What is Storno Accounting ?

It is a method for correcting errors or reversing transactions in an accounting system. Consider whether there was a problem with the money coming in or out, or if you need to return something and get your money back. Storno Accounting helps to resolve these issues.

The wonderful thing about Storno is that it prevents the same numbers from appearing twice in the book. Accounting professionals frequently use red ink to indicate these Storno entries, which is why they are sometimes referred to as "red Storno."

When reviewing financial reports, items marked with Storno will be highlighted in red, making them easy to recognize. In this manner, everything remains orderly, and it is evident what adjustments were made.

Storno accounting in Odoo is the process of undoing or canceling a previously recorded journal item. In the context of Odoo accounting, the Storno functionality enables users to repair errors or undo wrongly reported transactions.

Here is how Storno accounting usually works in Odoo.

Identification of Incorrect Entry: Users highlight journal entries that require revision due to errors or omissions. This may involve errors in money, accounts, or dates.

Access the Journal Entry: Users of the Odoo accounting module can discover and retrieve the precise journal entry that has to be corrected.

Initiate the Storno Process: Odoo includes a Storno capability that allows users to start the reversal of a specific journal entry. This technique creates a new entry that is effectively the inverse of the original record, fixing the error.

Review the Reversed Entry: After starting the Storno procedure, users can view the freshly generated entry. To correct the error, the values in this reversed entry should be inverted when compared to the original.

Verification of Financial Impact: Odoo recalculates balances to ensure entries are consistent with the financial records. Users should check the financial impact to ensure reversal was properly achieved.

Audit Trail: Odoo creates a clear audit trail by linking the reversed entry to its original counterpart. This traceability is critical for compliance, transparency, and internal controls.

Reporting Accuracy: It is critical to ensure that financial records, such as balance sheets and income statements, contain the rectified information following the Storno procedure. Odoo's reporting tools help with this verification.

Storno accounting in Odoo offers an approach to correcting errors and maintaining accurate financial records, improving the accounting system's general reliability and integrity.

Many Eastern European countries, including China, the Czech Republic, Croatia, Poland, Romania, Russia, Serbia, Slovakia, and Ukraine, commonly employ the Storno Accounting technique to manage their financial records.

Let us look at an example of how to manage storno accounting in Odoo 17 Accounting.

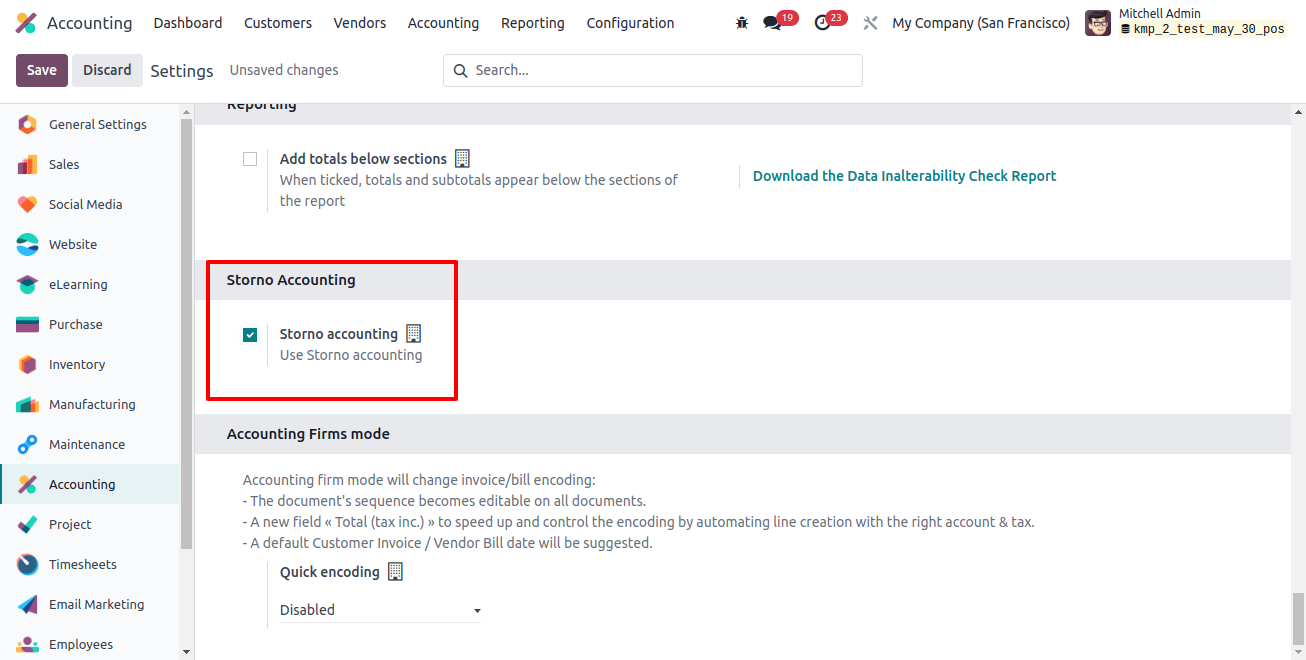

First, turn on the Storno Accounting option in your database. For this, go to the Accounting module's Settings menu and select the Storno Accounting tab, as seen in the screenshot below.

Activating this option enables you to use storno accounting in Odoo. This accounting method uses negative credit or debit balances within your account to balance initial journal entries. This procedure helps to correct errors in accounting records.

If a file contains incorrect money information, you can cancel it. After canceling, enter the relevant information to ensure everything is correct.

If you utilize Storno accounting in Odoo, the system will copy the original entry. The copied item shows the amount as negative, indicating a reversal.

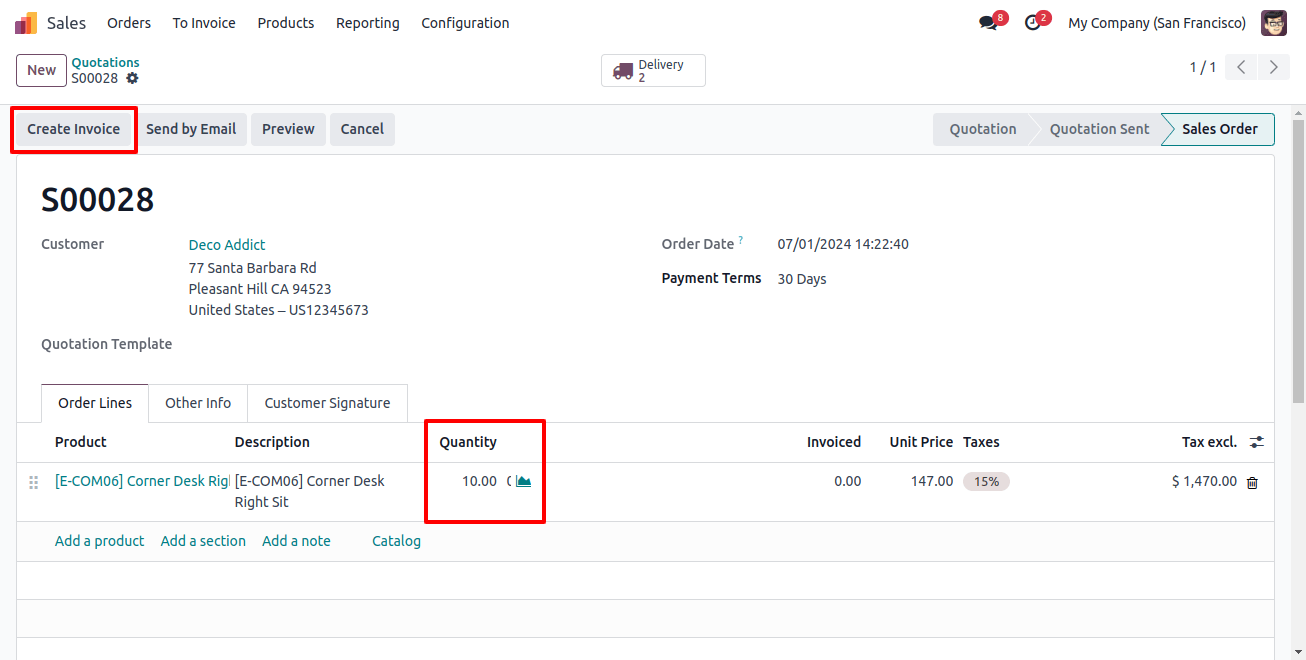

Let's start by creating a sales order for a certain product in response to a customer request for 10 units. The Sales module in Odoo allows us to create a new sales order.

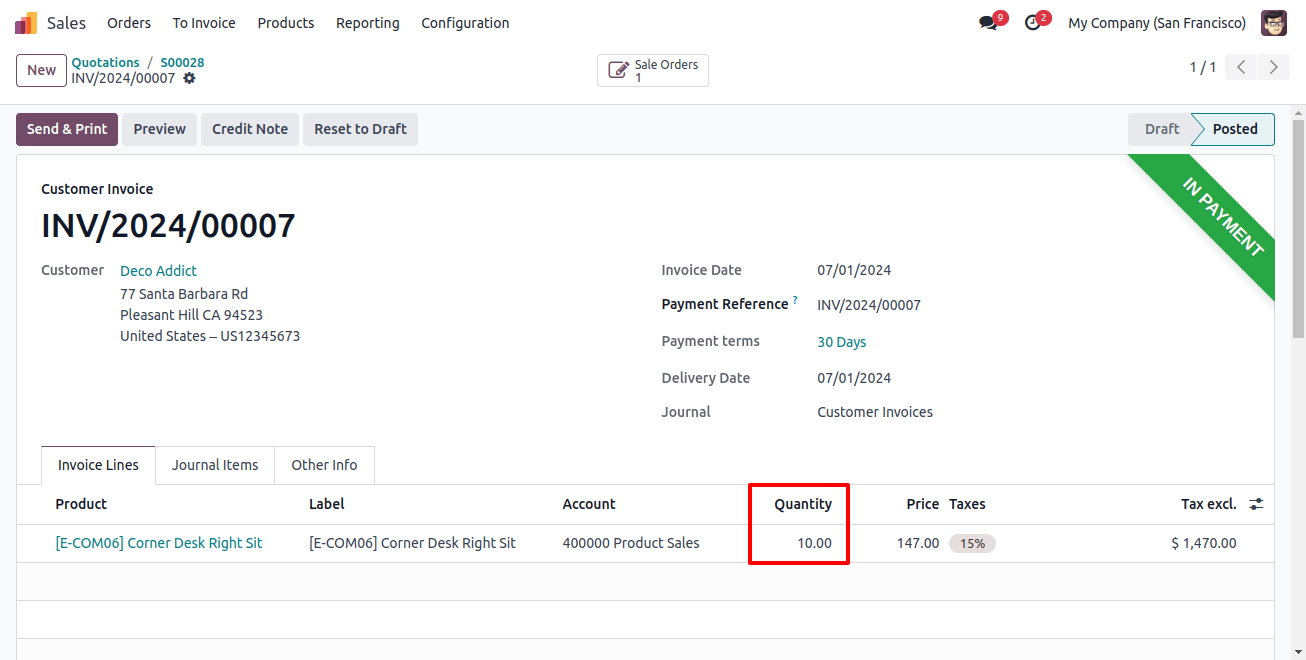

After confirming the order, we will generate an invoice for it. Take into account that the customer has already made the payment.

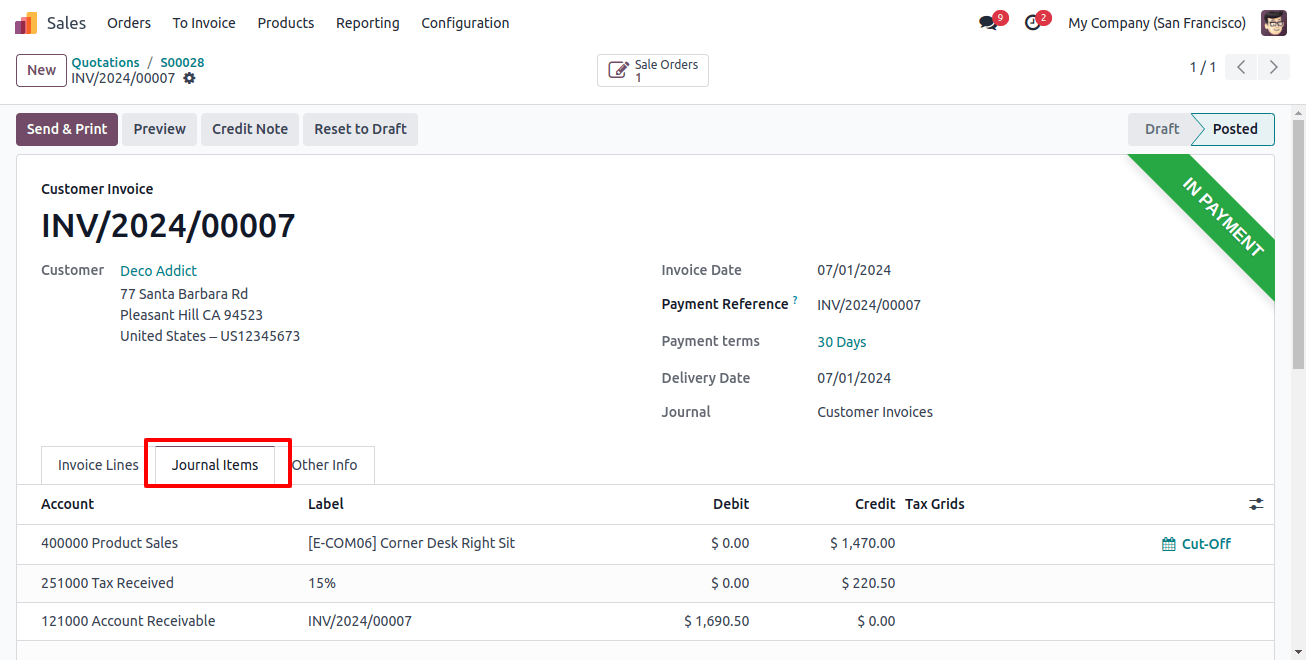

The ledger posting to the associated accounts is accessible on the Journal Items tab, as seen below.

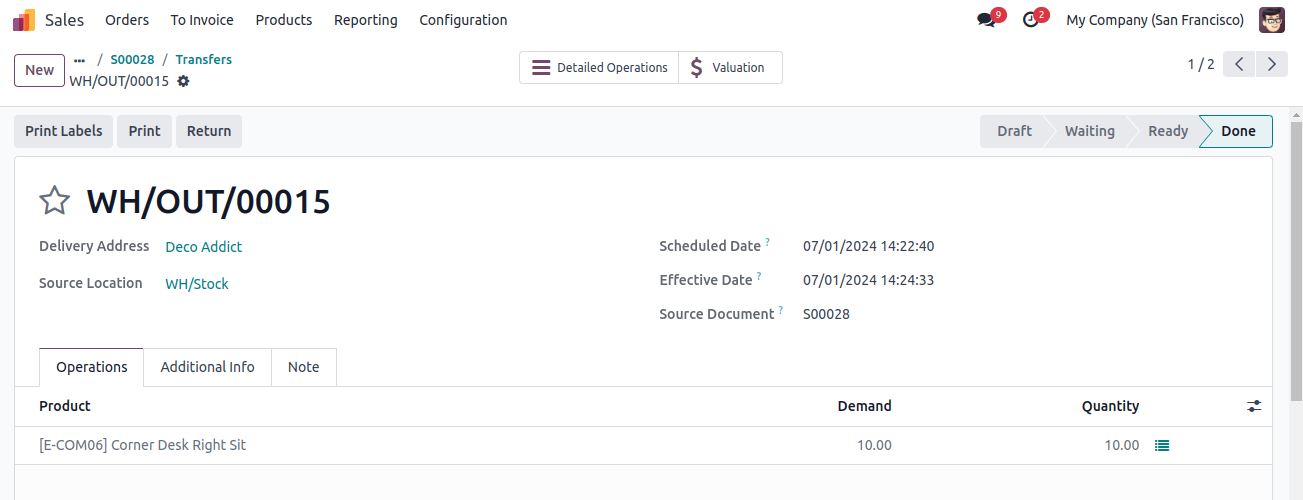

After completing the payment steps, you can finalize the delivery by validating the transfer.

When the transfer is validated, the status is updated to DONE, indicating that the product will be transferred from stock to the client. Product delivery may take several days, depending on the customer's lead time.

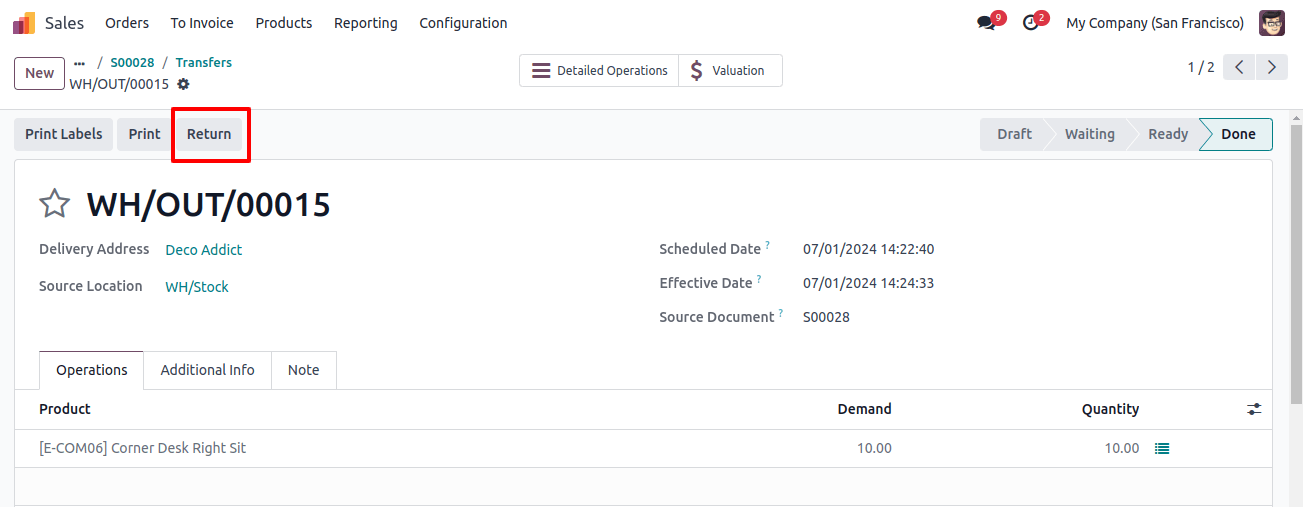

If the consumer discovers that two of the provided products do not work, they can return the defective products to the company.

To record a product return, pick the appropriate Sales Order from the Sales module and click the Return button, as illustrated below.

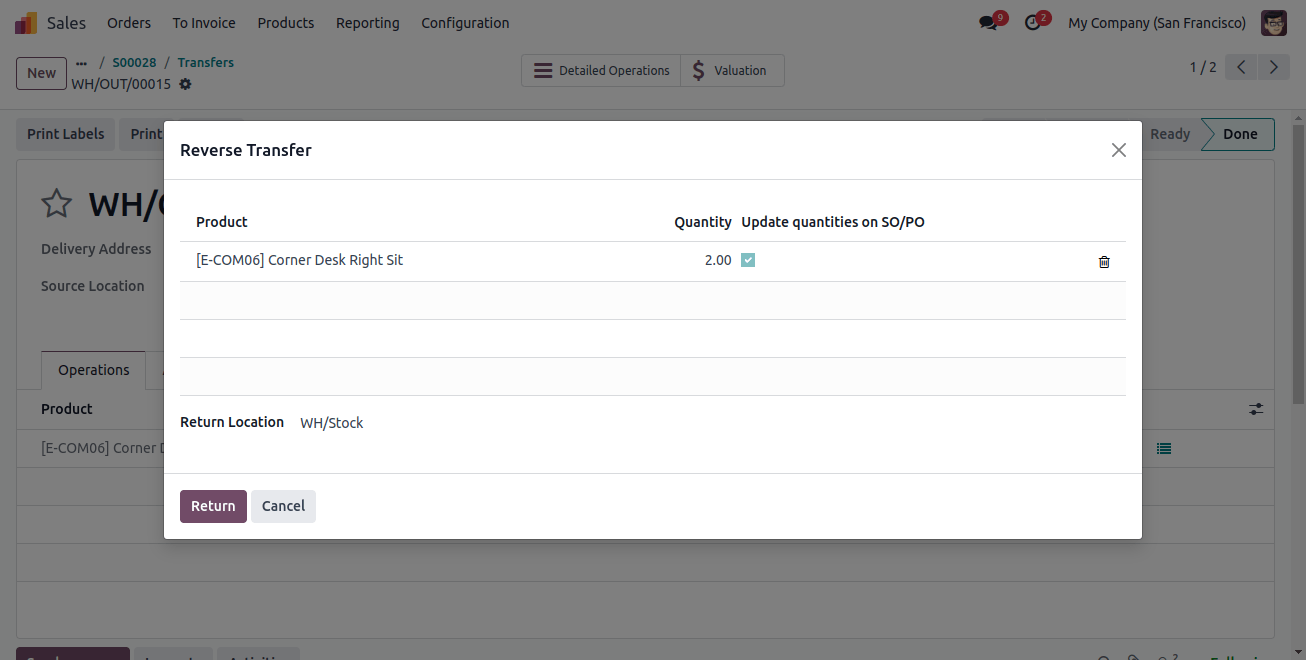

Clicking on this option will bring up a new pop-up window in which you can specify the quantity that the customer wishes to return.

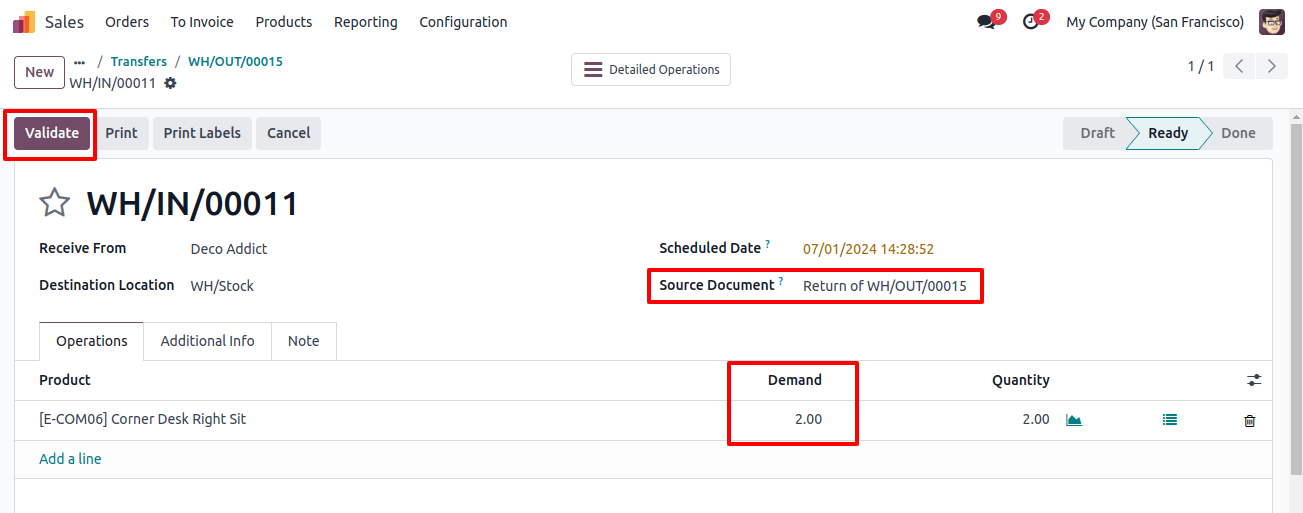

Now, click the Validate button to complete the return transfer.

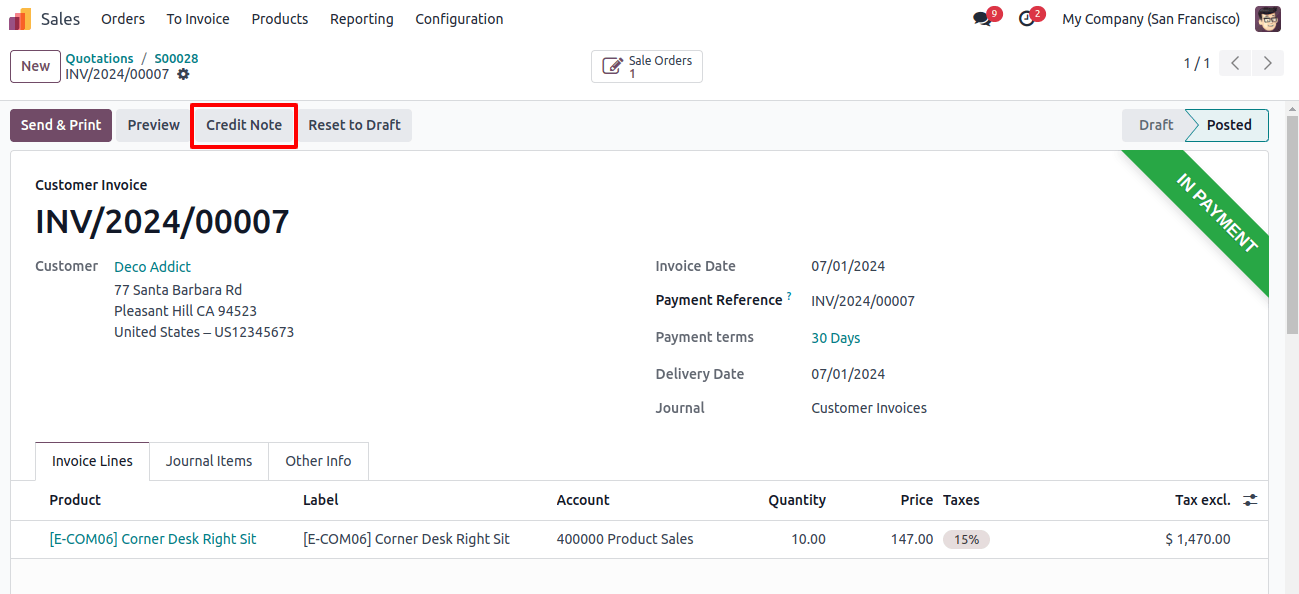

After validating the return, the corporation must issue the consumer a credit note.

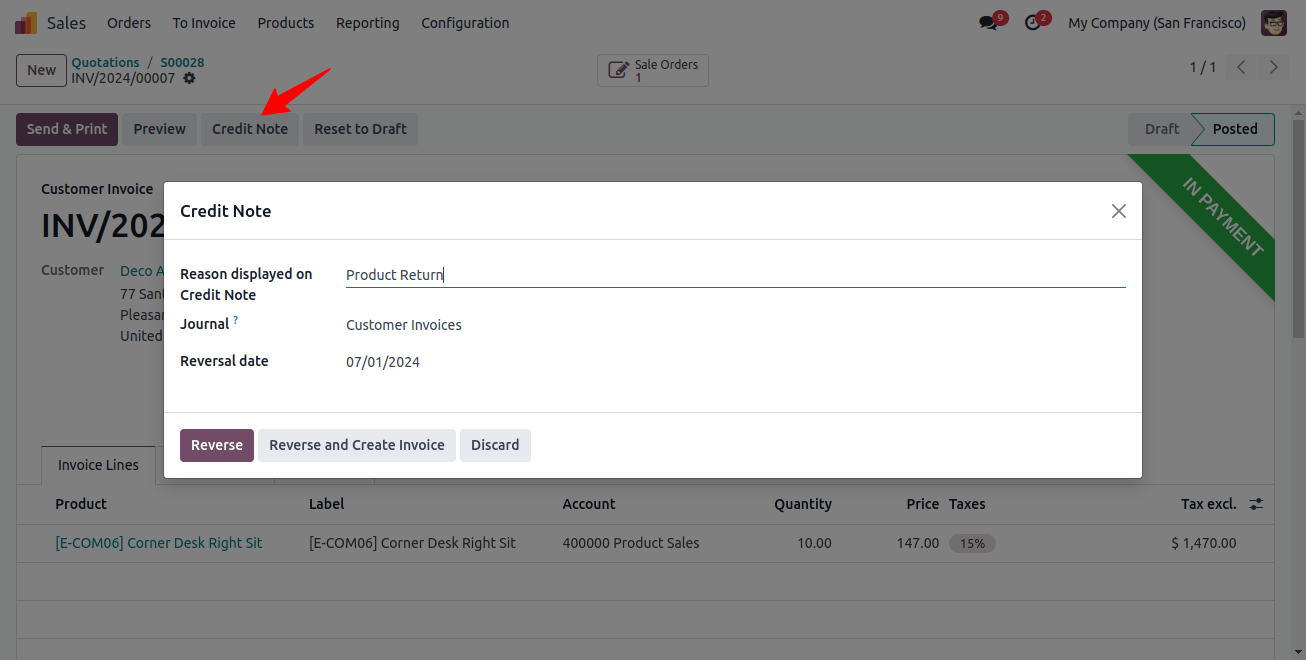

Click the Credit Note button on the client invoice. You'll see a new pop-up window, like shown below.

In the provided space, explain the rationale for the credit note. Now click the Reverse button.

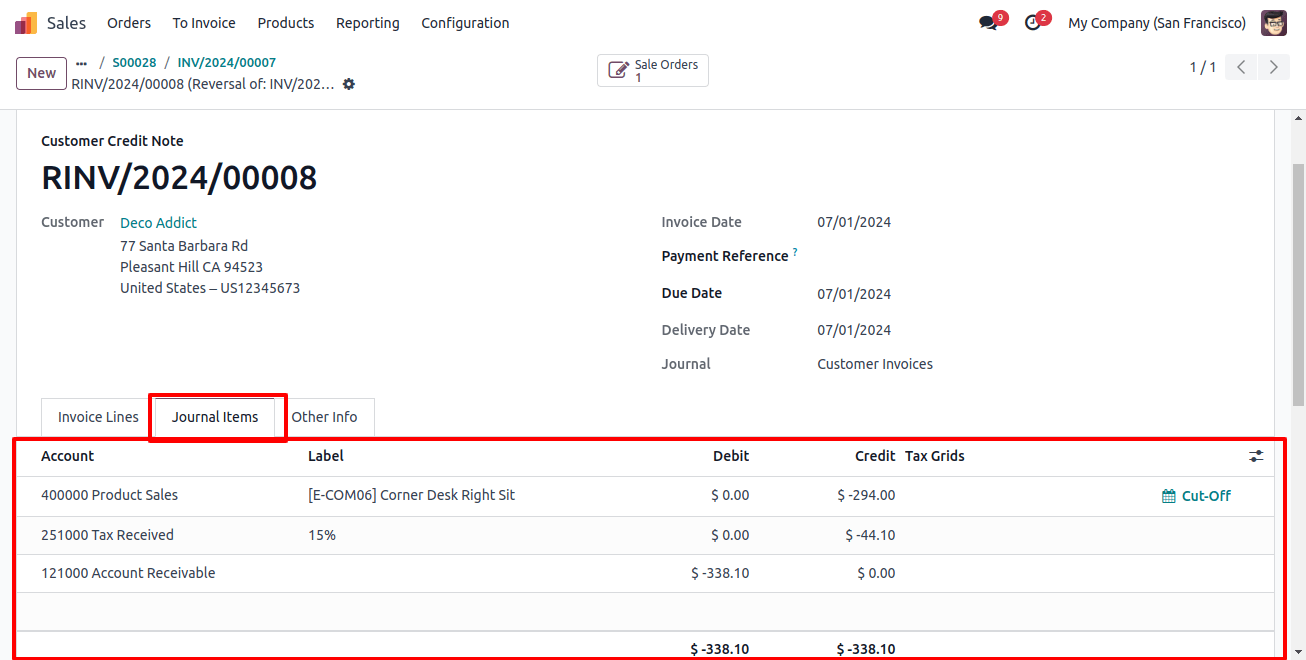

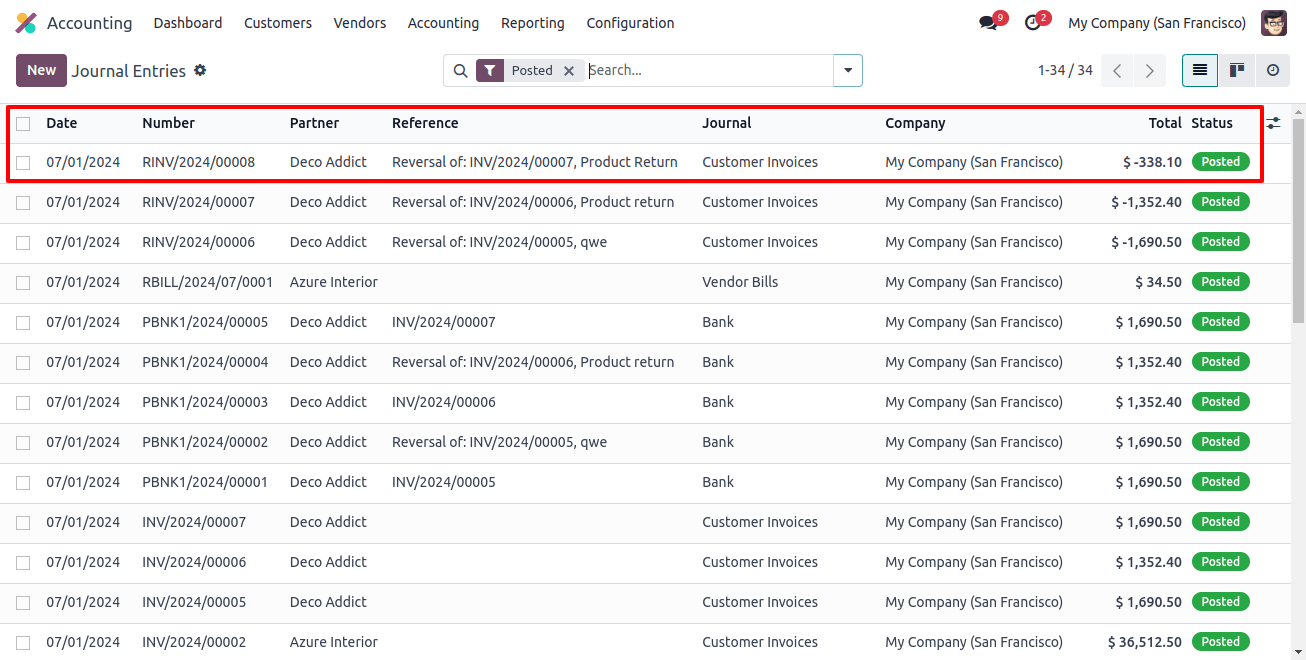

When you look at the reverse invoice ledgers, you'll notice that the income account is -(Credit) rather than debit, and all others are negative.

In storno accounting, reverse entries are shown in negative to make them easier to detect, as illustrated in the image above.

Effectively managing Storno accounting in Odoo 17 is critical for accurate financial records. Following these procedures allows organizations to speed the process of reversing journal entries, repair errors quickly, and ensure the integrity of their financial data.

Odoo's user-friendly interface and extensive functionality make it a solid alternative for organizations looking for effective accounting solutions.