Accounting Localization in Odoo 17

Accounting localization is the process of customizing accounting software to comply with a certain country’s specific accounting laws and regulations.

In layman's words, you're tailoring the product to your country's specific financial criteria. Several accounting tasks are automated by localization based on local standards. This contains characteristics such as:

In general words, you’re customizing the product to your country’s specific financial criteria. Several accounting tasks are automated by localization based on local standards.

The following are the attributes it covers such as:

* Automatic tax calculation.

* the creation of invoices and reports that match

* Integration with regional e-invoicing systems may be feasible.

Accounting localization automates operations as per local standards, saving your accounting team time and money.

They can focus on more strategic duties than compliance checks and tiresome data entry. In this blog, we’ll look at how an Estonian company manages localization.

Localization for Estonia in Odoo 17

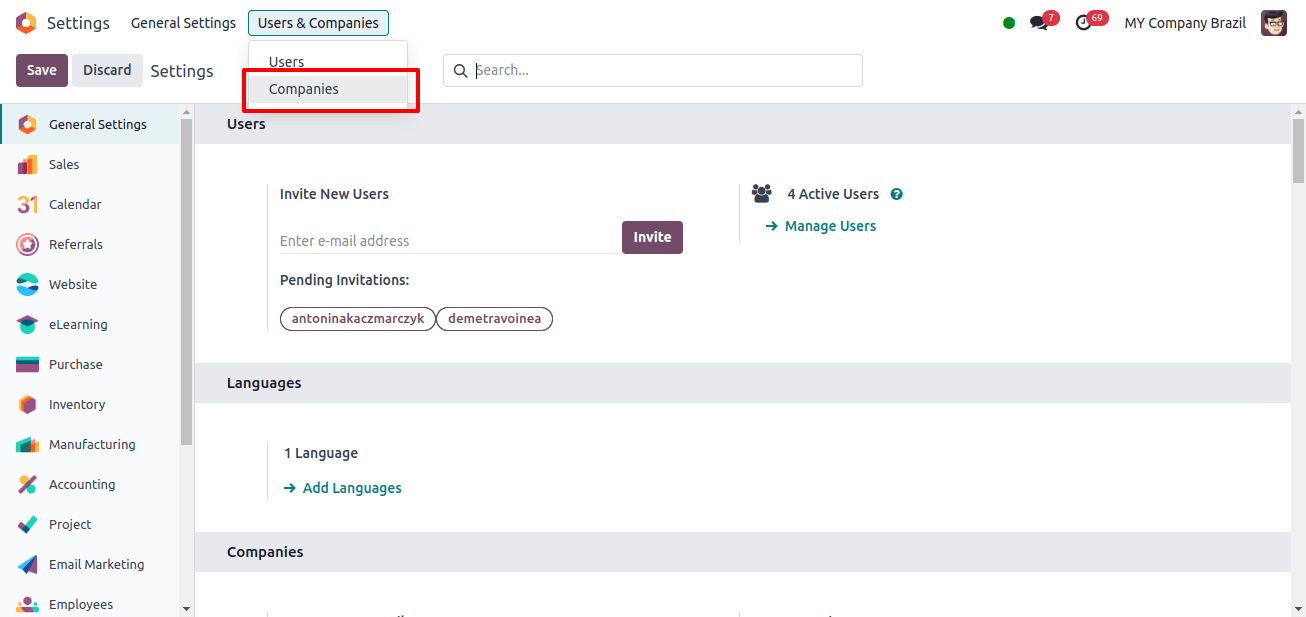

To set up the Estonia localization in Odoo, we must first set up an Estonian company. To achieve this, go to Odoo’s general settings and pick the users and companies menu, then the companies sub-menu.

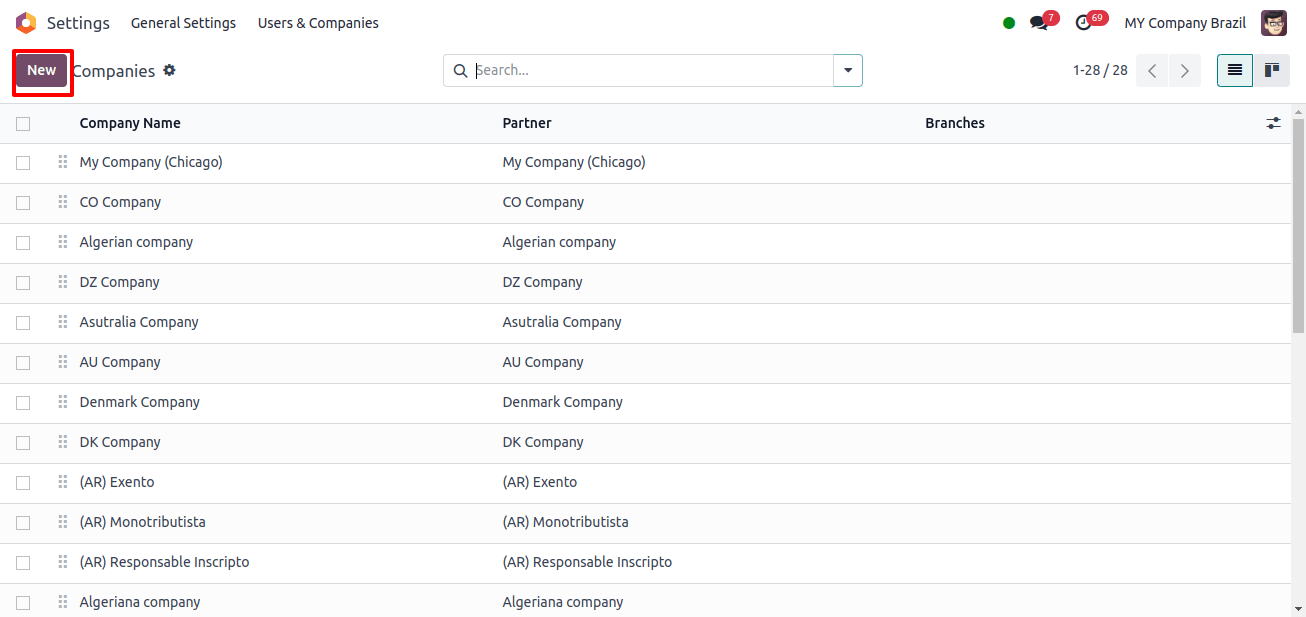

The ‘companies’ sub-menu displays all the companies that have already been created; to add a new company, click the ‘New’ button.

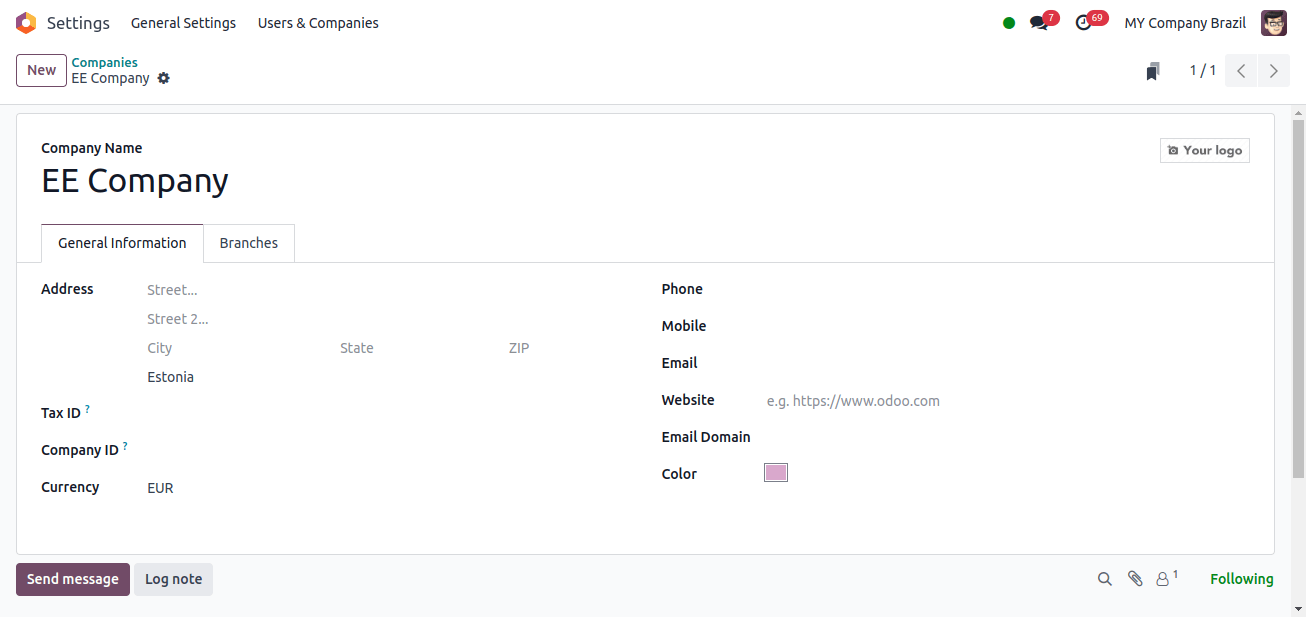

When we click the ‘New’ button, a form will emerge that we can fill out with details about the new company.

Once all parameters have been properly completed, click the save icon to save the company information. Since the Euro (EUR) is Estonia’s official currency, Odoo automatically updates the company’s currency to reflect this change when the country is set to Estonia.

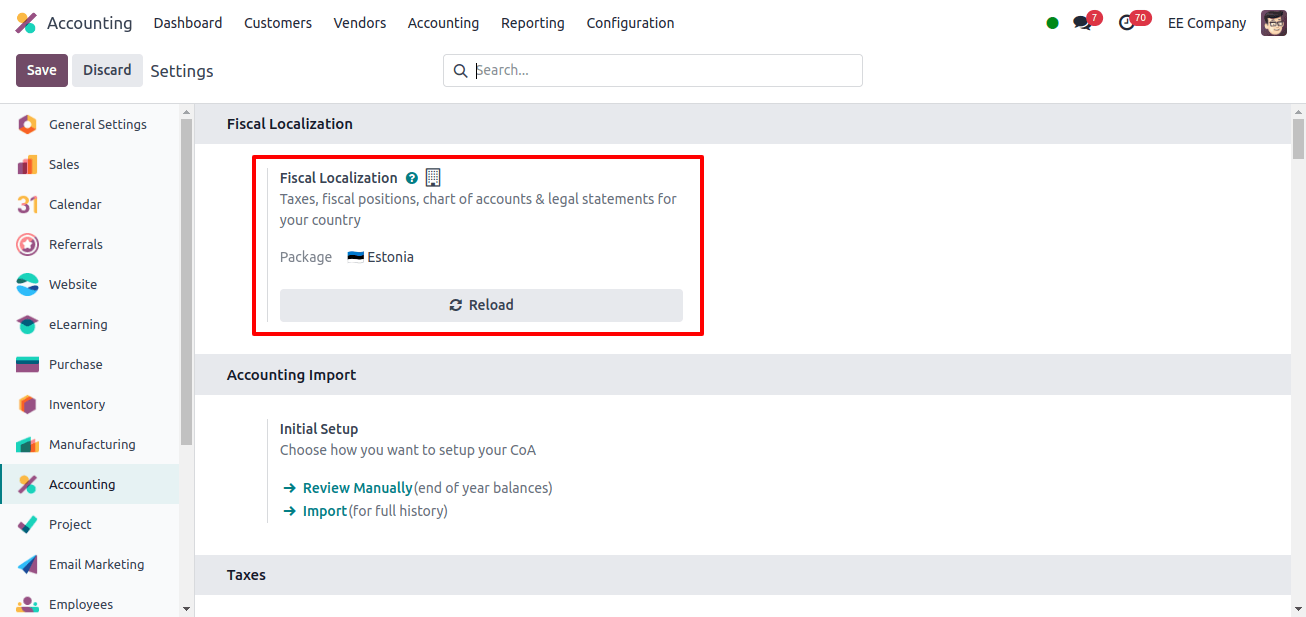

The next step is to set up a localization package for this business. Go to Odoo 17’s accounting application, then configure > Settings. We can specify the localization package in the Fiscal Localization section. Choose Estonia as the package and click the save button.

Changes noted while configuring the Estonian localization

Many changes will occur once the company’s localization is switched to Estonian. Odoo’s key configurations are fiscal position, chart of accounts, taxes, and journals. Let; 's have a look at these,

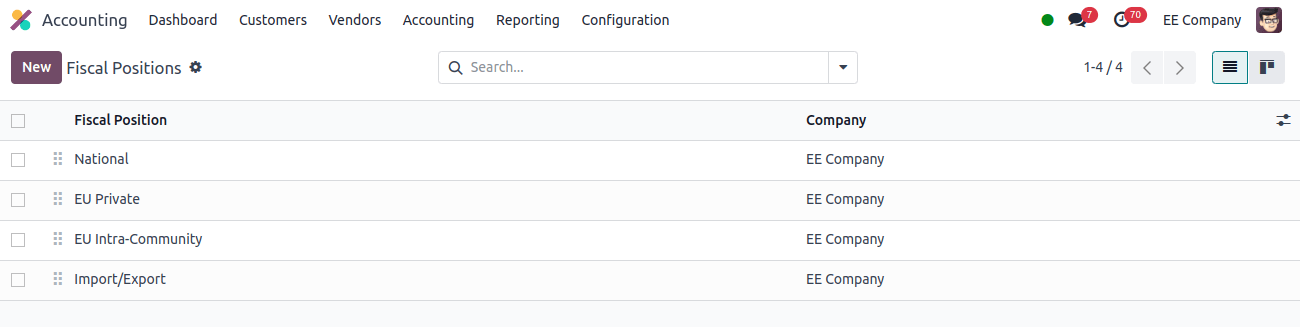

Fiscal Position: A fiscal position in Odoo defines how accounting and taxes are applied to transactions based on characteristics such as the customer’s location, the type of business, the product category, and so on.

In simple terms, it provides the management of accounting and taxi issues caused by multiple countries.

The fiscal positions indicated in the image above are Odoo’s default fiscal positions for Estonian companies. As previously stated, Account Mapping and Tax mapping for various purposes are carried out using the mentioned Fiscal positions.

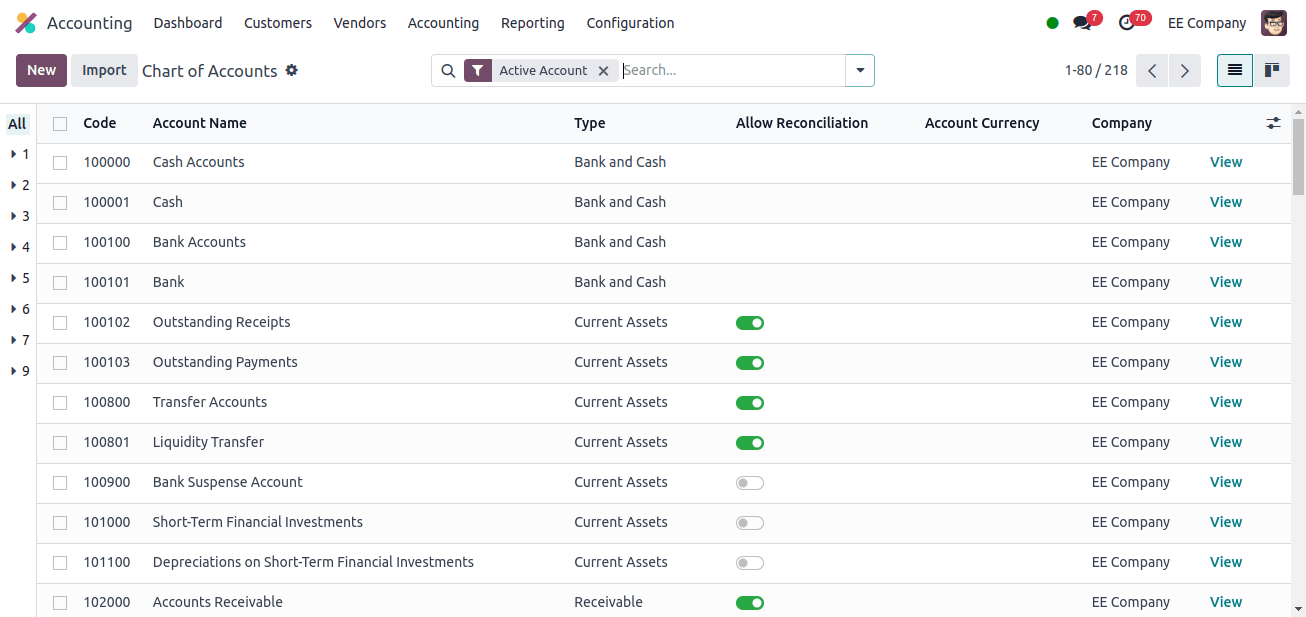

Chart of Accounts: Odoo’s accounting module relies heavily on the chart of accounts. It serves as a compendium of all the accounts you use to track your company’s financial activity.

The chart of accounts used by companies from various countries may differ. We can access the chart of accounts submenu via the configuration menu.

The image above shows the Estonian company's chart of accounts. You can also create a new chart of accounts by selecting the new option.

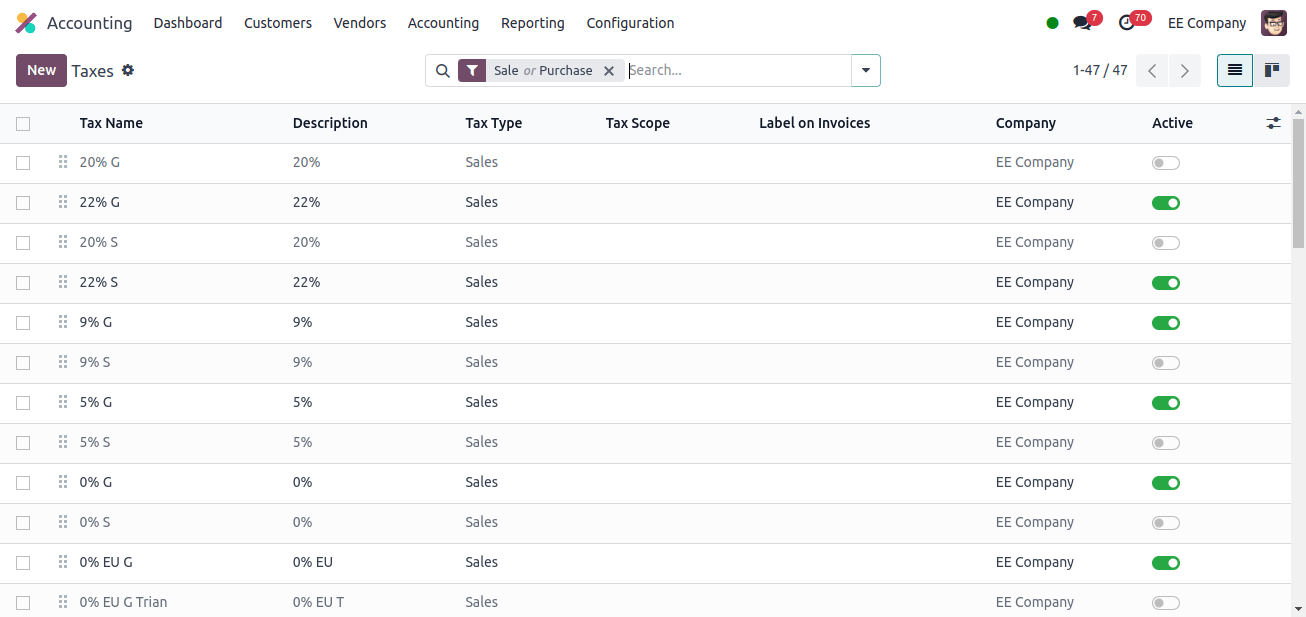

Taxes: Taxes are taxes levied on many parts of a commercial transaction. The tax capabilities in Odoo help you manage tax compliance, automate tax computations, and ensure accurate financial reporting.

Odoo allows you to create multiple tax types, such as sales tax and purchase tax, as well as their accompanying rates and limitations.

Odoo automatically calculates the applicable taxes when creating purchase orders or invoices based on the vendor’s location and the goods or services sold or acquired. Taxes are a submenu under the configuration menu.

When we select the Taxes sub-menu, we can see all the taxes that Estonian companies can charge. We can also impose new taxes on companies. There are two basic sorts of taxes: Sales taxes and purchase taxes. Sales taxes are applied to sale orders, while purchase taxes are applied to buy orders.

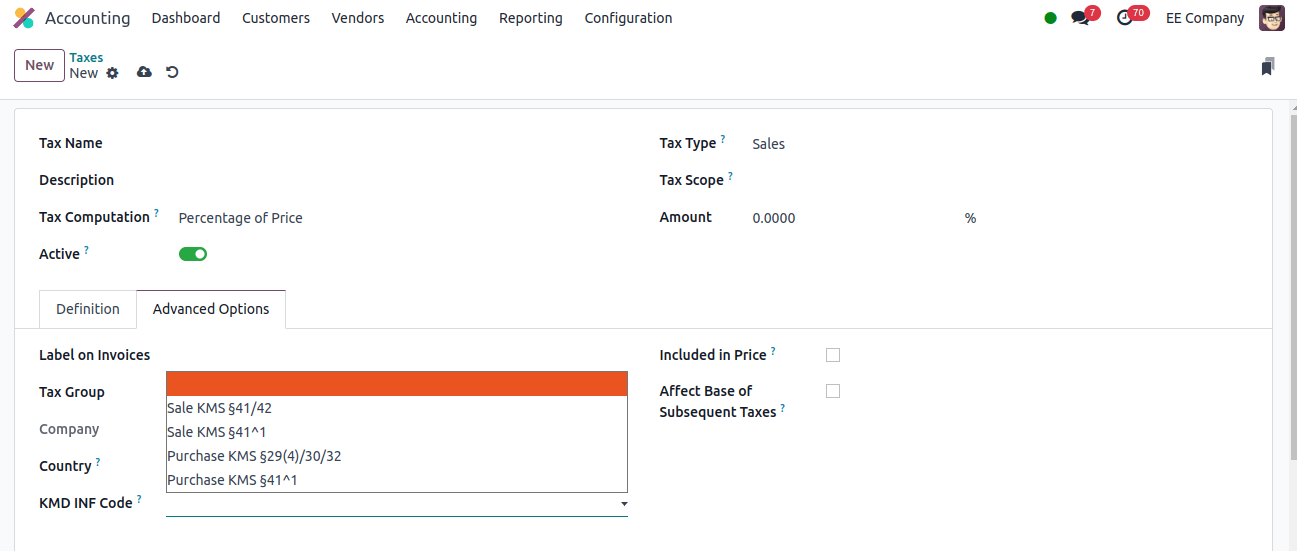

By clicking the new button, we can generate new taxes for this company. There, we can enter the name of the new tax, as well as its type and amount. When we move to the Advanced options tab, we may enter tax group, country, KMD INF code, and other information.

KMD INF Code: This field contains comments/special code columns in the KMD INF report. It serves as an identification in Odoo for the Estonian VAT report Annex. This code also streamlines the creation of the Estonian VAT report Annex in Odoo. We can select a code from the drop-down menu.

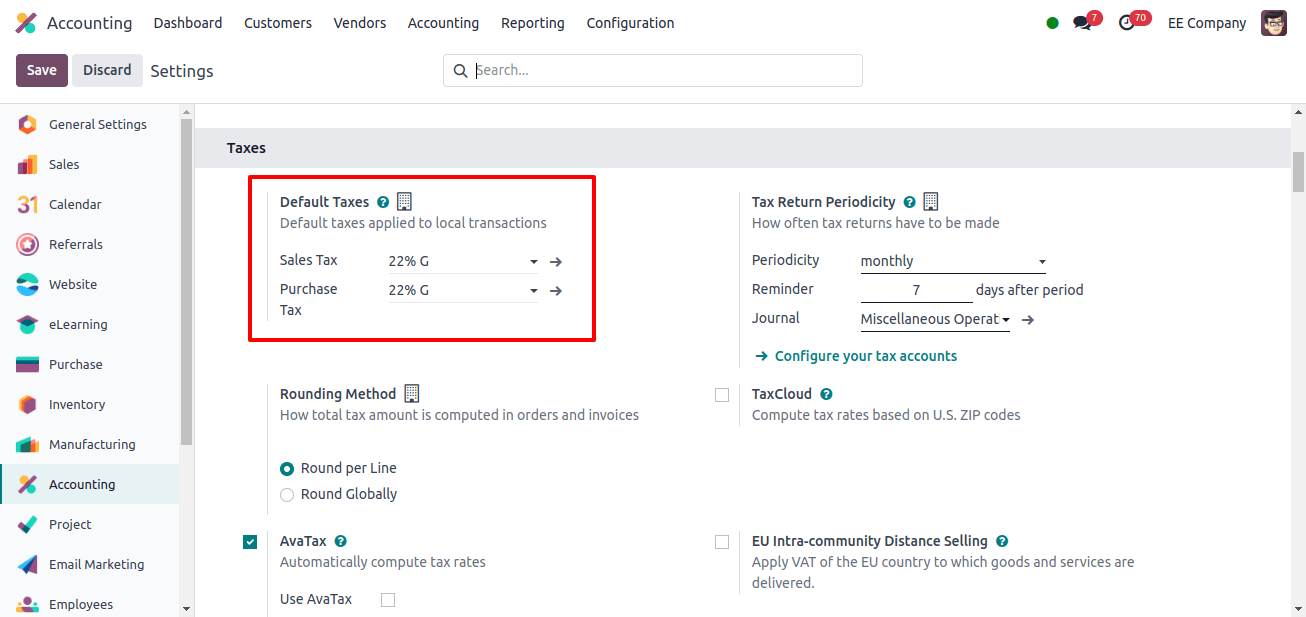

Then, in Configuration > Settings, under the Taxes section, there is an opportunity to add Default Taxes. We may manually add the default taxes or let Odoo do it. When we set the company’s localization package to Estonia, Odoo adds it automatically.

The default sales tax is 22% G, as is the Default Purchase Tax for the organization. That is, all Estonian enterprises should adopt this as the default tax for their commercial transactions.

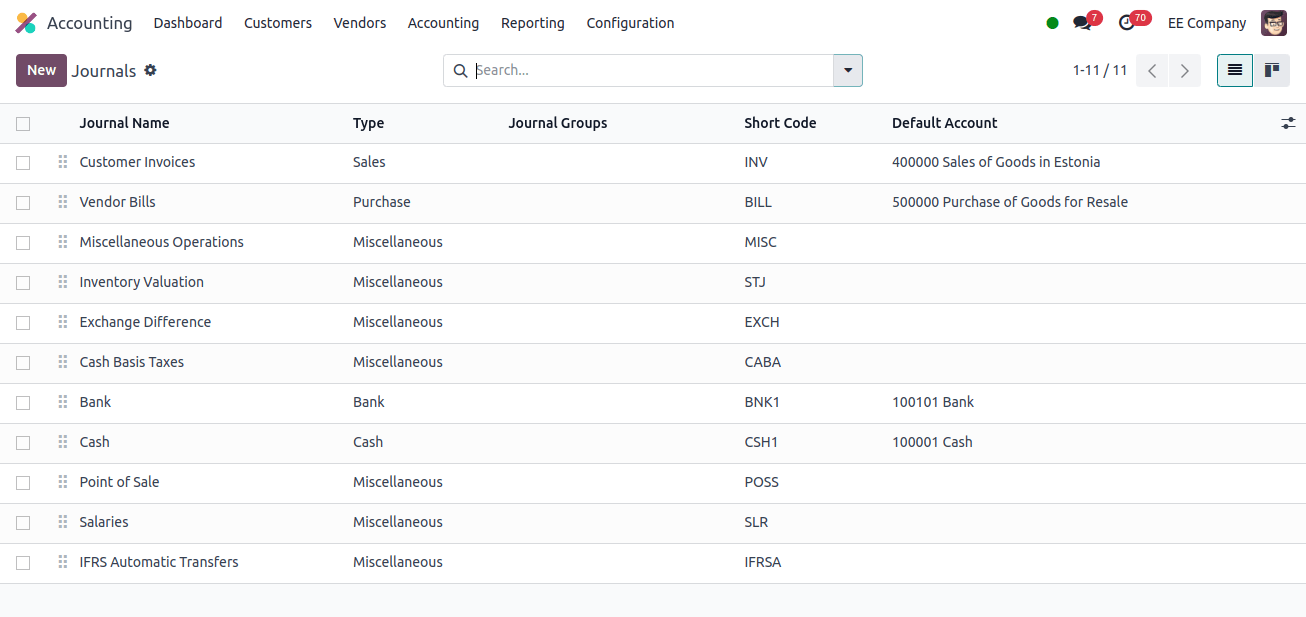

Journals: Journals are a chronological record of your financial transactions in Odoo’s accounting module. They organize these transactions properly and provide correct financial reporting by categorizing them.

Journals are the most common way to enter all financial transactions into your Odoo accounting system. Depending on its nature, each transaction is recorded in a separate journal.

There are 5 major types of journals: sales journals, purchase journals, bank journals, cash journals, and miscellaneous publications. All of these journals serve various functions.

The image above shows the many journals used by Estonian enterprises. There will be a separate account for each journal to store transactions.

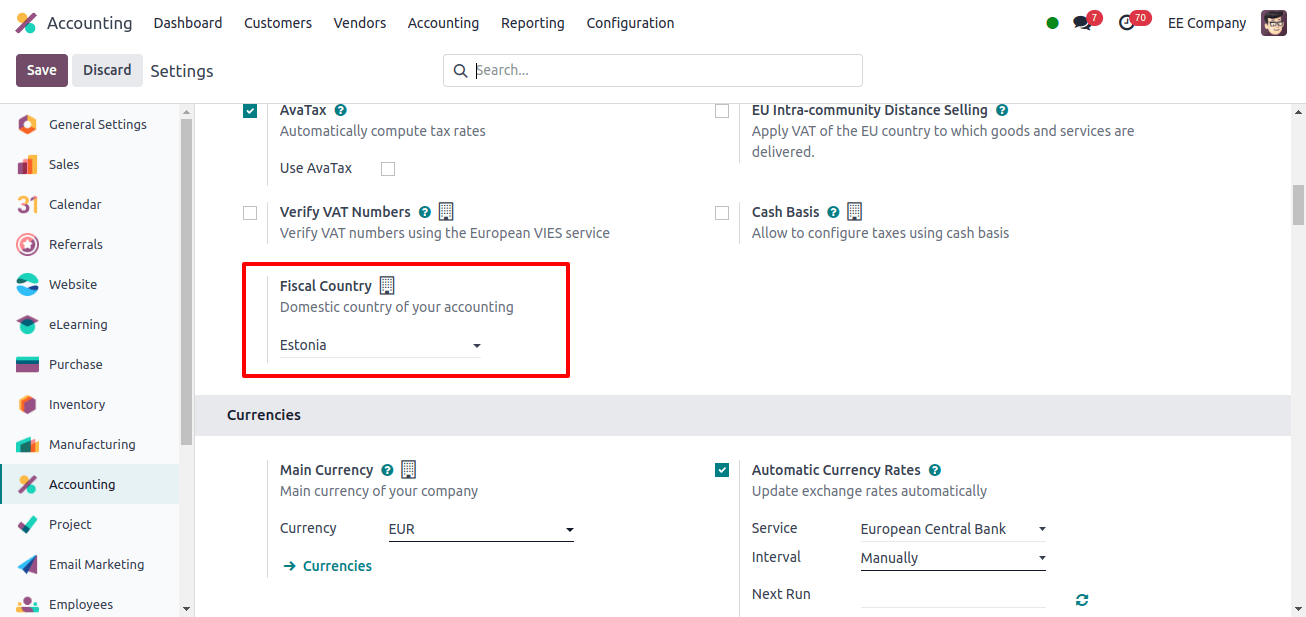

When we look at the Accounting module’s setup > Settings, we see an option to specify the Fiscal nation for the company, which is the domestic country for accounting.

When we configure the localization package for Estonia, Odoo automatically sets the company’s fiscal country to Estonia.

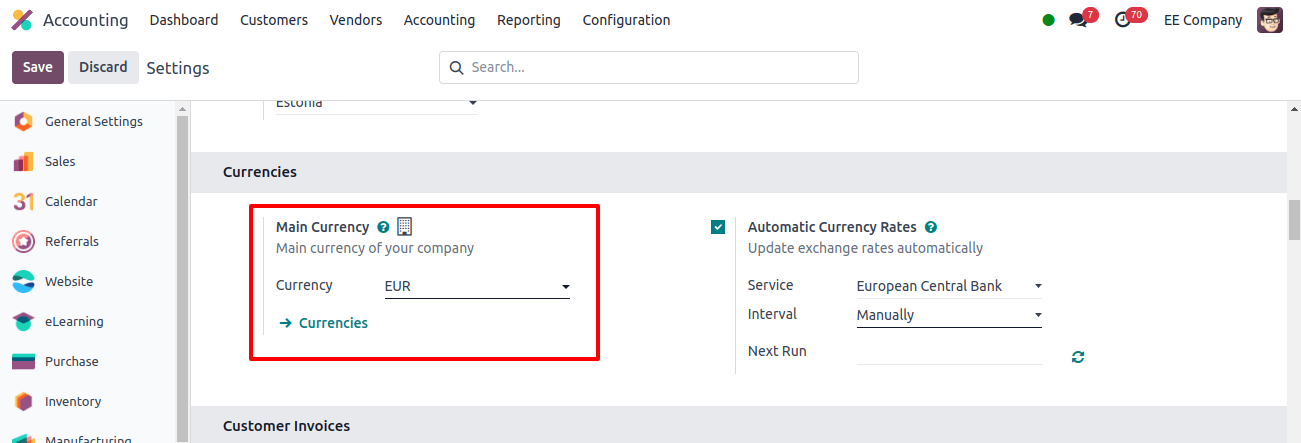

We know that the official currency in Estonia is the Euro, and Odoo allows us to specify the main currency for the company. Odoo automatically adjusts the company’s standard currency to the Euro.

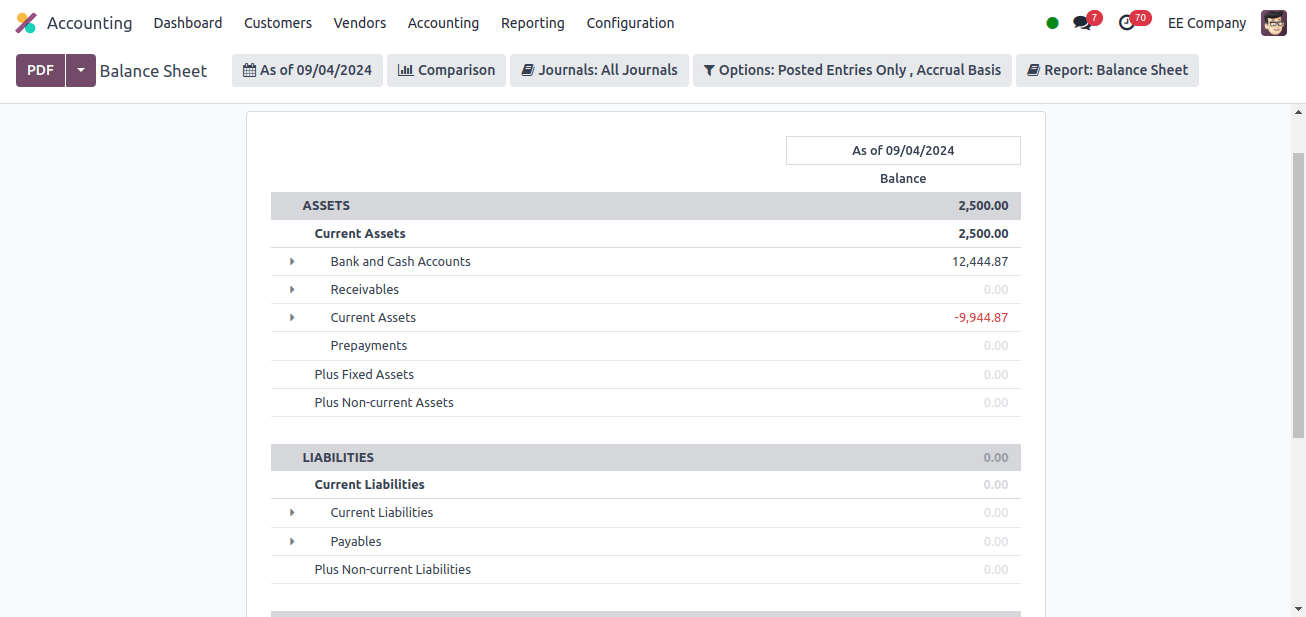

The newly configured company’s balance sheet is available in the accounting application’s reporting menu. It summarizes the company’s financial condition by displaying assets, liabilities, and equity.

* Assets: Assets are valuable possessions that are expected to improve in value over time. It can be characterized as a current or non-current asset.

Assets = Liabilities + Equity

* Liabilities: Liabilities refer to the company’s future financial responsibilities. They are characterized as either current or non-current liabilities.

* Equity: The owner’s investment in the company as well as earnings kept.

Current Assets consist of cash, financial investments, receivables and prepayments, inventory, and biological assets. Non-current assets include investments in subsidiaries and provides, as well as financial and real estate investments.

Provisions, government grants, loan liabilities, and so on are all classified as liabilities. Equity includes share capital, own shares, unallocated profits/losses, and so on.

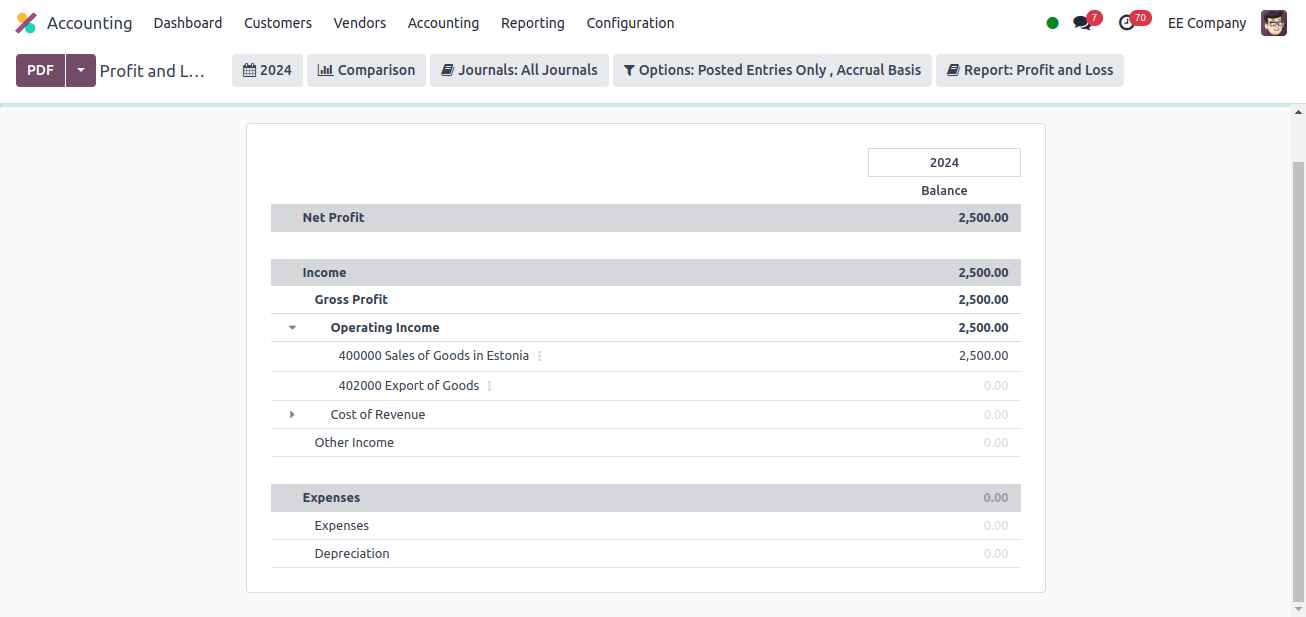

A profit and loss report is then available from the reporting option. The Odoo profit and loss report is one financial statement that can help you analyze your business’s profitability over time.

This company’s profit and loss statement comprises sales revenue, operating income, labor costs, interest income, and interest expense, among other products.

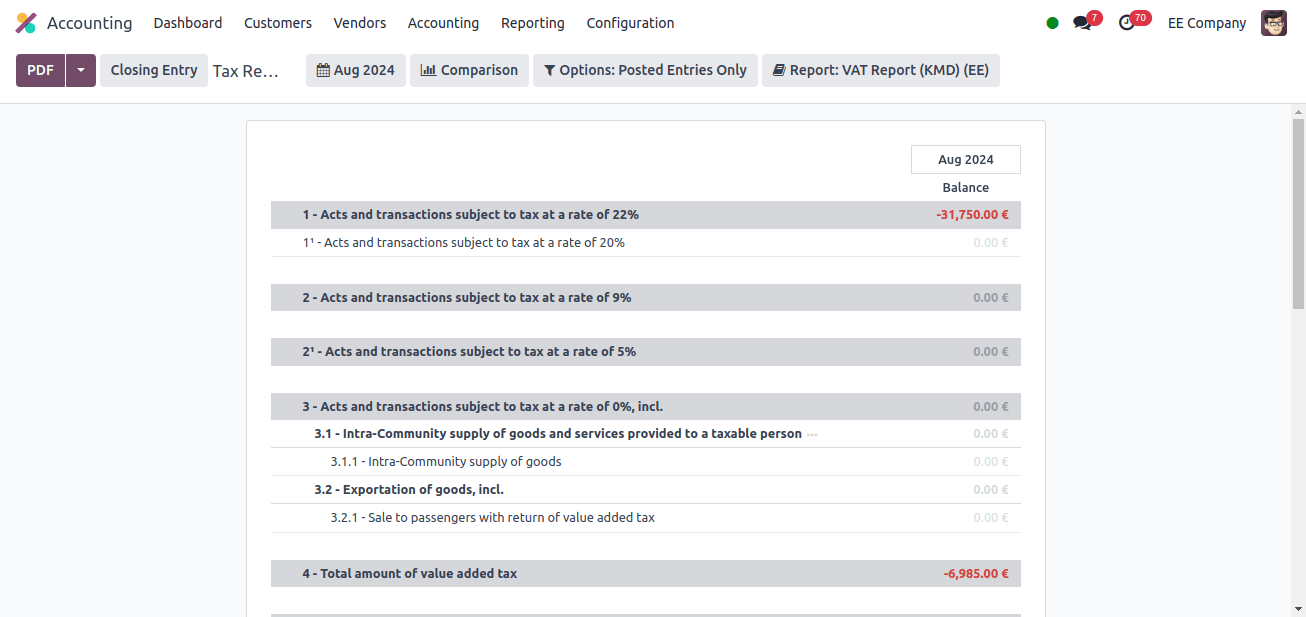

When we go to the company’s tax report, we may obtain a full tax report by selecting the tax reports sub-menu from the reporting menu.

A tax report in Odoo is a detailed recorded overview of your tax operations over a specific period. It allows you to schedule tax payments, calculate your tax bills, and even file for refunds. Odoo generates tax reports based on the taxes you’ve defined in your system.

The image above shows this company's Tax Report, delivered as a VAT Report (KMD).

VAT Report(KMD): In the Estonian localization of Odoo 17, a report designed specifically to meet the requirements for completing Estonian VAT returns is known as the VAT Report (KMD). KMD refers to "Käibemaksudeklaratsioon" or "VAT Declaration" in English.

This report allows enterprises in Estonia to generate the KMD form electronically within Odoo, simplifying the VAT return filing process.

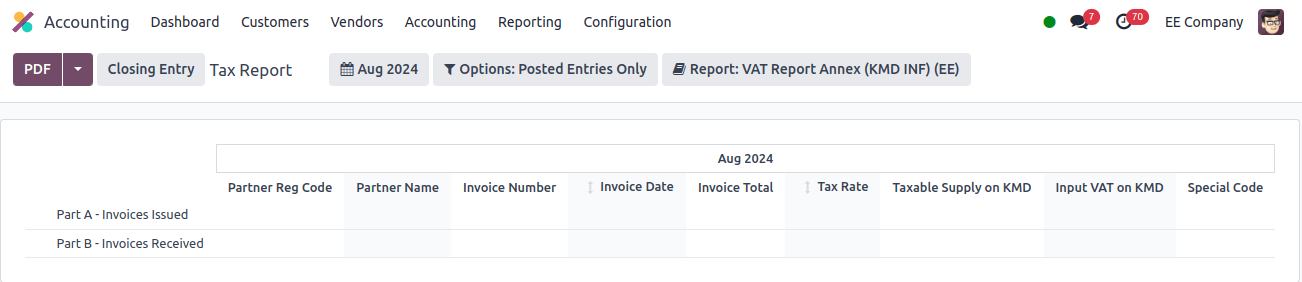

We have one more tax report, the VAT Report (KMD INF).

VAT Report Annex (KMD INF): In Estonia, the VAT Report Annex (KMD INF) is an additional document that must be submitted with the main VAT return form. It essentially details your sales and purchase transactions that exceed a certain level.

Estonian companies’ tax reports differ significantly from those of other nations. The report collects tax information from your credit notes, sales invoices, and vendor bills.

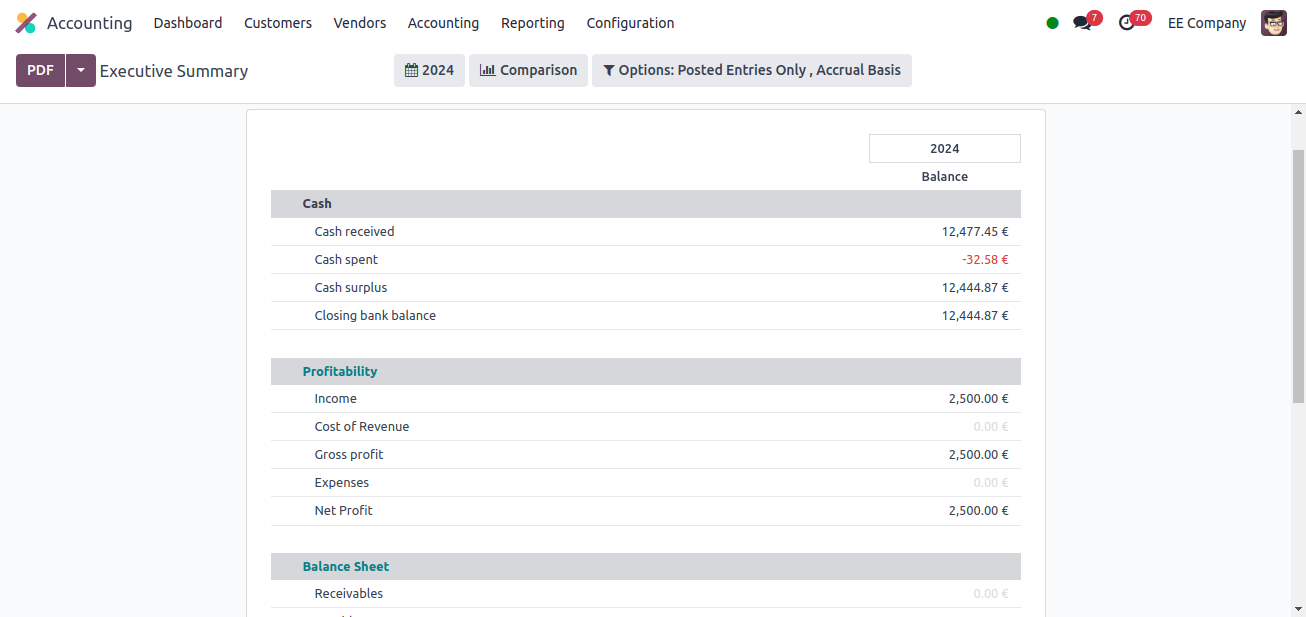

The Executive Summary feature in Odoo accounting reports provides a concise snapshot of your company's financial position. Essentially, it's an advanced financial dashboard that integrates with your Odoo reports.

It summarizes key financial data from several detailed accounting reports, saving executives and stakeholders time. It also reduces the need to read lengthy documents to comprehend the organization’s economic situation.

We discussed the localization package for an Estonian company. We may conclude that Odoo 17’s Estonian localization provides compliance with the complex Estonian tax legislation.

It allows us to create financial reports that adhere to national requirements and are basic enough for Estonian financial institutions and stakeholders to understand.

Overall, Odoo 17’s accounting localization for Estonia provides a full solution for regional enterprises. It assures compliance, streamlines operations, increases accuracy, and allows for better-informed financial decision-making.