Employee expenses are fees incurred by employees while doing their job tasks for which their company reimburse them. These expenses may include transportation, food, housing, and supplies.

To efficiently control employee expenses, companies frequently set exact cost regulations and standards that specify which expenses are eligible for reimbursement and the accompanying documentation required for each claim.

When working on a project, an employee may incur expenses, such as travel charges. It is important in these cases to invoice the consumer for such expenses. Odoo 16 makes it easy to assign employee expenses to a specific project in a few clicks.

First, ensure that the project management and employee expense modules are installed. Then, keep track of the employee’s spending and provide a comment about the project in the expense details.

Odoo allows you to link expenses to projects by selecting the right document from a dropdown menu when filling out an expense report.

It will be easy to track project expenses after they have been submitted and authorized because they will be automatically connected to your chosen project.

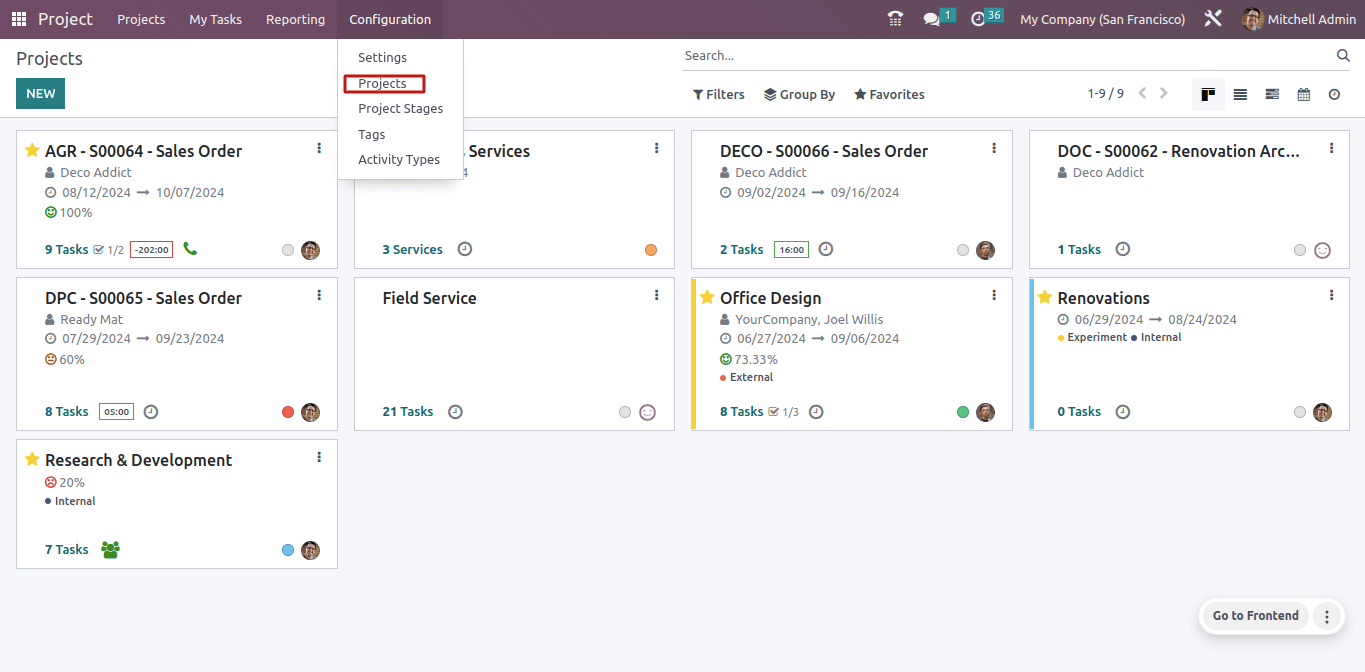

So let’s start by creating a project. To do so, go to the project module in Odoo 16. The project module dashboard includes a list of previously setup projects.

The user can either create a new project from the dashboard or go to the configuration and then select the projects.

: Configuration > Projects > New

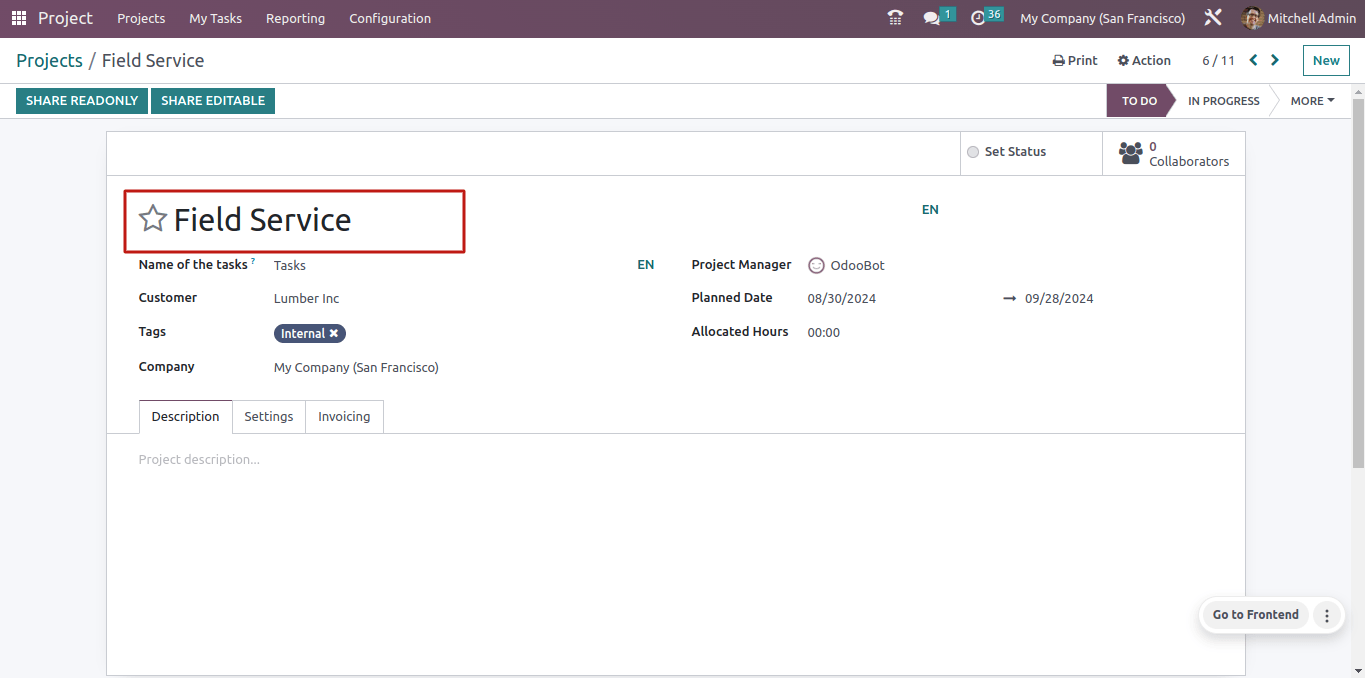

Here, the administrator starts a new project for the employee. So click the new button. Field service was the name given to the newly founded project. This is for a customer named Lumber Inc.

Details such as the project manager name, the planned date, the tag, the company name, and the allocated hours have been changed. To add more settings, select the settings tab. Then, after making your changes, save the project.

An employee is tasked with managing the field service project. Marc Demo. allows the employee to add a timesheet to the project. If any expenses are incurred to execute the task, these can be included to the customer’s invoice.

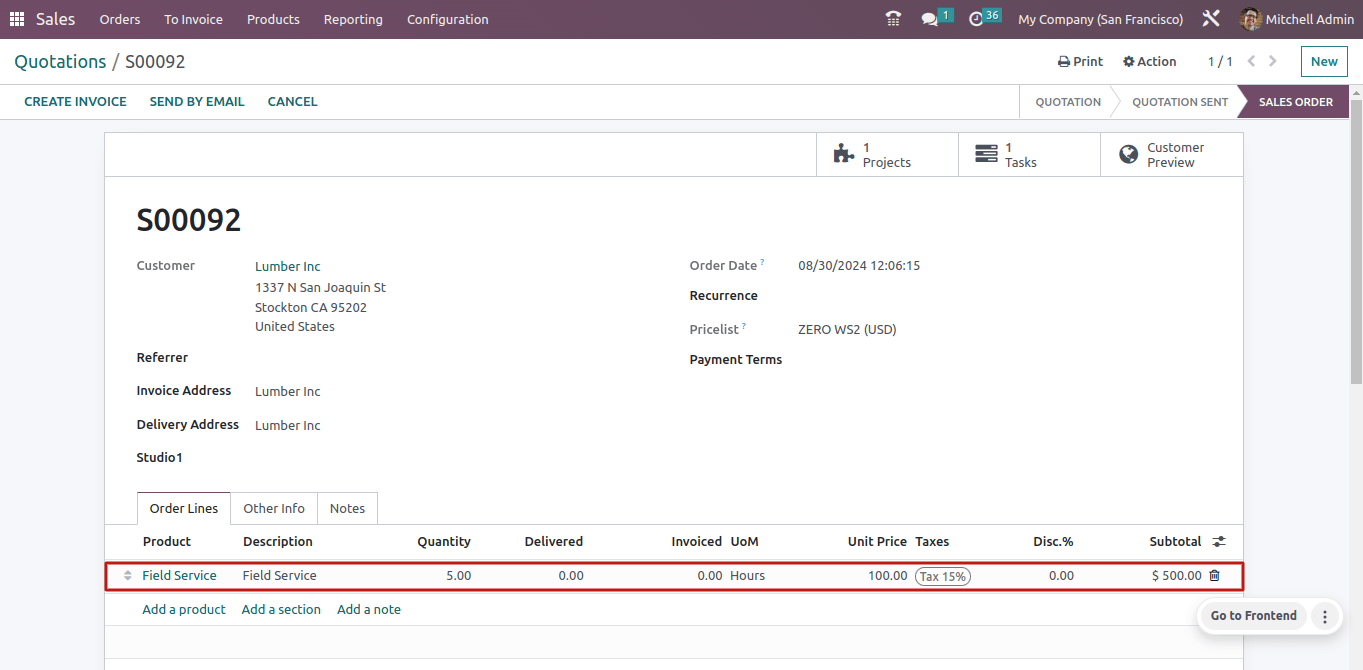

So, log in as Marc Demo. As a result, a sales order is generated for the customer. The product ‘Field Service Time’ is placed here since the employee must invoice both spent time and expenses on the same invoice. The product amount was added as 5 hours.

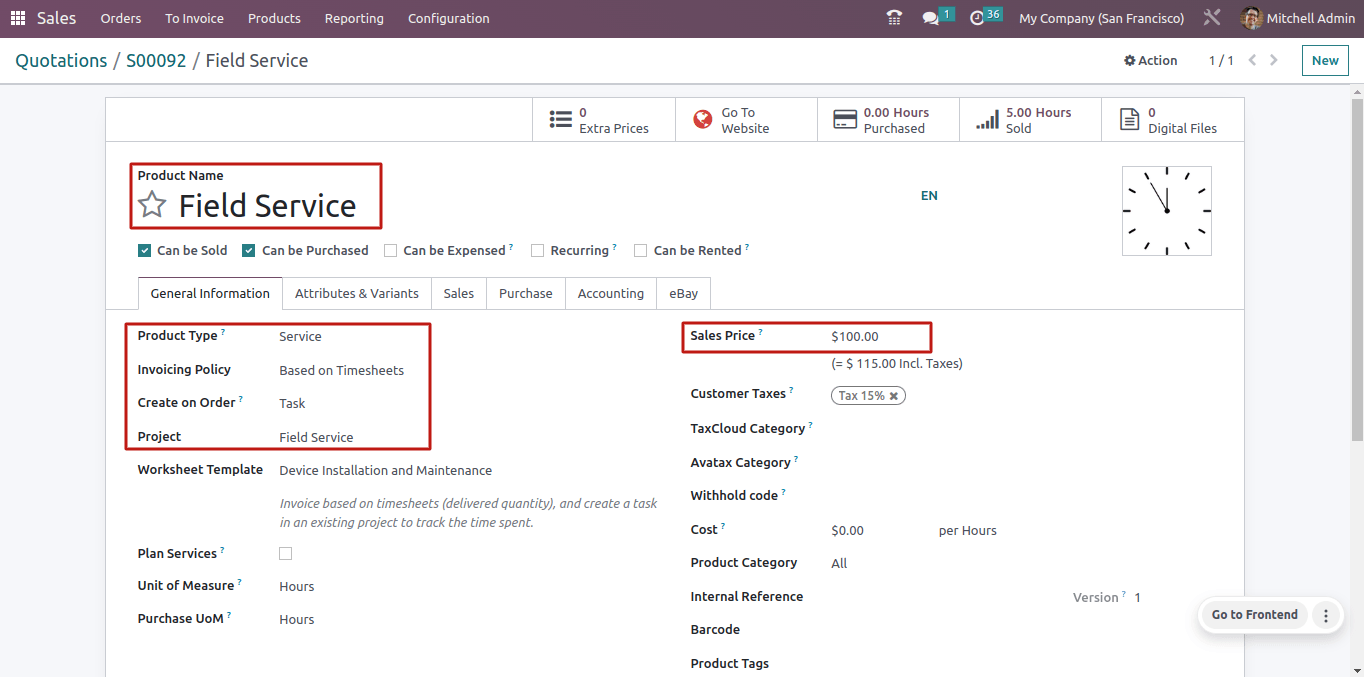

To test the product, open it via an external connection. The product type is service, and the invoicing policy is based on a timesheet.

The product sales price is set at $100, thus if the employee adds a one-hour timesheet, the invoice will be $100. Following the confirmation of the sale order, this product will set a task on the project named field service.

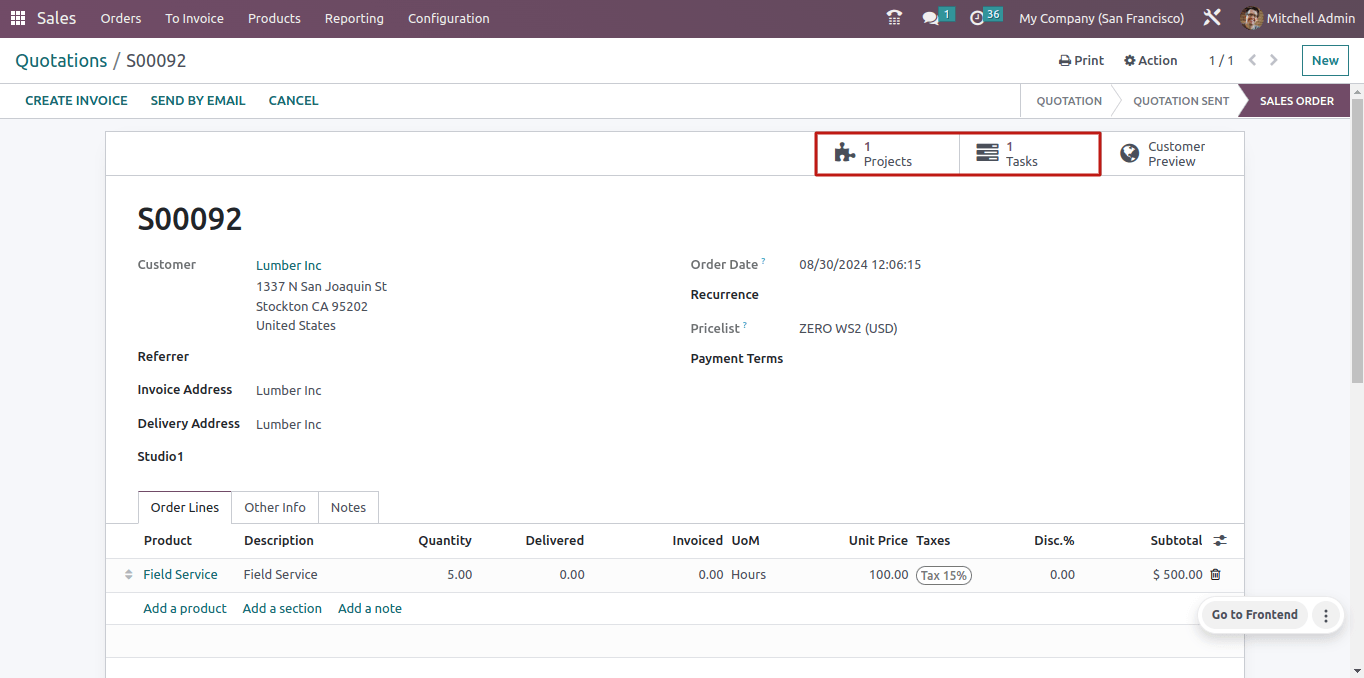

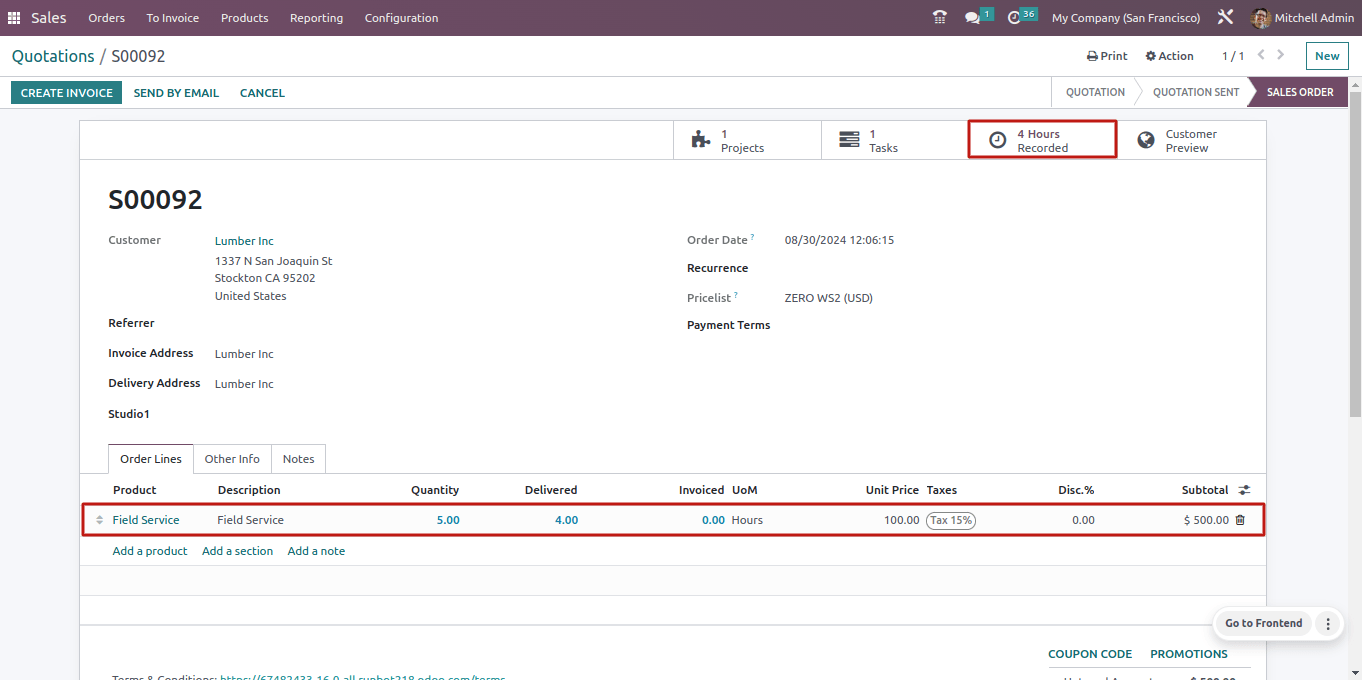

Confirm the sales order. Instead of delivery, two smart tabs were installed there. The first is a project, whereas the second is tasks. These smart tabs, ‘projects’, will direct the user to the same product developed by the administrator. The smart tab ‘Tasks’ indicates that a new task has been added to the project.

The employee travels to the Field and takes four hours to complete the assignment. So the time he takes to complete the assignment can be factored into the task. So, open the smart tab tasks.

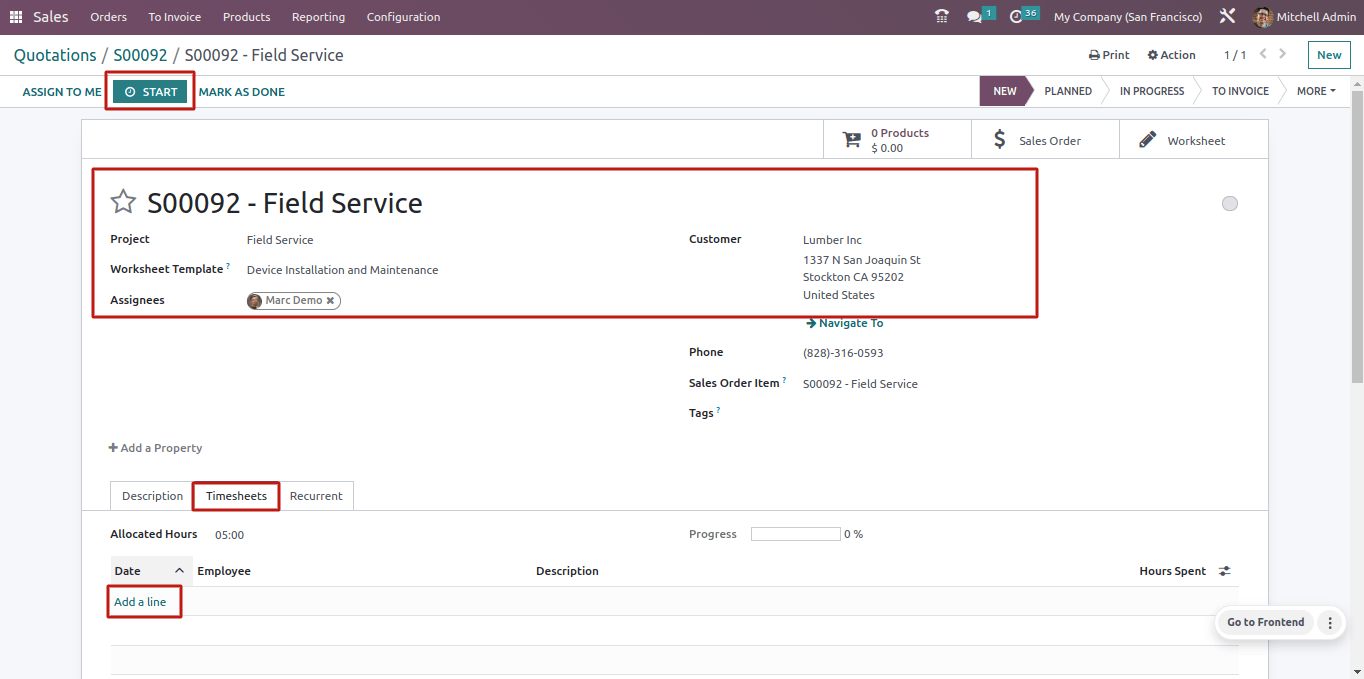

The task’s name is S00092 - Field Service. The project name, customer name, and order item are entered automatically. Marc Demo is the assigned person.

The assignee can create a timesheet in two ways. One option is to click on the START button in the upper left corner. The second method involves using the Add a Line option inside the Timesheet tab.

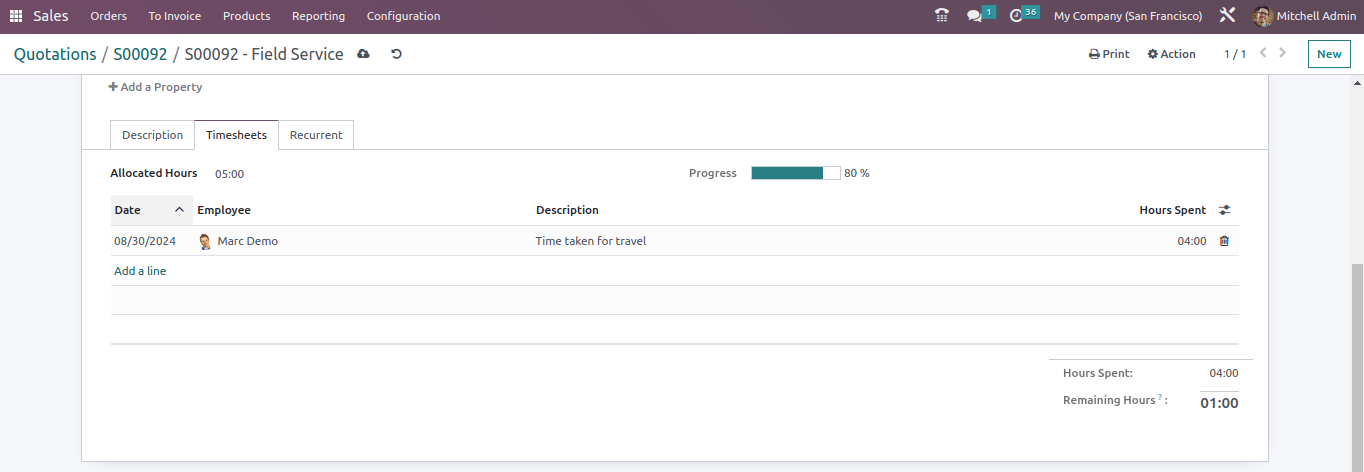

The employee added 4 hours for travel. Then return to the sales order. There, the time is updated automatically. A new smart tab called ‘ 4 hours Recorded’ has been added.

So, in order to fulfill the assignment, the employee incurs some fees, which are known as travel expenses. So the employee can include the expense in the same sales order. Let’s see how this works. For that, the employee must first enter his expenses into the system.

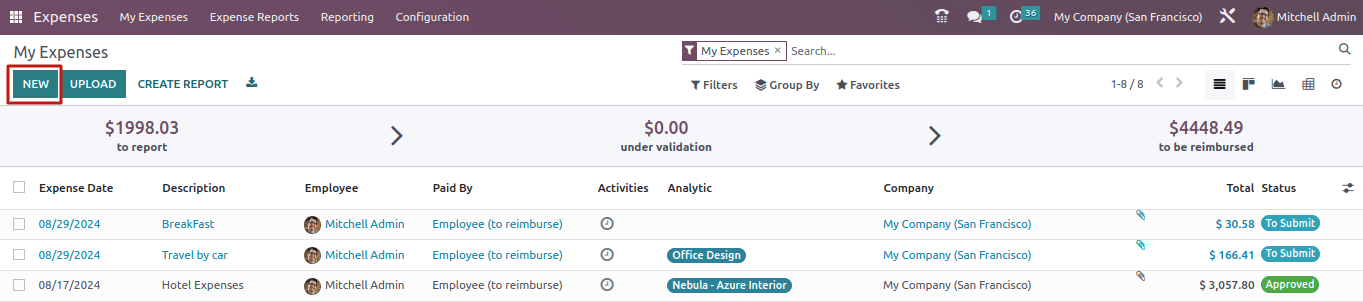

Which is possible using the Expense module. The dashboard displays all expenses produced for the employee Marc Demo; click the New button to add a new one.

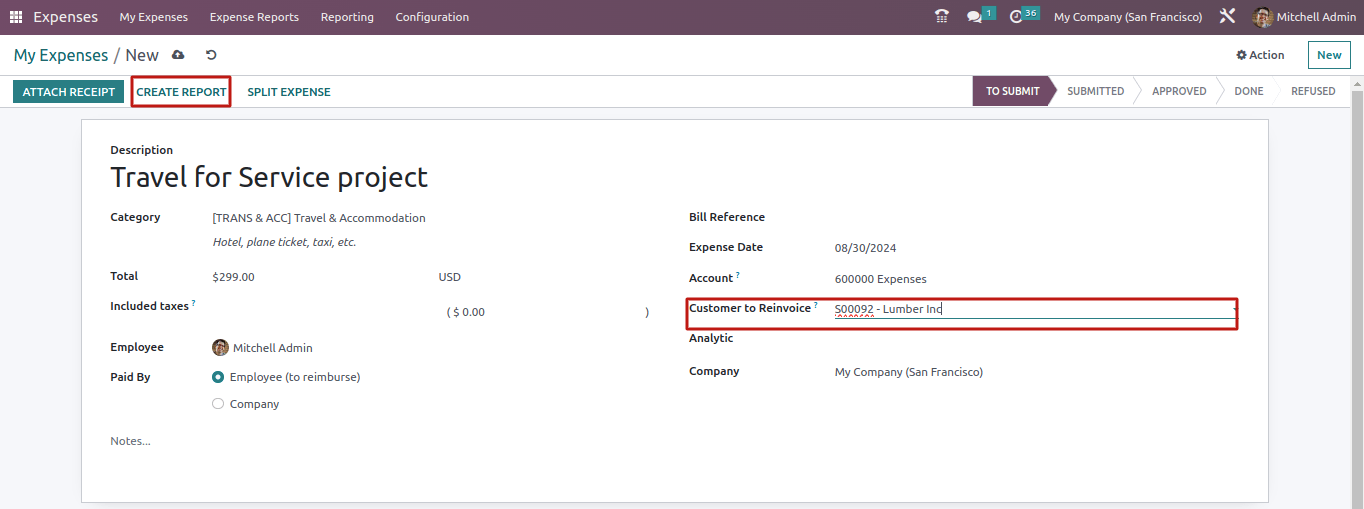

A cost was created with the description ‘Travel for Field Service Project’. The category chosen is Travel & Accommodation, and the total amount added is $299. Select the created sales order number from the customer to Re-Invoice field.

The employee can attach a receipt or bill to this expense by clicking the ATTACH RECEIPT button. Then create an expense report. The expense report includes all of the facts about the expense.

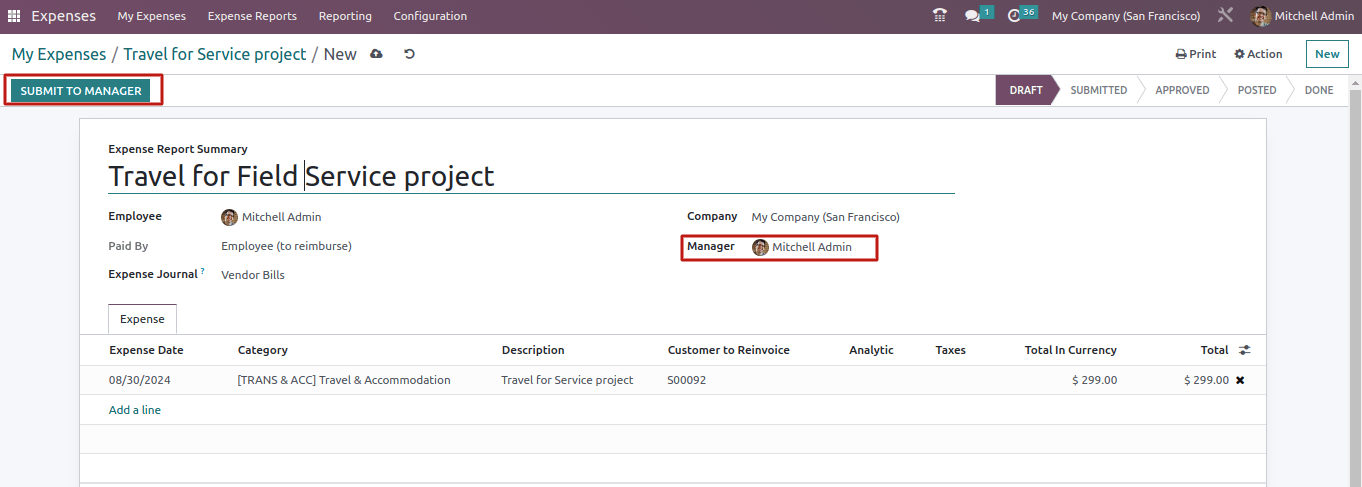

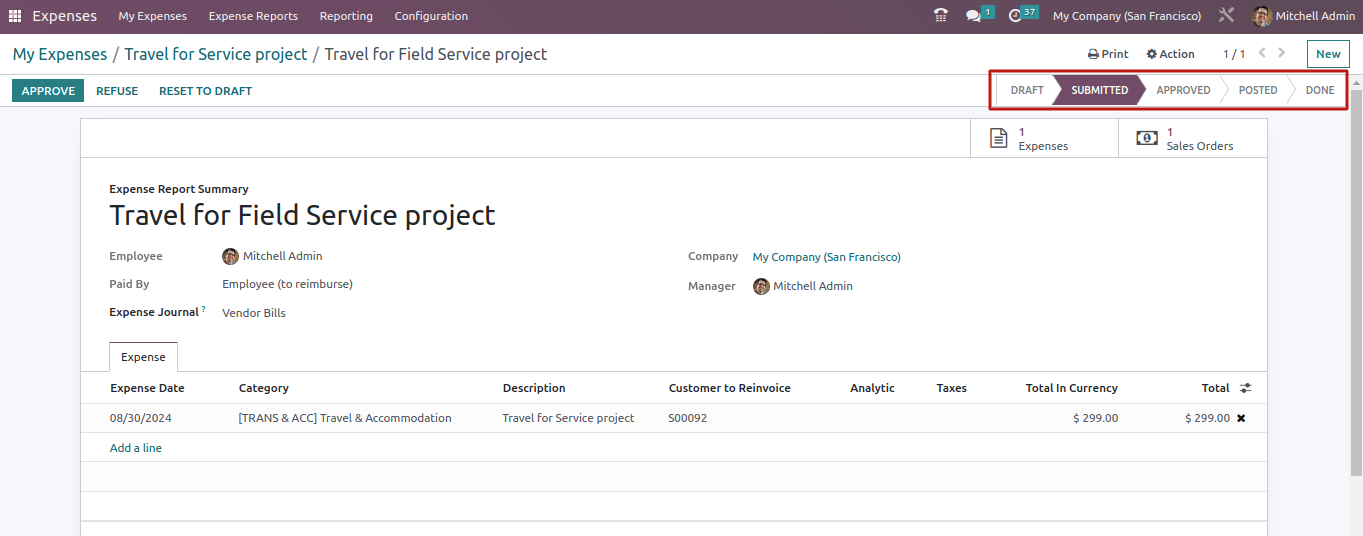

The employee must submit the report to his management for approval. So, the SUBMIT TO MANAGER button can be used to submit reports. The manager is Mitchell Admin. To stage then moved to submitted from draft.

The expense report is then moved to the submitted stage, where it awaits approval by the management.

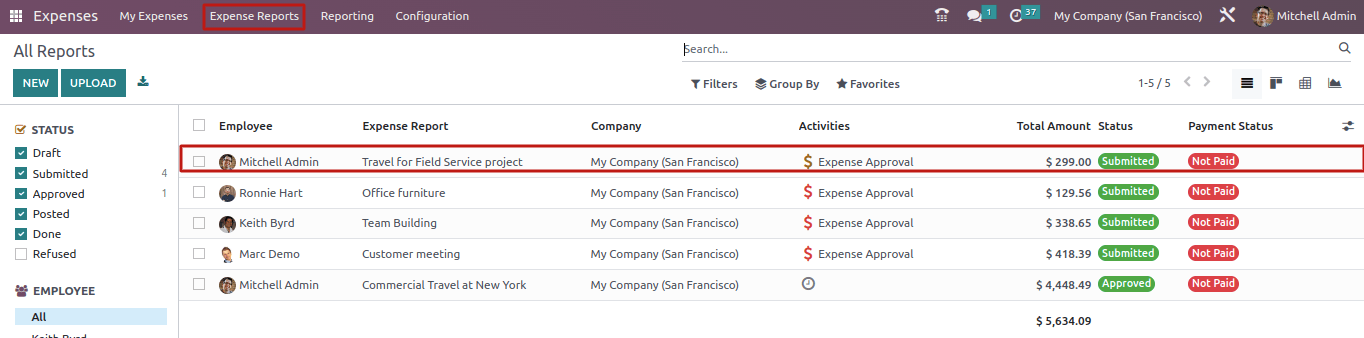

Log in as Mitchell Admin and select the expense module. The submitted report can be found via the expense report. Click on it to get the associated expense report submitted.

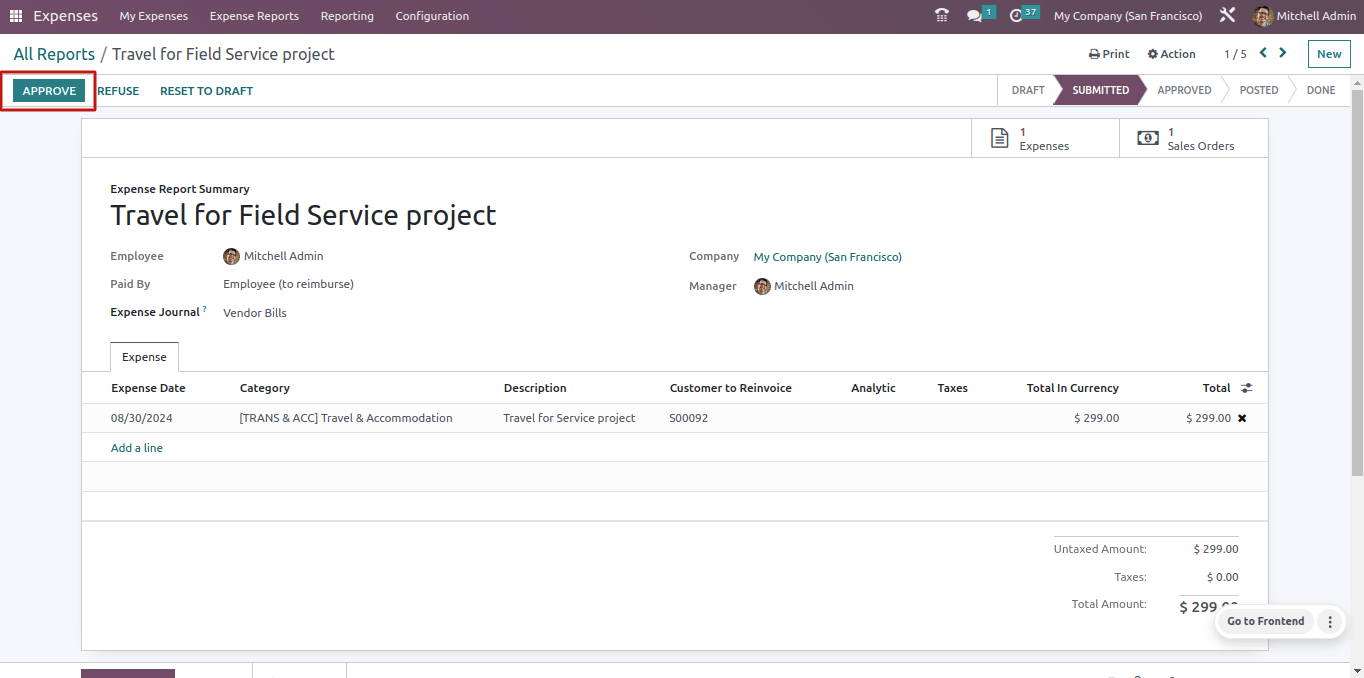

After confirming the expense report, the administrator can approve it with a single click. Click the APPROVE button located on the left side.

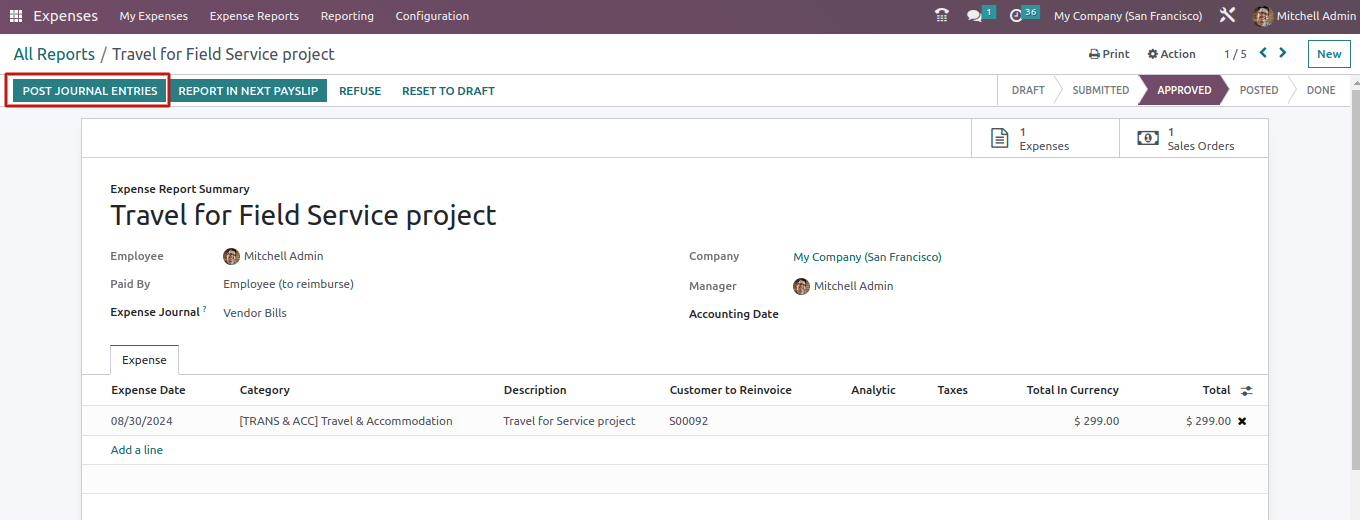

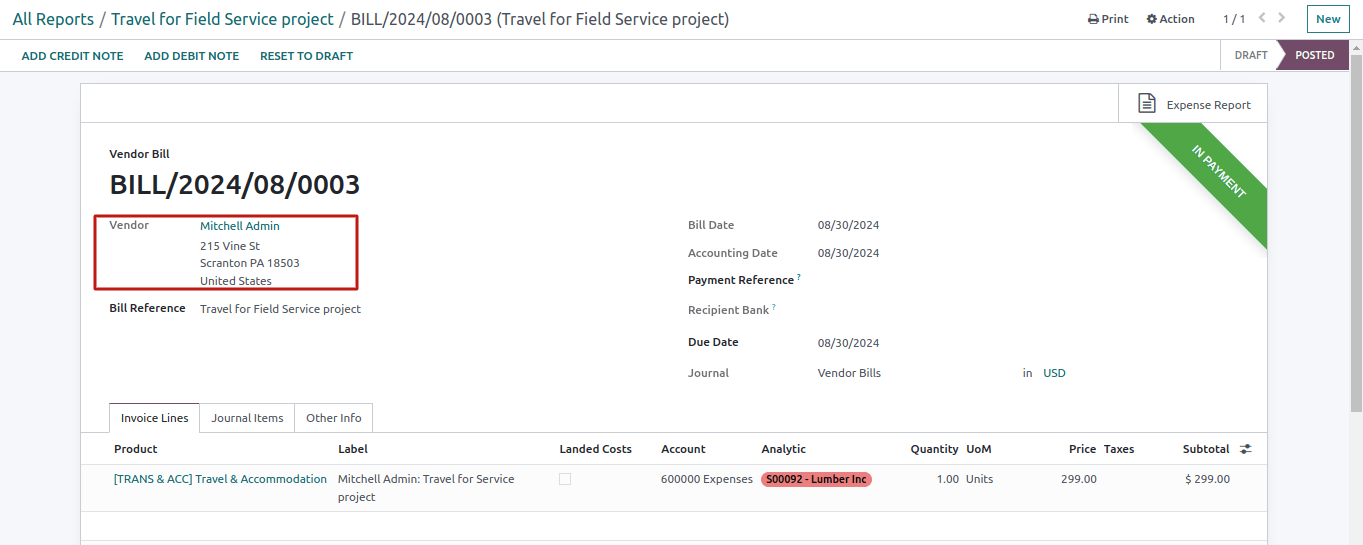

The diary entries can be posted by clicking the POS diary ENTRIES button.

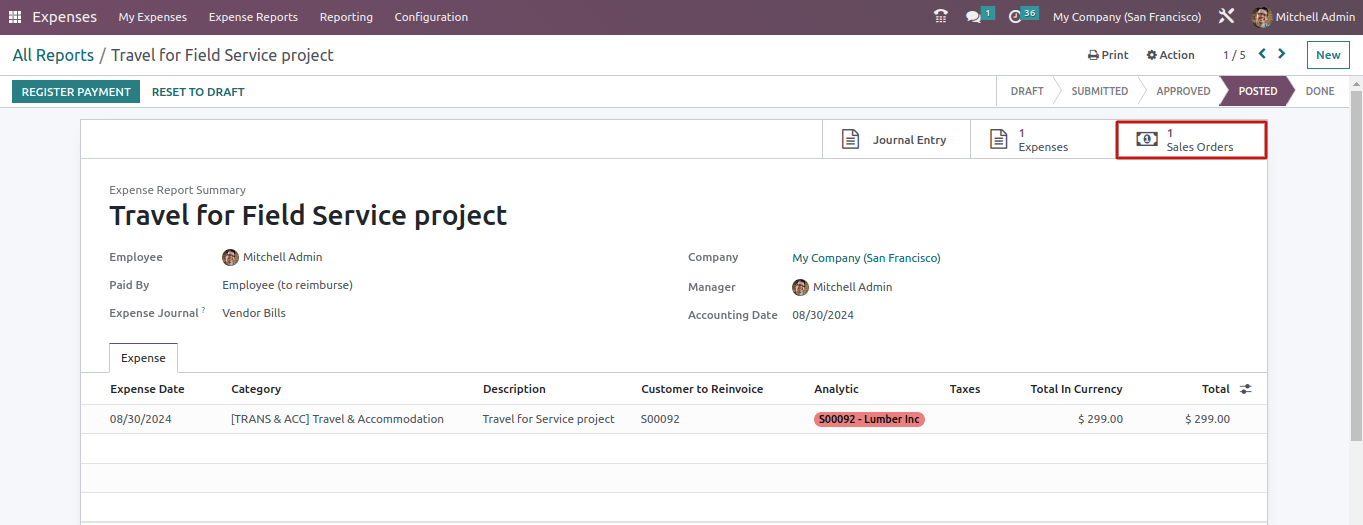

Then, enter the Sale Orders smart tab to view the recently made sale order.

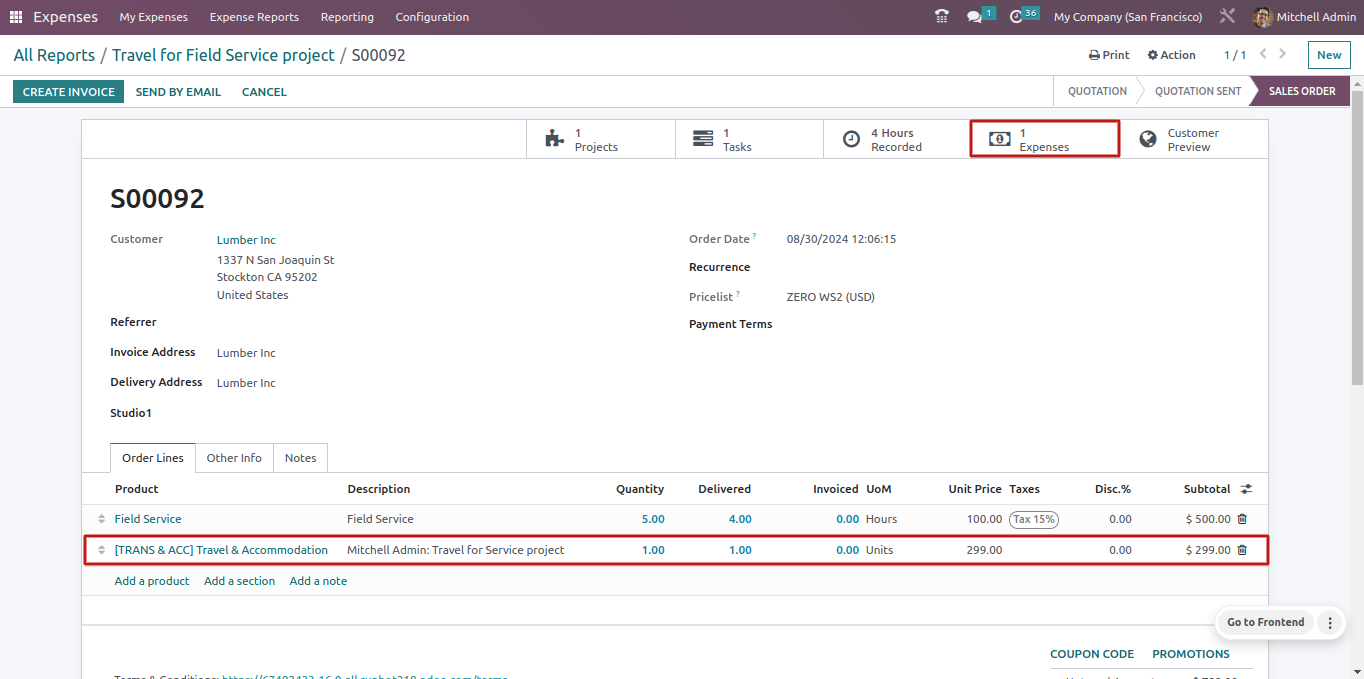

Two adjustments are made to the sale order. The first one is that there is a new smart tab called expenses. The second alteration is that the expense product is added to the boundary alongside the quantity and sales price. It is now possible to generate an invoice by clicking on the CREATE INVOICE button.

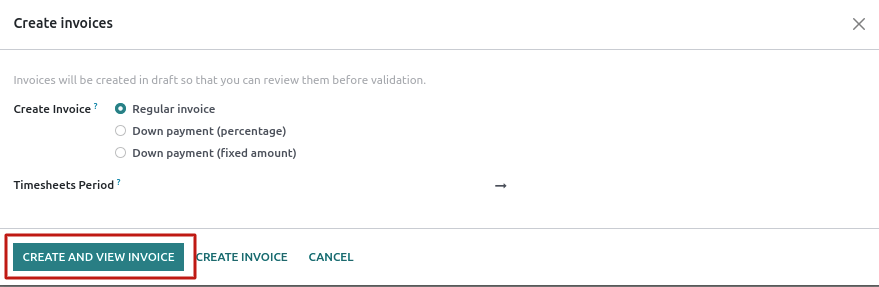

From the box, select a standard invoice and click the CREATE AND VIEW INVOICE button.

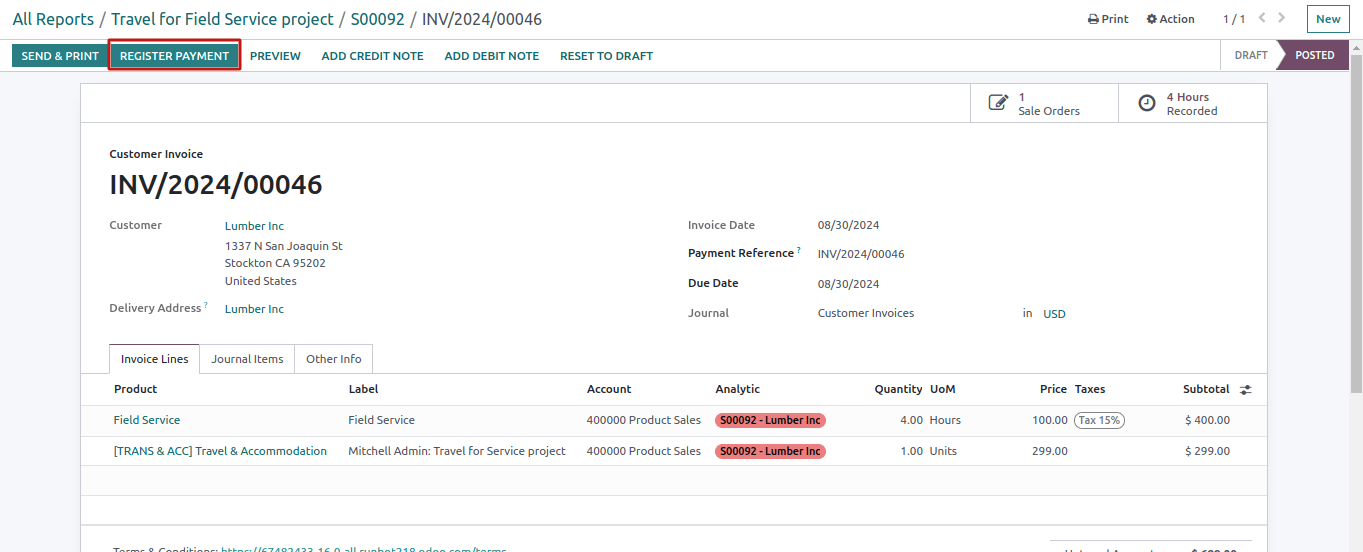

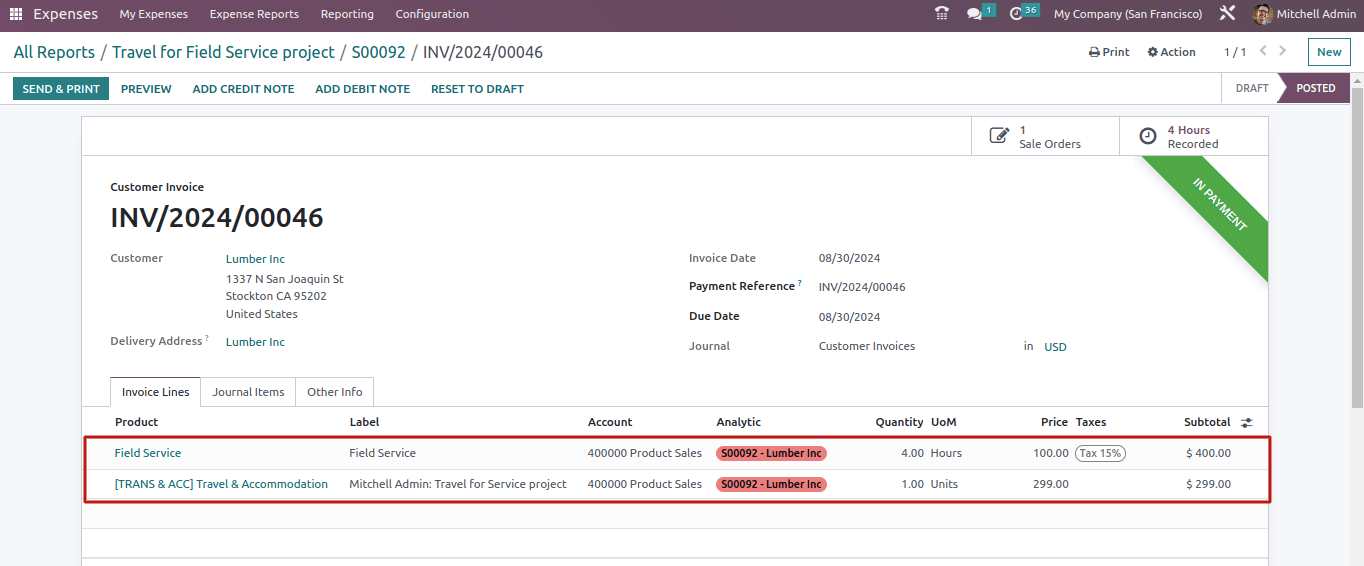

The invoice will then open. Confirm the invoice and accept payment from the customer.

The customer paid for both the added timesheet and the additional expense.

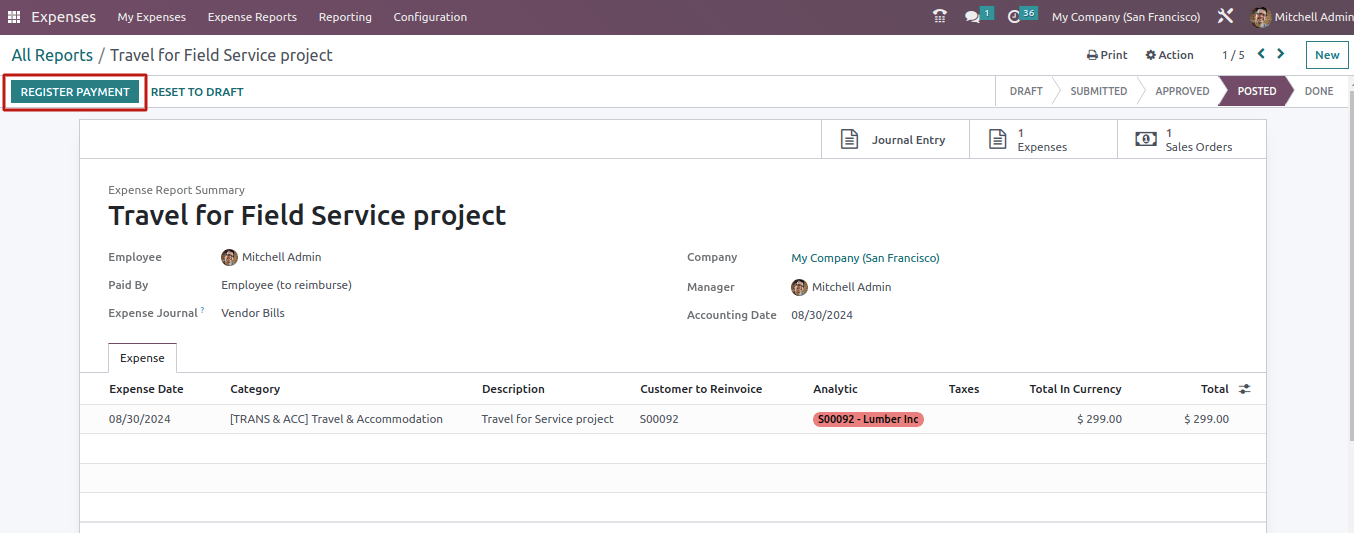

So go back to the expense report you made. The expense can now be re-billed to the employee by clicking the REGISTER PAYMENT button.

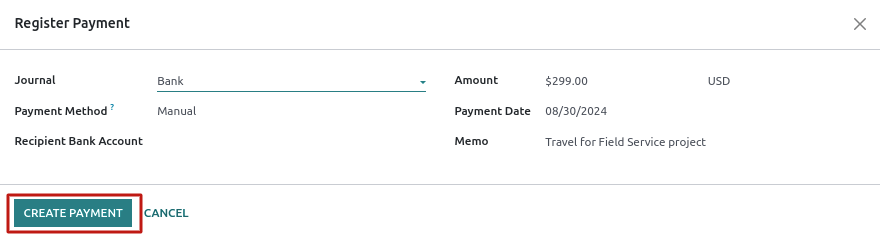

Then, another payment registration popup will display. The payment data, such as the journal, payment method, amount, and payment date, are displayed. The description entered into the cost will be updated as a memo here. Click the CREATE PAYMENT button.

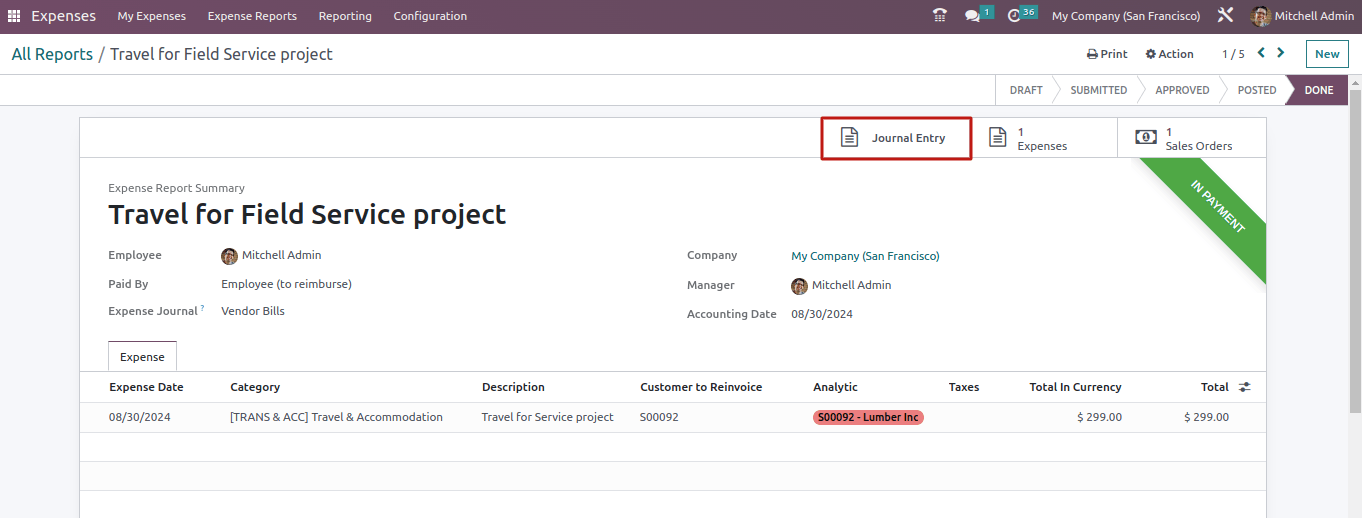

The expense included a ribbon In PAYMENT. Select the smart tab Journal Entry.

The smart tab Journal Entry has a bill for employee Marc Demo that is IN PAYMENT.

So, in this case, the employee entered an expense into the system that he or she spent as part of the assignment. As a result, the expense is added to the customer’s invoice. After the consumer pays the expense, it will be reinvoiced to the employee.