Odoo is a powerful business management software with a complete accounting module. To protect data security and confidentiality, Odoo includes a strong access rights system that allows administrators to regulate who can access and edit accounting information. In this blog, we will walk you through the process of configuring accounting access privileges in Odoo 17.

First, consider the importance of creating robust access rights within Odoo 17’s Accounting module.

Why to Create User Access in Odoo 17 Accounting?

Upholding Data Integrity and Security

Accounting requires data integrity and security. Unauthorized access to financial information can have serious consequences, such as financial loss, legal penalties, and a ruined reputation.

Odoo 17 provides a rich set of accounting tools, but without effective access controls, important data may be compromised.

By configuring access controls in Odoo 17, organizations can ensure that only authorized users can see, edit, or remove financial information.

This access control reduces the danger of internal fraud and data breaches, promoting a secure environment for financial transactions.

Compliance with Regulatory Standards

In today’s regulatory environment, businesses across industries prioritize compliance. Compliance with GDPR, SOX, and industry-specific rules is important for preserving confidence and avoiding penalties.

Odoo 17's accounting access rights functionality allows firms to customize access permissions based on regulatory needs.

By limiting access to sensitive financial data based on roles and responsibilities, firms can effectively show regulatory compliance.

This proactive strategy not only reduces legal risks, but also increases stakeholder confidence in the company's commitment to data protection and compliance.

Enhancing Operational Efficiency

In today’s business world, efficiency is important to success, Inefficient accounting systems can reduce productivity and limit expansion potential.

Companies may maximize the efficiency of their accounting process by using Odoo 17’s complete access rights system.

Businesses that offer proper access to important stakeholders can expedite financial processes, reduce risks, and accelerate decision-making.

Weather it’s generating financial reports, balancing accounts, or processing transactions, personalized access rights allow staff to complete their responsibilities more efficiently, resulting in overall operational excellence.

Facilitating Collaboration and Transparency:

Effective collaboration and transparency are important for developing a great work environment and instilling trust among teammates.

Accounting access permissions in Odoo 17 allow several users to access and edit financial data at the same time, promoting seamless collaboration.

Businesses can increase transparency and accountability in financial reporting by creating specific access permissions for various roles within the organization.

This transparency not only strengthens internal controls, but it also improves communication and collaboration between departments, resulting in better decision-making and business outcomes.

How to set up accounting access in Odoo 17?

Configuring User Roles

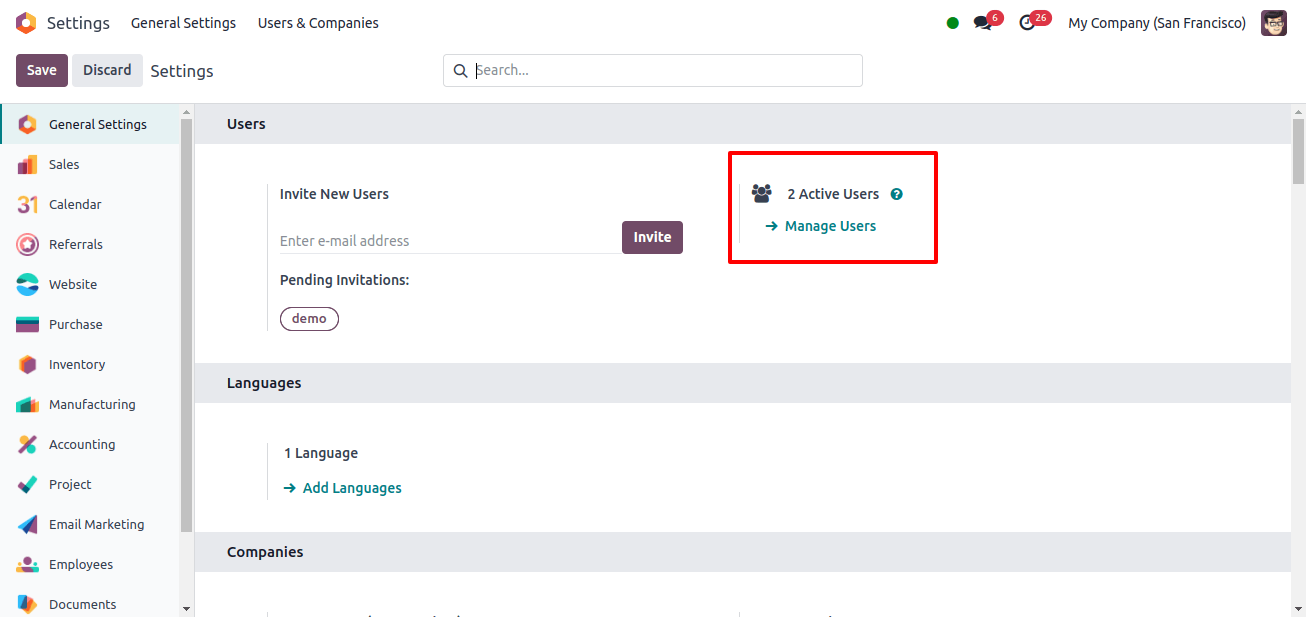

To configure access rights in Odoo, go to General Settings. The manage users options allows you to manage user information.

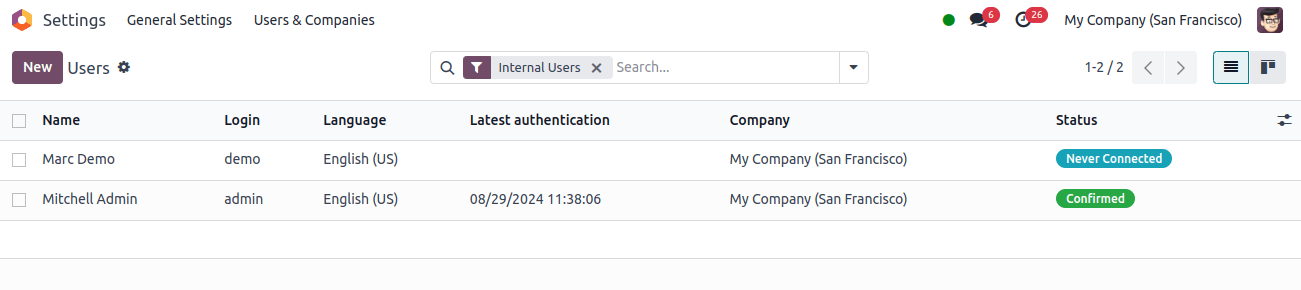

This section displays a list of users configured in the current database. The new button allows you to set up information for a new user, whilst clicking on the name of an existing user allows you to make changes.

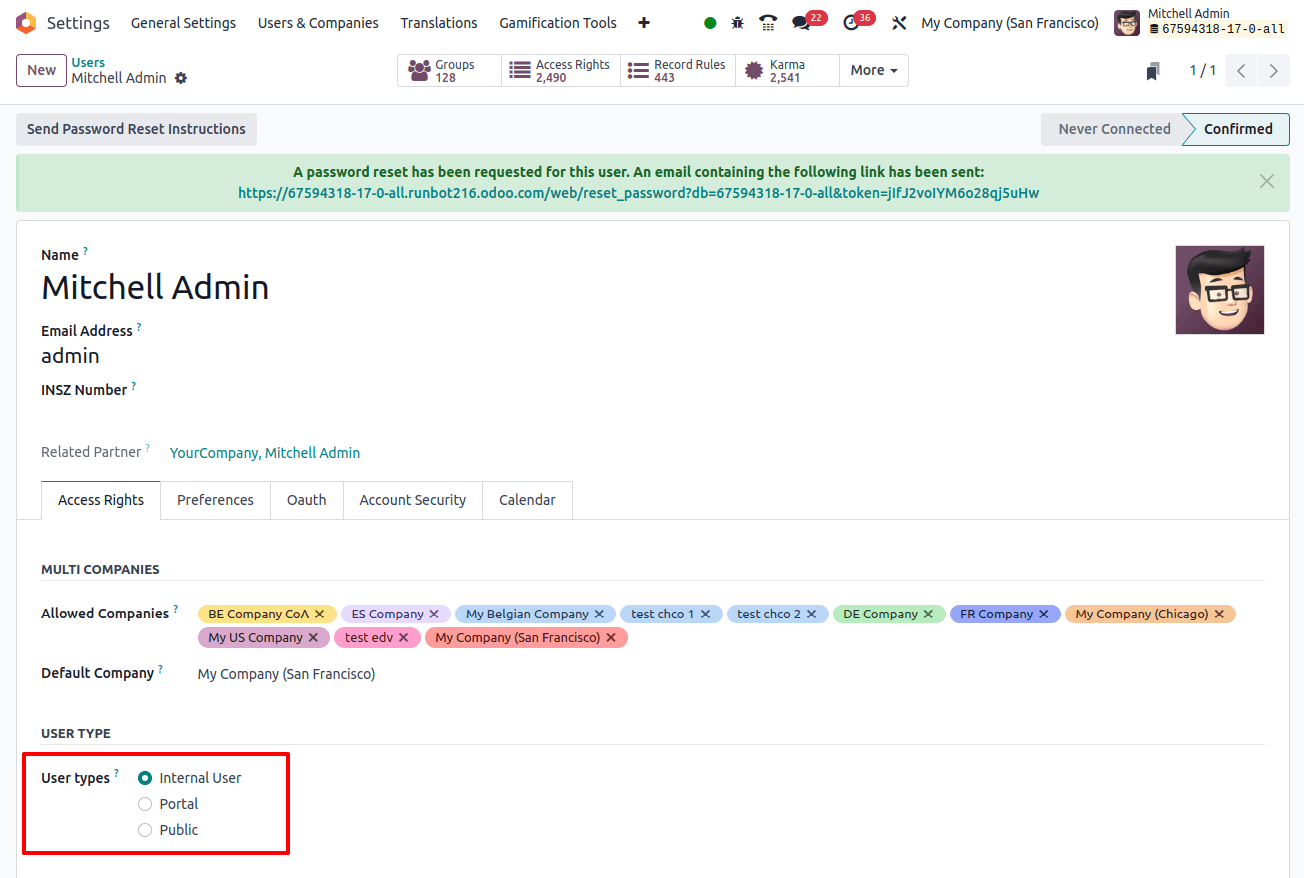

As shown in the image, Odoo has various user permissions, each with their own level of access and permissions:

* Internal User: The users, usually workers or members of your business, use Odoo to complete various tasks for the company.

Their access to Odoo modules and functionalities is determined by their responsibilities and permissions, hence providing internal process management.

* Portal User: Portal users have restricted access to specific areas of the Odoo system, such as the customer or supplier portals.

They can interact with your company via these portals by reading invoices, tracking orders, and contacting your business.

Their access is restricted in comparison to internal users, and it is frequently used for customer or supplier contacts.

* Public User: Public users, also known as website users, engage with your company via the Odoo website. They can get information, read public content, and possibly interact using forms or blogs.

However, they often do not have login access or the same level of involvement as internal or portal users, and instead serve as website visitors.

These differences make it easier to manage and regulate access to your Odoo system and its different features, allowing you to customize the user experience to specific roles and requirements.

Assigning Accounting Access Rights

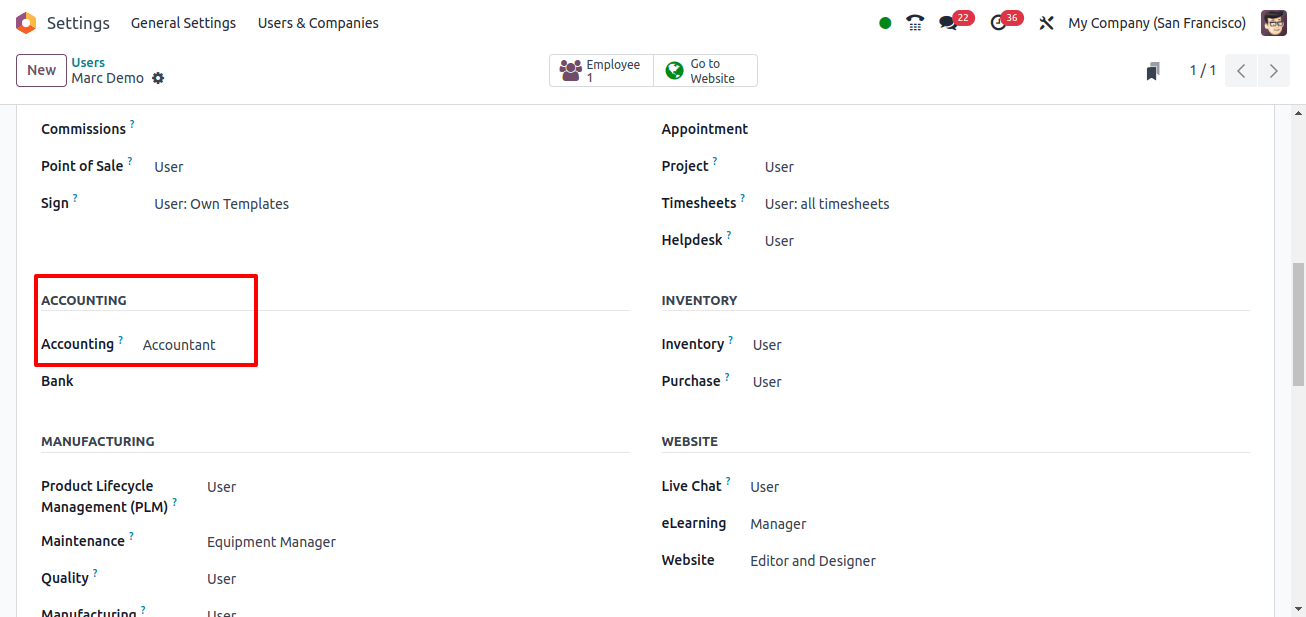

In Odoo Accounting, the user type must be set to Internal User.

The Internal Users accounting access rights can be configured to consolidate, billing, read-only, bookkeeper, or accountant. Let’s see how these users can manage their accounting processes in Odoo 17.

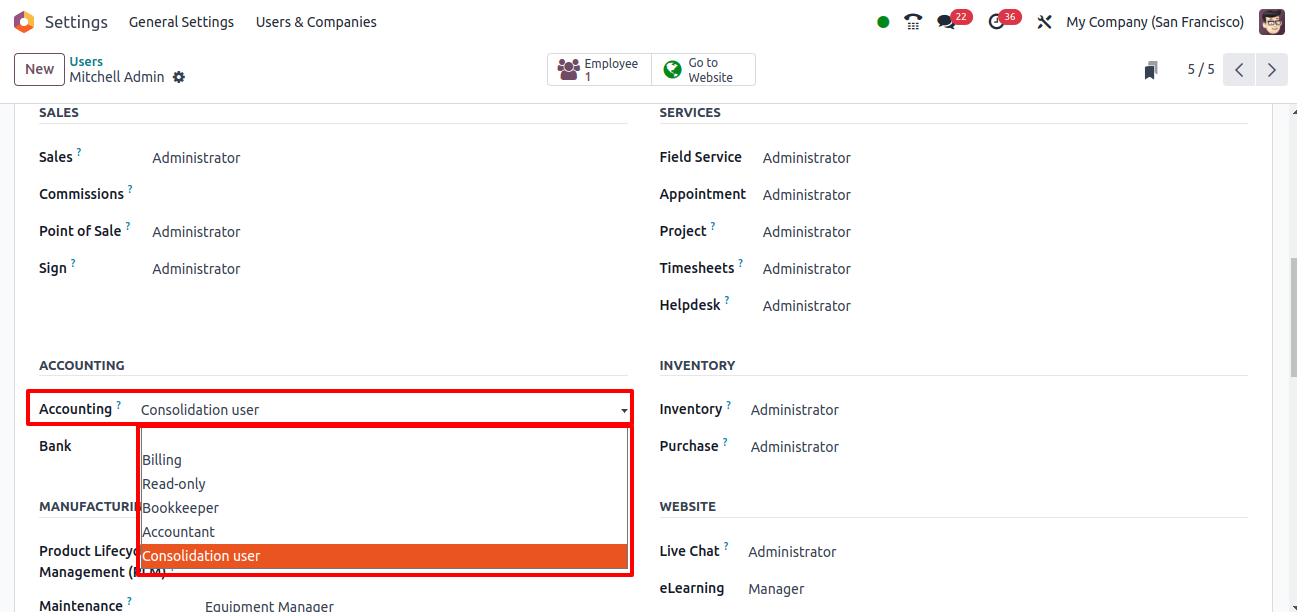

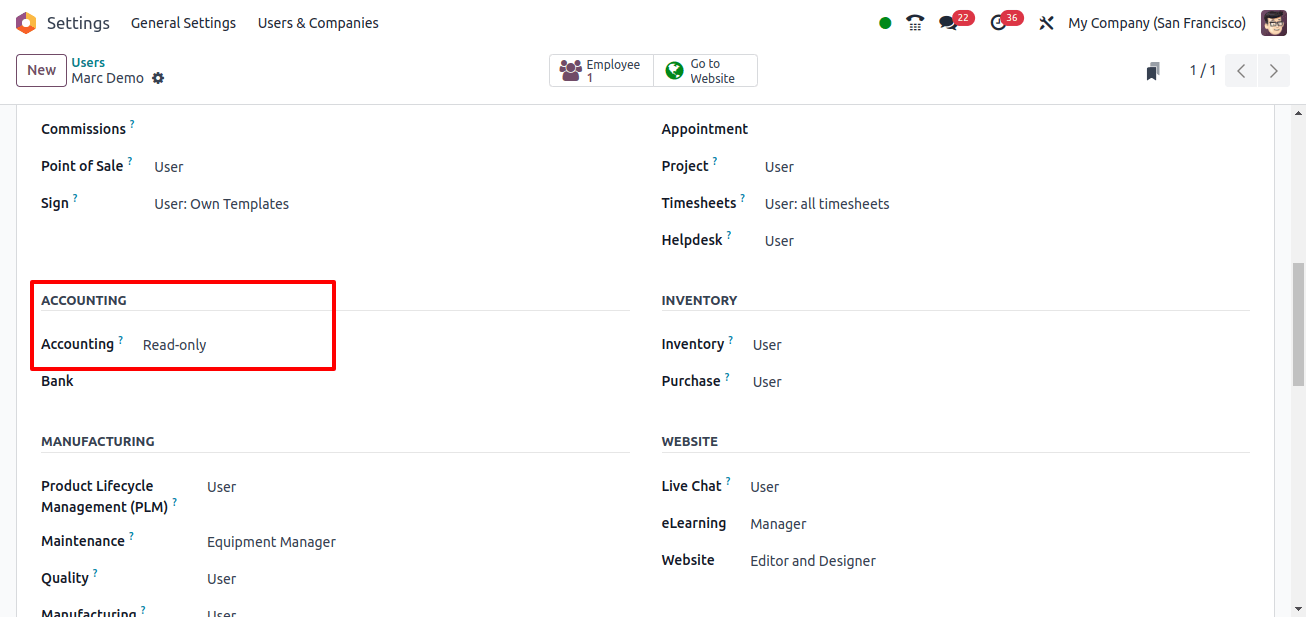

Scroll down to the ‘Access Rights’ section. Go to the ‘Accounting’ field in the module list. Click the drop-down option next to ‘Accounting,’ and you’ll see the different roles.

Choose the right role based on the user’s responsibilities.

* Consolidation User: To manage financial consolidation among many companies.

* Billing: For managing invoices and bills.

* Read-only: For viewing financial data without making changes.

* Bookkeeper: For handling daily financial transactions.

* Accountant: For full control over the accounting module.

After selecting a role, click ‘Save’ to save your choices.

Now that you’ve allocated the roles, let’s see how they work within the Accounting module.

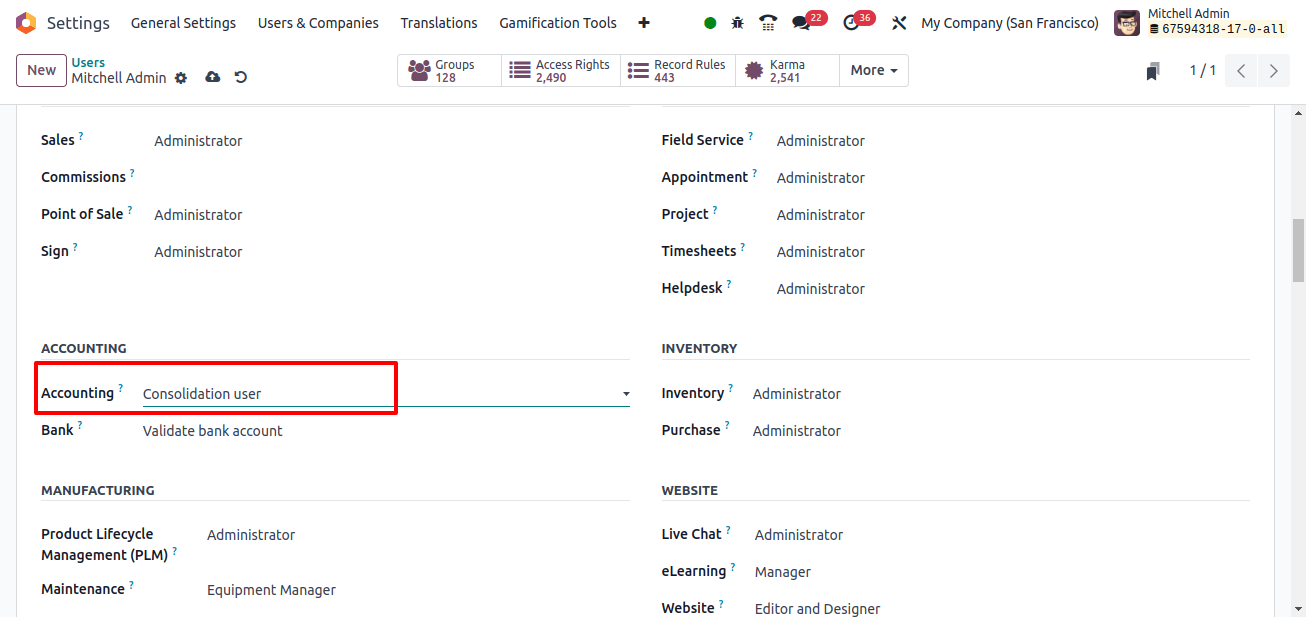

1. Consolidation User

The Consolidation user role is mentioned for people who need to oversee financial consolidation operations for many businesses. This job is especially beneficial for businesses that operate in many places or have multiple subsidiaries.

They may access and manage consolidation ledgers and journals, create and post consolidation entries, and make adjustments to inter-company transactions to ensure right financial-reporting.

They also do currency conversions, prepare consolidated financial statements such as balance sheets, income statements, and cash flow statements, and define consolidation procedures and periods.

The job also includes analyzing and amending consolidated reports, removing minority interests, and implementing consolidation factors to ensure uniformity and accuracy across the group’s financial statements.

Overall, the consolidation user is responsible for assuring the accuracy and compliance of the companies consolidated financial statements.

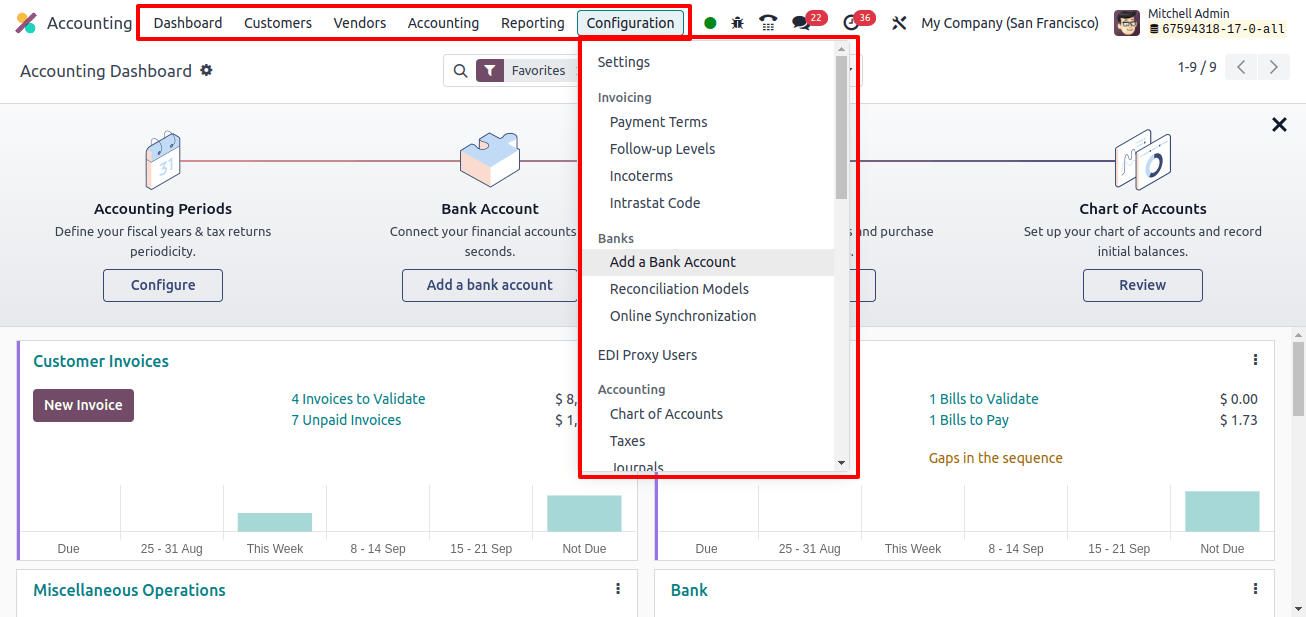

2. Billing

The Billing job is responsible for managing the invoicing and billing processes. The billing job is important for users responsible for guaranteeing timely invoicing and maintaining a healthy cash flow within the organization.

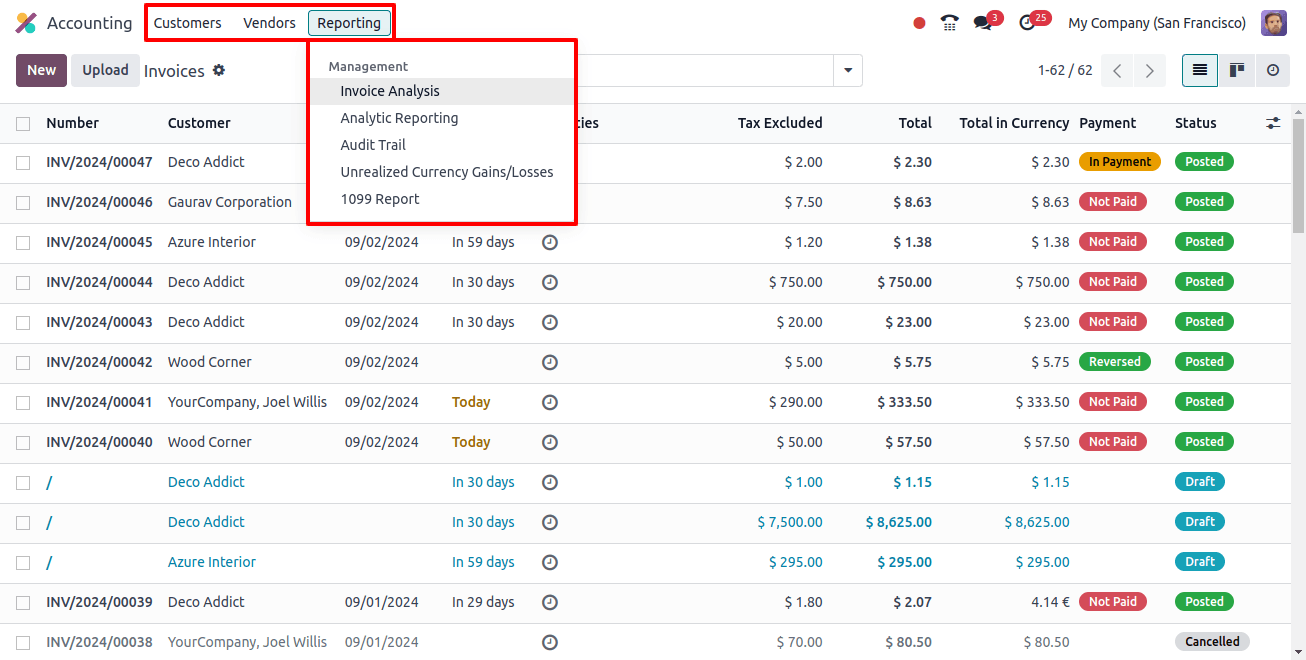

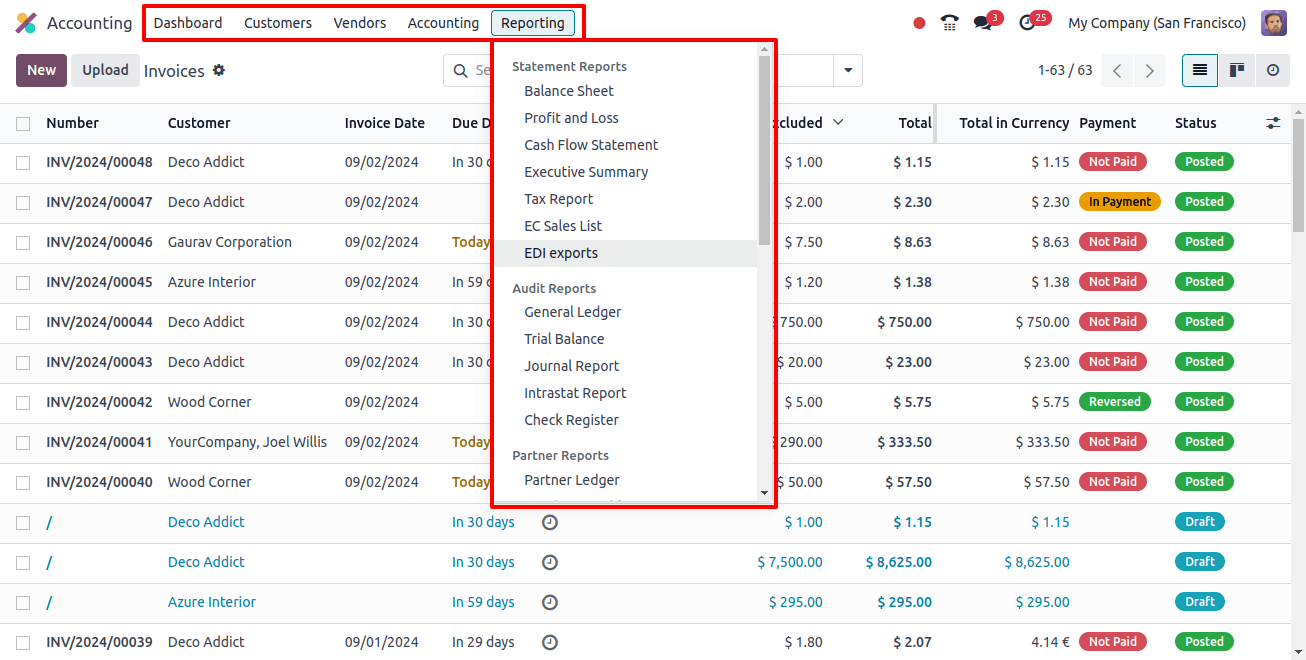

They have access to the customer, vendor, and reporting menus, which allows them to generate, process, and transmit customer invoices and vendor bills. They can also set payment arrangements, add discounts, and track payments.

The billing user can also generate and analyze billing-related reports to monitor invoice status, manage overdue balances, and ensure timely payments.

However, their access is restricted to certain regions, ensuring that they only engage with customer and vendor transactions and related reports.

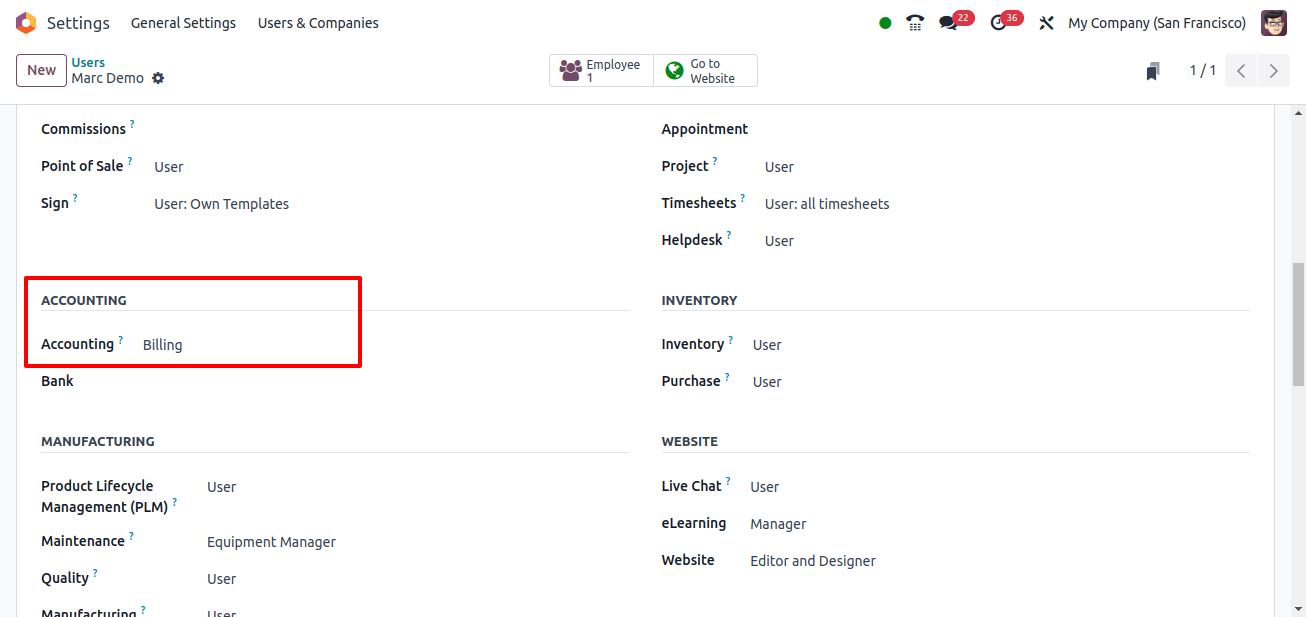

3. Read-only

The read-only role is excellent for people who need to access financial data but not make any changes.

They can browse and analyze all accounting records, such as journals, ledgers, financial reports, and transactions histories, but cannot process, change, or remove any data.

This position is right for stakeholders or auditors who must analyze financial information and monitor accounting activities without making any modifications, maintaining transparency while protecting the integrity of financial data.

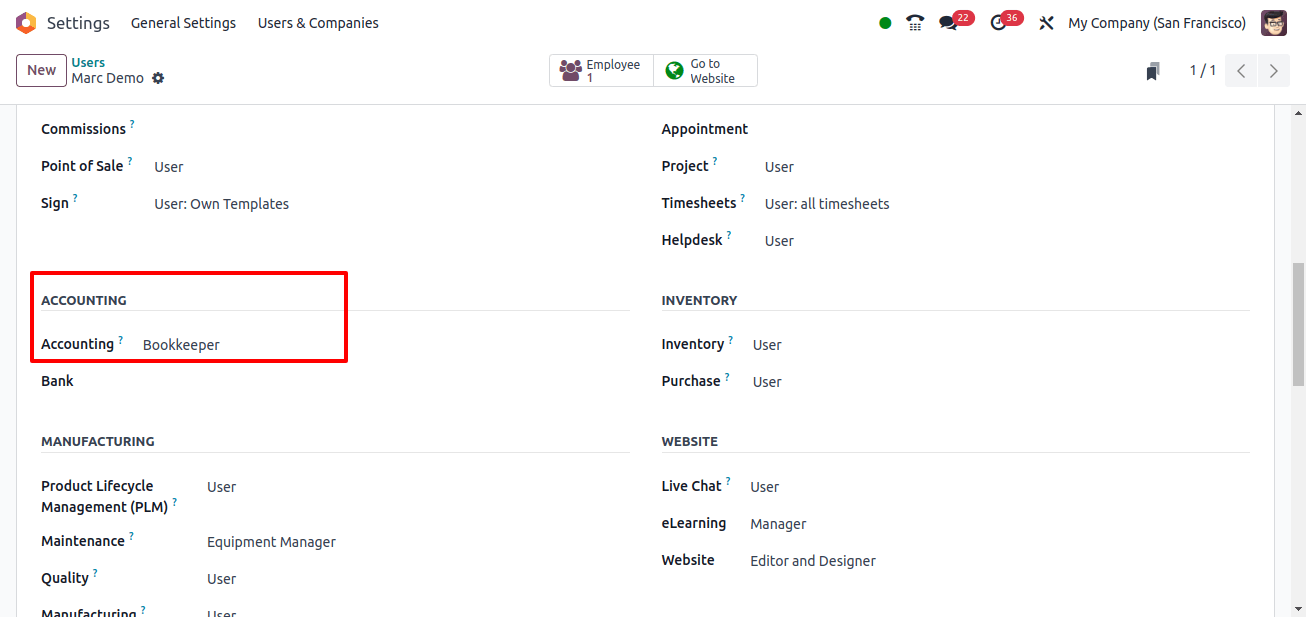

4. Bookkeeper

The Bookkeeper function is provided to users that manage financial transactions on a daily basis. Bookkeepers are responsible for ensuring that the company’s financial records are accurate and thorough.

They can enter and post sales, purchases, and costs, reconcile bank accounts, manage petty cash, and keep accurate records of all financial transactions. They also create preliminary financial reports for evaluation by senior accountants or management.

However, the Bookkeeper does not have access to the Accounting module’s Configuration and Settings, which means they cannot change system or accounting setups.

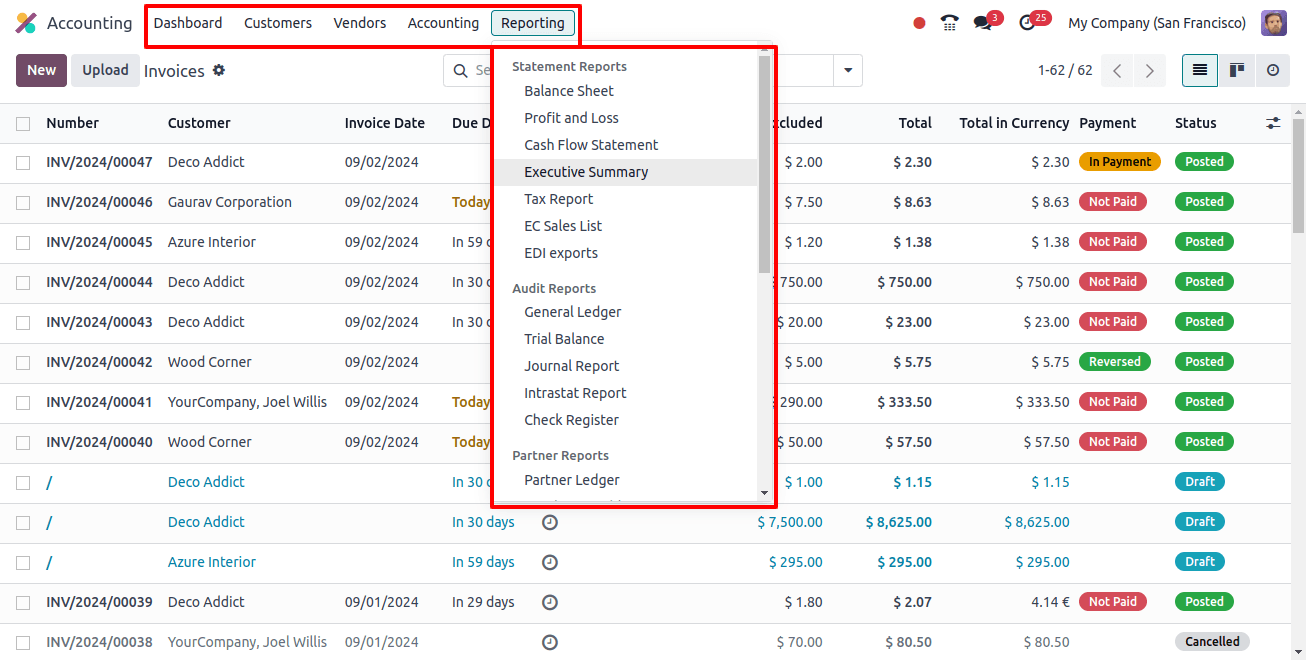

5. Accountant

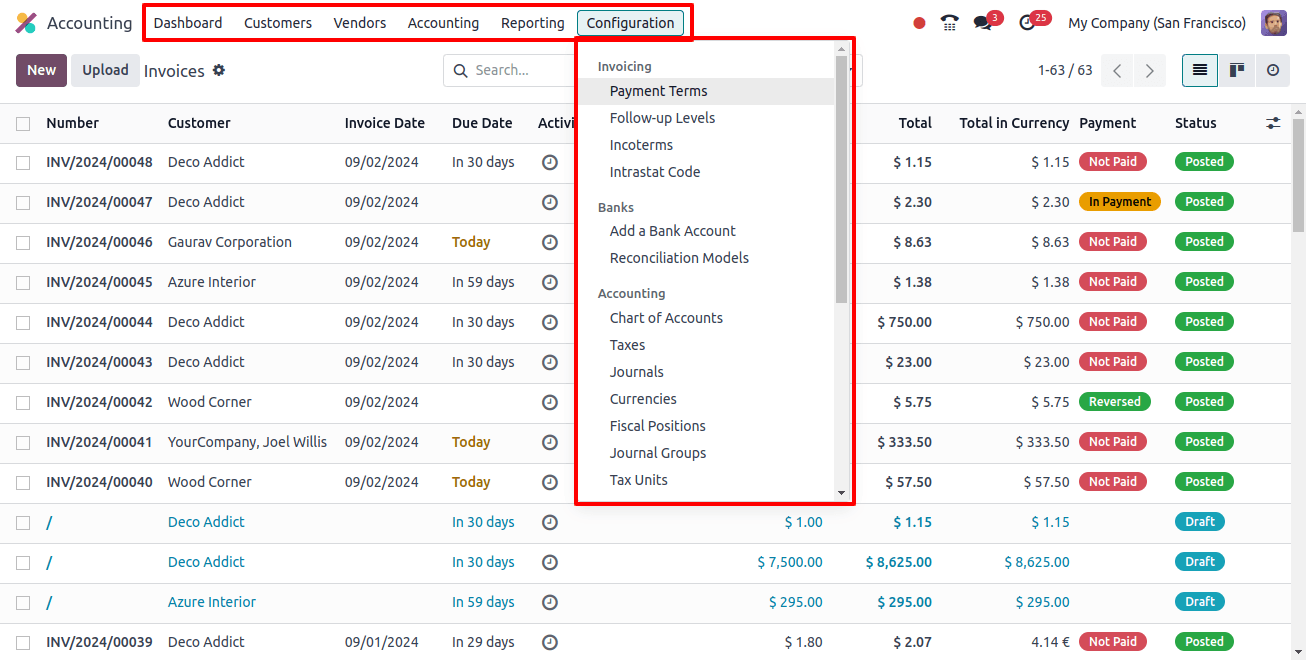

Accountants have the most board access rights. Accountants are responsible for ensuring the accuracy, compliance, and integrity of the company’s financial data, which is important to the businesses overall financial health.

In Odoo 17, an Accountant user has complete control over the whole accounting cycle, including recording and uploading journal entries, managing accruals, deferrals, and adjustments, and managing accounts payable and receivable.

They can reconcile bank statements, provide detail financial statements like balance sheets, profit and loss statements, and cash flow statements, and verify accounting standards are met.

The Accountant can also oversee the chart of accounts, adjust tax settings, and manage end-of-period closing tasks. However, while they have broad operational authority, they are unable to change the accounting module’s important parameters, ensuring that system setups are secure and consistent.

Whether your company needs a Consolidation User to manage financial data across multiple businesses, a billing role to manage invoices, or an accountant with complete authority over accounting operations, Odoo 17 offers the flexibility and security needed for effective financial management.

Setting up accounting access permissions in Odoo 17 is important for companies looking to succeed in the cutthroat business environment of today, as well as a technological requirement.

Robust access restrictions allow businesses to fully use the accounting features of Odoo 17 by maintaining data integrity, guaranteeing compliance, improving operational efficiency, and promoting teamwork.

Related Post:

- Odoo Accounting Software: The Next-Gen Accounting Software

- Step-by-Step Guide: Managing Access Rights in Odoo 17 Point of Sale

- Streamline Your Business with Odoo Chatbot Configuration: A Step-by-Step Guide

- How To Manage Online Signature and Payment with Odoo 17

- Manage Customer Accounts with Odoo 17 Efficiently