Odoo’s accounting localization function ensures that tax laws and accounting standards are followed at the national and global levels. This reduces the legal issues for businesses by supporting them in complying with local financial standards.

Odoo ensures accurate financial reporting by taking into account country-specific rules. This leads to more accurate financial accounting and analysis. Localized charts of accounts, tax structures, and reporting formats are offered.

Localization simplifies accounting processes by automating operations that are specific to a particular location. Accounting staff may now focus on more strategic activities as a result of less manual intervention, fewer errors, and more time saved.

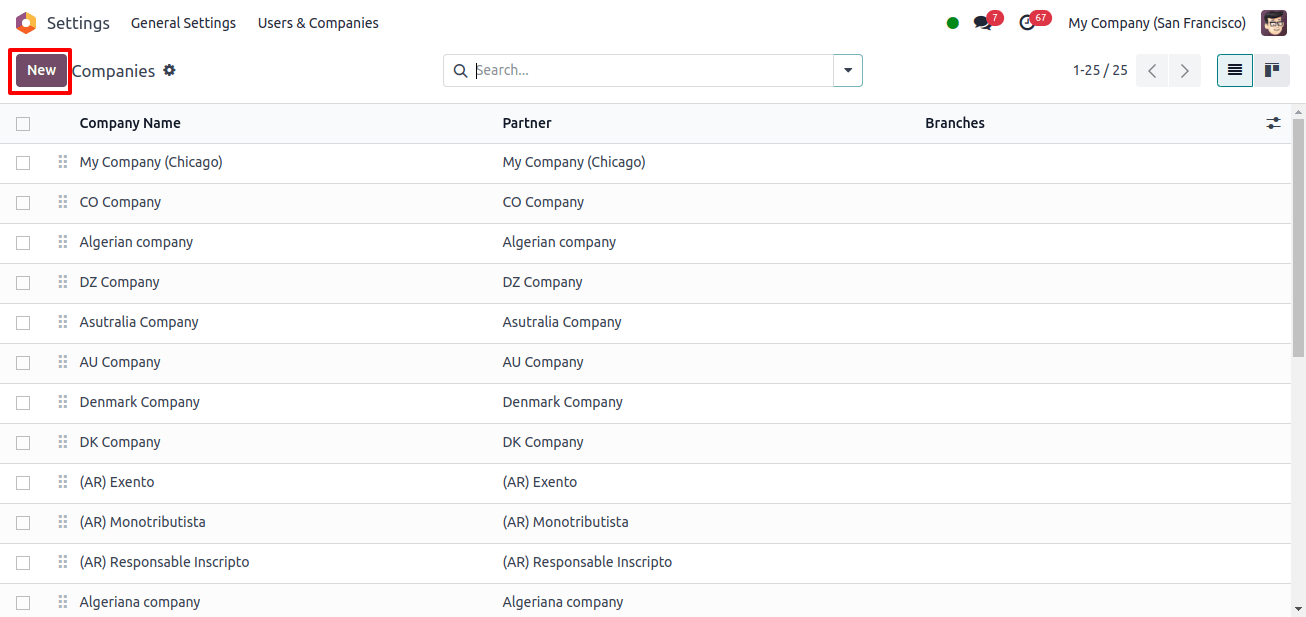

First, we wish to set up a Brazilian company. So that goes to Odoo’s general settings and selects the Users & Companies menu. We want to start a new firm, so click on the company’s submenu. There, we can see all of the pre-created companies as well as the New button. To start a new company, select the New button.

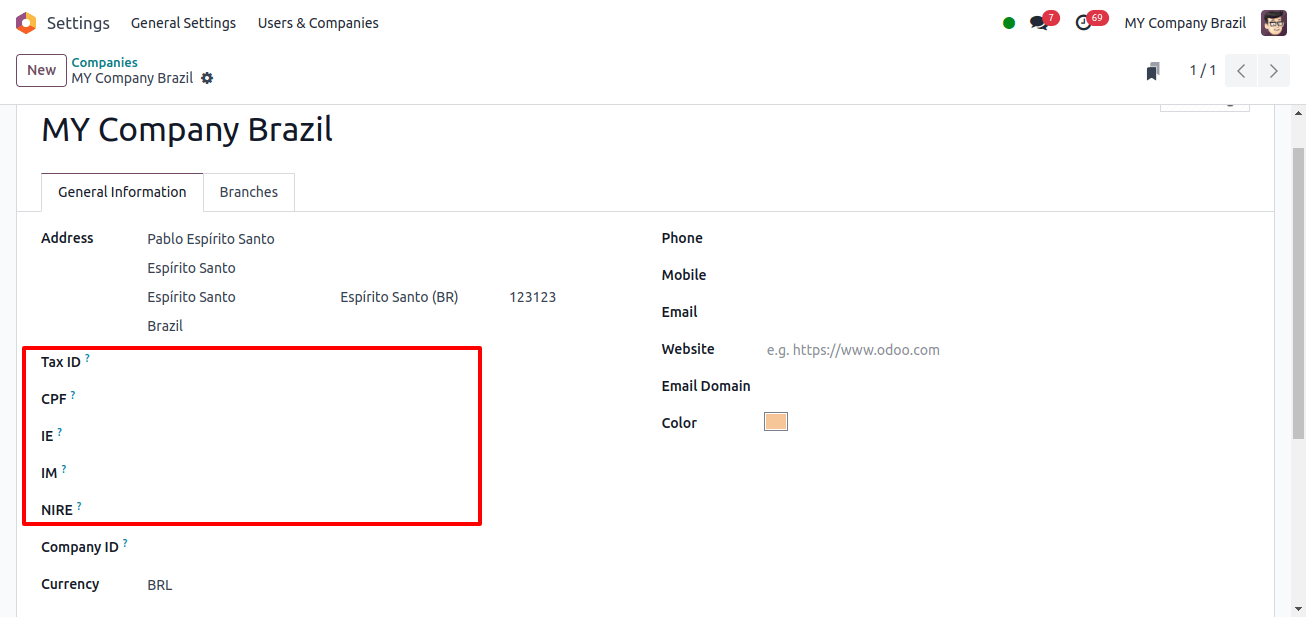

When you click the New button, you will get a Form view where you may enter all of the details. Give the details for the creating company, such as the country, name of the company, address of the company, and so on, and then click the save button.

In the form to fill out the firm details, there will be a few extra fields to put in, such as CPF, IE, IM, NIRE, etc.

* CPF: The term Cadastro de Pessoa Física translates as Individuals Taxpayer Registry in English. It is a unique identification number provided to each Brazilian citizen and resident.

* IE: Refer to Inscrição Estadual. This is a state-level tax identification number necessary for Brazilian businesses in the trade, industry, or interstate/municipal transportation sectors.

* IM: Municipal tax identification number.

* NIRE: State commercial identification number.

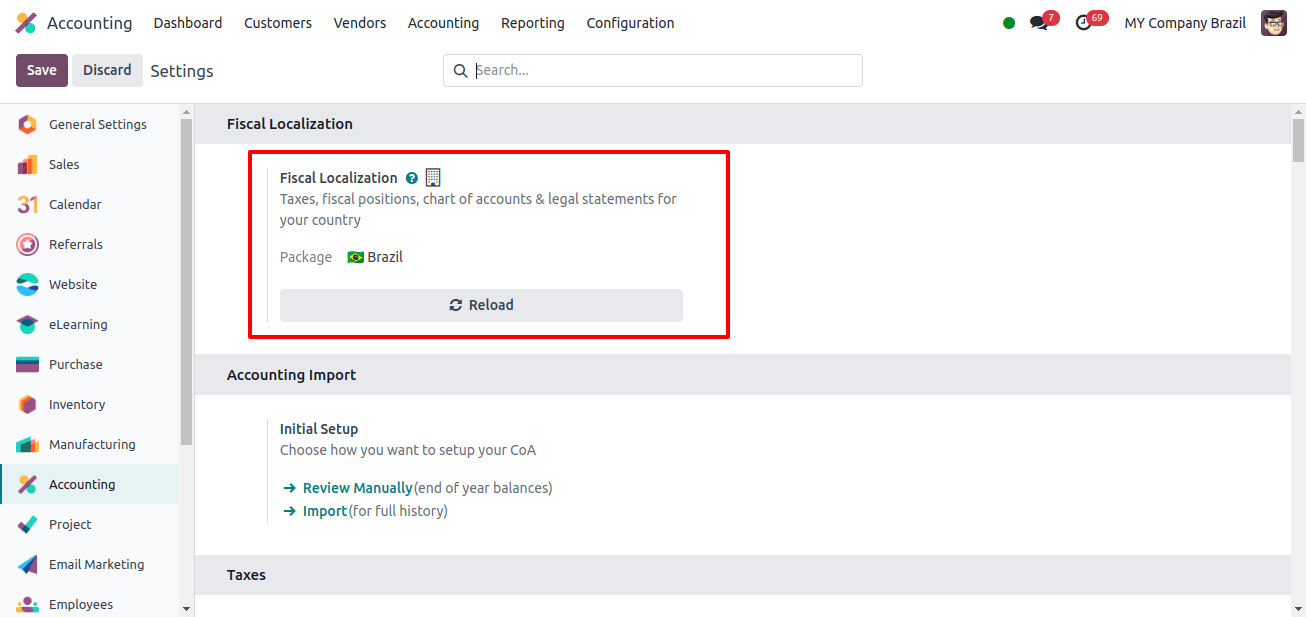

The next stage is to set up localization for the Brazilian company. To configure this company’s localization, go to Odoo’s accounting application. Go to the setup options.

Under the Fiscal Localization area, we may select the package for the company. Because the firm we founded is a Brazilian company, select the Brazil package and save the changes by clicking the save button in the configuration settings.

When the Brazilian localization was set up, changes occurred.

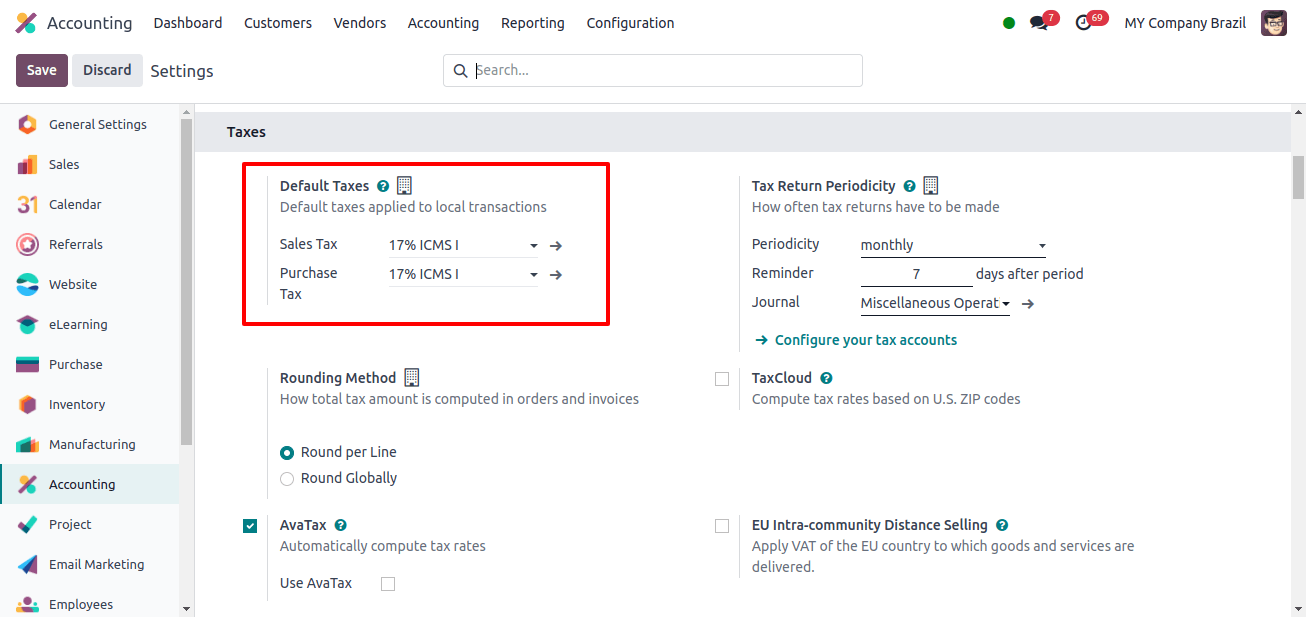

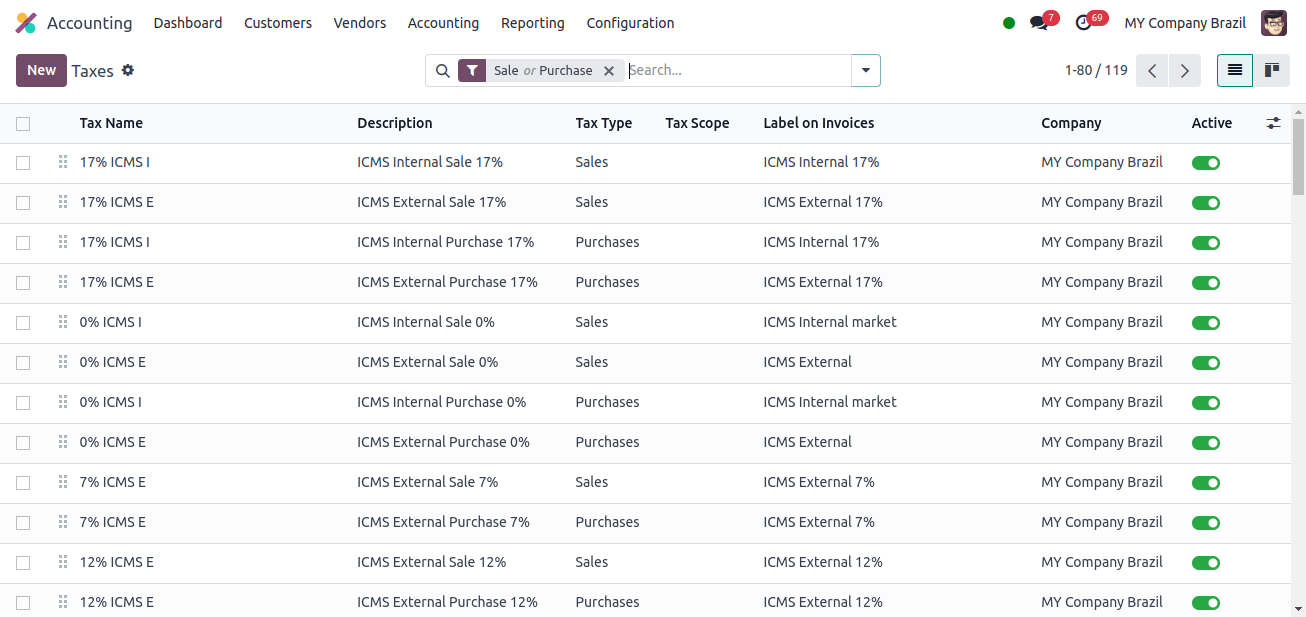

There will be a number of changes when we set up a national localization for a business or company. The default taxes can be found in the Taxes section of the accounting application’s configuration options. The default tax is the tax rate applied to all transactions.

The image above shows that Brazil’s default tax was different from that of other nations. As a result, this tax amount will be applied to all transactions conducted by this company.

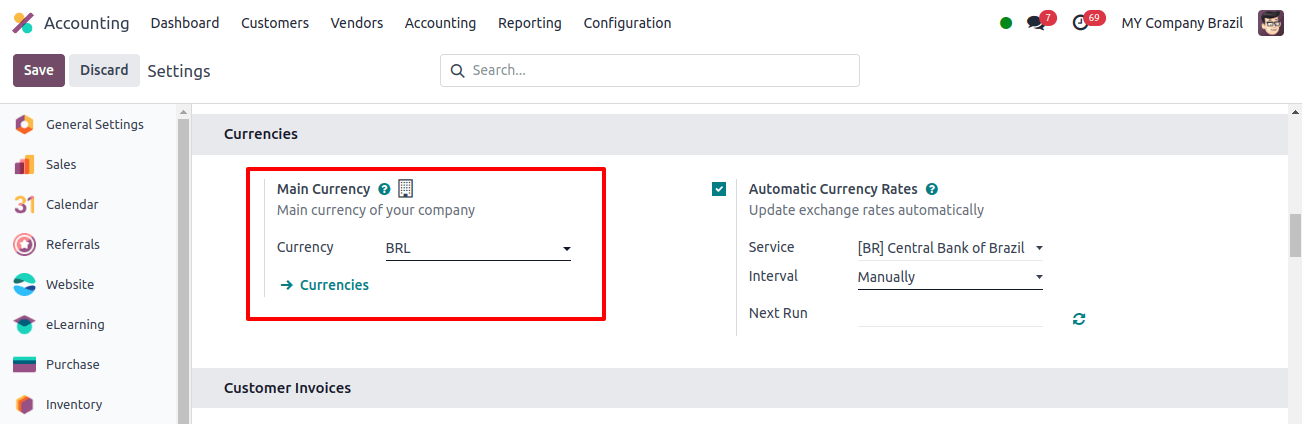

We know that Brazil’s currency is the Brazilian Real, known as (BRL), thus when we go to the Currencies field of the configuration settings, the main currency defined for this business is also the Brazilian Real (BRL).

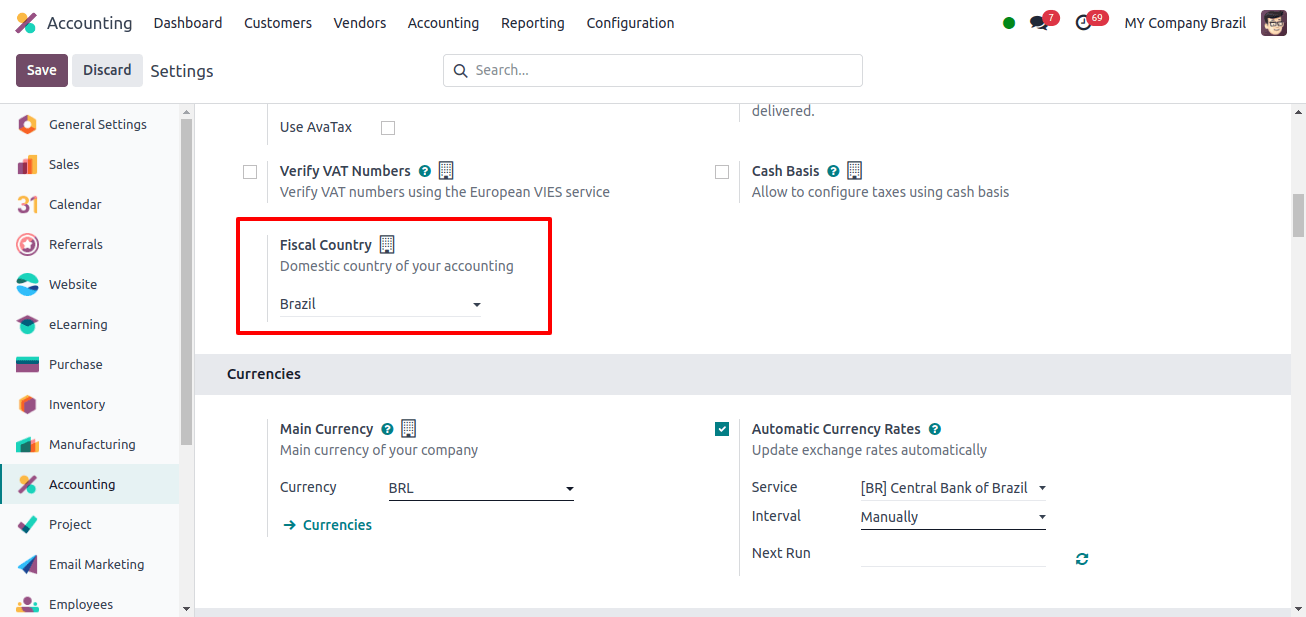

The fiscal country of this company should be Brazil. So, once the Brazil package is configured, Odoo automatically configures the fiscal country as Brazil.

Taxes is a sub-menu in the setup menu. When we select the taxes submenu, we are presented with a list of taxes.

All Brazilian companies are permitted to use all of the taxes listed, or these are the taxes that a Brazilian company may use.

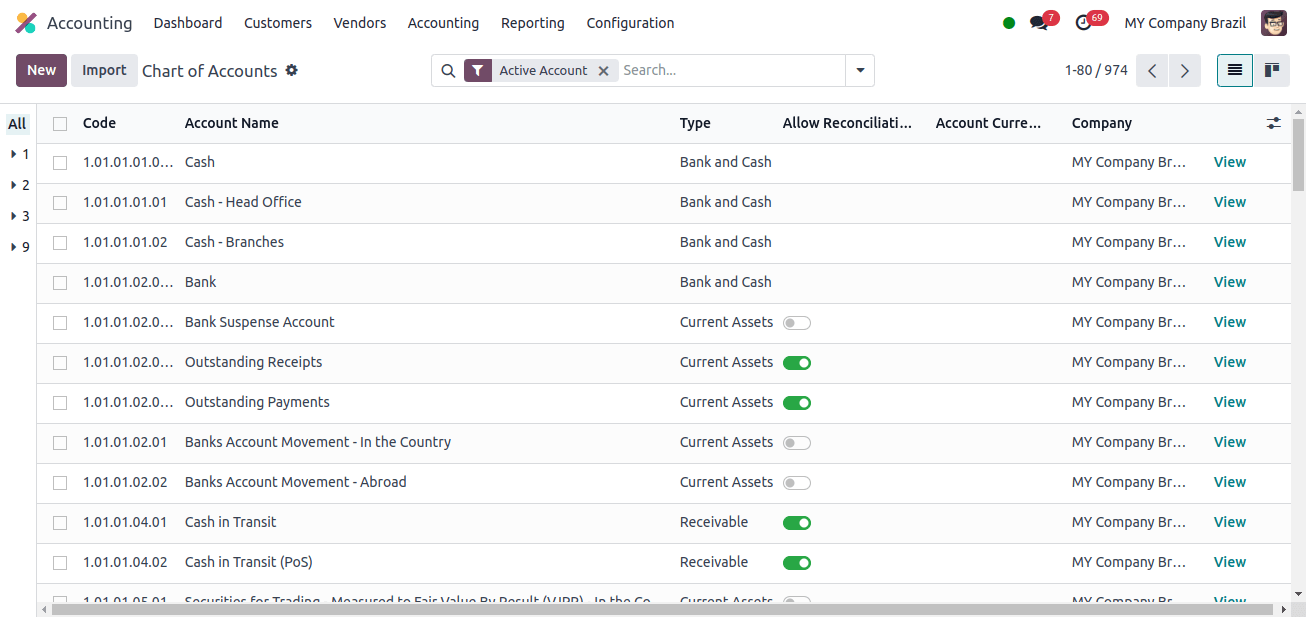

A chart of accounts refers to an ordered list of all a company’s general ledger accounts. The chart of accounts adopted by different countries may vary. The use case, code, and names could all differ.

The next image shows that the account codes and names used by Brazilian companies differ from the charts of accounts in other nations.

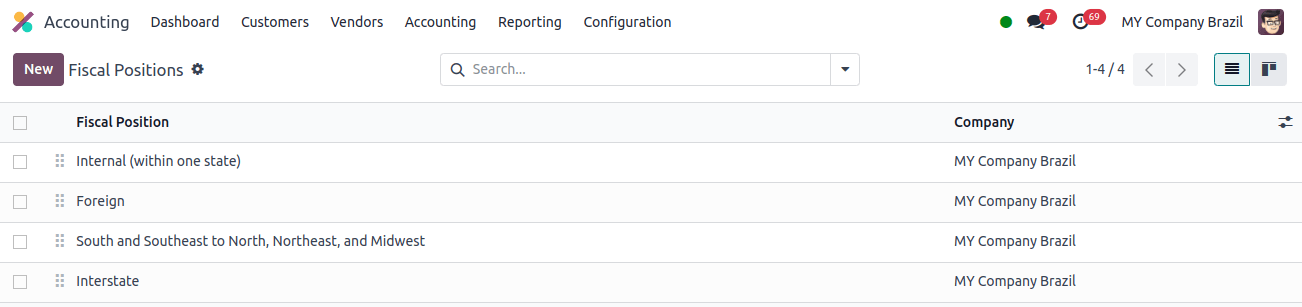

Take a look at the fiscal status of Brazilian companies. The fiscal position refers to an orderly list of all the general ledger accounts that a company uses.

The above image shows the fiscal status of Brazilian companies. When we go to the Reporting tab of the accounting application, we may see a tax report, a balance sheet, a cash flow statement, profit and loss, and so on.

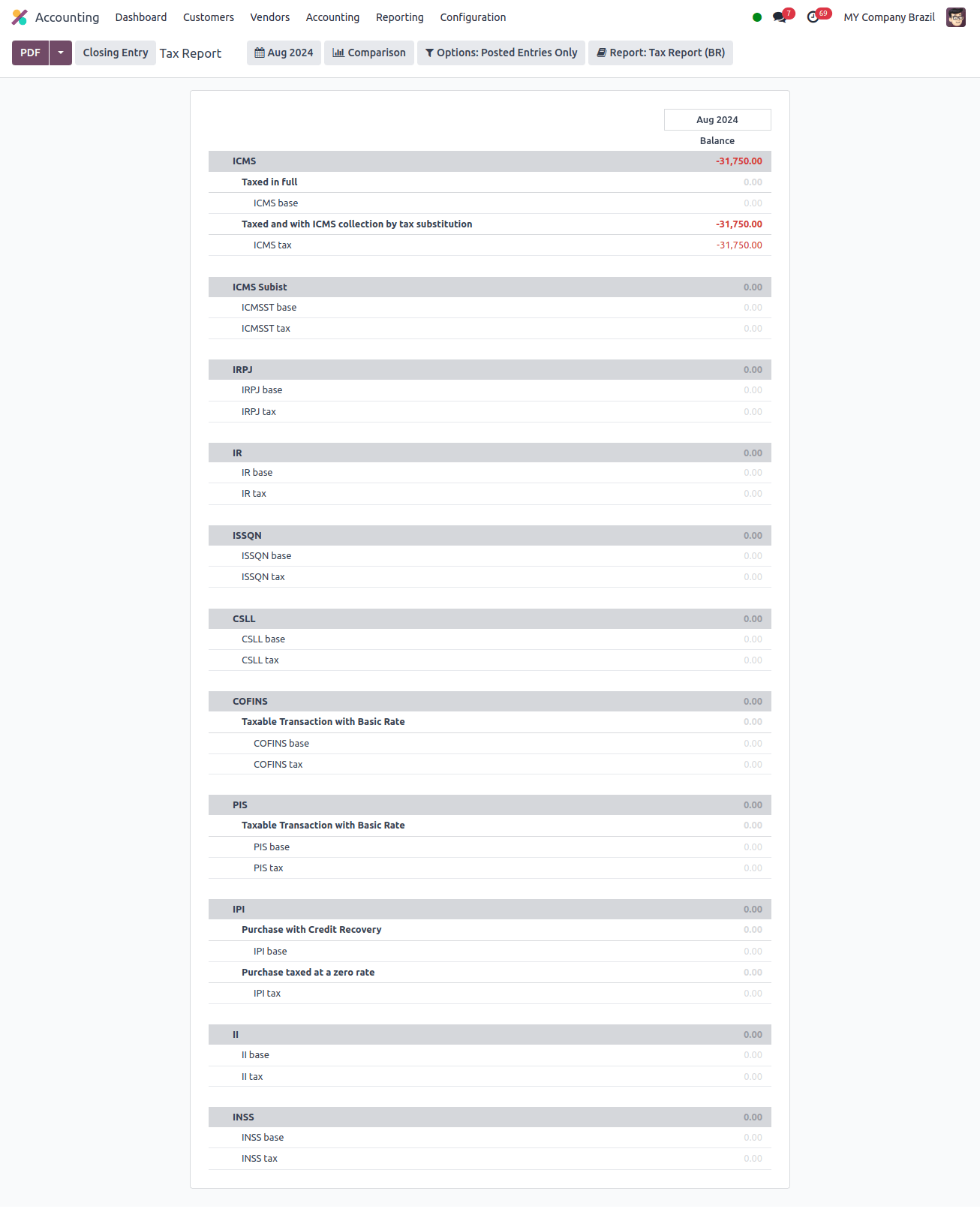

First, go to the Tax Report, where the Brazilian company’s various taxes and tax amounts are presented.

This report shows:

* ICMS: Which is the state tax on the passage of products, information, electricity, etc.

* IRPJ: This refers to the corporate income tax in Brazil.

* IR: Which is the federal income tax.

* ISSQN: This is a tax on all types of services.

* CSLL: Social contribution to net income. Legal organizations often pay a 9% CSLL.

* PIS: This is the program for social integration.

* COFFIN: Contribution towards the financing of social security.

* IPI: The federal government imposes an excise tax on commodities made and imported into Brazil.

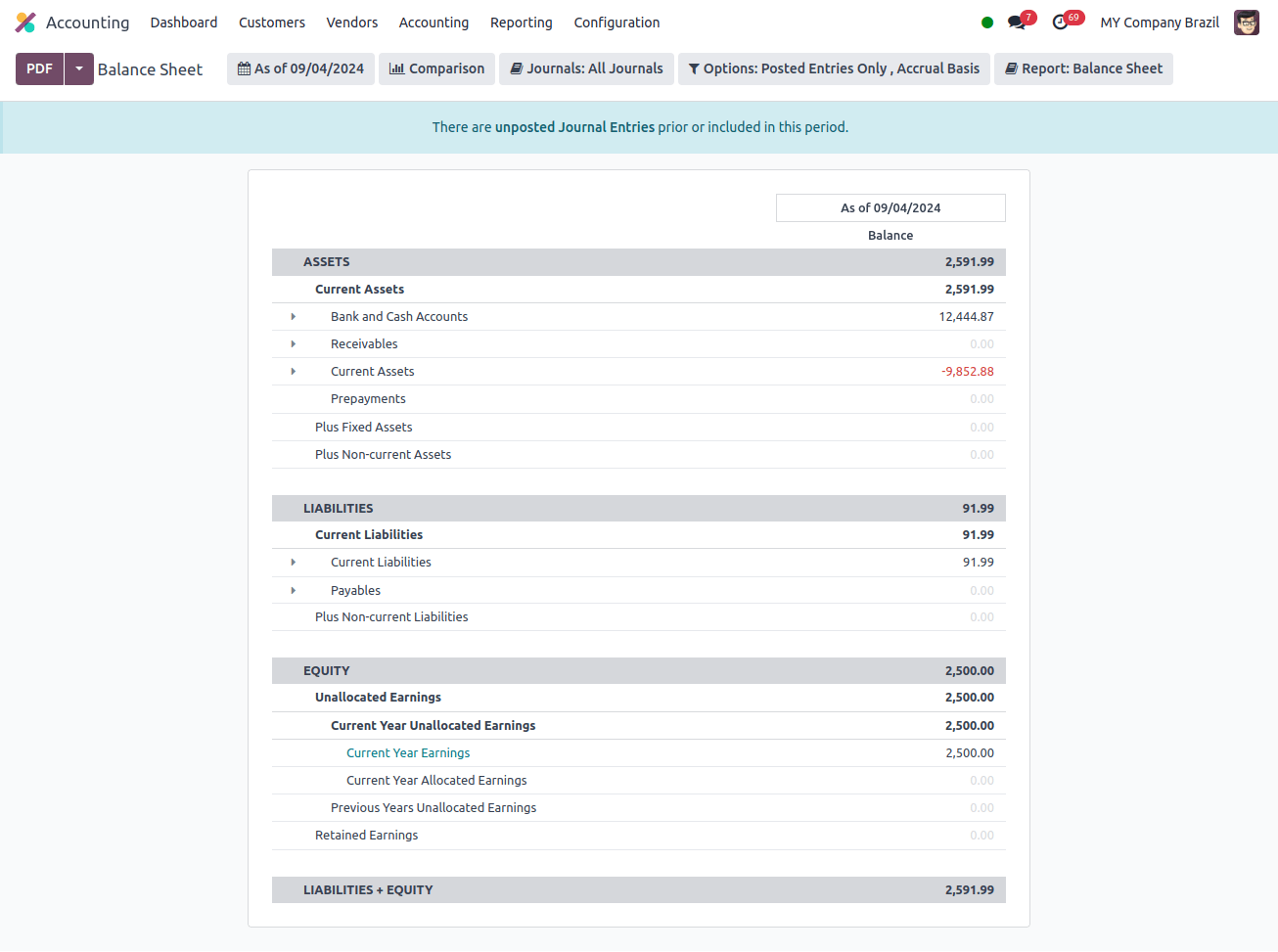

Now we may analyze the balance sheet created for Brazilian enterprises. The balance sheet is an important tool for tax reporting since it offers important financial information about a company’s assets, liabilities, and equity at a given point in time.

This is how tax reporting uses it. We can also see in the report that each and every tax report line is entered as per the provided tax grid.

The balance sheet has two primary terms: Assets comprise both current and noncurrent assets, including stocks and credits. Current year profit, current liability, and so on are all considered liabilities.

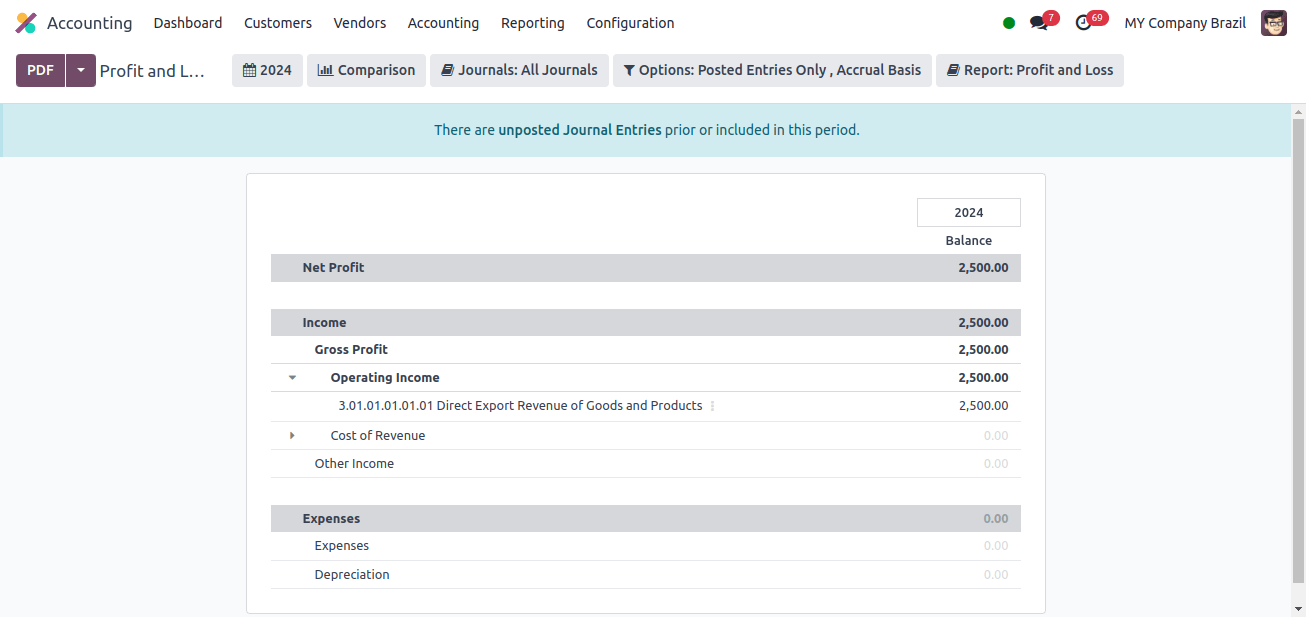

When we look at the profit and loss statements of Brazilian companies, we can see the net profit for the period as well as the net profit compared to various forms of taxes.

So we can say that when we start a company and arrange its accounting localization, the company’s operations will run smoothly. It also contributes to the company’s increased production and reduced errors.

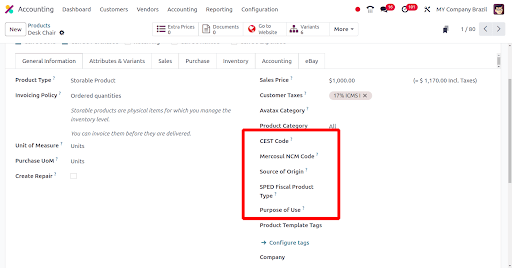

When we look at the product form, we notice that some additional fields have been added.

The product form’s general information tab now includes the CEST Code, Mercosul NCM Code, Source of Origin, SPED Fiscal Product Type, and Purpose of Use fields.

* CEST Code: A tax classifying code used to identify items and products that are eligible for tax substitution under ICMS regulations. It is helpful in determining the proper tax treatment and method for a certain product.

* Mercosul NCM Code: Brazil: The Mercosur List’s NCM (Nomenclatura comum do Mercosul) code.

* Source of Origin: Product source of origin describes whether a product is domestically or internationally manufactured, with varying features and variations based on the product’s intended usage.

* SPED Fiscal Product Type: Tax product category as shown in the SPED list table.

* Purpose of Use: Describe the intended use of this product.

Because Odoo has been localized into Portuguese, businesses operating in Brazil can use its robust platform to manage their financial operations successfully.

Odoo 17 streamlines accounting processes so companies can focus on expansion. Its all-inclusive capabilities include fiscal document preparation, tax compliance, and interaction with local payment channels.

Related Post:

- How Does Odoo 17 Simplify Accounting Localization for Argentina

- How Does Odoo 17 Simplify Accounting for French Businesses

- Why Is Odoo 17 the Best Choice for Accounting Localization in Spain