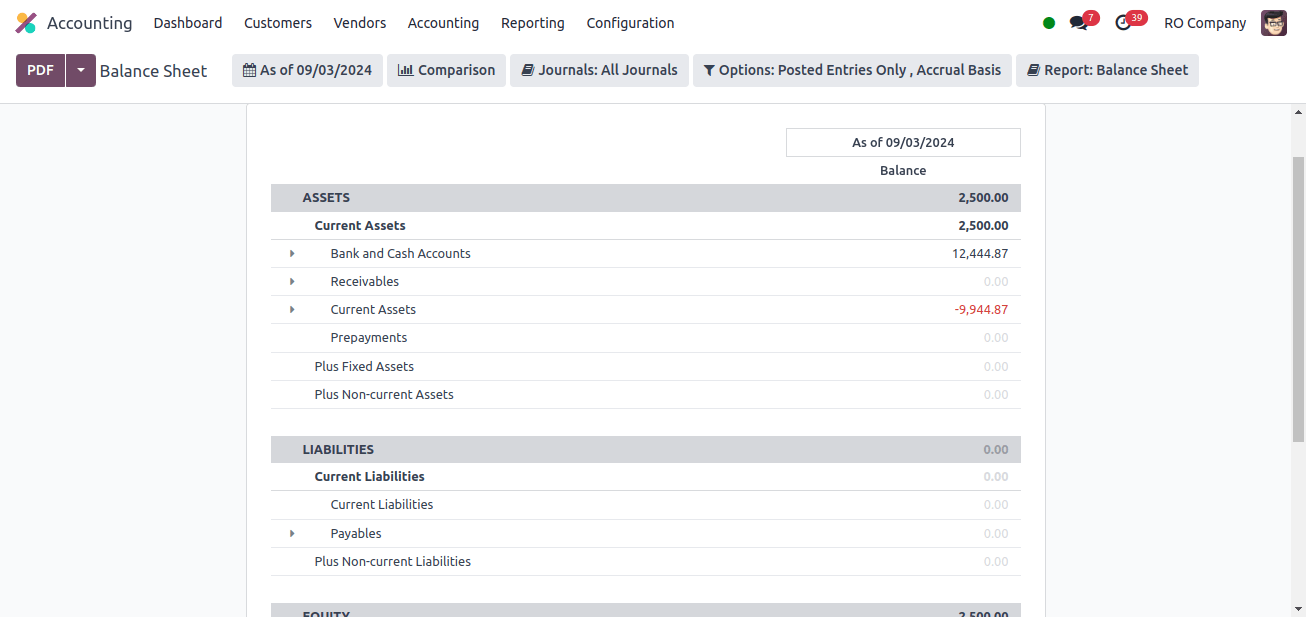

Balance Sheet

The balance sheet provides information of a company’s financial condition at any time. It collects data on equity, liabilities, and assets to provide shareholders with a complete picture of the company’s holdings and debts, as well as its remaining value.

This report is important for assessing financial soundness, making decisions, and ensuring accurate financial reporting. Odoo allows excellent financial management and compliance by automating the compilation of balance sheets and ensuring that the data is current and by accounting standards.

The balance sheet in Odoo with Romania localization gives a comprehensive picture of a company’s financial position and is customized to Romanian accounting standards. It shows the company’s equity, liabilities, and assets at a specific point in time, reflecting the health of its finances.

Related Post: How To Generate Powerful Balance Sheet Reports in Odoo 17

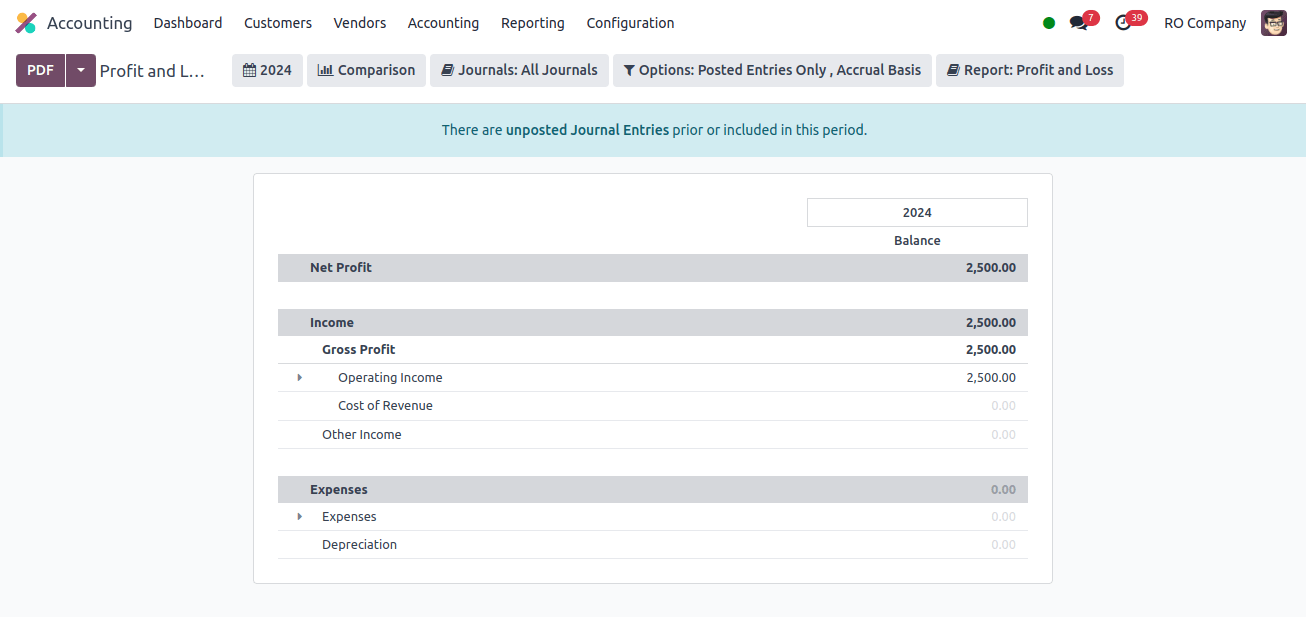

Profit and Loss Report

According to Romanian accounting standards, the Profit and Loss report in Odoo with Romania localization provides a strong snapshot of a company’s financial performance over a specific period.

The summary of revenue, expenses, and net income provides important information about the company’s profitability. This customized report provides precise and relevant financial information while ensuring compliance with Romanian financial reporting standards.

Odoo combines local tax and accounting requirements and automates the preparation of profit and loss statements to help with effective financial analysis and decision-making.

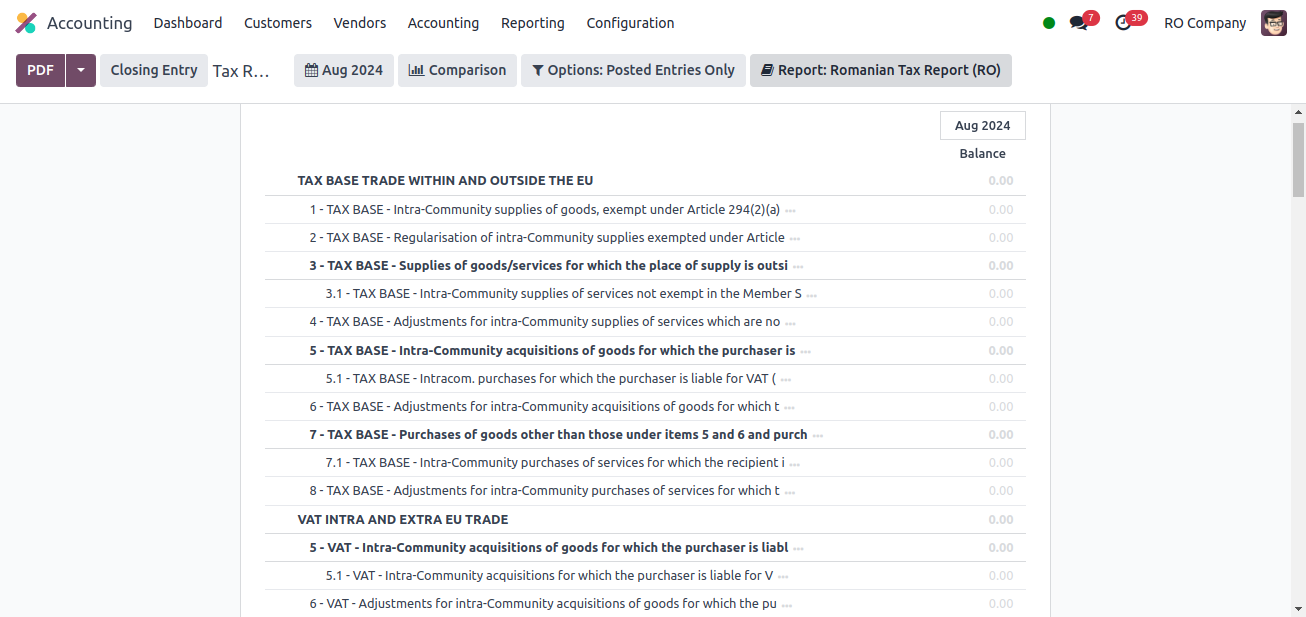

Tax Report

Net turnover in Odoo’s Profit and Loss report is defined as the entire income generated from core business activities minus returns, allowances, and discounts. It provides a clear picture of the company’s actual sales performance, representing income generated by key operations.

This metric is important for assessing business success and profitability since it highlights revenue that directly impacts the company’s financial outcomes. Odoo automatically estimates net turnover, ensuring accuracy and consistency with financial reporting standards.

The Romanian localization of Odoo’s accounting provides a strong solution that follows financial and legal standards. Odoo simplifies financial reporting and ensures regulatory compliance by integrating tax regulations, reporting requirements, and Romanian accounting standards.

By expediting activities like financial reporting, regulatory compliance, and VAT management, localization features help businesses to operate successfully within the constraints of Romanian accounting standards.

Odoo promotes accuracy and operational efficiency with automated tools and customizable features, aiding enterprises in maintaining financial integrity and making sound decisions.