Managing finances in Argentina has restrictions and complications, but the Odoo 17 Argentinian Localization module streamlines and simplifies accounting processes.

It is important to have the right accounting localization set up for the country in which they operate. This blog post goes into the module’s functionality and emphasizes the importance of testing them in the Odoo 17 designated environments.

Argentinian Accounting with Odoo 17

The Argentinian localization module in Odoo 17 makes it simple to comply with local tax legislation and accounting standards.

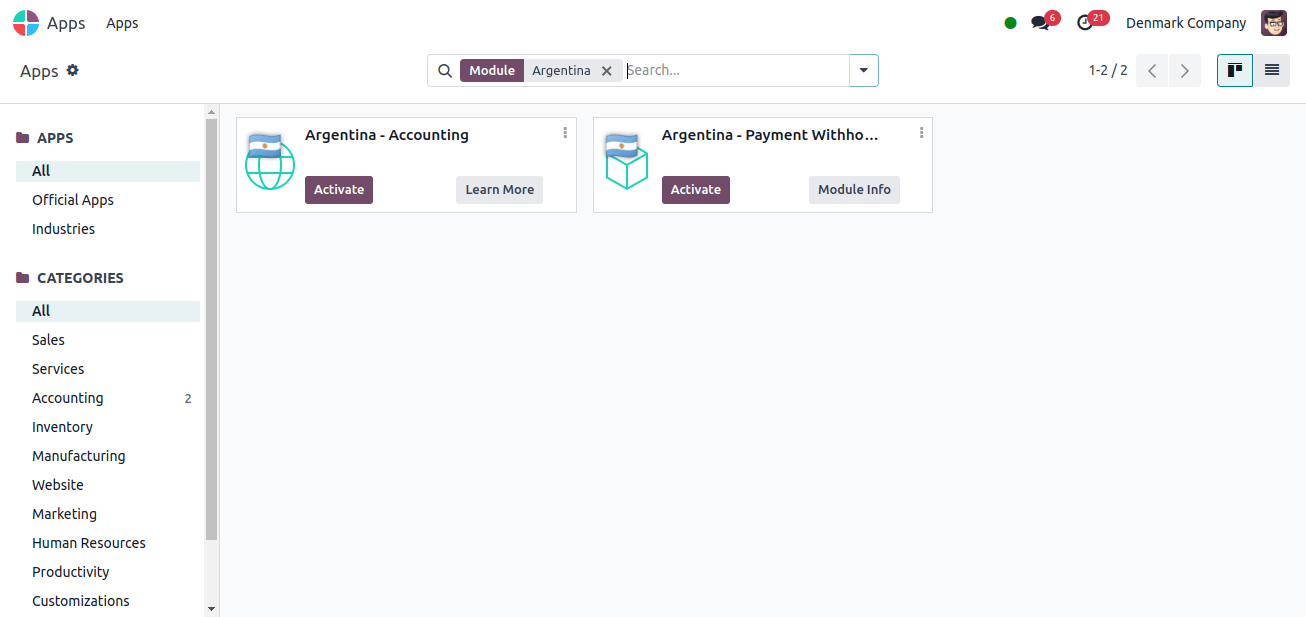

The first step in setting up the accounting localization for Argentina is to install the Argentina localization. For this, we may go to Apps and install the modules needed to set up accounting localization for Argentina.

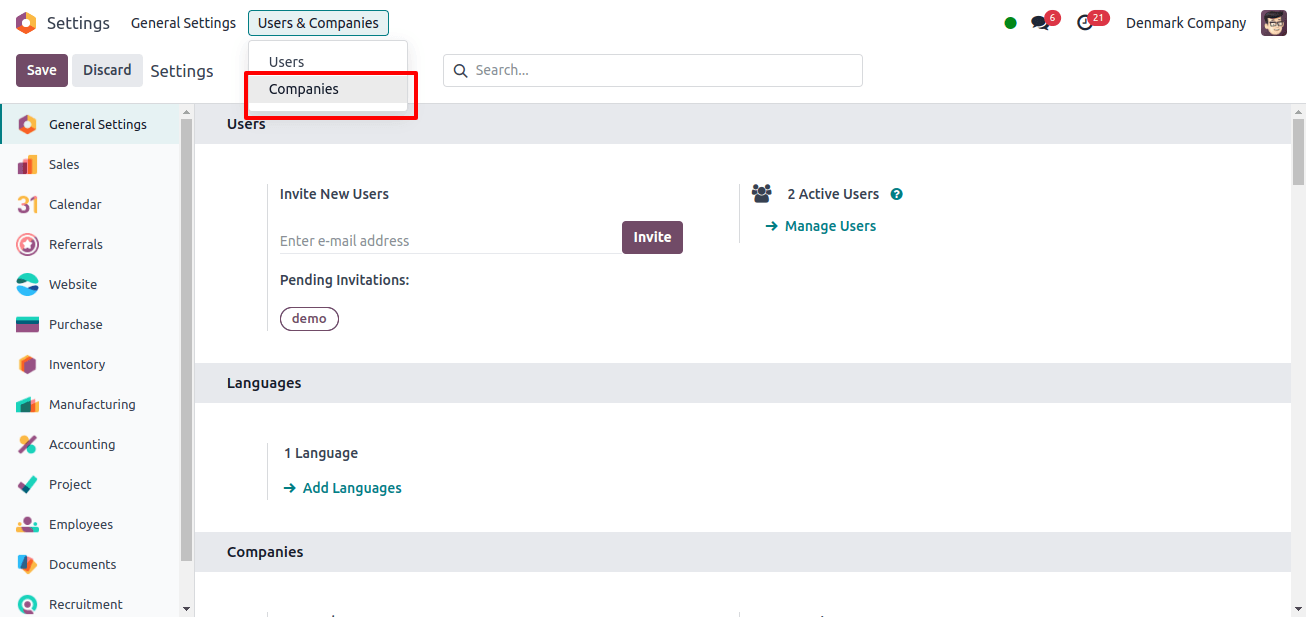

After installing the modules required for Argentina localization, we may verify that the firm is properly configured or start a new company with the necessary parameters. For that, go to settings → Users and Companies → Companies.

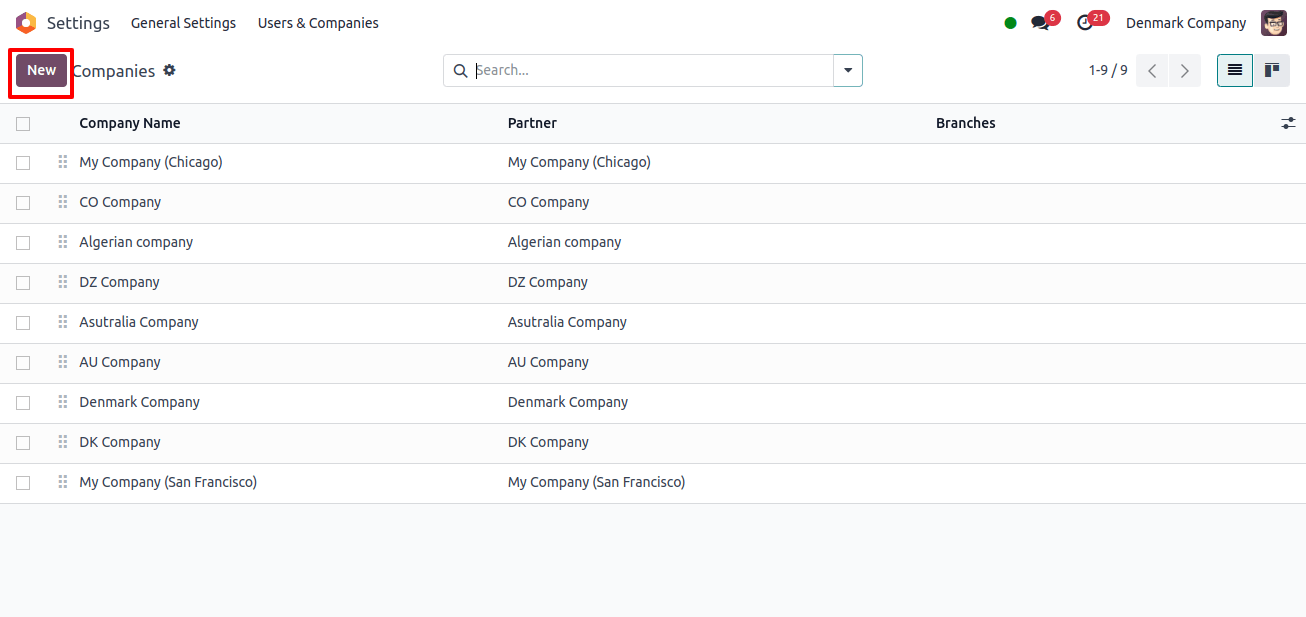

A page displays, and we can see a list of all the companies. To start a new company, click the new button in the upper left corner.

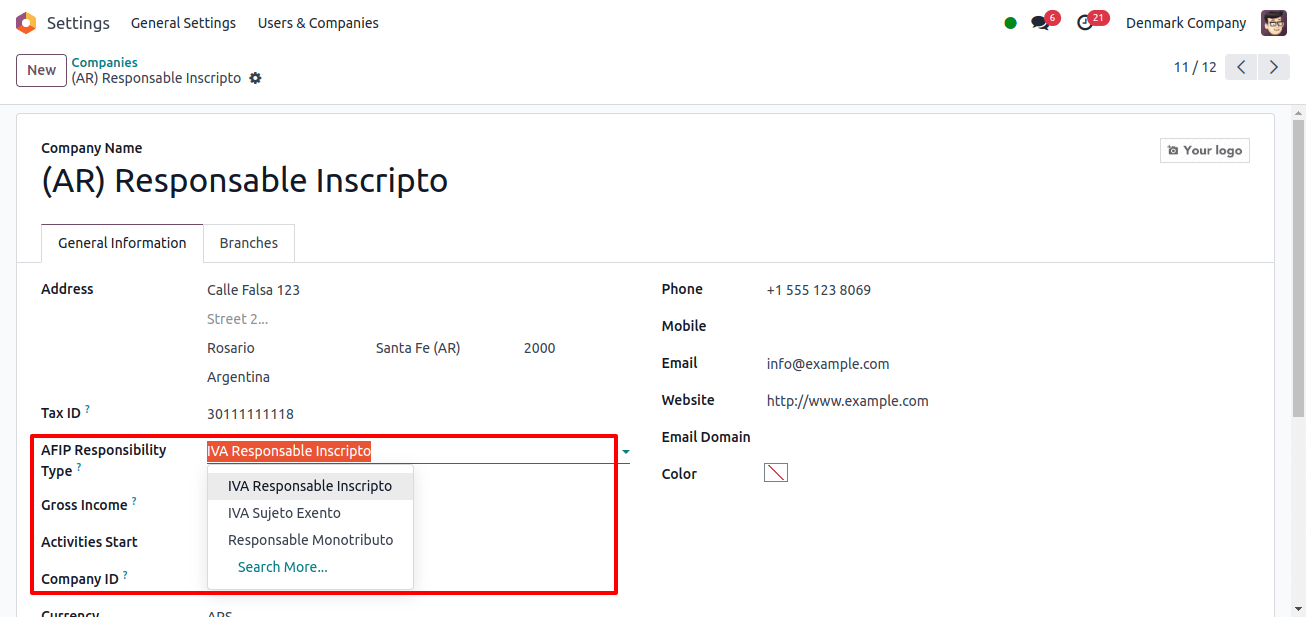

Alternatively, we can select the firm for which we wish to review the setup. Because the organization operates in Argentina, the user must specify the AFIP responsibility Type.

The AFIP responsibility type specifies the level of responsibility that a person or legal entity will have, creating the company’s obligation and assurance of operation. The IVA Responsable Inscripto, IVA Sujeto Exento, or Responsale Monotributo can be chosen as the AFIP Responsibility Type.

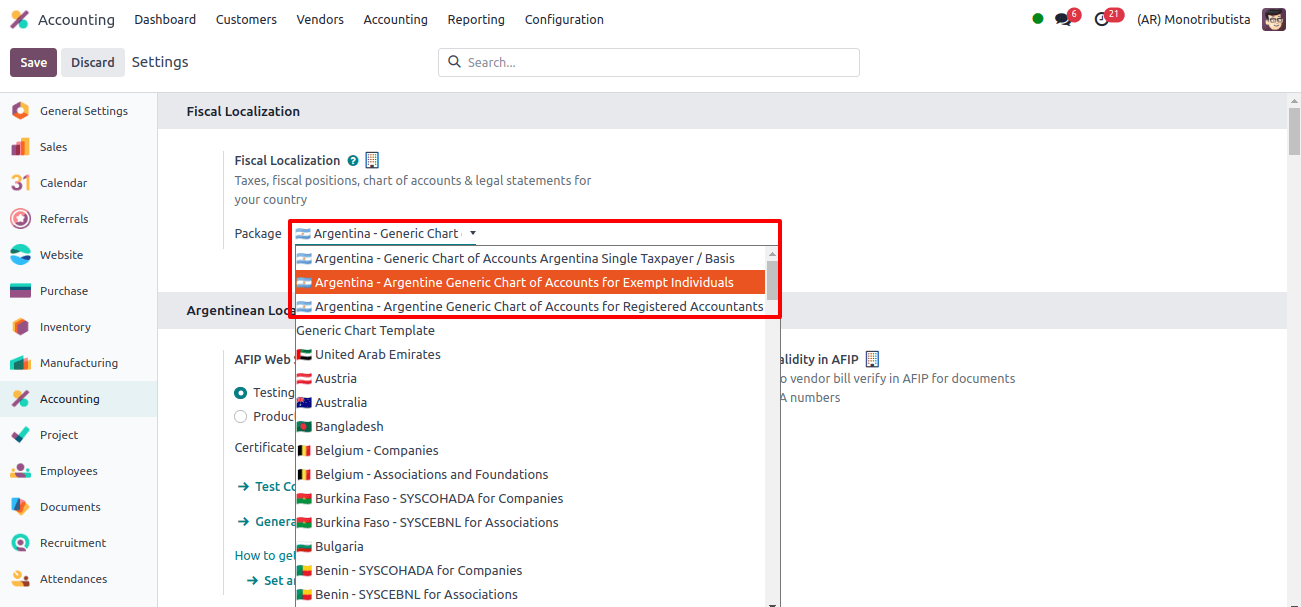

Now, navigate to the company’s configuration settings, where we have three packages for Fiscal Localization for Taxes, Fiscal Positions, Chart of Accounts, and Legal Statements for your nation.

To access it, navigate to Accounting → Configuration → Settings. Under Fiscal Localization, we can select the package based on the country.

After picking the package, we may save the settings and scroll down to see the Argentine localization.

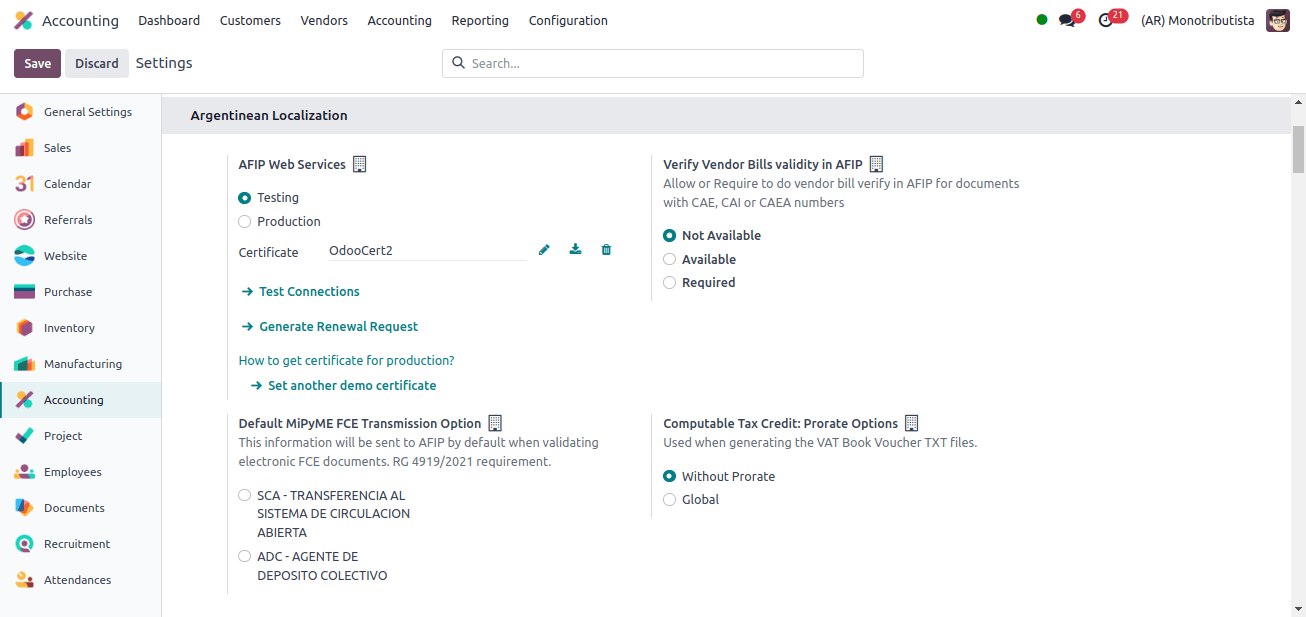

We have two environments for AFIP web services: testing and production.

Businesses can test their databases before moving them into production. Because these two settings are independent, digital certificates from one instance are invalid in the other.

In the partner form, we must select the AFIP responsibility sort to indicate the sort of responsibility that a person or legal entity may have, which influences the type of activities and requirements they require.

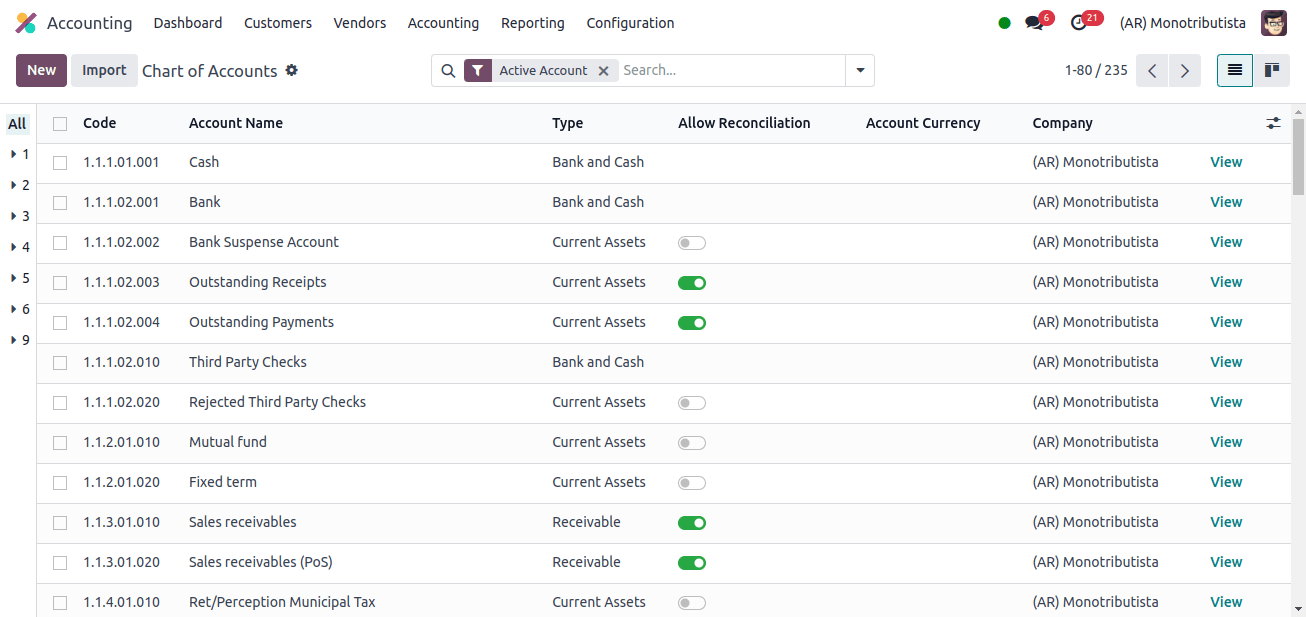

Now we can access the Chart of Accounts by navigating to Accounting → Configuration → Chart of Accounts. We can observe that various new charts of accounts have been added for this accounting localization.

Odoo 17 conforms to the Argentine chart of accounts, ensuring that your financial statements and reports meet local norms.

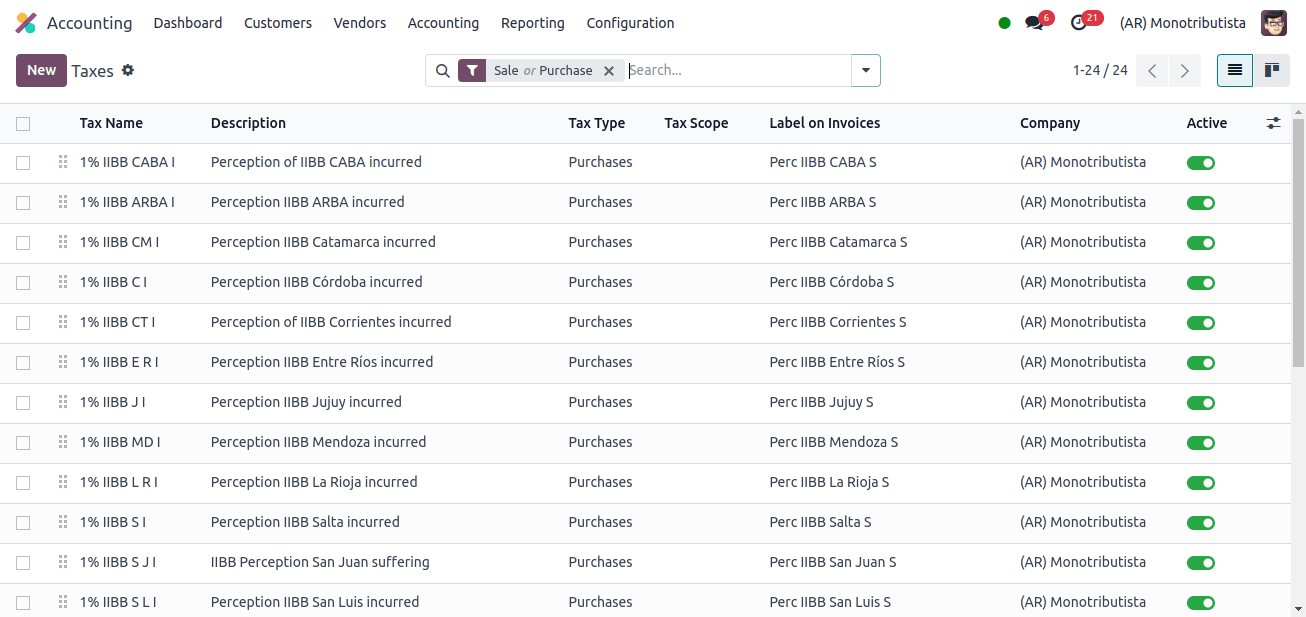

This localization module configures a variety of Argentine taxes, including IVA (Impuesto al Valor Agregado) and Ingresos Brutus. This eliminates the need for manual tax calculations while ensuring proper tax reporting.

Argentina has several tax kinds, including VAT, which can have varying percentages, and perception, which is an early payment of a tax that will be applied to bills. Retention is the upfront payment of a tax levied on payments.

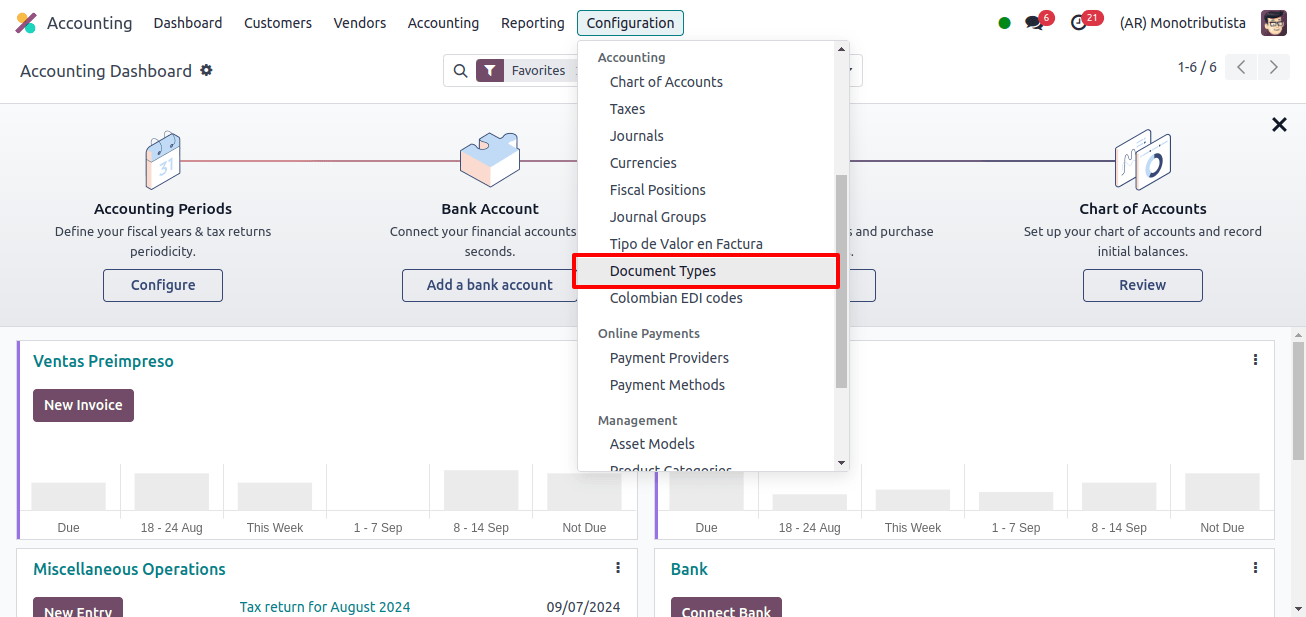

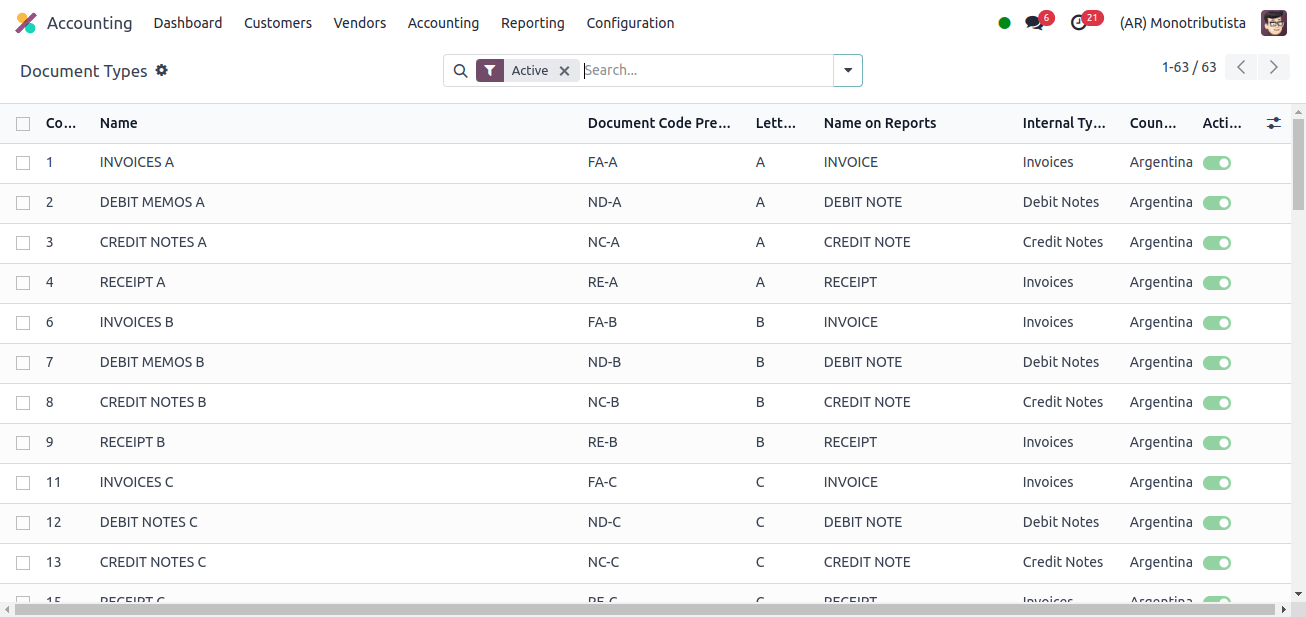

In Argentina Localization, while establishing customers, accounting documents can be allocated using the menu-defined document categories. To view that, go to Accounting → Configuration → Document Types.

The document type is an important piece of information that should be prominently displayed on printed reports, invoices, and journal entries that explain account transfers.

Here, we can see all of the document types available.

Automated Electronic Invoicing (CAE) is essential in Argentina. The module generates bills automatically, including the Código de Autorización Electrónico (CAE) given by the AFIP. This eliminates manual processes while ensuring compliance.

Accounting transactions in Argentina, such as vendor bills and invoices, are classified into document types established by national fiscal authorities in a few Latin American countries. Argentina’s national fiscal authority, the AFIP, defines certain transactions.

Every type of document may be assigned a unique sequence in each journal. The document type includes the country for which the document is appropriate as part of the localization process.

The type of document for each transaction will be determined by:

The invoice-related journal item (assuming the journal keeps the documentation);

Certain conditions are applied based on the issuer and receiver types (for example, the buyer’s and vendor’s fiscal regimes).

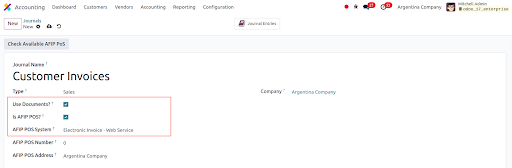

Depending on its internal nature and usage, the journal may take a different approach to Argentina localization. To set up your journals, go to Accounting → Configuration → Journals.

The Use Documents option, which displays a list of document types linked to invoices and vendor bills, can be activated for sales and purchase journals.

If the Use Documents option is not set, the sales and buy journals will mostly be used to document account movements related to internal control procedures. This is because they won't be able to generate fiscal invoices.

Is AFIP POS? The checkbox determines whether this journal will be used to transmit electronic invoices, and under the AFIP POS System, we can indicate which type of system will be used to generate electronic invoices.

We can also specify the AFIP POS Number, which is the number set up in the AFIP to identify this AFIP POS’s connected operations, and the AFIP POS Address, which is the field related to the registered business address for the POS system, which is usually the same address as the business.

For example, if a company has multiple stores, the AFIP will require one AFIP POS for each fiscal location. The invoicing report will include this address.

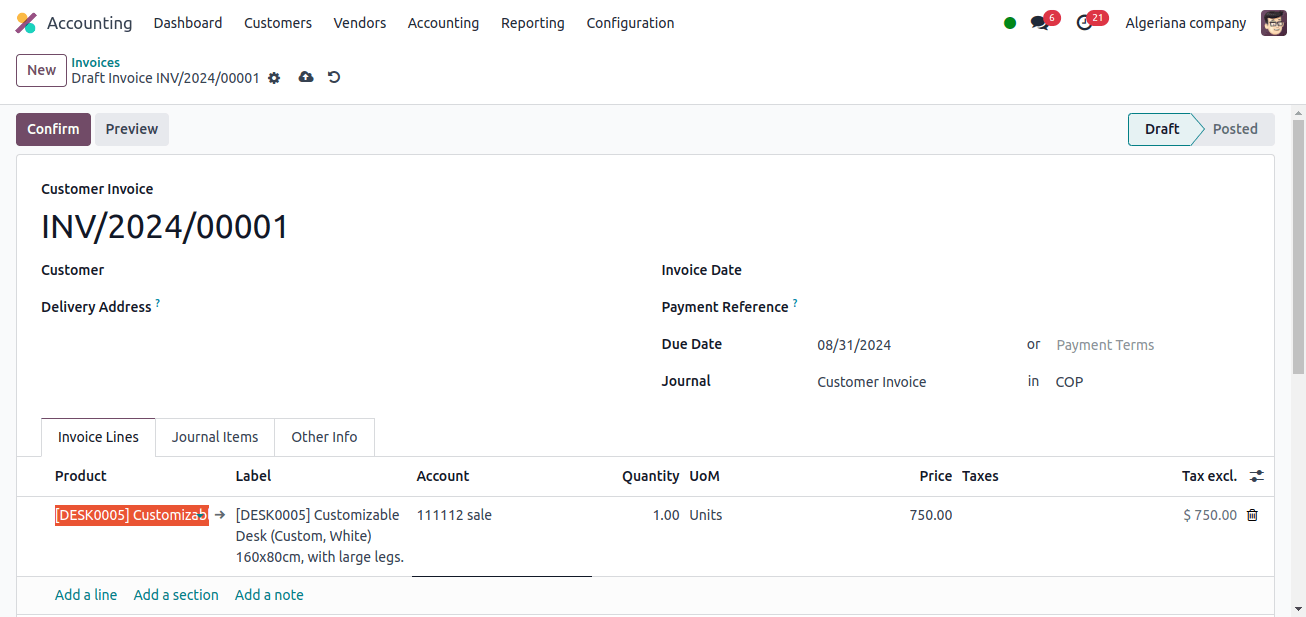

After properly setting up the partner and journal, we may generate an invoice and navigate to Accounting → Customers → Invoice. When we add a customer, the Document Type column is immediately filled based on the partner’s AFIP responsibility type.

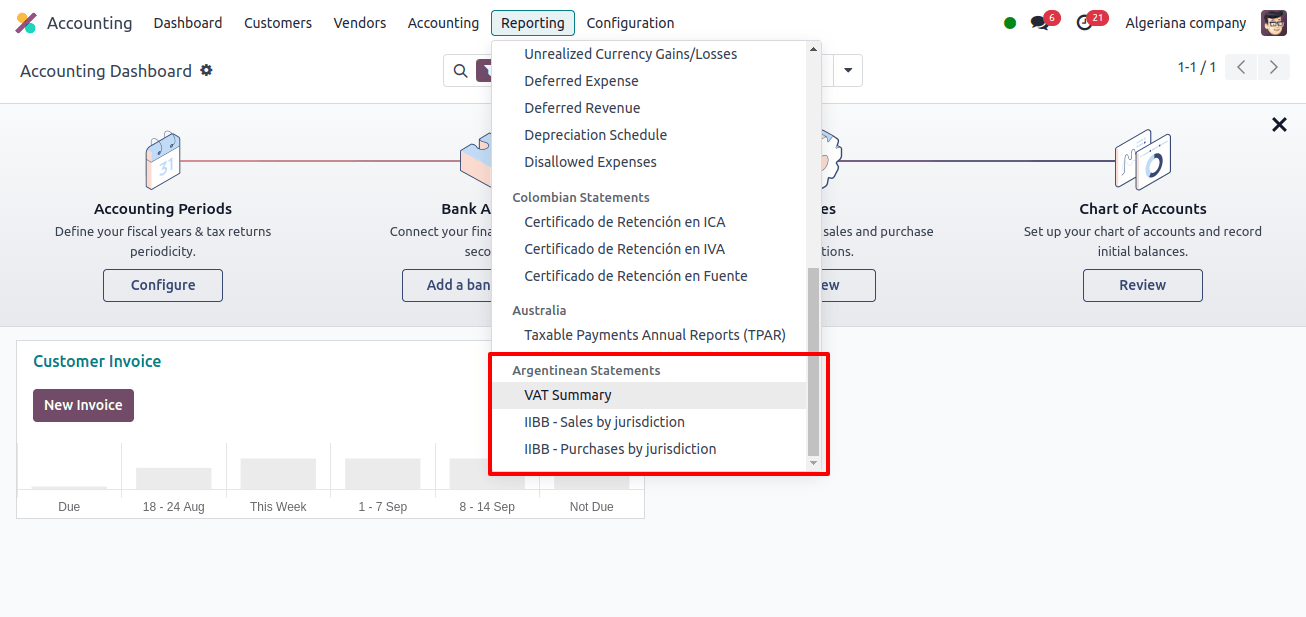

IIBB-Purchases by Jurisdiction, VAT Summary, and IIBB-Sales by Jurisdiction are the three new options in Argentinian Reporting.

VAT Summary:

This report covers VAT activity over a given period. It shows the VAT you collected on sales (Debito Fiscal) and the VAT we paid on purchases (Crédito Fiscal).

When we install the Argentinian localization module, it calculates VAT depending on the tax rates we choose for our sales and purchases.

It subsequently generates the Libro IVA Digital report, which categorizes VAT based on debit and credit accounts. This report meets AFIP’s format and data standards.

IIBB Sales by Jurisdiction (Ingresos Brutos - Ventas por Jurisdicción):

This report describes sales activity subject to Ingresos Brutos (IIBB), a provincial tax on gross income. It categorizes sales based on the jurisdiction (province) where your consumers live. The IIBB rate may vary by province.

Odoo can potentially be set up to capture the customer’s jurisdiction during the sales process. This data can then be used to create the IIBB Sales by Jurisdiction report, which summarizes sales in each relevant jurisdiction.

IIBB Purchases by Jurisdiction (Egresos Brutos - Compras por Jurisdicción):

This report, like the sales report, details IIBB purchases organized by supplier jurisdiction. This makes it easier to claim any IIBB credits that may be due as a result of your transactions.

Odoo can potentially be set up to collect the supplier’s jurisdiction during the buying process. This data can then be used to generalize the IIBB Purchases by Jurisdiction report, which summarizes your purchases in each relevant jurisdiction.

Thus, we can conclude that Odoo 17’s Argentinian localization module can be a useful tool for creating important tax reports such as the VAT Summary, IIBB Sales by Jurisdiction, and IIBB Purchases by Jurisdiction.

However, to get comprehensive functionality for jurisdictional IIBB reporting, adequate configuration must be ensured, and customization possibilities or other modules may be explored.

How Does Odoo 17 Enhance Accounting Localization For Brazil ?