What is accounting localization?

Odoo accounting localization is the customization and adaptation of Odoo’s accounting software to satisfy specific legal, regulatory, and corporate requirements in different countries.

This localization ensures that the program is consistent with local accounting standards, tax legislation, and financial reporting methods.

The major benefits of Odoo accounting localizations include an accurate tax management system, customized financial reporting, effective localization support, streamlined processes, increased accuracy, and more.

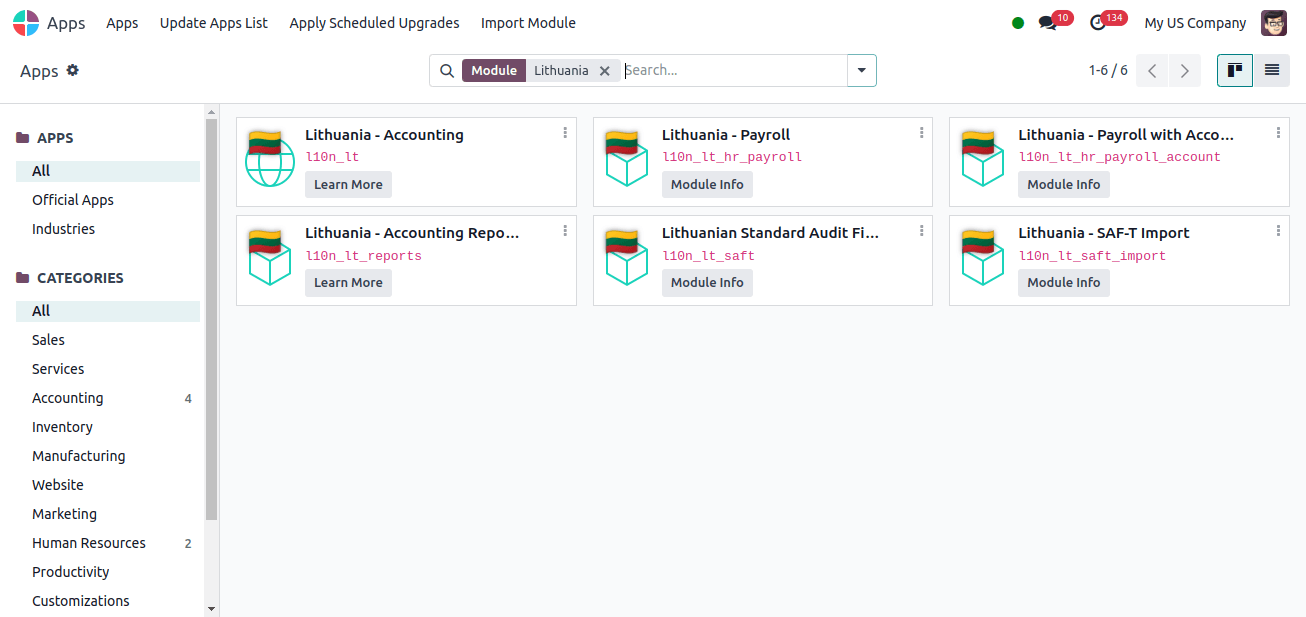

To set the configuration package, simply activate the packages listed in the screenshot below.

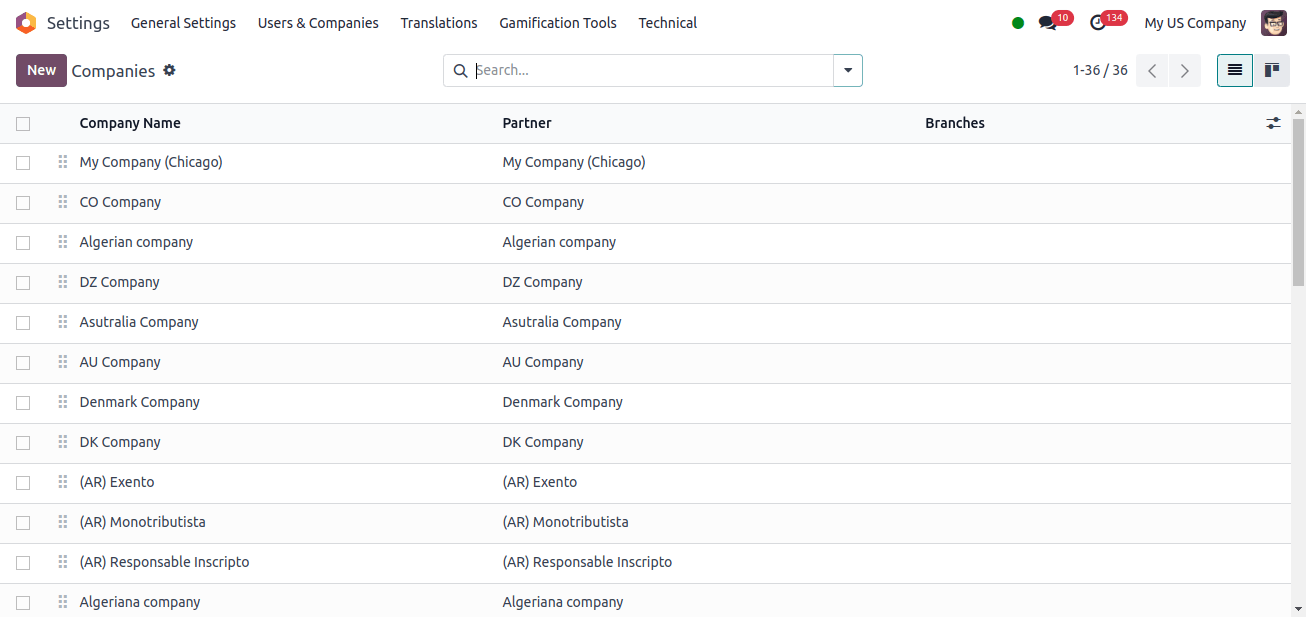

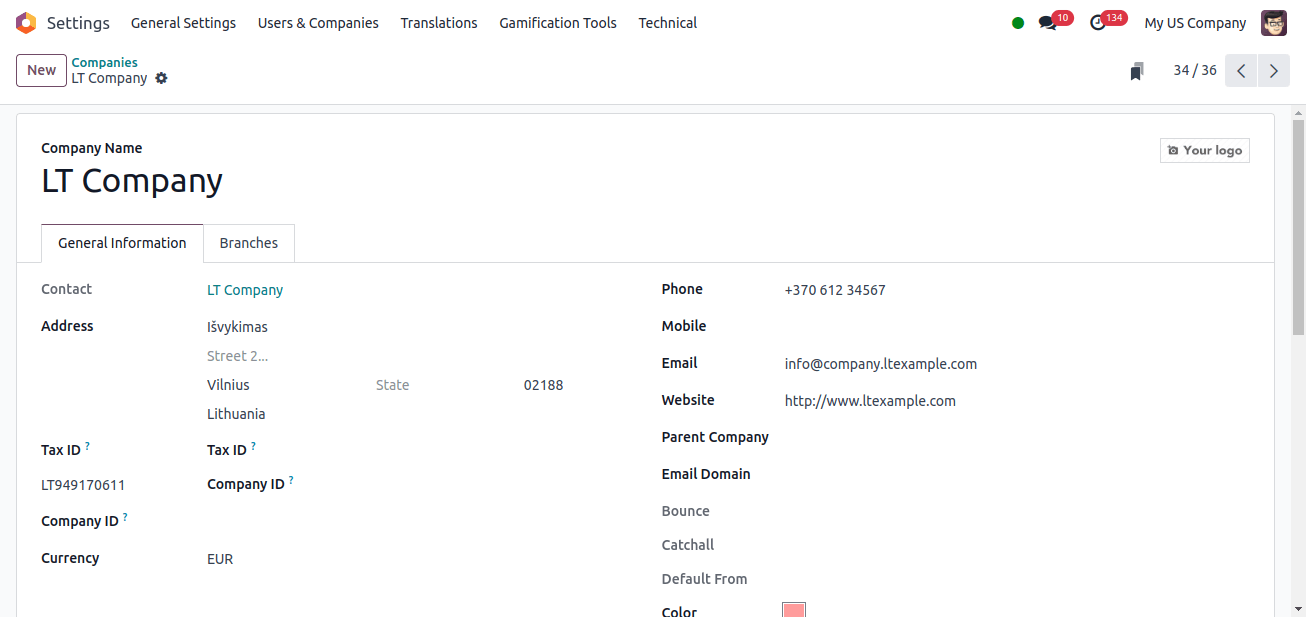

Then, once these packages are correctly installed, go to Odoo’s General Settings and set up a new company. There is a Users & Companies menu; select the Companies option to see a list of all companies that have already been created.

Click the new button to start a new Lithuanian company. Odoo will present a form for filling up the company’s details such as its name, address, and the country to which it belongs.

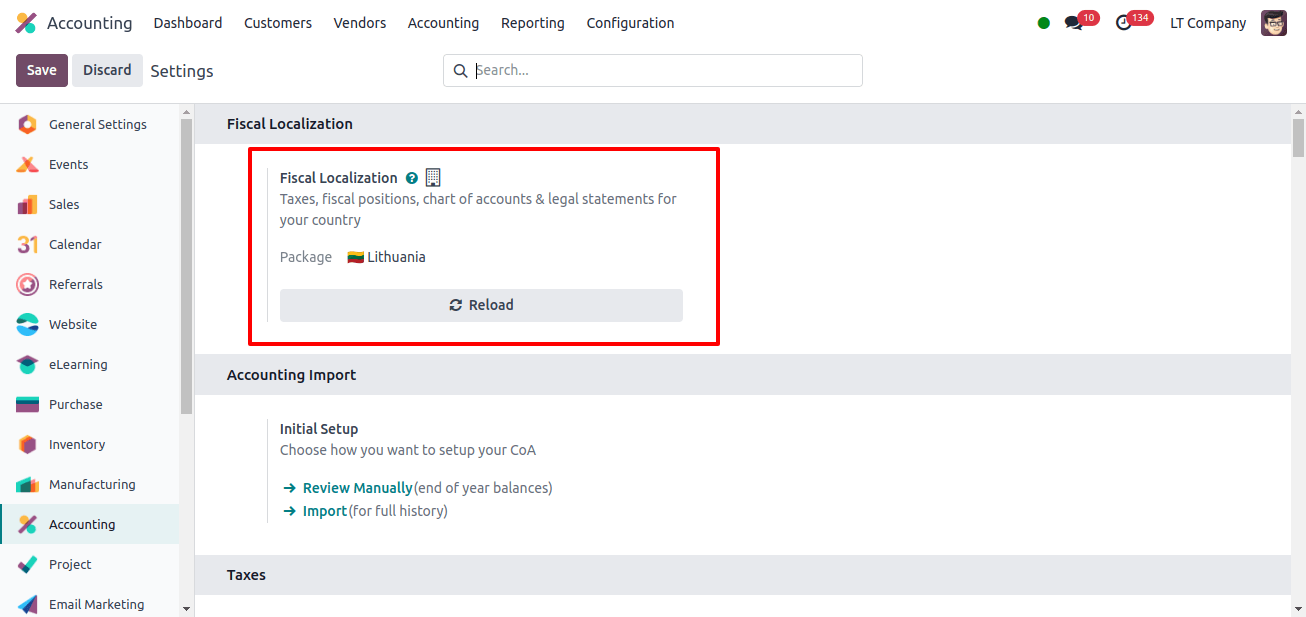

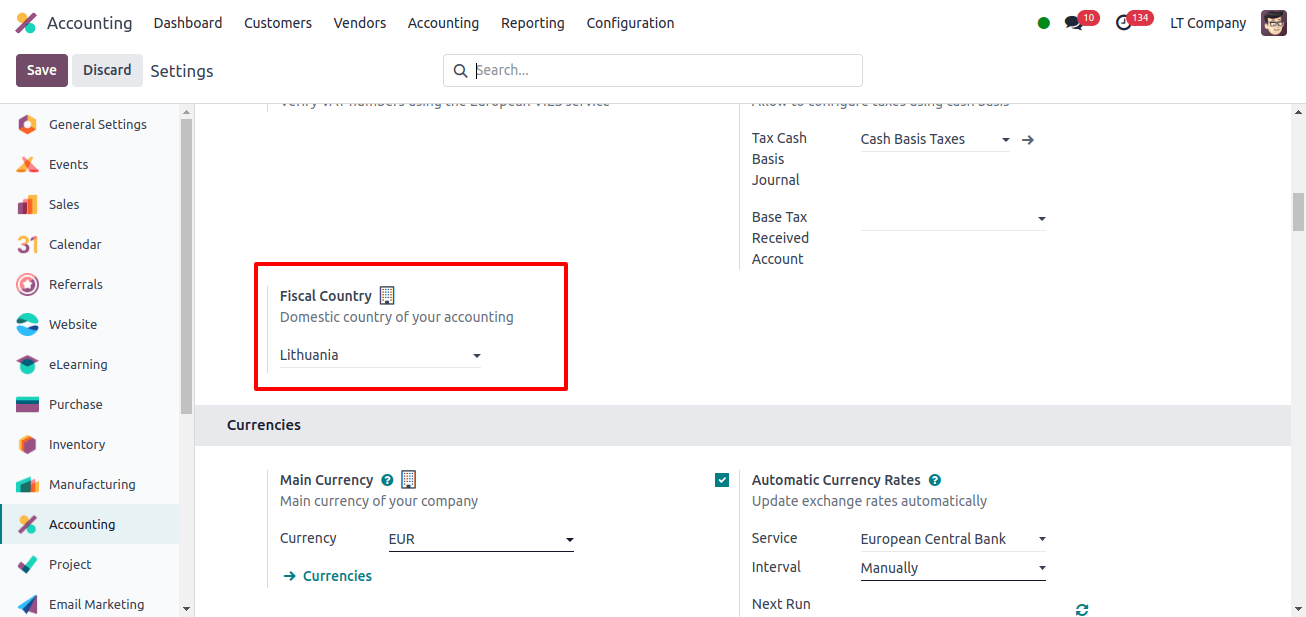

The next step is to determine the localization package for this company. Go to the Odoo 17 Accounting application, then Configuration > Settings. There is a fiscal localization component.

There, we may change the package for this company to Lithuania and click the Save button to save the newly configured Fiscal Localization package.

When we enable this localization package, Odoo will automatically configure the journals, taxes, fiscal positions, chart of accounts, currency, and other details for this company.

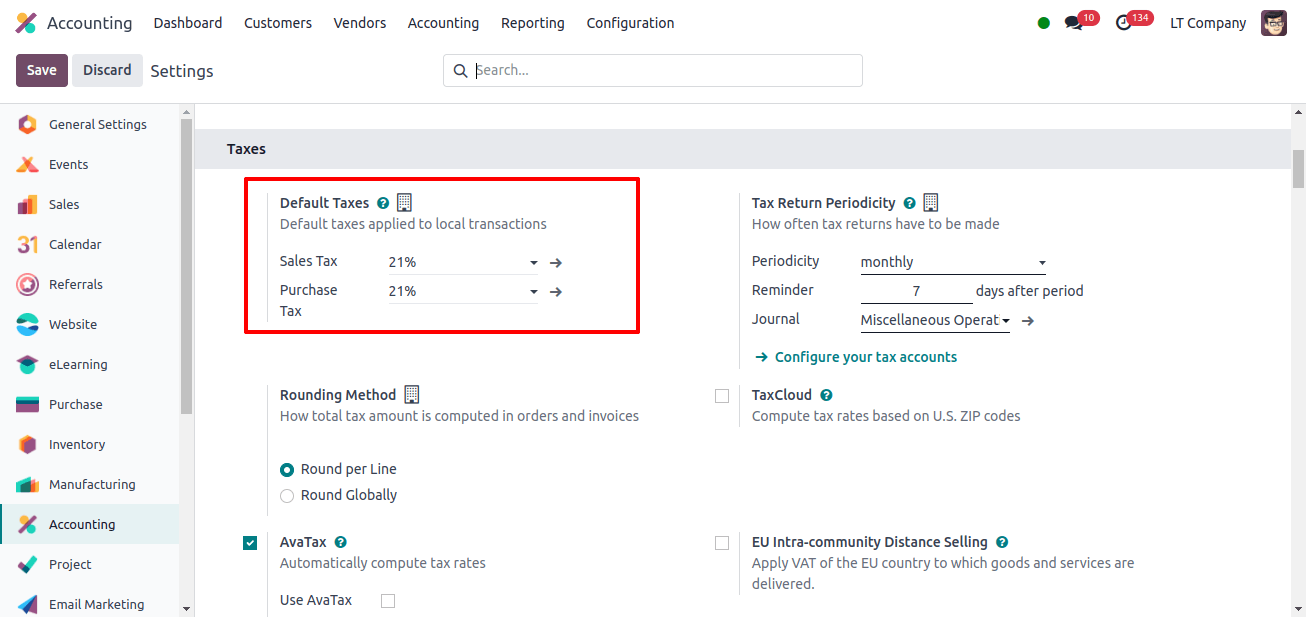

When the Localization package is enabled, Odoo sets the Default sales taxes and Default Purchase taxes for the company in Configuration > Settings, under the Taxes field.

* Default Sales Tax: Refers to the system’s established tax settings for sales transactions.

* Default Purchase Tax: Refers to the established tax setting that apply to buy transactions, such as acquiring products or services from suppliers.

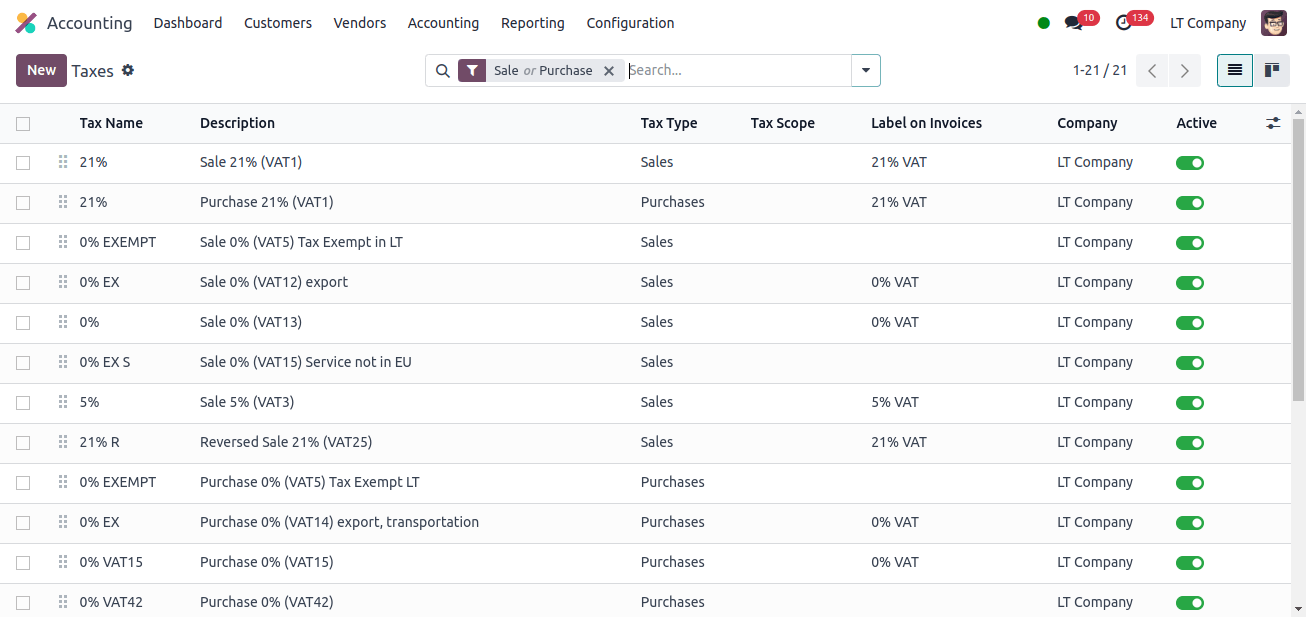

Next, under the configuration menu, there is a Taxes sub-menu. All taxes that have already been configured for the Lithuanian company can be seen there.

We can add a new tax for this company by clicking the New button on this page. This automatic tax setup reduces the need for manual tax calculations and entries, lowering the risk of human mistake. It also guarantees that tax rates and rules are applied uniformly across all transactions, rescuing disparities and inaccuracies.

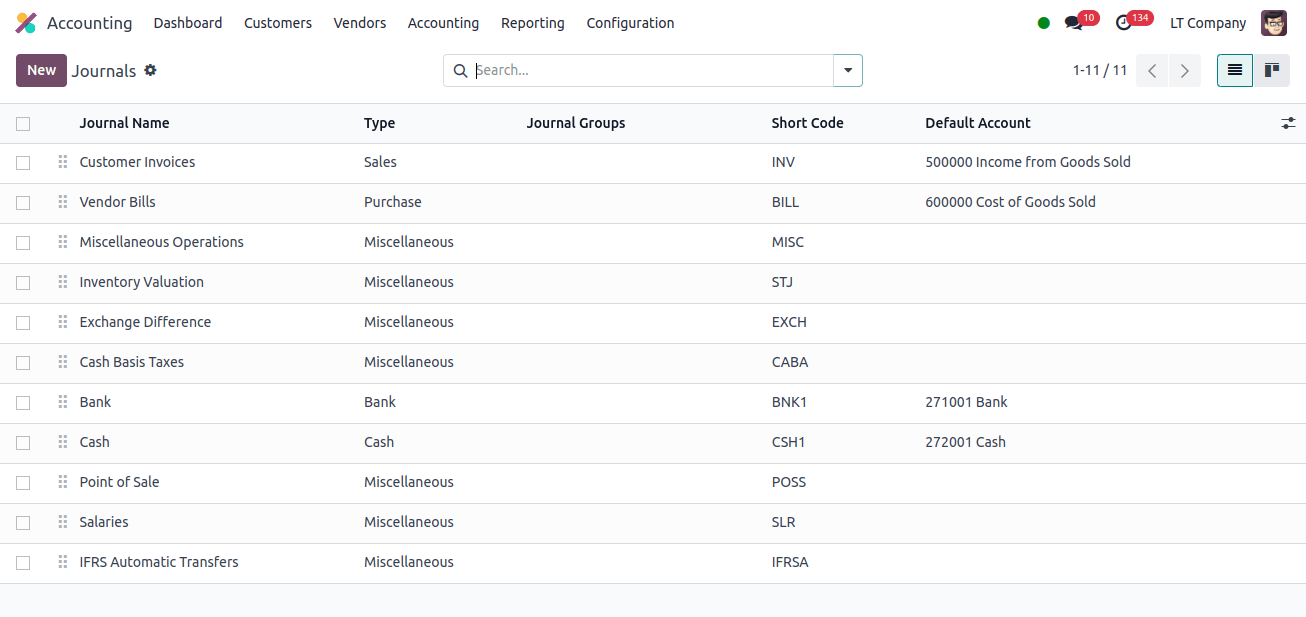

Journals are key components of the accounting module that help record and manage financial activities. They are the principal means of organizing and categorizing transitions, ensuring that they are properly recorded in the company’s financial records. The journal submenu can be found under the Configuration menu.

Odoo offers five types of Journals: Sales, purchase, cash, bank, and miscellaneous. The use of all journals may vary. That is, journals given an organized way to record many types of transactions, such as sales, purchases, and bank transactions. This structure helps to keep financial records organized and managed.

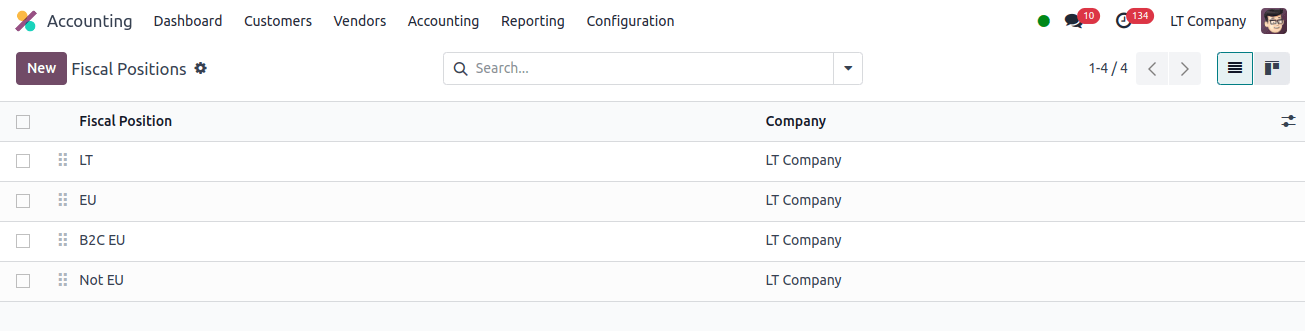

Odoo fiscal positions feature is a useful tool for managing and applying various tax laws based on certain variables, such as customer geography or product category. This assures precise tax estimates, attached to local legislation, and effective rule of complex tax issues.

Businesses that advantage fiscal positions can reduce their tax processes, preserve consistency, and improve overall financial performance. The Fiscal Position sub-menu can be found under the configuration menu.

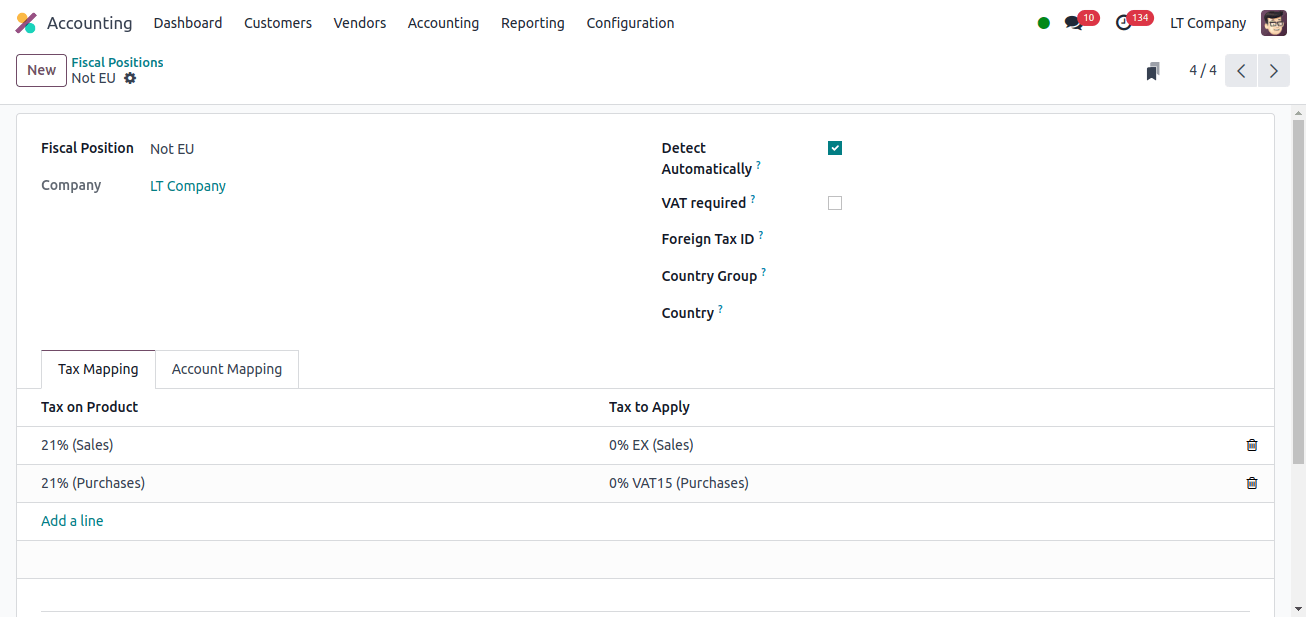

These are the already-configured fiscal positions for Lithuanian companies. When we open one of the fiscal positions, we can view the mapped accounts and taxes.

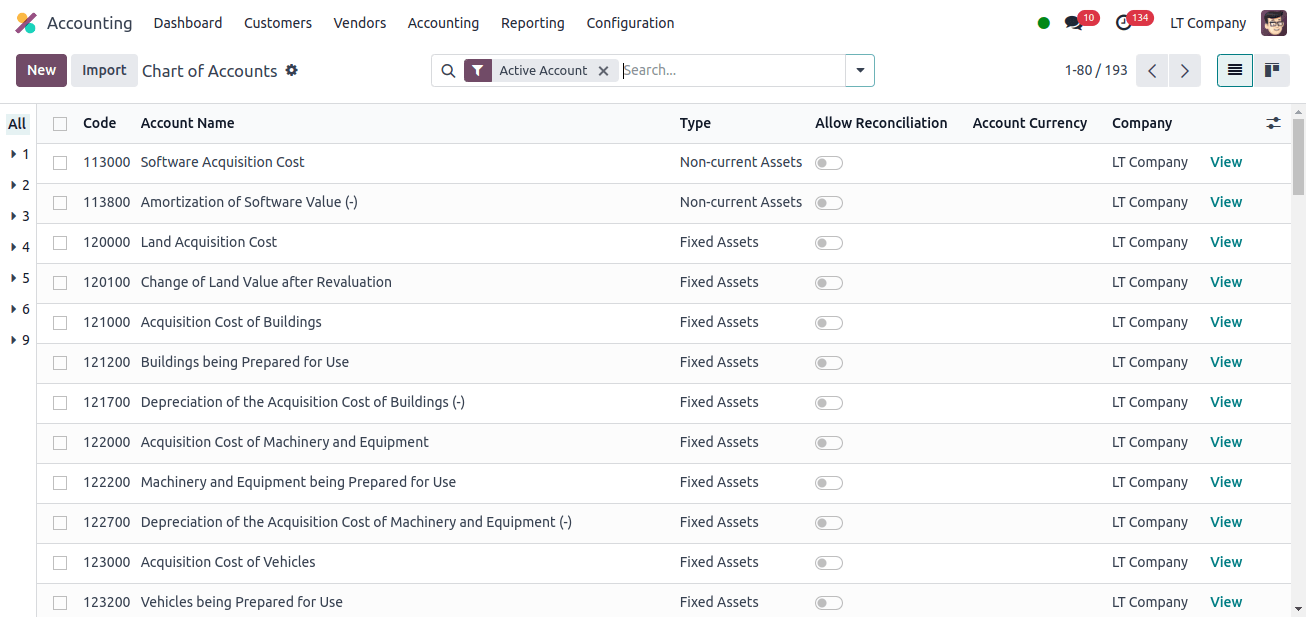

The following is the Company’s pre-configured chart of accounts. The Chart of Accounts in Odoo is an important tool for organizing and managing a company’s financial activities.

It provides a structured framework for recording financial data, creating accurate financial reports, and holding to accounting rules.

The Chart of Accounts assists companies in maintaining accurate financial records and gaining important insights into their financial performance by allowing for flexible setup and interaction with other modules. Click the Journal submenu in the Configuration menu.

With the preset chart of accounts in Odoo, transactions are automatically sent to the right accounts based on predefined rules and settings, avoiding human mistakes and increasing accuracy.

In Odoo, we may set the fiscal country for a corporation under Configuration > Settings. When the localization package is configured, Odoo automatically sets the company's fiscal country to Lithuania.

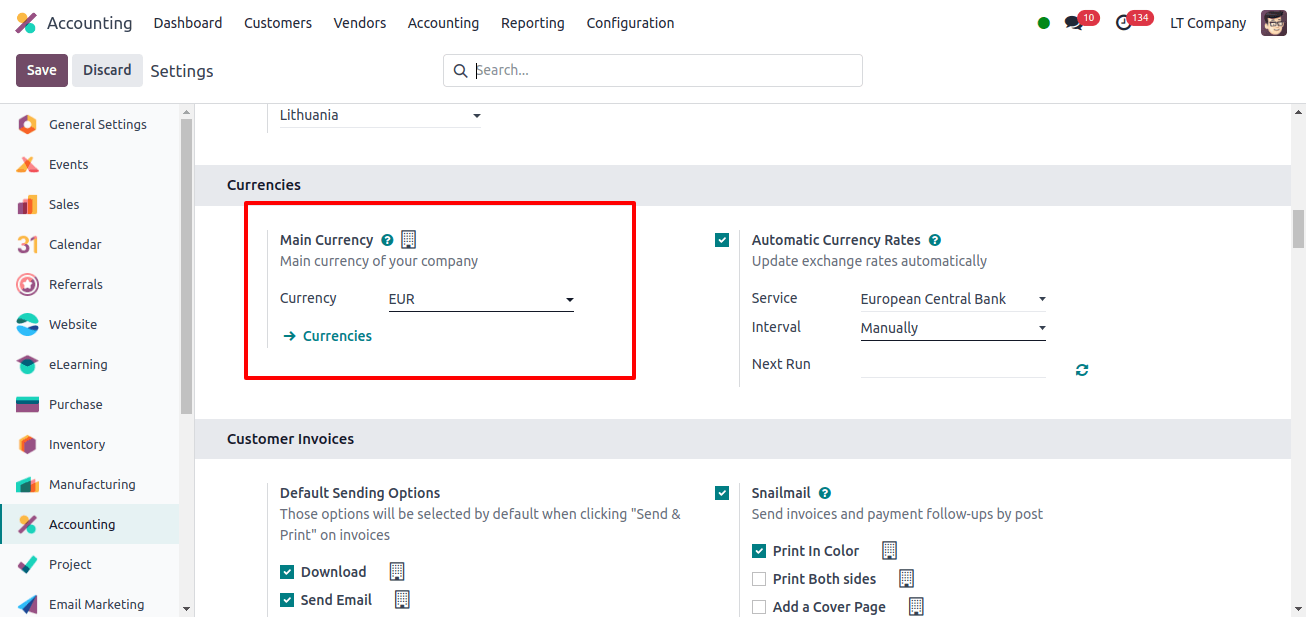

There is a currency field under Configuration > Settings. When a localization package is properly configured for a company, Odoo sets the company’s main currency to match the localization package.

We know that Lithuania's official currency is the Euro (EUR), and once the fiscal localization package for this nation is configured, Odoo automatically sets the company's main currency to the Euro (EUR).

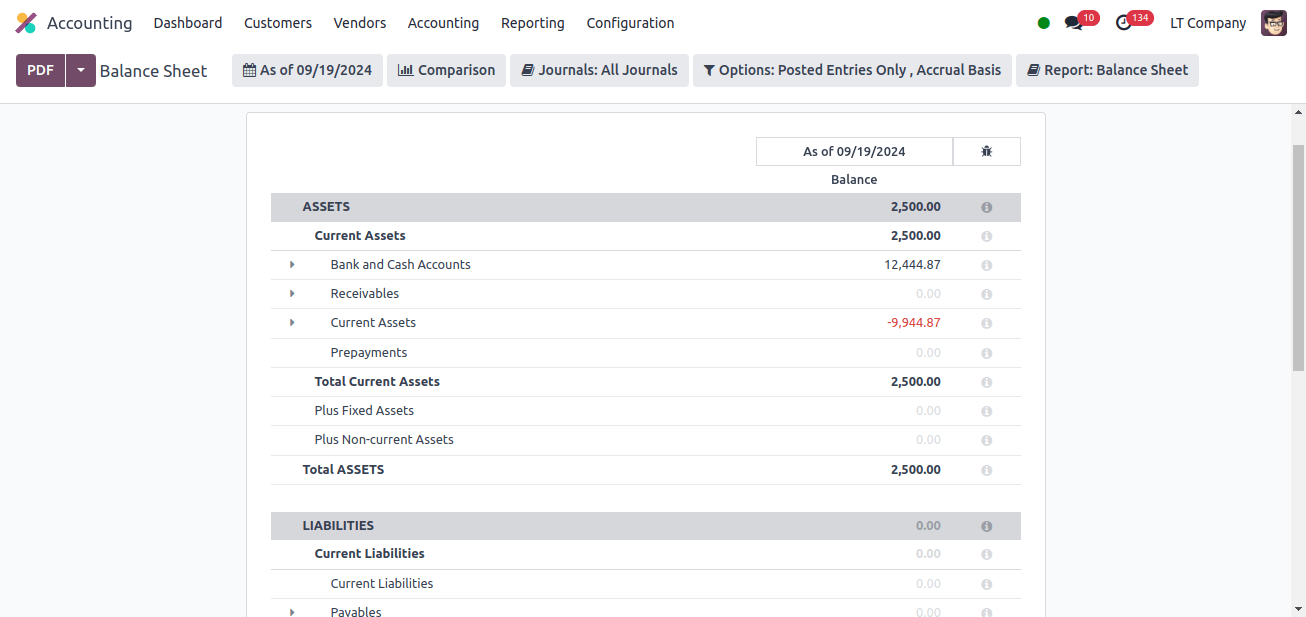

The Accounting application’s Reporting menu includes the Balance sheet, profit and loss report, and tax report.

Odoo's Balance Sheet is an important financial report that shows a company's assets, liabilities, and equity at a certain point in time. It makes accurate financial analysis easier, helps to ensure compliance with accounting rules, and provides crucial decision-making insights.

The Balance Sheet's interaction with Odoo's Chart of Accounts and other financial modules enables organizations to retain a clear picture of their financial condition and make smart financial decisions.

The Lithuanian company's balance sheet consists of two sections: TOTAL ASSETS and TOTAL EQUITY AND LIABILITY. Goodwill provides an up-to-date image of a company's financial status, including assets, liabilities, and equity, based on the most recent financial transactions.

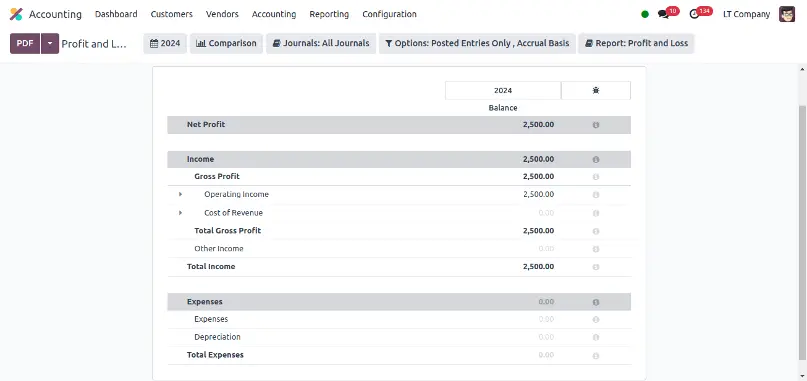

The Profit and Loss report shows how well your company is doing in terms of generating earnings and managing expenses. It aids in budgeting and projecting future financial performance. And helps management make better decisions regarding operations, investments, and cost control.

The Lithuanian company's profit and loss report comprises net turnover, cost of sales, selling expenses, other operating results, profit tax, other interests and similar incomes.

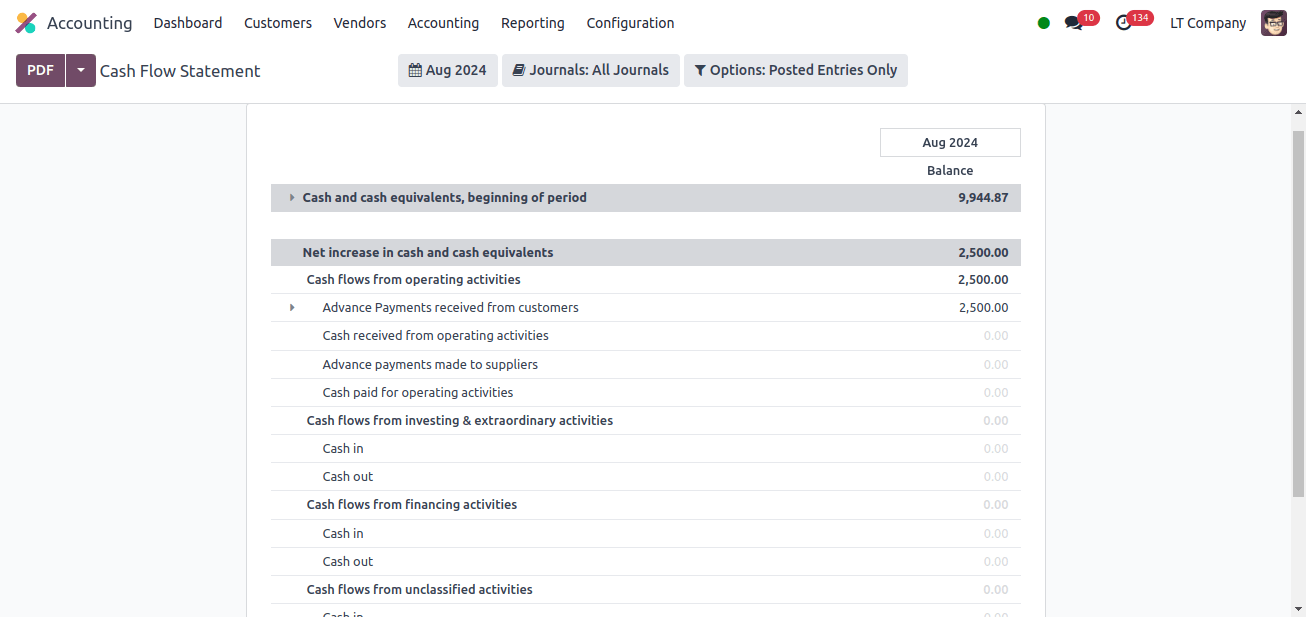

A cash flow report in Odoo shows a detailed breakdown of cash inflows and outflows over a certain time period. This report is critical for understanding how cash flows in and out of your company, allowing you to manage liquidity, plan for future expenses, and assess your organization's financial health.

Cash flow from operating activities, cash flow from financial activities such as cash in, cash out, cash in and cash out from unclassified activities, cash in and cash out from investing and exceptional activities, and so on are all included in the company's cash flow report.

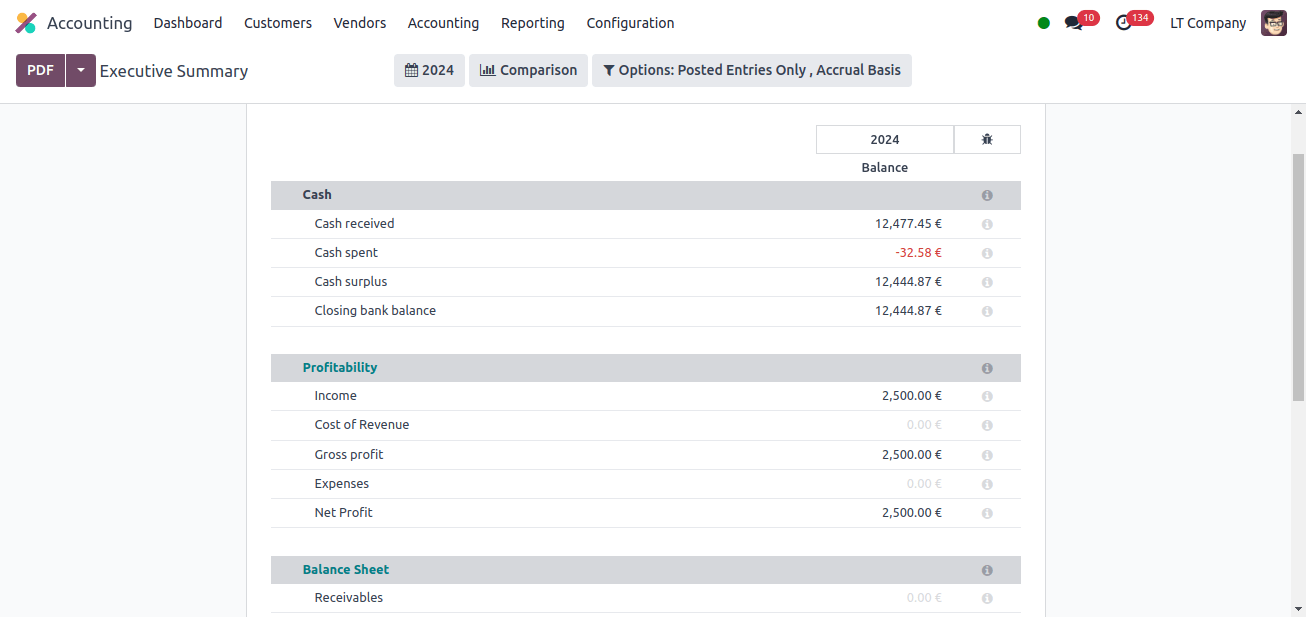

Finally, the executive summary of the company. In Odoo, an Executive Summary Report provides executives and managers with a high-level summary of essential financial and operational indicators. This report compiles critical data to provide an image of the company's performance, assisting with strategic decision-making.

The key sections of Lithuanian companies balance sheets include cash, profitability, balance sheet, performance, and position. It provides executives and managers with a clear picture of overall business performance without going into particular reports.

In this blog, we addressed the specifics of setting up a localization package for a Lithuanian company, as well as the package's essential features. So we may say that Odoo's localization packages are intended to adapt the system to local legislation, practices, and languages.