Tax laws, accounting standards, and legal reporting requirements vary by country. Accounting localization is the process of modifying Odoo’s accounting modules to meet the unique requirements of each country.

Odoo 17’s main feature is the provision of ‘Fiscal Localization Packages,’ which are nation-specific accounting localization modules. Odoo provides fiscal localization packages that are customized to each country’s unique tax laws, accounting systems, and legal reporting requirements.

This ensures that your accounting operations are compliant, lowering the risk of errors and penalties. Fiscal events, charts of accounts, and tax groups are examples of prepared components used to automate tax computations and reporting.

Odoo’s accounting localization for Poland contains several features that make it easier to comply with Polish tax laws, accounting standards, and reporting requirements.

Odoo’s localization tools help businesses to operate seamlessly inside the Polish accounting framework by allowing them to create invoice forms, interface with local accounting systems, adjust tax rates, and generate mandatory reports.

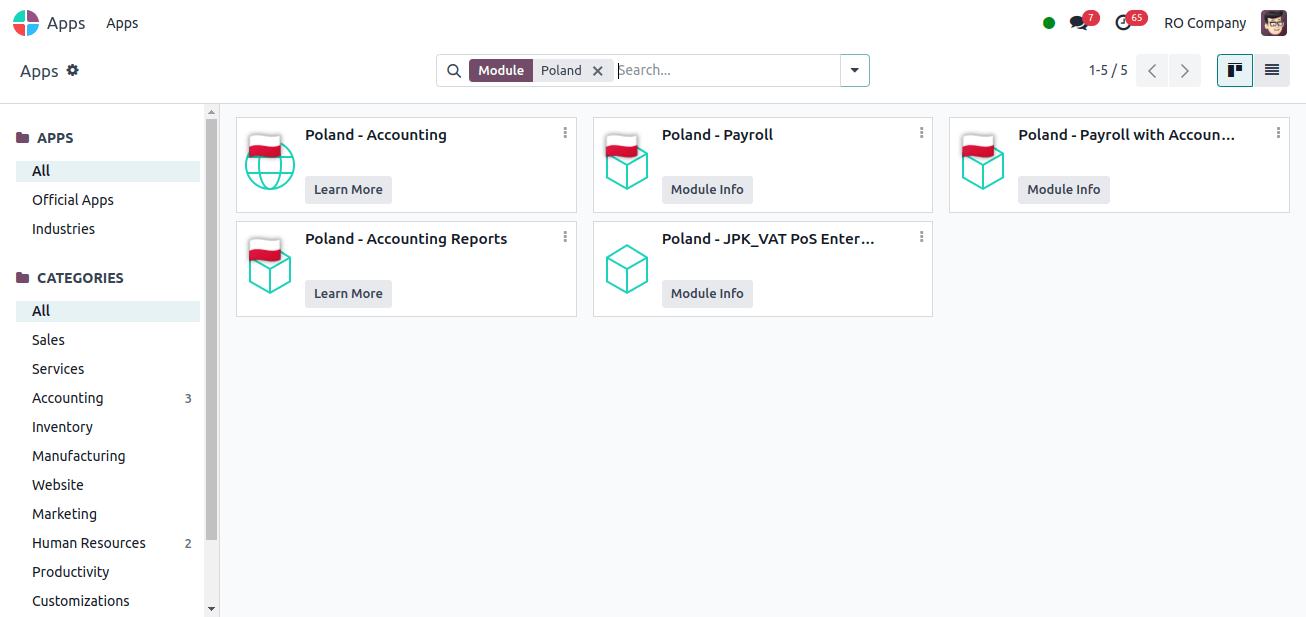

The accounting localization for Poland begins with the installation of the Poland localization. To accomplish this, go to Apps and install the module needed to configure the Poland accounting localization.

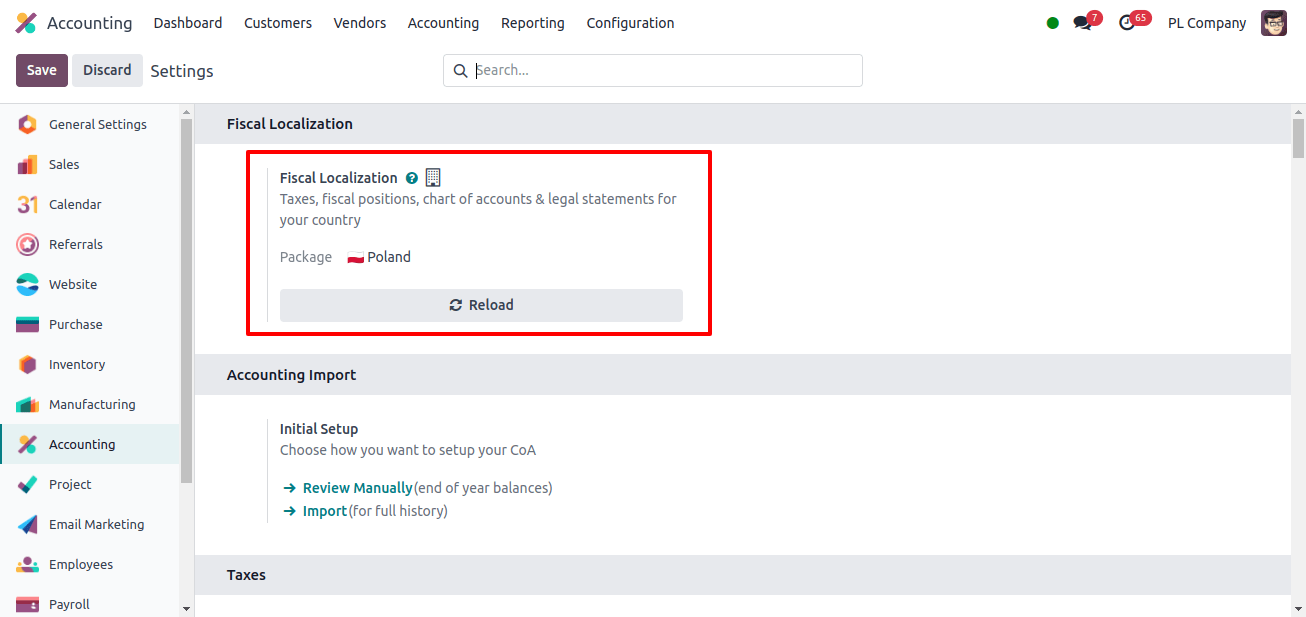

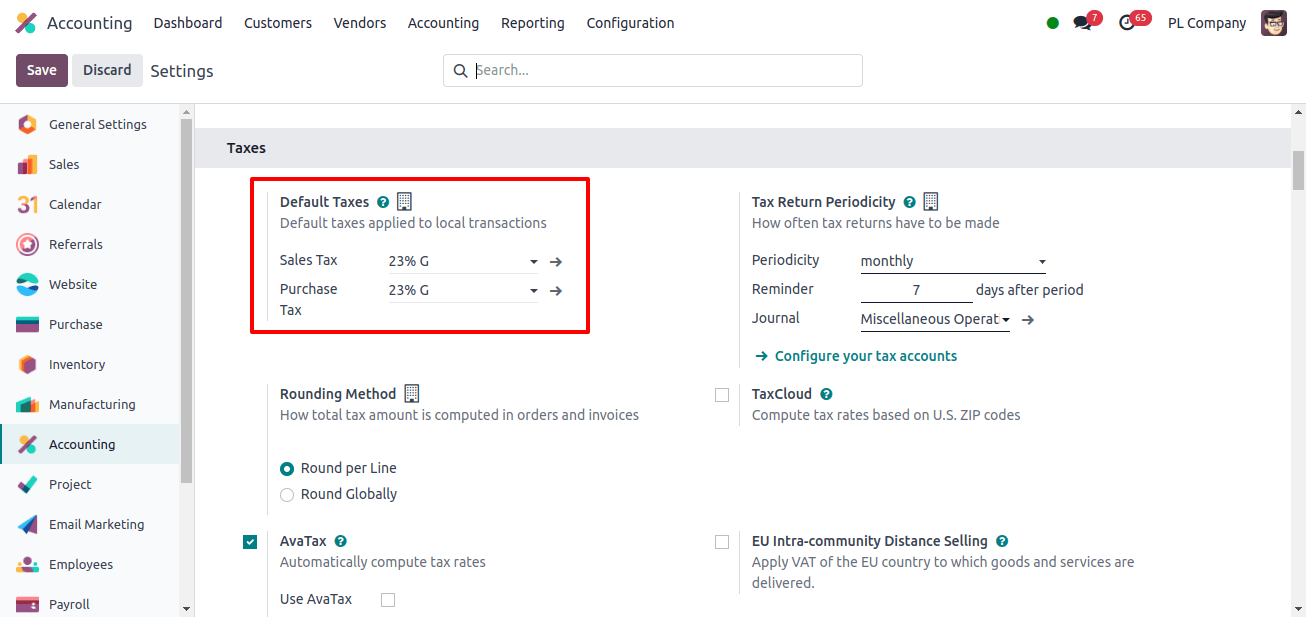

Now we may investigate the changes to Fiscal Localization, default taxes, and currency. Go to Accounting > Configuration > Settings, and we will notice that the Fiscal Localization is set to Poland.

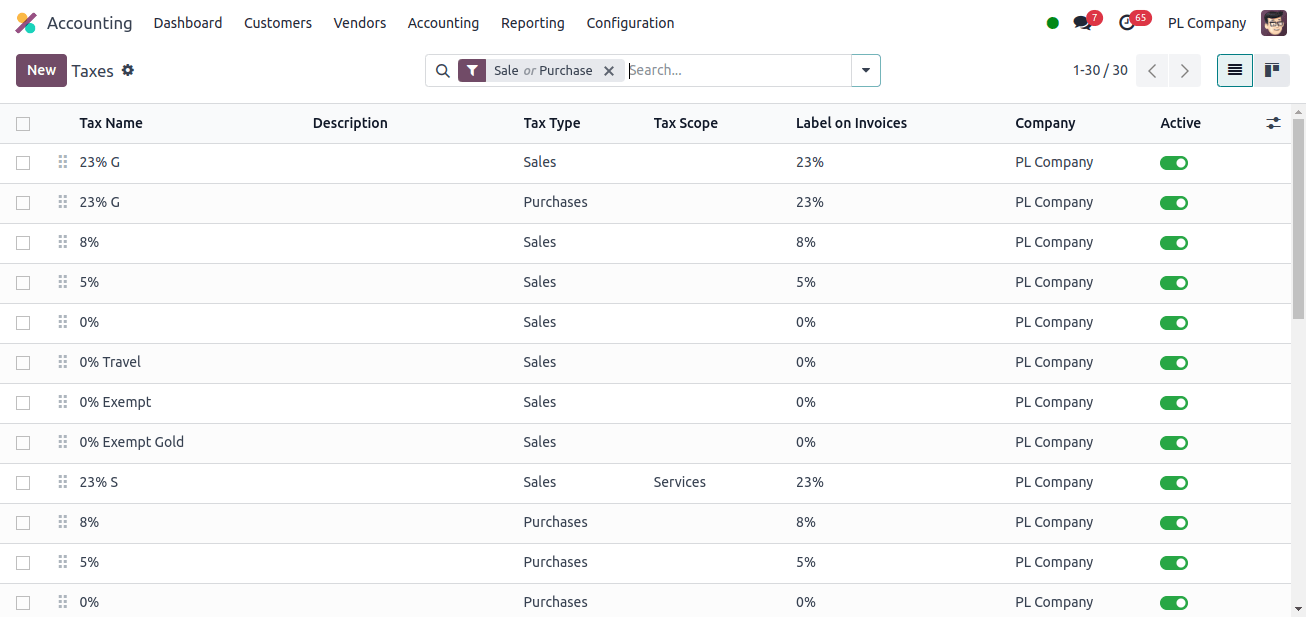

And the default taxes, Sales Tax and Purchase Tax, will be set at 23% G and will be applied to all transactions by default.

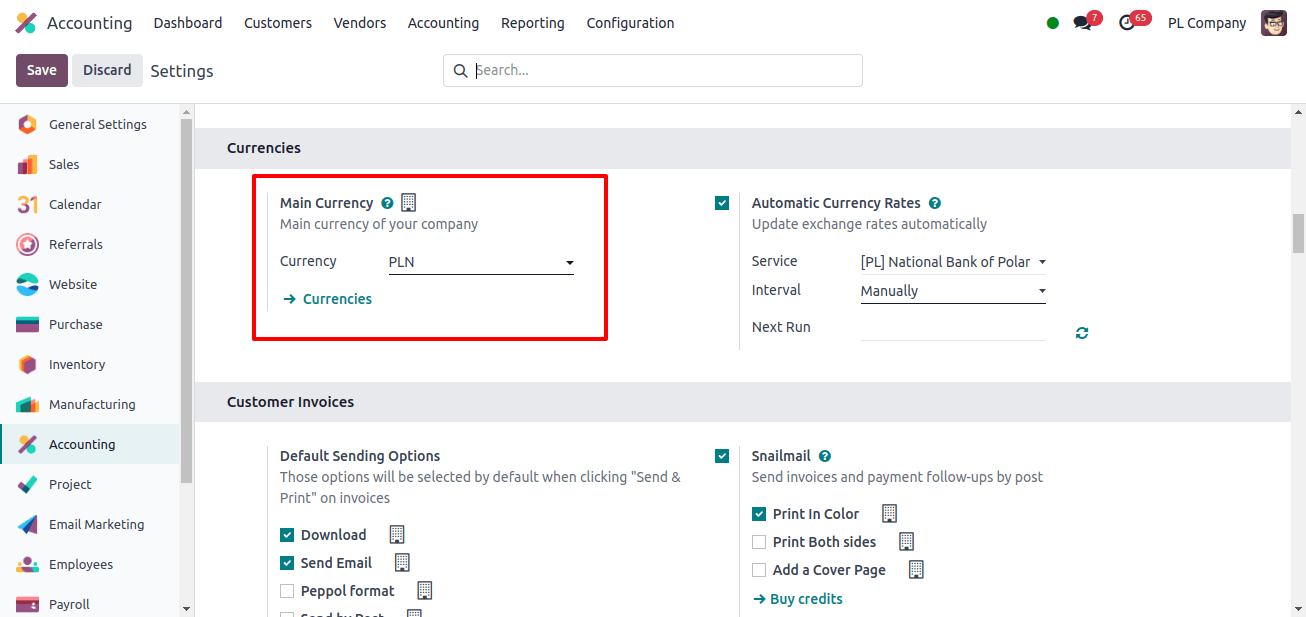

The main currency is set to the official currency of Poland, the Polish zloty (PLN), and all transactions take place in it.

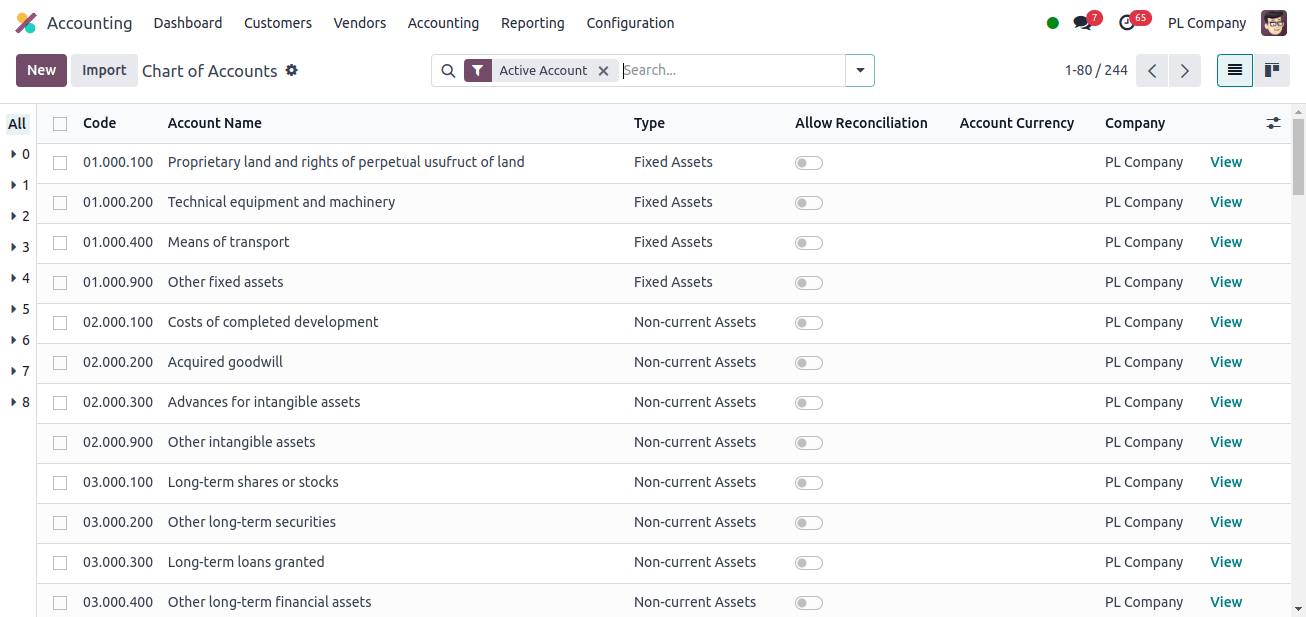

Now we may look at the Chart of Accounts for this localization. The Chart of Accounts identifies and arranges all of the company’s financial activities. All of a business’s accounts, including those for assets, liabilities, income, and costs, are arranged.

This arrangement ensures accurate financial reporting and effective account administration. Odoo’s customizable Chart of Accounts, which can be customized to meet specific business needs, allows effective financial data collection and analysis.

This feature helps businesses maintain transparent and legally acceptable financial records and supports a variety of accounting techniques.

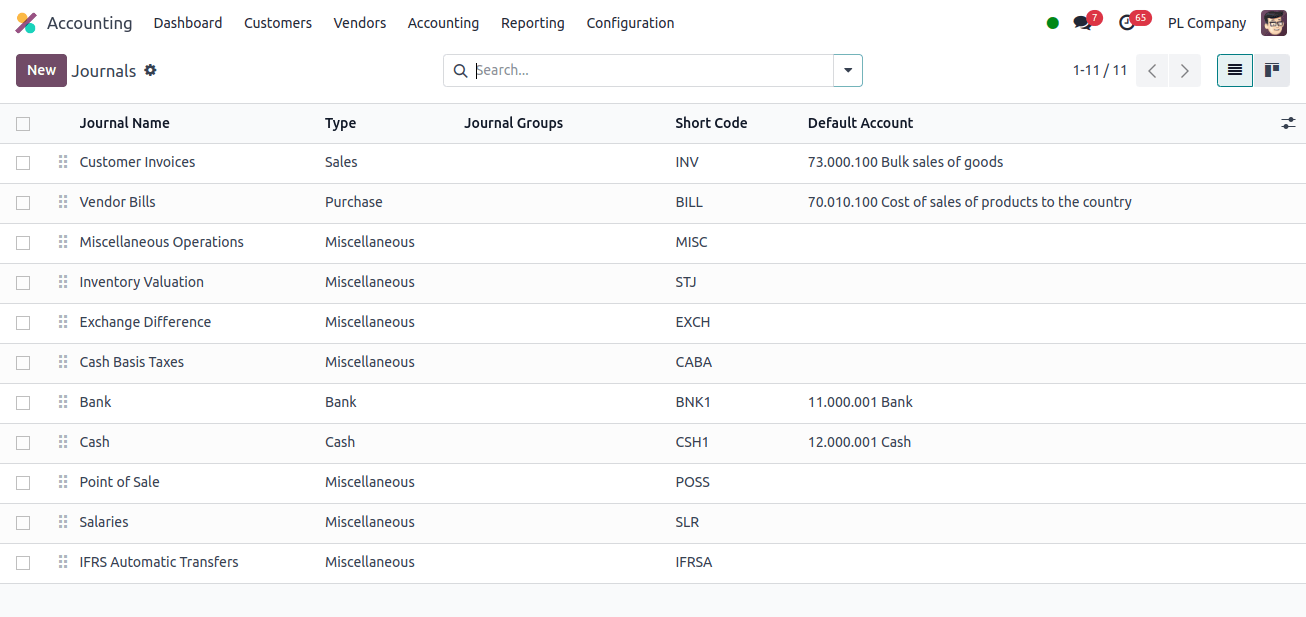

Journals are important components of Odoo accounting that are used to track and manage financial transactions. Each Journal serves a specific purpose, similar to how you manage sales, purchases, or account activities. To ensure precise and successful financial transactions, they carefully arrange transactions.

Odoo journals allow for personalized entries, automated postings, and detailed tracking, resulting in a transparent audit trail and a streamlined reconciliation process. Companies that use journals well can speed up their accounting operations while also keeping their data structured.

Odoo 17's tax feature automates tax computations and allows for precise application of tax rates, which simplifies the administration of intricate tax obligations.

Firms can design and customize tax rules for various locations and transaction kinds in order to provide comprehensive assistance in complying with local and international tax legislation.

Odoo’s integrated tax administration with other accounting capabilities allows different reporting, documentation, and regulatory compliance.

Tax management in Odoo is built to properly meet local tax rules, thanks to Poland’s accounting localization. The system covers a variety of Polish tax needs, including VAT, and allows companies to define tax rates and laws unique to Poland.

Odoo automates tax computations, assures loyalty to Polish tax rules, and allows proper reporting and documentation.

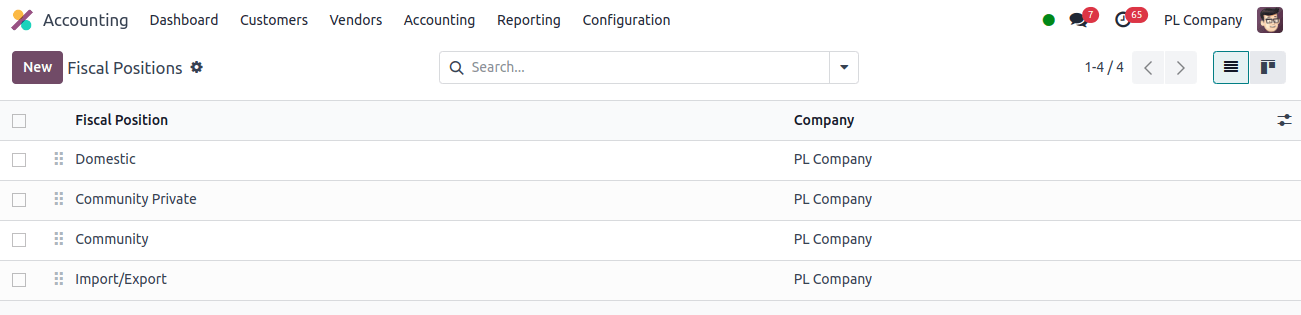

Fiscal Positions

Odoo’s fiscal localization for Poland is completely suited to the Polish market’s unique tax and financial reporting demands, and it manages a wide range of activities such as import/export, community private transactions, intra-community transactions, and domestic transactions.

* Domestic: This allows businesses to accurately record and report domestic financial activity, ensuring compliance with Polish tax rules.

* Community Private: Odoo covers VAT requirements that are specific to community private transactions, which involve private individuals or businesses within the EU.

It ensures that VAT is estimated and reported correctly based on the nature of the transaction and the rules that apply to communal private sales.

* Community: Odoo makes it easier for Polish businesses conducting business with other EU members to comply with intra-community VAT regulations. It supports the proper management of VAT exemptions and reporting duties for cross-border trade in goods and services.

This includes preparing the necessary reports and ensuring that VAT is administered correctly as per intra community standards.

* Import/Export: It manages customs charges and VAT on products imported into Poland. To ensure accurate reporting and loyalty to Polish import legislation, it automates import VAT calculation and integration into the accounting system.

Odoo assists with managing VAT exemptions and reporting accountability when exporting goods outside of Poland. It ensures that export transactions are properly recorded and that VAT is administered in compliance with international trade agreements and Polish export rules.

Balance Sheet

The Balance Sheet in Odoo’s Poland accounting is intended to meet the reporting needs of small and micro businesses. These balance sheets provide a clear financial picture for tiny firms based on Polish accounting requirements.

* Small PL Balance Sheet: This format, which complies with Polish law, provides a complete summary of assets, liabilities, and equity and is suitable for small businesses. It includes all relevant financial categories to ensure complete reporting.

* Micro PL Balance Sheet: The reporting requirements have been simplified in this edition, which is customized to small businesses. It clearly summarizes the financial position and meets Poland’s specific reporting requirements for small and medium businesses. These balance sheet features in Odoo ensure that these reports are generated automatically and precisely.

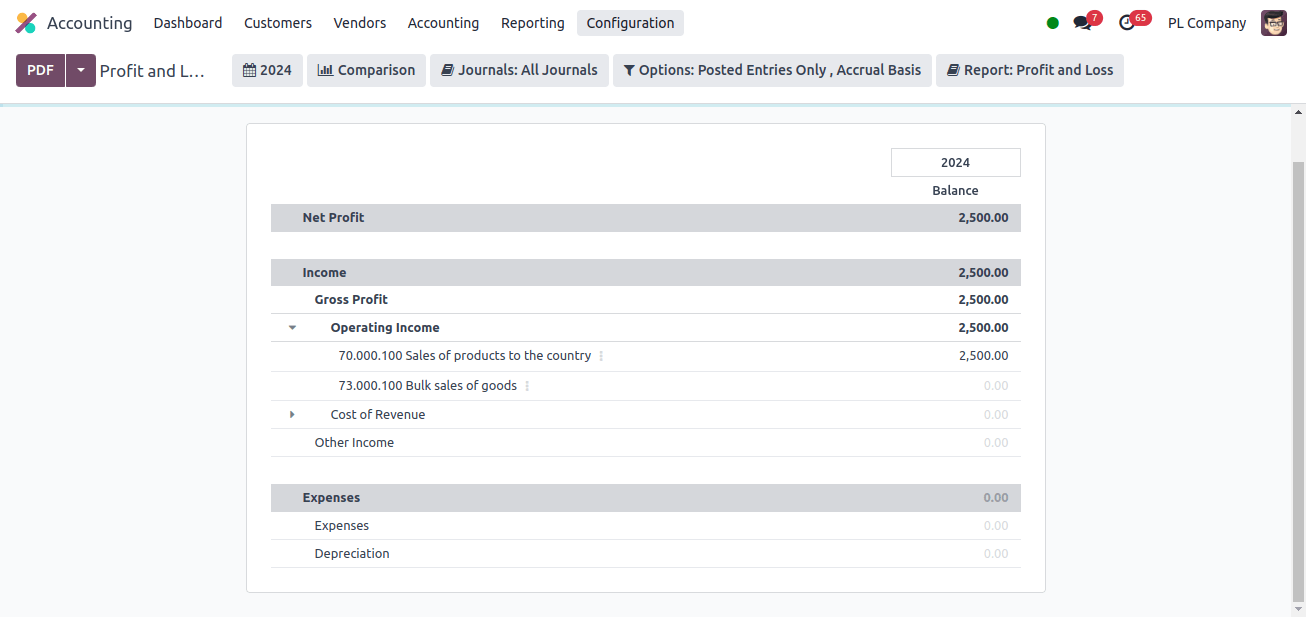

Profit and Loss Report

Odoo’s accounting module for Poland has a Tax Report feature to help users comply with Polish tax legislation. It generates complete reports containing a summary of all tax-related transactions, including VAT and other applicable taxes.

The report ensures accurate and timely submissions to tax authorities by providing a clear account of tax liabilities and credits. Odoo’s integrated tax reporting tools allow for automated data extraction and aggregation from a bigger accounting system.

This link allows businesses to better manage their liabilities and stay in compliance with rules. Tax reporting for Small and medium businesses is offered in Odoo’s Poland accounting module to meet specific legal requirements.

* Small PL Tax Report: Designed specifically for small businesses, this report provides an in-depth analysis of VAT and other tax requirements while ensuring compliance with Polish tax rules. It makes it easier to submit tax returns on time and accurately by giving detailed breakdowns of tax calculations and credits.

* Micro-Level Tax Report: This report, created specifically for small businesses, simplifies the tax reporting process by building the important tax data required for compliance. It provides a simplified image of tab liabilities, making it easier for small businesses to properly manage their taxes.

The Net Income from Sales Report thoroughly analyzes the profitability generated from sales activity. The net income in this report is calculated by deducting sales-related costs and expenses from the total revenue collected.

To manage operating costs in Odoo’s accounting module for Poland, costs connected to day-to-day business operations must be calculated, tracked and reported.

We can also look at the Profit (loss) on sales (A-B), which calculates the difference between sales revenue and related costs to provide an in-depth overview of the financial outcome of sales activities.

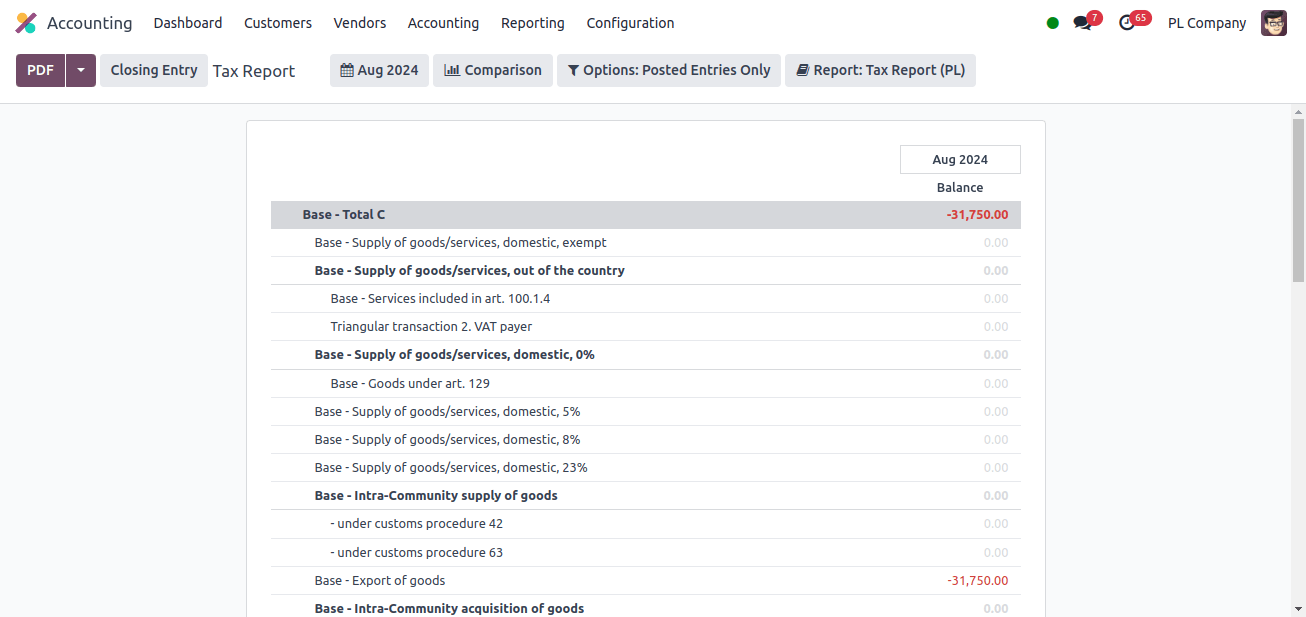

Tax Report

A tax report is a financial record that provides a complete picture of a company’s tax-related transactions during a specific time period. It includes information on sales taxes received, purchase taxes paid, and any changes or credits made.

The component of the report dealing with the value of items delivered between EU member states is known as the Base - Intra-Community Supply of items.

The Base-Supply of products/Services, Out of the Country part reports the value of transactions including the supply of products or services to companies outside of the local country.

The Base-Supply of Products/Services, home, 0% section describes transactions in which products and services are supplied within the home country but are subject to a 0% VAT rate.

Odoo’s Poland accounting localization offers a customized solution to meet the unique financial and regulatory requirements of Polish businesses.

Businesses may easily manage their accounting process in line with Polish standards thanks to odoo’s substantial capabilities for dealing with local tax legislation, VAT compliance, and special reporting requirements.