Every country has its own set of reporting requirements, tax legislation, and accounting standards.

As a global ERP solution, Odoo 17 includes localization capabilities that allow businesses to customize their accounting configuration to the regulations and conventions of the country in which they do business.

Accounting localization in Odoo 17 refers to the process of customizing the accounting elements of the ERP system to fit the unique legal and financial needs of a certain country.

Odoo 17 includes an Ecuadorian localization module that helps businesses in Ecuador optimize their accounting process. So, before we can configure the country-specific localization, we need to set up a new company.

Create New Company

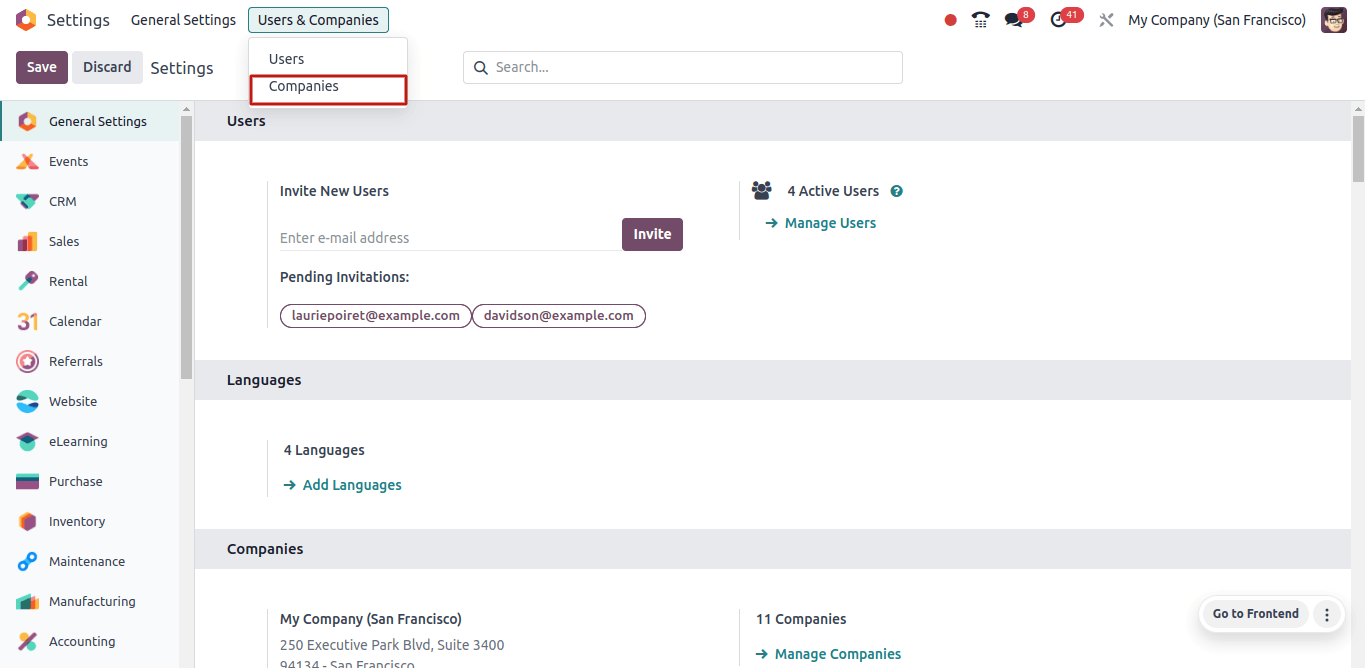

To create a new company, go to Odoo 17’s General Settings. There is a users and companies menu. Click user and companies, and then the companies submenu.

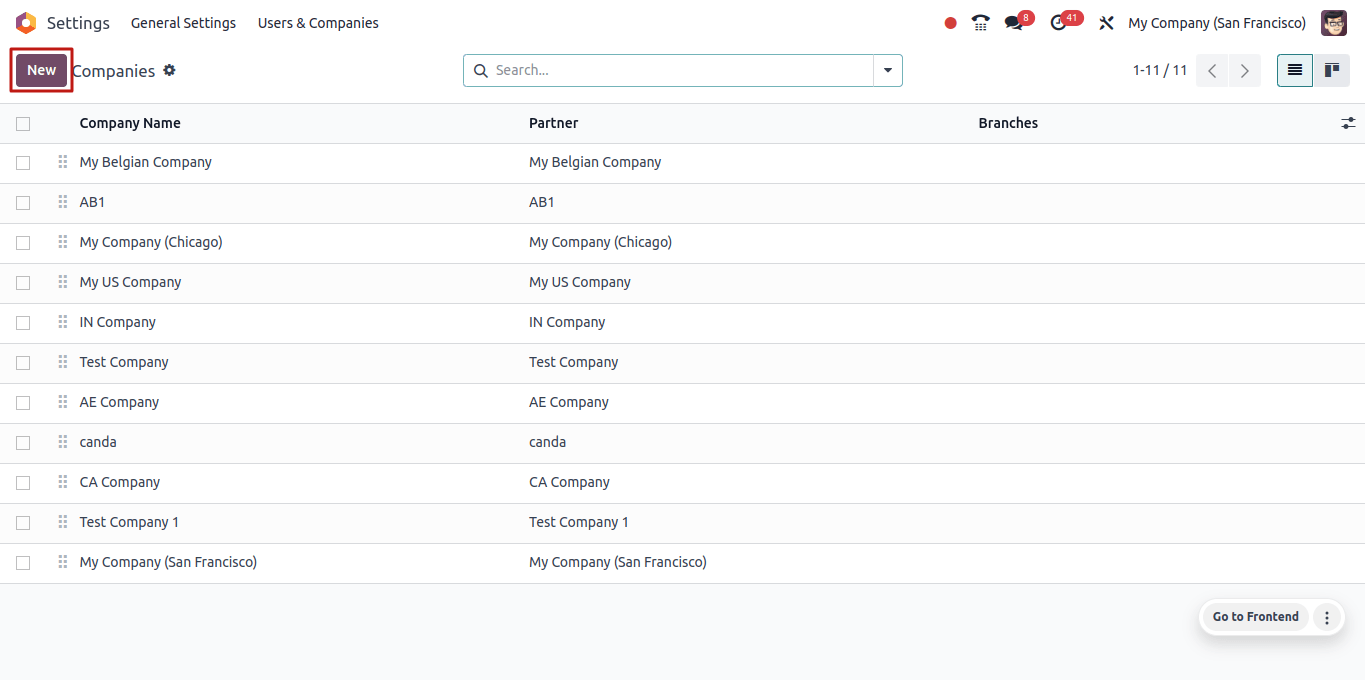

When you click the company sub-menu, you will see a list of already created companies. We can also form new companies using this page, Click the ‘New’ button.

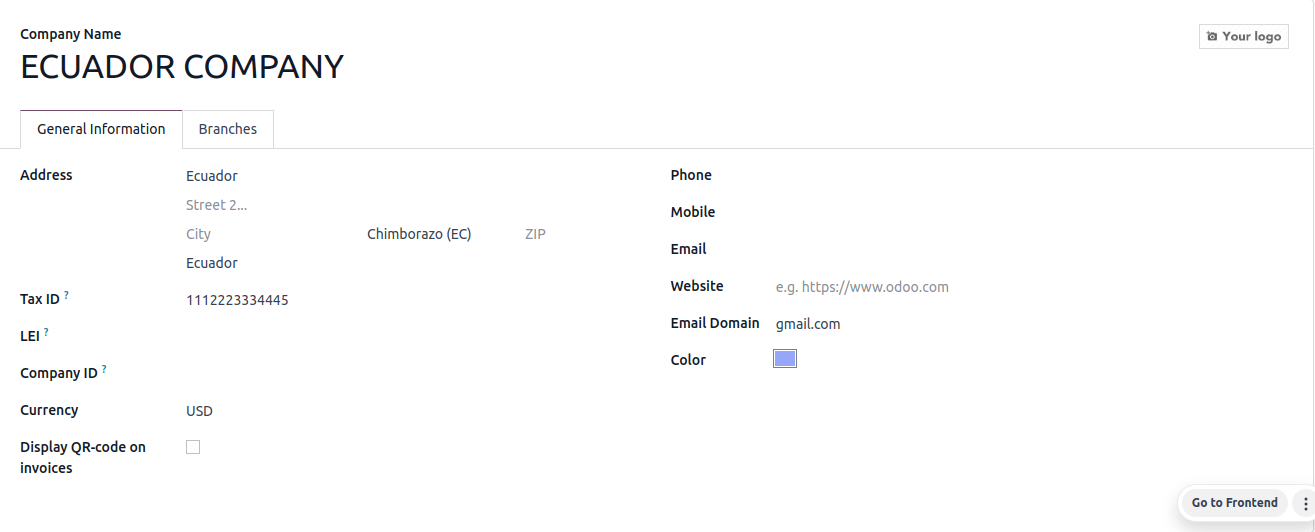

When you click the new button, you will be directed to a form where you can enter the company's details. In that form, you can enter the company name, address, and country.

We know that Ecuador’s currency is the US dollar (USD). So, when we enter the country for the company, Odoo 17 automatically sets the currency to the USD. After you’ve entered the company information, save it.

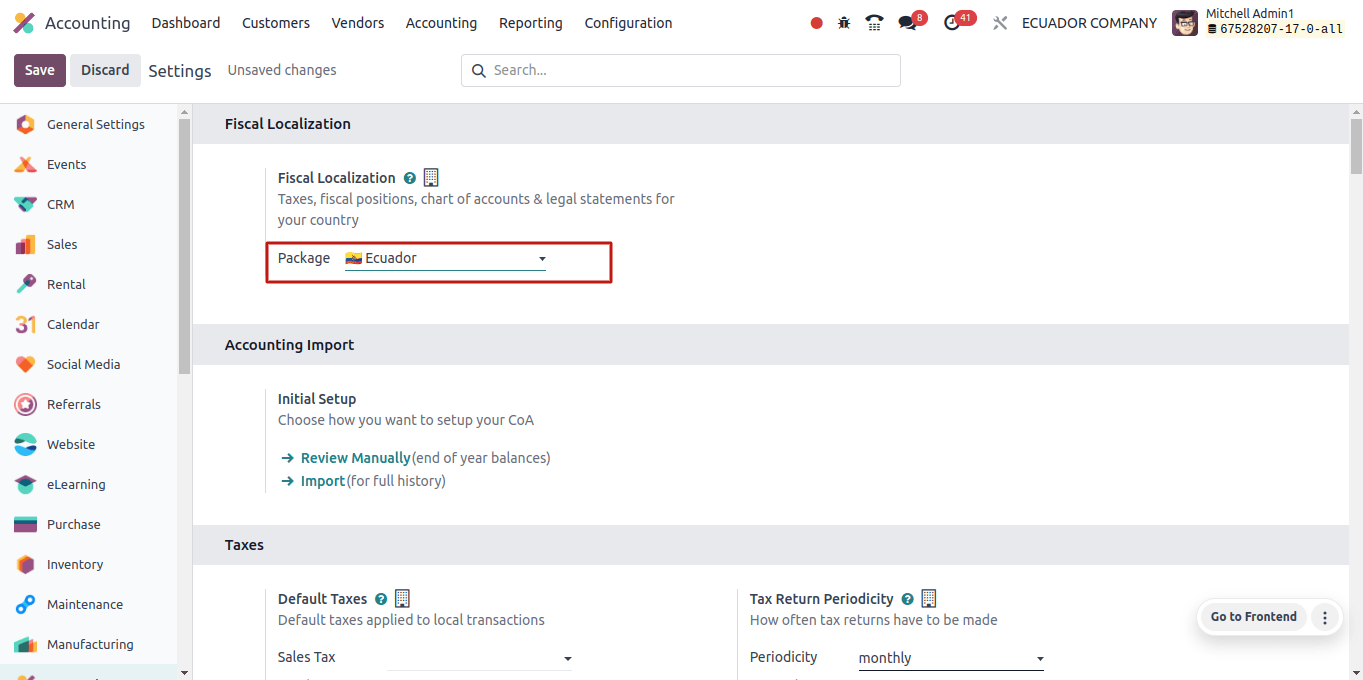

The next step is to set a localization package for this new company. To configure the localization package, go to the Accounting module in Odoo 17.

In the setup options, select Ecuador as the country package. This is the bundle designed specifically for Ecuadorian enterprises.

Changes occurred when Ecuadorian localization was configured

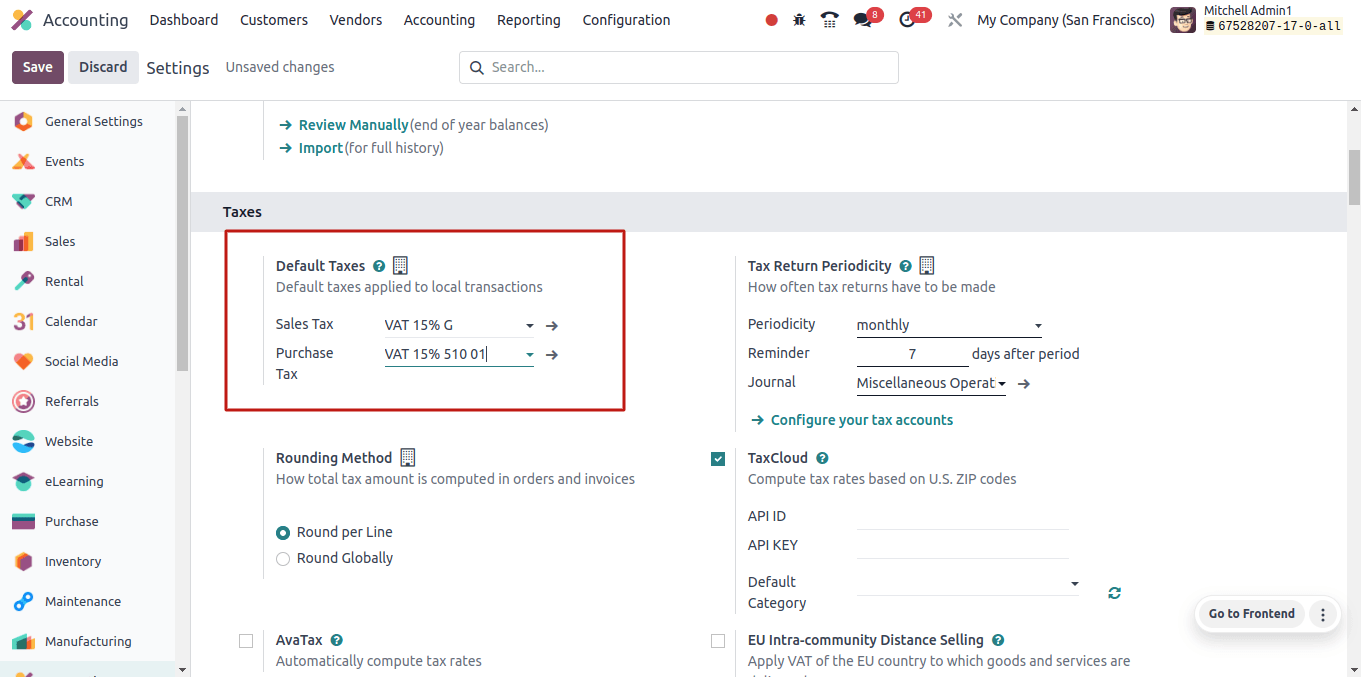

First, a default taxes field may be found in Configuration > Settings, under the Taxes section. We can manually configure the company’s default tax or let Odoo 17 do it for us.

When you save the package, Odoo will automatically set the company’s default tax.

Ecuadorian companies use ‘VAT 15% G’ as the default sales tax and ‘VAT 15% 510 01’ as the default purchase tax. There is a Fiscal Country field within the taxes field.

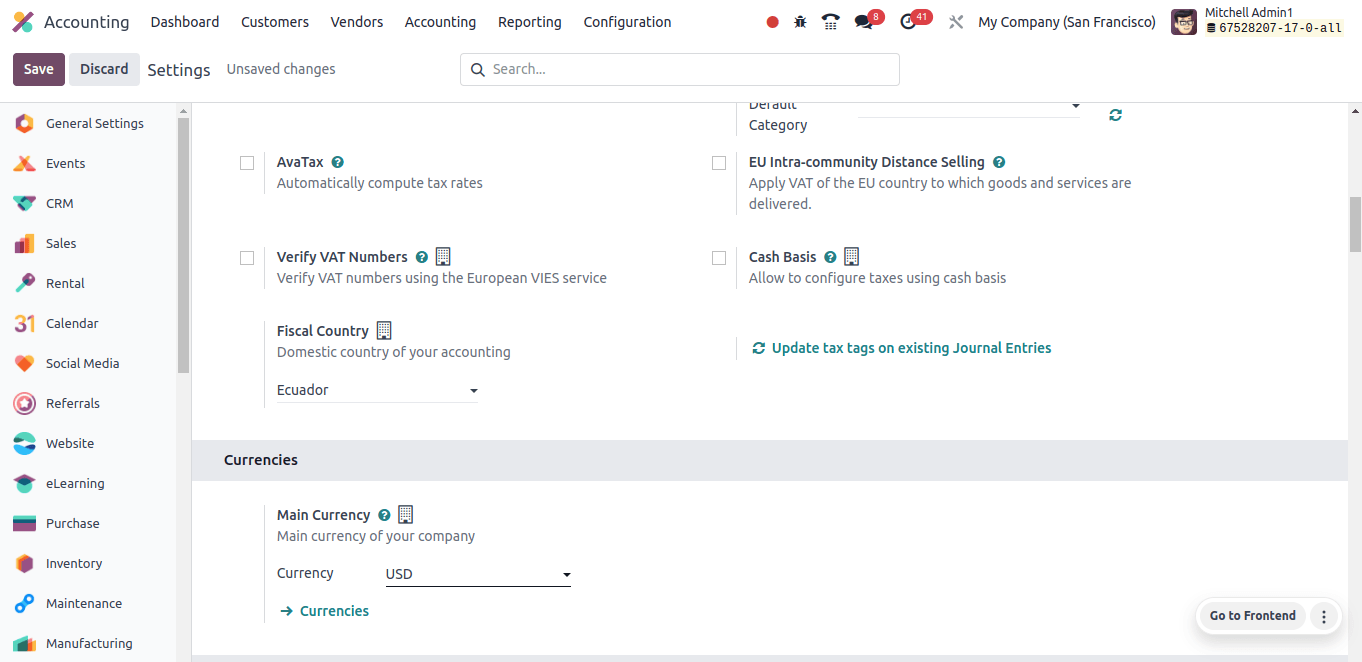

We can manually enter the name of the fiscal country. However, when we set the localization package for this company to Ecuador, Odoo 17 also sets the fiscal country to Ecuador.

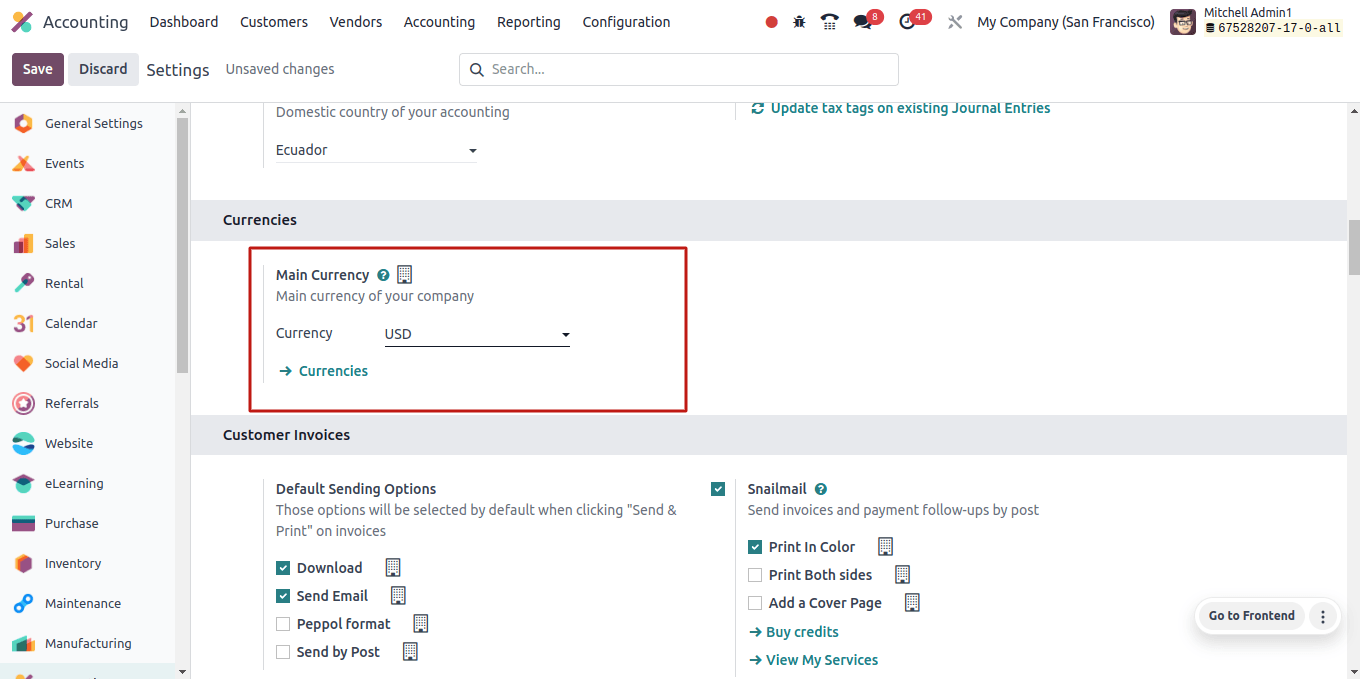

We know that Ecuador’s currency is the US dollar (USD). When we set up a localization package for the company Ecuador, Odoo automatically sets the main currency to the USD.

For this company, USD will be the primary currency, but we can also activate additional currencies by clicking the ‘Currency’ button under the Main Currency.

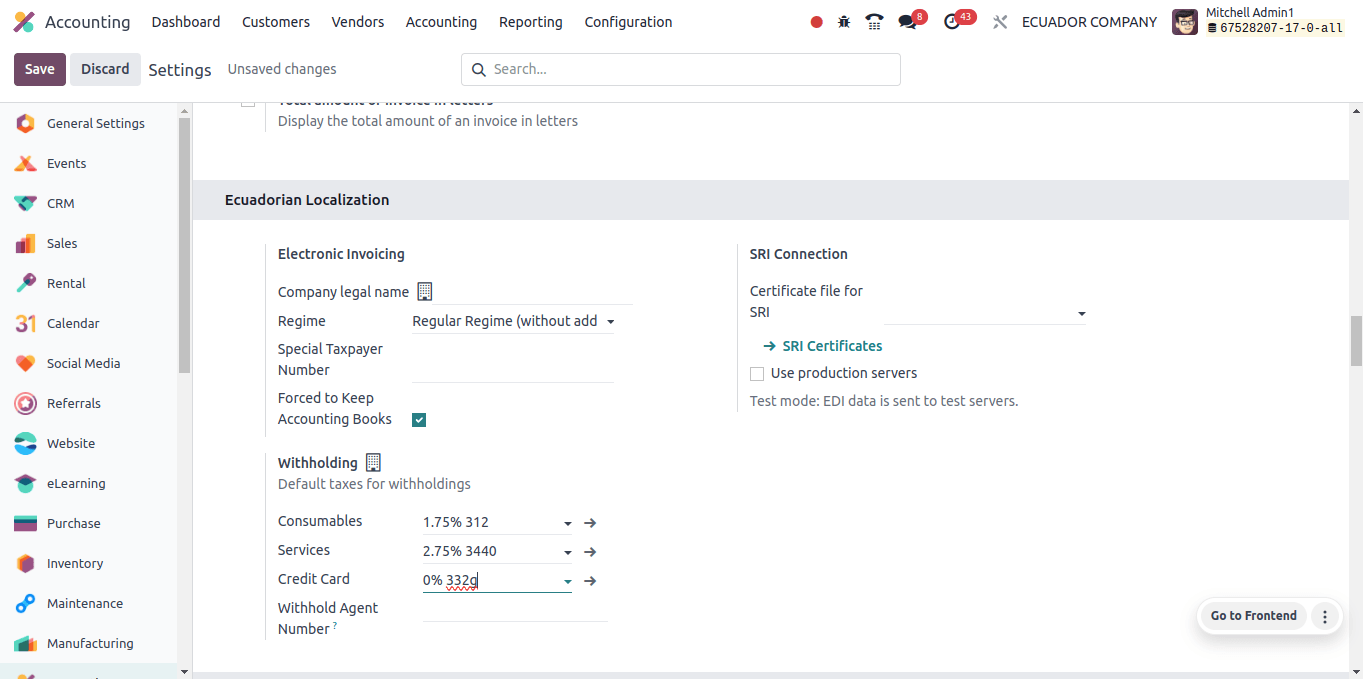

The 'Ecuadorian Localization' area has been added to the configuration tab. Under this part, we can offer the information required to perform the electronic invoice service.

Many companies are required to submit electronic invoices. It includes sending and receiving bills in a digital format that follows official guidelines.

Odoo 17, an accounting tool, may help you manage electronic bills in Ecuador.

Company legal name: This is used to represent the company on electronic invoices.

Regime: Tax regimes govern tax rates, permissible expenses, and reporting requirements for effective accounting. Odoo must be configured with the correct regime.

Special Taxpayer Number: The Unique Taxpayer Registry (RUC) is the most popular method for identifying taxpayers. It is not usually limited to "special" taxpayers.

Forced to Keep Accounting Books: When we enable this feature, businesses can keep comprehensive and accurate financial records as required by law.

Withholding Consumable: refers to the practice of withholding a portion of the payment made for specific consumables purchased from a supplier. The withheld funds are then transferred to the Ecuadorian government on the buyer's behalf.

Withholding Service: refers to the practice of keeping a portion of the money you provide a vendor or supplier before handing them the entire amount.

The withheld money is then remitted to the Ecuadorian government on behalf of the supplier, typically in lieu of income taxes or other mandatory payments.

Withholding Credit Card: Refers to a specific tax withholding technique for purchases made with SRI-issued credit or debit cards.

Withhold Agent Number: The Internal Revenue Service of Ecuador's (SRI) resolution number recognizes a business as a withholding agent.

Certificate file for SRI: It is a digital certificate that Ecuador's Internal Revenue Service (SRI) uses for electronic invoicing.

When sending electronic invoices, this certificate is required to provide a secure and reliable communication between your Odoo system and the SRI.

Production servers: Real-time server environment that allows you to access and save your current accounting data for day-to-day activities.

It is the server that handles reporting and real-time financial transactions for your Odoo application and database.

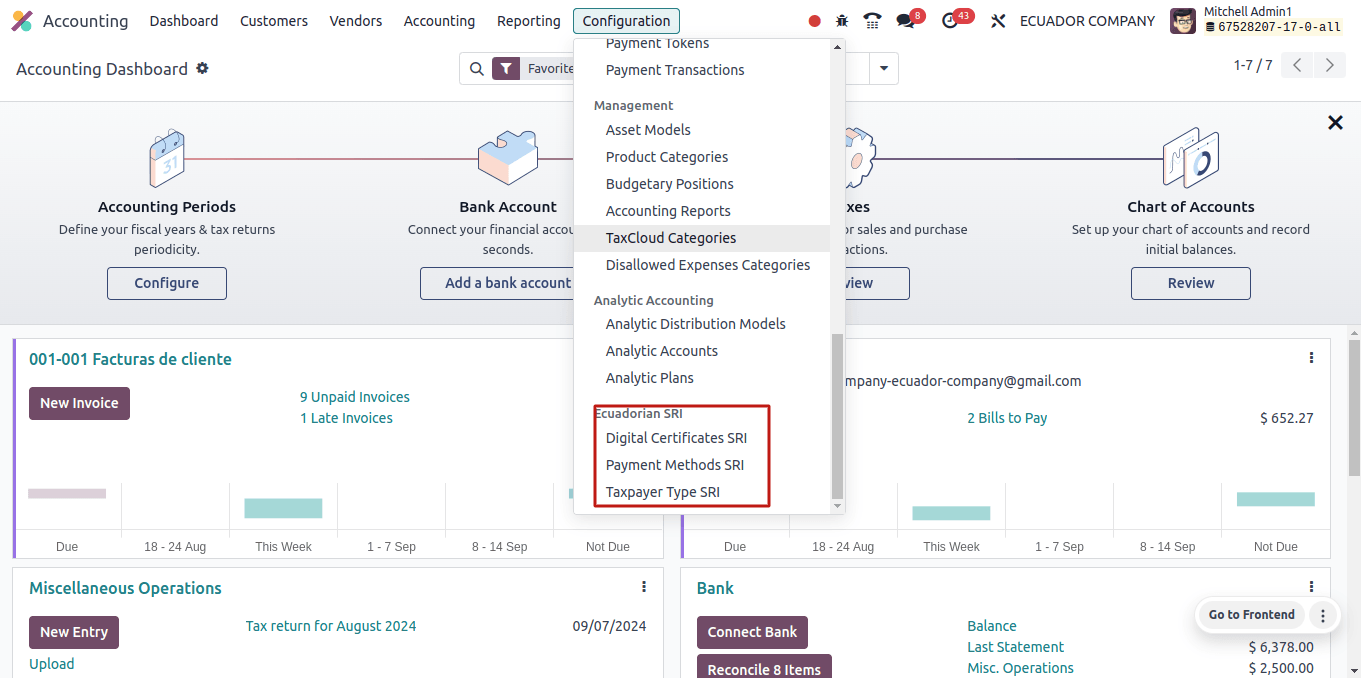

A new section called 'Ecuadorian SRI' has been added to the Configuration menu, with three sub-menus: Digital certificate SRI, Payment Method SRI, and Taxpayer Type SRI.

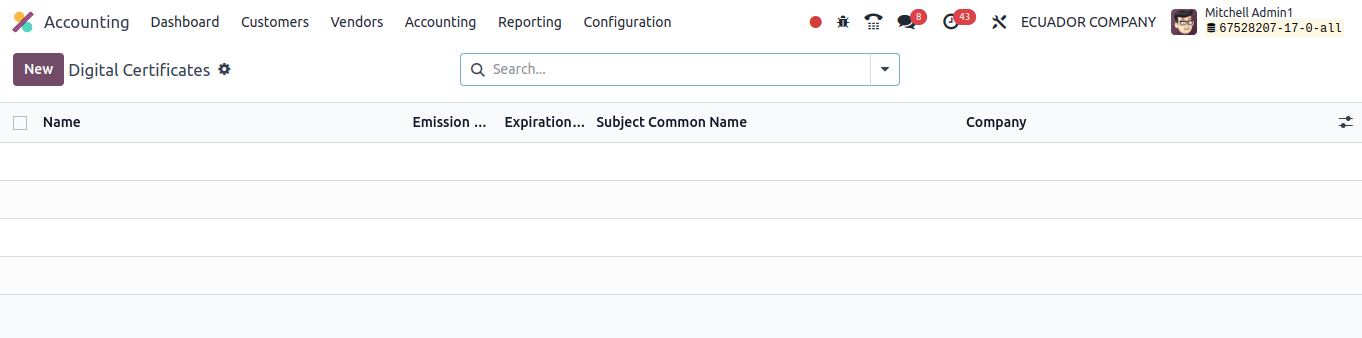

Digital Certificate SRI: This is a digital certificate issued by an Ecuadorian recognized. This certificate serves as your electronic signature, assuring the legitimacy and consistency of electronic documents submitted to Ecuador’s Internal Revenue Service, or Servicio de Rentas Internas (SRI).

Clicking the new button allows you to create digital certificates from the company.

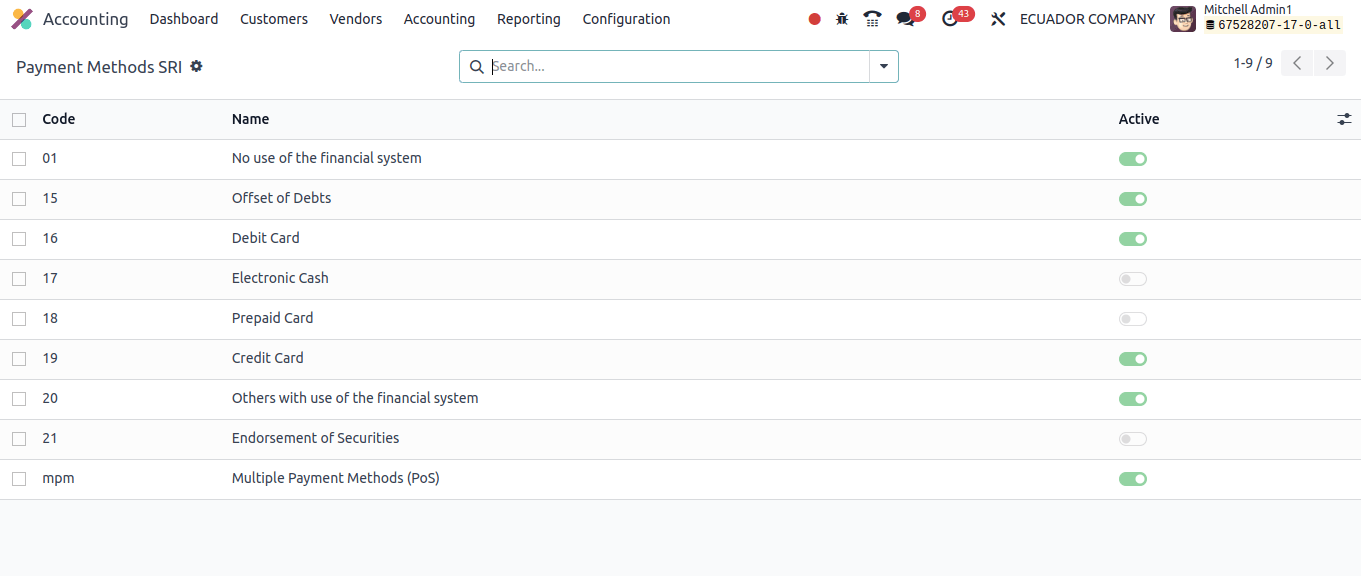

Payment methods SRI: The actual payment processing is unconnected to Odoo's "Payment Method SRI" for Ecuador.

It connects the electronic invoicing system mandated by the SRI, the Ecuadorian tax office, with the payment alternatives you've chosen in Odoo.

Click the payment method SRI sub-menu to open, and there we can see the payment method SRI for Ecuadorian enterprises.

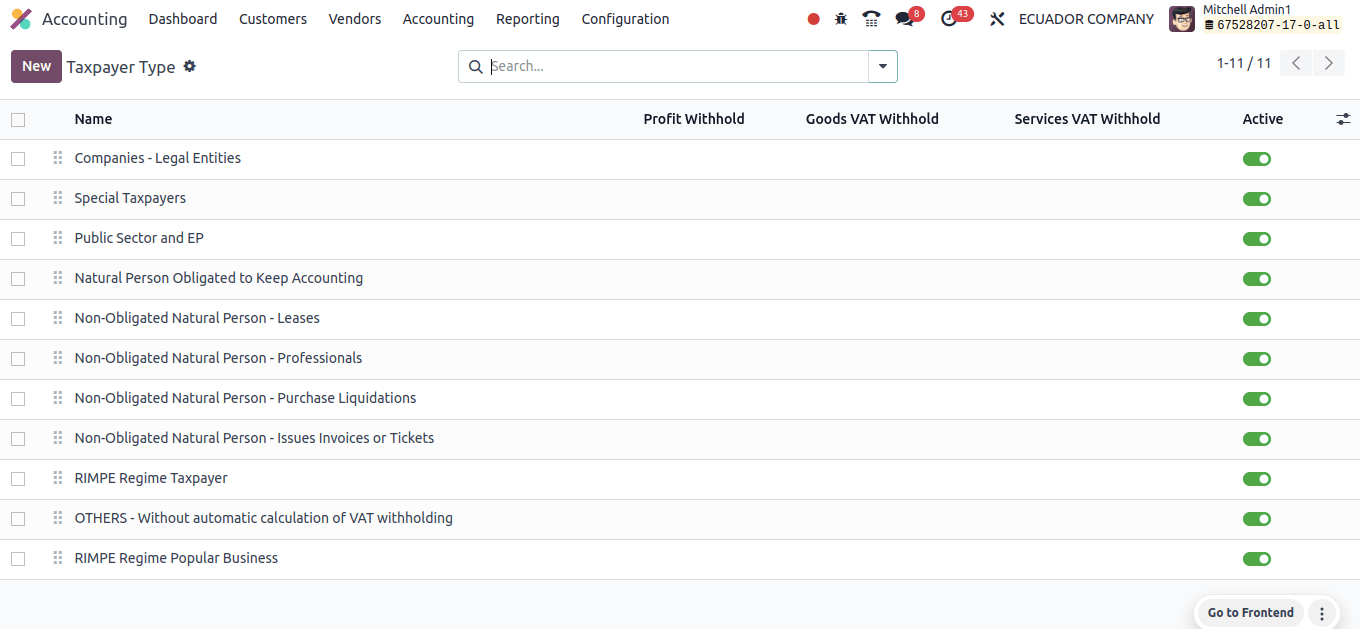

The above image shows the SRI payment methods used by Ecuadorian businesses. The following is the Taxpayer Type SRI.

Taxpayer type SRI: It is an important feature that allows for computerized invoicing and tax calculations based on your company's Ecuadorian tax status.

This box allows you to select the appropriate taxpayer category according to your company's SRI business registration.

The image above shows the default Taxpayer type used by Ecuadorian companies. We may also add a new Taxpayer type by clicking the New button.

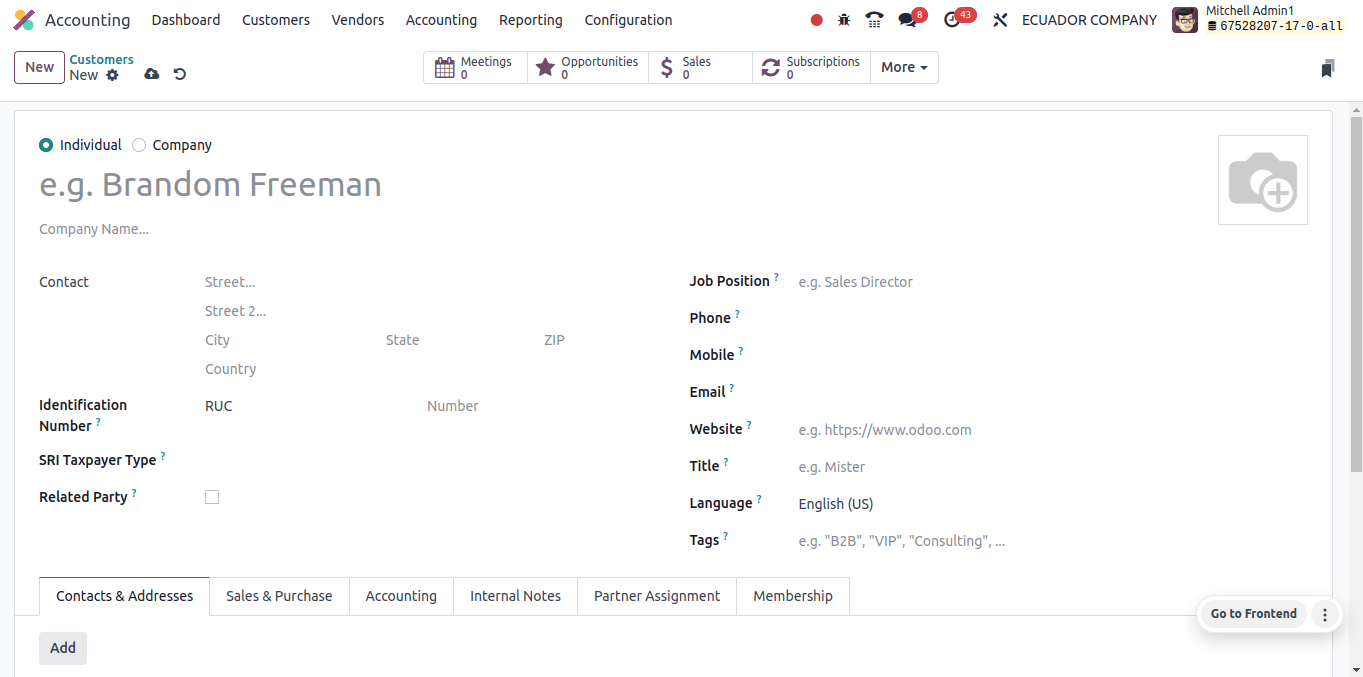

When we examine Ecuadorian firms' partner forms, we see two more fields: SRI Taxpayer Type and Related Party.

In the SRI Tax Payer Type section, we can select a Taxpayer Type from a dropdown list to designate the taxpayer category for business partners in this company.

Related parties are other firms or individuals who have a direct or indirect interest in your company’s management, administration, control, or capital. If your partner is a connected party, enable this option.

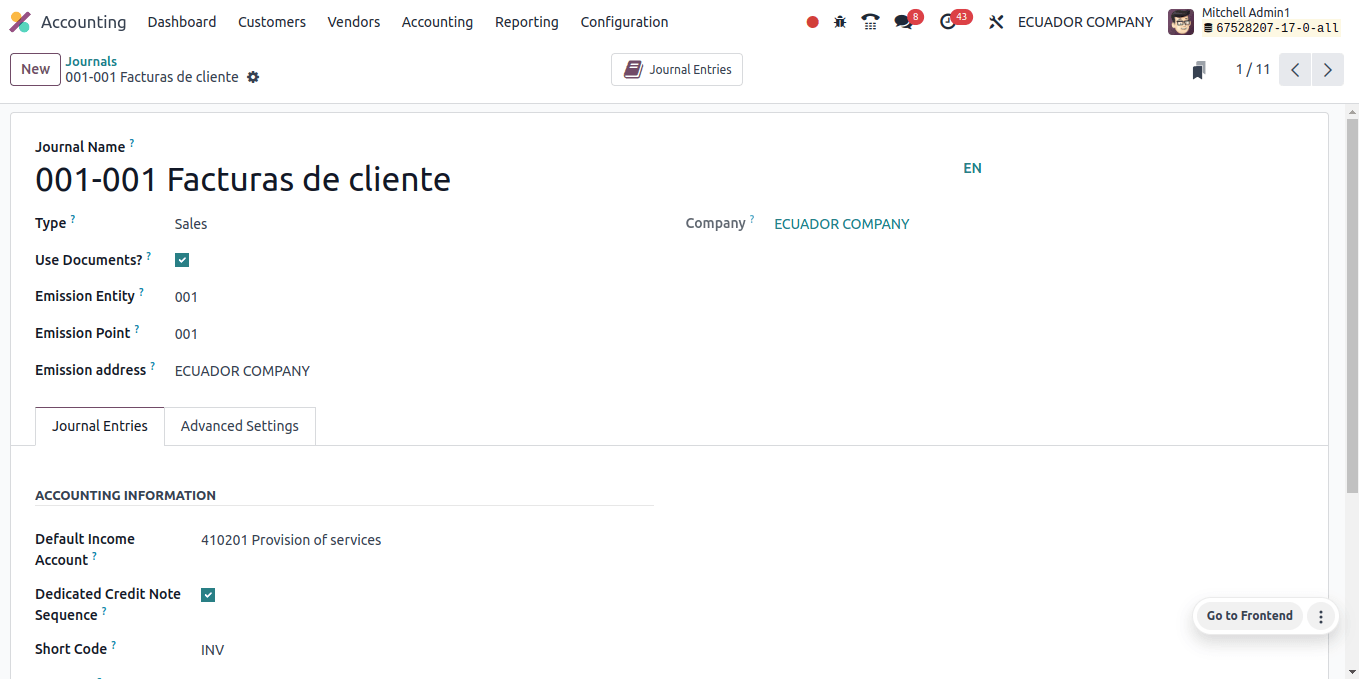

After clicking in the Configuration menu, select the Journals sub-menu and then the sales journal from the list of journals.

We may observe that use documents, emission entity, emission point, emission address are extra categories added especially for Ecuadorian businesses in the sales journal.

Emission Entity is the field used to specify the entity that issues electronic invoices, which is usually your company. There is another way: activate and deactivate the Use Documents option.

If the Use Document option is enabled, this journal will be used for legal invoicing; otherwise, it will be used to record accounting entries unrelated to billing legal documents.

Emission point refers to a specific location or department within your firm that has been granted permission to transmit an electronic invoice, and the Emission point number is assigned by SRI.

The next field is the Emission Address, which is the address of the company issuing the electronic invoice.

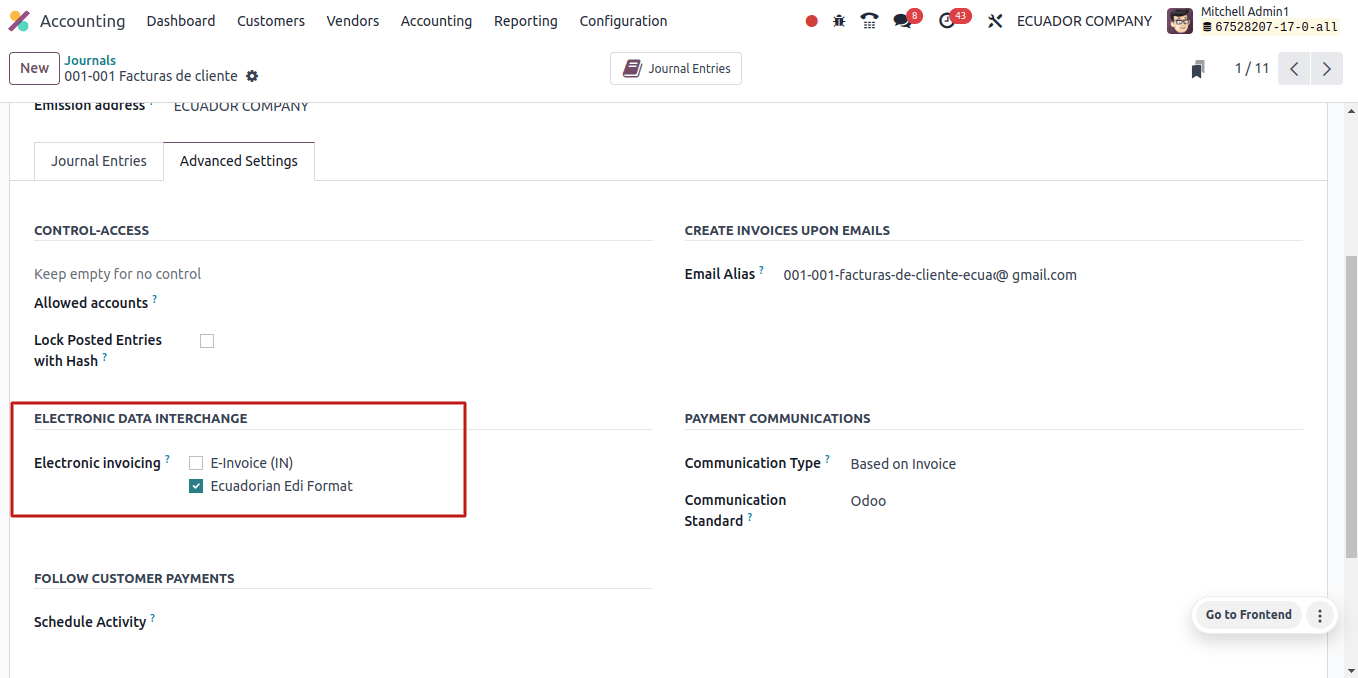

Electronic data interchange is an additional section under the Advanced Settings tab of the sales journal, and it is here that we can enable electronic invoicing. Once this electronic invoicing option is enabled, XML or EDI invoices will be sent.

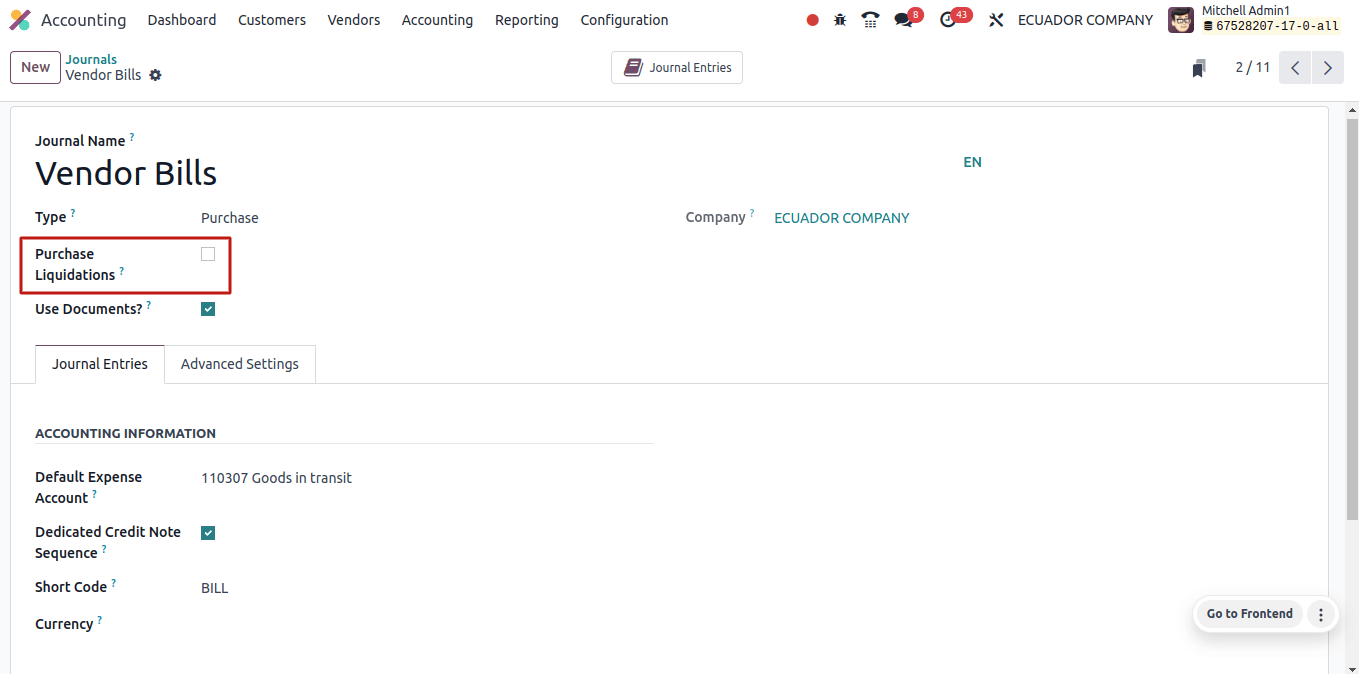

When we go to the buy journal, we can see an option to initiate the purchase liquidation.

Purchase liquidation is a specific document used to pay for products or services from a non-resident source who does not typically send out invoices on a regular basis. If the selected journal is only for buy liquidation, enable this option.

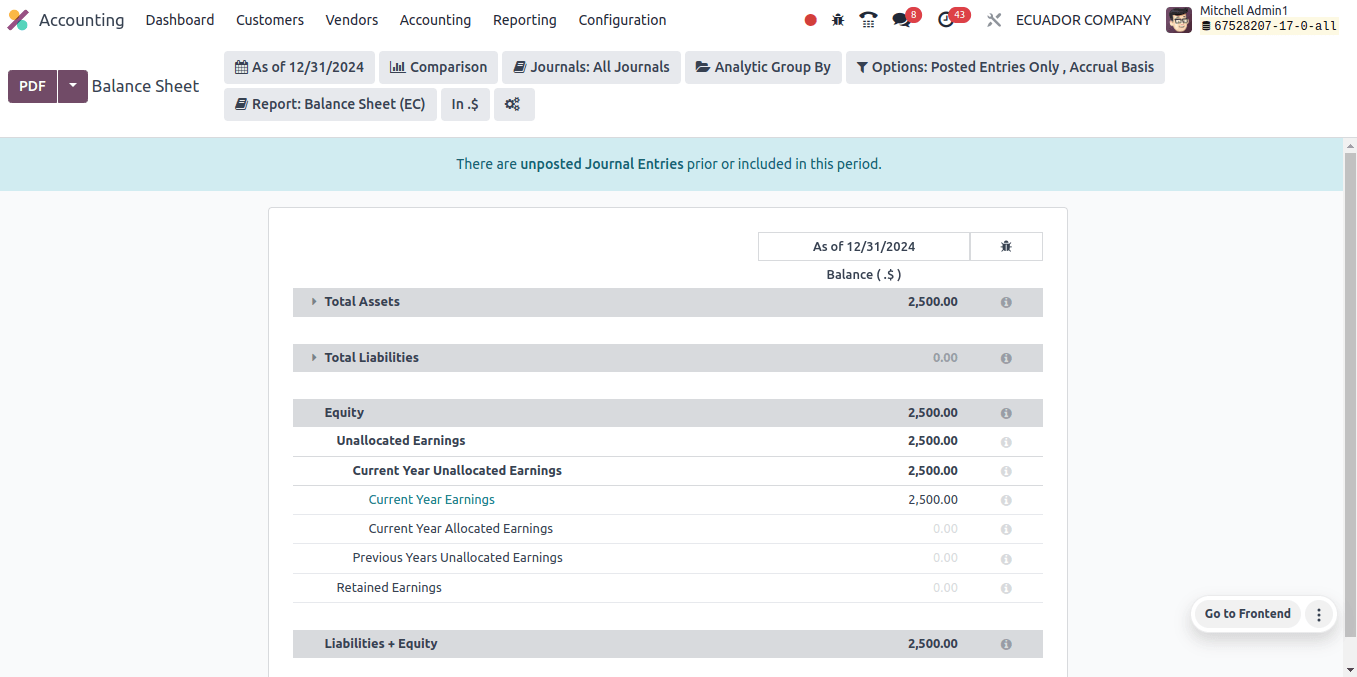

A balance sheet in Odoo 17 is a sort of financial report that reveals the state of a company’s finances as of a specific date. It describes three important factors.

Assets: On the Odoo 17 balance sheet, assets are the economic resources that a firm has and have the ability to be converted into cash at a later date.

Odoo 17 categorizes these assets based on their projected holding time and convertibility.

Liability: Liabilities in an Odoo 17 balance sheet represent the money a company owes to others. They are the company's principal sources of funding, but they also entail a debt that must be repaid eventually.

Equity: The financial statement shows the entire amount of stock invested by the owner in Odoo. It shows the company's net worth, which is calculated as,

Equity = Asset - Liability

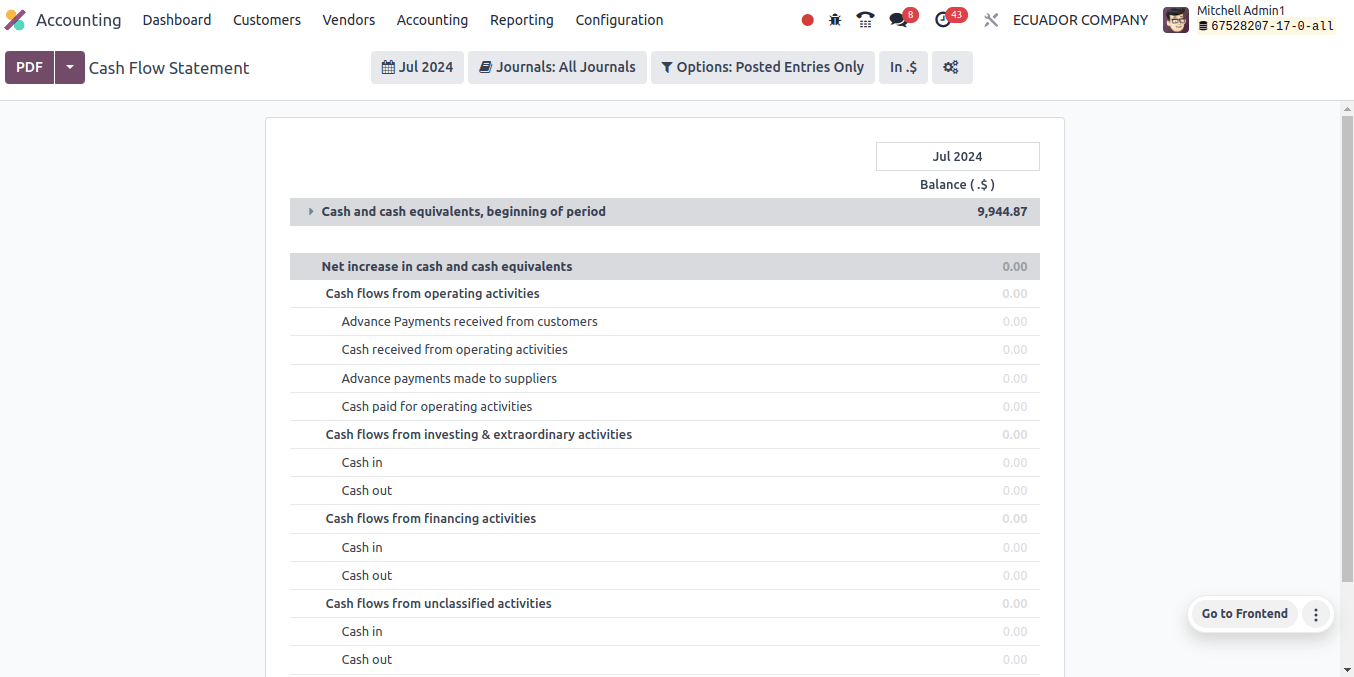

A cash flow statement in Odoo 17 is a financial report that lists a company's cash inflows and outflows over a specific time period. It helps you acquire insight into how efficiently your company provides and manages cash to pay its debts.

Ecuadorian companies' cash flow statements comprise cash and cash equivalents, the beginning of the period, the net increase in cash and cash equivalents, Cash flow from operating activities, investment and special activities, unclassified activities, and so on.

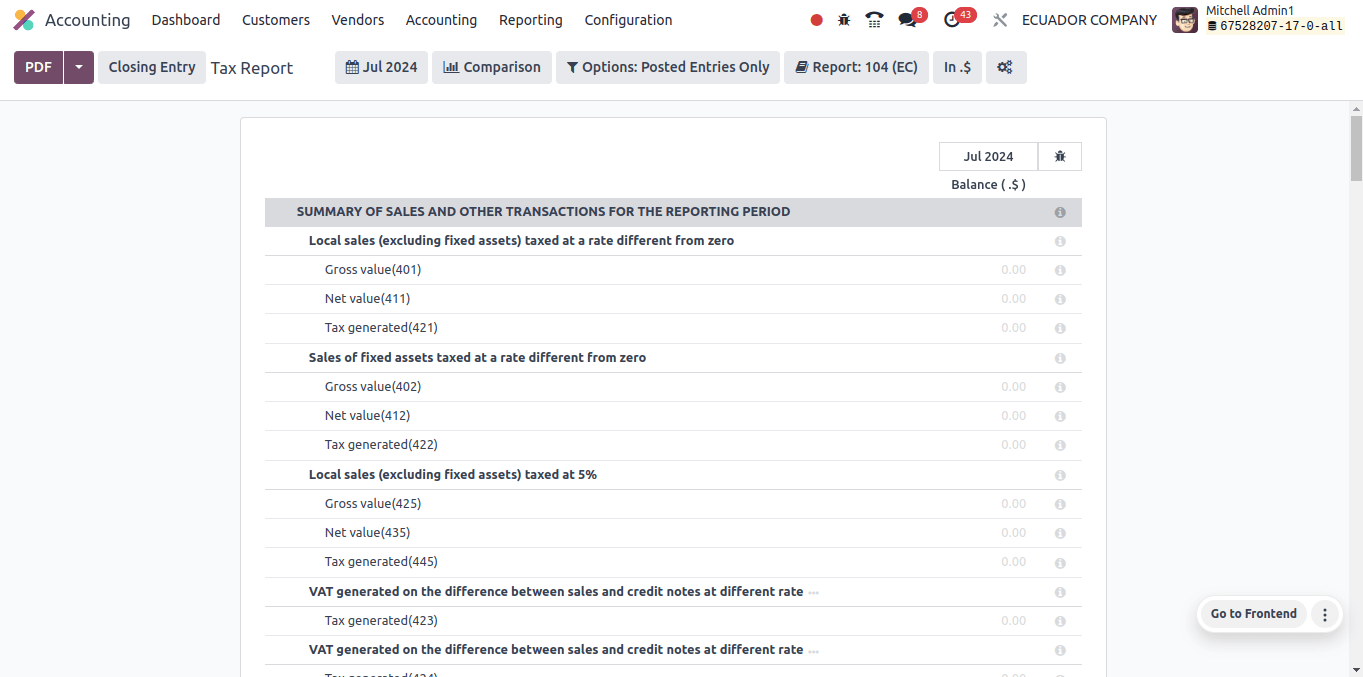

Odoo 17 tax reports are used to compile tax data for a specific time period (month, quarter, or year). Following that, the relevant authorities receive tax returns based on this information.

The tax report of the companies in Ecuador contains local sales (excluding fixed assets) taxed at a rate other than zero.

Sales of fixed assets taxed at a non-zero rate, VAT generated on the difference between sales and credit notes at varying rates, Sales of fixed assets taxed at 0% and not eligible for tax credits, exports of goods, etc.

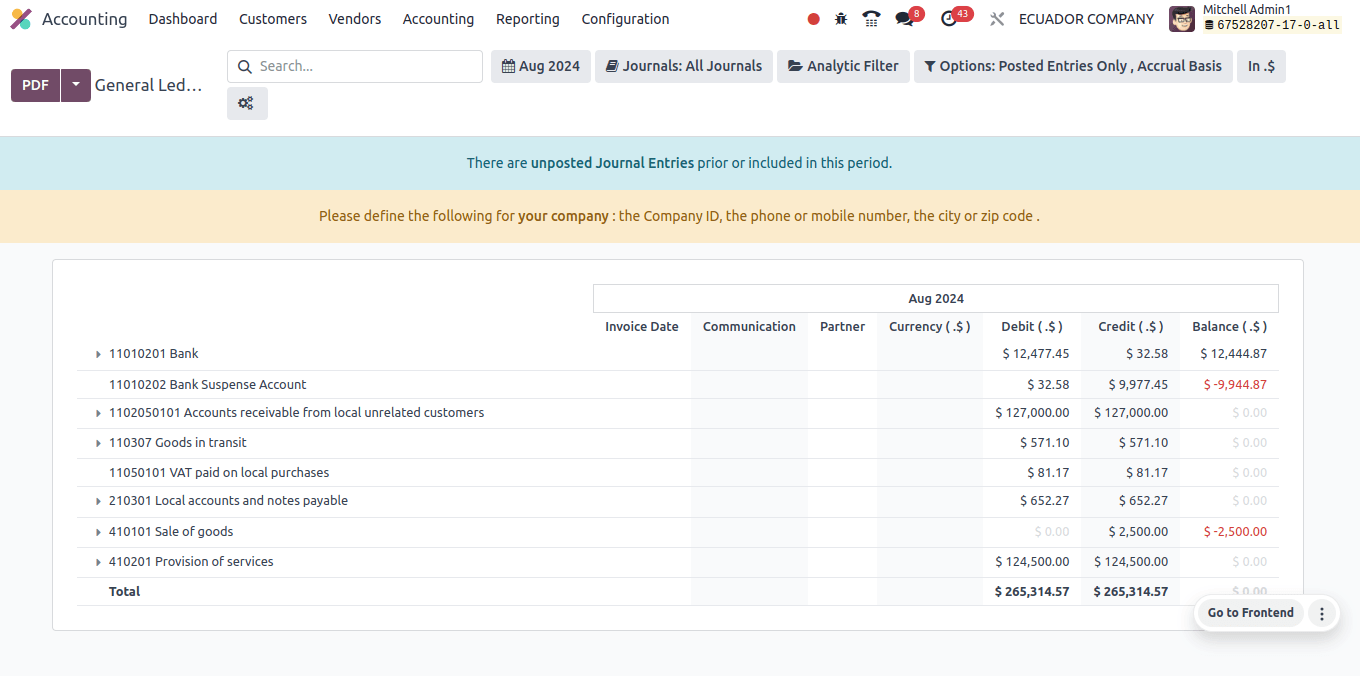

The general ledger is a key element of Odoo17's accounting module, serving as a central repository for all of your company's financial activities. It provides a detailed examination of each account in your chart of accounts.

Using a general ledger suited to a certain country will ensure that your chart of accounts is in accordance with the specific accounts required by regional tax laws and accounting standards.

This reduces the risk of errors or noncompliance with financial reporting standards.

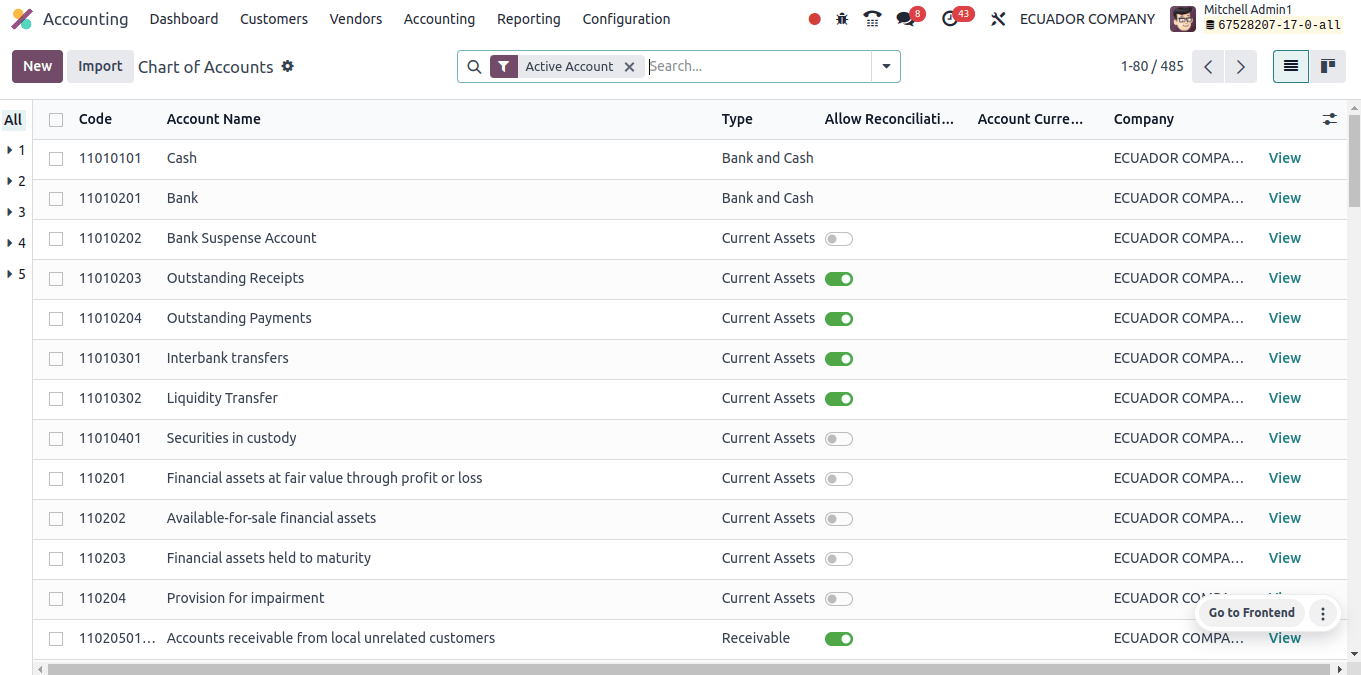

Your Odoo accounting system is built around the chart of accounts. It serves as a comprehensive list of all the accounts you use to track your financial activities. The chart of accounts for Ecuadorian companies depicts the typical accounts used by Ecuadorian businesses.

Overall, we can claim that Odoo 17's accounting localization for each region ensures compliance with state and federal tax rules, which is a huge benefit.

Modules customized for a single country arrive pre-configured to align the relevant accounts in your chart of accounts with regional standards.

This allows you to prevent potential fines and penalties by reducing the likelihood of errors or noncompliance during financial reporting.

Provide tools for automating tax computations in accordance with your country’s tax rules and rates. Reducing the need for human computations, it lowers errors and speeds the accounting process.