Target keywords: Odoo 17, Accounting Localization, Odoo’s Slovakia accounting localization, Slovakia accounting localization

Accounting localization is an important part of managing financial operations in any company since it guarantees that accounting processes are compliant with local legislation, standards, and tax laws.

Odoo’s accounting localization capabilities are designed to provide businesses with the tools needed to assure proper financial management, speed tax filing, and comply with local accounting rules.

Whether a company operates in one or more countries, Odoo’s country-specific modifications and capabilities enable them to effectively navigate the complex regulatory environments that they encounter.

In Slovakia, accurate financial management is important for companies. Odoo’s accounting localization features address these needs by customizing its ERP system to Slovakian accounting rules.

This blog will go over how Odoo helps businesses' financial process in Slovakia, from adhering to VAT legislation and financial reporting requirements to automating tax calculations. Businesses that use Odoo’s specialized tools can improve the accuracy, efficiency, and compliance of their financial processes.

Slovakia Accounting With Odoo 17

Odoo 17’s Slovakia localization module makes it possible to comply with local tax legislation and accounting standards.

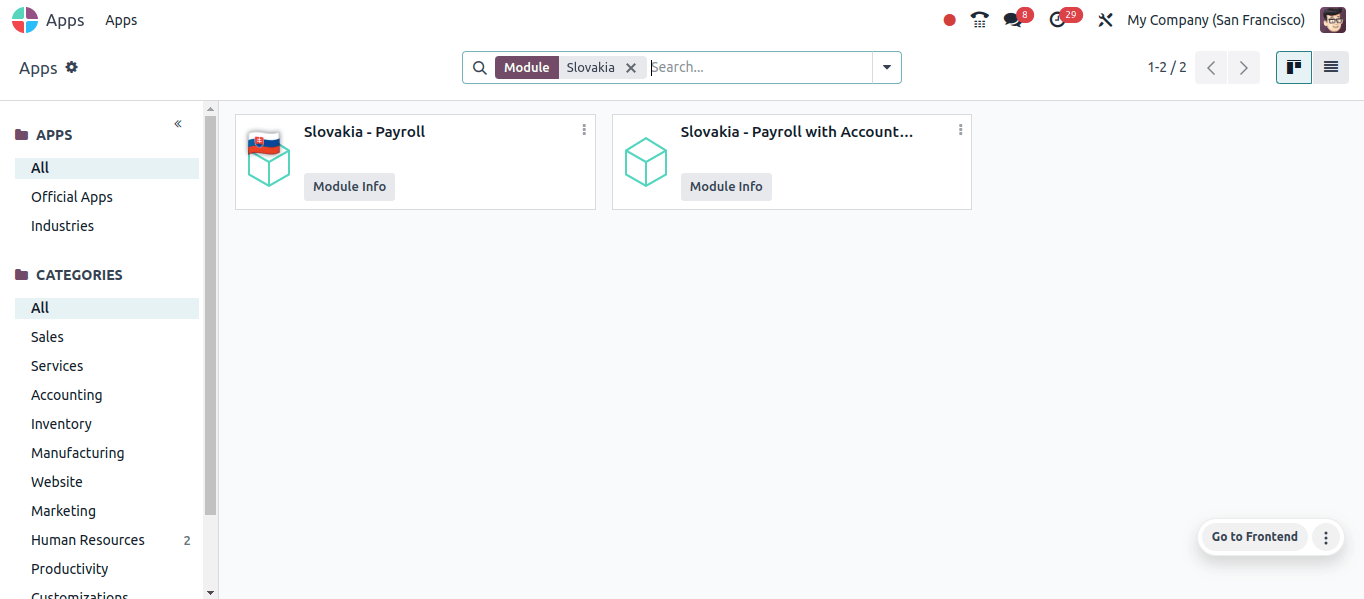

The first step in implementing accounting localization for Slovakia is to install the Philippine translation. Go to Apps and install the modules required to set up Slovakia’s accounting localization.

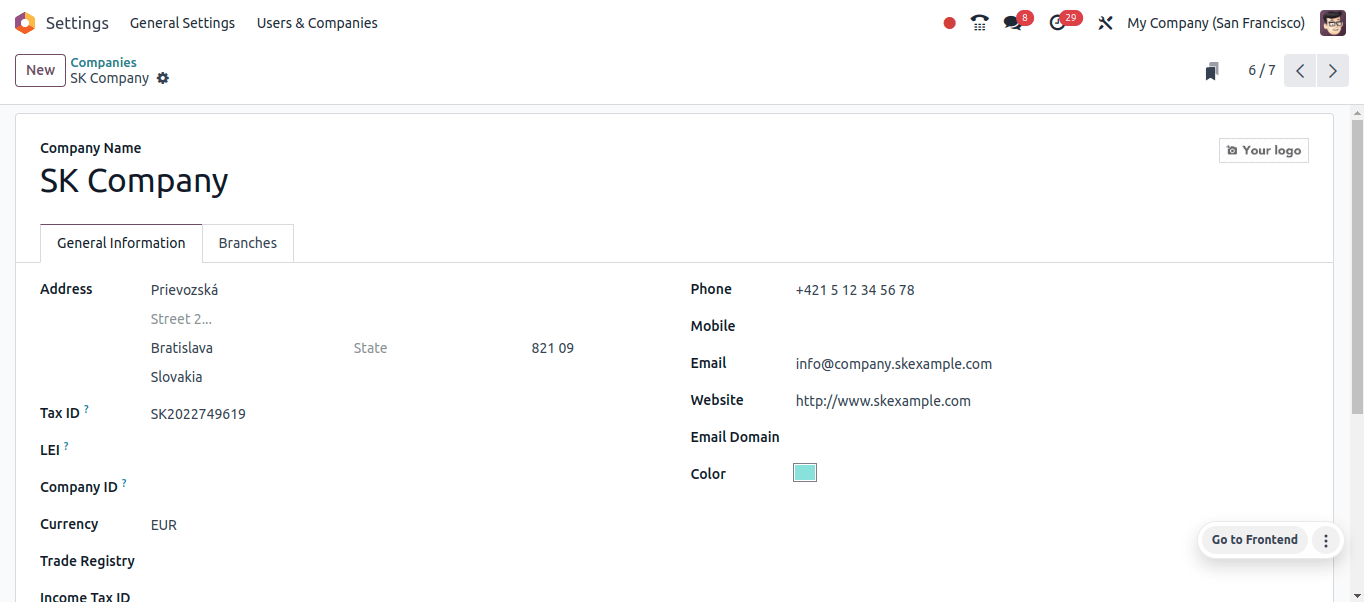

We can verify that the company is properly set up or create a new company with the relevant configuration after installing the Slovakia localization modules.

To accomplish this, go to Settings > Users and Companies > Companies. Click the New button to start a new company, or select a company from the list that appears.

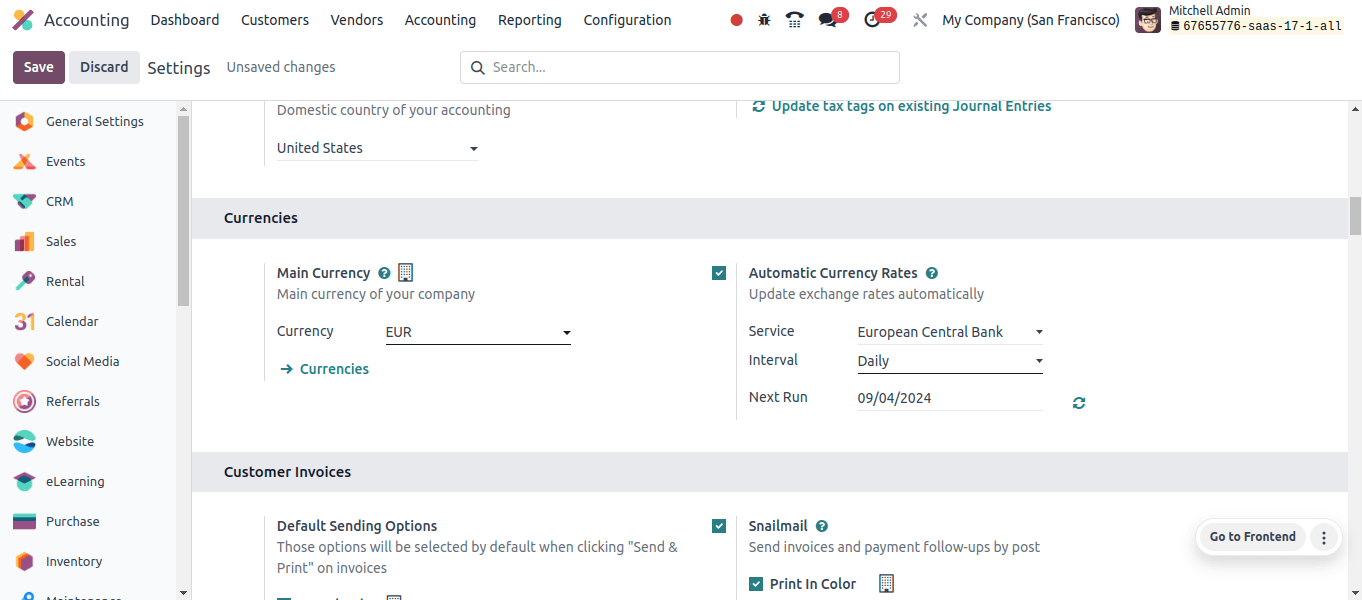

After evaluating the company setups, we can look into the fiscal localization, which will be set to Slovakia in the accounting module configuration settings. We may also see the default taxes and standard currencies for this localization.

In the settings that are automatically applied to invoices and sales orders, default taxes are set at 20% for both sales and purchase. These default tax configurations make invoicing easier since they apply the right tax rates and rules based on the product, service, or region.

This functionality simplifies tax management and compliance by ensuring accurate and consistent tax calculations across a wide range of transactions. The main currency is set to Euro (EUR), which is Slovakia’s official currency.

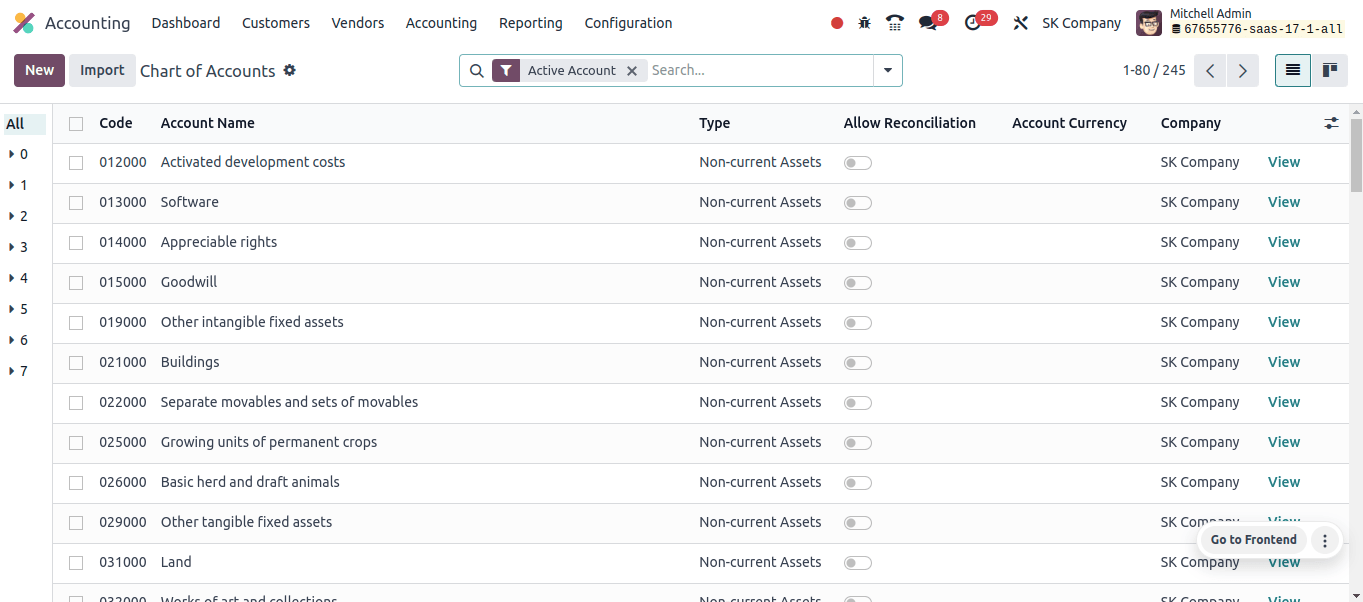

In Odoo’s Slovakia accounting localization, the chart of accounts is a structured framework that meets regional financial reporting and compliance requirements. It includes a comprehensive list of accounts that classify financial transactions in accordance with Slvakian accounting rules and legislation.

This localized chart of accounts ensures that companies may accurately record and manage their financial data, including assets, liabilities, income, and costs, in accordance with Slovakian accounting standards.

Odoo’s integration of these regional account formats enables precise financial reporting, smooth tax processing, and successful compliance with Slovakian regulatory standards.

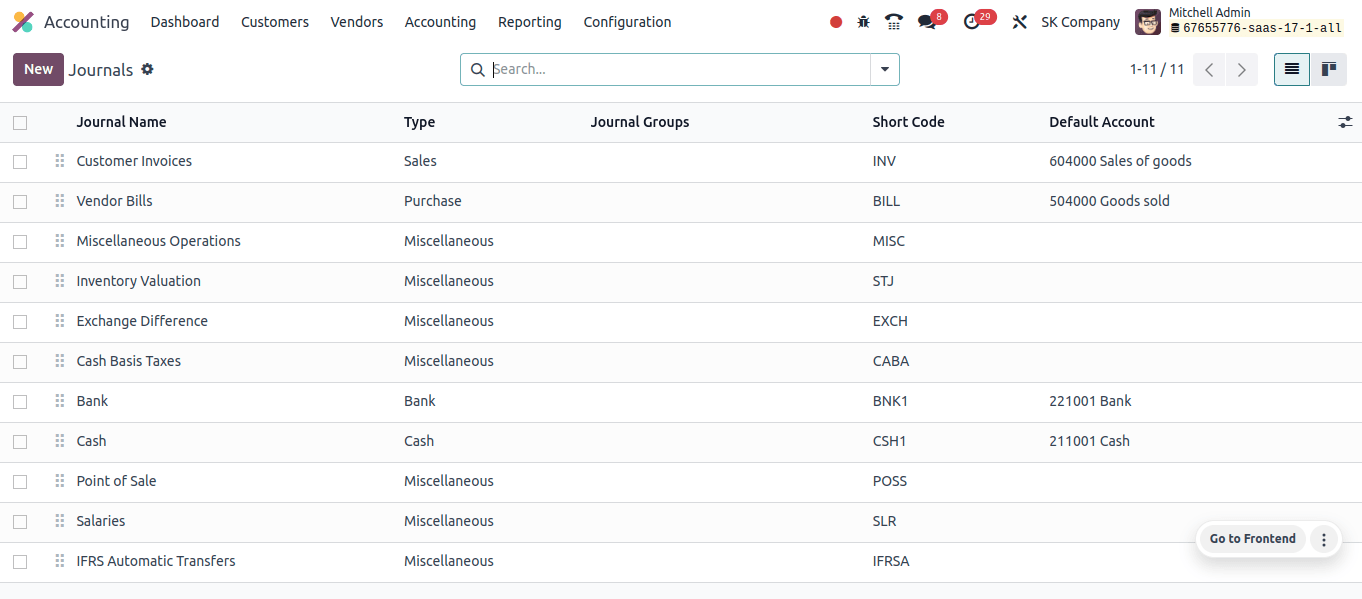

When it comes to recording and managing financial transactions in the Slovakian accounting localization of Odoo, journals are crucial. Every journal in Odoo is configured to conform with Slovakian accounting standards and processes, and it depicts a certain type of transaction, such as purchases, sales, or bank transactions.

This localization ensures that each input is properly classified and follows local rules, making financial tracking and reporting more efficient.

Using these localized journals allows businesses to preserve well-organized records, speed accounting process, and ensure compliance with Slovakian financial standards.

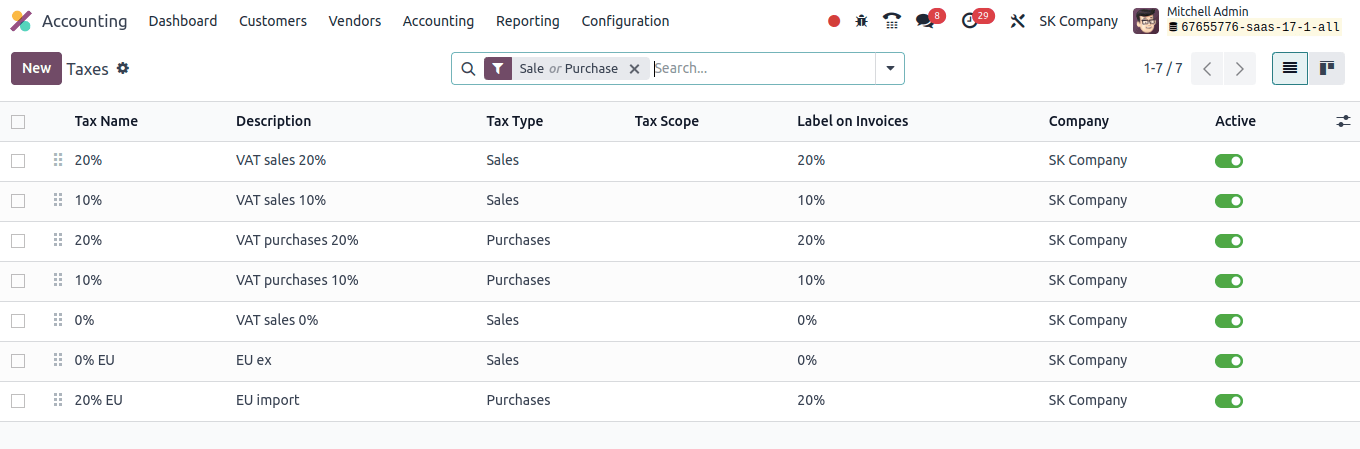

Taxes in Odoo's Slovakia accounting localization are configured in accordance with Slovakian tax legislation, ensuring precise and compliant financial operations.

The system allows you to set up numerous tax rates and rules, including VAT and other local tax laws, which are then applied automatically to transactions like invoices and sales orders.

This localization feature streamlines tax management by automating calculations and ensuring that all tax-related operations meet Slovakian norms, allowing for seamless tax reporting and compliance.

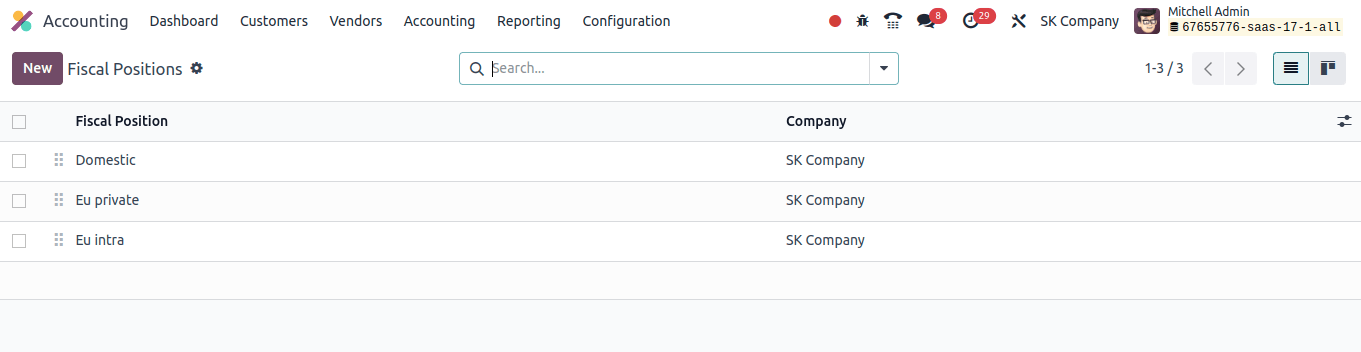

Fiscal Positions are dynamic instruments for managing and implementing applicable tax rules and accounting standards based on unique transaction scenarios.

Fiscal positions ensure that the right Slovak VAT rates are automatically applied to transactions based on client location, product type, or service category. This helps to keep tax calculations accurate in accordance with Slovakian tax legislation.

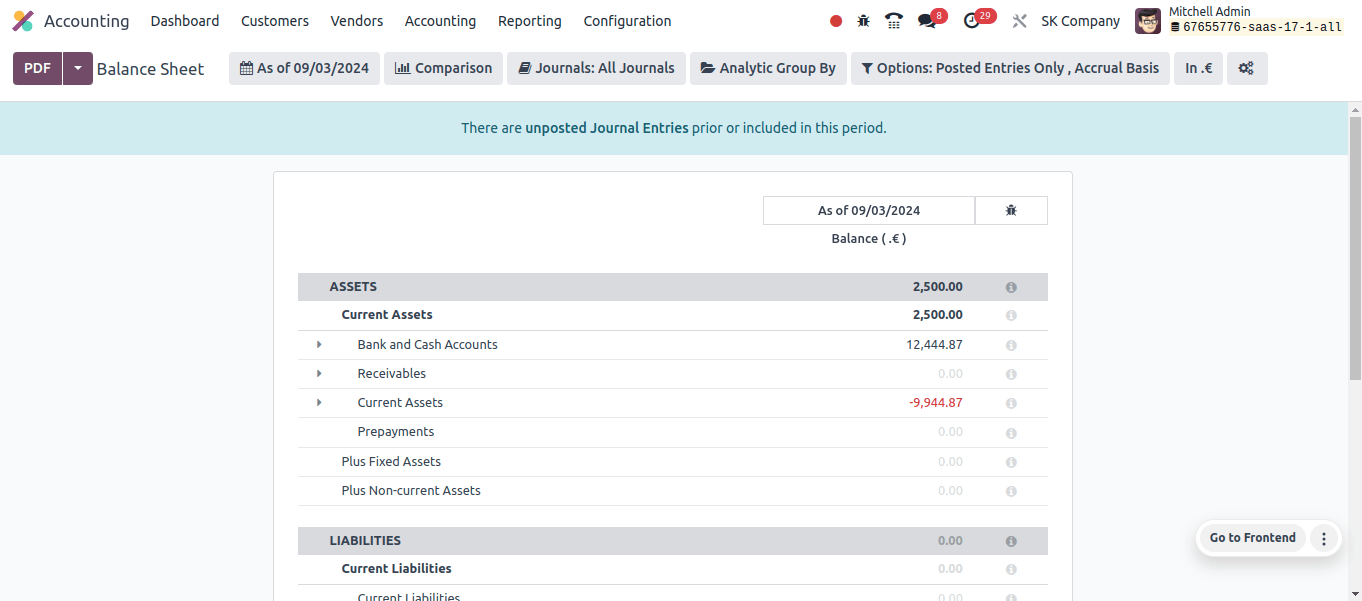

Balance Sheet

The Balance sheet assists companies in assessing their financial health by providing a precise breakdown of assets, liabilities, and equity.

This is important for assessing the company’s financial stability and guaranteeing compliance with Slovakian accounting regulations.

By using regional accounting guidelines, the balance sheet created in Odoo guarantees adherence to Slovakian reporting requirements. This simplifies legal compliance and allows for more accurate financial reporting.

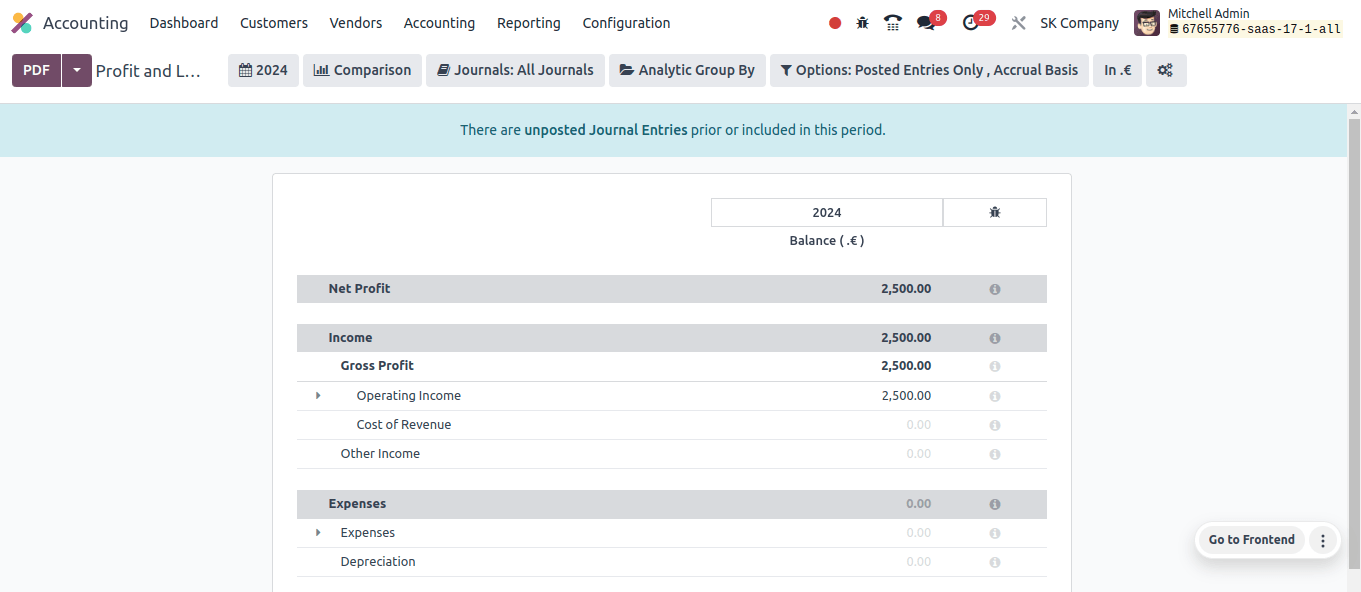

Profit and Loss Report

The profit and loss statement outlines income and expenses, providing a clear picture of a company’s financial situation.

This helps businesses evaluate their operational performance and profitability in conformity with Slovakian accounting standards.

Precise financial reporting is dependent on a profit and loss statement that adheres to Slovakian accounting standards.

Odoo's localization features make it easier to create P&L reports that meet regional regulatory standards, promoting compliance.

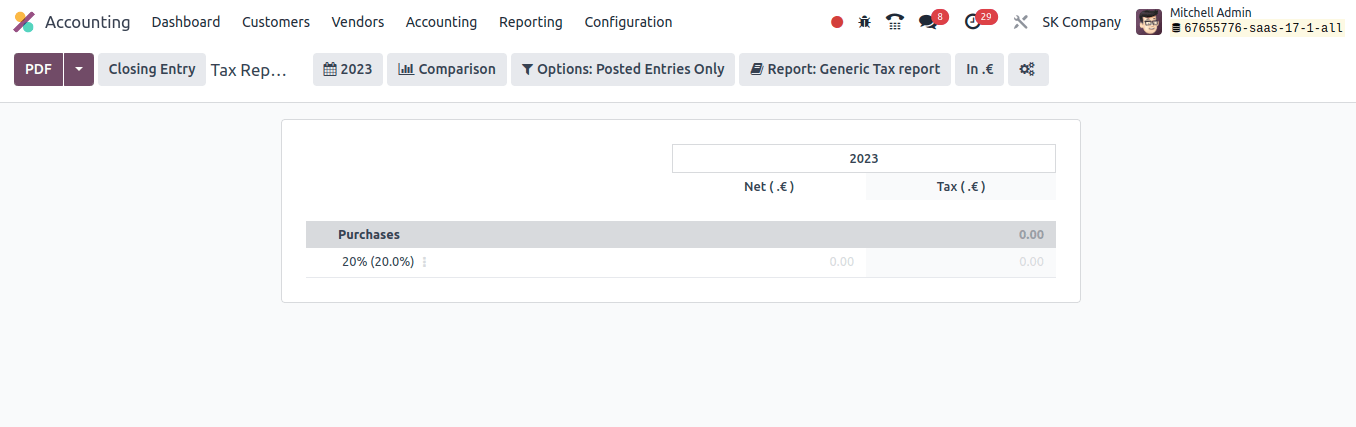

Tax Report

Tax reports give exact information on VAT and other taxes received and paid, assisting businesses in complying with Slovakian tax legislation. This allows you to fulfill your legal reporting duties while staying out of trouble.

Odoo simplifies the process of preparing and filing tax returns by creating detailed tax reports. These reports aggregate tax-related data, making it easier to file VAT returns and other tax documents correctly and on time.

Odoo’s tax reporting capabilities are routinely updated to reflect changes in Slovakian tax legislation and regulations. This ensures that enterprises comply with the most recent legislation and adjust their tax reporting process accordingly.

Odoo’s Accounting localization for Slovakia provides a strong foundation that is geared to satisfy the specific requirements of businesses operating in the country.

Odoo enables businesses to manage their financial operations with accuracy and efficiency by integrating Slovakian-specific features such as customized charts of Accounts, fiscal situations, tax setups, and compliance reports.

Localization helps overall financial management by simplifying processes and providing detailed reporting, as well as making regional tax and accounting rules more manageable.

Businesses in Slovakia may effortlessly navigate the accounting system with Odoo, maximizing financial performance and supporting strategic decision-making. Finally, Odoo’s Slovakia accounting localization provides businesses with the resources they need to succeed in a continuously evolving regulatory framework.