Prepaid or postponed expenses are payments made in advance that have not yet been used or spent. They are also called expense recognition, progressively recorded on the income statement over time.

A delayed expense occurs when a business pays for a service, asset, or benefit before it is used or consumed, resulting in an asset on the balance sheet that contributes to future economic benefits.

Instead of reporting the entire expense right away, businesses should defer it to future periods as the benefit is achieved. Properly managing deferred expenses is important for accurate financial reporting. Since it ensures that expenses are recognized when they occur and contributes to revenue generation.

In accounting, reducing delayed expenses is important to maintaining accurate financial records. Odoo 17, a flexible business management software, provides great accounting features, such as tools for managing deferred expenses.

In this blog post, we’ll go over how to compute deferred expenses in Odoo 17 accounting, giving businesses a clear path for smart financial management.

Steps to Automate Deferred Expense Tracking in Odoo 17 Accounting

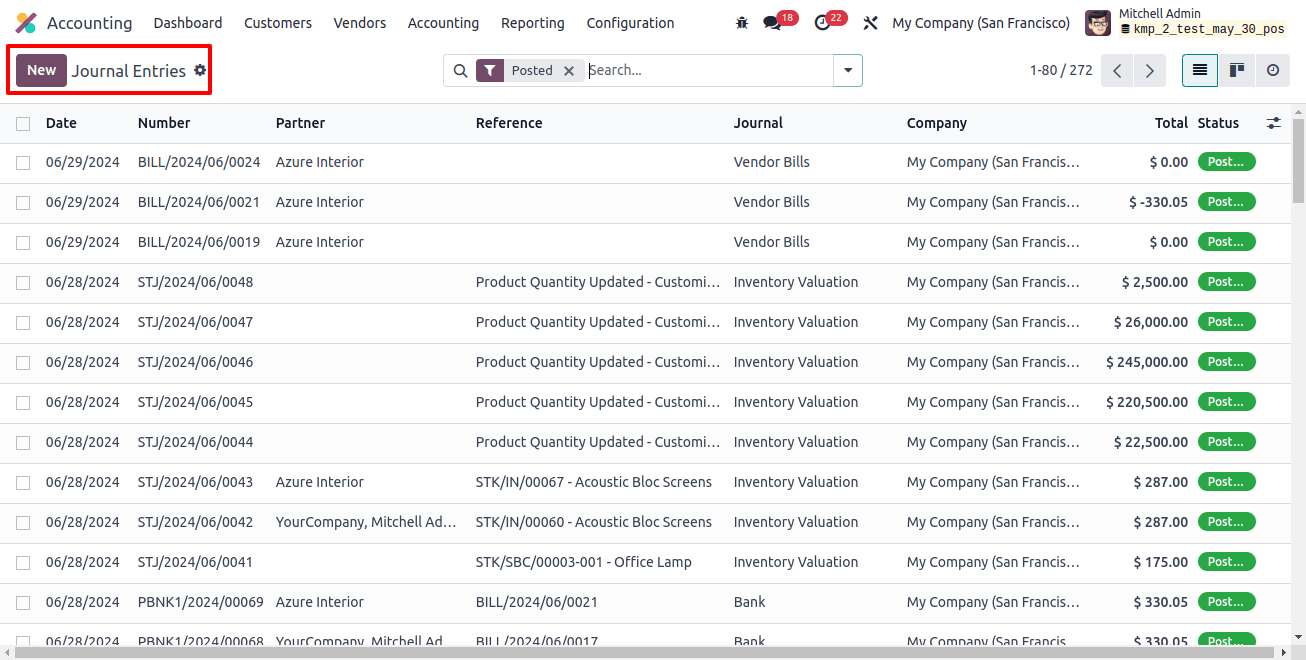

Creating new Journal Entries

Log in to your Odoo instance and go to the Accounting module. To access the journal entries dashboard, select the ‘Journal Entries’ menu option. As seen below, the dashboard will display the journal entries’ data, number, partner, reference, journal, company, and status.

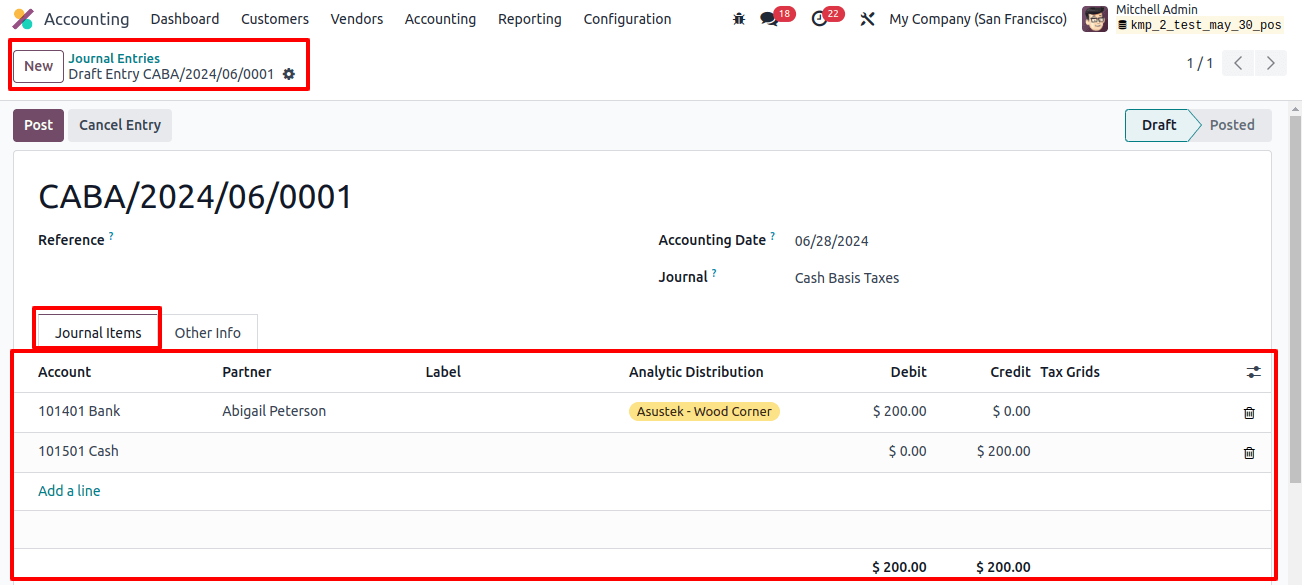

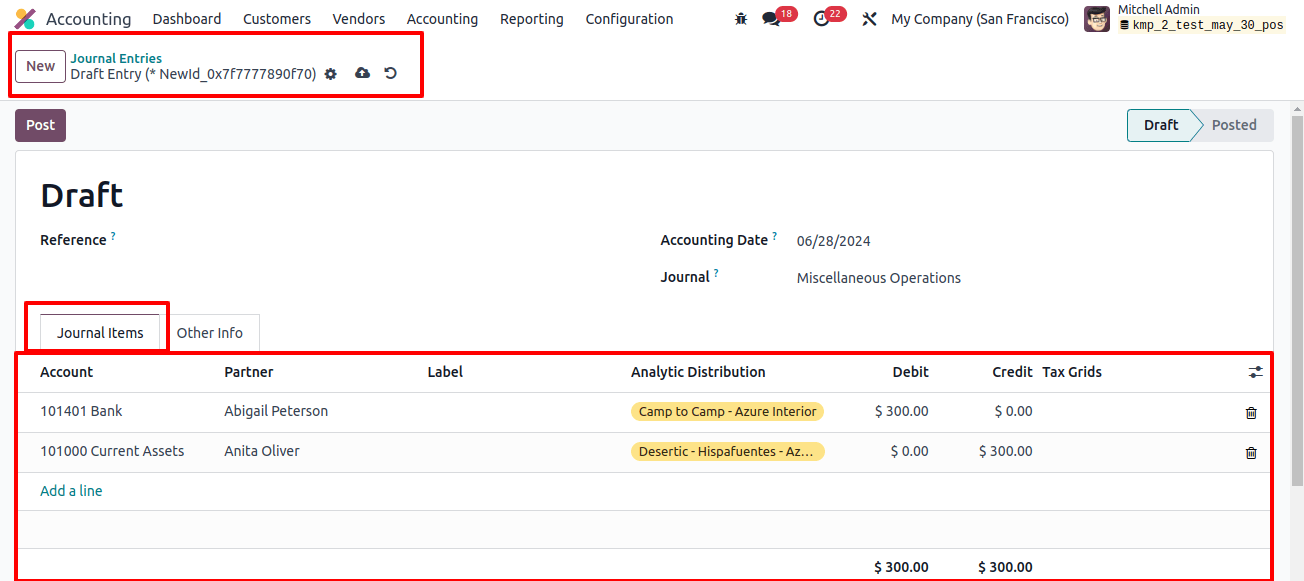

Create a new journal entry by clicking the ‘new’ button, and then choose the deferred spending account from the ‘Journal items’ field. When you pay for future expenses in advance, you will be charged to this account.

Enter the amount of the advance payment in the relevant field and charge it to a Deferred Expense Account. Set the transaction date to reflect when the expense is paid in advance.

The advance payment amount should be placed into the designated box, and the expense should be assigned to a deferred expense account.

Allocate the Expense to a Deferred Expense Account

In the ‘Debit’ column of the ‘Journal items’ tab, allocate the expense amount to the deferred expense account and make a second journal entry when the expense is recognized and the benefit is realized.

Credit the deferred expense account and debit the relevant expense account to reflect the incurred expense, as shown in the image below.

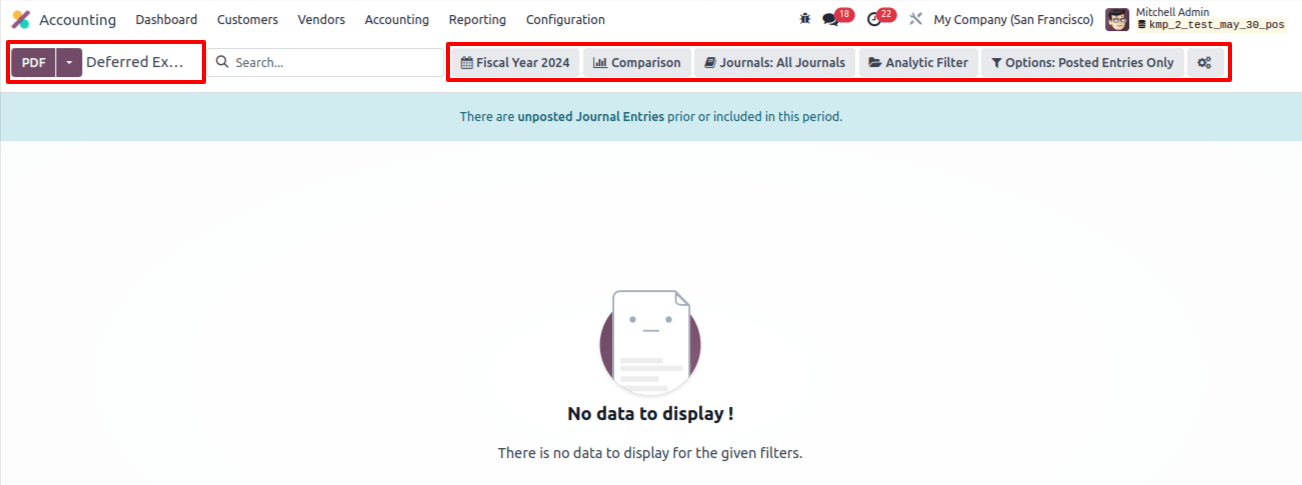

Generate Reports

Odoo includes a variety of reporting features. Create reports, such as profit and loss statements, to see how postponed spending affects your finances.

Regular Analysis and Adjustments: Analyzing deferred expense inputs regularly will ensure proper financial reporting. Make any necessary updates, especially if the timing of the expense changes.

We may generate delayed expenses based on the previous month, quarter, fiscal year, current month, quarter, and fiscal year. To ensure accurate financial reporting, review deferred expense entries regularly.

We can also use the various filtering options at the top of the page to make changes as needed, especially if the expected delivery date of the products or services changes.

Appropriate delayed expense management is important for maintaining accurate and honest financial records. Odoo 17’s accounting module simplifies this process by providing businesses with the tools they need to manage delayed expenses effortlessly.

Businesses that follow the methods provided in this guidance will ensure that their financial reports accurately represent the time of incurred expenses, resulting in better decision-making and financial management.