Odoo 17 PoS allows you to manage prices in a variety of ways, including the inclusion and deletion of taxes. This allows you to select the price strategy that best meets your business needs.

The ability of Odoo 17 PoS to manage pricing with or without tax highlights the need for price management even further. Tax-inclusive pricing refers to prices that include all applicable taxes. In many countries, this price mechanism is the most common.

When tax-included pricing is used, the total cost of a purchase is constant independent of the customer’s tax rate. Tax-excluded pricing does not include all applicable taxes. Although less popular, this pricing approach has several applications.

Odoo 17 PoS allows you to set tax-included prices for any product. Also, you can assign several price schemes to specific clients. This allows you to adjust your pricing approach to meet the specific needs of your business.

Tax-excluded (B2B) and tax-included (B2C) pricing are common price management solutions in Odoo 17 PoS. This is because it enables you to differentiate pricing between customers (B2C) and businesses (B2B). Use tax-exempt pricing for B2B clients.

This is because most businesses prefer to manage their own tax calculations and payments. You can also negotiate pricing with enterprises more freely if you use tax-exempt prices.

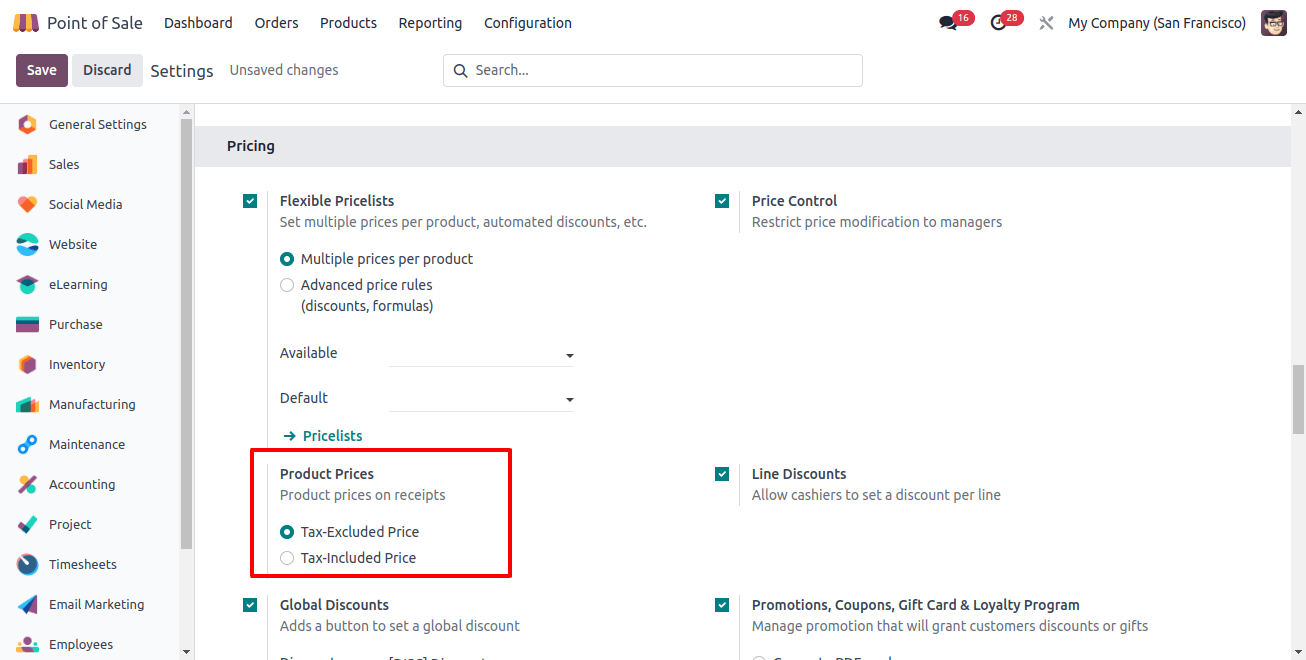

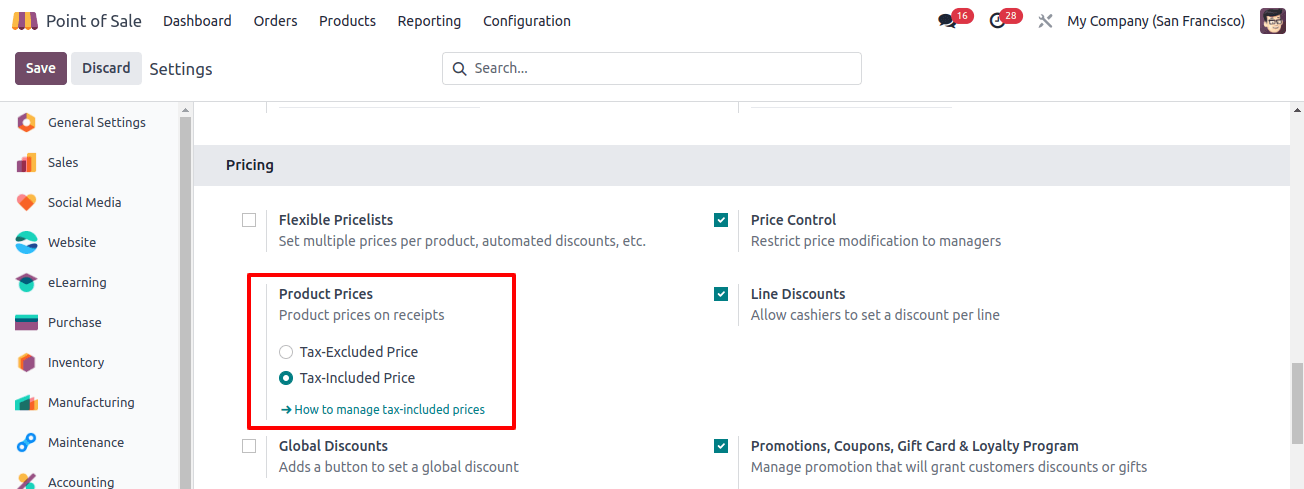

The PoS module’s configuration settings allow you to choose whether the product price includes tax when displayed in the PoS.

This is where you may customize the PoS to display the product price the way you want.

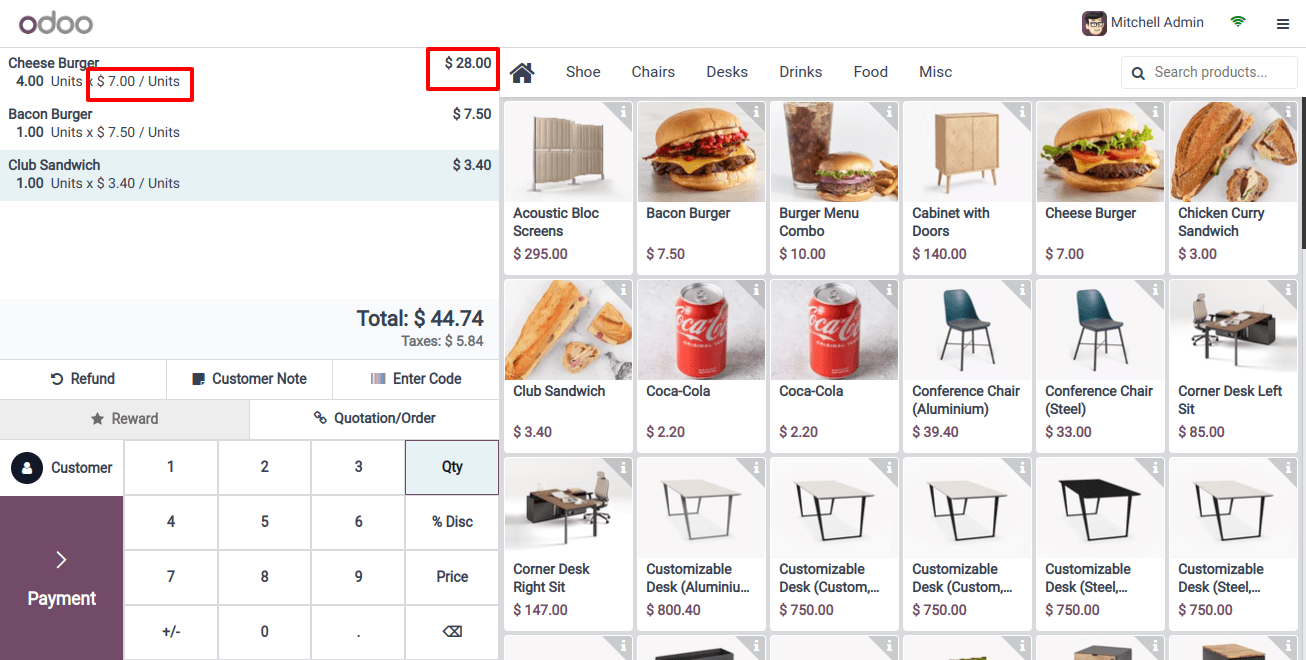

When you choose the tax-excluded option, the product price excludes the tax amount. The consumer may identify the product price without the tax amount, which will be added to the final amount.

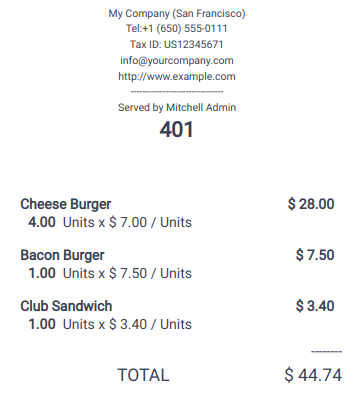

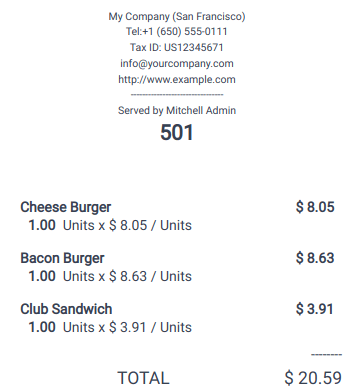

In the same way, the customer can confirm the figure on the receipt.

Individually specified tax prices make it easier to determine the total cost of an order. This reduces eros and saves customers from being overcharged.

Also, clients may see the actual amount of tax they are paying which can boost transparency and confidence in your business.

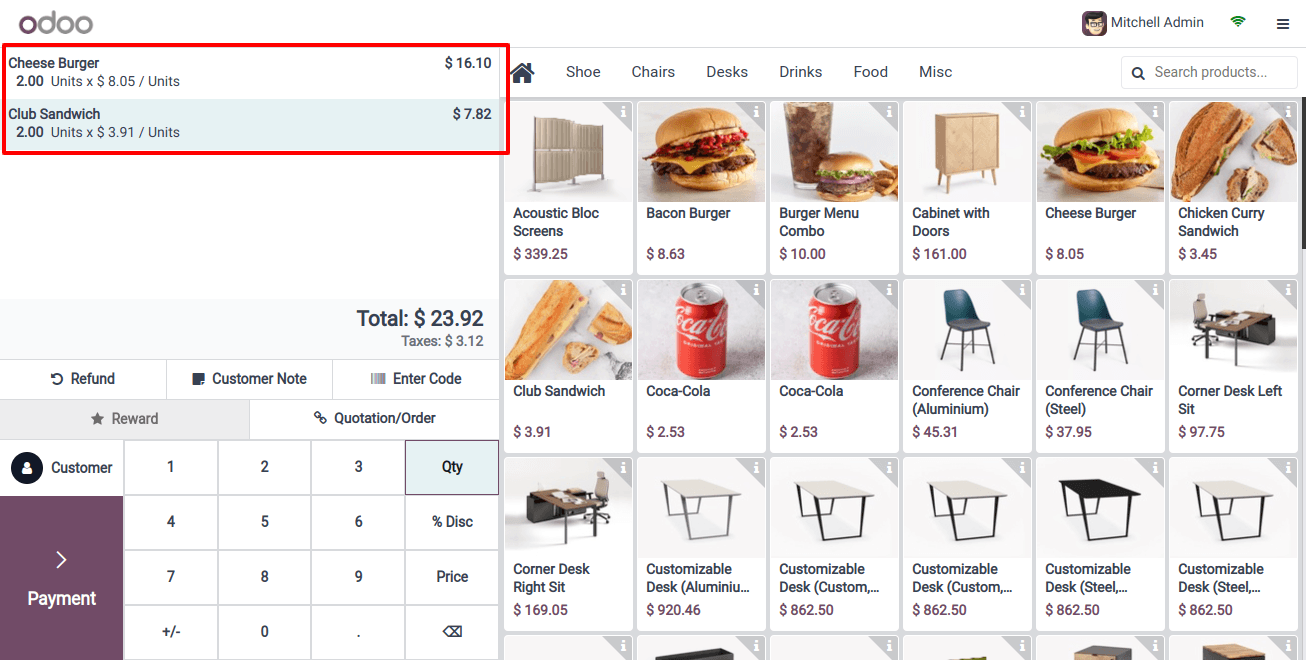

Let’s see how the tax-inclusive price appears in the POS orders. Remember to give the configuration price options, which include taxes.

The pricing for goods configuration has been revised to include taxes. Start a fresh proof of stake session to see the changes.

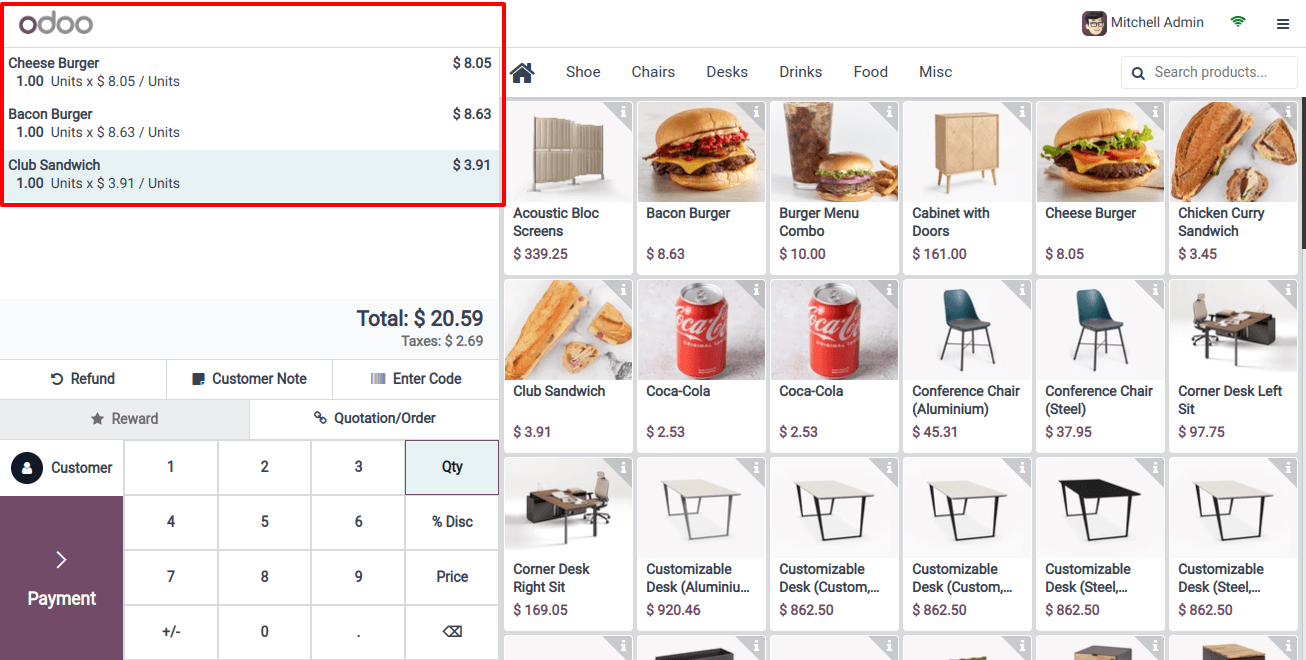

As you can see, the whole product price, including tax, is already displayed.

The receipts reflect the total amount, including taxes, showing tax costs, including VAT, that could help you satisfy legal needs. Several countries have tax prices displayed, including on receipts.

For B2C clients, you might use tax-included pricing. This is related to consumers’ general discomfort with performing their own tax calculations and payments. Also, using tax-included pricing may make it easier for consumers to compare costs offered by other companies.

Your business's specific demands will ultimately determine the right pricing plan.

If you want clarity and ease of use, pricing that includes taxes is the best option. If you want greater flexibility, tax-free prices may be a better option.

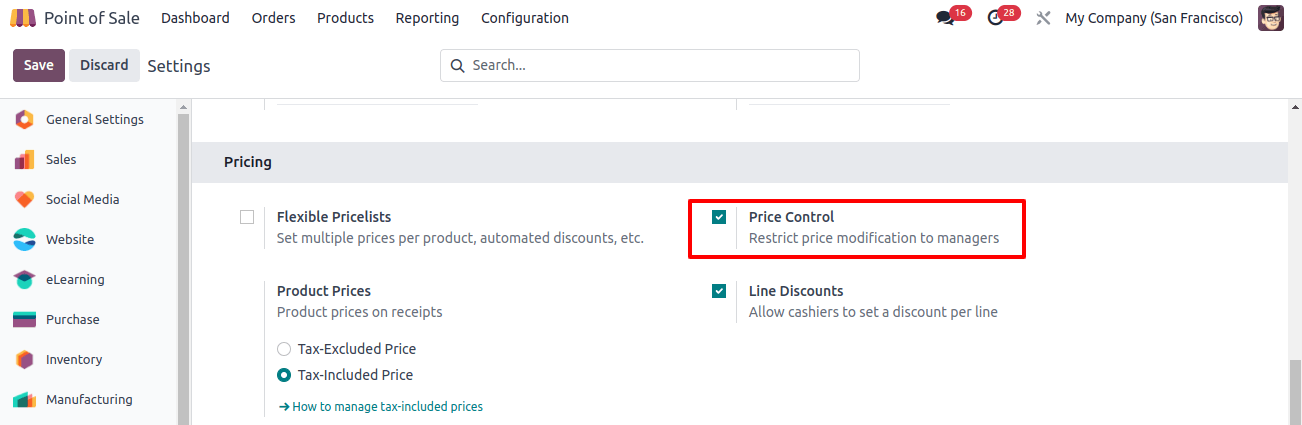

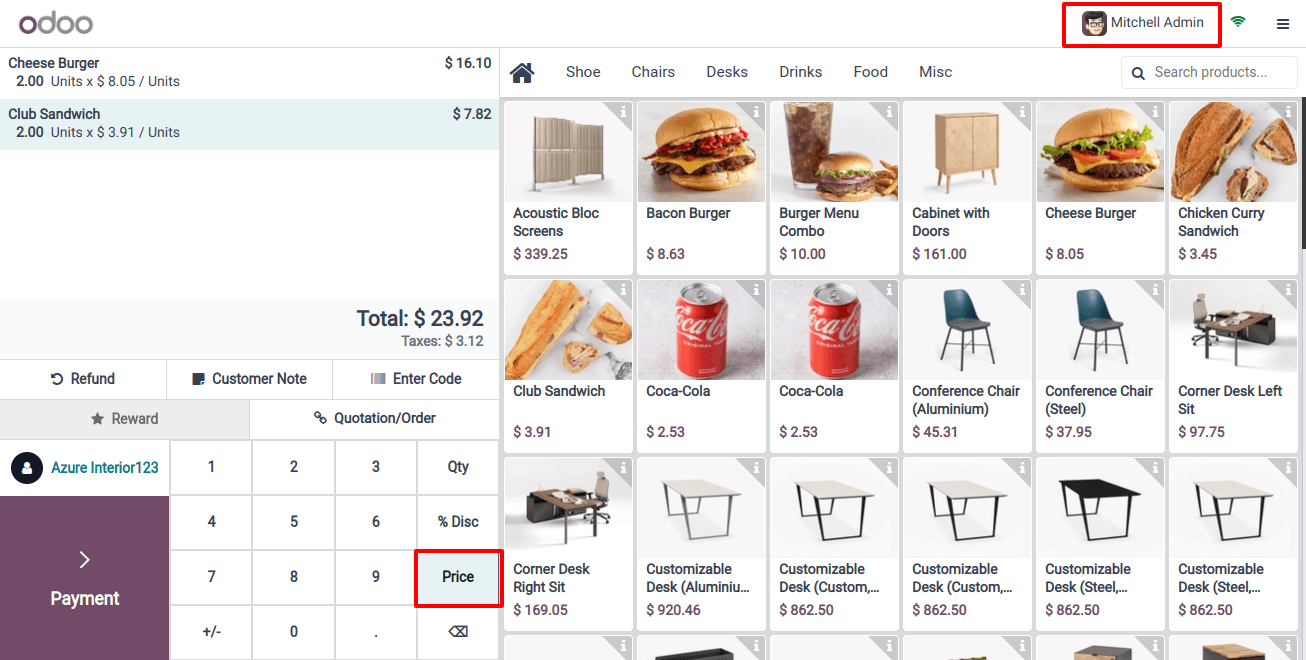

By allowing the pricing control feature, the Odoo 17 POS module now allows you to limit pricing changes. It allows you to restrict price changes to only managers.

This means that regular users will be unable to modify the POS’s product prices. Businesses who want to prevent employees from accidentally or purposely changing prices may find this handy.

Once this feature is activated, Odoo will block employees from adjusting product prices. Only management has the authority to change product pricing. Let us start the meeting with a few staff members.

The current logged-in user in Mitchell Admin. This is why the price modification button is shown as disabled. If the login user is a manager, he can adjust the product price by clicking the pricing button.

After going in as Mitchel Admin, you’ll find that the price button is active. Because his access level is administrative.

In this manner, you may use the PoS module to manage your product pricing. This assures that only authorized users, including managers, can adjust prices.

When only managers may make pricing changes, errors are less likely to occur. This guarantees that your pricing is reasonable and your revenue is maximized.